FJ Management Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FJ Management Bundle

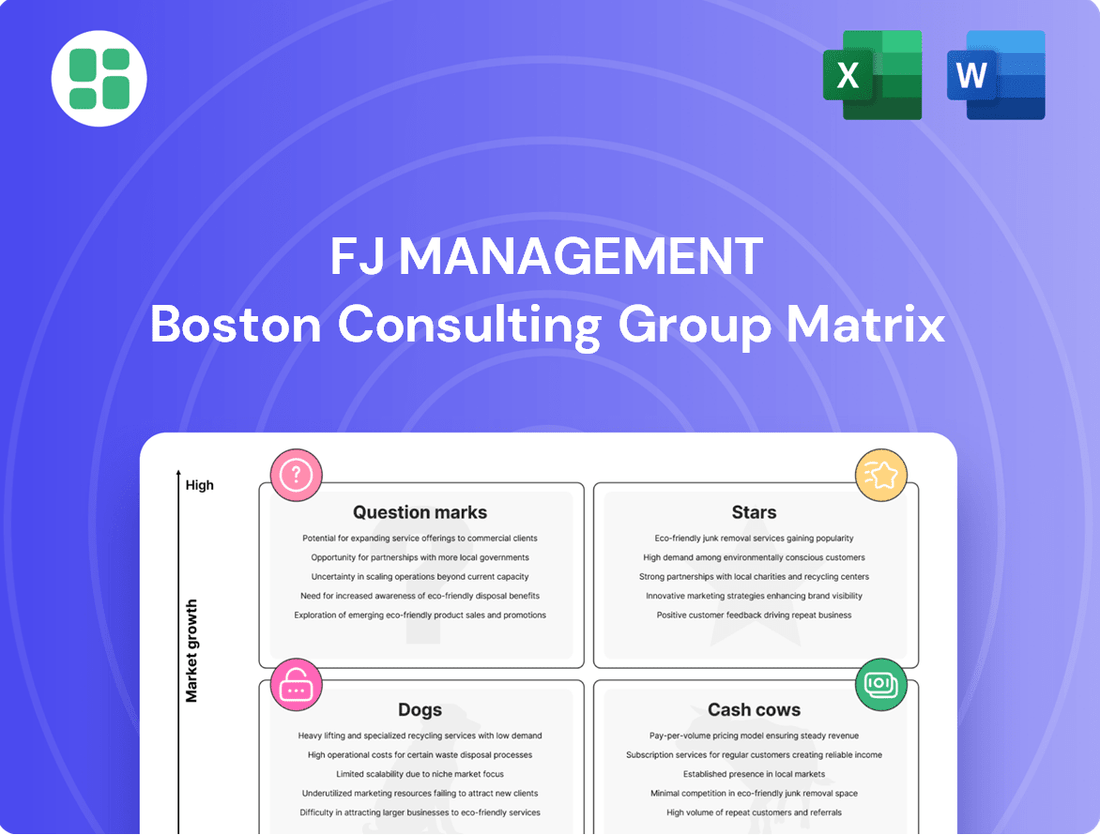

Unlock the strategic potential of FJ Management's product portfolio with a glimpse into its BCG Matrix. Understand which products are driving growth, which are sustaining profits, and which require critical evaluation.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Maverik, a key player in FJ Management's portfolio, is making significant moves with new store expansions. Groundbreakings are scheduled for Kansas by mid-2025, reflecting a strategic push into emerging markets. This expansion taps into the convenience store sector's robust growth, which experienced a 1.5% increase year-over-year from 2023 to 2024, indicating a healthy market.

Maverik's commitment to foodservice innovation positions it strongly within the evolving convenience store landscape. The industry saw prepared meals jump 16.3% in 2024, a clear indicator of consumer demand for quality, ready-to-eat options. By expanding its made-to-order menu, including popular items like burritos, sandwiches, and pizzas, Maverik is directly tapping into this lucrative segment.

