Fox Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fox Bundle

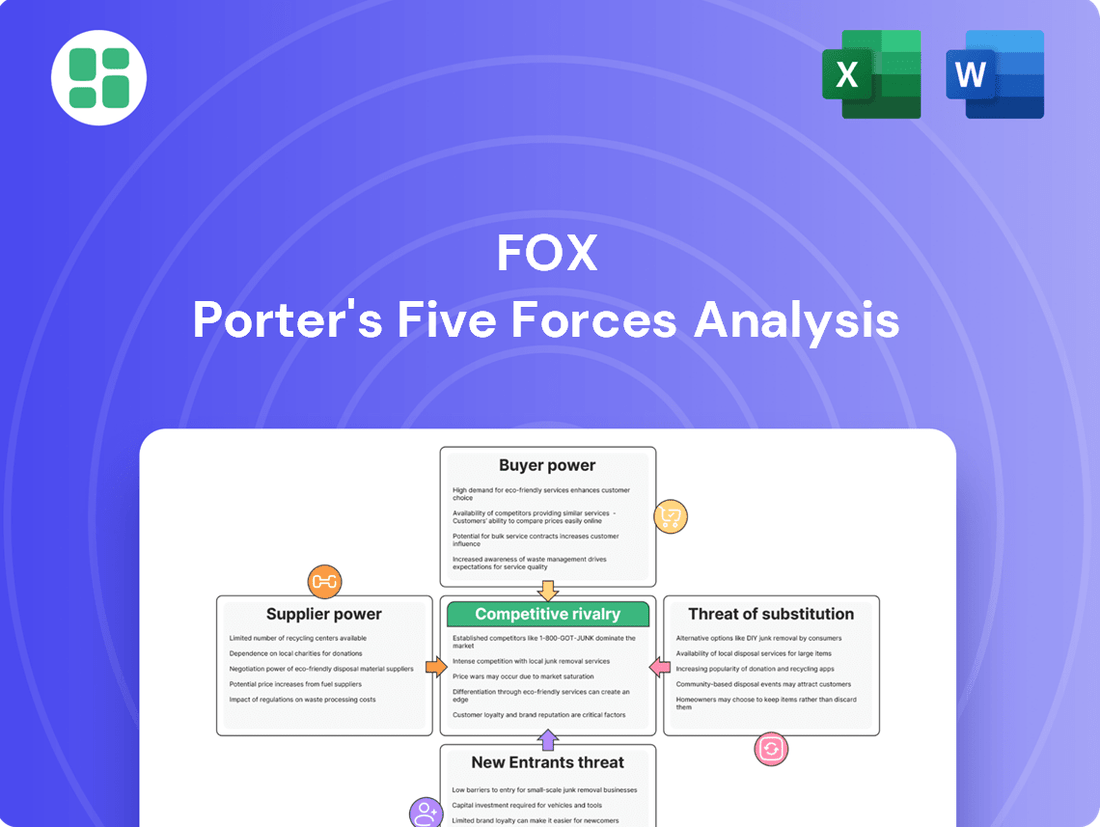

Porter's Five Forces reveals the competitive landscape Fox operates within, highlighting the power of buyers and suppliers, the threat of new entrants, and the intensity of rivalry. Understanding these forces is crucial for navigating Fox's market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Fox’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of highly sought-after content, like major sports leagues or prominent news personalities, wield considerable bargaining power over Fox Corporation. For instance, exclusive broadcasting rights to events such as the Super Bowl, which Fox aired in Q3 2025, are paramount for attracting viewers and generating revenue, thereby granting these leagues substantial leverage in their negotiations with Fox.

The significant cost and complexity associated with switching from established content suppliers represent a considerable bargaining power for those suppliers. For Fox, this means that replacing major news anchors or popular entertainment franchises with comparable quality and audience draw is not a simple or inexpensive undertaking.

Developing new talent or creating original programming that can rival existing, successful content requires substantial upfront investment in terms of capital, time, and expertise. This investment barrier naturally strengthens the position of current, proven content providers.

In 2023, major media companies often spent hundreds of millions of dollars on content acquisition and development. For instance, Disney's content spending was reported to be around $33 billion in fiscal year 2023, highlighting the immense financial commitment required to secure and produce desirable content, thereby underscoring the power of key content suppliers.

