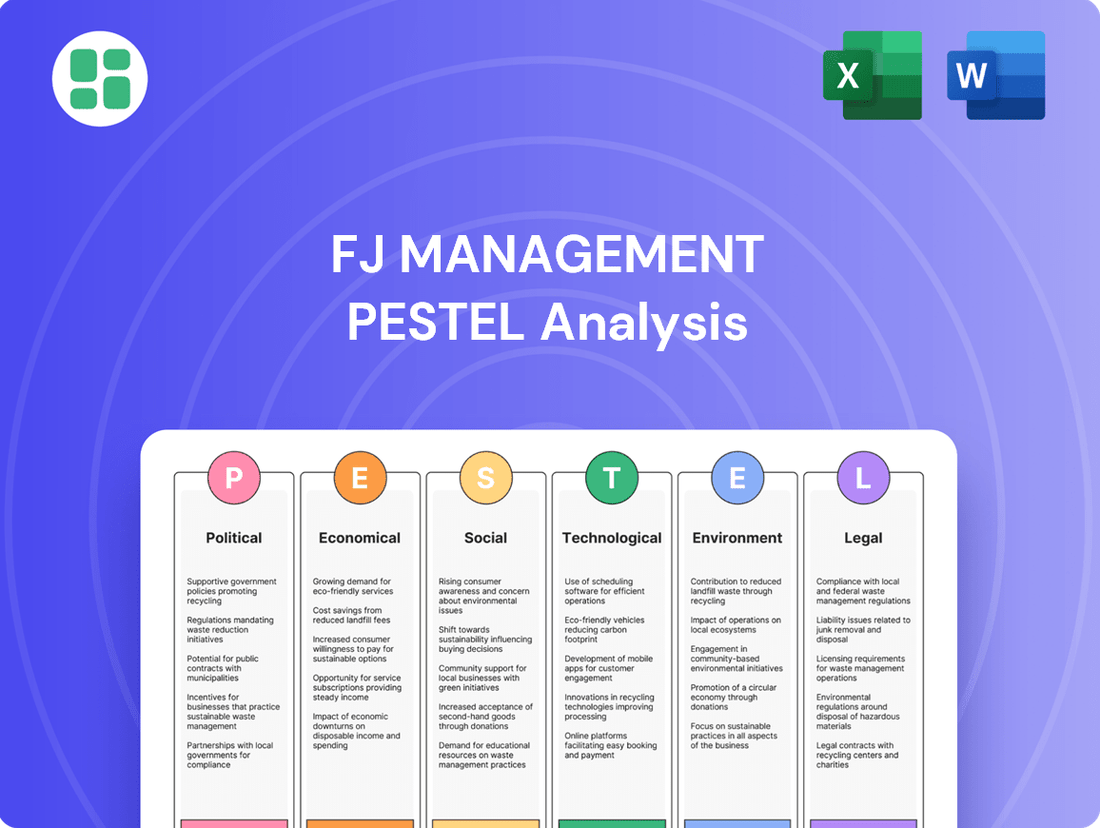

FJ Management PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FJ Management Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping FJ Management's trajectory. This comprehensive PESTLE analysis provides the essential external intelligence needed to navigate market complexities and identify strategic opportunities. Don't be left guessing; download the full report now and gain a decisive advantage.

Political factors

Government policies on fossil fuels significantly shape FJ Management's operations. Changes in federal and state regulations concerning production, consumption, and taxation directly affect its oil and gas exploration and production, as well as its retail fuel businesses. For instance, the U.S. Environmental Protection Agency (EPA) finalized new rules in March 2024 targeting methane emissions from oil and gas facilities, imposing compliance costs on both new and existing operations.

Legislative efforts to streamline energy project approvals, particularly for oil and gas developments, directly impact FJ Management's exploration and production (E&P) investments. These reforms can accelerate project timelines and reduce upfront costs.

The proposed Energy Permitting Reform Act, slated for introduction in July 2024, aims to cut bureaucratic delays. This could lead to a more efficient permitting process, potentially boosting the speed at which new E&P projects can commence operations, thereby influencing FJ Management's capital allocation strategies.

Global trade policies, including tariffs and trade agreements, directly impact FJ Management's refining and retail fuel margins by influencing the cost of imported crude oil and refined products. For instance, the ongoing trade tensions between major economies in 2024 could lead to increased volatility in oil prices, affecting FJ Management's profitability.

