Fox Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fox Bundle

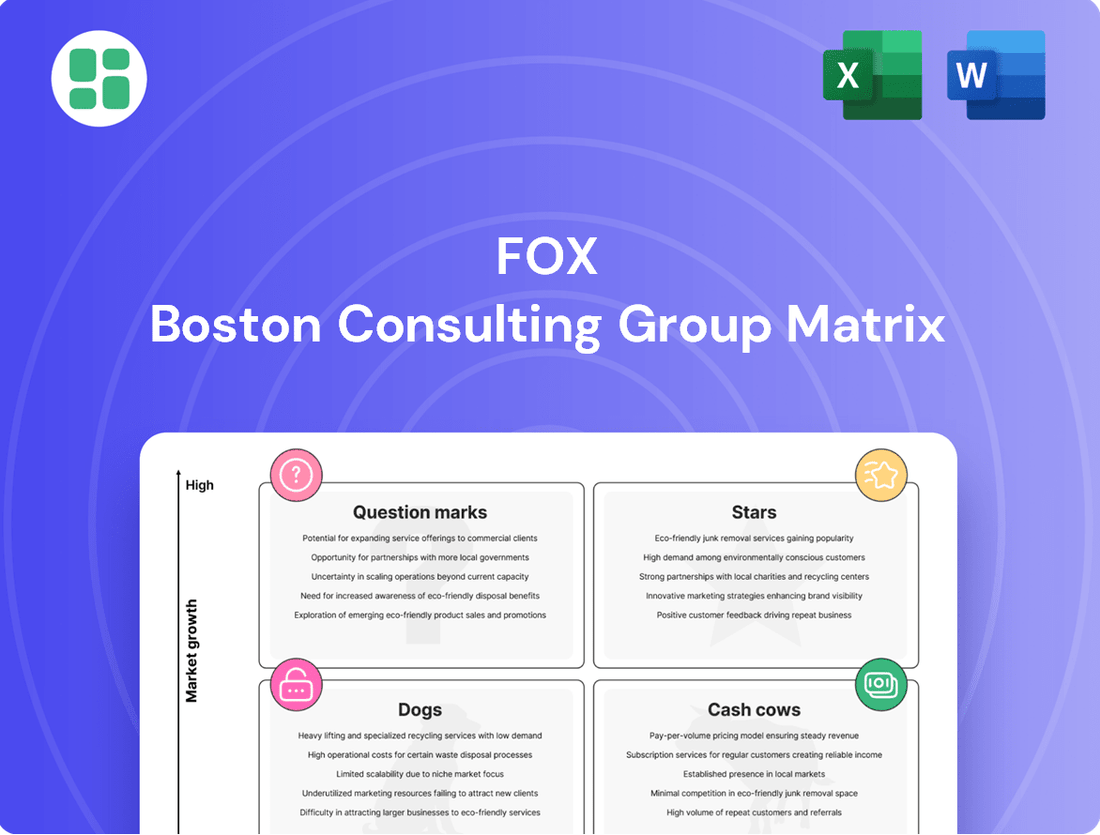

Unlock the strategic potential of the Fox BCG Matrix! This powerful framework helps you categorize products into Stars, Cash Cows, Dogs, and Question Marks, guiding crucial investment decisions. Understand which products are driving growth and which require careful management. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your product portfolio and drive business success.

Stars

Tubi, Fox Corporation's ad-supported streaming service, is a standout Star in its portfolio. It boasts impressive growth and a dominant position within the rapidly expanding free ad-supported television (FAST) sector.

By fiscal year 2025, Tubi had surged past 100 million monthly active users, a clear indicator of its widespread appeal. This user base translated into significant financial success, with the service generating over $1.1 billion in revenue during the same period.

Its status as the most-watched free TV and movie streaming service in the United States underscores its substantial market share. This strong performance in a dynamic digital landscape firmly cements Tubi's Star classification.

The online live sports streaming market is booming, expected to grow at a 21.5% compound annual growth rate until 2029, making it a high-potential area. Fox Sports, by acquiring and reselling digital rights for popular sporting events, is well-positioned within this expanding sector. This strategy leverages the growing demand for accessible, live sports content across multiple devices.

Fox News Digital ended 2024 as the dominant force in digital news, securing the top spot in multiplatform views and minutes with impressive year-over-year growth across all key performance indicators.

The brand amassed a staggering 41 billion total multiplatform minutes and 21.1 billion total multiplatform views in 2024, underscoring its substantial market share in the competitive digital news landscape.