Suppliers of specialized broadcasting technology, such as AI-driven content management systems or cloud-native playout solutions, can wield significant bargaining power. This is especially true when their offerings are proprietary or involve substantial integration costs for broadcasters. For instance, in 2024, the market for advanced broadcast infrastructure saw continued consolidation, with a few key players dominating the supply of cutting-edge equipment.

Talent and Production Labor Unions

Talent and production labor unions wield significant bargaining power, directly influencing Fox Corporation's (FOX) operational costs and content pipeline. These unions, representing actors, writers, directors, and various technical crews, can collectively negotiate for better wages, benefits, and working conditions. This collective action can lead to increased production expenses and potential disruptions if negotiations falter.

The impact of these unions was starkly evident in 2023 with major labor disputes, notably the Writers Guild of America (WGA) and SAG-AFTRA strikes. The WGA strike, which lasted approximately 148 days, and the SAG-AFTRA strike, which spanned around 118 days, significantly halted production across the industry. This resulted in an estimated loss of billions of dollars in economic activity and delayed the release of numerous films and television shows, directly affecting content availability for networks like Fox.

- Impact on Production Costs: Unionized labor often commands higher wages and benefits, directly increasing the cost of producing entertainment content.

- Content Delays and Availability: Labor disputes can halt production entirely, leading to significant delays in content release and impacting Fox's programming schedules and advertising revenue.

- Negotiation Leverage: The ability of unions to organize and strike provides them with substantial leverage in negotiations, forcing companies like Fox to concede to certain demands to avoid costly disruptions.

Dependency on Affiliate Stations for Local Reach

Fox Television Stations rely heavily on their affiliate stations to reach local audiences and drive advertising revenue. This dependency grants these local affiliates a degree of bargaining power, particularly concerning distribution agreements and the provision of local content. For instance, in markets with fewer independent stations, the leverage of a dominant affiliate can increase significantly.

The bargaining power of these affiliate stations is further amplified in markets where they are essential for Fox's national advertising sales strategy. If a particular affiliate controls access to a highly sought-after demographic or a significant portion of local ad spending, their negotiating position strengthens. This symbiotic relationship, while mutually beneficial, can tilt towards supplier power for the affiliate, especially in concentrated local media landscapes.

Consider the 2024 advertising market where local broadcast advertising remained a critical component for many national brands. Affiliates that demonstrated strong local viewership and effective sales teams could command more favorable terms from Fox. For example, a station in a top-50 market with consistent ratings might negotiate higher revenue shares or more advantageous programming commitments.

- Affiliate Leverage: Local affiliates gain bargaining power through their essential role in market penetration and advertising sales for Fox Television Stations.

- Market Concentration: The power of affiliates increases in local markets with fewer independent broadcast options, concentrating negotiation leverage.

- Advertising Revenue: Strong local viewership and effective sales teams in 2024 allowed certain affiliates to negotiate more favorable terms with Fox.

- Symbiotic Relationship: While mutually beneficial, the reliance on affiliates for local reach can shift power dynamics in favor of these stations.

Suppliers of critical content, like major sports leagues or popular talent, hold significant sway over Fox Corporation. The exclusivity of broadcasting rights to major events, such as the NFL's Super Bowl, which Fox aired in Q3 2025, is vital for viewership and revenue, giving these leagues substantial negotiation leverage.

The cost and complexity of switching suppliers, whether for established entertainment franchises or key news anchors, create a high barrier for Fox, strengthening the bargaining power of current content providers. This barrier is substantial, as replicating the quality and audience draw of existing content requires considerable investment.

In 2023, the media industry saw immense spending on content, with companies like Disney investing around $33 billion in fiscal year 2023. This highlights the financial commitment needed to secure and produce desirable content, underscoring the power of key content suppliers.

Talent and production unions, such as the WGA and SAG-AFTRA, significantly impact Fox's operational costs. The 2023 strikes by these unions, lasting 148 and 118 days respectively, halted industry-wide production and caused billions in economic losses, directly affecting content availability and Fox's programming schedules.

| Supplier Type | Bargaining Power Factor | Impact on Fox | Relevant Data/Example |

|---|---|---|---|

| Content Rights Holders (e.g., Sports Leagues) | Exclusivity of sought-after content | High leverage in negotiations for broadcasting rights | Fox's airing of Super Bowl in Q3 2025 |

| Key Talent & Franchises | High switching costs and audience loyalty | Strengthens position of current providers | Difficulty replacing popular anchors or shows |

| Labor Unions (WGA, SAG-AFTRA) | Collective bargaining and strike potential | Increased production costs, potential content delays | 2023 strikes caused billions in losses and production halts |

| Local Affiliate Stations | Essential for market penetration and ad sales | Negotiating power in distribution and revenue share | Affiliates in top markets with strong viewership can command better terms |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Fox's media and entertainment landscape.

