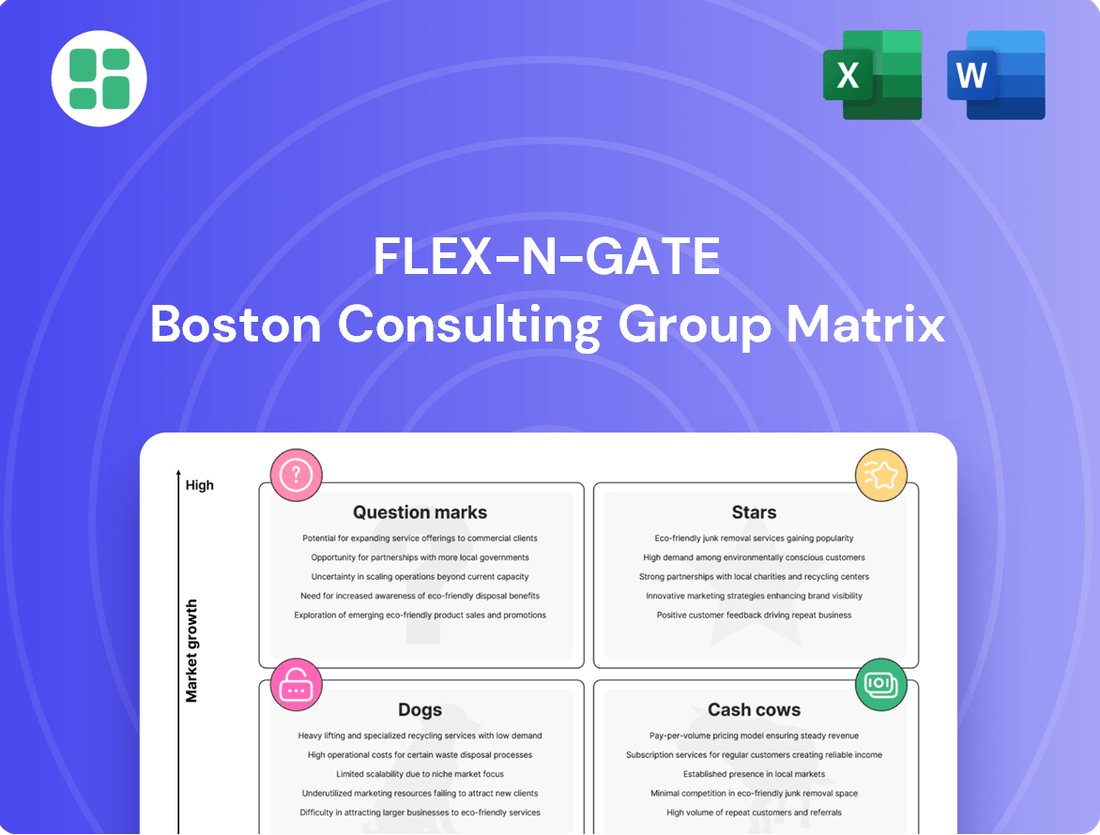

Flex-N-Gate Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flex-N-Gate Bundle

Curious about Flex-N-Gate's strategic product portfolio? This glimpse into their BCG Matrix highlights potential Stars and Cash Cows, but what about the hidden opportunities and risks?

Unlock the full picture by purchasing the complete BCG Matrix report. Gain detailed quadrant placements, actionable insights, and a clear roadmap to optimize Flex-N-Gate's market position and investment strategies.

Stars

Flex-N-Gate's EV Component Systems are a prime example of a Star within the BCG Matrix, given the booming electric vehicle sector. The company supplies critical parts for popular EVs like the Renault 4 E-Tech and Nissan Micra, reflecting strong current demand.

The global EV market is projected to reach over $1 trillion by 2026, with continued expansion expected. Flex-N-Gate's involvement in supplying components for award-winning models such as the Scenic E-Tech Electric underscores their high market share in a rapidly growing segment, positioning these systems as Stars.

The automotive lighting market is on a strong growth trajectory, with projections indicating significant expansion driven by innovations like LED technology and adaptive lighting systems. Flex-N-Gate's development in Adaptive Driving Beam (ADB) technology positions it well within this evolving landscape.