FJ Management's real estate division, FJM Real Estate, is a significant player in its own right, developing more than 40 new convenience stores each year for its various subsidiaries. This aggressive development pace underscores a strategic commitment to acquiring and building properties in high-growth markets, a trend expected to continue through 2025.

Advanced Digital Integration in Retail

The convenience store sector is seeing a significant digital overhaul. Companies are leveraging AI for smarter inventory, enabling mobile ordering, and creating personalized loyalty programs that truly stand out. These digital tools are becoming essential for success in the competitive convenience market.

Maverik, a prominent player, has made substantial investments in rolling out these advanced technologies across its operations. This commitment, particularly given Maverik's extensive network, signals that its digital ventures are poised for considerable growth. By enhancing efficiency and customer engagement, these innovations are key to capturing a larger market share.

- AI-Powered Inventory Management: Reduces stockouts and waste.

- Mobile Ordering & Payment: Streamlines the customer experience.

- Personalized Loyalty Programs: Drives repeat business and customer retention.

- Data Analytics: Informs strategic decisions and marketing efforts.

Strategic Acquisitions and Brand Unification

Maverik's strategic acquisition of Kum & Go stores is a significant move to consolidate its market presence. By mid-2025, Maverik aims to complete the rebranding of all acquired Kum & Go locations across 20 states, creating a unified brand identity. This consolidation is designed to capture a larger market share in newly entered regions.

The integration of these stores under the Maverik brand, known for its adventure-themed customer experience and quality products, is expected to enhance its competitive edge. This rebranding initiative is a key component of Maverik's growth strategy, leveraging the combined scale of the acquired assets.

- Brand Unification: Maverik is rebranding approximately 170 Kum & Go stores acquired in 2023.

- Geographic Expansion: The rebranding spans 20 states, significantly expanding Maverik's footprint.

- Market Share Growth: This consolidation aims to boost Maverik's market share in new and existing territories.

- Customer Experience: The integration focuses on extending Maverik's signature adventure-themed offerings to new customers.

Stars in the BCG Matrix represent high-growth, high-market-share businesses. Maverik, with its aggressive expansion and digital innovation, is positioned as a Star for FJ Management. Its strategic acquisitions and focus on customer experience, particularly in the booming convenience store sector, solidify its status. The company's investments in technology and foodservice align with industry growth trends, suggesting continued strong performance.

| Business Unit | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Maverik | High | High | Star |

What is included in the product

The FJ Management BCG Matrix offers a strategic overview of its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

A clear visual representation of your portfolio, helping you quickly identify where to focus resources and divest from underperformers.

Cash Cows

Maverik's established fuel and convenience stores are FJ Management's cash cows. These operations, primarily in mature markets, generate substantial and consistent cash flow. Their high market share and the steady demand for fuel and convenience items solidify their position as reliable revenue generators.

The strong brand recognition and customer loyalty built over years are key advantages. This allows Maverik to maintain its market position with relatively low promotional spending, further enhancing profitability. These core operations are the bedrock of FJ Management's financial stability.

In 2024, convenience store sales in the US have shown resilience. For instance, the National Association of Convenience Stores (NACS) reported that in-store sales for the sector continue to grow, indicating sustained customer engagement with established brands like Maverik.

Big West Oil's refining and distribution assets are a cornerstone of FJ Management's operations, acting as a reliable supplier for Maverik convenience stores and other businesses across the Intermountain West. This segment benefits from a mature market where demand for refined products like gasoline remains consistent, even with occasional price volatility. For instance, in 2023, refined product sales contributed significantly to FJ Management's overall revenue, showcasing the stable cash-generating nature of these assets.

FJ Management's legacy real estate portfolio, likely including properties managed by MacCall Management, functions as a Cash Cow. These established assets in stable markets generate consistent rental income, requiring minimal new investment for growth.

This mature segment provides a reliable source of cash flow, contributing steadily to FJ Management's overall financial stability. For example, in 2024, the company reported significant recurring revenue from its diversified real estate holdings, underscoring the dependable nature of these legacy assets.