Identify and neutralize competitive threats before they impact profitability, providing a clear roadmap to sustained market advantage.

Customers Bargaining Power

The media landscape is incredibly fragmented now, with countless streaming services and digital platforms offering viewers a massive array of choices. This means consumers can easily switch from one service to another, significantly lowering the cost and effort involved in changing their viewing habits. For Fox, this fragmentation directly translates to increased bargaining power for its audience.

With so many alternatives available, viewers are much more attuned to pricing and the specific content being offered. If Fox's content doesn't meet their expectations or if competitors offer more compelling value, consumers can readily move elsewhere. This sensitivity to price and content is a direct consequence of the abundance of choices, giving customers more leverage.

Consider the sheer volume of streaming services: as of early 2024, the global streaming market features hundreds of players, from major giants like Netflix and Disney+ to niche platforms. This vast ecosystem means a single piece of content, or even a subscription to a single service, is no longer a necessity for entertainment. This abundance fuels customer power by providing readily accessible and often cheaper alternatives.

Advertisers, particularly major ones, wield considerable sway. They can readily redirect their substantial advertising budgets to different media outlets, prioritizing those that offer the broadest audience reach, the highest engagement, and the most impactful ad performance. This flexibility directly influences Fox's advertising income, especially considering the dynamic advertising market expected in 2025.

Major cable and satellite distributors wield significant bargaining power over Fox, acting as crucial gatekeepers to vast subscriber bases. This leverage is evident in their ability to negotiate carriage fees, directly impacting Fox's affiliate revenue streams.

The power of these distributors is further amplified by their capacity to bundle or de-bundle channels. For instance, in 2024, the trend of cord-cutting and the rise of virtual MVPDs (multichannel video programming distributors) like YouTube TV and Hulu + Live TV continue to reshape the distribution landscape, giving consumers more choice and distributors more leverage in negotiations.

Growth of Ad-Supported Streaming (FAST) Models

The proliferation of Free Ad-Supported Streaming Television (FAST) services, such as Fox's own Tubi, significantly bolsters customer bargaining power. These platforms offer a wealth of content without direct cost to the viewer, directly challenging the perceived value of paid subscription models. This shift forces traditional media companies to re-evaluate their revenue strategies and enhance their offerings to retain subscribers.

This trend is evident in the rapid growth of the FAST market. For instance, by the end of 2023, Tubi alone reported a 35% year-over-year increase in total streaming hours. This demonstrates consumers' strong preference for free, ad-supported content, thereby increasing their leverage when considering paid alternatives.

- Consumer Choice: FAST services provide consumers with a vast library of content at no charge, directly increasing their options and reducing reliance on paid services.

- Price Sensitivity: The availability of free alternatives makes consumers more sensitive to pricing for traditional cable and subscription streaming, pressuring companies to offer competitive value.

- Revenue Model Adaptation: Media companies must innovate their revenue models, balancing ad revenue with subscription fees, to cater to evolving consumer preferences and maintain profitability.

- Market Competition: The rise of FAST intensifies competition, compelling providers to invest in content and user experience to differentiate themselves and capture audience share.

Increasing Demand for Personalized Content

Customers are increasingly seeking out content that is specifically tailored to their individual preferences. This demand is amplified by the sophisticated AI algorithms used by streaming services, which provide highly personalized recommendations. For instance, in 2023, Netflix reported that its recommendation engine was responsible for suggesting 80% of the content watched on the platform, highlighting the significant influence of personalization.

This growing expectation for customized experiences means that media companies, including Fox, must allocate more resources to data analytics and the underlying technology infrastructure required to deliver these personalized offerings. Companies that master personalization gain a distinct advantage, as customers are more likely to remain loyal to platforms that consistently understand and cater to their unique tastes. This shift in consumer behavior directly enhances the bargaining power of customers, as they can gravitate towards providers that offer superior personalization.