ADB systems, which intelligently adjust light patterns to optimize visibility and reduce glare for other drivers, are a prime example of advanced automotive lighting. This innovation is crucial as vehicles become more sophisticated and safety features become paramount. For instance, the global automotive lighting market was valued at approximately $28 billion in 2023 and is expected to reach over $45 billion by 2030, showcasing a compound annual growth rate of around 7%.

The automotive sector's relentless pursuit of lightweighting to boost fuel economy and electric vehicle range fuels a significant demand for novel materials. Flex-N-Gate's proficiency in creating components from advanced plastics and composites, coupled with their 'eco-lite design' philosophy and weight-reduction proposals for original equipment manufacturers, places these solutions firmly in the Stars quadrant of the BCG matrix.

Integrated Bumpers with ADAS/Sensor Integration

Modern vehicles are packing more advanced safety features, and that means sensors and systems for things like adaptive cruise control and automatic braking are being built right into the bumpers. Flex-N-Gate is really leaning into this trend. Their expertise in making bumper systems, combined with their work on integrating these ADAS and sensor technologies, positions their integrated bumper solutions as products with serious growth potential.

The demand for these smart bumper components is on the rise as cars move closer to full self-driving capabilities. In 2024, the global ADAS market was valued at approximately $30 billion, with bumper-integrated sensors being a key component of this growth. This trend is expected to continue, with projections indicating a compound annual growth rate of over 10% for ADAS components in the coming years.

Flex-N-Gate's focus here aligns perfectly with market needs:

- Technological Advancement: Integrating ADAS and sensors directly into bumpers enhances vehicle safety and enables advanced autonomous functions.

- Market Demand: The increasing consumer and regulatory demand for advanced safety features drives the market for these sophisticated bumper systems.

- Growth Potential: As autonomous driving technology matures, the market for integrated bumper solutions is projected for substantial expansion.

Tooling and Product Development for New Platforms

Flex-N-Gate's extensive engineering, design, and tooling expertise are vital for original equipment manufacturers (OEMs) introducing new vehicle platforms, particularly those featuring cutting-edge technologies. This capability allows them to be deeply involved from the initial stages of development through to the industrialization of components.

Their significant market share in this high-growth sector is evident in their work on new models such as the Alpine A390 and the Nissan Micra. For instance, in 2024, Flex-N-Gate secured contracts for critical components for these upcoming vehicles, highlighting their role in the initial product cycles.

- Engineering and Design: Flex-N-Gate offers end-to-end solutions, from concept to production-ready designs for new vehicle platforms.

- Tooling Capabilities: They possess advanced tooling facilities essential for manufacturing complex components for next-generation vehicles.

- Market Share in New Platforms: Their involvement in projects like the Alpine A390 and Nissan Micra in 2024 underscores their strong position in emerging vehicle segments.

- Strategic Importance: This focus on new product cycles ensures Flex-N-Gate remains a key partner for OEMs navigating rapid technological advancements in the automotive industry.

Flex-N-Gate's electric vehicle component systems are clear Stars in the BCG matrix, driven by the booming EV market. Their supply of parts for vehicles like the Renault 4 E-Tech and Nissan Micra demonstrates strong current demand and future potential.

The automotive lighting sector, particularly with innovations like Adaptive Driving Beam (ADB) technology, also represents a Star. ADB systems enhance safety and visibility, contributing to the market's projected growth from approximately $28 billion in 2023 to over $45 billion by 2030.

Furthermore, Flex-N-Gate's lightweight plastic and composite components, developed with an eco-lite design philosophy, are Stars due to the automotive industry's push for fuel efficiency and EV range extension.

Integrated bumper systems incorporating ADAS and sensors are also Stars, given the significant growth in the ADAS market, valued at around $30 billion in 2024, with bumper-integrated sensors being a key driver.

| Product/System | BCG Quadrant | Market Growth | Market Share | Key Driver |

|---|---|---|---|---|

| EV Component Systems | Star | High (Global EV market > $1 trillion by 2026) | High (Supplying critical parts for popular EVs) | Booming EV sector |

| Automotive Lighting (ADB) | Star | High (Global market $28B in 2023, projected $45B by 2030) | Strong (Development in advanced lighting) | Safety and technological innovation |

| Lightweight Components | Star | High (Demand for lightweighting) | Strong (Proficiency in advanced plastics/composites) | Fuel economy and EV range |

| Integrated Bumper Systems (ADAS) | Star | High (ADAS market $30B in 2024, >10% CAGR) | Strong (Work on ADAS integration) | Advanced safety and autonomy |

What is included in the product

This BCG Matrix analysis showcases Flex-N-Gate's product portfolio, identifying Stars for growth, Cash Cows for funding, Question Marks for evaluation, and Dogs for divestment.

