Fox PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fox Bundle

Uncover the hidden forces shaping Fox's future with our expert PESTLE analysis. From evolving political landscapes to technological advancements, this comprehensive report provides the critical insights you need to anticipate market shifts and capitalize on opportunities. Don't get left behind; download the full version now and gain a decisive strategic advantage.

Political factors

Fox Business operates under the watchful eye of the FCC, which governs broadcasting licenses and content. For instance, in 2024, the FCC continued its review of media ownership rules, a process that could potentially alter the landscape for companies like Fox. Changes in these regulations directly influence Fox's ability to expand its reach and shape its content strategy.

The quadrennial U.S. presidential election cycle is a significant revenue driver for media companies like Fox. Its local television stations and FOX News Media are particularly well-positioned to capitalize on the surge in political advertising spending. This electoral calendar directly impacts Fox's top line, creating predictable peaks in advertising income.

Looking ahead to fiscal 2025, the advertising landscape is projected to be particularly strong, bolstered by the presidential election and the Super Bowl. These high-profile events attract substantial advertising budgets, offering a direct financial benefit to Fox Corporation. This anticipated revenue boost highlights the importance of these quadrennial events to the company's financial health.

However, this reliance on political advertising also introduces a degree of cyclicality and vulnerability. Fluctuations in election spending, candidate engagement, and overall political climate can directly impact Fox's advertising revenue streams, making its performance somewhat tied to the ebb and flow of the electoral calendar.

Fox News, a cornerstone of Fox Corporation, navigates a deeply divided political arena, often acting as a central information hub for a particular political leaning. This strategic focus can amplify its audience and sway within that demographic, yet it simultaneously invites scrutiny, potential boycotts, and legal entanglements stemming from accusations of bias or the spread of misinformation. For instance, in Q1 2024, Fox News Media reported revenues of $794 million, demonstrating its significant economic footprint within this polarized landscape.

Lobbying and Political Contributions

Fox Corporation actively participates in the political arena through lobbying and campaign contributions to shape policies affecting its core business. These efforts focus on critical areas such as First Amendment protections, retransmission consent negotiations, and intellectual property rights, all vital for its media operations.

In 2024, Fox Government Relations was engaged in advocating for a broad spectrum of policy matters. The company's Political Action Committee demonstrated a commitment to a balanced contribution approach, supporting candidates from both major political parties to foster relationships across the political spectrum.

- Lobbying Focus: First Amendment rights, retransmission consent, intellectual property.

- 2024 Advocacy: Wide array of policy issues addressed by Fox Government Relations.

- Political Contributions: Balanced strategy between the two major political parties via its PAC.

- Objective: To cultivate a favorable legislative and regulatory landscape for Fox Corporation's business interests.

International Relations and Geopolitics

While Fox Corporation's core operations are in the United States, its news divisions are significantly impacted by global geopolitical shifts. Major international conflicts or shifts in diplomatic alliances can alter news agendas and influence audience engagement with foreign affairs coverage. For instance, ongoing tensions in Eastern Europe or the Middle East directly shape the narrative and demand for news content.

Fox Corporation's international presence, such as Fox Sports Mexico, means it's directly exposed to the political climate of other nations. Changes in trade relations, regulatory environments, or even local political stability in countries where Fox operates can affect its business operations and content distribution strategies. The company's ability to secure broadcast rights or manage local operations is intrinsically linked to the political landscape of these regions.

The company's global reach means it must navigate a complex web of international relations. For example, shifts in media ownership regulations in key international markets could necessitate strategic adjustments to its content licensing and distribution models. As of early 2024, several countries are reviewing their foreign investment rules in media, a trend that Fox must closely monitor.

- Geopolitical Events: Major international conflicts, such as the ongoing situation in Ukraine, directly influence the demand for news and the framing of global events by Fox News.

- International Operations: Fox Sports Mexico's performance is tied to the political and economic stability within Mexico, impacting advertising revenue and viewership.

- Regulatory Landscape: Evolving media regulations in countries where Fox has a presence, for example, potential changes in content quotas or ownership limits, require continuous monitoring and adaptation.

- Global Partnerships: International relations can affect the viability of cross-border content partnerships and the ability to distribute content globally.

Political factors significantly shape Fox Corporation's operational environment, from regulatory oversight to revenue generation. The company's reliance on political advertising, particularly during election years, creates predictable revenue surges, as seen in the projected strength for fiscal 2025 due to the presidential election and Super Bowl.

