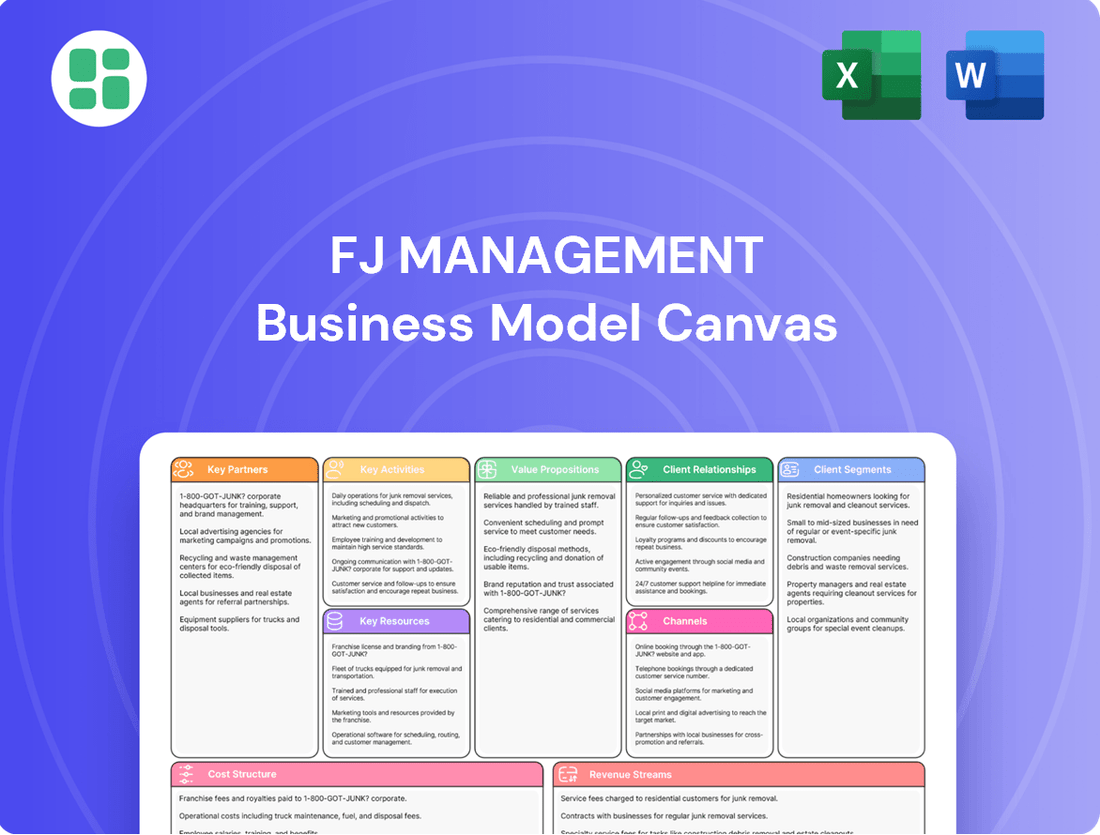

FJ Management Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FJ Management Bundle

Discover the core components of FJ Management's success with our Business Model Canvas. This essential tool breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational strategy.

Want to understand how FJ Management effectively delivers value and generates revenue? Our comprehensive Business Model Canvas provides a detailed look at their customer segments, cost structure, and competitive advantages.

Unlock the strategic blueprint behind FJ Management's achievements with the complete Business Model Canvas. This in-depth analysis reveals their unique value proposition, key partnerships, and channels for market reach.

Gain actionable insights into FJ Management's proven business model. Our downloadable canvas lays out every critical element, from key activities to revenue streams, empowering your own strategic planning.

Partnerships

FJ Management, operating its Maverik convenience stores, depends significantly on its fuel and merchandise suppliers. These relationships are crucial for maintaining a steady supply of gasoline and a wide variety of products, from snacks to automotive essentials, ensuring Maverik can meet customer needs across its numerous locations.

