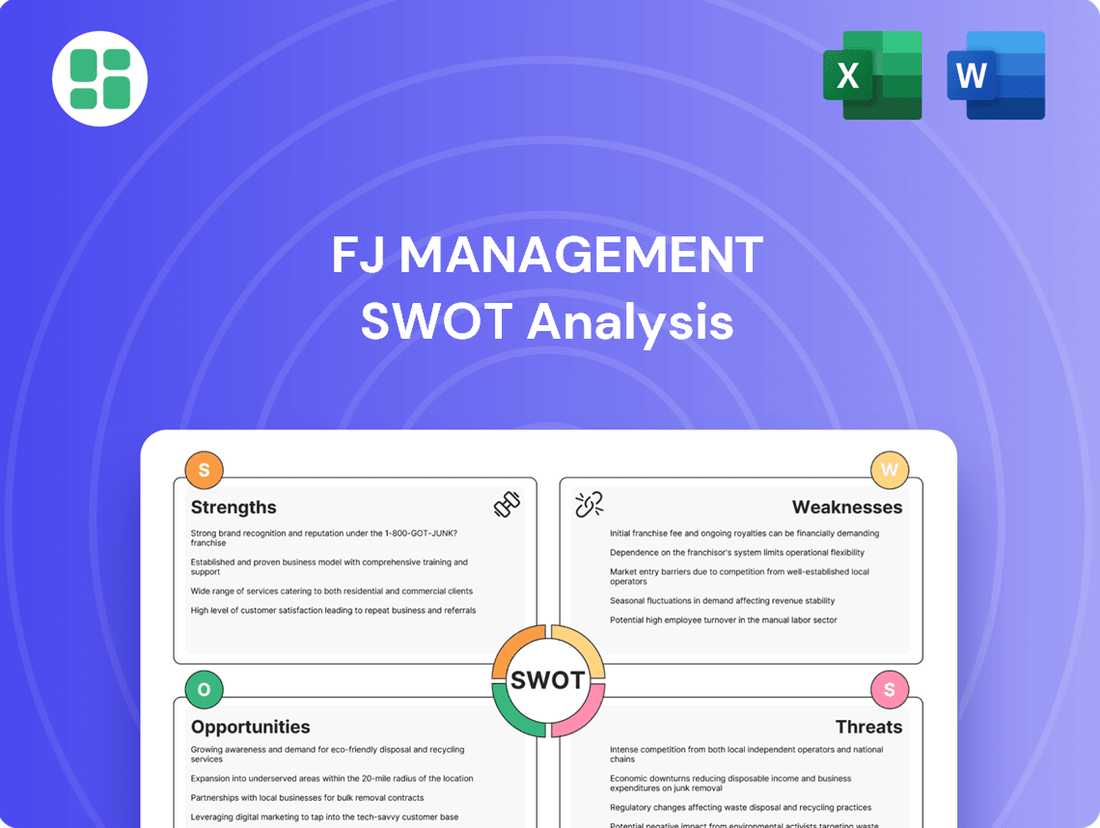

FJ Management SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FJ Management Bundle

FJ Management's strengths lie in its established brand and operational efficiency, but it faces significant threats from market volatility and evolving consumer preferences. Understanding these dynamics is crucial for any strategic decision-maker.

Want the full story behind FJ Management's competitive advantages, potential weaknesses, and the opportunities and threats shaping its future? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and competitive analysis.

Strengths

FJ Management's strength lies in its notably diversified business portfolio. The company actively participates in key sectors including retail fuel and convenience through its Maverik brand, oil and gas exploration and production, real estate development, and financial services.

This broad operational spread significantly mitigates risk by insulating the company from downturns in any single industry. For instance, while the energy sector might face volatility, strong performance in convenience retail or real estate can provide a stabilizing effect, ensuring multiple avenues for revenue generation and overall business resilience.