TAB Bank's Traditional Financial Services

TAB Bank, a key component of FJ Management's financial services, has broadened its reach beyond its origins in the transportation sector to offer online banking nationwide. Its established traditional financial services are likely significant revenue generators.

These mature offerings, benefiting from a strong market presence within their specific segments, function as a stable source of cash for FJ Management. This predictable income supports the company's investments in other business areas.

- TAB Bank's Net Interest Margin (NIM): While specific 2024 data for TAB Bank's NIM isn't publicly detailed, the average NIM for similar online banks in the US hovered around 3.5% to 4.5% in early 2024, indicating strong profitability on its lending activities.

- Customer Deposit Growth: Online banks generally experience robust deposit growth. For instance, many saw double-digit percentage increases in deposits throughout 2023, a trend likely to continue for established players like TAB Bank.

- Loan Portfolio Performance: Traditional banking services rely on loan performance. The overall US delinquency rates on commercial and industrial loans remained relatively low in early 2024, suggesting a healthy environment for TAB Bank's loan book.

Efficient Supply Chain and Logistics Infrastructure

Maverik's extensive supply chain and logistics infrastructure, supporting over 800 stores across 20 states, including integrated Kum & Go locations, is a prime example of an efficient operation. This robust system ensures cost-effective distribution of both goods and fuel, directly contributing to high profit margins.

The efficiency of this established infrastructure is a key driver for maximizing cash generation within Maverik's retail segment. By minimizing operational costs through optimized logistics, the company enhances its ability to convert sales into substantial cash flow.

- Operational Efficiency: Maverik's logistics network minimizes transportation and warehousing costs, directly boosting profitability.

- Market Reach: The infrastructure supports a broad geographic presence, allowing for consistent product availability and sales volume.

- Cost Advantage: Streamlined distribution channels provide a competitive edge by reducing the cost of goods sold.

Cash Cows within FJ Management's portfolio represent established, high-market-share businesses that generate consistent, predictable cash flow with minimal investment. These operations are the financial bedrock, funding growth initiatives in other segments. Maverik's convenience stores and Big West Oil's refining assets are prime examples, benefiting from steady demand and strong brand presence.

The legacy real estate portfolio and TAB Bank's traditional financial services also fall into this category, providing reliable income streams. These mature assets leverage existing infrastructure and customer bases to maintain profitability, ensuring a stable financial foundation for the company.

In 2024, the convenience store sector, where Maverik operates, continued to show resilience. NACS data indicates ongoing growth in in-store sales, highlighting the sustained customer engagement with established brands. Similarly, TAB Bank's lending activities are supported by generally low US delinquency rates on commercial loans, suggesting a healthy environment for its loan portfolio.

| Business Segment | Role as Cash Cow | Key Supporting Data (2023/Early 2024) |

|---|---|---|

| Maverik (Convenience Stores) | High market share, steady demand for fuel and convenience items. | Continued growth in in-store sales reported by NACS. |

| Big West Oil (Refining & Distribution) | Mature market, consistent demand for refined products. | Significant contribution to revenue in 2023, demonstrating stable cash generation. |

| Legacy Real Estate | Consistent rental income from established assets. | Significant recurring revenue reported in 2024 from diversified holdings. |

| TAB Bank (Traditional Services) | Stable income from established financial offerings. | Low delinquency rates on commercial loans support loan portfolio health. |

Preview = Final Product

FJ Management BCG Matrix

The FJ Management BCG Matrix you are previewing is the identical, fully functional document you will receive upon purchase. This means the strategic insights, clear visualizations, and actionable frameworks are exactly as presented, ready for immediate implementation in your business planning. No alterations or watermarks will be present in the final file, ensuring a seamless transition from preview to professional application.

Dogs

Some of the acquired Kum & Go locations, especially those in areas where Maverik's brand transition has been difficult, might have a low market share and low growth. These stores could become cash traps if their income doesn't cover the costs of rebranding and operations, possibly leading to them being sold or heavily restructured.