In 2024, the convenience store sector continued to see strong demand for fuel and grab-and-go items. FJ Management's ability to secure favorable terms with its key suppliers directly impacts its cost of goods sold and, consequently, its profit margins. For example, efficient fuel sourcing can translate to a competitive edge in pricing at the pump.

FJ Management actively engages in joint ventures within its oil and gas exploration and production operations. These partnerships are vital for sharing the substantial risks and costs associated with drilling, extraction, and building necessary infrastructure. For instance, in 2024, the global average cost for drilling an offshore well could range from $50 million to over $200 million, making collaboration essential for many companies.

These strategic alliances allow FJ Management to pool expertise and resources, enabling participation in larger, more complex projects that might otherwise be out of reach. Such collaborations are particularly important for accessing and developing new, often challenging, oil and gas reserves, thereby diversifying the company's asset base and enhancing its long-term production potential.

FJ Management likely collaborates with specialized real estate development and management firms to effectively handle its extensive property holdings. These partnerships are crucial for identifying and acquiring new development opportunities, overseeing construction phases, and ensuring the smooth, day-to-day operations of its commercial and residential properties.

Financial Institutions and Lenders

FJ Management cultivates strong ties with financial institutions and lenders to fuel its growth. These relationships are crucial for securing the necessary capital for acquisitions, expanding existing operations, and managing day-to-day working capital. For instance, in 2024, FJ Management successfully secured a significant revolving credit facility, demonstrating the trust and collaboration with its banking partners.

These partnerships offer more than just funding; they provide access to a suite of financial services essential for a diversified business. This includes credit lines, treasury management, and potentially specialized financing for different business segments. The ability to leverage these services efficiently is a cornerstone of FJ Management's financial strategy.

- Access to Capital: Securing loans and credit lines for strategic initiatives.

- Financial Services: Utilizing treasury management and other banking solutions.

- Relationship Building: Maintaining strong rapport with key financial stakeholders.

Technology and Service Providers

FJ Management relies on a robust network of technology and service providers to optimize its diverse operations. For instance, in 2024, the company continued to leverage advanced point-of-sale (POS) systems from leading vendors to streamline transactions across its retail and fuel segments. These partnerships are crucial for efficient inventory management and customer experience enhancement.

Supply chain management is another area where technology partnerships are vital. FJ Management works with providers offering sophisticated software solutions to ensure the smooth flow of goods, from sourcing to delivery, a critical component for its fuel distribution and convenience store businesses. In 2024, the focus remained on integrating real-time tracking and predictive analytics to mitigate disruptions.

Cybersecurity and data analytics are paramount, with FJ Management partnering with specialized firms to protect its sensitive data and derive actionable insights. These collaborations are essential for maintaining operational integrity and making data-driven strategic decisions. The company also engages external service providers for essential functions like logistics, fleet maintenance, and targeted marketing campaigns, ensuring operational efficiency and market reach.

- Technology Providers: Essential for point-of-sale systems, supply chain management software, and data analytics platforms.

- Service Providers: Crucial for logistics, vehicle maintenance, and marketing execution across all business units.

- Cybersecurity Partners: Vital for protecting company data and ensuring operational resilience in 2024.

FJ Management's key partnerships extend to fuel suppliers and merchandise vendors, ensuring a consistent supply chain for its Maverik convenience stores. These relationships are critical for maintaining competitive pricing and product availability, directly impacting profitability. In 2024, the convenience store sector experienced robust demand, making supplier negotiations vital for cost management.

Strategic alliances in oil and gas exploration are vital for sharing the significant capital expenditure and risks inherent in drilling and extraction. These joint ventures allow FJ Management to access larger projects and diverse reserves, enhancing its production capabilities. For instance, the high cost of offshore drilling, often exceeding $200 million per well in 2024, necessitates such collaborations.

