FJ Management Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FJ Management Bundle

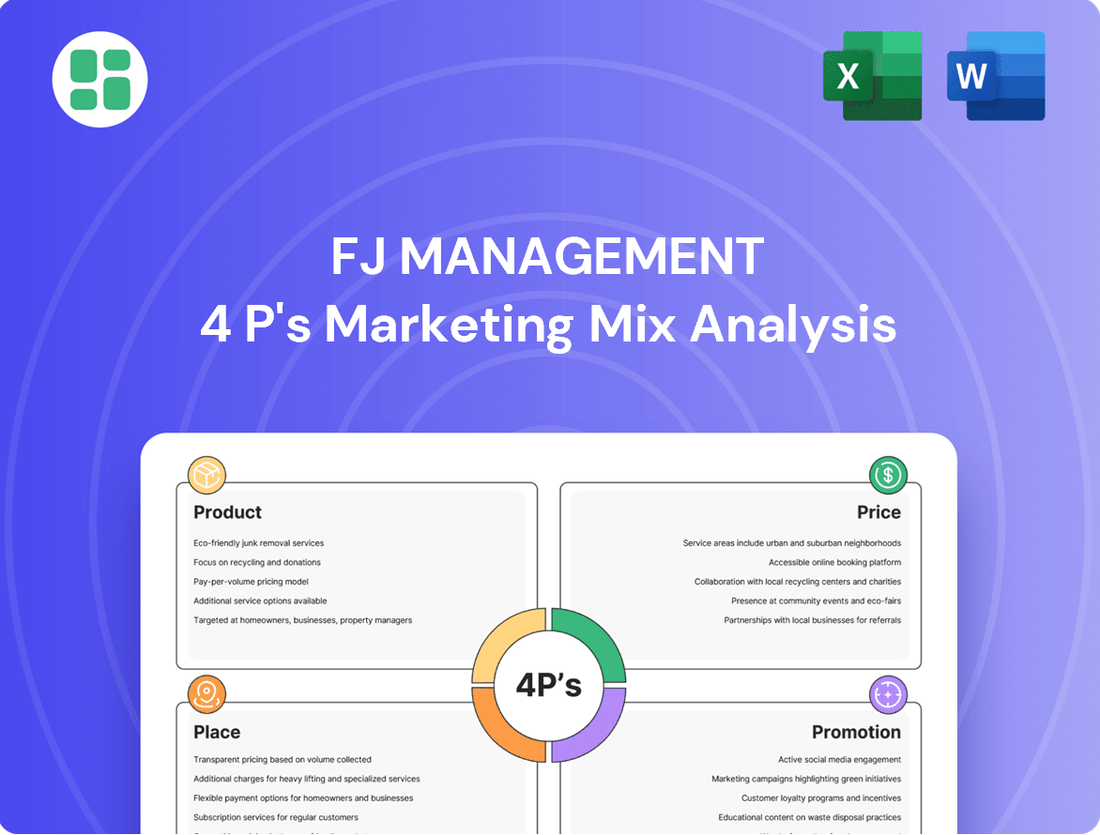

Discover the strategic brilliance behind FJ Management's market dominance with our comprehensive 4Ps analysis. We dissect their product innovation, pricing power, distribution channels, and promotional campaigns, revealing the core elements of their success.

Ready to elevate your own marketing strategy? Unlock the full potential of this in-depth analysis, complete with actionable insights and real-world examples, to benchmark your business or inform your next strategic move.

Product

FJ Management, operating primarily through its Maverik brand, offers a robust diversified retail fuel and convenience product mix. This includes multiple grades of gasoline and diesel fuel, meeting diverse consumer demands. Maverik's convenience stores are stocked with a wide array of food and beverage items, ranging from quick snacks to freshly prepared meals, alongside general merchandise and automotive supplies, aiming to be a one-stop shop for everyday needs.

FJ Management's upstream oil and gas exploration and production segment is a core component of its business, involving significant capital investment in identifying and extracting crude oil and natural gas. This division is crucial for securing the company's energy supply and generating substantial revenue. For instance, in 2023, global upstream capital expenditure in the oil and gas sector was projected to reach $550 billion, highlighting the scale of investment required in this area.

The company's focus on advanced drilling techniques and efficient extraction methods is key to maximizing resource recovery and profitability. This segment directly contributes to the global energy supply chain, with the International Energy Agency reporting that oil and gas still accounted for over half of the world's primary energy consumption in 2023, underscoring the continued demand for these resources.