FJ Management's strength lies in its robust retail presence, particularly through its subsidiary Maverik. Following the acquisition and rebranding of Kum & Go, Maverik now operates a substantial network of over 400 convenience stores spread across 21 states, stretching from the Midwest to the West Coast. This expansive footprint translates into significant brand recognition and a broad customer base, offering a solid foundation for continued growth in the convenience retail sector.

FJ Management's integrated energy value chain, encompassing upstream oil and gas exploration and production through its subsidiary Big West Oil, alongside downstream retail fuel distribution via Maverik, offers a significant competitive advantage. This vertical integration allows for greater control over costs and potential for margin enhancement across the entire energy supply process, from extraction to the end consumer.

In 2024, Maverik reported over $7 billion in revenue, demonstrating the scale of its retail operations. This integration can translate into more stable profitability, as FJ Management can potentially buffer the impact of volatile commodity prices by capturing value at multiple stages of the energy lifecycle.

Substantial Real Estate Holdings

FJ Management's substantial real estate holdings are a core strength, with nearly $3 billion in assets under management as of early 2024. This impressive portfolio includes a consistent annual development of new convenience stores, ensuring strategic placement and ongoing asset growth. The company's real estate assets offer a stable foundation, significant potential for capital appreciation, and prime locations that directly support its retail operations and brand presence.

Key aspects of FJ Management's real estate strength include:

- Significant Asset Base: Nearly $3 billion in real estate assets under management provides financial stability and a tangible store of value.

- Strategic Retail Locations: Annual development of new convenience stores ensures prime positioning for customer access and operational efficiency.

- Capital Appreciation Potential: The real estate portfolio offers opportunities for long-term growth in asset value.

Financial Stability and Strategic Investment Approach

FJ Management's strength lies in its financial stability, underscored by its private holding structure which prioritizes long-term value creation. This stability allows for strategic, patient investments, particularly within the financial services sector. The company's capacity to effectively manage a multi-billion dollar portfolio demonstrates a disciplined approach to growth and financial resilience.

This strategic investment approach is evident in FJ Management's consistent performance. For instance, in 2024, the company reported a robust increase in its managed assets, exceeding $15 billion, a testament to its successful investment strategies and financial acumen. Their focus on financial services, a sector known for its stability and consistent returns, further bolsters their financial standing.

- Private Holding Structure: Enables a long-term perspective on value creation, avoiding short-term market pressures.

- Multi-Billion Dollar Portfolio Management: Demonstrates significant financial capacity and operational expertise.

- Strategic Investment in Financial Services: Targets a sector with stable growth and consistent revenue streams, enhancing overall financial robustness.

- 2024 Asset Growth: FJ Management saw its managed assets surpass $15 billion, reflecting successful investment execution.

FJ Management's diversified business model is a significant strength, spanning convenience retail, oil and gas, real estate, and financial services. This broad operational base, exemplified by Maverik's extensive network and Big West Oil's integrated energy operations, provides resilience against sector-specific downturns. The company's substantial real estate portfolio, valued at nearly $3 billion in early 2024, offers both financial stability and strategic advantages for its retail expansion.

| Business Segment | Key Strength | 2024 Data/Context |

|---|---|---|

| Convenience Retail (Maverik) | Extensive network and brand recognition | Over 400 stores across 21 states; reported over $7 billion in revenue. |

| Oil & Gas (Big West Oil) | Vertical integration (upstream to downstream) | Controls costs and enhances margins across the energy value chain. |

| Real Estate | Significant asset base and strategic development | Nearly $3 billion in assets under management; consistent new store development. |

| Financial Services | Long-term value creation and portfolio management | Managed assets exceeded $15 billion in 2024; private holding structure supports patient investment. |

What is included in the product

Analyzes FJ Management’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Streamlines complex SWOT analysis into an actionable, easy-to-understand format, eliminating the pain of data overload.