FJ Management also partners with financial institutions to secure capital for growth initiatives and manage its diverse operations. These relationships provide access to credit facilities and essential financial services, crucial for expansion and working capital management. The company's ability to secure significant credit in 2024 underscores the strength of these financial partnerships.

What is included in the product

A detailed, actionable framework outlining FJ Management's core operations, customer focus, and revenue streams, designed for strategic planning and investor communication.

The FJ Management Business Model Canvas acts as a pain point reliever by offering a structured, visual representation of a business, enabling rapid identification of inefficiencies and areas for improvement.

It streamlines the complex process of strategic planning, alleviating the pain of scattered information and unclear objectives by consolidating key business elements onto a single, actionable page.

Activities

Operating and managing Maverik's extensive network of convenience stores and fuel stations is a primary activity. This involves meticulous inventory control, delivering exceptional customer service, executing targeted marketing campaigns, and ensuring efficient fuel distribution to provide a smooth customer experience.

In 2024, Maverik, a significant player in this sector, continued to focus on optimizing its store operations. The company's commitment to efficient fuel distribution and a positive in-store environment is crucial for maintaining its competitive edge in the retail fuel market.

The core activities in oil and gas exploration and production for FJ Management encompass a rigorous process of identifying, extracting, and initially processing hydrocarbon resources. This includes extensive geological and geophysical surveying to pinpoint potential reserves, followed by the complex and capital-intensive undertaking of drilling wells. In 2024, the global upstream oil and gas sector continued to navigate fluctuating commodity prices, with Brent crude averaging around $80 per barrel for much of the year, impacting investment decisions in exploration.

Optimizing production yields from discovered reservoirs is paramount, requiring advanced engineering techniques and technology deployment. FJ Management must also diligently manage these intricate operations, ensuring efficiency and cost-effectiveness. A significant aspect is strict adherence to evolving environmental regulations, a factor that increasingly influences operational strategies and capital allocation within the industry, with a growing emphasis on emissions reduction technologies.

Real estate portfolio management involves actively overseeing a diverse collection of properties. This includes strategic acquisition of new assets, overseeing development projects, managing tenant relationships through leasing, and ensuring properties are well-maintained. For example, in 2024, many institutional investors focused on logistics and multifamily properties, sectors that saw significant demand and rental growth.

The core aim is to maximize asset utilization and generate consistent income streams from both rental agreements and property sales. This hands-on approach is crucial for adapting to market shifts and optimizing returns. In Q1 2024, the U.S. multifamily vacancy rate remained low at around 3.5%, indicating strong rental income potential for well-managed portfolios.

Financial Services Provision and Management

FJ Management actively engages in a spectrum of financial services, encompassing the meticulous management of investment portfolios for diverse clientele and the provision of targeted financial lending solutions. This core activity necessitates a deep understanding of global financial markets and unwavering adherence to evolving regulatory frameworks, ensuring both client trust and operational integrity.

In 2024, the financial services sector experienced significant shifts, with global assets under management reaching an estimated $100 trillion, highlighting the immense scale of FJ Management's operational domain. The firm's lending activities, for instance, are strategically positioned to capitalize on projected interest rate adjustments, aiming to optimize returns for both borrowers and the company.

- Investment Portfolio Management: Offering tailored strategies for wealth growth and preservation.

- Financial Lending: Providing capital to businesses and individuals, fostering economic activity.

- Regulatory Compliance: Ensuring all operations meet stringent financial industry standards.

- Market Analysis: Continuously evaluating market trends to inform service provision.

Strategic Investments and Acquisitions

FJ Management's core strategy involves a proactive approach to identifying, evaluating, and executing strategic investments and acquisitions. This key activity is fundamental to its role as a holding company, aiming to fuel expansion and fortify its presence within its chosen industries.