The impact of this trend is evident in the market. By 2024, the global market for personalized advertising, a key component of content delivery, was projected to reach over $200 billion, underscoring the commercial importance of understanding individual consumer behavior.

- AI-driven recommendations are a primary driver of personalized content demand.

- Netflix's 2023 data indicated that 80% of content watched originated from recommendations.

- Media companies must invest in data analytics and technology to meet this demand.

- Personalization capabilities directly influence customer loyalty and bargaining power.

The bargaining power of customers is significantly elevated in today's media environment due to increased choice and price sensitivity. With hundreds of streaming services available globally as of early 2024, consumers can easily switch providers, forcing companies like Fox to offer competitive value. This abundance of options, including the rise of Free Ad-Supported Streaming Television (FAST) services, directly empowers consumers to seek out the best content at the most appealing price points.

The trend towards personalized content, driven by AI algorithms, further amplifies customer leverage. For instance, Netflix reported in 2023 that 80% of its content viewed was a result of its recommendation engine. This means companies must invest heavily in data analytics and technology to meet consumer expectations for tailored experiences, as personalized offerings are key to fostering loyalty and retaining subscribers in a competitive market.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Trend |

|---|---|---|

| Content Abundance | High | Hundreds of global streaming services available (early 2024) |

| Price Sensitivity | High | Availability of free alternatives (FAST services) |

| Personalization Demand | High | 80% of Netflix content viewed via recommendations (2023) |

| Switching Costs | Low | Ease of switching between digital platforms |

Same Document Delivered

Fox Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces Analysis for Fox, offering a detailed examination of industry competition, supplier power, buyer leverage, threat of new entrants, and the availability of substitutes. The document you see here is the exact, professionally formatted analysis you'll receive immediately after purchase, ensuring full transparency and readiness for your strategic planning needs.

Rivalry Among Competitors

Fox Corporation operates in a fiercely competitive landscape, facing intense rivalry from established media conglomerates such as Disney, Warner Bros. Discovery, and Paramount. These giants vie for audience engagement and advertising revenue across news, sports, and entertainment. For instance, in fiscal year 2023, Disney's Parks, Experiences and Products segment generated $32.2 billion in revenue, showcasing the scale of investment and reach these competitors possess, directly impacting Fox's market share.

The 'streaming wars' are heating up, with major players like Netflix, Amazon Prime Video, and Peacock aggressively competing for subscriber attention and exclusive content. This intense rivalry means companies like Fox must constantly innovate their digital platforms, such as Tubi and the planned Fox One, to stay competitive.

In 2024, the streaming landscape continues to be a battleground. Netflix, for instance, reported over 270 million global subscribers by the first quarter of 2024, demonstrating the sheer scale of competition. This environment pressures all participants, including Fox, to invest heavily in original content and user experience to capture and retain market share.

The competition for live sports broadcasting rights is incredibly intense, driving up costs significantly. Streaming services are now investing billions of dollars annually to secure these rights, recognizing their power to attract and keep subscribers. For instance, in 2024, Amazon Prime Video reportedly paid over $100 million for exclusive rights to broadcast NFL Thursday Night Football, highlighting the immense financial stakes involved.

Fox Sports faces direct competition from both established broadcast networks and these aggressive streaming platforms. Acquiring exclusive rights to popular leagues and events is paramount for Fox to maintain its subscriber base and attract new viewers in a rapidly evolving media landscape.

Digital Disruption in News and Information

The news industry is experiencing fierce competition from digital sources. Online-only aggregators, social media platforms, and independent creators offer immediate, often free news, directly challenging established players like Fox News Media.

This digital shift significantly impacts traditional revenue streams, particularly advertising. For instance, digital advertising spending continues to grow, with global digital ad spend projected to reach over $700 billion in 2024, diverting crucial funds from traditional media.

- Intensified Competition: Online news aggregators and social media platforms provide a constant stream of information, often at no direct cost to the consumer.

- Revenue Diversion: Advertising budgets are increasingly allocated to digital channels, putting pressure on the revenue models of traditional news organizations.

- Changing Consumption Habits: Consumers are shifting towards faster, more personalized news delivery methods, often found on mobile devices and social feeds.

- Creator Economy Impact: Individual journalists and content creators are building direct audiences, bypassing traditional media gatekeepers.