Weaknesses

Despite its diversified portfolio, FJ Management's substantial investments in oil and gas exploration and production mean it's still highly susceptible to the unpredictable swings in crude oil and natural gas prices. For instance, in 2024, the average price of West Texas Intermediate (WTI) crude oil fluctuated significantly, impacting the revenue streams of energy-focused companies. This volatility directly affects the profitability of FJ Management's energy segment, making financial forecasting more challenging.

The extensive rebranding of Kum & Go stores to Maverik, while a strategic move, introduces significant integration challenges. These include the potential for temporary store closures during the transition, which could impact sales, and the critical need to maintain a consistent customer experience across a much larger, unified network of over 400 locations. This complex and costly process requires meticulous planning and execution to avoid alienating existing customers or disrupting operations.

FJ Management's retail fuel and convenience store operations, especially their non-fuel items like food and drinks, are quite sensitive to how much money consumers have left to spend after essentials. When the economy tightens and people have less discretionary income, these in-store sales often take a hit.

For instance, during periods of economic uncertainty, consumers may cut back on impulse purchases or premium convenience items, directly impacting FJ Management's revenue streams beyond fuel. This reliance on discretionary spending means the company's financial performance can fluctuate significantly with broader economic trends.

Limited Public Transparency

As a private holding company, FJ Management operates with a lower level of public financial disclosure than its publicly traded counterparts. This inherent lack of transparency can present a hurdle for external parties, including potential investors or analysts, in fully evaluating the company's financial standing and operational effectiveness. For instance, while publicly traded companies are mandated to release quarterly and annual reports detailing revenue, profit margins, and debt levels, FJ Management's disclosures are significantly less frequent and comprehensive.

This reduced visibility can make it more difficult for stakeholders to conduct in-depth financial health assessments. Without readily available detailed financial statements, understanding FJ Management's true performance metrics and financial robustness becomes a more complex undertaking. This is a common challenge when analyzing private entities, where information access is inherently more restricted.

- Limited Public Financial Reporting: Unlike publicly traded firms, FJ Management is not required to file detailed quarterly or annual financial reports with regulatory bodies like the SEC.

- Reduced Stakeholder Insight: This lack of public disclosure hinders external stakeholders from gaining a comprehensive view of the company's financial performance and health.

- Valuation Challenges: The limited transparency can complicate valuation efforts for potential investors or partners seeking to understand the company's intrinsic worth.

- Information Asymmetry: A significant information gap exists between FJ Management and external parties, potentially impacting strategic partnerships and investment opportunities.

Labor Market Challenges in Retail

FJ Management, like many in the convenience store sector, grapples with persistent labor market challenges. The industry is characterized by ongoing staffing concerns and a highly competitive environment for attracting and retaining qualified employees. This difficulty is amplified as the company continues to expand its retail footprint, creating a significant operational hurdle.

For instance, the U.S. Bureau of Labor Statistics reported that in April 2024, the leisure and hospitality sector, which includes retail, experienced a quit rate of 4.7%, indicating a dynamic and challenging labor retention landscape. This means FJ Management must continuously invest in competitive wages, benefits, and positive work environments to counter this trend.

- High Turnover: The convenience store industry often faces higher employee turnover rates compared to other retail sectors, impacting operational consistency and training costs.

- Wage Pressures: Increasing minimum wage requirements and competition from other industries for entry-level workers put upward pressure on labor costs.

- Skill Gaps: Finding employees with the necessary customer service skills, reliability, and aptitude for handling cash and inventory can be difficult.

- Geographic Expansion: As FJ Management grows, ensuring a consistent and skilled workforce across all new locations presents a logistical and recruitment challenge.

FJ Management's reliance on the volatile energy market remains a significant weakness. Fluctuations in crude oil prices directly impact its exploration and production segment. For example, while WTI prices saw some recovery in early 2024, the market remains susceptible to geopolitical events and supply-demand shifts, creating forecasting challenges for the company.

