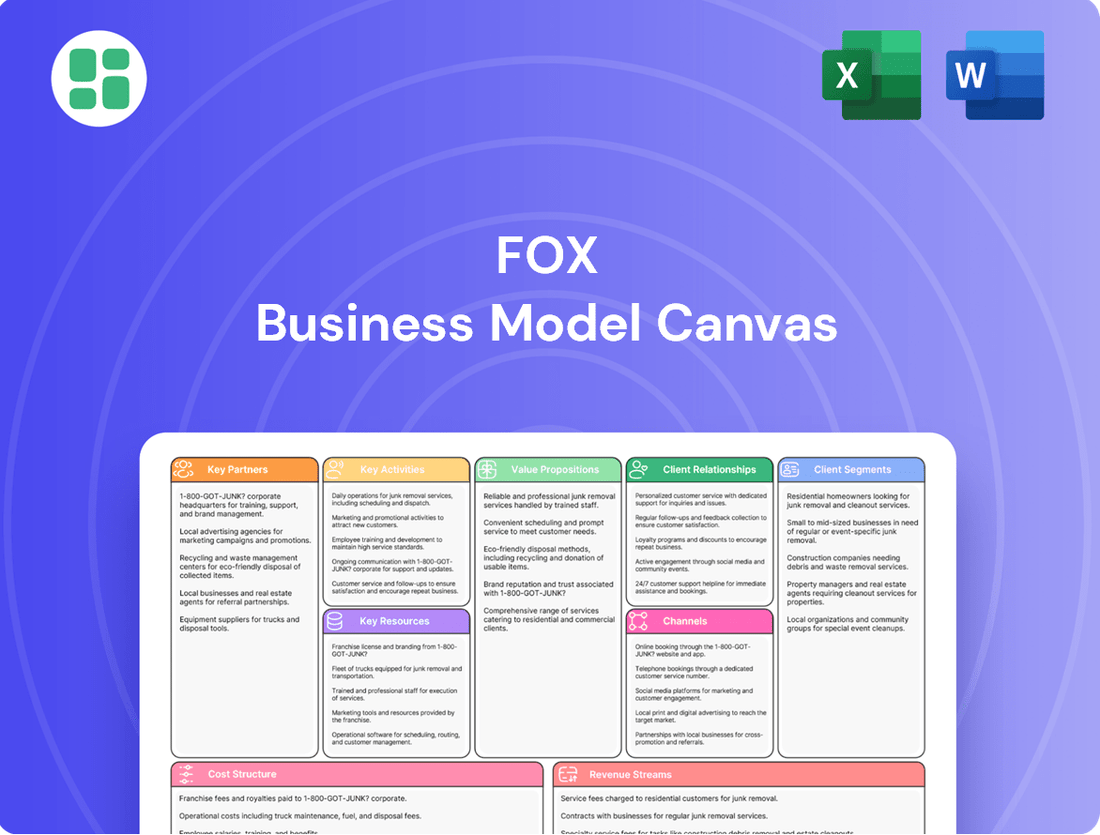

Fox Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fox Bundle

Curious how Fox dominates the media landscape? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. Discover the strategic framework that fuels their success and unlock actionable insights for your own ventures.

Partnerships

Fox collaborates extensively with independent content creators and major production houses to source and develop a wide array of programming. This includes everything from gripping dramas and insightful documentaries to live sporting events and breaking news segments.

These partnerships are crucial for maintaining a robust content pipeline across Fox's diverse distribution channels, encompassing its broadcast network, cable channels, and the burgeoning streaming service, Tubi. For instance, in 2023, Tubi saw significant growth in its content library, adding thousands of new titles through such strategic alliances, which directly contributed to its increasing viewership numbers.

Specifically, Fox's investment in securing exclusive rights and co-production deals with prominent studios is a cornerstone of its strategy to enhance Tubi's appeal, particularly to younger demographics. This approach has been instrumental in Tubi's expansion, with the platform reporting a substantial increase in active users and viewing hours throughout 2023 and into early 2024.

Fox Sports' key partnerships are anchored by its relationships with major sports leagues and organizations. These include agreements with entities like the NFL and MLB, which are vital for broadcasting popular live events that drive viewership and advertising revenue. For instance, Fox Sports entered into a significant multi-year media rights agreement with LIV Golf in January 2025, underscoring its commitment to securing premium sports content.

Fox’s relationship with cable and satellite distributors is foundational for its linear television business. These partnerships are crucial for delivering content from networks such as Fox News and Fox Sports to a vast viewership. This ensures Fox's programming is accessible within traditional pay-TV packages, a primary revenue stream.

The continued reliance on these distributors is evident in recent agreements. For instance, Fox's multi-year renewals with major distributors like Sinclair Broadcasting Group highlight the enduring significance of these relationships for securing affiliate fee revenue, a vital component of Fox's financial model.

Digital Platform Partners

Fox strategically partners with digital platforms and smart TV manufacturers to broaden the accessibility of its streaming services, including Tubi and the forthcoming Fox One. These alliances are vital for reaching audiences increasingly shifting away from traditional cable, such as cord-cutters and cord-nevers. For example, Fox One is slated for release across major operating systems and devices like iOS, Android, Roku, Fire TV, Apple TV, LG, Samsung, and Xbox, ensuring widespread availability.

These digital platform partnerships are critical for Fox's direct-to-consumer strategy, allowing them to tap into a vast user base. By ensuring content is readily available on popular smart TVs and streaming devices, Fox can effectively compete in the evolving media landscape. This approach directly addresses the growing trend of digital content consumption, with streaming services projected to continue their upward trajectory in the coming years.