The Flex-N-Gate BCG Matrix provides a clear, one-page overview, simplifying complex business unit analysis for strategic decision-making.

Cash Cows

Flex-N-Gate's traditional bumper systems for established vehicle models are clear cash cows. With a deep history in manufacturing these essential safety components for a vast array of vehicles, the company benefits from consistent, high cash flow. This stability is driven by the sheer volume of internal combustion engine (ICE) vehicles still in production and Flex-N-Gate's significant market share in this segment.

Standard exterior trim components like grilles and moldings are a cornerstone for Flex-N-Gate, representing a mature yet robust market. These parts are essential for vehicle appearance and function, ensuring consistent demand from a broad spectrum of established automotive models.

Flex-N-Gate's strong foothold in this segment translates into high profit margins, largely due to highly efficient and optimized manufacturing processes honed over years of operation. The sheer volume of these components produced for the global automotive industry contributes significantly to the company's steady revenue streams.

In 2024, the global automotive exterior trim market was valued at approximately USD 65 billion, with grilles and moldings making up a substantial portion. Flex-N-Gate's established market share in this area solidifies these product lines as key cash cows, generating reliable profits that can fund other strategic initiatives within the company.

Flex-N-Gate's conventional hinge and mechanical assemblies operate within a mature automotive market. This segment, characterized by predictable demand and established customer bases, functions as a cash cow. The company benefits from efficient, high-volume production of these standard components, which are integral to most vehicle designs.

Plastic Injection Molded Products for Interior/Exterior

Flex-N-Gate's plastic injection molded products for interior and exterior applications represent a significant portion of their business. These are often high-volume, established components for current vehicle models, fitting the description of cash cows within the BCG matrix. The company benefits from strong market share in these segments, ensuring stable demand and predictable revenue streams.

The automotive industry's reliance on these components, despite material innovations, means that many of Flex-N-Gate's plastic product lines continue to be strong performers. Their established manufacturing processes and economies of scale allow for efficient production, reinforcing their cash cow status. For instance, in 2024, the global automotive plastics market was valued at approximately $38.5 billion, with injection molding holding a dominant share, underscoring the stability of this sector for established players.

- High Market Share: Flex-N-Gate holds a substantial share in the market for interior and exterior plastic components for numerous vehicle platforms.

- Stable Demand: Demand for these established plastic parts remains consistent, particularly for high-volume, current-generation vehicles.

- Economies of Scale: Large-scale production of these standardized plastic parts leads to cost efficiencies and strong profitability.

- Mature Market: While evolving, the core market for these injection-molded parts is mature, offering predictable returns.

Aftermarket Parts and Replacement Components

Flex-N-Gate's aftermarket parts and replacement components likely represent a strong cash cow. By leveraging their existing relationships with original equipment manufacturers (OEMs), they can efficiently supply parts needed for vehicle maintenance and repair. This segment benefits from predictable demand, as vehicle fleets continue to age and require ongoing servicing, reducing the need for substantial new research and development investment.

The aftermarket business model offers stable, recurring revenue. For instance, in 2024, the global automotive aftermarket industry was projected to reach over $500 billion, demonstrating the consistent demand for replacement parts. This stability allows Flex-N-Gate to generate reliable cash flow without the high risks associated with developing entirely new product lines.

- Stable Revenue: The aftermarket benefits from consistent demand for maintenance and repair.

- Lower R&D Costs: Focus is on existing components, reducing investment in new technology.

- Long Product Lifecycles: Vehicle longevity ensures a continuous market for replacement parts.

- Market Size: The global automotive aftermarket is a multi-hundred-billion-dollar industry, offering significant revenue potential.

Flex-N-Gate's established product lines, particularly those serving the high-volume internal combustion engine (ICE) vehicle market, function as its cash cows. These are mature offerings with significant market share, generating consistent and substantial cash flow. The company’s expertise in manufacturing traditional components ensures profitability, allowing for reinvestment in growth areas.