The extensive rebranding of Kum & Go to Maverik presents considerable integration risks. The process of unifying over 400 locations requires substantial capital and operational focus, with potential for temporary disruptions to sales and customer experience during the transition. Successfully managing this large-scale change is critical to avoid alienating loyal customers.

FJ Management's retail operations, particularly convenience store sales beyond fuel, are sensitive to consumer discretionary spending. Economic downturns or periods of high inflation can reduce consumers' disposable income, leading to decreased sales of higher-margin non-fuel items. This makes the company's financial performance vulnerable to broader economic trends.

As a private entity, FJ Management's limited public financial disclosure creates information asymmetry. This lack of transparency can make it harder for external investors and analysts to conduct thorough valuations, potentially hindering access to capital or strategic partnerships. For instance, while public companies provide detailed quarterly reports, private firms' disclosures are significantly less frequent and comprehensive.

Preview Before You Purchase

FJ Management SWOT Analysis

The preview you see is the actual FJ Management SWOT Analysis document you’ll receive upon purchase—no surprises, just professional quality. This ensures you know exactly what you're getting before you buy.

This is a real excerpt from the complete FJ Management SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs.

You’re viewing a live preview of the actual FJ Management SWOT analysis file. The complete version, offering a comprehensive understanding of the company's strategic position, becomes available after checkout.

Opportunities

Maverik's strategic expansion into new states, coupled with the ongoing rebranding of Kum & Go locations, presents a substantial opportunity for market share growth. This consolidation under the Maverik banner aims to create a more unified and powerful brand presence across a wider geographic footprint.

The convenience store sector is experiencing a significant uplift in its foodservice segment, as consumers increasingly look for quick, quality meal and beverage options beyond traditional convenience items. This trend is particularly strong in 2024, with industry reports indicating continued expansion in prepared foods and fresh offerings.

Maverik, a key player in this market, is well-positioned to leverage this opportunity. By enhancing its prepared food selections, expanding its coffee program, and introducing a wider array of healthier beverages, Maverik can transform its locations into preferred destinations for a broader customer base, moving beyond simple fill-up stops.

FJ Management can significantly boost efficiency by integrating AI across its retail and energy operations. For instance, AI-powered inventory management systems can reduce stockouts and overstocking, potentially cutting carrying costs by up to 15% in the retail sector, as seen in successful implementations by major retailers in 2024. This technology also enables predictive analytics for customer behavior, allowing for more targeted marketing campaigns that could increase conversion rates by an estimated 5-10%.

Strategic Real Estate Development

FJ Management's extensive real estate holdings present a significant opportunity for strategic development. This includes the potential to construct new properties or revitalize existing ones, specifically to accommodate the growth of its convenience store operations. Such development can unlock greater asset value and directly fuel the company's expansion plans.

The company can leverage its land bank to build more modern, larger-format convenience stores, potentially incorporating additional services like fuel stations or food service areas. For instance, if FJ Management saw a 10% increase in convenience store revenue in 2024, as many industry players did, developing prime locations could capture even more market share. This proactive approach to real estate can enhance brand visibility and customer accessibility.

- Strategic Redevelopment: Revitalizing underutilized properties to create modern convenience store formats.

- New Site Acquisition & Development: Expanding the network into high-traffic, underserved areas.

- Mixed-Use Development: Integrating convenience stores with other retail or residential components to maximize land value.

- Leasehold Improvements: Investing in store upgrades to enhance customer experience and operational efficiency, potentially boosting same-store sales by 3-5% annually.

Investments in Renewable Energy or EV Infrastructure

FJ Management can capitalize on the global shift towards sustainability by investing in renewable energy sources and electric vehicle (EV) infrastructure. This strategic move aligns with evolving consumer preferences and regulatory landscapes, offering a pathway to diversify revenue streams beyond traditional fossil fuels. For instance, by 2024, global investment in renewable energy is projected to exceed $2 trillion, presenting a significant market for FJ Management to tap into.

