Flex-N-Gate PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flex-N-Gate Bundle

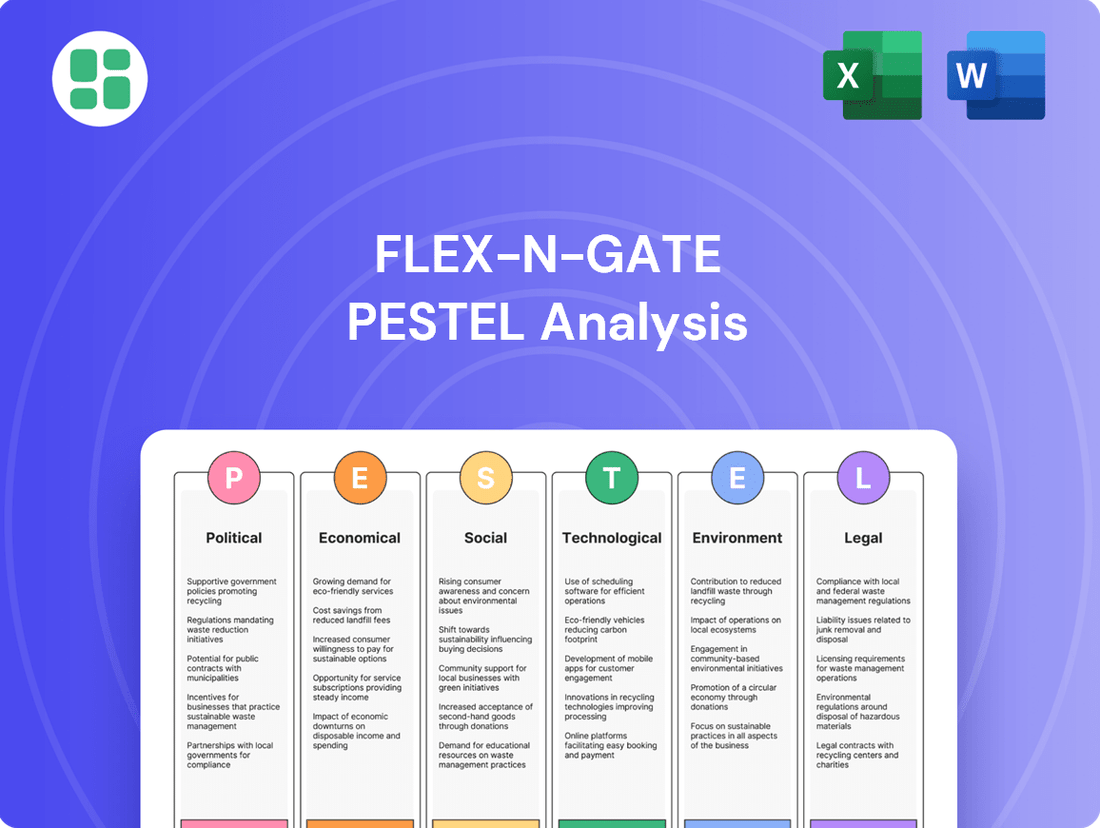

Navigate the complex external forces impacting Flex-N-Gate with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping the automotive supplier's landscape. Gain actionable insights to inform your strategic decisions and competitive positioning. Download the full PESTLE analysis now for a deeper understanding.

Political factors

Global trade policies, particularly tariffs and protectionist measures, directly impact Flex-N-Gate's international business and supply chain. For instance, the USMCA agreement, which replaced NAFTA in 2020, introduced new rules of origin for automotive components, affecting sourcing strategies.

The potential for increased tariffs on automotive parts, especially from major suppliers like Mexico, Canada, and China, could significantly raise production costs. In 2023, the automotive industry continued to navigate complex trade landscapes, with ongoing discussions around potential tariffs on imported vehicles and parts from various nations, impacting profit margins.

These evolving trade policies demand flexibility in Flex-N-Gate's supply chain and may drive a need for more localized production to buffer against financial disruptions and maintain competitiveness in a shifting global market.

Governments globally, including the U.S. EPA and the European Union, are tightening vehicle emissions standards significantly through 2027 and beyond. These regulations target reductions in carbon dioxide, nitrogen oxide, and particulate matter, directly impacting automotive component suppliers like Flex-N-Gate.

Flex-N-Gate must therefore evolve its product development and manufacturing to comply with these stricter environmental mandates. Failure to meet these evolving requirements could result in substantial penalties and jeopardize existing agreements with Original Equipment Manufacturers (OEMs).

Geopolitical tensions, such as the ongoing trade disputes and regional conflicts, can significantly disrupt the global automotive supply chain. This instability directly impacts the availability and cost of essential raw materials and components needed by companies like Flex-N-Gate.