Fox actively engages in lobbying and political contributions to influence policy, focusing on First Amendment rights and intellectual property. In 2024, its Political Action Committee maintained a balanced approach, contributing to both major parties to foster broad political relationships.

Global geopolitical shifts also impact Fox's news divisions, influencing coverage of international affairs and audience engagement, while its international operations, like Fox Sports Mexico, are directly tied to the political stability and regulatory environments of those host nations.

| Factor | Impact on Fox Corporation | 2024/2025 Relevance |

| Electoral Cycles | Drives political advertising revenue | Strong presidential election year in 2024/2025 |

| Lobbying & PAC Contributions | Shapes regulatory and legislative landscape | Continued advocacy on key policy issues in 2024 |

| Geopolitical Events | Influences news agenda and content demand | Ongoing global conflicts shape international news coverage |

| International Regulations | Affects global operations and distribution | Monitoring of foreign investment rules in media markets |

What is included in the product

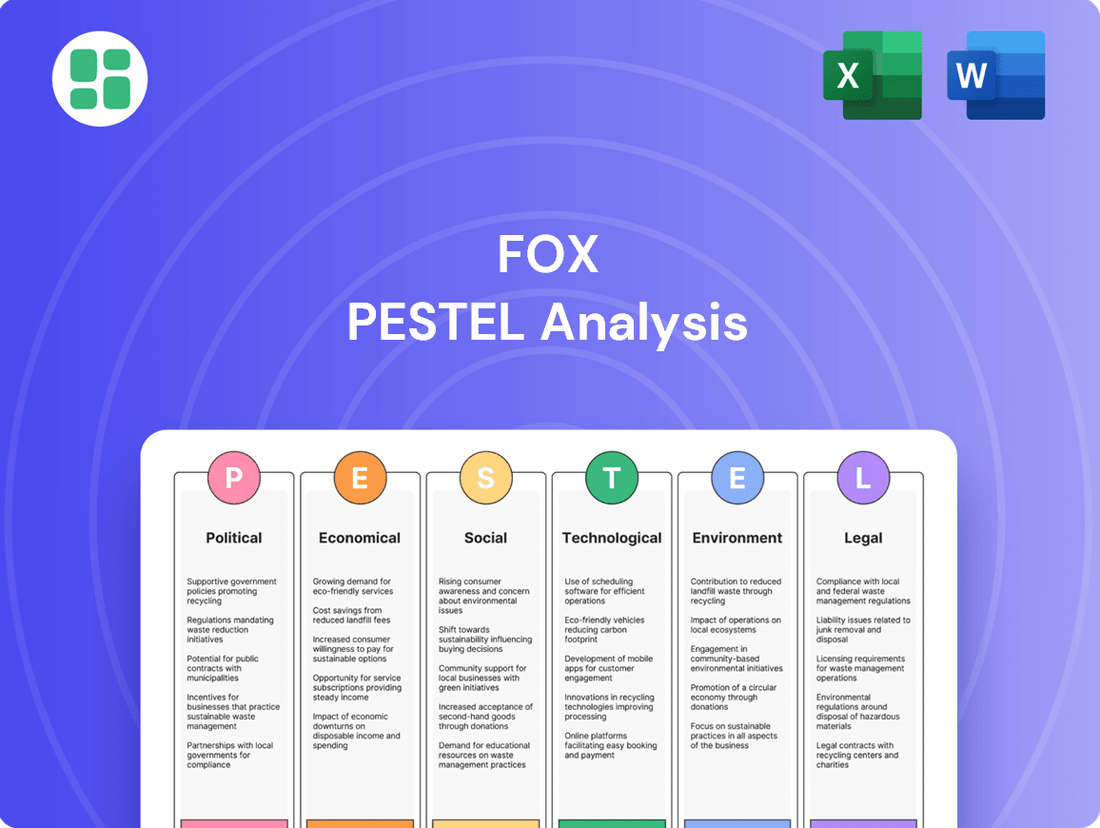

The Fox PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting the organization across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A PESTLE analysis by Fox provides a structured framework to identify and understand external factors, alleviating the pain of navigating complex market dynamics and unforeseen challenges.

Economic factors

Advertising revenue is a crucial income stream for Fox Corporation, making its performance closely tied to the overall health of the advertising market. Economic slowdowns or shifts in how companies allocate their advertising budgets can significantly impact Fox's top line.

