Flex-N-Gate Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flex-N-Gate Bundle

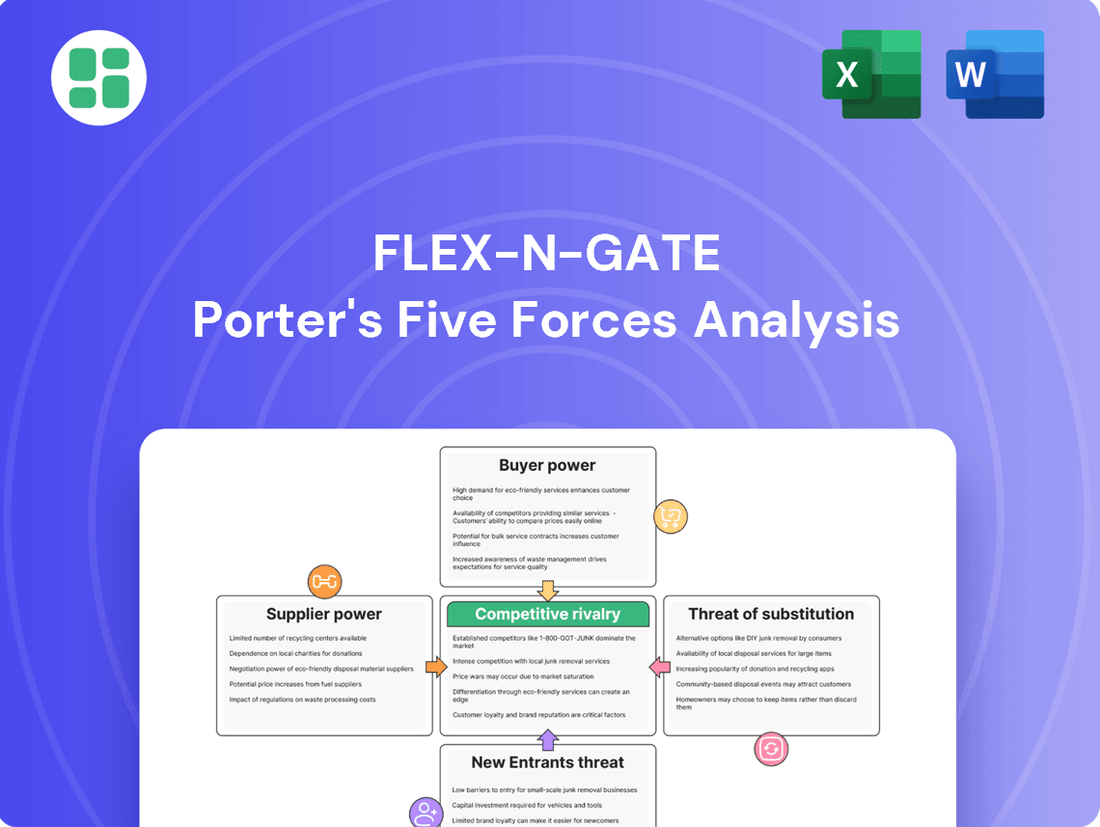

Flex-N-Gate operates in a dynamic automotive supply industry, facing significant pressure from powerful buyers and intense rivalry among established competitors. Understanding these forces is crucial for any stakeholder looking to navigate this complex landscape.

The complete report reveals the real forces shaping Flex-N-Gate’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Flex-N-Gate sources materials like steel, aluminum, plastics, lighting, and electronics, meaning supplier power depends heavily on availability and uniqueness. If these inputs are scarce or have few producers, suppliers gain leverage.

The automotive sector, including companies like Flex-N-Gate, experienced significant supplier power increases due to events like the 2020-2022 semiconductor shortage, where chip prices rose and lead times extended dramatically, impacting production schedules across the industry.