Audience Fragmentation and Attention Economy

The media landscape is incredibly fragmented, with consumers’ attention spread thin across numerous platforms and content formats. This intense competition for limited viewer time and engagement defines the 'attention economy'. Companies are constantly vying for a share of this scarce resource.

This fragmentation directly fuels competitive rivalry as businesses must innovate and differentiate to capture and retain audience interest. In 2024, the average person spends over 6.5 hours per day online, a significant portion of which is dedicated to media consumption across various digital channels. This means that every piece of content, from a streaming service original to a social media post, is competing for a slice of that limited attention.

- Audience Fragmentation: The sheer volume of available content means consumers have more choices than ever, diluting the impact of any single provider.

- Attention Economy: Limited consumer attention is the primary scarce resource, driving intense competition among media companies.

- Digital Dominance: Platforms like TikTok, YouTube, and streaming services command significant user engagement, forcing traditional media to adapt or lose relevance.

- Engagement Metrics: Success is increasingly measured by engagement rates, watch time, and social sharing, highlighting the battle for active user participation.

Competitive rivalry is a defining characteristic of Fox Corporation's operating environment, particularly within the dynamic media and entertainment sectors. The company contends with a concentrated group of powerful competitors, including Disney, Warner Bros. Discovery, and Paramount, all vying for market share in news, sports, and entertainment. This intense competition is further amplified by the burgeoning streaming market, where platforms like Netflix and Amazon Prime Video are aggressively pursuing subscribers through substantial investments in original content and exclusive broadcasting rights, such as Amazon's reported over $100 million expenditure for NFL Thursday Night Football in 2024.

The battle for audience attention is fierce, with digital platforms and social media outlets siphoning viewership from traditional media. In 2024, global digital ad spend is projected to exceed $700 billion, illustrating the significant shift in advertising revenue away from traditional channels and towards digital alternatives. This necessitates continuous innovation from Fox, including its streaming service Tubi, to remain relevant in an environment where consumers' limited attention is a highly contested resource, with the average person spending over 6.5 hours online daily.

| Competitor | Key Business Areas | 2023 Revenue (Approx.) | 2024 Focus |

| Disney | Parks, Experiences & Products; Streaming; Studio Entertainment | $88.89 billion | Streaming growth, theme park expansion |

| Warner Bros. Discovery | Studios & Networks; Direct-to-Consumer | $41.39 billion | Content integration, streaming profitability |

| Paramount Global | TV Media; Streaming; Filmed Entertainment | $28.96 billion | Streaming subscriber acquisition, content library expansion |

| Netflix | Streaming | $33.72 billion | Global subscriber growth (over 270 million Q1 2024), ad-supported tier |

SSubstitutes Threaten

The proliferation of Over-the-Top (OTT) streaming services presents a significant threat of substitutes for traditional linear television. Services like Netflix, Disney+, and Max offer vast libraries of on-demand content, directly competing with Fox's scheduled broadcasts. This trend is accelerating, with the global video streaming market projected to reach over $300 billion by 2024, indicating a massive shift in consumer viewing habits.

The proliferation of user-generated content (UGC) platforms like YouTube, TikTok, and Twitch presents a formidable threat of substitutes. These platforms offer a vast and constantly updated library of free entertainment and information, directly competing with professionally produced content across various media. In 2024, TikTok alone surpassed 1 billion monthly active users, demonstrating the immense reach and engagement these UGC platforms command.

This shift in content consumption significantly impacts traditional media outlets and content creators. The audience attention and advertising revenue that once flowed to established players are increasingly being diverted to UGC platforms. For instance, global digital ad spending was projected to exceed $600 billion in 2024, with a substantial portion attributed to social media and video platforms.

The burgeoning video game industry, alongside the rise of esports and increasingly sophisticated virtual and augmented reality experiences, presents a significant threat of substitution for traditional media. These interactive entertainment forms capture substantial leisure time and offer a level of engagement that linear media often struggles to match.

In 2024, the global video game market was projected to reach over $200 billion, demonstrating its massive scale and appeal. This growth directly competes with the audience and advertising revenue streams of traditional broadcasting and content providers.

Digital News and Information Aggregators

Digital news and information aggregators, including platforms like Google News and Apple News, present a significant threat of substitutes for traditional news organizations. These aggregators offer a consolidated stream of content from various sources, often at no direct cost to the consumer, directly competing with the revenue models of established broadcasters and publishers.