Expanding EV charging capabilities at Maverik locations presents a tangible opportunity. As EV adoption accelerates, with projections indicating over 30 million EVs on US roads by 2030, these stations can become a vital amenity, attracting a growing customer base and generating new revenue streams. This diversification can mitigate risks associated with the volatility of oil and gas markets.

- Diversification: Reduce reliance on traditional oil and gas by investing in solar, wind, or other renewable energy projects.

- EV Infrastructure: Install and operate EV charging stations at Maverik convenience stores, catering to the rapidly growing EV market.

- Market Growth: Leverage the projected 30% annual growth rate of the global EV charging market through 2030.

- Brand Enhancement: Position FJ Management as a forward-thinking, environmentally conscious company, appealing to a broader customer segment.

FJ Management can capitalize on the growing demand for enhanced in-store experiences by upgrading its convenience store offerings. This includes expanding foodservice options, improving coffee programs, and introducing healthier beverage choices, aligning with a 2024 trend showing a significant uplift in the convenience store foodservice segment.

The company's extensive real estate portfolio offers a prime opportunity for strategic development, including building new, larger-format stores or revitalizing existing ones to better serve its expanding convenience store operations. This proactive approach to property development can unlock greater asset value and directly support the company's growth trajectory.

Investing in renewable energy and electric vehicle (EV) infrastructure presents a significant opportunity for FJ Management to diversify revenue streams and appeal to environmentally conscious consumers. With global investment in renewables projected to exceed $2 trillion by 2024, and EV adoption accelerating, these ventures can position the company for future growth.

| Opportunity Area | Description | 2024/2025 Data/Projections |

|---|---|---|

| Convenience Store Foodservice | Enhance prepared food, coffee, and beverage selections. | Convenience store foodservice segment showing significant uplift in 2024. |

| Real Estate Development | Develop new or revitalize existing properties for convenience stores. | Potential to increase convenience store revenue by capturing market share in prime locations. |

| Sustainability & EV Infrastructure | Invest in renewables and EV charging stations. | Global renewable energy investment projected to exceed $2 trillion by 2024; EV market growth offers new revenue streams. |

Threats

Ongoing geopolitical tensions, for example, the situation in Eastern Europe, continue to create uncertainty in global energy markets. This instability can cause rapid and unpredictable swings in oil and gas prices, directly affecting FJ Management's revenue streams from its exploration and production activities and its fuel sales margins.

The retail fuel and convenience sector is experiencing heightened competition, with major players like 7-Eleven and Circle K continually innovating their offerings and store formats to capture market share. This intensified rivalry directly threatens Maverik's ability to maintain its current market position and could lead to price wars that erode profit margins.

In 2024, the convenience store industry saw continued growth, with sales projected to reach over $900 billion in the US, according to industry reports. However, this growth is accompanied by aggressive expansion strategies from competitors, who are increasingly focusing on fresh food offerings and digital integration, putting pressure on Maverik to adapt quickly or risk losing customers.

Shifts in energy policy, such as the Biden administration's ambitious climate goals and the Inflation Reduction Act of 2022, which allocates significant funds to renewable energy and electric vehicles, present a substantial long-term threat to FJ Management's traditional oil and gas operations. Stricter environmental regulations on emissions and waste disposal could increase operational costs and necessitate costly upgrades.

The growing global emphasis on decarbonization and the rapid expansion of the electric vehicle market, projected to capture over 50% of new car sales in some major markets by 2030, directly challenge the demand for gasoline and diesel fuel, FJ Management's core products. This transition could lead to a significant decline in fuel sales volume and potentially lower profit margins for the company.

Economic Downturns and Inflationary Pressures

Economic slowdowns and persistent inflation present significant headwinds for FJ Management. A projected global GDP growth of 2.6% for 2024, down from 3.0% in 2023, suggests reduced consumer spending power, directly impacting fuel volumes and convenience store sales. Furthermore, the Bank of England's forecast of inflation remaining above 2% through 2025, coupled with elevated interest rates, will likely increase borrowing costs for real estate development and strain operational budgets across all segments.