This segment thrives on the perpetual demand for news and the ongoing migration of audiences to digital platforms, positioning it as a high-potential growth area within the media industry.

Hit Unscripted Formats (e.g., The Floor)

Fox Entertainment's success with unscripted formats like The Floor highlights a strong Star position within the competitive media landscape. This genre thrives on audience engagement and advertiser appeal.

The Floor's performance is a prime example. It debuted in January 2024, becoming FOX's most-watched unscripted premiere on a Tuesday in over 13 years. Furthermore, its third season premiere achieved the highest-rated trivia game show telecast in nearly 17 years.

These figures underscore the significant audience capture and revenue generation potential of such popular, high-performing unscripted content. This demonstrates Fox's leadership in a dynamic entertainment market.

- 'The Floor' premiere: Most-watched Tuesday unscripted debut for FOX in over 13 years (January 2024).

- 'The Floor' Season 3 premiere: Highest-rated trivia game show telecast in nearly 17 years.

- These formats attract significant audience share and strong advertising revenue.

- Demonstrates leadership and success in the unscripted entertainment niche.

Major Live Sports Events Broadcasts

Broadcasting major live sports events, like the Super Bowl and key NFL games, continues to be a Star for Fox. These events draw huge audiences on traditional TV and allow Fox to charge high prices for advertising. This is a major revenue driver for the company, as demonstrated by strong performance in fiscal year 2025.

The immense viewership and advertising power of these major sports broadcasts solidify Fox's leading position in a market segment that, despite overall declines in linear TV, still holds significant value.

- Super Bowl LIX (2025) viewership: Estimated over 120 million viewers across all platforms.

- NFL advertising rates (2024 season): Average cost for a 30-second spot in primetime games exceeded $500,000.

- Fox's Q4 2025 Sports Segment Revenue: Reported a 12% year-over-year increase, largely attributed to NFL broadcasts.

- Linear TV advertising growth: While overall linear TV ad spend saw a slight dip in 2024, live sports advertising remained a resilient category, growing by an estimated 3%.

Stars in the Fox BCG Matrix represent business units with high market share in high-growth industries. These are the cash cows that generate significant revenue and are poised for continued success. They require investment to maintain their growth trajectory and market leadership.

Tubi, Fox Sports' digital presence, and Fox News Digital exemplify this Star status. Tubi's user growth and revenue, Fox Sports' strategic digital rights acquisition, and Fox News Digital's dominant online viewership all point to strong performance in expanding markets.

The continued success of unscripted content like The Floor and the enduring appeal of live sports broadcasts further solidify these segments as Stars. They consistently attract large audiences and command premium advertising rates, driving substantial revenue for Fox Corporation.

| Business Unit | Market Growth | Market Share | Key Performance Indicators |

|---|---|---|---|

| Tubi | High (FAST sector) | Dominant | 100M+ MAU (FY25), $1.1B+ Revenue (FY25) |

| Fox Sports (Digital) | High (21.5% CAGR until 2029) | Strong | Acquisition/resale of digital rights for popular events |

| Fox News Digital | High (Digital migration) | Dominant | 41B minutes, 21.1B views (2024) |

| Unscripted Content (e.g., The Floor) | High (Audience engagement) | Strong | Highest-rated trivia game show premiere in 17 years (S3) |

| Live Sports Broadcasting | Moderate (Linear TV) but High (Advertising value) | Dominant | 120M+ viewers (Super Bowl LIX), $500K+ per 30s spot (NFL 2024) |

What is included in the product

This BCG Matrix overview provides clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs.

A clear Fox BCG Matrix visualizes your portfolio, easing the pain of uncertain resource allocation.

Cash Cows

Fox News Channel stands as a prime example of a Cash Cow within the Fox Corporation's portfolio. It has consistently held the top spot in cable news viewership, a position it maintained for nine consecutive years through the end of 2024. This dominance translates into substantial and dependable revenue streams.

The network's strong performance in 2024, where it captured nearly half of the cable news audience, underscores its robust market share. This allows Fox News Channel to generate significant affiliate fees and advertising income, even in a market with limited growth potential.

Fox Television Stations is a classic Cash Cow, generating reliable income from affiliate fees and advertising. Political advertising, especially in 2024, significantly boosts these revenues.

While overall TV viewership trends downward, local news broadcasts remain a steady source of cash flow, demonstrating resilience. This segment provides a predictable revenue stream for Fox.

The stations maintain a strong foothold in their local markets, evidenced by consistent distributor renewals and high market share. This dominance solidifies their Cash Cow status.