- Tubi's Growth: As of early 2024, Tubi, a key digital partner, reported significant user engagement, demonstrating the effectiveness of these platform collaborations in reaching a broad audience.

- Smart TV Penetration: Smart TV households continue to rise globally, with projections indicating over 75% of all TVs will be smart TVs by 2026, underscoring the importance of partnerships with manufacturers like LG and Samsung.

- Fox One Distribution: The planned broad distribution of Fox One across iOS, Android, Roku, Fire TV, Apple TV, LG, Samsung, and Xbox highlights a commitment to multi-platform accessibility, aiming to capture a significant share of the streaming market.

Advertising Agencies and Brands

Fox Corporation maintains crucial relationships with advertising agencies and direct brands, forming the backbone of its content monetization strategy. These partnerships are essential for driving advertising revenue across Fox's diverse platforms, including broadcast television, cable networks, and digital properties.

These collaborations are fundamental to Fox's financial health, as advertising sales represent a substantial portion of its income. For instance, in the fiscal year 2023, Fox Corporation reported total advertising revenue of approximately $3.9 billion, underscoring the critical role of these key partnerships.

- Advertising Agencies: They act as intermediaries, connecting brands with Fox's audience across various media.

- Direct Brands: Fox works directly with companies seeking to advertise their products and services.

- Monetization Models: Partnerships facilitate revenue generation through traditional ad buys, sponsorships, and digital advertising solutions.

- Digital Transformation Focus: Fox's investment in digital capabilities aims to provide more targeted advertising options, enhancing value for both agencies and brands.

Fox's key partnerships extend to content creators and production houses, ensuring a steady stream of diverse programming for its broadcast, cable, and streaming platforms. These alliances are vital for maintaining a competitive edge, especially in the rapidly evolving digital landscape, with Tubi's significant content expansion in 2023 being a prime example of their success.

Crucial relationships with sports leagues like the NFL and MLB underpin Fox Sports' ability to broadcast high-demand live events, a significant driver of viewership and advertising revenue. The recent multi-year media rights agreement with LIV Golf in January 2025 further solidifies this strategy.

Partnerships with digital platforms and smart TV manufacturers are essential for expanding the reach of streaming services like Tubi and the upcoming Fox One, targeting cord-cutters and digital-native audiences. This multi-platform distribution strategy is key to capturing market share in the growing streaming sector.

Fox Corporation relies heavily on advertising agencies and direct brands to monetize its content, with advertising revenue forming a substantial portion of its income. In fiscal year 2023, Fox reported approximately $3.9 billion in advertising revenue, highlighting the critical nature of these partnerships.

What is included in the product

A detailed breakdown of Fox Corporation's business strategy, outlining its key customer segments, revenue streams, and operational activities.

This model provides a clear, visual representation of how Fox generates value and achieves its financial objectives.

Helps you visualize and address customer pain points by clearly defining value propositions and customer relationships.

Provides a structured framework to identify and solve specific customer problems by mapping them to your business activities.

Activities

Fox Corporation actively produces a significant volume of original content across news, sports, and entertainment. In the fiscal year 2024, this commitment translated into substantial investment in live broadcasting and the development of new series, aiming to capture audience attention and drive viewership across its diverse platforms.

Beyond in-house production, Fox strategically acquires licensing rights for various programming, enriching its content portfolio. This includes bolstering the offerings on its digital platforms, such as Tubi, by securing popular shows and movies, thereby expanding its digital reach and appeal to a wider audience.

The company's content strategy in 2024 heavily emphasized creating compelling narratives and extending its digital footprint. This dual focus on high-quality original production and smart content acquisition is designed to solidify Fox's position in the evolving media landscape, particularly as it seeks to grow its streaming presence.

Broadcasting and distribution are central to Fox's operations. This includes airing content on its national TV network, local stations, and cable channels. A key aspect is securing and managing distribution deals with providers like cable, satellite, and digital platforms, ensuring broad audience access.

Fox's revenue from these distribution agreements shows growth. For instance, in the first quarter of 2024, affiliate fees, which are payments from pay TV operators, saw an increase, reflecting the ongoing value of their broadcast and cable content to these distributors.

Fox's core activities revolve around selling advertising across its vast media empire. This includes traditional television slots, digital ad space on websites and apps, and increasingly, opportunities on streaming platforms like Tubi.

To drive revenue, Fox crafts attractive advertising packages, utilizes audience data to target specific demographics, and actively cultivates relationships with brands and agencies. This strategic approach ensures they can effectively monetize their reach.

In fiscal year 2025, Fox saw a substantial boost in advertising revenue, partly fueled by major events such as the Super Bowl and a robust political advertising season. The continued growth of their ad-supported streaming service, Tubi, also played a significant role in this financial upswing.

Platform Development and Management

Fox Corporation actively manages and develops its diverse media platforms, encompassing the Fox Network, Fox News Media, Fox Sports, Fox Television Stations, and the Tubi Media Group. This involves maintaining robust technological infrastructure and continuously enhancing the user experience across digital offerings.

A significant focus is placed on the strategic rollout of new direct-to-consumer streaming services, such as the forthcoming Fox One. This initiative aims to deliver a uniquely personalized user interface and innovative technology to subscribers.

- Platform Infrastructure: Ongoing investment in the technological backbone supporting linear broadcasts and digital streaming services ensures reliable delivery and scalability.

- User Experience (UX) Optimization: Continuous refinement of digital platforms, including websites and apps, to improve engagement and accessibility for a broad audience.

- New Service Development: The development and launch of direct-to-consumer (DTC) offerings like Fox One represent a key activity, focusing on personalized content delivery and proprietary technology.