While digital advertising shows consistent growth, broader market trends, such as increased competition from streaming services and evolving advertiser preferences, play a vital role in Fox's financial well-being. These factors directly influence the demand for advertising slots across Fox's various media properties.

For example, Fox reported a decline in advertising revenues for its third quarter of fiscal year 2024 compared to the same period in the previous year. This decrease was partly attributed to the absence of a major sporting event, the Super Bowl, which typically drives substantial advertising income.

Affiliate fee revenues from cable and satellite distributors remain a foundational, albeit evolving, income source for Fox. In fiscal year 2023, Fox Corporation reported that its affiliate and advertising revenues from its TV segment reached $10.3 billion, showcasing the ongoing importance of these agreements. This stability is bolstered by successful contract renewals and negotiated rate increases, particularly for its popular television and cable network programming.

However, the persistent trend of cord-cutting and the increasing migration of viewers to streaming platforms pose a significant long-term challenge to this traditional revenue model. While Fox has seen consistent growth in affiliate fees, the underlying subscriber declines in pay-TV services create a headwind that the company must actively manage through its own direct-to-consumer strategies.

Robust economic growth, particularly in developed markets, directly fuels consumer discretionary spending, a critical driver for the media and entertainment sector. As economies expand, consumers tend to allocate more of their income towards entertainment, from streaming subscriptions to live events.

The global entertainment and media industry is expected to see continued growth, with PwC's Global Entertainment & Media Outlook 2024-2028 forecasting a compound annual growth rate (CAGR) of 3.1% through 2028, reaching $3.3 trillion. This steady, albeit moderating, expansion reflects the underlying health of global economies and consumer confidence.

This economic backdrop significantly influences advertising budgets, as businesses increase spending to capture a larger share of consumer wallets during periods of prosperity. Conversely, economic slowdowns often lead to reduced advertising spend and a more cautious approach to consumer entertainment purchases.

Content Production and Acquisition Costs

Content production and acquisition costs are a significant hurdle for Fox. The company's investment in premium content, particularly live sports rights and its own original series, represents a substantial portion of its expenses. For instance, Fox reported an increase in its programming rights amortization expense in recent fiscal quarters, directly reflecting these escalating acquisition costs.

The ability to effectively manage these outlays is key to Fox's financial health. Balancing the substantial investment required for high-demand content against the revenue it generates is a constant challenge. This dynamic directly influences the company's profit margins and overall financial performance.

- Rising Sports Rights: The cost of acquiring rights for major sporting events continues to climb, putting pressure on Fox's content budget.

- Original Programming Investment: Significant capital is allocated to developing and producing original series to attract and retain viewers.

- Amortization Impact: Increased amortization of these content assets directly impacts reported earnings, as seen in recent financial reporting.

- Revenue Generation Challenge: Translating these content investments into sufficient advertising and subscription revenue is critical for profitability.

Inflationary Pressures and Operational Costs

Inflationary pressures directly impact Fox's operational costs. Rising expenses for labor, technology infrastructure, and marketing can erode profit margins. For instance, the news publishing sector, a key part of the media landscape, has seen significant increases in editorial and content production costs.

Despite Fox Corporation reporting robust financial performance, including a notable increase in Adjusted EBITDA for fiscal year 2024, effectively managing these escalating operational costs remains critical for sustained profitability. This requires strategic cost control measures across all segments of the business.

- Rising Input Costs: Inflation drives up the cost of essential inputs for media production, from talent salaries to digital advertising spend.

- Erosion of Purchasing Power: Higher inflation can reduce consumer discretionary spending, potentially impacting advertising revenue and subscription growth.

- Fox's Fiscal Year 2024 Performance: Fox reported a significant increase in Adjusted EBITDA, demonstrating resilience, but ongoing cost management is key to maintaining this trend.

Economic factors significantly influence Fox Corporation's revenue streams, particularly advertising and affiliate fees. While a growing global economy generally boosts consumer spending and advertising budgets, inflation and rising content costs present ongoing challenges.

The media and entertainment industry is projected to grow, with PwC forecasting a 3.1% CAGR through 2028, indicating a generally positive economic outlook for the sector. However, Fox's fiscal year 2024 results showed a decline in advertising revenue in Q3 compared to the prior year, partly due to the absence of major sporting events like the Super Bowl, highlighting the volatility within this sector.