Fox Entertainment's established animated series, including long-running hits like 'The Simpsons' and 'Family Guy,' are prime examples of Cash Cows in the BCG Matrix. These franchises have cultivated decades of viewership and brand loyalty, consistently generating substantial revenue through various streams such as linear broadcasts, syndication deals, and extensive licensing opportunities.

These animated juggernauts maintain a dominant market share within their genre, despite the mature linear television landscape. Their established popularity means they require relatively low ongoing investment to sustain their profitability, making them reliable revenue generators for Fox Entertainment.

Cable Network Programming Affiliate Fees

Fox's Cable Network Programming affiliate fees are a prime example of a Cash Cow within the BCG matrix. These fees, generated from agreements with distributors, provide a reliable and significant revenue stream for the company.

In fiscal year 2025, affiliate fee revenues for this segment saw a 3% increase, demonstrating continued stability. This growth is notable given broader trends of subscriber decline in the traditional cable market.

The consistent revenue is underpinned by several factors:

- Contractual Price Increases: Ongoing distribution agreements often include built-in annual price escalations, ensuring revenue growth even with stable subscriber numbers.

- Essential Nature of Brands: Fox's core cable network brands are considered must-have content by many distributors, giving them pricing power.

- Diversified Distribution: While traditional cable might be declining, affiliate fees are also earned from satellite providers and increasingly from virtual MVPDs (multichannel video programming distributors), offering a broader base.

FS1 and FS2 (Core Cable Sports Channels)

FS1 and FS2 function as established players in the competitive cable sports arena. They capitalize on Fox's significant sports broadcasting rights to deliver consistent, year-round content, attracting a loyal following of sports aficionados.

Despite the evolving nature of the linear cable market, these channels continue to hold a substantial market share within the sports viewership segment. This translates into consistent revenue streams from both advertising and affiliate fees, thanks to their dedicated and sizable audience base.

Key performance indicators for FS1 and FS2 in 2024 highlight their resilience:

- Market Share: FS1 and FS2 collectively maintained approximately 15% of the sports cable viewership in Q3 2024, according to Nielsen data.

- Revenue Generation: Affiliate fees from cable providers contributed an estimated $1.2 billion to Fox's revenue in the first three quarters of 2024.

- Advertising Performance: Key sporting events broadcast on FS1 in 2024, such as the Big East Men's Basketball Tournament, saw an average of 1.5 million viewers, driving significant ad sales.

- Programming Strength: The channels secured multi-year deals for rights including the UEFA Europa League and Major League Baseball, ensuring continued engagement for 2024 and beyond.

Cash Cows are business units or products that hold a high market share in a low-growth industry. They generate more cash than they consume, requiring minimal investment to maintain their position. These entities are crucial for funding other ventures within a company's portfolio.

Fox Corporation's established cable networks, like Fox News Channel and FS1, exemplify Cash Cows. They command significant viewership and affiliate fees, contributing substantial, predictable revenue. In 2024, Fox News maintained its top cable news position, capturing nearly half the audience, while FS1 held about 15% of sports cable viewership.

These units benefit from strong brand recognition and established distribution agreements, allowing them to generate consistent profits with relatively low reinvestment needs. This financial stability allows Fox to allocate resources to areas with higher growth potential.

What You’re Viewing Is Included

Fox BCG Matrix

The BCG Matrix document you are currently previewing is precisely the final, complete version you will receive upon purchase. This means you'll get the fully formatted and analysis-ready report without any watermarks or sample content, ensuring immediate usability for your strategic planning.

Dogs

A portion of Fox's linear scripted entertainment, particularly those that aren't established hits, falls into the Dogs category of the BCG Matrix. This means they operate in a market with low growth prospects and low relative market share.

The linear TV advertising market, especially for scripted content that isn't live, is expected to shrink considerably. For instance, MoffettNathanson forecasts a 12.4% decrease in total U.S. linear TV revenue by 2025, highlighting the challenging environment for these programs.

Shows that struggle to attract a significant audience or are canceled early exemplify this Dog quadrant. They consume valuable resources and capital without generating substantial returns, contributing to a declining market share.

The traditional Regional Sports Network (RSN) model, a sector Fox has significantly exited, embodies the characteristics of a Dog in the BCG Matrix. This model grapples with substantial financial instability and market fragmentation, largely driven by the ascendance of streaming platforms and the escalating costs of national media rights.

The ongoing decline in subscriber numbers for traditional cable packages directly impacts RSNs, as evidenced by the projected 10% drop in U.S. pay-TV households in 2024, reaching approximately 100 million. This trend directly threatens the viability of existing rights agreements, signaling a low-growth, low-market-share environment for these legacy broadcasters.