- Content Integration: Seamlessly integrating content from various Fox brands onto these platforms to create a cohesive and appealing user ecosystem.

Sports Rights Management

Fox Sports actively manages and secures exclusive broadcasting rights for major sporting events. This core activity is crucial for maintaining its position as a leading sports broadcaster, involving strategic bidding and contract negotiations with leagues and organizations.

In 2024, Fox Sports continued its significant investment in sports rights, including agreements for the NFL, MLB, and college sports. For instance, its long-term deal with the NFL guarantees a substantial number of high-profile games, driving viewership and advertising revenue.

- Securing Broadcasting Rights: Fox Sports actively bids on and negotiates exclusive rights for major sporting leagues and events, such as the NFL and MLB, to ensure premium live content.

- Contract Negotiation: The company engages in complex negotiations with sports leagues to secure long-term broadcasting agreements, a critical component of its revenue model.

- Content Strategy: Fox Sports strategically places acquired sports rights across its various channels and platforms to maximize audience reach and engagement.

Fox Corporation's key activities center on the creation and distribution of content across its diverse media properties. This includes producing original programming for its television networks and digital platforms, as well as acquiring licensing rights for third-party content. The company also focuses on selling advertising across all its platforms, from traditional broadcast to digital streaming services like Tubi. Furthermore, Fox actively manages and develops its technological infrastructure to support its broadcasting and streaming operations, with a strategic emphasis on launching new direct-to-consumer services.

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive file you'll gain access to. Once your order is complete, you will instantly download this same, fully populated Business Model Canvas, ready for your strategic planning needs.

Resources

Fox's broadcast licenses and spectrum are critical for its core business, allowing it to transmit content nationwide. These licenses are not just permits; they are valuable, regulated assets that provide exclusive rights to airwaves. In 2024, the FCC continued to manage and allocate spectrum, a process vital for broadcasters like Fox.

Access to broadcast spectrum is a significant competitive advantage, acting as a substantial barrier to entry for new players. Fox's ability to reach millions of households directly via over-the-air signals relies heavily on these spectrum rights. The ongoing evolution of spectrum management by regulatory bodies directly impacts the long-term value and operational flexibility of these key resources.

Fox's extensive content library, encompassing news, sports, and entertainment, is a core asset. This includes highly valuable intellectual property tied to brands like Fox News Media and Fox Sports, which are significant drivers of audience engagement and revenue.

These iconic brands are instrumental in attracting viewers, which in turn fuels affiliate fees and advertising income. For instance, in the first quarter of 2024, Fox Corporation reported advertising revenue of $1.3 billion, underscoring the commercial power of its content.

Key on-air talent, journalists, sports commentators, and entertainment personalities are critical resources that drive viewership and brand loyalty across Fox's networks. Their expertise and popularity are vital for attracting and retaining audiences, particularly in competitive news and sports markets.

Fox has been actively engaging with independent media stars and podcasters, expanding its reach. For instance, in 2024, Fox News continued to dominate cable news ratings, with shows like The Five and Jesse Watters Primetime consistently drawing millions of viewers, underscoring the value of established on-air personalities.

Distribution Network and Infrastructure

Fox leverages a robust distribution network comprising owned television stations, cable infrastructure, and digital streaming services. This multi-platform approach ensures broad audience access to its content. For instance, Tubi, a Fox-owned streaming service, is accessible through more than 100 local station feeds, highlighting the expansive reach of its distribution capabilities.

This infrastructure is crucial for delivering a diverse range of programming, from live sports to news and entertainment. The integration of traditional broadcast with digital channels allows Fox to adapt to evolving consumer viewing habits. In 2024, Fox Corporation reported significant engagement across its platforms, underscoring the effectiveness of its distribution strategy.

- Owned Television Stations: A cornerstone of Fox's traditional reach.

- Cable Network Infrastructure: Facilitates distribution to millions of cable subscribers.

- Digital Streaming Capabilities: Encompasses services like Tubi, expanding digital reach.

- Tubi's Local Station Feeds: Over 100 local feeds enhance content accessibility.

Digital Platforms and Technology

Fox's digital platforms, including the free ad-supported streaming service Tubi and subscription service Fox Nation, represent critical key resources. These digital assets, powered by sophisticated technology and data analytics, are vital for direct consumer engagement and expanding content reach in today's dynamic media environment.

Tubi, in particular, has demonstrated robust performance. For the fiscal year 2023, Tubi saw a substantial increase in total view time, reaching 14.7 billion hours, a 33% jump year-over-year. Monthly active users also climbed to 73.5 million, up 20% compared to the previous year, highlighting the platform's growing appeal and reach.

The company is also investing in future growth through initiatives like the upcoming Fox One streaming service, aiming to further diversify its digital offerings. These platforms are not just distribution channels; they are also crucial for gathering valuable consumer data, enabling more precise advertising targeting and personalized content recommendations.

- Tubi's Total View Time (FY 2023): 14.7 billion hours (up 33% YoY)

- Tubi's Monthly Active Users (FY 2023): 73.5 million (up 20% YoY)

- Key Digital Assets: Tubi, Fox Nation, Fox One (upcoming)

- Underlying Capabilities: Technology infrastructure, data analytics

Fox's broadcast licenses and spectrum are foundational, granting exclusive rights to airwaves and serving as a significant barrier to entry. These regulated assets are crucial for nationwide content transmission. In 2024, the FCC's ongoing spectrum management directly influences the long-term value of these vital resources.

The company's extensive content library, including brands like Fox News Media and Fox Sports, is a prime asset, driving audience engagement and revenue. In Q1 2024, Fox reported $1.3 billion in advertising revenue, showcasing the commercial power of its content portfolio.