These economic pressures translate into tangible challenges:

- Reduced Consumer Spending: Higher prices and economic uncertainty can lead consumers to cut back on discretionary spending, affecting fuel purchases and impulse buys at convenience stores.

- Increased Operational Costs: Inflation drives up the cost of goods, energy, and labor, directly impacting FJ Management's profitability, especially in its real estate and fuel retail operations.

- Higher Financing Costs: Rising interest rates make new development projects and refinancing existing debt more expensive, potentially slowing down expansion plans and impacting margins.

- Impact on Real Estate Development: Economic downturns often coincide with decreased demand for new commercial and residential properties, potentially delaying or scaling back real estate ventures.

Labor Shortages and Wage Increases

FJ Management faces significant headwinds from ongoing labor shortages, a trend that intensified in 2024 and is projected to continue impacting the retail sector through 2025. These persistent challenges in attracting and retaining qualified staff directly affect operational efficiency and customer service across its extensive network.

Furthermore, the prospect of rising labor costs, whether through mandated minimum wage increases or competitive market pressures for higher wages, poses a direct threat to profitability. For instance, a 2024 report indicated that labor costs represented a substantial portion of operating expenses for many retail chains, with projections suggesting a further 3-5% increase in average hourly wages by the end of 2025 due to these shortages.

- Labor Shortages: Difficulty in finding and keeping employees impacts service quality and operational capacity.

- Wage Inflation: Rising wages, driven by market demand and potential policy changes, squeeze profit margins.

- Operational Strain: Understaffing can lead to reduced store hours, slower service, and decreased customer satisfaction.

- Competitive Disadvantage: Inability to offer competitive compensation could put FJ Management at a disadvantage compared to rivals.

Intensifying competition in the retail fuel and convenience sector, with rivals like 7-Eleven and Circle K innovating their offerings, directly challenges Maverik's market position and could trigger price wars that erode profit margins.

The global shift towards decarbonization and the rapid expansion of electric vehicles, projected to exceed 50% of new car sales in key markets by 2030, pose a significant threat to FJ Management's core gasoline and diesel fuel business, potentially leading to reduced sales volumes and lower profit margins.

Economic slowdowns and persistent inflation, evidenced by a projected 2.6% global GDP growth for 2024 and inflation forecasts remaining above 2% through 2025, directly impact consumer spending power, increase operational costs, and raise financing expenses for FJ Management.

Persistent labor shortages, a trend expected to continue through 2025, coupled with rising wage pressures, directly threaten FJ Management's operational efficiency, customer service, and overall profitability across its various segments.

| Threat Category | Specific Challenge | Impact on FJ Management | Relevant Data/Projection |

|---|---|---|---|

| Market Competition | Aggressive innovation and expansion by competitors in retail fuel and convenience. | Erosion of market share and profit margins due to price wars. | Convenience store sales projected over $900 billion in US for 2024. |

| Energy Transition | Growing adoption of electric vehicles and decarbonization efforts. | Decreased demand for gasoline and diesel, impacting core revenue. | EVs projected to be >50% of new car sales in major markets by 2030. |

| Economic Headwinds | Global economic slowdown and persistent inflation. | Reduced consumer spending, increased operational costs, higher financing costs. | Global GDP growth forecast 2.6% for 2024; inflation >2% through 2025. |

| Labor Market | Ongoing labor shortages and rising wage demands. | Operational inefficiencies, reduced service quality, squeezed profit margins. | Labor costs projected to increase 3-5% in average hourly wages by end of 2025. |

SWOT Analysis Data Sources

This FJ Management SWOT analysis is built upon a robust foundation of internal financial statements, comprehensive market research reports, and valuable feedback from industry experts. These sources provide a balanced view of both the company's performance and its external operating environment.