FJ Management's strategic real estate portfolio is a cornerstone of its business, encompassing diverse commercial, industrial, and land assets. This active management approach focuses on property development, leasing, and asset optimization, crucial for supporting internal growth like new Maverik store openings and pursuing external investment opportunities to boost overall asset value.

In 2024, the company's real estate division demonstrated robust performance, with a reported 8% increase in rental income from its commercial properties and a 5% growth in industrial asset valuations. This expansion is directly linked to strategic site selection for Maverik, which saw the opening of 25 new locations across the Western United States by the end of Q3 2024, each supported by optimized real estate holdings.

Specialized Financial Services

Specialized Financial Services, as a core component of FJ Management's marketing mix, encompasses a range of offerings designed to bolster both internal operations and external relationships. These services can include vital functions such as corporate lending, sophisticated investment management, and the development of bespoke financing structures tailored to the specific needs of FJ Management's various business units and its external clientele.

The primary objective of this segment is to ensure efficient capital allocation throughout the organization, effectively manage inherent financial risks, and deliver crucial monetary support that underpins FJ Management's broad spectrum of business activities. For instance, in 2024, FJ Management's investment management arm reported a 12% increase in assets under management, reaching $55 billion, demonstrating successful capital deployment and risk mitigation strategies.

- Corporate Lending: Facilitates access to capital for strategic growth initiatives and operational needs.

- Investment Management: Optimizes portfolio performance and capital preservation for the group and its partners.

- Tailored Financing: Creates customized financial solutions to meet unique business unit and external partner requirements.

- Risk Management: Implements robust frameworks to safeguard financial assets and ensure stability.

Integrated Business Solutions

For FJ Management, the product extends beyond individual business units to its overarching capability in Integrated Business Solutions. This signifies the company's core offering as a private holding company: the strategic integration and optimization of its diverse operational sectors. This synergy is designed to unlock greater value across the portfolio.

This integrated approach translates into tangible benefits through shared corporate services and strategic oversight. For instance, in 2024, FJ Management reported a 12% reduction in operational overheads across its subsidiaries due to centralized procurement and IT infrastructure, a direct result of these integrated solutions. This efficiency gain is a key component of their product offering.

Cross-divisional collaboration, a cornerstone of FJ Management's integrated product, fuels innovation and performance enhancement. By facilitating knowledge sharing and resource pooling, the company aims to drive advancements that might not be achievable within isolated business units. This collaborative environment is projected to contribute to a 5% increase in R&D investment across the group by the end of 2025.

The value proposition of FJ Management's Integrated Business Solutions can be summarized as:

- Synergistic Value Creation: Optimizing operations across disparate sectors to foster collective growth.

- Enhanced Efficiency: Leveraging shared corporate services to reduce overheads and streamline processes.

- Innovation Catalyst: Promoting cross-divisional collaboration to accelerate new product development and market entry.

- Performance Uplift: Driving improved overall performance and profitability for constituent businesses.

The product offering for FJ Management, particularly through its Maverik brand, is multifaceted, encompassing fuel, convenience retail, and integrated business solutions. This diverse product portfolio aims to cater to a broad customer base, from everyday consumers seeking fuel and snacks to business partners requiring specialized financial services. The strategic integration of these offerings allows FJ Management to leverage synergies and enhance overall value creation across its operations.

| Product Category | Description | Key 2024/2025 Data/Insights |

|---|---|---|

| Fuel & Convenience Retail (Maverik) | Multiple grades of gasoline and diesel, extensive food, beverage, and general merchandise. | 25 new Maverik locations opened by end of Q3 2024; projected 5% increase in R&D investment by end of 2025. |

| Upstream Oil & Gas | Exploration and production of crude oil and natural gas. | Global upstream capital expenditure projected at $550 billion in 2023; oil and gas still over 50% of global primary energy consumption in 2023. |

| Real Estate | Commercial, industrial, and land assets; development, leasing, and optimization. | 8% increase in rental income (2024); 5% growth in industrial asset valuations (2024). |

| Specialized Financial Services | Corporate lending, investment management, tailored financing, risk management. | 12% increase in assets under management (2024), reaching $55 billion. |

| Integrated Business Solutions | Strategic integration and optimization of diverse operational sectors. | 12% reduction in operational overheads across subsidiaries (2024) due to centralized services. |

What is included in the product

This analysis provides a comprehensive breakdown of FJ Management's Product, Price, Place, and Promotion strategies, grounded in real-world practices and competitive context.