Switching suppliers for highly integrated or proprietary components presents significant switching costs for Flex-N-Gate. These costs can manifest as expenses for re-tooling, re-engineering, and re-validation, all of which are necessary to ensure compatibility and performance with new suppliers. This dynamic inherently strengthens the bargaining power of suppliers, particularly those with whom Flex-N-Gate has established, long-term relationships, as specific tooling and established processes are already in place.

For instance, in the automotive sector, the development and validation of a new braking system component can take 2-3 years and cost millions of dollars, making abrupt supplier changes exceptionally challenging. Flex-N-Gate's own substantial investments in tooling and product development facilities, however, offer a degree of mitigation. These internal capabilities allow for more efficient in-house adaptation of designs and potentially quicker transitions when necessary, somewhat counterbalancing the supplier's leverage.

While rare for basic material providers, specialized component manufacturers might consider integrating forward into assembly or directly supplying original equipment manufacturers (OEMs). This risk is amplified if a supplier boasts proprietary technology or a recognized brand, enabling them to bypass intermediaries like Flex-N-Gate for specific parts. For instance, in 2024, the automotive supplier industry saw consolidation, with some tier-one suppliers acquiring smaller specialized firms, hinting at this potential trend.

Importance of Flex-N-Gate to Suppliers

Flex-N-Gate's position as a significant global automotive supplier grants it considerable leverage over its own suppliers. When Flex-N-Gate represents a substantial portion of a supplier's business, that supplier becomes more reliant on Flex-N-Gate's orders, thus diminishing the supplier's bargaining power.

However, the dynamic shifts if Flex-N-Gate's procurement volume is a minor part of a supplier's overall sales. In such scenarios, the supplier's dependence on Flex-N-Gate is reduced, empowering them with greater negotiation strength.

For instance, in 2024, the automotive supply chain experienced ongoing consolidation. Suppliers who serve multiple large OEMs, including Flex-N-Gate, may find their individual dependence on any single buyer lessened, enhancing their ability to negotiate terms.

- Supplier Dependence: Flex-N-Gate's significant order volumes can make suppliers dependent, reducing their bargaining power.

- Market Share Impact: If Flex-N-Gate constitutes a large percentage of a supplier's revenue, the supplier has less leverage.

- Supplier Diversification: Suppliers serving a broad customer base, including Flex-N-Gate, may have increased bargaining power.

- Industry Trends: In 2024, supply chain dynamics, including supplier consolidation, influenced these power balances.

Availability of Substitutes for Supplier Inputs

The availability of substitutes for the components Flex-N-Gate sources significantly influences supplier power. If alternative materials or suppliers emerge, Flex-N-Gate gains leverage, potentially driving down costs and improving terms. For instance, the automotive sector's push for sustainability is spurring the development of new materials.

The automotive industry is actively investigating eco-friendly materials like recycled plastics and bio-based composites. This diversification of the supply base means Flex-N-Gate has more choices, which naturally weakens the bargaining power of any single supplier. For example, by 2024, the global market for sustainable automotive materials was projected to reach tens of billions of dollars, indicating substantial growth and the availability of new options.

- Emerging Material Substitutes: The development of lightweight or sustainable alternatives provides Flex-N-Gate with more sourcing options, thereby reducing supplier leverage and potentially lowering input costs.

- Industry Trend Towards Sustainability: The automotive industry's increasing exploration of eco-friendly materials, such as recycled plastics and bio-based composites, diversifies the supplier landscape.

- Market Growth for Sustainable Materials: The global market for sustainable automotive materials showed significant expansion, with projections indicating substantial growth through 2024, underscoring the increasing availability of alternative inputs.

Suppliers of critical components like semiconductors or specialized plastics can wield significant power, especially when alternatives are limited or switching costs are high, as seen during the 2020-2022 chip shortage where prices surged.

Flex-N-Gate's own scale can reduce supplier power if it represents a large portion of a supplier's business, but this is countered if suppliers serve many large clients, diluting their dependence on any single buyer.