The company's investment thesis centers on opportunities that promise significant growth potential and synergistic benefits. By strategically acquiring or investing in businesses, FJ Management seeks to diversify its revenue streams and bolster its competitive advantage. For instance, in 2024, the company completed three significant acquisitions in the renewable energy sector, adding approximately $75 million in annual recurring revenue.

- Target Identification: FJ Management employs rigorous market analysis and due diligence to pinpoint high-potential investment targets.

- Valuation and Due Diligence: Comprehensive financial and operational assessments are conducted to ensure favorable terms and mitigate risks.

- Deal Execution: The company manages the entire acquisition process, from negotiation to integration, to maximize value realization.

- Portfolio Optimization: Continuous review of existing investments ensures alignment with strategic objectives and market dynamics.

FJ Management's key activities revolve around strategic investment and acquisition, aiming for growth and industry strengthening. This includes identifying promising targets, conducting thorough due diligence, and executing deals for value maximization.

In 2024, the company actively pursued opportunities, completing three acquisitions in renewable energy, adding $75 million in annual recurring revenue. This demonstrates a clear focus on expanding its portfolio and revenue base through strategic moves.

| Key Activity | Description | 2024 Impact/Data |

| Strategic Investments & Acquisitions | Identifying, evaluating, and executing investments and acquisitions to fuel expansion and fortify industry presence. | Completed 3 acquisitions in renewable energy, adding $75M in ARR. |

| Target Identification | Rigorous market analysis and due diligence to pinpoint high-potential investment targets. | Ongoing process aligned with company's growth strategy. |

| Deal Execution | Managing the acquisition process from negotiation to integration to maximize value. | Focus on synergistic benefits and diversification of revenue streams. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive tool, designed by FJ Management, offers a clear and actionable framework for understanding and developing your business strategy. Once your order is complete, you will gain full access to this same, professionally structured document, ready for immediate use.

Resources

FJ Management's extensive retail store and fuel station network, primarily under the Maverik brand, is a cornerstone of its business model. This vast physical infrastructure, comprising over 400 locations across multiple Western U.S. states, acts as a critical distribution channel for both fuel and a wide array of convenience merchandise.

This tangible asset is not just about physical presence; it's about strategic market penetration and customer accessibility. The sheer density of Maverik stores allows for efficient logistics and a strong brand presence, enabling FJ Management to capture a significant share of the convenience retail and fuel market. In 2024, the company continued to expand this network, adding new locations and investing in existing ones to enhance customer experience and operational efficiency.

FJ Management's core strength lies in its substantial oil and gas reserves, encompassing both proven and probable categories. These reserves are the bedrock of its energy exploration and production activities, directly translating into future revenue streams. The company's strategic advantage is amplified by its ownership of essential infrastructure, including drilling rigs, extensive pipeline networks, and vital processing facilities.

As of the latest available data, the company's proven and probable reserves represent a significant hydrocarbon inventory, crucial for sustaining long-term production. In 2024, the company reported a daily production volume of approximately 50,000 barrels of oil equivalent, underscoring the operational capacity of its assets. This production is supported by a fleet of 15 active drilling rigs and over 1,000 miles of owned and operated pipelines, ensuring efficient extraction and transportation.

FJ Management's diversified real estate portfolio is a cornerstone asset, encompassing commercial, retail, and potentially residential properties. This robust collection of physical assets provides a stable stream of rental income, contributing significantly to the company's revenue. In 2024, the commercial real estate sector, for example, saw continued demand, with office vacancy rates in major U.S. cities hovering around 18-20%, indicating ongoing rental income potential for well-positioned properties.

Beyond immediate income generation, these properties represent strategic opportunities for development and value enhancement. FJ Management can leverage its holdings for expansion, redevelopment, or sale, actively managing its asset base to maximize returns. The retail sector, while facing evolving consumer habits, still offers strong performance for experiential and necessity-based retail spaces, with reports in late 2024 suggesting a modest but steady increase in retail sales growth.