These cash cows benefit from economies of scale and optimized production processes, contributing to high profit margins. The sheer volume of vehicles still utilizing these components globally underpins their reliable revenue generation. For example, in 2024, the global automotive production remained robust, with millions of ICE vehicles rolling off assembly lines, directly benefiting Flex-N-Gate's core product segments.

The stability of these mature markets provides a predictable revenue stream, essential for funding innovation and expansion. Flex-N-Gate’s dominance in these established segments allows them to capitalize on consistent demand, reinforcing their position as reliable profit generators.

The table below highlights key cash cow product categories for Flex-N-Gate, showcasing their market position and revenue generation potential.

| Product Category | Market Position | Revenue Contribution | Key Driver | 2024 Market Context |

| Bumper Systems (ICE) | High Market Share | High | Volume Production | Continued demand from millions of ICE vehicles |

| Exterior Trim (Grilles, Moldings) | Strong Market Share | High | Established Models | USD 65 billion global market segment |

| Hinges & Mechanical Assemblies | Established Player | Moderate to High | Vehicle Integration | Integral to most vehicle designs |

| Plastic Injection Molded Parts | Dominant Share | High | Economies of Scale | USD 38.5 billion global automotive plastics market |

| Aftermarket Parts | Significant Presence | Consistent | Vehicle Longevity | Part of a USD 500 billion+ global aftermarket industry |

What You’re Viewing Is Included

Flex-N-Gate BCG Matrix

The Flex-N-Gate BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive immediately after purchase, ensuring complete transparency and immediate usability for your strategic planning needs. This comprehensive report, meticulously crafted to analyze Flex-N-Gate's product portfolio, will be delivered without any watermarks or demo content, allowing you to directly implement its insights. You can trust that the strategic depth and professional presentation you observe here are precisely what you will obtain, ready for immediate integration into your business development processes. This preview serves as your definitive look at the complete Flex-N-Gate BCG Matrix, empowering you with actionable intelligence the moment your purchase is complete.

Dogs

Components for discontinued or niche legacy platforms would be classified as Dogs in the Flex-N-Gate BCG Matrix. These are parts designed for vehicle models that are being phased out or have very limited production, meaning the market for them is shrinking.

The declining demand for these older platforms translates to low market growth and a diminishing market share for Flex-N-Gate's components supporting them. For instance, if a specific legacy sedan model, which once sold 50,000 units annually, now only produces 2,000 units in 2024, the components for it are clearly in a Dog category.

Continuing to invest in and produce these specialized components can tie up valuable manufacturing and R&D resources that could be better allocated to more promising product lines. This strategy offers minimal returns and detracts from the company's overall growth potential.

In the automotive industry, certain basic plastic components, like standard clips or simple interior trim pieces, are highly commoditized. This means there's little to distinguish one supplier's product from another, leading to fierce competition and thin profit margins. For instance, the global automotive plastics market, valued at approximately $37 billion in 2023, sees significant price sensitivity in these less specialized segments.

If Flex-N-Gate holds a small market share in these highly commoditized, low-margin plastic parts, they would likely be categorized as Dogs in the BCG Matrix. This classification stems from their limited growth potential in a mature market and their low profitability, often making them a drag on overall company performance and requiring careful management to avoid resource drain.

Flex-N-Gate's involvement with outdated lighting technologies, such as halogen, firmly places them in the 'Dog' category of the BCG Matrix. The global automotive lighting market, while growing, is overwhelmingly favoring LEDs, which offer superior energy efficiency and longevity. In 2024, the demand for halogen bulbs continues to shrink as regulations and consumer preferences push for more advanced solutions.

Manufacturing Facilities with Obsolete Processes

Manufacturing facilities with obsolete processes are prime examples of Dogs in a BCG Matrix context. These plants often struggle with higher production costs and lower output quality due to outdated machinery and inefficient workflows, making them uncompetitive. For instance, a plant relying on manual assembly lines instead of automated robotics might incur significantly higher labor costs and experience slower production cycles.

These operations typically exhibit low market share because their uncompetitive pricing or quality fails to attract customers. Furthermore, their growth prospects are dim unless substantial capital is invested in modernization. The automotive sector, for example, is rapidly adopting Industry 4.0 technologies, making older facilities that haven't kept pace vulnerable. In 2024, the global manufacturing sector saw increased investment in automation, with companies prioritizing efficiency gains to combat rising input costs.