Key on-air talent and personalities are essential for attracting and retaining viewers, particularly in competitive news and sports markets. In 2024, Fox News maintained its strong ratings, with shows like The Five drawing millions, highlighting the enduring value of its established talent.

Fox's robust distribution network, encompassing owned stations, cable infrastructure, and digital platforms like Tubi, ensures broad audience access. Tubi's growth is notable, with 73.5 million monthly active users in FY23, up 20% year-over-year.

| Key Resource | Description | 2024/Recent Data |

| Broadcast Licenses & Spectrum | Exclusive rights for content transmission; barrier to entry. | FCC spectrum management ongoing in 2024. |

| Content Library & IP | Valuable brands (Fox News, Fox Sports) driving engagement. | Q1 2024 Advertising Revenue: $1.3 billion. |

| On-Air Talent | Personalities driving viewership and brand loyalty. | Fox News' The Five consistently draws millions in 2024. |

| Distribution Network | Owned stations, cable, digital platforms (Tubi). | Tubi FY23: 73.5M MAUs (up 20% YoY). |

Value Propositions

Fox News Media delivers news and analysis that is both timely and relevant, often infused with strong opinions. This value proposition is built around providing breaking news and political commentary, appealing directly to a specific audience segment that values particular viewpoints.

The network's commitment to delivering these perspectives has solidified its position, with Fox News consistently ranking as a top-rated national cable news channel. For instance, in 2024, it continued to attract a significant viewership, often leading in key demographic ratings for news programming.

Fox Sports' premier live sports programming is a cornerstone value proposition, offering access to major events and exclusive broadcasting rights. This attracts a dedicated audience of sports enthusiasts who tune in for high-profile competitions.

Key events like the Super Bowl, MLB World Series, and NFL games are broadcast by Fox Sports, drawing massive viewership and enabling premium advertising revenue. In 2023, Super Bowl LVII on Fox garnered an average of 115.1 million viewers, highlighting the network's ability to command large audiences.

Fox offers a wide array of entertainment through its AVOD and SVOD platforms, including Tubi and Fox One. These services provide consumers with diverse content like movies, TV series, and unscripted shows, catering to varying preferences and budgets.

The availability of both ad-supported and subscription models ensures accessibility for a broad audience, particularly appealing to cord-cutters and cord-nevers seeking flexible viewing options.

Tubi, a key component of Fox's strategy, has demonstrated significant growth, underscoring the effectiveness of its diverse entertainment proposition in the evolving media landscape.

Local Community Connection

Fox Television Stations enhance their value by deeply connecting with local communities. They achieve this by offering news that directly addresses local concerns and by broadcasting community-focused programming, alongside popular syndicated shows. This commitment to local relevance sets them apart from national-only networks.

This localized approach is crucial for building strong relationships within specific geographic markets. For instance, in 2024, Fox owned-and-operated stations across the US, such as WNYW in New York and KTTV in Los Angeles, continued to be primary conduits for Fox's entertainment and news content tailored for their respective regions.

- Local News Dominance: Fox stations often rank highly in local news viewership, especially in key demographic segments.

- Community Engagement: Programming often includes segments that highlight local events, charities, and issues, fostering a sense of belonging.

- Syndicated Content Appeal: While local, they also leverage popular syndicated shows that resonate with a broad audience within the market.

- Market Differentiation: This local focus provides a unique selling proposition, attracting advertisers seeking to reach specific, engaged local consumer bases.

Targeted Advertising Opportunities for Businesses

For businesses looking to reach a broad yet specific audience, Fox provides a powerful platform. Advertisers gain access to large, engaged viewerships across Fox's extensive network of news, sports, and entertainment channels. This allows for highly targeted campaigns, ensuring marketing efforts connect with the right demographics.

The value proposition for brands is clear: effective marketing solutions that leverage Fox's reach. This is demonstrated by Fox Corporation's reported advertising revenue growth. For fiscal year 2025, the company saw a notable increase in advertising income, underscoring the effectiveness of its targeted advertising opportunities.

- Targeted Audience Reach: Access to diverse demographics across news, sports, and entertainment.

- Effective Marketing Solutions: Ability to create campaigns that resonate with specific consumer groups.

- Revenue Growth: Fox Corporation's advertising revenue increased in fiscal 2025, validating the platform's value.

- Brand Connection: Opportunity for brands to build strong connections with engaged viewers.

Fox's value propositions cater to diverse consumer needs, offering opinionated news, premier live sports, and accessible entertainment across various platforms. This multi-faceted approach ensures broad market appeal and distinct advantages for advertisers seeking targeted reach.

The company's commitment to local relevance through its television stations further strengthens its value by fostering community connections and providing localized content. This blend of national reach and local engagement solidifies Fox's position as a comprehensive media provider.

Advertisers benefit from Fox's extensive audience, enabling effective marketing campaigns that connect with specific demographics across its news, sports, and entertainment offerings. This targeted approach is validated by consistent advertising revenue growth.