Sanctions regimes and geopolitical conflicts, such as the ongoing situation in Eastern Europe, create significant supply chain disruptions and price uncertainty for crude oil. FJ Management must navigate these risks, as the International Energy Agency reported in early 2025 that geopolitical events contributed to a 15% increase in crude oil price volatility over the preceding year.

Shifting geopolitical landscapes and military conflicts are compelling financial institutions, including FJ Management, to adapt to rapidly evolving sanctions frameworks. This necessitates constant monitoring and compliance adjustments to avoid penalties and maintain operational integrity in a complex international environment.

Government Support for EV Infrastructure

Government support for electric vehicle (EV) infrastructure, while potentially impacting traditional fuel demand, also creates avenues for diversification. The U.S. saw a significant expansion of EV charging, adding approximately 12,500 DC fast chargers in 2024 alone. Projections indicate continued growth in 2025, bolstered by programs such as the National Electric Vehicle Infrastructure (NEVI) initiative, which aims to build out a nationwide charging network.

This evolving landscape presents both challenges and opportunities for companies like FJ Management. The expansion of EV charging infrastructure, supported by government funding and policy, could gradually reduce reliance on gasoline and diesel, impacting established retail fuel markets. However, this shift also opens doors for FJ Management to explore new business models, potentially involving EV charging services, renewable energy integration, or convenience store offerings tailored to EV drivers.

- EV Charging Growth: Nearly 12,500 new DC fast EV chargers were added in the U.S. in 2024.

- Infrastructure Programs: Initiatives like the NEVI program are accelerating EV charging network development.

- Market Impact: Increased EV adoption and charging availability pose a long-term threat to traditional retail fuel demand.

- Diversification Opportunities: FJ Management can explore new revenue streams related to EV charging and alternative energy.

Local Zoning and Development Policies

Local zoning and development policies are critical for FJ Management, directly impacting where and how its Maverik convenience stores can be built and operated. These regulations dictate everything from building size and signage to parking requirements and operational hours, influencing site selection and construction timelines. Navigating these local ordinances efficiently is key to the company's growth strategy.

The company's recent expansion efforts underscore this. For instance, FJ Management announced plans to open new Maverik stores in Kansas by mid-2025. Successfully executing these plans necessitates a deep understanding and proactive engagement with the specific zoning laws and permitting processes in each target municipality. This includes adhering to urban development plans that may prioritize certain types of businesses or development in specific areas.

- Zoning Ordinances: These laws define land use, density, and building setbacks, directly affecting site feasibility for new Maverik locations.

- Permitting Processes: Streamlined or cumbersome permitting can significantly impact project timelines and costs for FJ Management's development projects.

- Urban Development Plans: Municipal plans for growth and revitalization can create opportunities or constraints for retail expansion, influencing where FJ Management can best invest.

- Regulatory Compliance: Adherence to local regulations is paramount to avoid delays, fines, and reputational damage for FJ Management.

Government policies on energy production and consumption directly influence FJ Management's operational landscape. New environmental regulations, such as the EPA's March 2024 methane emission rules, impose compliance costs on oil and gas operations. Furthermore, legislative efforts in 2024 aimed at streamlining energy project approvals could accelerate FJ Management's exploration and production investments.

Global trade dynamics and geopolitical events in 2024 significantly impact FJ Management's refining and retail fuel margins. Trade tensions can increase oil price volatility, while sanctions and conflicts, as highlighted by the IEA's early 2025 report of a 15% increase in crude oil price volatility due to geopolitical events, create supply chain disruptions.

The expansion of electric vehicle (EV) infrastructure, supported by government initiatives like the NEVI program, presents both challenges and opportunities. The addition of approximately 12,500 DC fast chargers in the U.S. during 2024 signals a shift that could affect traditional fuel demand, while also opening avenues for FJ Management to diversify into EV charging services.

Local zoning and development policies are critical for FJ Management's retail expansion, influencing site selection and construction timelines for its Maverik stores. The company's plans for new locations in Kansas by mid-2025, for example, require careful navigation of municipal ordinances and urban development plans to ensure efficient execution.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing FJ Management across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key threats and opportunities within FJ Management's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions by highlighting key external factors impacting FJ Management.

Economic factors

Fluctuations in crude oil and retail fuel prices directly impact FJ Management's profitability across its oil and gas, refining, and retail fuel operations. These price swings influence operating costs and consumer demand, creating a dynamic market environment.

The U.S. Energy Information Administration (EIA) projects a decrease in average U.S. retail gasoline prices to $3.30 per gallon in 2024 and $3.21 per gallon in 2025. Similarly, diesel prices are expected to average $3.93 per gallon in 2024 and $3.86 per gallon in 2025, driven by increased refinery capacity and slightly lower consumption.