The recent layoffs at the former Kum & Go headquarters in Des Moines indicate a move towards consolidation and a potential review of underperforming assets. For example, if a rebranded store in a competitive market like Denver continues to show declining sales, below the projected 2024 targets of a 5% year-over-year increase, it would signal a need for immediate strategic reassessment.

Within FJ Management's oil and gas exploration and production, marginal assets often fall into the "dog" category of the BCG Matrix. These are typically properties with high operating expenses and low output, or those situated in basins that are naturally declining. For instance, many older, onshore wells in the Permian Basin, while historically productive, are now facing increased water handling costs and lower reservoir pressures, pushing their operational breakeven points higher.

These marginal assets might just cover their costs or, worse, demand significant capital injections for very little return, especially when oil prices are volatile. In 2024, with many exploration and production companies focusing on efficiency and debt reduction, these low-margin operations become even less attractive. The average lifting cost for some of these marginal wells can exceed $40 per barrel, making them vulnerable to even moderate price dips.

Strategically, FJ Management would likely consider divesting these marginal oil and gas exploration assets. This move frees up capital that can be redirected towards more promising exploration targets or acquisitions that offer higher growth potential and better returns on investment, aligning with a portfolio optimization strategy. Companies are increasingly looking to shed these less productive units to improve overall portfolio economics and focus on core, profitable operations.

FJ Management's real estate holdings might contain properties that are either aging or situated in less desirable locations. These could be in areas with limited economic growth or face challenges with consistently high occupancy. For instance, properties in declining industrial zones or areas with poor infrastructure might fall into this category.

Such underperforming assets often contribute little to the company's overall revenue and can even become a drain due to ongoing maintenance expenses and a lack of significant value appreciation. In 2023, the national average vacancy rate for commercial real estate, excluding retail, hovered around 10-12%, a figure that could be significantly higher for older, poorly located properties.

Retaining these properties can tie up valuable capital. This capital could otherwise be reinvested in newer, more promising real estate ventures or allocated to FJ Management's more dynamic business units, thereby improving the company's overall financial health and growth trajectory.

Niche or Unsuccessful Financial Service Ventures

Within FJ Management's portfolio, niche or unsuccessful financial service ventures would be classified as dogs. These are ventures that, despite initial promise, have struggled to achieve meaningful market traction or demonstrate a clear path to profitability. An example could be a specialized fintech platform launched in 2023 that targeted a very narrow demographic and saw limited user adoption, perhaps acquiring only a few thousand users by mid-2024 against a projected target of tens of thousands.

These ventures, like a hypothetical digital lending product introduced in late 2022 that failed to gain significant traction due to regulatory hurdles and intense competition, represent areas where resources might be better reallocated. By mid-2024, such a product might have only processed a fraction of its expected loan volume, indicating a need for strategic review and potential divestment.

FJ Management's approach would involve minimizing further investment in these underperforming assets.

- Limited Market Penetration: Ventures failing to capture even 5% of their target market share by mid-2024 would be considered dogs.

- Low ROI: A negative or negligible return on investment within 18-24 months of launch would signal a dog status.

- Resource Drain: Continued operational costs without a clear growth trajectory, such as a specialized wealth management tool that incurred $500,000 in operating expenses in 2023 with minimal revenue generation, would highlight the need for divestment.

- Strategic Reassessment: These ventures often require a difficult but necessary decision to either pivot significantly or exit the market to focus on more promising opportunities.

Non-Core, Legacy Business Units with Diminishing Returns

FJ Management, as a diversified entity, may hold onto niche, legacy business units that have experienced a decline in market relevance and future growth potential. These are often historical assets from broader past ventures that no longer fit the company's current strategic direction or significantly contribute to its substantial asset base.

These units, characterized by diminishing returns, represent opportunities for strategic divestment. For instance, if a legacy segment, like a small regional distribution network acquired years ago, now accounts for less than 0.5% of FJ Management's total revenue, which was reported to be in the billions in 2024, it signals a need for re-evaluation.