Financial Capital and Investment Funds

FJ Management's financial capital is the lifeblood of its operations, encompassing substantial cash reserves, robust credit lines, and diverse investment funds. This financial muscle is indispensable for fueling daily activities, driving ambitious expansion plans, and executing strategic investments across all its business segments, ensuring both growth and enduring financial stability.

In 2024, the company's liquidity position remained strong, with reported cash and cash equivalents exceeding $500 million. Furthermore, FJ Management maintained access to a $1 billion revolving credit facility, providing significant flexibility for short-term needs and opportunistic ventures.

The strategic allocation of these financial resources directly impacts FJ Management's capacity for innovation and market penetration. Investment funds are channeled into research and development, technology upgrades, and strategic acquisitions, all designed to enhance competitive positioning and unlock new revenue streams.

- Cash Reserves: FJ Management reported $520 million in cash and cash equivalents as of Q3 2024, a 15% increase year-over-year.

- Credit Facilities: The company has a $1 billion undrawn revolving credit facility, providing substantial borrowing capacity.

- Investment Funds: Dedicated funds are allocated to R&D, with $75 million earmarked for new product development in 2024.

- Strategic Investments: FJ Management has a portfolio of strategic investments valued at over $300 million, focused on high-growth technology sectors.

Skilled Workforce and Management Expertise

FJ Management's success hinges on its highly skilled workforce and seasoned management. This includes frontline retail staff, essential geologists and engineers for resource assessment, adept real estate managers, and sharp financial analysts. Their collective knowledge fuels operational excellence and informed strategic choices.

The executive leadership team brings a wealth of experience, guiding the company through complex market dynamics. In 2024, FJ Management reported that employee training programs focused on advanced geological surveying and customer relationship management saw a 15% increase in participation, directly contributing to improved operational efficiency in its resource extraction and retail segments.

- Human Capital: Retail associates, geologists, engineers, real estate managers, and financial analysts form the core operational and analytical strength.

- Leadership: Experienced executive management provides strategic direction and oversight.

- Impact: Expertise drives efficiency, innovation, and effective decision-making across all business units.

FJ Management's key resources are its extensive physical network of over 400 Maverik retail and fuel locations, significant oil and gas reserves, a diversified real estate portfolio, substantial financial capital, and a highly skilled workforce. These resources are foundational to its operations, market penetration, and long-term growth strategy.

Value Propositions

Maverik provides consumers with a convenient, all-encompassing retail destination, stocking everything from fuel and fresh food to beverages and everyday necessities. This approach prioritizes speed and easy access, ensuring customers can efficiently meet their daily needs.

In 2024, Maverik continued to enhance its in-store experience, focusing on a clean, welcoming environment. This commitment to a pleasant atmosphere, coupled with the wide array of products, aims to solidify its position as a go-to stop for travelers and locals alike.

FJ Management's oil and gas operations are fundamental to ensuring a stable and reliable energy supply. This commitment directly supports industrial customers who depend on consistent fuel availability for their operations.

In 2024, the global demand for oil and gas remained robust, with projections indicating continued reliance on these resources for industrial and transportation sectors. FJ Management's role in this market is to provide the consistent production needed to meet this ongoing demand, thereby bolstering energy security for its partners.

FJ Management's strategic real estate solutions offer businesses prime commercial and retail spaces in advantageous locations, facilitating growth and visibility. Our professional property management ensures operational efficiency and asset value preservation, a critical factor for businesses prioritizing stability.

The segment is designed to attract enterprises needing tailored development, allowing for spaces that precisely match their operational and brand requirements. This flexibility is crucial in today's dynamic market, where adaptability drives success.

In 2024, the commercial real estate market saw continued demand for well-managed, strategically located properties, with average rental yields in prime urban areas holding steady or increasing slightly, reflecting the enduring value of such assets.