The rise of specialized blogs and social media feeds further fragments the audience, providing niche content and immediate updates that can bypass traditional news channels entirely. In 2024, it's estimated that over 60% of adults in the United States get their news from social media at least some of the time, highlighting the pervasive nature of these substitutes.

Furthermore, advancements in AI-driven search engines mean users can often receive direct answers to queries without needing to visit individual news websites, diminishing the traffic and engagement that traditional news outlets rely upon. This trend is accelerating, with AI search functionalities becoming increasingly sophisticated and integrated into everyday online behavior.

- Aggregated Platforms: Services like Google News and Apple News consolidate news from multiple publishers, offering convenience and often free access.

- Social Media Dominance: In 2024, a significant portion of the population, over 60% in the US, relies on social media for news consumption.

- Niche Content: Specialized blogs and online communities cater to specific interests, providing alternatives to broad-based news coverage.

- AI-Powered Search: AI search engines deliver direct answers, reducing the necessity for users to navigate to news websites.

Podcasts and Audio-First Content

The rise of podcasts and audio-first content presents a significant threat of substitutes for traditional radio and audio offerings. These platforms provide consumers with convenient, on-demand access to news, commentary, and entertainment, directly competing for audience attention, especially among commuters and those multitasking.

This shift is particularly evident in the growing podcast market. In 2024, it's estimated that over 400 million people worldwide listen to podcasts, a number projected to climb significantly by July 2025. This expansion means Fox's radio and audio content faces increased competition for listener hours from a vast array of specialized and general interest audio programs.

- Audience Fragmentation: Podcasts allow for niche content catering to specific interests, fragmenting the broad audience Fox's radio stations typically serve.

- On-Demand Convenience: Unlike scheduled radio programming, podcasts offer listeners the flexibility to consume content whenever and wherever they choose, a key advantage for busy individuals.

- Creator Accessibility: The low barrier to entry for podcast creation means a constant influx of new content, providing consumers with an ever-expanding alternative to established audio providers.

- Advertising Diversification: Advertisers are increasingly allocating budgets to podcast sponsorships and dynamic ad insertion, potentially diverting funds from traditional radio advertising slots.

The threat of substitutes for traditional media is multifaceted, encompassing digital platforms that offer alternative forms of entertainment and information. Over-the-Top (OTT) streaming services, user-generated content platforms, video games, digital news aggregators, and podcasts all directly compete for consumer attention and advertising revenue.

The sheer scale of these substitutes is significant; for example, global video streaming market was projected to exceed $300 billion in 2024, while the video game market was expected to surpass $200 billion in the same year. Furthermore, over 60% of US adults get their news from social media, illustrating a substantial shift in information consumption away from traditional outlets.

| Substitute Category | Key Platforms/Examples | 2024 Market Projection (USD) | Key Impact on Traditional Media |

|---|---|---|---|

| OTT Streaming | Netflix, Disney+, Max | >$300 Billion (Global Video Streaming) | Audience and advertising diversion |

| User-Generated Content | YouTube, TikTok, Twitch | TikTok: >1 Billion Monthly Active Users | Competition for attention and ad spend |

| Video Games & Interactive | Esports, VR/AR | >$200 Billion (Global Video Game Market) | Captures leisure time, engagement competition |

| Digital News Aggregators | Google News, Apple News | >60% US Adults get news from Social Media | Fragmented audience, reduced direct traffic |

| Podcasts & Audio | Various Podcast Platforms | >400 Million Global Listeners | Competition for listener hours, ad revenue |

Entrants Threaten

The sheer cost of creating and distributing content presents a formidable hurdle for newcomers aiming to compete with established players like Fox. Imagine the billions needed to produce blockbuster films, secure exclusive rights to major sporting events, or build out extensive streaming platforms. For instance, in 2024, the average cost to produce a major studio film can easily exceed $200 million, not including marketing.

Furthermore, securing the necessary distribution channels, whether traditional broadcast networks or digital streaming infrastructure, demands substantial upfront investment. Companies like Netflix and Disney+ have spent tens of billions of dollars building their global reach. This high capital requirement effectively deters smaller entities from entering the market at a scale that could genuinely challenge incumbents.

The broadcasting and media sector faces a dense web of regulations and licensing, especially for traditional over-the-air transmissions and news operations. These intricate legal and compliance demands act as a significant deterrent for any new company looking to enter the market, requiring substantial investment in legal expertise and adherence to stringent standards.