Flex-N-Gate's dependence on specific geographic regions for critical minerals and processed materials presents a notable vulnerability. For instance, the concentration of electric vehicle (EV) component manufacturing, particularly for battery materials, in China means disruptions there could severely affect production timelines and costs.

The company's reliance on Chinese suppliers for certain EV components, a market that saw significant growth and dominance in the early 2020s, highlights the need for robust diversified sourcing strategies. This diversification is crucial to mitigate risks associated with political instability or trade policy shifts in any single region.

Government Incentives and Support for EVs

Government incentives and subsidies for electric vehicle (EV) production and adoption significantly influence the demand for EV components supplied by Flex-N-Gate. For instance, the U.S. Inflation Reduction Act (IRA) offers substantial tax credits for EV purchases, driving consumer demand. As of early 2024, the IRA's clean vehicle credit can provide up to $7,500 for eligible new EVs, directly boosting the market for electrified components.

Conversely, shifts in these policies can create market volatility. The potential rescinding or alteration of such incentives, like those within the IRA, could dampen consumer enthusiasm and slow OEM investment in EV platforms. Similarly, the phasing out of EV subsidies in various European markets, which have historically been strong drivers of EV adoption, presents a risk to sustained growth in demand for Flex-N-Gate's EV-related offerings.

- U.S. Inflation Reduction Act (IRA): Provides up to $7,500 tax credit for new eligible EVs, impacting component demand.

- European Union Policy: While some nations are phasing out direct purchase subsidies, the EU's CO2 emission standards continue to push manufacturers towards electrification.

- Global Policy Trends: Many countries are setting targets for EV sales, indicating a long-term supportive environment, though specific incentive structures can change.

Labor Laws and Union Relations

Labor laws and union negotiations significantly impact Flex-N-Gate's operational costs and production continuity, especially in major manufacturing hubs. For instance, ongoing discussions and contract renewals with unions like Unifor in Canada directly affect the automotive supply chain's stability.

Wage hikes and benefit demands from organized labor can compress profit margins. In 2024, the automotive sector in North America saw continued wage pressure, with some unionized workforces securing average annual wage increases of 3-5% plus cost-of-living adjustments in new contracts, directly influencing manufacturing overhead for companies like Flex-N-Gate.

- Unionization Trends: Monitoring unionization drives and their success rates in key Flex-N-Gate operating regions is crucial for anticipating labor cost fluctuations.

- Contract Negotiations: The outcomes of major union contract negotiations, such as those impacting automotive suppliers in the US and Canada, directly influence labor expenses and production schedules.

- Wage and Benefit Pressures: Rising demands for higher wages and improved benefits can increase direct labor costs, potentially impacting Flex-N-Gate's pricing strategies and overall profitability.

- Regulatory Compliance: Adherence to evolving labor laws, including minimum wage adjustments and worker safety regulations, necessitates ongoing investment in compliance measures.

Government trade policies, including tariffs and trade agreements like USMCA, directly influence Flex-N-Gate's global operations and costs. Evolving emissions standards from bodies such as the EPA and EU necessitate adaptation in product development, impacting the automotive component sector. Geopolitical tensions can disrupt supply chains, particularly for critical materials like those used in EV batteries, highlighting the need for diversified sourcing strategies.

Government incentives, such as the U.S. Inflation Reduction Act's EV tax credits, stimulate demand for electrified components, though policy shifts can create market volatility. Labor laws and union negotiations, with average wage increases of 3-5% seen in 2024 for some North American auto sector unionized workforces, directly affect operational costs and production continuity.

What is included in the product

This Flex-N-Gate PESTLE analysis offers a comprehensive examination of the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations and strategic positioning.

It provides actionable insights and forward-looking perspectives to help navigate the complex external landscape and identify key opportunities and threats.

The Flex-N-Gate PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing during meetings and presentations.

Economic factors

Global economic growth and consumer demand are critical drivers for Flex-N-Gate's business. The overall health of the world economy directly impacts consumer spending, and a significant portion of that spending goes towards new vehicles. This, in turn, dictates the demand for automotive components like those Flex-N-Gate produces.

Looking ahead to 2025, projections suggest a somewhat muted global automotive sales growth. This slowdown is anticipated due to a combination of factors, including persistent inflationary pressures affecting consumer purchasing power and a generally mixed economic outlook across various regions. Consequently, suppliers like Flex-N-Gate may experience a tempering of order volumes as automakers adjust their production schedules in response to these market conditions.

Persistent inflation and elevated interest rates directly impact Flex-N-Gate's bottom line by increasing costs for essential inputs like steel and aluminum, as well as for financing operations and expansion. For instance, in the US, the Federal Reserve's benchmark interest rate remained at 5.25%-5.50% through early 2024, a significant increase from previous years, making borrowing more expensive.