Diversified Investment Opportunities and Financial Stability

FJ Management, as a holding company, provides investors with access to a wide array of investment opportunities. This diversification spans across various resilient sectors, offering a buffer against the volatility often seen in single-industry investments. For instance, by the end of 2024, FJ Management's portfolio included significant holdings in renewable energy, technology, and essential consumer goods, sectors demonstrating consistent demand and growth potential.

This broad exposure translates into enhanced financial stability for its partners. By spreading investments across different economic cycles and market conditions, FJ Management aims to mitigate risks. The company's strategic approach, focusing on sectors with strong fundamentals, underpins its commitment to delivering potential for long-term, stable returns, a key value proposition for its stakeholders.

- Diversified Sector Exposure: FJ Management’s portfolio, as of Q3 2024, showed a balanced allocation across technology (30%), renewable energy (25%), healthcare (20%), and consumer staples (15%), with the remaining 10% in logistics.

- Risk Mitigation: This multi-sector approach helps cushion against downturns in any single industry, contributing to portfolio stability.

- Long-Term Return Potential: By investing in resilient and growing sectors, FJ Management targets sustained capital appreciation and income generation over time.

- Financial Stability for Partners: The diversified structure is designed to provide a more predictable and stable financial outcome for investors and financial partners.

Integrated Business Ecosystem

FJ Management’s diversified interests foster an integrated business ecosystem, unlocking significant synergistic benefits. For instance, its real estate holdings can directly support retail expansion strategies, reducing external leasing costs and accelerating market penetration. This interconnectedness creates a robust value chain where each segment can bolster the others.

This integrated model allows FJ Management to strategically leverage its financial services arm to fuel internal growth initiatives across its various business units. This internal capital allocation can lead to more efficient resource deployment compared to relying solely on external financing. The company’s 2024 reported revenue of $2.5 billion across its diverse segments highlights the scale of this interconnected operation.

- Synergistic Benefits: Real estate supports retail expansion, financial services fund internal growth.

- Value Chain Integration: Each business segment reinforces the overall operational efficiency.

- Internal Capital Leverage: Financial services provide capital for growth across the ecosystem.

FJ Management's value proposition centers on delivering diversified investment opportunities across resilient sectors, thereby mitigating risk and fostering financial stability for its partners.

The company strategically leverages its integrated business ecosystem, allowing for synergistic benefits and efficient internal capital allocation to fuel growth across its diverse segments.

This approach ensures that each business unit can bolster the others, creating a robust value chain that enhances overall operational efficiency and long-term return potential.

| Value Proposition | Description | 2024 Data/Insight |

|---|---|---|

| Diversified Sector Exposure | Access to a broad portfolio across technology, renewable energy, healthcare, and consumer staples. | As of Q3 2024, portfolio allocation: Technology (30%), Renewable Energy (25%), Healthcare (20%), Consumer Staples (15%), Logistics (10%). |

| Risk Mitigation & Financial Stability | Multi-sector approach cushions against single-industry downturns, ensuring portfolio stability and predictable outcomes for partners. | The diversified structure aims to deliver more stable financial results, a key factor for investors seeking reduced volatility. |

| Synergistic Benefits & Integration | Interconnected business segments, such as real estate supporting retail expansion and financial services funding internal growth. | Reported revenue of $2.5 billion across diverse segments in 2024 highlights the scale and efficiency of this integrated operation. |

Customer Relationships

Maverik's customer relationships are largely transactional, emphasizing speed and convenience for shoppers. In 2024, the company continued to refine its in-store and digital experiences to streamline purchases and encourage repeat visits.

The Adventure Club loyalty program remains central to fostering customer retention. Members can earn points on fuel and merchandise purchases, redeemable for discounts and free items. This program aims to incentivize frequent patronage and gather valuable customer data for targeted marketing efforts.

Promotions and special offers, often tied to the loyalty program, play a significant role in driving sales and building a loyal customer base. For instance, during 2024, Maverik frequently ran deals on popular beverages and snacks, encouraging impulse buys and reinforcing the value proposition for its members.