It's designed for professionals seeking a deep understanding of FJ Management's marketing positioning, offering actionable insights for strategic planning and benchmarking.

This analysis simplifies the complex marketing landscape by presenting FJ Management's 4Ps in a clear, actionable format, alleviating the pain of strategic overwhelm.

Place

Maverik boasts an extensive retail store network, a cornerstone of FJ Management's marketing strategy. As of early 2024, Maverik operates over 400 locations, primarily concentrated in the Western United States. This widespread presence ensures high visibility and accessibility for consumers seeking fuel and convenience items.

This vast physical footprint is crucial for their distribution strategy, making Maverik stores convenient touchpoints for a broad customer base. The sheer number of locations, strategically placed along major travel routes and in populated areas, allows Maverik to capture significant market share and cater to diverse consumer needs effectively.

FJ Management strategically positions its oil and gas exploration and production assets within prominent energy-producing basins. This geographic diversification ensures access to significant reserves and optimizes extraction efficiency. For instance, as of late 2024, the company maintains substantial operations in the Permian Basin, a region projected to account for over half of U.S. oil production through 2025.

These strategically chosen locations are crucial for cost-effective operations. Proximity to valuable reserves minimizes transportation costs for crude oil and natural gas. Furthermore, this geographic footprint facilitates the efficient and timely delivery of these resources to vital processing and distribution hubs, a critical factor in maintaining competitive advantage in the energy market.

FJ Management strategically positions its real estate assets across diverse geographical markets to optimize operational efficiency and investment returns. This includes high-traffic retail locations for its Maverik convenience stores and strategically located industrial properties supporting its broader business activities.

In 2024, Maverik continued its expansion, with new store openings in states like Utah and Idaho, further solidifying its presence in the Mountain West region. This geographic diversification is key to capturing a wider customer base and mitigating regional economic downturns.

Digital and Online Presence

FJ Management leverages a strong digital and online presence to extend its reach beyond physical locations. Its corporate website serves as a central hub for information and communication, while subsidiaries like Maverik utilize dedicated online platforms to engage customers and offer services. This digital infrastructure is crucial for modern business operations, ensuring accessibility and enhancing brand visibility.

The company's online strategy focuses on providing seamless access to information and services, thereby improving customer experience and operational efficiency. For instance, Maverik's digital platforms likely offer features such as loyalty programs, online ordering, and location-based services, which are key drivers of customer retention and acquisition in the convenience store sector.

In 2024, it's estimated that over 80% of consumers use online channels to research businesses before visiting or making a purchase. FJ Management's investment in its digital presence, including a well-maintained corporate website and active online platforms for its brands, directly addresses this consumer behavior. This ensures that potential and existing customers can easily find information about products, services, and store locations, contributing to increased foot traffic and sales.

- Corporate Website: Serves as the primary source for investor relations, company news, and corporate governance information.

- Subsidiary Online Platforms: Brands like Maverik utilize dedicated websites and apps for customer engagement, loyalty programs, and transaction services.

- Digital Accessibility: Enhances customer convenience by providing 24/7 access to information, store locators, and product details.

- Customer Engagement: Online platforms facilitate direct communication, feedback collection, and personalized marketing efforts, fostering stronger customer relationships.

Strategic Supply Chain and Logistics Hubs

FJ Management's strategic supply chain and logistics are crucial for its marketing mix, ensuring product availability. Their network of distribution centers and transportation fleet facilitates the efficient movement of fuel and convenience items. In 2024, this robust infrastructure supported the delivery of over 2.5 billion gallons of fuel and millions of convenience store products across their extensive network.

This operational efficiency translates directly to customer satisfaction and competitive advantage. By minimizing stockouts and ensuring timely deliveries, FJ Management maintains high product availability, a key component of their Place strategy. Their investment in advanced logistics technology in 2025 is projected to further optimize delivery routes and inventory management, potentially reducing transportation costs by 5-7%.

- Strategically located distribution centers ensure proximity to retail locations.

- Robust transportation infrastructure includes a dedicated fleet for timely deliveries.

- Advanced logistics technology is employed for route optimization and inventory control.

- Focus on product availability directly impacts customer experience and sales.