Despite these pressures, Fox reported a notable increase in Adjusted EBITDA for fiscal year 2024, demonstrating effective cost management. The company's affiliate and advertising revenues from its TV segment were $10.3 billion in fiscal year 2023, underscoring the foundational importance of these revenue sources.

| Economic Factor | Impact on Fox | Relevant Data/Observation |

|---|---|---|

| Economic Growth | Boosts consumer spending and advertising budgets | Global Entertainment & Media industry CAGR of 3.1% expected through 2028 (PwC) |

| Inflation | Increases operational costs (labor, technology) | News publishing sector costs for editorial and content production have risen significantly. |

| Advertising Market | Directly impacts Fox's top line | Q3 FY24 advertising revenue declined year-over-year, partly due to absence of Super Bowl. |

| Content Costs | Significant expense for Fox | Fox reported increased programming rights amortization expense in recent quarters. |

Full Version Awaits

Fox PESTLE Analysis

The preview you see here is the exact Fox PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real snapshot of the product you’re buying, covering Political, Economic, Social, Technological, Legal, and Environmental factors impacting the fox industry, delivered exactly as shown, no surprises.

The content and structure shown in this preview is the same comprehensive Fox PESTLE Analysis document you’ll download after payment, providing a detailed strategic overview.

Sociological factors

Consumer preferences are rapidly changing, with a clear move towards on-demand content and digital platforms, especially on mobile devices. This trend directly challenges the long-standing broadcast television models that Fox has historically relied upon.

Fox Corporation is actively adapting by boosting its investment in digital assets like Tubi. Tubi has demonstrated impressive revenue acceleration, securing a solid foothold in the growing free ad-supported streaming sector.

The market is also seeing an anticipated rise in the influence and number of specialized streaming services, indicating a further fragmentation of the media landscape that Fox must navigate.

Understanding and catering to diverse audience demographics is crucial for Fox Business. In Q1 2024, Fox News maintained its position as the most-watched cable news channel, averaging 1.7 million total viewers, demonstrating significant engagement within its core demographic.

This strong viewership directly impacts advertising revenue and affiliate fees, as Fox News Media consistently commands premium rates due to its reach. Engagement across news, sports (like the NFL on FOX), and entertainment content fuels these commercial successes.

Public trust in media is a significant sociological element, especially for news organizations such as Fox News. Declining trust can erode audience loyalty and advertiser confidence, impacting the company's bottom line.

Concerns about misinformation and disinformation pose substantial risks, potentially leading to reputational damage and legal entanglements. For example, Fox News settled a defamation lawsuit with Dominion Voting Systems in 2023 for $787.5 million, underscoring the severe financial and reputational consequences of inaccurate reporting.

The ongoing debate surrounding media accuracy and bias directly affects how audiences perceive Fox News. This scrutiny can influence viewership numbers and advertiser decisions, particularly in the polarized media landscape of 2024 and heading into 2025.

Social and Cultural Trends

Broader social and cultural trends significantly shape consumer preferences and public perception, directly impacting media companies like Fox Corporation. Discussions around social justice, diversity, and environmental consciousness are increasingly influencing content creation and editorial choices. For instance, a 2024 survey indicated that over 60% of media consumers consider a company's stance on social issues when deciding which content to engage with.

Fox Corporation's commitment to corporate social responsibility is evident through its FOX Forward initiative. This program actively supports various community non-profit organizations, demonstrating an engagement with and response to evolving societal values. In 2023, FOX Forward contributed over $10 million to initiatives focused on education and community development, aligning with broader public interest in social impact.

- Growing Demand for Diverse Representation: Audiences increasingly expect on-screen and behind-the-scenes diversity, influencing casting and storytelling.

- Environmental Awareness: Consumers are more attuned to sustainability, prompting media companies to consider their environmental footprint and messaging.

- Social Justice Advocacy: Public discourse on equity and fairness can lead to pressure on media outlets to address these issues in their programming and corporate practices.

- Impact on Advertising: Brands are aligning with companies that reflect positive social values, potentially influencing Fox's advertising revenue streams.

Impact of Live Events and Sports Culture

Live sports and major news events are foundational to Fox's cultural relevance and revenue streams. These tentpole events are critical for drawing large, engaged audiences, which in turn fuels advertising income.

Fox's portfolio benefits immensely from high-profile sporting competitions. For instance, the Super Bowl consistently delivers massive viewership numbers, with Super Bowl LVIII in February 2024 drawing an average of 123.4 million viewers across all platforms, setting a new record for the most-watched Super Bowl ever. Similarly, major international soccer tournaments like the UEFA European Championship and the CONMEBOL Copa América attract global attention, providing significant advertising opportunities.