- Declining Market Share: Units showing consistent year-over-year decreases in their market position.

- Low Growth Prospects: Segments operating in stagnant or contracting industries.

- Strategic Misalignment: Businesses that do not align with FJ Management's core competencies or future growth ambitions.

- Resource Drain: Units requiring disproportionate management attention or capital investment relative to their returns.

Dogs in FJ Management's portfolio represent underperforming assets with low market share and low growth potential. These could include certain Kum & Go locations struggling with brand transition, marginal oil and gas exploration assets with high operating costs, or real estate properties in less desirable locations. Niche or unsuccessful financial service ventures and legacy business units with declining market relevance also fall into this category.

These assets often drain resources without generating significant returns, making them candidates for divestment or restructuring. For example, oil wells with lifting costs exceeding $40 per barrel in 2024, or commercial properties with vacancy rates well above the national average of 10-12% in 2023, exemplify such dogs.

FJ Management's strategy would likely involve minimizing further investment in these units and reallocating capital to more promising ventures. This focus on portfolio optimization aims to improve overall financial health and growth trajectory by shedding non-core or underperforming assets.

Divesting these underperforming assets frees up capital for reinvestment in higher-growth opportunities, enhancing the company's overall financial health and strategic direction.

| Asset Category | Example | Key Characteristics | 2023-2024 Data Point |

|---|---|---|---|

| Retail Locations | Kum & Go stores in difficult transition markets | Low market share, low growth | Some locations may not meet projected 5% YoY sales growth in 2024. |

| Oil & Gas | Marginal onshore wells | High operating costs, low output | Lifting costs can exceed $40/barrel for some wells in 2024. |

| Real Estate | Aging properties in declining zones | Low economic growth, high vacancy | Vacancy rates for older properties could exceed national average of 10-12% (2023). |

| Financial Services | Niche fintech platforms | Limited market traction, low profitability | Limited user adoption, possibly thousands vs. projected tens of thousands by mid-2024. |

| Legacy Units | Small regional distribution networks | Declining relevance, low growth | May account for less than 0.5% of total revenue for a company with billions in revenue in 2024. |

Question Marks

Maverik's exploration of new convenience store formats, often featuring enhanced foodservice and digital integration, is a classic example of a question mark in the BCG matrix. These innovative concepts are being tested in emerging markets, indicating high potential for future growth but currently holding a small market share due to their nascent stage.

For instance, Maverik's pilot programs in 2024 have focused on integrating grab-and-go meal solutions and advanced technology like self-checkout kiosks. While these initiatives aim to capture future market demand, their current penetration is minimal, placing them firmly in the question mark category.

FJ Management faces a critical decision with these question mark formats: either commit significant capital to accelerate market penetration and move them towards stars, or risk them faltering and becoming dogs if they fail to gain traction. The success of these pilots will heavily influence their future strategic allocation of resources.

FJ Management's 'FJ Investments' solar program, boasting over $800 million in equity for solar projects, signifies a substantial push into high-growth renewable energy markets. This strategic move, alongside potential ventures into alternative fuels, positions the company to capitalize on the evolving energy landscape.

While these sectors offer immense growth potential, they represent newer territories for FJ Management compared to its established petroleum operations. This implies a lower initial market share, characteristic of question mark investments that require careful nurturing and strategic development to climb the market share ladder.

Significant, sustained investment is crucial to ascertain whether these renewable and alternative fuel initiatives can transition from question marks to future stars within the company's portfolio. By 2024, global renewable energy investments were projected to reach new heights, underscoring the opportunity for FJ Management to carve out a meaningful presence.

FJ Management's Real Estate division might be actively exploring acquisitions and development opportunities in emerging markets. These markets typically exhibit strong growth potential but currently represent a smaller footprint for the company. For instance, MacCall Management, a subsidiary, is slated to begin construction on new hotel properties in these regions between 2024 and 2025, signaling a strategic push into new territories.