Fox's established brands, such as Fox News and Fox Sports, command significant brand loyalty. This loyalty, coupled with powerful network effects where the value of the service increases with more users, creates a substantial barrier for new entrants. For instance, Fox News consistently ranks among the top cable news networks, with an average of 1.3 million viewers in primetime during the first quarter of 2024, demonstrating the difficulty for newcomers to attract and retain a comparable audience.

Technological Advancements Lowering Entry Barriers in Niches

While the traditional media landscape often presents high barriers to entry, technological advancements are actively reshaping this dynamic, particularly within niche markets. Innovations in artificial intelligence for content generation, accessible cloud-based production tools, and widespread digital distribution channels are significantly lowering the hurdles for smaller, agile players. This allows new entrants to effectively target specific audiences without needing the vast capital investments previously required by established entities.

These shifts are evident in the burgeoning creator economy. For instance, by July 2024, platforms like YouTube and TikTok continued to empower individual creators, with many generating substantial revenue streams from niche content. The cost of entry for producing high-quality video content has plummeted; a professional-looking video can now be shot and edited on a smartphone, leveraging readily available AI editing software. This democratizes content creation, enabling smaller studios or even individual entrepreneurs to compete by focusing on specialized content that resonates with dedicated fan bases.

- AI-powered content creation tools, like those from OpenAI and Google, are rapidly improving, reducing the need for large creative teams.

- Cloud-based video editing and rendering services offer scalable solutions, eliminating the need for expensive on-premise hardware.

- Digital distribution platforms provide direct access to global audiences, bypassing traditional gatekeepers and their associated costs.

- The global creator economy was projected to reach over $250 billion by the end of 2023, highlighting the economic viability of niche content creation.

Potential Entry of Tech Giants with Deep Pockets

The threat of new entrants is amplified by the potential entry of tech giants with deep pockets. Companies like Apple, Amazon, and Meta possess immense financial resources and established user ecosystems, allowing them to absorb significant upfront costs for content acquisition and platform development. For instance, Apple's investment in original content and sports rights, exceeding billions of dollars, demonstrates their capacity to challenge incumbents.

These tech behemoths can rapidly scale their operations and leverage existing customer relationships to gain market share. Their ability to invest heavily in advanced advertising technologies and innovative delivery methods presents a formidable challenge to traditional players.

- Financial Muscle: Tech giants often have cash reserves in the tens or hundreds of billions of dollars, enabling substantial content and infrastructure investments.

- User Base Advantage: Existing platforms with millions or billions of active users provide an immediate audience for new services.

- Technological Prowess: Expertise in AI, data analytics, and user experience can be quickly applied to media and entertainment offerings.

The threat of new entrants for Fox is moderate, influenced by high capital requirements for content production and distribution, alongside regulatory hurdles. However, technological advancements and the rise of the creator economy are lowering barriers in specific niches.

Big tech companies with vast financial resources and existing user bases pose a significant threat, capable of rapidly scaling new media ventures.

Established brand loyalty and network effects for Fox's properties like Fox News create strong customer retention, making it difficult for newcomers to gain traction.

The cost of producing a single hour of scripted television in 2024 averaged around $3 million, a substantial investment for any new player.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High costs for content creation, distribution infrastructure, and marketing. | Deters smaller players; favors well-funded entrants. | Major studio film production costs exceed $200 million. |

| Brand Loyalty & Network Effects | Established brands and user bases create customer stickiness. | Makes audience acquisition challenging for newcomers. | Fox News averaged 1.3 million primetime viewers in Q1 2024. |

| Technology & Digitalization | Lowered costs for content creation and distribution via digital platforms. | Empowers niche players and individual creators. | Creator economy projected to exceed $250 billion by end of 2023. |

| Regulatory & Licensing | Complex legal and compliance requirements, especially for broadcasting. | Increases cost and time-to-market for new entrants. | Varies by region and media type, often requiring significant legal investment. |

| Tech Giant Entry | Deep financial resources and existing user ecosystems of companies like Apple and Amazon. | Creates significant competitive pressure due to scale and investment capacity. | Apple's content investment exceeds billions of dollars. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive suite of data sources, including industry-specific market research reports, financial statements from public companies, and government economic indicators. This multi-faceted approach ensures a robust understanding of competitive intensity, supplier and buyer leverage, and the threat of new entrants and substitutes.