Fox Corporation reported strong advertising revenue growth in fiscal year 2025, demonstrating the effectiveness of its platform for brands. For example, its sports division consistently draws significant viewership for major events, offering prime advertising opportunities.

| Value Proposition Area | Key Offering | Audience Appeal | Advertiser Benefit |

|---|---|---|---|

| News & Opinion | Timely news, political commentary, strong viewpoints | Viewers seeking specific perspectives | Targeted reach for politically engaged demographics |

| Live Sports | Exclusive broadcasting rights for major events | Sports enthusiasts, general entertainment viewers | High viewership for premium advertising slots |

| Entertainment Platforms (AVOD/SVOD) | Diverse content library (movies, TV series) on Tubi, Fox One | Cord-cutters, budget-conscious viewers, diverse tastes | Broad consumer reach, flexible ad/subscription models |

| Local Television Stations | Localized news, community programming | Residents within specific geographic markets | Targeted local advertising, community engagement |

Customer Relationships

Fox cultivates direct consumer connections through its digital ecosystem, including Tubi and FOX Nation, with the forthcoming FOX One streaming service further strengthening this approach. These channels facilitate tailored content suggestions and direct user interaction, boosting engagement and loyalty.

The upcoming FOX One platform is designed with a highly personalized user interface, aiming to deepen the relationship with each viewer by understanding and catering to individual preferences.

This direct digital engagement strategy allows Fox to gather valuable user feedback, fostering a sense of community and enhancing the overall viewing experience, which is crucial for subscription-based models.

Maintaining robust business-to-business relationships with cable and satellite distributors is paramount for Fox. These partnerships are the backbone of content distribution, requiring continuous negotiation, technical support, and joint marketing initiatives to ensure seamless delivery and favorable terms for all parties involved.

Fox's commitment to these vital partnerships was underscored by its recent affiliation renewal with Sinclair. This agreement, crucial for reaching a broad audience, reflects the ongoing importance of these B2B relationships in the media landscape.

Fox maintains robust advertiser sales and account management by employing dedicated teams who understand client needs and offer customized advertising solutions. This focus on tailored strategies and data-driven insights aims to optimize campaign performance and build lasting relationships.

In 2024, advertising revenue remains a critical component of Fox's financial success, with the company actively leveraging its platforms to deliver value to advertisers. These relationships are foundational, ensuring continued investment in Fox's media properties.

Audience Interaction and Feedback

Fox actively seeks audience interaction through multiple avenues. This includes robust social media engagement, where platforms like X (formerly Twitter) and Facebook serve as key channels for real-time discussions and feedback. For instance, Fox News Digital reported significant social media reach in early 2024, with millions of engagements across its platforms.

Call-in shows, particularly within the news division, offer a direct line for viewers to voice opinions and ask questions, fostering a more immediate connection. Interactive features on digital platforms, such as polls and comment sections, further allow Fox to gauge audience sentiment and gather valuable feedback.

- Social Media Engagement: Fox News Digital consistently ranks high in social media interactions, demonstrating a strong connection with its digital audience.

- Call-In Shows: Direct viewer participation through call-in programs allows for immediate feedback on current events and programming.

- Interactive Digital Features: Polls and comment sections on Fox's websites and apps provide ongoing sentiment analysis and content direction.

- Content Adaptation: Feedback gathered through these channels directly informs programming adjustments and content strategy to enhance viewer satisfaction and community building.

Public Relations and Media Relations

Fox actively manages its public image through strategic public relations and media relations, aiming to foster positive perceptions and maintain strong connections with the press. This continuous effort involves disseminating company updates, promptly addressing media inquiries, and proactively shaping the public narrative surrounding its diverse portfolio of brands and content. For instance, in early 2024, Fox Corporation reported a 3% increase in revenue for its fiscal second quarter, partly attributed to strong advertising performance across its news and sports segments, underscoring the impact of effective brand communication.

Maintaining a robust reputation is paramount for Fox, influencing consumer trust and advertiser confidence. The company leverages its investor relations website as a key channel to provide transparent and timely information to stakeholders, including financial performance, strategic initiatives, and corporate governance. This commitment to accessibility helps build credibility and manage expectations within the financial community.

- Brand Narrative Control: Fox works to shape how its news, sports, and entertainment offerings are perceived by the public and media.

- Stakeholder Communication: The investor relations website is a crucial tool for sharing financial data and corporate updates with investors.

- Reputation Management: Proactive engagement with media and consistent communication are key to upholding Fox's brand image.

- Market Perception: Positive media relations can directly influence market sentiment and investor confidence in Fox's business.

Fox nurtures customer relationships through a multi-pronged approach, blending direct-to-consumer digital platforms like Tubi and the upcoming FOX One with essential business-to-business partnerships. This strategy aims to foster loyalty, gather feedback, and ensure widespread content distribution.

Channels

Broadcast Television Networks are a core distribution channel for Fox, reaching a vast audience across nearly all U.S. markets. This channel is particularly crucial for delivering live content like sports and news, leveraging its extensive network of owned and operated stations and affiliates.

In 2024, Fox Corporation continued to rely on its broadcast network to deliver a wide array of programming, from primetime entertainment to live sports events. This traditional media segment remains a significant driver of viewership and advertising revenue, underscoring its enduring importance in the media landscape.

Cable television networks like Fox News, Fox Business, Fox Sports (FS1, FS2), and the Big Ten Network are crucial distribution channels for Fox Corporation. These channels are primarily accessed by consumers through traditional pay-TV bundles offered by cable and satellite providers.

This widespread distribution via cable and satellite is a cornerstone of Fox's strategy, ensuring broad reach across millions of households. In 2024, the pay-TV market, while evolving, still represents a significant portion of media consumption for many demographics.

The revenue generated from affiliate fees, paid by these distributors for the right to carry Fox's channels, forms a substantial and reliable income stream for the company. This model underpins the financial health of Fox's media properties.

Fox's owned and operated local television stations are vital components of its business model, acting as direct conduits to regional viewers for local news, syndicated shows, and network programming. These stations offer unique hyper-local content and valuable advertising avenues. As of 2024, Tubi, Fox's streaming service, integrates over 100 of these local station feeds, extending their reach and monetization potential.