The prevailing interest rate environment is a critical determinant for FJ Management, directly influencing the profitability of its real estate ventures and the cost of financing for strategic growth initiatives. As of September 2024, mortgage rates saw a notable decrease, falling below the 6% threshold. Projections suggest a continued downward trend for these rates throughout 2025, which is anticipated to stimulate greater activity within the real estate sector.

Inflationary pressures significantly impact FJ Management's diverse operations, driving up costs for essential inputs like labor, inventory, and construction projects. This directly squeezes profit margins and can reduce the anticipated returns on various investments across their portfolio.

The convenience retail sector, a key area for FJ Management, experienced considerable stress in the past year due to persistent inflation. This led consumers to become more price-conscious and scrutinize their spending habits. However, as 2025 began, there were signs of inflation cooling, offering some relief.

Consumer Spending and Economic Growth

Consumer spending is a critical driver for businesses like Maverik, directly impacting demand for their products and services. The overall health of the economy, particularly the level of disposable income consumers have, plays a significant role in how much they spend. For instance, a robust economy generally translates to higher consumer confidence and spending, benefiting retail operations.

While economic growth has shown signs of slowing, it remains consistent, which is a positive indicator for consumer spending. However, specific sectors might see different trends. Gasoline consumption, a key commodity for convenience stores, is projected to remain stable in 2024, with an anticipated slight decline in 2025. This suggests a need for businesses to adapt to evolving consumer habits and potential shifts in transportation patterns.

- Economic Growth: The U.S. economy grew at an annualized rate of 1.3% in the first quarter of 2024, indicating continued but moderating expansion.

- Consumer Spending Trends: Retail sales in the U.S. increased by 0.3% in April 2024 compared to the previous month, showing ongoing consumer activity.

- Gasoline Consumption Forecast: The U.S. Energy Information Administration (EIA) projects total U.S. motor gasoline consumption to average 8.6 million barrels per day in 2024, a slight decrease from 2023, and further decline to 8.5 million barrels per day in 2025.

Real Estate Market Dynamics

The U.S. real estate market's performance is a critical factor for FJ Management, given its significant holdings. Home prices reached new peaks in June 2024 and again in May 2025, reflecting strong demand. However, the pace of this appreciation is projected to moderate throughout 2025.

Persistently high mortgage rates remain a key challenge, impacting housing affordability for many potential buyers. This could influence demand for residential properties and, consequently, the performance of FJ Management's residential real estate investments.

- Record Home Prices: U.S. median home prices reached record highs in both June 2024 and May 2025.

- Slowing Appreciation: Forecasts indicate a deceleration in home price growth during 2025.

- Affordability Concerns: Elevated mortgage rates continue to present a barrier to entry for many buyers.

Economic factors present a mixed outlook for FJ Management. While the U.S. economy continues to expand, the pace is moderating, with Q1 2024 growth at 1.3%. Consumer spending remains active, evidenced by a 0.3% retail sales increase in April 2024, but inflation's impact on price-sensitive consumers necessitates careful strategy. Projected decreases in gasoline and diesel prices for 2024-2025, alongside moderating home price appreciation and a downward trend in mortgage rates, offer some stabilization opportunities.

| Economic Indicator | 2024 Projection/Data | 2025 Projection |

|---|---|---|

| U.S. GDP Growth (Annualized Q1) | 1.3% | Projected to moderate |

| U.S. Retail Sales (April) | +0.3% (MoM) | Continuing activity |

| U.S. Avg. Retail Gasoline Price | $3.30/gallon | $3.21/gallon |

| U.S. Avg. Diesel Price | $3.93/gallon | $3.86/gallon |

| U.S. Median Home Prices | Record highs (June 2024) | Record highs (May 2025), then moderating appreciation |

| U.S. Mortgage Rates | Below 6% (Sept 2024) | Continued downward trend |

Preview the Actual Deliverable

FJ Management PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive FJ Management PESTLE analysis provides a detailed breakdown of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape FJ Management operates within.

Sociological factors

The growing consumer preference for electric vehicles (EVs) presents a significant long-term challenge to FJ Management's traditional fuel retail operations. This societal shift is driven by environmental concerns and evolving consumer values.

To stay competitive, FJ Management must strategically adapt by exploring opportunities like installing EV charging stations at its Maverik convenience stores. This pivot is crucial for maintaining customer engagement and revenue streams in a changing market landscape.