While inflation showed signs of moderation in various global markets during 2023 and early 2024, concerns about its potential resurgence, coupled with sustained high interest rates, continue to dampen consumer appetite for new vehicles. This reduced demand for automobiles directly translates to lower order volumes for automotive component suppliers like Flex-N-Gate, potentially impacting their revenue and profitability.

Fluctuations in the cost of essential raw materials like steel and plastics directly impact Flex-N-Gate's cost of goods sold. For instance, the average price of steel, a primary input for automotive components, saw significant volatility throughout 2024, with some benchmarks experiencing double-digit percentage increases in certain quarters due to global demand shifts and production constraints.

Ongoing supply chain disruptions, such as the persistent shortages of semiconductor chips and specialized metals, continue to affect Flex-N-Gate's production schedules and component pricing. As of mid-2025, the automotive industry is still navigating the residual effects of these shortages, leading to extended lead times and elevated costs for critical electronic and metal components, impacting overall manufacturing efficiency.

Currency Fluctuations

Currency fluctuations present a significant economic factor for Flex-N-Gate, a global automotive parts manufacturer. As a company operating across various international markets, changes in exchange rates directly influence the cost of raw materials sourced from abroad and the pricing of its exported products. For instance, a stronger US dollar could make Flex-N-Gate's exports more expensive for foreign buyers, potentially reducing sales volume.

The translation of foreign subsidiary earnings back into the parent company's reporting currency is also heavily impacted. If a subsidiary operates in a country whose currency depreciates against the US dollar, the reported profits from that subsidiary will be lower when converted, affecting overall financial performance. This volatility necessitates careful financial management and hedging strategies.

Recent economic trends highlight this exposure. For example, during 2023 and early 2024, the Japanese Yen experienced significant weakening against the US dollar. If Flex-N-Gate has substantial operations or sales in Japan, this could lead to a reduction in the dollar value of those earnings. Conversely, a strengthening Euro could boost the reported profits from European operations.

- Impact on Costs: A 10% depreciation of the Mexican Peso against the USD in early 2024 could increase the cost of components sourced from Mexico for US-based production.

- Export Competitiveness: If the Brazilian Real weakens significantly, Brazilian competitors might offer their automotive parts at lower prices in USD terms, impacting Flex-N-Gate's export market share.

- Revenue Translation: A stronger Canadian Dollar in late 2023 positively impacted the USD equivalent of Flex-N-Gate's Canadian sales revenue.

- Profitability: Unfavorable currency movements can lead to margin compression, as seen when a significant appreciation of the Swiss Franc impacted the profitability of European operations translated into USD in Q1 2024.

Investment in Electrification and New Technologies

The automotive sector's massive push into electrification and new technologies, including autonomous driving and connected car features, is reshaping the supply chain. Major Original Equipment Manufacturers (OEMs) are earmarking significant capital for EV production. For instance, by the end of 2024, global automotive investment in electrification was projected to exceed $1.5 trillion cumulatively.

This transition creates opportunities for suppliers like Flex-N-Gate to develop and provide components for these advanced vehicles. However, the pace of consumer adoption for Battery Electric Vehicles (BEVs) has been uneven across different regions. This necessitates a strategic balancing act for suppliers, ensuring they invest in future technologies while still meeting the ongoing demand for components used in internal combustion engine (ICE) vehicles.

Key considerations for Flex-N-Gate include:

- Capital Allocation: Deciding how much to invest in EV-specific manufacturing versus maintaining capacity for traditional components.

- Technological Adaptation: Acquiring or developing the expertise and manufacturing capabilities for new materials and complex electronic systems.

- Market Demand Fluctuations: Navigating the uncertainty in BEV adoption rates and potential shifts in demand for legacy automotive parts.

- Competitive Landscape: Facing competition from both established automotive suppliers and new entrants specializing in EV technology.

Global economic conditions continue to shape demand for automotive components, with 2025 projections indicating a tempered growth in vehicle sales. Persistent inflation and elevated interest rates, such as the US Federal Reserve's benchmark rate holding between 5.25%-5.50% through early 2024, directly increase operational costs for raw materials like steel and financing expenses for Flex-N-Gate.

Currency fluctuations also pose a significant challenge; for instance, a 10% depreciation of the Mexican Peso against the USD in early 2024 could raise the cost of components sourced from Mexico for US production. This volatility necessitates robust financial management and hedging strategies to mitigate impacts on profitability and revenue translation from international operations.

The automotive industry's rapid shift towards electrification, with global investments in EVs projected to surpass $1.5 trillion cumulatively by the end of 2024, presents both opportunities and challenges for Flex-N-Gate. Adapting to new technologies and fluctuating consumer adoption rates for electric vehicles requires strategic capital allocation and a keen eye on evolving market demands.