The growing availability of sustainable materials, with the global market for these projected to reach tens of billions by 2024, offers Flex-N-Gate more options, thereby weakening individual supplier leverage.

Forward integration by suppliers, particularly those with proprietary technology, poses a risk, a trend observed in 2024 with consolidation among tier-one automotive suppliers.

| Factor | Impact on Flex-N-Gate | Example/Data Point (2024 Context) |

|---|---|---|

| Supplier Concentration | High power if few suppliers exist for critical inputs. | Semiconductor shortages highlighted this in recent years. |

| Switching Costs | High costs for re-tooling/validation strengthen supplier position. | Automotive component validation can take years and millions. |

| Customer Dependence | Low dependence on Flex-N-Gate increases supplier leverage. | Suppliers serving multiple large OEMs may have less Flex-N-Gate dependence. |

| Substitute Availability | Increased availability of alternatives reduces supplier power. | Growth in sustainable automotive materials market by 2024. |

What is included in the product

This analysis details the competitive forces impacting Flex-N-Gate, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the automotive supply industry.

Flex-N-Gate's Five Forces analysis provides a clear, one-sheet summary of all competitive pressures—perfect for quick, strategic decision-making.

Customers Bargaining Power

Flex-N-Gate's customer base is dominated by major automotive Original Equipment Manufacturers (OEMs), a group characterized by high concentration and substantial purchase volumes. This concentration means that a few key clients account for a significant portion of Flex-N-Gate's sales, giving these OEMs considerable sway in negotiations.

The sheer scale of orders placed by these automotive giants is critical to Flex-N-Gate's financial health, directly translating into substantial bargaining power for the customers. For instance, in 2024, the top five automotive OEMs globally represented over 60% of the total automotive market value, highlighting the dependency of suppliers like Flex-N-Gate on these large accounts.

Adding to this leverage, a notable trend observed in 2024 is the increasing tendency for OEMs to establish direct sourcing agreements with raw material suppliers. This strategic move bypasses intermediaries and further amplifies the OEMs' ability to dictate terms, potentially impacting pricing and supply chain relationships for component manufacturers.

While original equipment manufacturers (OEMs) hold considerable sway, the process of switching from an established supplier like Flex-N-Gate for intricate, integrated parts, such as bumper assemblies or advanced lighting systems, incurs substantial costs. These include expenses related to redesign, rigorous testing, and validation, effectively creating a degree of customer lock-in that limits immediate flexibility once a supply agreement is finalized.

Major Original Equipment Manufacturers (OEMs) in the automotive sector, such as General Motors and Ford, often have substantial financial reserves and advanced engineering expertise. This enables them to consider producing certain components internally, particularly those that are crucial to their vehicle's performance or are manufactured in very high volumes. For instance, in 2024, many large automakers continued to invest heavily in advanced manufacturing technologies, making in-house production of specialized parts more feasible than in previous years.

The very possibility of OEMs pursuing backward integration acts as a significant check on suppliers like Flex-N-Gate. Knowing that a major customer could potentially bring production in-house if pricing becomes unfavorable gives OEMs considerable leverage. This capability allows them to negotiate more aggressively on price and terms, as they can credibly threaten to become their own supplier for specific components, thereby influencing supplier behavior.

Customer Price Sensitivity

The automotive industry's intense competition means Original Equipment Manufacturers (OEMs) are always looking to cut production costs and vehicle prices. This pressure directly impacts Flex-N-Gate, as its customers are highly sensitive to price changes. For instance, in 2024, many automotive suppliers faced margin compression due to rising raw material costs and the need to offer competitive pricing to OEMs.

This customer price sensitivity forces Flex-N-Gate to constantly optimize its own operational expenses. The global automotive market is projected to see sluggish growth in 2025, further intensifying these cost pressures. Suppliers like Flex-N-Gate must therefore focus on efficiency to maintain profitability.