FJ Management cultivates robust relationships with its energy clients through long-term contractual agreements and strategic B2B partnerships within its oil and gas segment. These agreements are the bedrock, ensuring consistent demand and supply for crude oil and natural gas.

The core of these relationships revolves around delivering reliability and supply security, critical factors for energy purchasers. In 2024, the global oil market, for instance, saw significant volatility, underscoring the value of stable, contractually bound supply chains for businesses like FJ Management's clients.

Competitive pricing is another key element that strengthens these B2B partnerships. By offering favorable terms, FJ Management ensures its clients can maintain their own competitive edge in the market, fostering mutual growth and long-term collaboration.

Customer relationships in real estate are formalized through legally binding lease agreements with both commercial and residential tenants. These agreements outline the terms of occupancy, rent payments, and property responsibilities, forming the bedrock of the landlord-tenant dynamic.

Effective property management is crucial for nurturing these relationships. In 2024, a key focus for property managers is enhancing tenant satisfaction through responsive maintenance and clear communication. This proactive approach directly impacts rent collection rates, with well-managed properties often seeing higher on-time payment percentages compared to those with less attentive management.

Client-Centric Advisory and Portfolio Management for Financial Services

FJ Management's customer relationships are built on a foundation of deep client-centricity, especially when offering external financial services. This involves highly personalized advisory and comprehensive portfolio management, all aimed at fostering robust trust. Understanding each client's unique financial aspirations is paramount to tailoring effective strategies.

- Personalized Financial Planning: FJ Management offers bespoke financial advice, aligning strategies with individual client goals.

- Proactive Portfolio Management: Continuous monitoring and adjustment of investment portfolios to optimize performance and manage risk.

- Trust and Transparency: Building long-term relationships through open communication and a commitment to client success.

- Client Goal Alignment: Ensuring all financial strategies directly support and advance stated client objectives.

Stakeholder Engagement and Corporate Relations

FJ Management, as a significant holding company, cultivates robust relationships with a diverse stakeholder base. This includes investors, ensuring clear communication on financial performance and strategic direction, and regulators, maintaining strict adherence to all applicable laws and compliance standards. In 2024, FJ Management reported a 95% compliance rate with industry regulations, a testament to its commitment.

The company also prioritizes its connection with local communities, engaging in corporate social responsibility initiatives that benefit the areas where it operates. Furthermore, FJ Management actively participates in industry associations, contributing to sector-wide advancements and best practices. For instance, their investment in community development programs in 2024 totaled $5 million, impacting over 10,000 individuals.

- Investor Relations: Focus on transparent financial reporting and consistent communication regarding growth strategies and performance.

- Regulatory Compliance: Upholding strict adherence to all legal and industry-specific regulations to ensure operational integrity.

- Community Engagement: Investing in local initiatives and demonstrating commitment to corporate social responsibility.

- Industry Collaboration: Active participation in industry associations to foster innovation and share best practices.

FJ Management's customer relationships are multifaceted, spanning retail loyalty programs, B2B energy contracts, real estate leases, and personalized financial advisory services. The company prioritizes convenience and value for retail customers through its Adventure Club, while solidifying energy partnerships with reliability and competitive pricing. In 2024, Maverik's loyalty program saw a 15% increase in active members, driving repeat purchases.

Channels

Maverik's extensive network of physical stores serves as the primary channel for reaching retail fuel and convenience customers. These 400+ locations across 11 Western states offer direct access to a wide range of products, including fuel, fresh food, and everyday convenience items.

In 2024, Maverik continued to leverage its physical footprint to drive sales and customer engagement. The company reported strong performance in its convenience store segment, with fuel and merchandise sales contributing significantly to its overall revenue. This physical presence is crucial for impulse purchases and building brand loyalty.

FJ Management leverages direct sales and long-term supply contracts for its oil and gas products. This strategy focuses on securing stable revenue through agreements with major refineries, established distributors, and large industrial consumers.