The U.S. EV fast-charging infrastructure is rapidly expanding, with an estimated 16,700 new fast-charging ports expected to become operational by 2025, highlighting the accelerating adoption of EVs and the need for businesses like FJ Management to integrate this technology.

Consumers increasingly seek healthier food options and fresh, prepared meals, directly impacting convenience store offerings. Maverik, for instance, is adapting by expanding its selection of fresh salads, fruits, and grab-and-go meals, reflecting a broader industry trend. This shift is supported by data showing a significant rise in demand for healthier convenience foods; a 2024 report indicated that 65% of consumers are actively looking for healthier choices when shopping at convenience stores.

Digital convenience is another major driver, with customers expecting seamless online ordering, in-store pickup, and mobile payment options. Maverik's investment in its mobile app and loyalty program, allowing for pre-ordering and personalized offers, directly addresses this evolving preference. The convenience retail sector saw a 20% increase in mobile app usage for transactions in 2024, highlighting the growing importance of digital integration.

Labor shortages are a significant concern for FJ Management, particularly in the retail and energy sectors, potentially affecting operational efficiency and increasing costs. The convenience store industry, a key area for FJ Management, has seen ongoing labor challenges stemming from the global pandemic, with many businesses turning to technology to bridge these gaps.

For instance, in 2024, reports indicated that over 60% of convenience stores were experiencing staffing difficulties, leading some to implement self-checkout systems and AI-powered inventory management to mitigate the impact of fewer available workers.

Public Perception and ESG Concerns

Public perception of FJ Management is increasingly shaped by environmental, social, and governance (ESG) concerns, directly impacting its oil and gas operations. Growing awareness means stakeholders are scrutinizing energy companies more closely than ever. By 2025, strong ESG performance will be critical for reputation and even continued operation in the energy sector.

Investor sentiment is a key driver, with a significant portion of global assets under management now considering ESG criteria. For instance, a 2024 report indicated that over 70% of institutional investors factor ESG into their decision-making processes. This trend places immense pressure on companies like FJ Management to demonstrate tangible progress in sustainability and ethical governance to attract and retain capital.

- Growing Investor Demand: A substantial percentage of global AUM is now ESG-integrated, influencing capital allocation towards responsible energy producers.

- Reputational Risk: Negative public perception due to environmental incidents or governance failures can lead to boycotts and damage brand value.

- Regulatory Scrutiny: Evolving regulations on emissions and social impact will further amplify public and investor focus on ESG metrics.

- Talent Acquisition: A positive ESG profile is becoming crucial for attracting and retaining skilled employees, particularly younger generations.

Urbanization and Lifestyle Trends

Urbanization continues to reshape consumer behavior, directly influencing Maverik's store placement strategy and the valuation of FJ Management's real estate portfolio. As more people flock to cities, the demand for accessible, convenient retail options, especially those offering 24/7 service, surges. This trend is particularly pronounced in emerging markets, where rapid urban development fuels the growth of convenience retail.

The shift towards urban living also alters commuter habits. Longer commutes and busier schedules often translate into a greater reliance on convenience stores for everyday needs. This necessitates a strategic approach to site selection for Maverik, prioritizing locations that cater to these evolving commuter patterns and urban lifestyles. For instance, the increasing density in urban centers by 2024 and 2025 suggests a higher potential customer base for stores located along major commuter routes or in densely populated residential areas.

- Urban Population Growth: Global urbanization is projected to continue, with the UN estimating that 68% of the world's population will live in urban areas by 2050. This ongoing trend directly impacts the potential customer base for convenience retail.

- Commuter Time: In many major metropolitan areas, average commute times have been steadily increasing. Data from 2024 indicates that in some cities, commuters spend over an hour each way, highlighting the value of convenient, quick stops.

- Convenience Retail Market: The convenience retail sector, particularly in Asia-Pacific, is experiencing robust growth. Reports from 2024 suggest a compound annual growth rate (CAGR) exceeding 7% in this segment, driven by urbanization and changing consumer preferences.

- 24/7 Accessibility Demand: Consumer surveys conducted in late 2024 and early 2025 consistently show a strong preference for businesses offering round-the-clock services, aligning with the operational model of many convenience stores.

Societal shifts are profoundly impacting FJ Management's business model, particularly its reliance on traditional fuel sales. The growing consumer preference for electric vehicles (EVs) is a significant long-term challenge, driven by environmental concerns and evolving values, necessitating strategic adaptation like installing EV charging stations.