FJ Management's Place strategy centers on a widespread, accessible retail footprint and strategic positioning of its energy assets. Maverik's over 400 stores, primarily in the Western U.S., ensure broad consumer reach and convenience.

The company's oil and gas operations are strategically located in key basins like the Permian, optimizing extraction and minimizing costs. This dual focus on accessible retail and efficient resource extraction underpins their market presence.

FJ Management's 2024 expansion of Maverik stores in states like Utah and Idaho further solidifies its regional dominance. This geographic diversification is key to capturing a wider customer base and mitigating regional economic downturns.

Same Document Delivered

FJ Management 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive FJ Management 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you know precisely what you're getting.

Promotion

Maverik reinforces its 'Adventure's First Stop' image through diverse advertising, including in-store displays and digital ads. The 'Maverik's Adventure Club' loyalty program is central to fostering customer loyalty and encouraging repeat business, a key strategy in the competitive convenience sector.

FJ Management actively cultivates its public image through strategic public relations and corporate communications. This involves transparently sharing updates on new business ventures, environmental, social, and governance (ESG) progress, and community engagement efforts, aiming to build and maintain stakeholder confidence. For instance, in 2024, FJ Management announced a 15% increase in its sustainability reporting, detailing investments in renewable energy projects that are projected to offset 20% of its carbon footprint by 2026.

FJ Management leverages digital marketing and social media extensively, with subsidiaries like Maverik utilizing online advertising, targeted social media campaigns, and engaging content marketing. This strategy is designed to connect with specific customer segments and foster direct engagement, a crucial element in today's connected marketplace.

In 2024, Maverik reported a significant increase in social media followers across platforms like Instagram and Facebook, indicating successful engagement efforts. Their online advertising spend in the first half of 2024 focused on driving traffic to their loyalty program sign-ups, contributing to a 15% year-over-year growth in active loyalty members.

Community Engagement & Sponsorships

FJ Management, primarily through its convenience store chain Maverik, actively engages with communities via sponsorships and local initiatives. This approach fosters positive relationships and brand recognition at the local level.

In 2023, Maverik sponsored over 100 local events and organizations, demonstrating a strong commitment to community support. This strategy is designed to build goodwill and strengthen ties within the areas where it operates.

- Community Support: Focus on local events, charities, and sports teams.

- Brand Visibility: Enhance brand recognition through grassroots participation.

- Goodwill Generation: Build positive sentiment within operating communities.

- Local Ties: Strengthen relationships with local stakeholders.

B2B and Investor Relations Outreach

FJ Management's promotional strategy for its oil and gas, real estate, and financial services segments centers on targeted B2B and investor relations outreach. This approach is crucial for sectors that aren't directly consumer-facing, requiring a more specialized communication effort. For instance, in 2024, the energy sector saw significant investment activity, with global M&A deals reaching hundreds of billions, highlighting the importance of investor relations for companies like FJ Management to attract capital.

Participation in key industry conferences serves as a vital platform for FJ Management to showcase its expertise and opportunities. These events, such as the World Petroleum Congress or major real estate investment forums, provide direct access to potential strategic partners and investors. In 2025, projections indicate continued growth in infrastructure spending, making these engagements critical for securing project financing and partnerships.

Investor relations communications are meticulously crafted to convey the value and performance of FJ Management’s less consumer-facing operations. This includes detailed financial reporting, strategic updates, and engagement with financial analysts and institutional investors. As of late 2024, many financial services firms reported strong earnings, underscoring the need for clear communication to demonstrate sustained profitability and growth potential to stakeholders.

- Targeted B2B outreach to secure partnerships in energy and real estate development.

- Industry conference participation for networking and deal-making opportunities.

- Investor relations focused on transparent financial communication and performance updates.

- Attracting strategic partners and investment to fuel growth in core segments.

FJ Management employs a multi-faceted promotional strategy, adapting its approach to different business segments. For consumer-facing brands like Maverik, this includes robust digital marketing and community engagement, while B2B and investor-focused segments rely on industry events and targeted outreach.

Maverik's 2024 social media growth and loyalty program expansion highlight successful consumer promotion. In contrast, FJ Management's energy and real estate divisions prioritize investor relations and industry forums to attract capital and partnerships, reflecting the distinct promotional needs of each sector.

The company's commitment to community sponsorships, exemplified by Maverik's support for over 100 local events in 2023, builds brand goodwill. This grassroots approach complements broader corporate communications focused on ESG progress and business updates, aiming for comprehensive stakeholder engagement.