These live broadcasts are instrumental in anchoring traditional broadcast viewership in an era increasingly dominated by streaming services. They offer a shared, communal viewing experience that is difficult for on-demand platforms to replicate, thereby maintaining Fox's position in the media landscape.

- Super Bowl LVIII (2024): Averaged 123.4 million viewers, a record for the event.

- Advertising Revenue: Live sports are a primary driver of advertising sales for Fox.

- Cultural Significance: Major events foster shared national experiences and maintain broadcast relevance.

- Competitive Advantage: Live sports provide a distinct advantage over pure streaming models.

Sociological factors significantly influence Fox's audience engagement and brand perception, particularly concerning media trust and representation. While Fox News maintained strong viewership in Q1 2024, averaging 1.7 million total viewers, the broader societal concern over misinformation, highlighted by the 2023 Dominion settlement, remains a critical challenge impacting public trust and advertiser confidence.

Evolving consumer expectations around diversity and social responsibility are also shaping the media landscape. A 2024 survey found over 60% of consumers consider a company's stance on social issues, pushing companies like Fox to demonstrate commitment through initiatives such as FOX Forward, which contributed over $10 million to community programs in 2023.

The enduring appeal of live events, such as the record-breaking 123.4 million viewers for Super Bowl LVIII in February 2024, underscores their cultural significance and Fox's ability to capture large, shared audiences, driving advertising revenue and maintaining broadcast relevance in a fragmented media environment.

Technological factors

The rapid expansion of streaming and digital platforms significantly alters the media consumption habits, posing a challenge to traditional broadcast models. Fox Corporation has actively participated in this shift, notably through its advertising-supported video-on-demand (AVOD) service, Tubi. Tubi's user base grew by 40% in 2023, reaching over 70 million registered users, demonstrating Fox's commitment to this evolving technological frontier.

Artificial intelligence is fundamentally reshaping how media companies like Fox operate, from creating content to getting it to audiences. AI tools are now integral to optimizing everything from energy use in studios to the very flow of production, making processes smoother and allowing for more tailored content experiences for viewers.

For Fox, this translates into significant opportunities. By harnessing AI, the company can refine its content recommendation engines, ensuring viewers see more of what they love. This also fuels more precise targeted advertising, a key revenue driver. Furthermore, AI promises substantial operational efficiencies across the board, streamlining workflows and reducing costs.

The impact is already visible. In 2024, the global AI in media market was valued at over $1.5 billion, with projections indicating rapid growth. Companies are investing heavily in AI for tasks like automated journalism, personalized advertising, and audience analytics, with Fox actively exploring these avenues to maintain a competitive edge.

Data analytics has become a cornerstone for media companies like Fox, enabling them to understand their audience at a granular level. By analyzing user behavior, preferences, and engagement patterns, Fox can personalize content delivery, making it more relevant and appealing to individual viewers. This not only boosts user satisfaction but also significantly enhances the effectiveness of advertising campaigns. For instance, in 2024, many digital platforms reported a substantial increase in ad revenue, often attributed to improved targeting capabilities driven by advanced data analytics.

Fox can leverage these capabilities to refine its digital strategies, ensuring that its streaming services and online platforms offer tailored experiences. This data-driven approach allows for dynamic content recommendations and optimized ad placements, maximizing both viewer engagement and advertiser ROI. The ability to adapt quickly to changing audience tastes, informed by real-time data, is a critical competitive advantage in the rapidly evolving media landscape.

Broadcasting Technology and Infrastructure

Fox's broadcasting technology and infrastructure are constantly evolving. Advances like high-definition (HD), 4K, and emerging broadcasting standards necessitate continuous investment in equipment and network upgrades. For instance, the transition to ATSC 3.0 in the US, which offers enhanced video quality and interactive features, requires significant capital expenditure for broadcasters like Fox.

Maintaining these cutting-edge capabilities is crucial for delivering premium news and sports content, directly impacting viewership and advertising revenue. In 2024, the broadcast industry is increasingly focusing on sustainability, with companies exploring ways to reduce their carbon footprint through more energy-efficient transmission and production methods. This shift is driven by both regulatory pressures and growing consumer demand for environmentally conscious operations.

- Technological Advancement: Ongoing investment in HD, 4K, and next-generation broadcasting standards is critical for maintaining competitive content delivery.