Furthermore, consumer demand for healthier food options and digital convenience is reshaping the convenience store landscape. Maverik is responding by expanding its fresh offerings and enhancing its mobile app for seamless ordering and payment.

Labor shortages remain a critical operational hurdle, with over 60% of convenience stores reporting staffing difficulties in 2024, prompting the adoption of technology like self-checkout systems to maintain efficiency.

Public perception, increasingly tied to ESG factors, is crucial for FJ Management's reputation and capital access, as over 70% of institutional investors factored ESG into their 2024 decisions.

Urbanization trends continue to influence store placement and real estate valuation, with urban populations projected to reach 68% by 2050, increasing demand for convenient, accessible retail options.

| Sociological Factor | Impact on FJ Management | Supporting Data (2024/2025) |

|---|---|---|

| EV Adoption | Decreased demand for traditional fuel; opportunity for charging infrastructure | 16,700 new fast-charging ports expected by 2025 |

| Health & Wellness Trends | Increased demand for fresh/healthy food options in convenience stores | 65% of consumers seek healthier choices in convenience stores |

| Digital Convenience | Expectation of seamless online ordering and mobile payment | 20% increase in mobile app usage for transactions in convenience sector |

| Labor Market Dynamics | Staffing challenges impacting operational efficiency | Over 60% of convenience stores experienced staffing difficulties |

| ESG Awareness | Pressure to demonstrate strong environmental, social, and governance performance | Over 70% of institutional investors factor ESG into decisions |

| Urbanization | Shift in consumer behavior and store location strategy | Urban populations projected to reach 68% by 2050; increasing commute times |

Technological factors

Rapid advancements in electric vehicle (EV) charging technology, such as ultra-fast charging and wireless solutions, are key considerations for FJ Management's potential expansion into this sector. These innovations directly impact the user experience and the feasibility of widespread EV adoption.

The U.S. EV charging infrastructure market is experiencing robust growth, with projections indicating significant expansion through 2030. Innovations like portable charging stations and intelligent grid integration are creating new avenues for businesses to engage with this evolving market.

The retail sector, including convenience stores, is rapidly embracing digitalization. This means more mobile payment options, sophisticated loyalty programs, and AI for smarter inventory control are becoming standard. For instance, by 2024, global retail mobile payment transaction value is projected to reach over $3.5 trillion, showcasing a significant shift in consumer behavior.

Artificial intelligence is poised to be a major disruptor, not just in banking but across retail. AI is expected to automate many tasks, leading to more personalized customer experiences and a redefinition of job roles within the industry. By 2025, the AI market in retail is forecast to grow substantially, with AI-powered solutions expected to improve operational efficiency by up to 20% in some areas.

Technological advancements are reshaping oil and gas exploration and production (E&P). Innovations like enhanced drilling techniques and carbon capture technologies are boosting efficiency while also mitigating environmental impact. For instance, the adoption of AI is becoming crucial for optimizing operations and ensuring adherence to stringent regulatory standards within the sector.

In 2024, the global oil and gas industry saw significant investment in digital transformation, with AI and machine learning solutions projected to increase operational efficiency by an average of 15-20%. Companies are leveraging these technologies for predictive maintenance, reservoir analysis, and improved safety protocols, demonstrating a clear trend towards data-driven decision-making.

Data Analytics and AI for Business Optimization

FJ Management can significantly enhance its operations by integrating data analytics and AI. These technologies offer deep insights for optimizing pricing strategies, streamlining supply chains, and improving customer interactions. For instance, by analyzing vast datasets, the company can identify optimal price points for its services and predict demand fluctuations, leading to better resource allocation.

Artificial intelligence is particularly transformative for managing electric vehicle (EV) charging infrastructure. AI algorithms can analyze real-time data to optimize the performance of EV charging networks, ensuring efficient energy distribution and balancing grid demand. This also directly contributes to an improved driver experience by minimizing wait times and ensuring charger availability. By 2025, the global AI market is projected to reach over $500 billion, highlighting the significant investment and adoption of these technologies across industries.

Key areas where data analytics and AI can empower FJ Management include:

- Pricing Optimization: Utilizing AI to dynamically adjust pricing based on demand, competitor analysis, and customer segmentation.

- Supply Chain Efficiency: Employing predictive analytics to forecast inventory needs, reduce waste, and optimize logistics routes.

- Customer Engagement: Leveraging AI-powered tools for personalized marketing, customer service automation, and churn prediction.

- Real Estate Management: Using data analytics to identify optimal locations for new facilities and manage existing property portfolios more effectively.