Direct-to-Consumer (DTC) Streaming Platforms

Fox's direct-to-consumer strategy is primarily built around its ad-supported video-on-demand (AVOD) service, Tubi, and the forthcoming subscription-based platform, Fox One. These channels are crucial for bypassing traditional media gatekeepers and establishing a direct relationship with viewers, aligning with shifting consumer preferences towards digital content consumption. Tubi, for instance, has demonstrated significant growth, reaching over 200 million app downloads by early 2024, highlighting the potential of AVOD models.

The upcoming launch of Fox One in August 2025 signifies Fox's commitment to expanding its digital footprint and offering a premium content experience. This move is designed to capture a larger share of the burgeoning subscription streaming market, which saw global revenues exceeding $100 billion in 2024. By offering exclusive content and a direct connection, Fox aims to cultivate a loyal subscriber base.

- Tubi's Reach: Over 200 million app downloads by early 2024.

- Fox One Launch: Scheduled for August 2025.

- Subscription Market Growth: Global revenues surpassed $100 billion in 2024.

- Strategic Importance: Bypassing distributors and directly engaging consumers.

Digital and Social Media Platforms

Fox extensively utilizes digital and social media platforms to broaden its content distribution and audience engagement. This includes dedicated websites, mobile applications like the Fox News app and Fox Sports app, and a significant presence on platforms such as YouTube, Facebook, and X (formerly Twitter). These channels are crucial for reaching a wider audience, offering exclusive or supplementary content, and fostering direct interaction with viewers and readers.

In 2024, Fox News Digital continued to demonstrate robust multiplatform engagement, with its digital properties attracting millions of unique visitors monthly. For instance, Fox News.com consistently ranks among the top news websites, driving substantial traffic and ad revenue. The Fox Sports app also plays a vital role, providing live streaming and on-demand content, further solidifying Fox's digital footprint.

- Website Traffic: Fox News.com averaged over 100 million monthly unique visitors in early 2024, a key metric for digital ad sales.

- App Engagement: The Fox News app and Fox Sports app reported millions of downloads and consistent user activity, indicating strong mobile reach.

- Social Media Reach: Fox's aggregated social media presence across platforms like YouTube and Facebook boasts hundreds of millions of followers, facilitating broad content dissemination and audience interaction.

- Video Consumption: YouTube channels associated with Fox News and Fox Sports generated billions of video views in 2023, highlighting the importance of video content in their digital strategy.

Fox's distribution strategy is multifaceted, encompassing traditional broadcast and cable networks, alongside a growing digital presence. This hybrid approach ensures broad audience reach while adapting to evolving media consumption habits. The company leverages its owned and operated local stations, providing a direct link to regional audiences and valuable advertising opportunities.

The company's digital channels, particularly the AVOD service Tubi and the upcoming Fox One subscription platform, are central to its direct-to-consumer ambitions. Tubi's significant user growth, surpassing 200 million app downloads by early 2024, underscores the viability of ad-supported streaming. Fox One's planned August 2025 launch signals a strategic push into the premium subscription market, which saw global revenues exceed $100 billion in 2024.

| Channel Type | Key Platforms/Examples | 2024/2025 Data Points |

|---|---|---|

| Broadcast Television | Fox Broadcasting Company | Core for live events (sports, news); significant advertising revenue driver. |

| Cable Television | Fox News, Fox Business, FS1, Big Ten Network | Crucial for pay-TV bundles; affiliate fees are a stable income stream. |

| Local Stations | Fox Owned & Operated Stations | Direct regional reach; Tubi integrates over 100 local station feeds in 2024. |

| Digital/DTC | Tubi (AVOD), Fox One (Subscription) | Tubi: >200M app downloads (early 2024); Fox One launch: Aug 2025. |

| Digital/Social Media | Fox News Digital, Fox Sports App, YouTube, Facebook | Fox News.com: >100M unique monthly visitors (early 2024); strong social media following. |

Customer Segments

Mass market TV viewers represent a significant portion of Fox's audience, encompassing individuals who regularly tune into its broadcast and cable channels for news, sports, and entertainment. This segment is characterized by its appreciation for broadly appealing content that is easily accessible through traditional television platforms.

Fox reaches these viewers primarily through extensive advertising campaigns across its own networks and other media channels, leveraging its established brand recognition. In 2024, Fox Corporation reported that its television segment, which includes its broadcast network and owned-and-operated stations, generated approximately $13.3 billion in revenue, underscoring the financial importance of this broad viewership.

News Consumers represent a core audience segment, primarily tuning in for news, political commentary, and analysis of current events. This group is well-served by both the Fox News Channel and the Fox Business Network, often seeking specific perspectives and detailed information.

This dedicated viewership demonstrates a strong engagement with financial news. For instance, Fox News Digital reported its third best month ever in April 2025, reaching a significant number of total digital multiplatform unique visitors, underscoring the audience's appetite for timely and relevant content.

Sports enthusiasts and fans represent a core customer segment for Fox, driven by their passion for live sporting events, breaking sports news, and in-depth analysis. This group primarily engages with Fox's dedicated sports channels, including Fox Sports, FS1, FS2, and the Big Ten Network, demonstrating a strong preference for premium sports content.

This highly engaged audience is incredibly valuable for advertisers seeking to reach a dedicated and receptive demographic. In 2023, Fox Sports solidified its position as an industry leader, consistently delivering high viewership numbers for major sporting events, underscoring the segment's significant market influence.