- Infrastructure Needs: Upgrading broadcast infrastructure, including transmission networks and studio equipment, is essential for high-quality output.

- Sustainability Focus: The industry is moving towards more sustainable broadcasting technologies to minimize environmental impact and operational costs.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are critical technological factors for Fox Corporation. As a digital media company, safeguarding user data and intellectual property from increasingly sophisticated cyber threats is paramount. Failure to do so can lead to severe reputational damage and significant financial penalties.

The evolving landscape of data privacy regulations, such as GDPR and CCPA, necessitates continuous investment in compliance measures. Fox Corporation must ensure its data handling practices align with these global standards to maintain consumer trust and avoid legal repercussions. For instance, the estimated global cost of data breaches reached $4.35 million in 2023, highlighting the financial stakes involved.

- Increased Sophistication of Cyber Threats: Fox must invest in advanced threat detection and prevention systems to counter evolving cyberattacks.

- Regulatory Compliance Costs: Adhering to data privacy laws like GDPR and CCPA requires ongoing investment in technology and personnel.

- Reputational Risk: Data breaches can erode consumer trust, impacting Fox's brand image and customer loyalty.

- Intellectual Property Protection: Robust cybersecurity is essential to protect Fox's valuable content and digital assets from theft or unauthorized access.

Technological advancements are reshaping media consumption, with Fox leveraging platforms like Tubi, which saw a 40% user growth in 2023. AI is optimizing content creation and delivery, enhancing personalized viewer experiences and targeted advertising, a market valued over $1.5 billion in 2024. Data analytics allows Fox to understand audiences deeply, improving content relevance and ad effectiveness, with digital platforms reporting significant ad revenue increases in 2024 due to better targeting.

| Technology Area | Fox's Engagement/Investment | Industry Trend/Data (2023-2025) |

|---|---|---|

| Streaming & Digital Platforms | Tubi user growth: 40% (2023) | Shift in media consumption habits |

| Artificial Intelligence (AI) | Optimizing content, production, and advertising | Global AI in media market: >$1.5 billion (2024) |

| Data Analytics | Personalized content delivery, enhanced ad targeting | Increased ad revenue driven by analytics |

| Broadcasting Infrastructure | Investment in HD, 4K, ATSC 3.0 compatibility | Focus on energy-efficient and sustainable broadcasting |

| Cybersecurity & Data Privacy | Safeguarding user data and intellectual property | Global cost of data breaches: ~$4.35 million (2023) |

Legal factors

Fox Corporation has been embroiled in significant defamation lawsuits, notably from Dominion Voting Systems and California Governor Gavin Newsom. These legal battles underscore the substantial financial and reputational risks inherent in content dissemination, especially within news operations.

The Dominion lawsuit resulted in a substantial settlement for Fox Corporation, reportedly around $787.5 million in April 2023. This settlement highlights the severe financial consequences of defamation claims and the importance of rigorous fact-checking and editorial standards.

These cases have significant implications for media accountability, potentially shaping future legal interpretations of libel and the responsibilities of news organizations in verifying information. The outcomes can influence how misinformation is addressed and litigated in the media landscape.

Fox Business navigates a stringent regulatory landscape, overseen by bodies like the Federal Communications Commission (FCC), Federal Trade Commission (FTC), and Department of Justice (DOJ). These agencies enforce rules on media ownership concentration, content standards, and fair competition, directly influencing Fox's operational scope and strategic decisions.

In 2024, the ongoing discourse around media accountability and the spread of misinformation continues to place companies like Fox under a microscope. Potential violations of FCC or FTC guidelines, particularly concerning accuracy and impartiality in news reporting, could result in significant financial penalties, with fines potentially reaching millions of dollars, and could even lead to limitations on broadcasting licenses or content distribution.

Fox Corporation heavily relies on intellectual property and copyright law to safeguard its extensive collection of news, sports, and entertainment programming. This protection is vital in combating content piracy, which can significantly erode revenue streams. For instance, the Digital Millennium Copyright Act (DMCA) provides a legal framework for addressing online copyright infringement, a constant challenge in the digital age.

Ensuring proper licensing for content distribution across diverse platforms, from traditional broadcasting to streaming services, is another critical aspect. In 2023, the media and entertainment industry saw continued evolution in licensing models, with companies like Fox negotiating complex agreements to monetize their intellectual property effectively. Fox's lobbying efforts actively engage with policymakers on intellectual property matters, advocating for stronger protections and clearer regulations to support its business model.