- Low Market Share: Facilities with outdated processes often struggle to compete on price or quality, leading to diminished customer interest.

- Low Growth Prospects: Without significant investment in new technology and process upgrades, these operations are unlikely to see market expansion.

- High Operational Costs: Obsolete equipment and inefficient methods typically result in higher labor, energy, and maintenance expenses.

- Competitive Disadvantage: Modern competitors leveraging advanced manufacturing techniques can often produce goods faster, cheaper, and to a higher standard.

Components for Declining Global Vehicle Segments

If Flex-N-Gate has a significant market share in components exclusively tied to vehicle segments experiencing a consistent decline in global sales, such as traditional sedans in markets rapidly shifting towards SUVs and CUVs, these product lines could be classified as Dogs within the BCG matrix. The shrinking market for these components directly limits both growth opportunities and the potential to expand market share, making them less attractive investments. For instance, while global vehicle sales saw a rebound in 2023, reaching approximately 89 million units, the share of sedans continued its downward trend in many key regions.

The implications for Flex-N-Gate are clear: these component lines face diminishing demand and potentially lower profitability. This scenario necessitates careful strategic consideration, as continued investment may not yield proportional returns. Analyzing specific component categories, such as those for mid-size sedans, reveals this trend. In 2024, the global market for mid-size sedans is projected to continue its contraction, with some analysts predicting a decline of 2-3% year-over-year.

- Declining Demand: Components tied to shrinking vehicle segments, like certain sedan models, face reduced global sales, impacting revenue.

- Limited Growth Potential: A contracting market offers little room for Flex-N-Gate to increase its market share or achieve significant sales growth for these specific components.

- Reduced Profitability: As demand falls, component prices may face downward pressure, potentially squeezing profit margins for Flex-N-Gate's Dog products.

- Strategic Re-evaluation: Flex-N-Gate may need to consider divesting, reducing investment, or finding alternative uses for manufacturing capacity dedicated to these declining segments.

Components for discontinued or niche legacy platforms represent Flex-N-Gate's Dogs. These are parts for vehicle models with shrinking market demand, leading to low market growth and a diminishing market share for Flex-N-Gate. For example, if components for a specific legacy sedan model, which once sold 50,000 units annually, now only cater to 2,000 units in 2024, they are clearly in the Dog category.

These Dog products, like basic commoditized plastic parts where Flex-N-Gate holds a small market share, offer limited growth and thin profit margins. The global automotive plastics market, valued around $37 billion in 2023, highlights the price sensitivity in these less specialized segments. Investing in these areas ties up resources with minimal returns, hindering overall growth potential.

Outdated lighting technologies, such as halogen, also fall into the Dog category as the automotive lighting market increasingly favors LEDs. In 2024, halogen bulb demand continues to shrink due to regulations and consumer preference for more advanced solutions. Similarly, manufacturing facilities with obsolete processes and high operational costs, struggling with lower output quality, are uncompetitive and have dim growth prospects without modernization.

Flex-N-Gate's involvement with components tied to declining vehicle segments, like traditional sedans, further solidifies their Dog classification. The global market for mid-size sedans, for instance, is projected to contract by 2-3% year-over-year in 2024, impacting revenue and profitability for related components. This necessitates strategic re-evaluation, potentially leading to divestment or reduced investment.

| Product Category | Market Growth | Market Share | Profitability | BCG Classification |

|---|---|---|---|---|

| Legacy Sedan Components | Low | Low | Low | Dog |

| Commoditized Plastic Parts | Low | Low | Low | Dog |

| Halogen Lighting | Declining | Low | Low | Dog |

| Obsolete Manufacturing Processes | N/A (Internal) | Low | Low | Dog |

Question Marks

Flex-N-Gate's FLEX-ION initiative, encompassing the full spectrum of EV battery development from cell to pack manufacturing, is a classic Question Mark in the BCG matrix. The electric vehicle battery market is experiencing explosive growth, projected to reach over $400 billion globally by 2027, but Flex-N-Gate is a newcomer with a minimal market share in this burgeoning sector.

To transform FLEX-ION from a Question Mark into a Star, substantial capital investment is essential. This funding will be critical for scaling production, advancing cell chemistry and manufacturing technologies, and establishing a strong competitive position against established players in the rapidly evolving EV battery landscape.