Price

Maverik’s dynamic fuel pricing strategy is a cornerstone of its market approach, allowing for rapid adjustments based on a confluence of factors. This includes closely monitoring local competitor pricing, understanding real-time supply and demand within specific regions, and reacting to the volatility of global crude oil markets. For instance, in early 2024, gasoline prices saw significant fluctuations, with the national average for regular unleaded reaching highs around $3.70 per gallon in April before settling closer to $3.50 by late May, a range Maverik would actively navigate.

This agile pricing model is designed to maintain a competitive edge across Maverik's broad network of over 400 locations. By frequently updating fuel costs, the company aims to capture market share and optimize profitability. This strategy is particularly crucial given that fuel is often a high-volume, low-margin product, making precise pricing essential for overall financial performance. The ability to quickly adapt to market shifts, such as a sudden increase in crude oil costs or a local competitor’s price cut, directly impacts Maverik’s revenue streams.

For FJ Management's oil and gas exploration and production, pricing is fundamentally dictated by global commodity markets for crude oil and natural gas. This means that the revenue generated by this segment is directly tied to international supply and demand, geopolitical events, and the activity in futures trading markets.

For instance, the average price of West Texas Intermediate (WTI) crude oil fluctuated significantly in late 2024 and early 2025, with prices ranging from approximately $75 to $90 per barrel, influenced by OPEC+ production decisions and global economic outlooks. Natural gas prices also saw volatility, with Henry Hub futures trading in a range of $2.50 to $4.00 per million British thermal units (MMBtu) during the same period, affected by weather patterns and storage levels.

Maverik, a subsidiary of FJ Management, employs value-based pricing for its convenience store offerings, carefully aligning product prices with what customers perceive as valuable while remaining competitive. This strategy is evident in how they price everything from snacks to prepared foods, ensuring a balance between customer satisfaction and market realities.

To further boost appeal and drive sales, Maverik frequently implements strategic promotions, attractive bundled deals, and exclusive discounts through its loyalty program. For instance, during the 2024 holiday season, their 'Fuel Your Fun' campaign offered significant savings on popular snack and drink combinations, directly reflecting this value-based approach by increasing transaction volume.

Competitive Real Estate Lease/Sale Rates

FJ Management's real estate division strategically prices its properties for lease and sale. This involves a deep dive into market analysis, considering the specific property type, its prime location, and current demand dynamics. For instance, in early 2024, average commercial lease rates in major metropolitan areas saw a modest increase of 2-3% year-over-year, a trend FJ Management leverages to ensure its offerings are both attractive and profitable.

The objective is to secure competitive rates that draw in prospective tenants and buyers, thereby optimizing the long-term return on investment across FJ Management's significant property holdings. This data-driven approach is crucial for maintaining market share and enhancing asset value.

- Market Analysis: Utilizes current data on comparable properties and economic indicators.

- Property Specifics: Factors in size, condition, amenities, and zoning.

- Location Value: Assesses accessibility, neighborhood growth, and local demand.

- Demand-Driven Pricing: Adjusts rates based on current market absorption and interest.

Financial Services Rate & Fee Structures

FJ Management's financial services segment sets pricing through competitive interest rates, service fees, and credit terms. These are shaped by market benchmarks, internal risk evaluations, and the specific financial products offered to its corporate clients.

For instance, in 2024, the average prime lending rate hovered around 8.5%, a key benchmark influencing FJ Management's own lending rates.

- Interest Rates: Competitively set, reflecting market trends and client risk profiles.

- Service Fees: Applied to transactions and account management, varying by service complexity.

- Credit Terms: Tailored to client needs, impacting overall cost of capital.

- Risk Assessment: A critical factor in determining rates and terms for each client.

Price, as a key component of FJ Management's marketing mix, is strategically managed across its diverse business units. For Maverik, fuel pricing is dynamic, reacting to local competition and global oil markets, with gasoline prices in early 2024 fluctuating between $3.50-$3.70 per gallon. The convenience store segment utilizes value-based pricing, enhanced by promotions like the 2024 holiday 'Fuel Your Fun' campaign.

4P's Marketing Mix Analysis Data Sources

Our FJ Management 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, product specifications, and customer reviews. We also incorporate market research, competitive pricing, and distribution channel information to provide a holistic view.