These ventures are inherently speculative, demanding significant capital investment and carrying a higher risk profile due to their nascent stage and FJM's limited market share. The success of these emerging market plays, such as the planned hotel developments, will critically depend on effective market penetration and operational efficiency to ensure they contribute positively to the portfolio rather than becoming underperforming assets.

Strategic Investments in Financial Technology (FinTech)

FJ Management's strategic investment of 20% in Balentine LLC, a wealth management firm, positions this venture as a potential 'Question Mark' within the BCG Matrix. This move signifies FJ Management's entry into a high-growth sector, but with Balentine likely holding a relatively low market share initially, it requires careful cultivation to become a star performer.

The wealth management industry, projected to grow significantly, presents an opportunity for FJ Management. For instance, the global wealth management market was valued at approximately USD 10.2 trillion in 2023 and is expected to reach USD 16.5 trillion by 2028, demonstrating a strong growth trajectory.

This investment demands strategic nurturing and potentially further capital infusion to enhance Balentine's market position and unlock its full potential within FJ Management's portfolio. Success will hinge on FJ Management's ability to support Balentine's growth and market penetration strategies.

- Investment: 20% stake in Balentine LLC.

- Sector: Wealth Management (high growth potential).

- Market Share: Assumed to be low initially, characteristic of a Question Mark.

- Strategic Focus: Nurturing and potential further investment to drive market share growth.

Digital Transformation of Internal Operations

FJ Management's internal operations are undergoing a significant digital transformation, a complex undertaking that positions it as a question mark within the BCG matrix. While the potential for increased efficiency and data utilization is immense, particularly through AI adoption in sectors like oil and gas, these initiatives are still in their nascent stages across the entire conglomerate. For instance, in 2024, many of FJ Management's subsidiaries were in the pilot or early implementation phases of AI-driven predictive maintenance or supply chain optimization, with widespread integration still a future goal.

The success of these internal digital transformation efforts hinges on substantial, ongoing investment in new technological systems and revamped operational processes. Without this dedicated capital and strategic focus, these ambitious projects risk becoming costly failures rather than drivers of growth. For example, the cost of implementing enterprise-wide data analytics platforms or cloud migration for legacy systems can run into tens of millions of dollars, demanding careful management and a clear return on investment strategy.

- Early-stage AI implementation in oil & gas: Focus on predictive maintenance and operational efficiency.

- Cross-subsidiary digital integration: Aiming for high growth in efficiency and data utilization.

- Significant investment requirement: New systems and process overhauls are critical.

- Risk of failure without proper execution: Potential for costly, underutilized technology.

Question marks represent business units or investments with low market share in high-growth industries. FJ Management's exploration into new convenience store formats, renewable energy, emerging market real estate, and its investment in Balentine LLC all fit this description. These ventures require significant capital and strategic focus to potentially transition into stars, or they risk becoming dogs.

The success of these question marks is crucial for FJ Management's future growth. For instance, global renewable energy investments were projected to reach new heights in 2024, highlighting the opportunity. Similarly, the wealth management market is expected to grow substantially, reaching USD 16.5 trillion by 2028.

FJ Management must carefully decide which question marks to invest in heavily to foster growth and which to divest from if they fail to gain traction. The company's internal digital transformation, including AI adoption in oil and gas, also falls into this category, demanding substantial investment for successful integration.

| Business Unit/Investment | Industry Growth Potential | Current Market Share | Strategic Consideration |

| New Convenience Store Formats | High | Low | Invest to grow or divest |

| Renewable Energy (FJ Investments) | High | Low | Nurture for future star potential |

| Emerging Market Real Estate (MacCall Mgmt) | High | Low | Requires significant capital for penetration |

| Balentine LLC (Wealth Management) | High (projected USD 16.5T by 2028) | Low | Strategic nurturing and potential further investment |

| Internal Digital Transformation (AI) | High (efficiency gains) | Low (early stages) | Substantial ongoing investment needed |

BCG Matrix Data Sources

Our FJ Management BCG Matrix leverages comprehensive data from financial statements, competitor analysis, and market research reports to provide strategic insights.