- Customer Price Sensitivity: OEMs demand lower prices, squeezing supplier margins.

- Cost Optimization: Suppliers must relentlessly reduce their own costs to remain competitive.

- Market Conditions: Projected sluggish growth in the global automotive market for 2025 exacerbates price pressures.

- Industry Landscape: The highly competitive nature of the automotive sector means price is a critical factor in customer purchasing decisions.

Availability of Alternative Suppliers for OEMs

The global automotive component market is highly competitive, featuring numerous large-scale suppliers such as Robert Bosch GmbH, Denso, and Magna International. This robust competition means Original Equipment Manufacturers (OEMs) are not reliant on a single source for their parts.

OEMs frequently employ dual-sourcing strategies or cultivate relationships with multiple suppliers. This practice significantly broadens their options and diminishes their dependence on any one provider, thereby amplifying their bargaining power.

- Competitive Landscape: The automotive component sector is populated by major global players, ensuring a wide array of choices for OEMs. For instance, in 2024, the top automotive suppliers globally generated billions in revenue, reflecting the scale and competition within the industry.

- OEM Sourcing Strategies: OEMs actively manage supplier relationships to mitigate risk and leverage competition. This often involves having at least two qualified suppliers for critical components, a strategy that directly strengthens their negotiation position.

- Impact on Bargaining Power: The availability of multiple, capable suppliers allows OEMs to negotiate more favorable terms, including pricing, delivery schedules, and quality standards, directly increasing their leverage.

Flex-N-Gate faces significant bargaining power from its customers, primarily large automotive OEMs. The concentration of these buyers, coupled with their substantial order volumes, gives them considerable leverage in negotiations. For instance, in 2024, the top five global automotive OEMs accounted for over 60% of the market's value, underscoring supplier dependence.

OEMs' ability to dictate terms is further enhanced by their increasing practice of direct sourcing from raw material providers, bypassing intermediaries and strengthening their control over the supply chain. Additionally, the substantial costs associated with switching suppliers, including redesign and validation, create a degree of customer lock-in, paradoxically empowering them once committed.

The competitive automotive landscape, where OEMs constantly strive for cost reduction, makes them highly price-sensitive. This pressure forces suppliers like Flex-N-Gate to maintain operational efficiency, especially with projected sluggish global automotive market growth in 2025. The potential for OEMs to engage in backward integration, producing parts in-house, also serves as a potent negotiation tool.

| Factor | Impact on Flex-N-Gate | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Customer Concentration | High leverage for major OEMs | Top 5 OEMs represent >60% of global auto market value. |

| Switching Costs | Limits immediate OEM flexibility, but doesn't negate long-term power. | Costs include redesign, testing, and validation. |

| Price Sensitivity | Squeezes supplier margins, demanding cost optimization. | Projected sluggish global auto market growth in 2025 intensifies pressure. |

| Backward Integration Threat | OEMs can credibly threaten in-house production. | Major automakers investing in advanced manufacturing capabilities. |

| Supplier Competition | OEMs have multiple sourcing options, increasing leverage. | Highly competitive market with players like Bosch, Denso, Magna. |

Preview Before You Purchase

Flex-N-Gate Porter's Five Forces Analysis

This preview showcases the complete Flex-N-Gate Porter's Five Forces Analysis, offering a detailed examination of industry competitiveness. You are viewing the exact document you will receive immediately after purchase, ensuring no surprises or missing information. This professionally formatted analysis is ready for your immediate use, providing valuable insights into Flex-N-Gate's strategic landscape.

Rivalry Among Competitors

The automotive component manufacturing sector is intensely competitive, populated by numerous global entities. Flex-N-Gate faces off against major diversified suppliers and niche specialists across its product offerings like bumpers, lighting, and trim.

The global automotive market is navigating a phase of subdued growth, with projections indicating modest increases in light vehicle sales for 2025. This slower pace, a departure from previous expansionary periods, naturally fuels more intense competition among established manufacturers and suppliers like Flex-N-Gate.