Cord-Cutters and Cord-Nevers

Cord-cutters and cord-nevers represent a significant and growing customer segment for Fox. This group actively avoids or has abandoned traditional cable or satellite television, opting instead for content delivered via the internet. By 2024, it's estimated that over 60 million U.S. households will have cut the cord, a trend that continues to accelerate.

Fox is strategically targeting this demographic through its ad-supported streaming service, Tubi. Tubi saw substantial growth in 2023, with total viewing hours increasing by 30% year-over-year, demonstrating its appeal to audiences seeking flexible content consumption. The forthcoming Fox One direct-to-consumer service is specifically designed to capture this cordless market, offering a curated selection of Fox's premium content.

- Growing Market: Over 60 million U.S. households are projected to have cut the cord by 2024.

- Tubi's Success: Fox's ad-supported platform, Tubi, experienced a 30% rise in viewing hours in 2023.

- Direct-to-Consumer Strategy: Fox One aims to directly serve the needs of the cord-nevers and cord-cutters.

- Content Diversification: This segment seeks content across various digital platforms, aligning with Fox's streaming initiatives.

Advertisers and Brands

Advertisers and brands represent a core customer segment for Fox, leveraging its extensive reach to connect with specific demographics and broad audiences for marketing and promotional efforts. This group prioritizes Fox's vast distribution network, its diverse array of content across various verticals, and its sophisticated data-driven advertising solutions that enable targeted campaign delivery.

The value proposition for these advertisers is amplified by Fox's ability to deliver substantial viewership, particularly during high-profile events. For instance, political advertising cycles and major sporting events like the Super Bowl are significant revenue drivers, showcasing the platform's capacity to attract massive, engaged audiences. In 2023, Fox Corporation reported advertising revenue of approximately $10.2 billion, underscoring the financial significance of this segment.

- Extensive Reach: Access to millions of viewers across Fox's broadcast and cable networks.

- Targeted Demographics: Ability to reach specific consumer groups through tailored content and advertising placements.

- High-Impact Events: Opportunities for significant brand exposure during major events like political campaigns and the Super Bowl, which command premium advertising rates.

Businesses and brands are a crucial customer segment, utilizing Fox's platforms for advertising and brand building. They value the extensive reach and the ability to target specific demographics through Fox's diverse content offerings. This segment is vital for advertising revenue, which is a cornerstone of Fox's business model.

In 2023, Fox Corporation's advertising revenue reached approximately $10.2 billion, highlighting the significant financial contribution of this group. Fox's ability to deliver large, engaged audiences during major events like the Super Bowl or political advertising cycles offers premium opportunities for these businesses.

| Customer Segment | Key Value Proposition | 2023 Financial Impact |

| Advertisers and Brands | Extensive reach, targeted demographics, high-impact event exposure | ~$10.2 billion in advertising revenue |

Cost Structure

A significant chunk of Fox's expenses goes into securing rights for popular content, especially live sports. They also spend heavily on creating their own news, sports, and entertainment shows.

These costs are substantial, particularly the amortization of sports programming rights and the expenses involved in producing shows. For instance, major sporting events like the Super Bowl represent a considerable investment.

Talent salaries, particularly for high-profile on-air personalities and sports commentators, represent a significant cost for Fox. Attracting and retaining these key individuals is crucial for drawing and retaining viewership, making compensation a major operational expense.

In 2024, Fox Corporation's compensation expenses for its top executives and talent likely remained substantial, reflecting the competitive landscape for media personalities. While specific figures for on-air talent are often not broken out, the company's overall selling, general, and administrative expenses, which include talent costs, are a key indicator of these expenditures.

Broadcast and distribution expenses are significant for Fox, encompassing the costs of transmitting content. This includes maintaining crucial broadcast infrastructure, such as studios and transmission towers, as well as managing satellite uplinks for wider reach. In 2024, companies like Fox continue to invest heavily in these areas to ensure widespread content delivery.

Retransmission fees paid to local affiliates are another substantial cost component, reflecting agreements for Fox content to be aired on various local channels. Furthermore, expenses related to distributing content across a multitude of cable, satellite, and increasingly, digital platforms, add to this category. The shift towards digital distribution is notably increasing these associated costs.

Technology and Digital Platform Development

Fox's cost structure heavily features investments in technology and digital platform development. This includes significant spending on the infrastructure, software, and ongoing maintenance required for platforms like Tubi and Fox One. These costs are essential for improving user experience, leveraging data analytics, and expanding the company's digital reach.

The growth of Tubi, in particular, has driven higher operational costs within this category. For instance, in fiscal year 2023, Fox reported that its direct-to-consumer segment, which includes Tubi, saw increased expenses related to content, marketing, and technology as the service expanded its user base and content library.

- Technology Infrastructure: Costs for servers, cloud hosting, and network capabilities supporting digital operations.

- Software Development & Maintenance: Expenses for building new features, updating existing software, and ensuring platform stability.

- Data Analytics & AI: Investment in tools and personnel for analyzing user data and improving personalization.

- User Experience Enhancements: Spending on design, testing, and implementation to optimize user interfaces and engagement.

Marketing and Promotional Activities

Fox allocates substantial resources to marketing and promotional activities across its diverse networks, programs, and digital platforms. These investments are crucial for attracting and retaining both viewers and advertisers, ensuring strong brand visibility and audience engagement.

These efforts encompass a wide range of initiatives, including extensive advertising campaigns, strategic public relations, and engaging promotional events. For example, Fox Corporation reported $1.07 billion in selling, general, and administrative expenses in the third quarter of fiscal year 2024, a significant portion of which is dedicated to these outreach endeavors.

- Advertising Campaigns: Broad-reaching advertisements across various media to promote new and existing content.