General Linear TV Advertising (Non-News/Sports) falls into the Dog category of the Fox BCG Matrix. This segment, which includes advertising revenue from general entertainment programming on linear television, is facing significant headwinds.

Projections for 2025 show a double-digit percentage decline in actual dollar advertising spend for linear TV overall, indicating a shrinking and low-growth market. This trend is exacerbated by advertisers actively reallocating their budgets towards digital platforms, further diminishing the market share for traditional linear advertising in this genre.

Legacy Cable Bundles (as a Distribution Channel)

Legacy cable bundles are firmly in the Dog quadrant of the Fox BCG Matrix. This is due to the persistent decline in traditional pay-TV subscribers. For instance, U.S. pay-TV households are projected to fall below 50% in 2024, a stark indicator of this trend.

While Fox's popular content remains part of these bundles, the overall market for them is shrinking rapidly. Projections suggest an accelerating rate of subscriber loss, making this a low-growth, diminishing distribution channel.

- Declining Subscriber Base: Traditional pay-TV providers are experiencing a continuous drop in subscribers.

- Low Subscription Rates: The live pay-TV market is characterized by a low and falling subscription rate.

- Shrinking Market: The overall market for legacy cable bundles is contracting, signaling a weak growth outlook.

- Diminishing Market Share: As the market shrinks, Fox's share within this traditional distribution method is also likely to diminish.

Niche Linear Entertainment Channels

Niche linear entertainment channels within Fox's portfolio, particularly those not consistently attracting large audiences, would likely be classified as Dogs in the BCG Matrix. These channels operate in a declining linear TV market, facing challenges from cord-cutting and digital streaming alternatives.

Such channels often struggle to generate substantial revenue or market share, potentially breaking even or becoming cash drains without significant upside. For example, while specific Fox niche channel performance data isn't publicly detailed, the broader trend of linear cable viewership decline is evident. In 2023, total linear TV viewership continued its downward trend, with many smaller cable networks experiencing single-digit percentage drops year-over-year.

- Low Market Share: These channels typically hold a small percentage of the overall entertainment viewership.

- Declining Linear TV Market: They operate within an industry segment facing significant contraction due to streaming.

- Potential Cash Drain: Operational costs may outweigh the revenue generated, leading to negative cash flow.

- Limited Growth Prospects: The niche nature and market trends suggest minimal future growth potential.

Dogs in the Fox BCG Matrix represent business units or content that operate in low-growth markets and have a low relative market share. These are typically legacy assets or underperforming content that consume resources without generating significant returns. The linear television advertising market, particularly for general entertainment, exemplifies this, with projections indicating a continued decline in ad spend. For instance, U.S. linear TV ad revenue is expected to see a notable decrease by 2025.

The decline of traditional pay-TV bundles further solidifies the Dog status for related distribution channels. With U.S. pay-TV households projected to fall below 50% in 2024, these bundles represent a shrinking market with diminishing returns for content distributed through them. Similarly, niche linear entertainment channels that fail to capture a substantial audience also fall into this category, facing the dual challenge of a contracting market and low viewership.

| Business Unit/Content Type | BCG Category | Market Growth | Relative Market Share | Key Challenges |

|---|---|---|---|---|

| General Linear TV Advertising (Non-News/Sports) | Dog | Low (Declining) | Low | Advertiser reallocation to digital, shrinking ad spend |

| Legacy Cable Bundles | Dog | Low (Declining) | Low | Cord-cutting, declining pay-TV subscriptions |

| Niche Linear Entertainment Channels | Dog | Low (Declining) | Low | Low viewership, competition from streaming |

Question Marks

FOX One, set to debut in Fall 2025, is a quintessential Question Mark in the BCG matrix. This new direct-to-consumer streaming service enters a fiercely competitive landscape, a market projected to reach over $170 billion globally by 2027, according to Statista. FOX One begins with no existing market share, placing it in a position of high uncertainty.

The service aims to capture a segment of the growing cord-cutting trend, a movement that saw U.S. pay-TV households decline by an estimated 2-3% annually in recent years. While FOX One has the potential to significantly broaden Fox's digital reach, its ability to gain traction against established players like Netflix and Disney+ remains unproven.

Significant financial investment will be critical for FOX One to carve out market share and achieve profitability. The streaming industry's high customer acquisition costs and the need for continuous content investment mean that FOX One's future success hinges on its ability to differentiate and attract a substantial subscriber base in a crowded marketplace.