As the overall market expands at a more limited rate, companies are compelled to vie more aggressively for existing market share. This dynamic means that even small gains in sales or customer retention become critical, raising the stakes for competitive strategies and operational efficiency.

While Flex-N-Gate provides extensive engineering and design services, its foundational products such as bumpers and exterior trim face the risk of becoming commoditized. This means that without clear distinctions, these items can be easily substituted by competitors, intensifying price pressures.

To counter this, Flex-N-Gate must focus on strong product differentiation. Innovations like advanced lightweight materials, integrated functionalities, and novel designs are key. For instance, the automotive industry in 2024 is seeing a significant push towards materials that reduce vehicle weight, contributing to fuel efficiency and electric vehicle range, a trend Flex-N-Gate can leverage.

Furthermore, establishing high customer switching costs, particularly for intricate assemblies and integrated systems, is crucial. When a customer has invested heavily in a particular supplier's technology or requires extensive retooling to switch, their propensity to change suppliers diminishes, thereby reducing the intensity of competitive rivalry.

Exit Barriers

Flex-N-Gate faces significant competitive rivalry due to high exit barriers in the automotive component sector. These barriers are largely driven by substantial investments in specialized machinery and dedicated facilities, often tied to long-term supply agreements with original equipment manufacturers (OEMs). For instance, the automotive industry relies heavily on highly specific tooling and assembly lines, making it difficult and costly to repurpose or sell these assets if a company decides to exit.

Companies within this industry often find themselves compelled to continue operations, even at reduced profit margins, rather than incur the immense costs associated with shutting down and liquidating specialized assets. This dynamic can lead to prolonged periods of intense price competition as firms strive to maintain market share and cover their fixed costs. In 2024, the global automotive market experienced fluctuations impacting component suppliers, with some regions seeing production slowdowns that could exacerbate the pressure on less profitable players to stay in the game due to these exit challenges.

The presence of these exit barriers can also influence strategic decisions, potentially leading to consolidation or a focus on niche markets to mitigate the risks associated with a highly competitive environment where exiting is not a simple option. The financial commitment required for automotive component manufacturing means that firms are often locked into the industry for the long haul, contributing to the sustained rivalry.

- High Fixed Costs: Significant capital is required for specialized manufacturing equipment and facilities.

- Specialized Assets: Automotive component production often involves unique tooling and machinery that are not easily transferable to other industries.

- Long-Term Contracts: Agreements with OEMs create an obligation that makes early termination or asset disposal complex and costly.

- Continued Operation Despite Low Profitability: Companies may operate at a loss to avoid the substantial costs of exiting the market.

Strategic Stakes and Global Presence

The automotive component industry is characterized by fierce competition, with major players like Flex-N-Gate vying for global market share. Companies actively pursue original equipment manufacturer (OEM) contracts across various regions, driving significant investment in advanced manufacturing and research and development to stay ahead. This global pursuit of business intensifies the rivalry, as firms aim to establish a strong presence wherever vehicles are manufactured.

The strategic imperative for automotive suppliers to maintain a worldwide manufacturing and supply chain network is substantial. By serving OEMs in their diverse production locations, these companies secure vital, long-term business relationships. This global reach necessitates considerable capital expenditure on R&D and production facilities, directly fueling the intense competition within the sector.

- Global Footprint Necessity: Automotive suppliers must operate globally to serve OEMs wherever they assemble vehicles, leading to substantial investments in international manufacturing and distribution networks.

- R&D and Capability Investment: Intense rivalry compels companies to invest heavily in research and development and advanced manufacturing capabilities to meet evolving OEM demands and maintain a competitive edge.

- OEM Contract Significance: Securing long-term contracts with major OEMs is a primary driver of strategic decisions and fuels the competitive landscape as suppliers compete for these crucial relationships.