Cybersecurity Threats and Solutions

FJ Management's increasing reliance on digital infrastructure across its diverse sectors, from finance to logistics, makes robust cybersecurity paramount. This heightened dependence means protecting sensitive customer data and ensuring uninterrupted operations are critical. The finance industry, in particular, is prioritizing advanced security measures as a key trend for 2025, recognizing the escalating sophistication of cyber threats.

Cyberattacks can lead to significant financial losses, reputational damage, and regulatory penalties. For instance, the average cost of a data breach in the financial sector reached $5.90 million in 2023, according to IBM's Cost of a Data Breach Report, a figure expected to continue rising. FJ Management must therefore invest in and continuously update its defenses.

Effective cybersecurity solutions for FJ Management include:

- Implementing multi-factor authentication (MFA) across all systems.

- Regularly conducting vulnerability assessments and penetration testing.

- Deploying advanced endpoint detection and response (EDR) solutions.

- Providing ongoing cybersecurity awareness training for all employees.

Technological advancements are rapidly shaping FJ Management's operational landscape, particularly with the rise of AI and data analytics. These tools are crucial for optimizing pricing, enhancing supply chain efficiency, and personalizing customer engagement, with AI in retail alone projected for substantial growth by 2025.

The increasing digitalization across FJ Management's sectors, from finance to logistics, necessitates a strong focus on cybersecurity. The finance industry, for example, is prioritizing advanced security measures for 2025 due to escalating cyber threats, with data breaches costing millions.

Innovations in EV charging, such as ultra-fast and wireless solutions, present opportunities for FJ Management, aligning with the U.S. EV charging infrastructure market's projected expansion. AI's role in optimizing these networks is also a key technological factor.

The oil and gas sector is seeing significant investment in digital transformation, with AI and machine learning projected to boost operational efficiency by 15-20% in 2024, highlighting the trend towards data-driven decision-making.

Legal factors

FJ Management faces significant operational and financial impacts from stringent environmental regulations. The EPA's new methane emission standards, finalized in March 2024, alongside state-specific legislation like California's SB 1137, directly affect oil and gas operations by increasing compliance burdens and costs.

The Environmental Protection Agency (EPA) has been actively shaping environmental policy, with an interim final rule issued in July 2025 extending certain compliance deadlines for these new regulations, offering a slight reprieve for companies like FJ Management in the near term.

Changes in labor laws and minimum wage requirements significantly impact FJ Management's operational expenses and human resource planning across its diverse retail and service sectors. For instance, an increase in the federal minimum wage, which has been a recurring discussion point in 2024 and is likely to continue into 2025, could directly raise labor costs for its many frontline employees.

Compliance with evolving regulations, such as those concerning overtime pay or mandated employee benefits, is essential for FJ Management's extensive network. In 2024, some states and cities have already implemented higher minimum wages, with projections suggesting further adjustments in 2025, potentially impacting FJ Management's profitability and requiring strategic adjustments to compensation and staffing models.

FJ Management's financial services operations navigate a complex web of evolving regulations, particularly in consumer protection, data privacy, and anti-money laundering (AML). These rules are not static; for instance, in 2024, many jurisdictions are enhancing data breach notification requirements, adding layers of compliance for financial institutions.

The intensified regulatory focus on risk elimination, while intended to safeguard the system, paradoxically introduces new challenges. This push is driving some borrowers towards the less regulated non-bank financial sector, and simultaneously increasing the scrutiny on traditional institutions concerning sanctions compliance and fraud detection, a trend that saw significant enforcement actions in late 2023 and is projected to continue through 2025.

Real Estate Zoning and Land Use Laws

Real estate zoning and land use laws are paramount for FJ Management's strategic growth, particularly in expanding its portfolio and constructing new convenience stores. These legal frameworks, encompassing zoning ordinances, land use permits, and environmental impact assessments, directly influence project feasibility and execution timelines.

Navigating these regulations is essential, as they dictate where and how FJ Management can develop properties. For instance, a proposed convenience store location might be zoned for commercial use, but specific restrictions on operating hours or signage could still impact the business model. In 2024, the average time to obtain a building permit in the United States was approximately 150 days, a figure that can fluctuate significantly based on local government efficiency and project complexity.

- Zoning Ordinances: These laws dictate permitted land uses within specific geographic areas, directly impacting where FJ Management can establish new stores.

- Land Use Permits: Securing these permits is a crucial step, often requiring detailed site plans and adherence to community development goals.

- Environmental Impact Assessments: Increasingly stringent environmental regulations necessitate thorough assessments to ensure compliance and mitigate potential ecological concerns, adding to project timelines and costs.