For hydrogen fuel cell vehicles (FCVs), key components include the fuel cell stack itself, which generates electricity through a chemical reaction, and the hydrogen storage system, typically high-pressure tanks. Other crucial elements are the power control unit, electric motor, and balance-of-plant components like compressors and humidifiers. The global FCV market, while still small, is projected for significant expansion, with sales of fuel cell passenger vehicles expected to reach over 1.2 million units annually by 2030.

The evolution towards autonomous vehicles is transforming cabin interiors, creating a significant demand for advanced plastic components and integrated human-machine interface (HMI) solutions. Flex-N-Gate's potential expansion into these sophisticated, connected interior systems, where its current market share might be limited, represents a high-growth opportunity.

Components for Vehicle-to-Everything (V2X) Communication Integration

Flex-N-Gate's potential development of exterior components designed to integrate Vehicle-to-Everything (V2X) communication systems would likely place them in the Question Mark quadrant of the BCG Matrix. This is due to V2X being a high-growth sector within the automotive industry, driven by advancements in autonomous driving and enhanced safety features. For instance, the global V2X market was valued at approximately USD 3.1 billion in 2023 and is projected to reach USD 12.7 billion by 2030, exhibiting a compound annual growth rate of over 22%.

If Flex-N-Gate is focusing on producing these specialized exterior parts, such as bumpers or body panels engineered to house V2X sensors and antennas, they are tapping into a burgeoning technological space. While the overall V2X market is expanding rapidly, Flex-N-Gate's specific market share within this niche might currently be low as they establish their offerings.

Key components enabling this integration include:

- Dedicated Short-Range Communications (DSRC) or Cellular V2X (C-V2X) modules

- Integrated antenna systems within exterior panels

- Sensor housings designed for lidar, radar, and camera systems

- Robust and weather-resistant materials to protect sensitive electronics

New Market Entries in Emerging Automotive Regions

New market entries by Flex-N-Gate into emerging automotive regions, such as Southeast Asia or Africa, represent potential Stars or Question Marks in a BCG analysis. These regions often exhibit high projected automotive market growth, but Flex-N-Gate's current market share might be low, necessitating significant investment to build brand recognition and establish production capabilities. For instance, the African automotive market, while nascent, is projected to grow significantly, with Nigeria and South Africa being key hubs.

- Emerging Market Potential: Regions like Vietnam and Indonesia in Southeast Asia are seeing robust growth in vehicle production, with Vietnam's automotive output increasing by over 20% year-on-year in early 2024.

- Investment Requirements: Establishing a manufacturing presence and distribution network in these new territories demands substantial capital, often exceeding hundreds of millions of dollars for large-scale operations.

- Strategic Importance: These entries are crucial for long-term diversification and capturing future market share, especially as developed markets mature.

- Risk and Reward: While high growth potential exists, these markets also carry higher political, economic, and operational risks compared to established automotive hubs.

Question Marks in Flex-N-Gate's portfolio represent areas of high growth potential but uncertain market dominance. These are typically new ventures or technologies where the company has a low market share but operates in a rapidly expanding industry. Significant investment is often required to nurture these into Stars, or they may fail to gain traction and become Dogs.

Flex-N-Gate's involvement in the burgeoning electric vehicle battery market, specifically through its FLEX-ION initiative, clearly falls into the Question Mark category. While the global EV battery market is projected to exceed $400 billion by 2027, Flex-N-Gate's current market share in this space is minimal, necessitating substantial capital to scale production and compete effectively.

Similarly, the company's potential expansion into exterior components designed for Vehicle-to-Everything (V2X) communication systems positions it as a Question Mark. The V2X market, valued at approximately USD 3.1 billion in 2023, is forecasted to reach USD 12.7 billion by 2030, growing at over 22% annually. Flex-N-Gate's low market share in this high-growth sector requires strategic investment to establish its presence.

Emerging market entries, such as in Southeast Asia, also represent Question Marks for Flex-N-Gate. While regions like Vietnam saw over 20% year-on-year automotive output growth in early 2024, establishing a manufacturing presence demands significant investment, often in the hundreds of millions of dollars, to build brand recognition and operational capabilities in these high-potential but higher-risk territories.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.