- Market Share Competition: The drive to capture significant market share on a global scale means that companies are constantly evaluating and adjusting their strategies to outmaneuver competitors in key automotive manufacturing hubs.

Competitive rivalry is a significant force for Flex-N-Gate, intensified by a global automotive market experiencing moderate growth. This environment compels suppliers to aggressively pursue market share, especially as product differentiation becomes harder for core components like bumpers.

The industry's high exit barriers, stemming from substantial investments in specialized machinery and long-term OEM contracts, mean companies often continue operations even with slim margins. This can lead to prolonged price wars as firms try to cover fixed costs and avoid the expense of leaving the market.

Flex-N-Gate must leverage innovation, such as lightweight materials gaining traction in 2024 for fuel efficiency, and build customer loyalty through integrated systems to mitigate intense competition. A global operational footprint is also essential for securing OEM business, further fueling the rivalry as companies invest heavily in R&D and manufacturing capabilities worldwide.

SSubstitutes Threaten

The automotive industry's push for lighter vehicles, particularly with the rise of electric cars, is driving innovation in alternative materials. For instance, the increasing adoption of carbon fiber composites and advanced aluminum alloys can directly substitute for steel components that Flex-N-Gate traditionally manufactures. By 2024, the global automotive lightweight materials market was projected to reach over $30 billion, highlighting the significant shift away from traditional materials.

The automotive industry's move towards modular vehicle architectures and software-defined vehicles presents a significant threat of substitution for traditional component suppliers. As original equipment manufacturers (OEMs) increasingly opt for highly integrated systems, the need for numerous discrete parts diminishes.

This trend means OEMs might consolidate sourcing, preferring to buy larger, more complex modules from a limited number of suppliers. For instance, the increasing prevalence of centralized computing platforms in electric vehicles, which replace many distributed ECUs, exemplifies this shift. This consolidation directly reduces the market opportunities for companies still focused on supplying individual, less integrated components.

The rise of alternative mobility solutions presents a long-term threat to automotive component suppliers like Flex-N-Gate. As ride-sharing services gain traction and autonomous vehicle technology matures, there's a potential for reduced individual car ownership. For instance, in 2024, ride-sharing services continued to expand their reach in major urban centers, indicating a growing preference for access over ownership for some consumers.

This shift could lead to a significant decrease in overall vehicle production volumes. If fewer cars are manufactured, the demand for essential components such as those produced by Flex-N-Gate will naturally decline. Analysts in 2024 projected that the global automotive market, while showing some recovery, faced headwinds from these evolving consumer preferences and technological advancements impacting traditional sales models.

Aftermarket Parts and DIY Solutions

The rise of aftermarket parts and do-it-yourself (DIY) repair solutions presents a potential, though largely indirect, threat. For non-Original Equipment Manufacturer (OEM) supplied components, the availability of lower-cost alternatives or easier repair methods could divert some demand. However, Flex-N-Gate's primary business model focuses on supplying directly to OEMs, which significantly mitigates the direct impact of this threat on its core operations.

While the aftermarket for automotive parts is substantial, with the global automotive aftermarket valued at over $400 billion in 2023 and projected to grow, Flex-N-Gate's strategic focus on OEM supply chains insulates it from the most direct competitive pressures within this segment. The company's expertise lies in integrated manufacturing and supplying complex assemblies to vehicle manufacturers, rather than individual replacement parts sold to consumers.

- Aftermarket Growth: The global automotive aftermarket is a significant market, demonstrating consumer willingness to seek alternative parts and repair solutions.

- Flex-N-Gate's Focus: Flex-N-Gate's core strategy is direct supply to OEMs, minimizing exposure to the independent aftermarket.

- Indirect Impact: While not a direct threat to Flex-N-Gate's primary business, the aftermarket's existence reflects broader industry trends in parts availability and repairability.