- Regulatory Compliance Costs: In 2024, businesses nationwide reported an average of 8% of their operating budget allocated to regulatory compliance, a significant factor for real estate development.

Antitrust and Competition Laws

As FJ Management, now including Kum & Go's approximately 400 locations, expands its retail fuel and convenience store presence, it faces scrutiny under antitrust and competition laws. The acquisition, finalized in August 2023, with plans to rebrand all Kum & Go stores by mid-2025, necessitates careful adherence to regulations designed to prevent market monopolization and ensure fair competition.

These laws are critical for maintaining a level playing field, especially in consolidated markets like the convenience store sector. Regulatory bodies will monitor FJ Management's integration of Kum & Go to ensure it does not unduly stifle competition or lead to price gouging for consumers.

Key considerations include:

- Market Share Analysis: Regulators will assess FJ Management's combined market share in specific geographic areas to identify any potential antitrust concerns.

- Impact on Competitors: The acquisition's effect on smaller competitors and the overall competitive landscape will be evaluated.

- Consumer Welfare: The primary focus will be on whether the merger benefits or harms consumers through pricing, product availability, and service quality.

FJ Management's operations are significantly shaped by legal frameworks governing labor, including minimum wage laws and overtime regulations. With many frontline employees, increases in the federal minimum wage, a topic of ongoing discussion in 2024 and projected into 2025, directly impact labor expenses. States and cities have already implemented higher wages, with further adjustments anticipated in 2025, necessitating strategic adjustments to compensation models.

Antitrust and competition laws are critical as FJ Management integrates Kum & Go's approximately 400 locations, a process expected to be completed by mid-2025. Regulatory bodies will scrutinize market share and the impact on competitors to prevent monopolization and ensure fair consumer pricing. The focus remains on whether the merger ultimately benefits or harms consumers through pricing, availability, and service quality.

FJ Management's financial services arm must navigate a complex regulatory environment, particularly concerning consumer protection, data privacy, and anti-money laundering (AML). Enhanced data breach notification requirements, implemented in 2024, add compliance layers, while intensified scrutiny on risk elimination and sanctions compliance, seen in late 2023 enforcement actions, is projected to continue through 2025.

| Legal Factor | Impact on FJ Management | Key Considerations/Data (2024-2025) |

|---|---|---|

| Labor Laws | Increased operational costs, HR planning | Federal minimum wage discussions; state/local increases impacting 2025 budgets. |

| Antitrust Laws | Scrutiny on market share, competition post-acquisition | Integration of Kum & Go (approx. 400 stores) by mid-2025; focus on consumer welfare. |

| Financial Regulations | Compliance burdens in data privacy, AML, consumer protection | Enhanced data breach notification rules (2024); continued focus on sanctions and fraud detection. |

Environmental factors

Global and national climate change policies, such as net-zero commitments and carbon pricing, significantly impact FJ Management's long-term strategy, particularly for its fossil fuel operations. For instance, the EU's Emissions Trading System (ETS) saw carbon prices averaging around €80 per tonne in early 2024, a substantial increase that raises operational costs for carbon-intensive industries.

The energy sector is rapidly shifting towards decarbonization. Major oil and gas firms are channeling billions into renewable energy projects and carbon capture technologies. By mid-2024, many of the largest energy companies had publicly committed to substantial reductions in their Scope 1 and 2 emissions, with some setting targets for Scope 3 emissions as well.

The global shift towards renewable energy sources is accelerating, presenting significant strategic considerations for FJ Management. By 2025, worldwide investment in solar and wind power is projected to outpace that in fossil fuels, signaling a fundamental change in the energy landscape.

This transition necessitates that energy companies, including FJ Management, actively diversify their operations and investments into renewable sectors like solar, wind, and hydropower to remain competitive and capitalize on emerging growth opportunities.

Water scarcity presents a significant challenge for FJ Management, impacting both its oil and gas operations and real estate ventures. The company's 2025 environmental goals directly address this, aiming for the sustainable use and protection of marine and freshwater resources, crucial for maintaining operational licenses and public image.

In 2024, many regions where oil and gas exploration occurs faced heightened water stress. For instance, reports from the World Resources Institute indicated that over 2 billion people lived in countries experiencing high water stress in 2023, a figure projected to rise. This directly affects FJ Management's ability to secure and manage water for fracking and other extraction processes, potentially increasing operational costs and regulatory scrutiny.