Preview the Actual Deliverable

Flex-N-Gate PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Flex-N-Gate PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Flex-N-Gate's operations and strategic decisions.

Sociological factors

Consumer tastes are definitely changing. We're seeing a real uptick in interest for hybrid electric vehicles (HEVs), not just fully electric ones (BEVs). At the same time, those popular SUVs aren't going anywhere. This means Flex-N-Gate needs to make sure its parts work for all these different kinds of cars.

For example, in 2024, the global market for HEVs was projected to reach over $300 billion, showing a strong consumer pull. This trend, coupled with the ongoing popularity of SUVs which often have higher profit margins for manufacturers, presents a clear directive for component suppliers like Flex-N-Gate to diversify their product lines to capture these evolving market segments.

Consumers are increasingly prioritizing vehicles equipped with advanced infotainment and connectivity options, a trend amplified by the rollout of 5G and the development of Vehicle-to-Everything (V2X) communication. By 2024, the global connected car market was valued at over $100 billion, with projections indicating substantial growth through 2030.

This growing consumer demand means Flex-N-Gate, a key supplier of exterior components like trim and lighting, faces an opportunity to integrate sensors and communication modules directly into its product offerings. Such integration would be crucial for enabling the seamless functionality of these advanced connected car features.

Consumer demand for sustainability is a significant sociological factor. In 2024, reports indicate that over 60% of consumers consider sustainability when making purchasing decisions, a figure that has steadily climbed. This trend directly impacts the automotive industry, with OEMs increasingly scrutinizing their supply chains for environmental and ethical compliance.

Flex-N-Gate's proactive approach to sustainable materials, such as increased use of recycled aluminum and plastics, and investments in energy-efficient manufacturing processes, directly addresses this growing consumer and OEM expectation. For instance, a commitment to reducing its carbon footprint by 15% by 2027, as outlined in their latest sustainability report, can bolster their brand image and secure preferred supplier status with environmentally conscious automotive manufacturers.

Demographic Shifts and Urbanization

Global demographic shifts, including rapid urbanization, are reshaping consumer behavior and transportation needs. By 2050, it's projected that 68% of the world's population will live in urban areas, a significant increase from today. This trend influences vehicle ownership models, with younger generations, particularly Gen Z and Millennials, increasingly favoring mobility-as-a-service (MaaS) solutions over traditional car ownership.

These evolving generational preferences mean a potential decrease in demand for personally owned vehicles, impacting production volumes and the types of vehicles manufacturers like Flex-N-Gate need to produce. For instance, the ride-sharing market, a key component of MaaS, saw significant growth in 2023, with global revenue in this segment reaching an estimated $120 billion. Flex-N-Gate must strategically adapt its product offerings to align with these long-term market trends, focusing on components for shared mobility fleets and potentially electric vehicles designed for urban use.

- Urbanization: 68% of the global population projected to live in urban areas by 2050.

- MaaS Adoption: Younger consumers increasingly prioritize mobility-as-a-service over personal vehicle ownership.

- Ride-Sharing Market: Estimated global revenue of $120 billion in 2023, indicating strong MaaS growth.

- Product Adaptation: Need for Flex-N-Gate to focus on components for shared and electric urban mobility solutions.

Labor Availability and Skill Gaps

The manufacturing sector, especially in automotive, faces a significant challenge with the availability of skilled labor and widening skill gaps. This is particularly true as the industry pivots towards electric vehicle (EV) production, demanding new expertise in areas like battery technology and advanced electronics. Flex-N-Gate must navigate this landscape to ensure its operations remain efficient and scalable.

Attracting and retaining a qualified workforce is paramount for maintaining robust production capabilities. The competition for talent in specialized manufacturing roles is intense, impacting companies like Flex-N-Gate's ability to meet production demands and innovate.

- Labor Shortages: The U.S. manufacturing sector experienced an estimated shortage of 3.8 million workers in 2023, according to Deloitte and The Manufacturing Institute.

- Skill Gap Impact: A 2024 report by the National Association of Manufacturers indicated that 77% of manufacturers reported a shortage of skilled production workers.

- EV Transition Needs: The shift to EVs requires workers proficient in areas such as advanced battery assembly, software integration, and high-voltage electrical systems, skills not always abundant in the traditional automotive workforce.

Societal expectations regarding corporate responsibility are evolving, pushing companies like Flex-N-Gate to demonstrate strong ethical practices and community engagement. Consumers and stakeholders are increasingly scrutinizing a company's social impact, demanding transparency in labor practices and supply chain management. This heightened awareness means that positive social contributions can significantly enhance brand reputation and customer loyalty.