Advancements in Vehicle Design for Repairability and Durability

Future vehicle designs are increasingly focusing on repairability and durability, which could impact the demand for replacement parts. As vehicles are engineered to last longer and be easier to fix, the need for certain components over a car's lifespan might decrease.

This trend, while still developing, could subtly alter the overall volume of replacement parts required. For instance, advancements in materials science and modular design could mean fewer parts fail or require replacement. In 2024, the automotive industry continued to invest in these areas, with a growing emphasis on sustainability and reduced lifecycle costs for consumers.

- Enhanced Durability: New vehicle architectures may incorporate components with significantly longer expected lifespans, reducing the frequency of replacements.

- Modular Design: Vehicles designed with easily replaceable modules rather than individual, hard-to-access parts could streamline repairs and potentially reduce the overall number of parts needed throughout ownership.

- Advanced Materials: The use of more resilient and wear-resistant materials in critical components can directly translate to fewer failures and replacements over time.

The threat of substitutes for Flex-N-Gate stems from evolving automotive materials and design philosophies. The shift towards advanced materials like carbon fiber and aluminum, driven by the demand for lighter vehicles, directly substitutes for traditional steel components. Furthermore, the trend towards integrated vehicle architectures and software-defined systems reduces the need for discrete parts, favoring consolidated module suppliers.

| Threat of Substitution | Description | Impact on Flex-N-Gate | 2024 Data/Trend |

| Alternative Materials | Use of carbon fiber, advanced aluminum alloys replacing steel. | Reduces demand for steel-based components. | Global automotive lightweight materials market projected over $30 billion in 2024. |

| Integrated Systems | Modular vehicle architectures, software-defined vehicles. | Decreases need for numerous discrete parts, favors module suppliers. | Increased adoption of centralized computing platforms in EVs. |

| Alternative Mobility | Ride-sharing, autonomous vehicles reducing individual car ownership. | Potential decrease in overall vehicle production volumes. | Continued expansion of ride-sharing services in urban centers (2024). |

Entrants Threaten

Entering the automotive component manufacturing sector, particularly at a Tier 1 supplier level comparable to Flex-N-Gate, demands immense capital. Significant investments are necessary for state-of-the-art manufacturing plants, specialized tooling, advanced research and development, and rigorous quality assurance infrastructure. For instance, setting up a new automotive stamping plant can easily cost hundreds of millions of dollars, creating a formidable financial hurdle for potential newcomers.

Established players like Flex-N-Gate leverage substantial economies of scale in manufacturing, procurement, and logistics, translating to lower per-unit production costs. For instance, in 2024, the automotive supply chain saw continued consolidation, with larger firms like Flex-N-Gate benefiting from bulk purchasing power that smaller newcomers cannot easily replicate.

New entrants face a significant hurdle in matching these cost efficiencies, making it challenging to compete on price against incumbents who have already optimized their operations through years of experience and volume.

Flex-N-Gate's deep-rooted relationships with major original equipment manufacturers (OEMs) and its extensive design and manufacturing know-how present a significant barrier. Developing truly differentiated products and earning the trust of OEMs, who often prioritize reliability and proven performance, requires substantial upfront investment in research and development for any new competitor.

Access to Distribution Channels and OEM Relationships

The automotive supply chain is a deeply entrenched network, built on years of trust and collaboration between Original Equipment Manufacturers (OEMs) and their established suppliers. New companies entering this space would find it incredibly difficult to break into these existing distribution channels. For instance, in 2024, securing a contract with a major automaker like General Motors or Toyota often requires a proven track record and extensive OEM relationship history, which new entrants lack.

Gaining access to these crucial distribution channels and forging essential relationships with OEMs represents a significant barrier to entry. Automakers typically prefer to work with suppliers who have demonstrated reliability and quality over time. This preference means that new entrants must overcome substantial hurdles to even be considered for supplying components, let alone securing substantial orders.

- Established OEM Relationships: Major automakers have long-standing partnerships with their current suppliers, making it hard for newcomers to get a foot in the door.