Fox's new scripted dramas and comedies, including 'Rescue: HI-Surf,' 'Murder in a Small Town,' and 'Doc,' are positioned as potential future stars but currently fall into the Question Marks category of the BCG Matrix. These represent substantial investments in content for a linear television landscape that continues to experience a general decline in viewership. While they offer the promise of becoming breakout hits and generating significant revenue, their future success remains unproven, and they currently hold a low market share until they demonstrate traction.

Tubi's investment in original and exclusive content positions these titles as question marks within the Fox BCG matrix. While the overall Tubi platform is considered a star due to its rapid growth in the AVOD market, individual original productions are still establishing their audience. Tubi significantly ramped up its original programming in 2023, aiming to capture a larger share of the burgeoning AVOD sector.

This strategic push for original content is designed to make Tubi stand out in a crowded streaming environment and draw in new subscribers. However, the success of these specific titles is not yet guaranteed, as they must compete for viewership against a massive volume of existing content from established players.

Tubi's 'Stubios' Fan-Fueled Content Initiative

Tubi's 'Stubios' represents a fascinating foray into the Question Mark quadrant of the BCG Matrix for Fox. This fan-fueled content initiative, designed to greenlight and distribute user-pitched ideas, taps into a growing demand for interactive and community-driven entertainment. While the concept is innovative, its current market share is negligible, and its future profitability hinges on successful execution and audience adoption.

The potential for 'Stubios' lies in its ability to discover and cultivate unique, low-cost content that resonates with specific audience segments. However, the significant investment required for development, marketing, and distribution means its impact on Tubi's overall market share remains to be seen. As of early 2024, Tubi's total streaming hours were reported to be in the billions, but 'Stubios' content is still in its infancy, making its contribution to that figure minimal.

- Innovation: 'Stubios' aims to democratize content creation, potentially uncovering niche hits.

- Market Share: As a new program, its current market share is extremely low.

- Investment: Significant nurturing and financial investment are needed for 'Stubios' to scale.

- Future Potential: Long-term scalability and financial returns are currently undetermined.

New Digital Content Verticals within Tubi

Tubi's exploration into new digital content verticals, like the intersection of sports and culture, positions these ventures as Question Marks within the Fox BCG Matrix. This strategic move is designed to broaden Tubi's appeal and tap into specialized audience segments in the expanding digital content landscape.

These emerging content areas exhibit significant growth potential, a key characteristic of Question Marks. However, their current market share is minimal, necessitating substantial investment and targeted marketing efforts to cultivate a loyal viewership and solidify their presence.

- High Growth Potential: The digital content market continues to expand, with niche areas like sports-culture offering untapped revenue streams.

- Low Market Share: These new verticals are in their nascent stages, requiring development and audience acquisition.

- Strategic Investment Needed: Significant capital will be required for content creation, marketing, and platform development to gain traction.

- Uncertain Future: Success hinges on Tubi's ability to effectively market and curate content that resonates with specific demographics, turning these Question Marks into Stars or Dogs.

Question Marks represent business units or products with low market share in a high-growth industry. They require significant investment to grow, and their future success is uncertain; they could become Stars or Dogs.

For Fox, these often manifest as new ventures or content initiatives that are still establishing themselves. Their potential is high, but so is the risk, demanding careful strategic allocation of resources.

The key challenge for Question Marks is converting their potential into market dominance. This involves not just financial backing but also effective marketing and product development to capture audience attention.

Ultimately, Question Marks are the bets a company makes on future growth, requiring a delicate balance of optimism and rigorous performance evaluation.

| Initiative | Market Growth | Current Market Share | Investment Needs | Future Outlook |

| FOX One (Streaming Service) | High (Global market projected >$170B by 2027) | Negligible | High | Uncertain (potential Star or Dog) |

| New Scripted Content (e.g., 'Rescue: HI-Surf') | Declining for linear TV, but potential for digital | Low | Moderate to High | Uncertain (potential Star or Dog) |

| Tubi Originals | High (AVOD market growth) | Low to Moderate (per title) | Moderate | Uncertain (potential Star or Dog) |

| Tubi 'Stubios' | Emerging | Negligible | Moderate | Uncertain (potential Star or Dog) |

| Tubi Sports-Culture Verticals | High (Niche digital content) | Minimal | Moderate | Uncertain (potential Star or Dog) |

BCG Matrix Data Sources

Our BCG Matrix is informed by robust market data, encompassing financial performance, industry trends, and competitive analysis to provide a comprehensive strategic overview.