The automotive industry is experiencing a notable shift in consumer preferences, with a growing demand for vehicles that are not only technologically advanced but also environmentally sustainable. This trend is particularly evident among younger demographics, who are more inclined to support brands that align with their values. For Flex-N-Gate, this translates into a need to adapt its product offerings to meet these evolving consumer expectations, potentially by focusing on lightweight materials and components that contribute to fuel efficiency or electrification.

| Sociological Factor | Description | Impact on Flex-N-Gate | Supporting Data (2024/2025) |

|---|---|---|---|

| Ethical Consumerism | Growing consumer demand for socially responsible and ethically produced goods. | Requires Flex-N-Gate to ensure ethical labor practices and transparent supply chains. | Over 60% of consumers consider sustainability in purchasing decisions (reports from early 2024). |

| Shifting Generational Values | Younger generations (Millennials, Gen Z) prioritize sustainability and social impact. | Drives demand for eco-friendly vehicle components and brands with strong CSR. | Increasing preference for EVs and hybrid vehicles among younger car buyers. |

| Workforce Demographics | Changes in workforce age, education, and skill sets. | Necessitates adaptation in recruitment, training, and employee engagement strategies. | Continued demand for skilled labor in advanced manufacturing, with potential shortages in specialized areas. |

Technological factors

The automotive industry's accelerated move to electric vehicles (EVs) presents a significant technological imperative for Flex-N-Gate. This shift demands innovation in areas like lightweight materials to offset battery weight and the seamless integration of battery components into vehicle structures. For instance, the global EV market is projected to reach over 30 million units in 2024, a substantial increase from previous years, highlighting the scale of this transition.

Ongoing advancements in battery technology, including the development of next-generation solid-state batteries and strategic efforts to build more resilient EV battery supply chains, directly impact the types of components Flex-N-Gate will need to produce. Companies are investing heavily in battery research and development, with global R&D spending in this sector expected to exceed $100 billion by 2025, signaling a critical period for component suppliers to adapt.

The push towards autonomous driving, with Level 2 systems becoming more common in 2024 and beyond, demands sophisticated sensors and processing units. Flex-N-Gate's lighting and trim divisions must adapt, potentially integrating these advanced components to align with the evolving needs of self-driving vehicles.

Flex-N-Gate's adoption of advanced manufacturing, including automation and AI, is key to boosting efficiency and quality. For instance, by 2024, the global manufacturing automation market was projected to reach $300 billion, highlighting the significant investment in these technologies.

Embracing Industry 5.0 principles, such as real-time digital monitoring and AI for risk analysis, will bolster Flex-N-Gate's supply chain resilience. This is particularly relevant as supply chain disruptions, like those seen in 2021-2022, cost businesses billions, making proactive risk management essential.

Lightweight Materials and Design Innovation

The automotive sector's relentless pursuit of better fuel economy and extended electric vehicle (EV) range directly fuels the demand for lighter materials and smarter design. This trend is a significant technological driver.

Flex-N-Gate, with its established proficiency in both plastics and metals, is well-positioned to innovate and supply these advanced lightweight components. These parts are crucial for enhancing vehicle performance and promoting environmental sustainability.

For instance, the average weight of vehicles has been steadily decreasing. In 2024, the average curb weight for new passenger cars in the US was around 3,500 pounds, a reduction from previous years driven by material science advancements.

- Demand for Lightweight Materials: Driven by fuel efficiency and EV range targets, the global automotive lightweight materials market was valued at approximately $85 billion in 2023 and is projected to reach over $130 billion by 2030, with a compound annual growth rate (CAGR) of around 6.5%.

- Flex-N-Gate's Role: The company's expertise in polymer composites and advanced high-strength steels allows it to develop components that reduce vehicle mass without compromising safety or durability.

- Design Innovation: Integrated design solutions, such as multi-material structures and optimized component geometry, are key to achieving significant weight savings.

- Impact on Performance: Lighter vehicles generally offer improved acceleration, handling, and braking, alongside reduced emissions and energy consumption.

Digitalization of Supply Chain Management

The automotive industry's supply chains are undergoing a significant digital overhaul, with technologies like AI, machine learning, and blockchain becoming increasingly crucial. For a company like Flex-N-Gate, this means opportunities to enhance efficiency and resilience. For instance, AI-powered demand forecasting can significantly reduce inventory costs and prevent stockouts. The global supply chain management market is projected to reach $37.06 billion by 2027, indicating a strong trend towards digital solutions.

Leveraging these advancements allows Flex-N-Gate to gain better visibility and control over its intricate global operations. Improved traceability, facilitated by blockchain, ensures greater transparency and can help in identifying and resolving issues quickly. Real-time monitoring, powered by IoT sensors and data analytics, enables proactive management of potential disruptions, a critical factor in today's volatile market. The automotive sector's investment in digital transformation is substantial, with many OEMs and Tier 1 suppliers allocating significant portions of their R&D budgets to these areas.