Labor Laws and Guild Disputes

Fox Corporation, as a significant employer in the entertainment sector, must navigate a complex web of labor laws. These regulations directly influence hiring practices, compensation, and employee benefits across its operations.

Industry-wide guild disputes, such as the 2023 Writers Guild of America (WGA) and SAG-AFTRA strikes, pose a direct risk. These labor actions can significantly disrupt production schedules and inflate costs, impacting Fox's financial performance. For instance, Fox's Q3 2024 earnings report acknowledged the financial strain caused by these disruptions.

- Labor Law Compliance: Fox must adhere to federal and state labor laws, including those related to minimum wage, overtime, and workplace safety, impacting operational costs.

- Guild Negotiations: Ongoing negotiations with unions like the WGA and SAG-AFTRA directly influence production budgets and timelines for Fox's content creation.

- Production Delays: The financial impact of strikes, as evidenced in Fox's Q3 2024 reporting, highlights the vulnerability of its business model to labor disputes.

Data Privacy Regulations (e.g., CCPA, GDPR)

Fox Corporation, with its extensive digital operations and data collection practices, must diligently adhere to a growing landscape of data privacy regulations. This includes state-specific laws like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), as well as international mandates such as the General Data Protection Regulation (GDPR) for its European operations.

Non-compliance carries significant financial risks; for instance, GDPR violations can result in fines up to 4% of global annual revenue or €20 million, whichever is higher. The CCPA, and subsequently CPRA, allows for statutory damages of up to $7,500 per intentional violation, impacting Fox's bottom line and brand reputation if data handling is not robust.

- CCPA/CPRA Compliance: Fox must ensure consumers have rights regarding their personal information, including access, deletion, and opt-out of sale.

- GDPR Adherence: For data pertaining to EU residents, Fox needs to maintain lawful bases for processing, ensure data subject rights, and implement appropriate security measures.

- Reputational Impact: Maintaining consumer trust is paramount; data breaches or privacy missteps can severely damage Fox's brand image and customer loyalty.

- Operational Adjustments: Adapting to evolving privacy laws often requires significant investment in technology, policy updates, and employee training to manage data responsibly.

Legal factors present significant operational and financial risks for Fox Corporation, particularly concerning defamation and regulatory compliance. The substantial $787.5 million settlement with Dominion Voting Systems in April 2023 starkly illustrates the financial ramifications of content accuracy. Furthermore, ongoing scrutiny from regulatory bodies like the FCC and FTC in 2024 means potential fines for non-compliance with media standards could reach millions, impacting broadcasting licenses.

Intellectual property protection is crucial, with laws like the DMCA safeguarding Fox's content against piracy, which directly impacts revenue. Navigating complex licensing agreements for content distribution across various platforms remains a key operational challenge. Labor laws and union negotiations, highlighted by the 2023 WGA and SAG-AFTRA strikes, also pose risks, as evidenced by financial impacts noted in Fox's Q3 2024 earnings, potentially disrupting production and increasing costs.

Data privacy regulations, including CCPA/CPRA and GDPR, demand rigorous adherence, with potential fines for violations being substantial—up to 4% of global annual revenue under GDPR. These legal frameworks necessitate ongoing investment in technology and policy updates to ensure responsible data management and maintain consumer trust.

| Legal Area | Key Legislation/Regulation | Potential Impact/Risk | 2023/2024 Data Point |

|---|---|---|---|

| Defamation | Libel Laws | Financial penalties, reputational damage | $787.5 million settlement (Dominion) |

| Regulatory Compliance | FCC, FTC Guidelines | Fines, license limitations | Ongoing scrutiny in 2024 |

| Intellectual Property | DMCA, Copyright Law | Revenue loss from piracy, licensing complexity | Continued evolution of licensing models in 2023 |

| Labor Law | Minimum Wage, Safety Laws, Guild Agreements | Increased operational costs, production delays | Financial strain from 2023 WGA/SAG-AFTRA strikes noted in Q3 2024 earnings |

| Data Privacy | CCPA, CPRA, GDPR | Significant fines, reputational damage | GDPR fines up to 4% of global annual revenue; CCPA/CPRA up to $7,500 per intentional violation |

Environmental factors

Broadcasting operations, much like Fox's, are inherently energy-intensive. The production of content, the transmission of signals, and the operation of data centers all contribute to a significant energy demand. This reliance on energy directly translates into a substantial carbon footprint.