For FJ Management's real estate developments, access to reliable water sources is fundamental for construction and ongoing operations, including landscaping and resident needs. In 2024, several major urban areas experienced drought conditions, leading to water restrictions that could impact construction timelines and the desirability of properties. Proactive water management strategies are therefore essential for mitigating these risks and aligning with the company's 2025 sustainability targets.

Waste Management and Pollution Control

Governments worldwide are tightening regulations on waste management and pollution control, directly impacting FJ Management's operational costs and supply chain. For instance, the European Union's ambitious Circular Economy Action Plan, with updated targets for 2025, pushes for greater material reuse and waste reduction across industries. This regulatory environment necessitates significant investment in cleaner production technologies and waste treatment processes.

Public pressure concerning environmental impact is also a major driver. Consumers and investors alike are increasingly scrutinizing companies' environmental, social, and governance (ESG) performance. FJ Management must demonstrate a commitment to waste reduction and pollution prevention to maintain its social license to operate and attract capital. By 2025, the emphasis on circular economy principles is expected to intensify, requiring innovative approaches to product design and end-of-life management.

- Regulatory Landscape: Expect stricter emissions standards and landfill restrictions globally, potentially increasing compliance costs for FJ Management.

- Circular Economy Adoption: By 2025, an estimated 45% of manufacturing companies will have integrated circular economy principles into their core business strategies, according to industry forecasts.

- Consumer Demand: Surveys indicate that over 60% of consumers are willing to pay a premium for products with a reduced environmental footprint, influencing FJ Management's product development.

- Investment Trends: ESG-focused funds are projected to manage over $50 trillion in assets by 2025, making strong environmental performance critical for attracting investment to FJ Management.

Biodiversity and Land Conservation

FJ Management faces increasing scrutiny regarding its impact on biodiversity and land conservation, particularly concerning its real estate development and oil and gas exploration activities. Stricter regulations and growing public awareness are driving a demand for more sustainable land use practices.

By 2025, many environmental agencies and international bodies are setting ambitious targets for ecosystem protection and biodiversity restoration. For instance, the Kunming-Montreal Global Biodiversity Framework, adopted in December 2022, aims to halt and reverse biodiversity loss by 2030. This framework influences national policies and corporate environmental, social, and governance (ESG) strategies, potentially increasing compliance costs and project timelines for FJ Management.

- Increased regulatory compliance costs: FJ Management may incur higher expenses for environmental impact assessments and mitigation measures to protect sensitive ecosystems.

- Project delays and cancellations: Opposition from environmental groups or government intervention due to biodiversity concerns could lead to significant delays or the outright cancellation of development projects.

- Reputational risk: Negative publicity stemming from perceived damage to biodiversity or failure to engage in effective land conservation can harm FJ Management's brand image and investor relations.

- Opportunities for sustainable development: Proactive engagement in land conservation and biodiversity protection can create new business opportunities, such as eco-tourism or carbon credit projects, aligning with evolving market expectations.

FJ Management must navigate evolving climate policies, with carbon prices in the EU averaging around €80 per tonne in early 2024, impacting operational costs. The global energy sector is rapidly decarbonizing, with major firms investing billions in renewables, and by mid-2024, many had set significant emission reduction targets.

The accelerating shift to renewables means worldwide investment in solar and wind is projected to surpass fossil fuels by 2025, compelling FJ Management to diversify its operations into these growing sectors.

Water scarcity is a critical concern, as over 2 billion people lived in high water stress regions in 2023, a figure expected to rise, directly affecting FJ Management's water-intensive operations and increasing potential costs and scrutiny.

Stricter waste management and pollution control regulations, like the EU's Circular Economy Action Plan with updated 2025 targets, necessitate investment in cleaner technologies and waste treatment for FJ Management.

| Environmental Factor | 2024/2025 Data Point | Impact on FJ Management |

| Climate Policy | EU carbon prices ~€80/tonne (early 2024) | Increased operational costs for carbon-intensive activities. |

| Energy Transition | Renewable investment projected to exceed fossil fuels by 2025 | Need for diversification into solar, wind, and hydropower. |

| Water Scarcity | 2 billion+ people in high water stress regions (2023) | Higher operational costs and regulatory scrutiny for water usage. |

| Waste/Pollution Regulation | EU Circular Economy Action Plan targets for 2025 | Requirement for investment in cleaner production and waste treatment. |

PESTLE Analysis Data Sources

Our FJ Management PESTLE analysis is informed by a comprehensive review of official government publications, reputable industry analysis firms, and global economic databases. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in current and credible information.