- AI and Machine Learning are being used to optimize logistics, predict equipment failures, and improve quality control in manufacturing processes.

- Blockchain Technology offers enhanced security and transparency for tracking parts and materials throughout the supply chain, reducing fraud and errors.

- Real-time Data Analytics provide immediate insights into inventory levels, production status, and potential bottlenecks, enabling faster decision-making.

- Digital Twins are emerging as a tool for simulating and optimizing supply chain operations before physical implementation, minimizing risks.

The automotive industry's rapid technological evolution, particularly the shift towards electric and autonomous vehicles, necessitates continuous innovation in component design and manufacturing for Flex-N-Gate. Advancements in battery technology and the integration of sophisticated sensors for self-driving capabilities are key areas requiring adaptation. The global market for automotive sensors alone was projected to exceed $50 billion in 2024, underscoring the growing complexity of vehicle components.

Flex-N-Gate must also embrace advanced manufacturing techniques like AI and automation to maintain competitiveness, as the global manufacturing automation market was expected to surpass $300 billion by 2024. This focus on efficiency and quality is critical for meeting the demands of modern vehicle production. Furthermore, the increasing emphasis on lightweight materials, driven by fuel efficiency and EV range requirements, presents significant opportunities for Flex-N-Gate's expertise in plastics and metals.

| Technological Factor | Description | Impact on Flex-N-Gate | Relevant Data (2024/2025 Projections) |

|---|---|---|---|

| Electrification | Shift to Electric Vehicles (EVs) | Demand for EV-specific components, battery integration expertise. | Global EV sales projected to reach over 30 million units in 2024. |

| Autonomous Driving | Development of self-driving systems | Need for integrated sensor and processing unit components in lighting and trim. | Level 2 autonomous systems becoming standard in new vehicles. |

| Advanced Materials | Lightweighting for fuel efficiency and EV range | Opportunity to supply advanced lightweight plastics and metal components. | Automotive lightweight materials market valued at ~$85 billion in 2023. |

| Manufacturing Technology | Automation, AI, Industry 5.0 | Enhance efficiency, quality, and supply chain resilience. | Global manufacturing automation market projected to exceed $300 billion by 2024. |

Legal factors

Flex-N-Gate must adhere to rigorous automotive safety standards mandated by organizations such as the National Highway Traffic Safety Administration (NHTSA) in the US and the United Nations Economic Commission for Europe (UNECE). For instance, NHTSA's New Car Assessment Program (NCAP) ratings, which influence consumer purchasing decisions, require manufacturers to meet specific crashworthiness and active safety criteria.

The evolving landscape of vehicle technology, including advanced driver-assistance systems (ADAS) and autonomous driving, introduces new legal complexities. Regulations concerning liability in case of accidents involving automated systems and data privacy for connected vehicles are rapidly developing. In 2024, the US Department of Transportation continued to refine guidelines for automated driving systems, emphasizing safety and cybersecurity.

Flex-N-Gate faces significant legal hurdles with evolving environmental regulations. The U.S. Environmental Protection Agency (EPA) continues to implement stringent multi-pollutant emissions standards for light and medium-duty vehicles, impacting automotive component suppliers. Similarly, the European Union's aggressive CO2 reduction targets for new vehicles necessitate cleaner manufacturing and more sustainable product design.

Protecting intellectual property (IP) is paramount for Flex-N-Gate, especially given its focus on innovative automotive components and advanced manufacturing techniques. In 2024, the automotive industry saw continued investment in R&D, with global spending projected to exceed $200 billion, much of which is driven by technological advancements. Flex-N-Gate's ability to safeguard its patents and proprietary processes directly impacts its competitive edge and market valuation.

Navigating the intricate landscape of technology licensing is also a critical legal factor. As the automotive sector embraces new technologies like advanced driver-assistance systems (ADAS) and electric vehicle (EV) powertrains, licensing agreements for software, materials, and manufacturing processes become essential. Ensuring compliance and preventing infringement, particularly with global supply chains and diverse regulatory environments, is a constant challenge for companies like Flex-N-Gate, which operates internationally.

Labor and Employment Laws

Flex-N-Gate's global presence necessitates strict adherence to a complex web of labor and employment laws. These regulations govern everything from worker safety standards and minimum wage requirements to collective bargaining rights and the proper classification of employees. For instance, in 2024, the average manufacturing wage in the United States, a key market for Flex-N-Gate, continued to see upward pressure, influenced by inflation and labor market dynamics.

Navigating these legal frameworks is paramount for maintaining operational continuity and managing human resources effectively. Union negotiations, a common aspect of the automotive supply chain, directly influence labor costs and production schedules. In 2024, significant union contract renewals across the automotive sector highlighted the ongoing importance of these discussions.