- Distribution Channel Lock-in: Existing suppliers often control key distribution networks, limiting access for new entrants.

- Supplier Qualification Processes: OEMs have rigorous qualification processes that can take years to navigate, demanding proven quality and reliability.

- High Switching Costs for OEMs: Changing suppliers involves significant costs and risks for automakers, reinforcing their preference for existing, trusted partners.

Government Policy and Regulations

Government policy and regulations present a significant barrier to entry for new players in the automotive supply sector. Strict safety, environmental, and quality standards, such as those mandated by the EPA and NHTSA in the United States, require substantial investment in compliance and rigorous testing. For instance, the average cost for a new vehicle model to meet all regulatory requirements can run into millions of dollars, a daunting figure for potential entrants. Navigating this complex web of rules, which are constantly evolving, demands specialized expertise and resources, effectively deterring many new competitors.

These regulatory hurdles translate into high upfront capital expenditures for new entrants. They must invest in advanced manufacturing processes, emissions control technology, and robust quality assurance systems to meet mandates. Failure to comply can result in severe penalties, product recalls, and reputational damage, making adherence a non-negotiable aspect of market entry. For example, in 2024, the average cost of recalls for automotive parts due to safety or regulatory non-compliance can easily reach tens of millions of dollars, a risk new entrants are unlikely to absorb easily.

- High Compliance Costs: New entrants face substantial expenses to meet safety, environmental, and quality standards.

- Complex Regulatory Landscape: Navigating evolving regulations requires specialized knowledge and resources.

- Significant Capital Investment: Meeting mandates necessitates investment in advanced technology and processes.

- Risk of Penalties and Recalls: Non-compliance can lead to costly fines and reputational damage.

The threat of new entrants for a company like Flex-N-Gate is generally considered moderate to low. The automotive component manufacturing industry requires substantial capital investment for advanced machinery, research and development, and establishing quality control systems. For instance, the initial setup costs for a state-of-the-art stamping facility can easily exceed $100 million, a significant barrier for most potential new players.

Existing suppliers benefit from established economies of scale, which lower per-unit costs. In 2024, the trend of consolidation in the automotive supply chain meant that larger firms like Flex-N-Gate had greater purchasing power, making it difficult for newcomers to compete on price. Furthermore, deep-seated relationships with Original Equipment Manufacturers (OEMs) and stringent supplier qualification processes, which can take years to complete, create significant hurdles for new entrants seeking to secure contracts.

Regulatory compliance, covering safety, environmental, and quality standards, adds another layer of complexity and cost. Meeting these evolving mandates, such as those from the EPA and NHTSA, requires considerable investment in technology and processes. For example, the average cost for a new vehicle model to meet all regulatory requirements can run into millions of dollars, a substantial deterrent for new market participants.

| Barrier to Entry | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High investment needed for plants, tooling, R&D, and quality assurance. | Deters new firms due to substantial upfront costs. | Setting up a new automotive stamping plant can cost hundreds of millions of dollars. |

| Economies of Scale | Established players benefit from lower per-unit costs through high-volume production and procurement. | New entrants struggle to match incumbent pricing. | Continued consolidation in 2024 favored larger suppliers' bulk purchasing power. |

| OEM Relationships & Distribution | Entrenched partnerships with automakers and control over distribution channels. | Difficult for newcomers to gain access and trust. | Securing contracts with major automakers often requires proven track records and existing relationships. |

| Regulatory Compliance | Strict safety, environmental, and quality standards require significant investment and expertise. | Increases upfront costs and complexity for market entry. | Average cost for a new vehicle model to meet all regulatory requirements can be millions of dollars. |

Porter's Five Forces Analysis Data Sources

Our Flex-N-Gate Porter's Five Forces analysis is built upon a foundation of comprehensive data, including publicly available financial statements, industry-specific market research reports, and news articles detailing competitor strategies and market trends.