The scrutiny over corporate environmental impact is intensifying. Reports from 2024 highlight that digital streaming, a core component of modern broadcasting, accounts for a notable portion of global carbon emissions, with some estimates placing it around 1-4% of the total. This puts companies like Fox under pressure to demonstrate progress in reducing their environmental impact.

Growing global environmental awareness is compelling media companies, including Fox Corporation, to embed sustainability into their operations and provide transparent Environmental, Social, and Governance (ESG) reporting. This shift is driven by increasing demands from regulators, investors, and consumers who expect tangible proof of environmental stewardship.

Fox Corporation, like its industry peers, is responding to this pressure by implementing initiatives aimed at reducing its environmental footprint. For instance, in fiscal year 2023, Fox reported on its efforts to decrease energy consumption and waste generation across its facilities, aligning with broader industry trends toward eco-conscious business practices.

Content production, particularly for major news and sports events, demands substantial resources. This includes energy for extensive lighting setups, powering sophisticated broadcast equipment, and facilitating travel for crews and talent. For instance, major sporting events in 2024 and 2025 are increasingly scrutinized for their carbon footprints related to these operational needs.

The industry is actively exploring and implementing greener production methods. Innovations in energy efficiency, such as AI-driven optimization of studio lighting and broadcast workflows, are gaining traction. Companies are investing in renewable energy sources for their facilities and exploring sustainable travel options to mitigate environmental impact.

Waste Management and Equipment Disposal

Broadcasting operations generate significant electronic waste, from old broadcast equipment to consumer devices that receive signals. The disposal of these items presents a considerable environmental challenge, requiring careful consideration of their impact.

Responsible waste management and recycling are crucial to mitigate ecological harm. For instance, the global e-waste generated reached an estimated 53.6 million metric tons in 2019, with projections indicating a rise to 74 million metric tons by 2030. This highlights the urgency for robust recycling infrastructure and practices within the broadcasting sector.

The entire technical supply chain, from the manufacturing of broadcast equipment to its eventual disposal, is increasingly under environmental scrutiny. Companies are facing pressure to adopt circular economy principles, aiming to reduce waste and maximize resource utilization.

- E-waste Growth: Global e-waste is projected to reach 74 million metric tons by 2030, up from 53.6 million metric tons in 2019, underscoring the scale of the challenge.

- Supply Chain Scrutiny: The environmental footprint of broadcast equipment, from production to end-of-life, is a growing concern for regulators and consumers alike.

- Recycling Mandates: Many regions are implementing stricter regulations on e-waste disposal, pushing broadcasters to invest in certified recycling partners and sustainable practices.

Climate Change Coverage and Public Perception

Fox News's approach to climate change reporting significantly shapes public understanding and affects its relationships with various stakeholders. While corporate broadcast news coverage of environmental justice issues saw a dip in 2024, the overall media landscape, including Fox, continues to play a crucial role in framing the climate change narrative.

The perception of Fox News's climate coverage can impact advertiser confidence and audience engagement. For instance, a 2023 study indicated that a substantial portion of the US population relies on cable news for their information, making Fox's editorial stance on environmental matters particularly influential.

- Shaping Public Opinion: Fox News's editorial decisions on climate change directly influence how millions of viewers understand environmental risks and solutions.

- Stakeholder Relations: Advertisers and business partners may evaluate their association with Fox News based on its perceived stance on climate issues.

- Media Landscape Impact: Despite declines in specific coverage areas like environmental justice in 2024, the broader media's role in climate discourse remains a critical factor influencing public perception.

Broadcasting's energy consumption, from studios to data centers, creates a significant carbon footprint, with digital streaming alone contributing an estimated 1-4% of global emissions. This necessitates a focus on sustainability and transparent ESG reporting, driven by increasing pressure from investors and consumers who expect demonstrable environmental stewardship.

Fox Corporation is actively implementing eco-conscious practices, such as reducing energy use and waste, aligning with industry trends. The company is exploring greener production methods and investing in renewable energy to mitigate its environmental impact.

The broadcasting sector faces challenges with e-waste, projected to reach 74 million metric tons by 2030. Stricter regulations are pushing companies like Fox to adopt circular economy principles and invest in certified recycling partners to manage their supply chain's environmental footprint.

PESTLE Analysis Data Sources

Our Fox PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable market research firms, and leading academic journals. This approach ensures that every political, economic, social, technological, legal, and environmental factor is grounded in verifiable and current data.