- Worker Safety: Compliance with Occupational Safety and Health Administration (OSHA) standards in the US and similar bodies globally is non-negotiable.

- Wage and Hour Laws: Adherence to federal and state minimum wage laws, overtime regulations, and equal pay acts is crucial.

- Collective Bargaining: Managing relationships with unions and complying with the National Labor Relations Act (NLRA) or equivalent international legislation shapes employee relations.

- Employee Classification: Correctly classifying workers as employees versus independent contractors avoids legal penalties and ensures proper benefits administration.

Antitrust and Competition Laws

Flex-N-Gate operates within a global landscape where antitrust and competition laws are paramount. These regulations, enforced by bodies like the U.S. Federal Trade Commission (FTC) and the European Commission, aim to prevent monopolies and ensure a level playing field for businesses. For instance, in 2023, the FTC continued its scrutiny of the automotive sector, with ongoing investigations into potential anti-competitive practices, impacting supply chains and pricing strategies for major players.

The automotive industry, in particular, is characterized by frequent mergers, acquisitions, and strategic alliances. Flex-N-Gate must carefully assess these collaborations to ensure they do not stifle competition or lead to market dominance. Recent trends, such as the significant investments and partnerships announced in 2024 between major automotive manufacturers and technology firms focused on electric vehicle (EV) components, highlight the need for meticulous legal review to comply with evolving antitrust frameworks.

- Regulatory Scrutiny: Antitrust authorities globally are increasingly vigilant, particularly in consolidated industries like automotive parts manufacturing.

- Merger & Acquisition Compliance: Flex-N-Gate must ensure any M&A activity adheres to pre-merger notification requirements and avoids creating anti-competitive market structures.

- Fair Competition: Adherence to these laws is crucial for maintaining fair pricing, product innovation, and consumer choice in the automotive supply chain.

- Global Harmonization Challenges: Navigating differing antitrust regulations across various international markets presents a complex legal challenge for a global supplier like Flex-N-Gate.

Flex-N-Gate must navigate a complex web of global and national regulations, including stringent automotive safety standards from bodies like NHTSA and UNECE, which directly impact product design and market access. Evolving laws around autonomous driving and connected vehicles, with continued refinement of guidelines in 2024, present new liability and data privacy considerations.

Environmental regulations from agencies like the EPA are increasingly strict, pushing for lower vehicle emissions and sustainable manufacturing practices, a trend reinforced by the EU's aggressive CO2 reduction targets. Protecting intellectual property is crucial, especially with over $200 billion projected in global automotive R&D spending in 2024, where safeguarding patents is key to competitive advantage.

Labor laws, covering worker safety, wages, and collective bargaining, are critical for operational continuity, with rising manufacturing wages in the US in 2024 adding to cost considerations. Antitrust and competition laws, actively scrutinized by bodies like the FTC, are vital for managing strategic alliances and ensuring fair market practices, particularly with the surge in EV technology partnerships announced in 2024.

Environmental factors

The automotive sector, and by extension suppliers like Flex-N-Gate, are under significant pressure to curb carbon emissions and move towards climate neutrality. This push is driven by regulatory bodies, consumer demand, and the sustainability commitments of original equipment manufacturers (OEMs).

Flex-N-Gate has publicly stated its commitment to reducing absolute Scope 1 and 2 greenhouse gas emissions. The company is also actively investigating the potential of carbon offset projects to further its climate goals, demonstrating an alignment with broader industry and global sustainability targets.

Stricter environmental regulations are pushing companies like Flex-N-Gate to prioritize waste minimization and adopt circular economy principles. This means enhancing waste sorting processes and exploring innovative material recovery methods. For instance, by 2024, the European Union aims to increase the recycling rate for municipal waste to 60%, a target that will influence automotive supply chains.

Flex-N-Gate's commitment to achieving zero waste across its manufacturing sites by 2025 underscores the growing importance of resource efficiency. This objective necessitates integrating recycled content into its product lines, a trend supported by increasing consumer demand for sustainable automotive components and a growing market for recycled plastics, which is projected to reach over $60 billion globally by 2027.

Flex-N-Gate faces growing pressure from regulators and consumers to ensure its material sourcing is sustainable and traceable, especially for components in electric vehicles. This means looking closely at how raw materials, like those for batteries, are obtained. For instance, the demand for cobalt, a key element in many EV batteries, has driven up prices and scrutiny on mining practices, with some estimates suggesting the global cobalt market could reach over $20 billion by 2027.

To navigate this, Flex-N-Gate is focusing on diversifying its supplier base and performing thorough checks on their ethical labor and environmental standards. This proactive approach helps mitigate risks associated with supply chain disruptions and reputational damage, ensuring a more resilient and responsible operation.