- Public Relations: Managing media relations and crafting positive narratives for networks and shows.

- Promotional Events: Hosting or sponsoring events to generate buzz and direct audience interaction.

- Digital Marketing: Targeted online advertising and social media engagement to reach specific demographics.

Fox remains optimistic about its growth trajectory, projecting continued investment in these areas to fuel its expansion in fiscal year 2025.

The cost structure of Fox is heavily influenced by content acquisition and production, with significant outlays for sports rights and original programming. These expenses are fundamental to their business model, directly impacting their ability to attract and retain audiences.

Operational costs also include substantial investments in technology and digital platforms like Tubi, alongside extensive marketing and promotional efforts. These expenditures are vital for maintaining a competitive edge and expanding their reach in the evolving media landscape.

Talent compensation for key on-air personalities and executives forms another major cost center. In fiscal year 2024, Fox Corporation's selling, general, and administrative expenses, which encompass these talent costs, were a significant indicator of these ongoing investments.

| Cost Category | Description | 2024 Relevance |

|---|---|---|

| Content Rights & Production | Securing rights for sports, producing original shows. | Major driver of expenses; Super Bowl rights are a prime example. |

| Talent Compensation | Salaries for executives and on-air personalities. | Crucial for viewership; reflected in SG&A expenses. |

| Technology & Digital Platforms | Infrastructure for Tubi, Fox One, data analytics. | Essential for user experience and digital expansion. |

| Marketing & Promotion | Advertising, PR, events to boost viewership and ad sales. | Significant investment; $1.07 billion in Q3 FY24 SG&A highlights this. |

Revenue Streams

Advertising revenue is the cornerstone of Fox's business model, stemming from the sale of ad spots across its extensive media empire. This includes its broadcast network, popular cable channels like Fox News and Fox Sports, and its growing digital presence, notably Tubi.

The financial success of this stream is directly tied to viewership figures, the draw of major live events such as the Super Bowl, and the significant influx of revenue from political advertising, particularly during election years. In fiscal year 2025, Fox reported a robust 26% increase in advertising revenues, underscoring the continued strength and adaptability of this core income source.

Fox generates significant revenue through affiliate fees and retransmission consent fees. These are payments collected from cable, satellite, and other video distributors for the right to carry Fox's broadcast and cable channels.

This revenue stream is both stable and shows consistent growth. For instance, affiliate fee revenues saw a healthy increase of 5% in fiscal year 2025, highlighting its importance to Fox's financial model.

Subscription revenue from direct-to-consumer (DTC) offerings like FOX Nation and the recently introduced FOX One is a key growth area for Fox. This strategy directly targets consumers moving away from traditional cable packages.

The new FOX One subscription service is priced at $20 per month, providing a clear revenue stream as Fox continues to build its digital presence and attract cord-cutters.

Sports Sublicensing Revenue

Sports sublicensing revenue is a significant income stream for Fox, generated by licensing its valuable sports broadcasting rights to other media companies. This strategy allows Fox to leverage its extensive sports content portfolio, reaching wider audiences and generating additional revenue beyond its primary broadcasts. In fiscal year 2025, this segment, along with other miscellaneous revenues, saw a substantial increase of 47%, highlighting its growing importance.

- Monetization of Sports Rights: Fox earns income by licensing its sports broadcasting rights to third-party media entities, expanding the reach of its sports content.

- Portfolio Leverage: This revenue stream allows Fox to capitalize on its broad sports portfolio, generating value beyond direct broadcasting.

- Growth Indicator: Other revenues, including sports sublicensing, experienced a robust 47% increase in fiscal year 2025, underscoring its financial momentum.

Content Licensing and Other Revenues

Fox generates revenue through content licensing, selling rights to its produced shows and films to various third-party platforms and international broadcasters. This diversifies its income beyond its own distribution channels.

Additionally, the company benefits from other miscellaneous revenue streams. These can include providing production services to external clients or generating income from the sale of digital products related to its content.

This segment is a significant contributor to Fox's overall financial performance. Notably, other revenues experienced a substantial increase of 33% in the fourth quarter of fiscal year 2025, highlighting its growing importance.

- Content Licensing: Revenue from selling broadcast and streaming rights to Fox-produced content.

- International Sales: Income derived from licensing content to overseas markets.

- Production Services: Fees earned for providing production capabilities to external entities.

- Digital Product Sales: Revenue from selling digital goods, such as apps or merchandise, linked to Fox's intellectual property.

Fox's revenue streams are diverse, encompassing advertising, affiliate fees, subscriptions, and content licensing. Advertising remains a primary driver, boosted by strong viewership and political ad spending. Affiliate and retransmission fees provide a stable, growing income base from distributors. Direct-to-consumer subscriptions, like FOX Nation and FOX One, represent a key growth area as the company adapts to changing consumer habits.

| Revenue Stream | Description | Fiscal Year 2025 Performance |

|---|---|---|

| Advertising | Sale of ad spots across broadcast, cable, and digital platforms. | 26% increase in advertising revenues. |

| Affiliate & Retransmission Fees | Payments from distributors for carrying Fox channels. | 5% increase in affiliate fee revenues. |

| Subscription Revenue (DTC) | Direct consumer payments for services like FOX Nation and FOX One. | FOX One priced at $20/month, targeting cord-cutters. |

| Content Licensing & Other | Selling broadcast rights, international sales, production services, and digital products. | 47% increase in sports sublicensing and other revenues; 33% increase in other revenues in Q4 FY25. |

Business Model Canvas Data Sources

The Business Model Canvas is built using financial data, market research, and strategic insights. These sources ensure each canvas block is filled with accurate, up-to-date information.