Water Usage and Conservation

Water scarcity is becoming a significant concern, and environmental regulations are tightening, pushing companies like Flex-N-Gate to prioritize water reduction. This means looking closely at how much water is being drawn, particularly in areas already facing water stress. For instance, the United Nations reported in 2023 that over 2 billion people live in countries experiencing high water stress, a figure projected to rise.

Implementing advanced water management systems is crucial for Flex-N-Gate. This isn't just about being good environmental citizens; it's about ensuring long-term operational sustainability. Efficient systems can lead to cost savings and reduce the risk of disruptions due to water shortages. Many industrial facilities are exploring technologies like water recycling and rainwater harvesting.

Flex-N-Gate's commitment to water conservation aligns with broader industry trends. For example, the automotive sector, where Flex-N-Gate operates, is increasingly focused on reducing its environmental footprint. A 2024 report by the World Resources Institute highlighted that many manufacturers are setting ambitious targets for water use reduction, often aiming for 20-30% decreases by 2030.

Key areas for Flex-N-Gate to focus on include:

- Reducing withdrawal in water-stressed regions: Prioritizing facilities located in areas identified as having high water stress.

- Implementing efficient technologies: Investing in water-saving equipment and processes, such as closed-loop cooling systems.

- Monitoring and reporting: Establishing robust systems to track water usage and identify areas for further improvement.

- Employee engagement: Educating and involving employees in water conservation efforts across all operations.

Energy Efficiency and Renewable Energy Adoption

Flex-N-Gate's focus on energy efficiency and renewable energy adoption is a critical environmental consideration. The company is actively exploring ways to reduce its energy footprint, which is crucial not only for meeting environmental regulations but also for managing operational costs. For instance, in 2023, the automotive industry as a whole saw a significant push towards sustainability, with many manufacturers investing heavily in energy-saving technologies.

The company is investigating the implementation of local renewable energy sources at its manufacturing facilities. This move aligns with broader industry trends, as companies worldwide seek to diversify their energy portfolios away from fossil fuels. By 2024, it's projected that investments in renewable energy for industrial applications will continue to climb, driven by both environmental mandates and economic incentives.

Flex-N-Gate's efforts include finding viable alternatives to traditional fossil fuels for its operations. This research is essential for long-term operational resilience and for contributing to a cleaner industrial landscape.

- Energy Consumption Reduction: Flex-N-Gate aims to lower its overall energy usage across all operations.

- Renewable Energy Integration: The company is assessing the feasibility of installing local renewable energy sources at its sites.

- Fossil Fuel Alternatives: Research is ongoing to identify and implement replacements for fossil fuels in manufacturing processes.

- Industry Trend Alignment: These initiatives position Flex-N-Gate with the automotive sector's growing emphasis on sustainability and environmental responsibility.

Environmental factors significantly influence Flex-N-Gate's operations, primarily through the global drive for carbon neutrality and stricter emissions regulations. The company is actively pursuing emission reductions, including investigating carbon offset projects, to align with OEM sustainability commitments and consumer demand for greener automotive components.

Waste minimization and circular economy principles are becoming paramount, with Flex-N-Gate targeting zero waste by 2025 and incorporating recycled content, a trend supported by a growing global market for recycled plastics projected to exceed $60 billion by 2027.

Water scarcity is another critical concern, prompting Flex-N-Gate to focus on water reduction strategies and efficient management systems, especially in water-stressed regions, an issue affecting over 2 billion people globally as of 2023.

Furthermore, energy efficiency and the adoption of renewable energy sources are key environmental priorities for Flex-N-Gate, reflecting a broader industry shift towards sustainability and cost management.

| Environmental Factor | Impact on Flex-N-Gate | Key Initiatives/Targets | Relevant Data/Projections |

|---|---|---|---|

| Carbon Emissions Reduction | Regulatory pressure, OEM demands, consumer preference for sustainable vehicles | Reducing Scope 1 & 2 emissions, exploring carbon offsets | Global push for climate neutrality |

| Waste Management & Circularity | Stricter waste regulations, resource efficiency goals | Zero waste by 2025, increasing recycled content | EU municipal waste recycling target: 60% by 2024; Global recycled plastics market: >$60B by 2027 |

| Water Scarcity & Management | Increasing water stress, tighter regulations | Water reduction, efficient management systems, exploring recycling/harvesting | 2B+ people in high water stress countries (2023); Automotive sector aiming for 20-30% water reduction by 2030 |

| Energy Efficiency & Renewables | Cost management, environmental responsibility | Reducing energy footprint, exploring local renewable energy sources, fossil fuel alternatives | Increasing investments in industrial renewable energy (2024 onwards) |

PESTLE Analysis Data Sources

Our Flex-N-Gate PESTLE analysis is meticulously crafted using data from governmental bodies, industry associations, and reputable market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the automotive supply chain.