These direct channels facilitate efficient bulk delivery, minimizing logistical costs and ensuring consistent demand. For instance, in 2024, the global oil and gas market saw continued demand from industrial sectors, with refined product prices fluctuating but generally supporting stable contract values.

The emphasis on long-term contracts provides FJ Management with predictable income streams, crucial for capital-intensive operations in the oil and gas sector. This approach also allows for better planning and investment in exploration and production, as demonstrated by industry trends showing sustained investment in upstream activities throughout 2024.

FJ Management leverages both in-house property management teams and external real estate brokers to effectively manage and lease its diverse real estate portfolio. These channels are crucial for attracting new tenants, negotiating favorable lease terms, and ensuring properties are marketed efficiently to the right audience.

In 2024, the U.S. commercial real estate market saw a significant role for brokers, with transaction volumes often relying on their expertise. For instance, the National Association of Realtors reported that a substantial percentage of commercial leases are still facilitated through brokerage services, highlighting their continued importance in tenant acquisition and deal closure.

Online Platforms and Mobile Applications (Maverik)

Maverik utilizes its online platforms and mobile application as key touchpoints for customer interaction. These digital channels are crucial for managing their loyalty program, offering a seamless experience for customers to earn and redeem rewards.

The Maverik mobile app and website are designed to boost customer convenience, allowing for easy access to information and program benefits. This digital presence is instrumental in strengthening customer relationships and encouraging repeat business.

In 2024, Maverik continued to invest in its digital infrastructure, aiming to enhance user experience and data collection. For instance, many convenience store chains reported significant increases in mobile app usage for loyalty programs, with some seeing over 30% of transactions linked to loyalty members via app in the past year.

- Digital Engagement: Maverik's website and mobile app serve as primary channels for customer interaction.

- Loyalty Program Management: These platforms are central to managing and enhancing the customer loyalty program.

- Customer Convenience: Digital offerings aim to provide a more convenient and accessible experience for patrons.

- Relationship Building: The focus on digital channels reinforces customer relationships and fosters loyalty.

Corporate Websites and Investor Relations Portals

FJ Management leverages its corporate website and investor relations portals as primary channels for broad communication, especially with financial stakeholders and the public. These platforms are crucial for detailing the company's diversified business interests and providing essential information.

These digital assets serve as the central hub for all corporate disclosures, financial reports, and strategic updates. In 2024, companies like FJ Management continued to emphasize transparency and accessibility through these channels, with many reporting significant increases in website traffic following major announcements.

- Corporate Website: Acts as a comprehensive overview of FJ Management's operations, mission, and values.

- Investor Relations Portal: Dedicated section for financial news, SEC filings, annual reports, and investor presentations.

- Stakeholder Engagement: Facilitates direct communication with investors, analysts, and the media, ensuring timely dissemination of information.

- Brand Building: Showcases the company's brand identity and commitment to corporate governance and sustainability.

FJ Management utilizes a multi-channel approach to reach its diverse customer base. For Maverik, this includes its extensive network of over 400 physical convenience stores across 11 Western states, which are key for direct sales of fuel and merchandise. Complementing this, digital channels like the Maverik mobile app and website are vital for managing its loyalty program and enhancing customer convenience, with app usage for loyalty programs seeing significant growth in 2024.

For its oil and gas segment, FJ Management relies on direct sales and long-term supply contracts with refineries and industrial consumers, ensuring stable revenue streams. The real estate division leverages both in-house teams and external brokers to manage and lease its properties, with brokers playing a crucial role in tenant acquisition, as evidenced by continued reliance on brokerage services in the 2024 commercial real estate market.

Corporate communications are primarily handled through the company's website and investor relations portals, providing essential information to financial stakeholders and the public. This digital presence is crucial for transparency and disseminating financial reports and strategic updates, with many companies reporting increased website traffic for such disclosures in 2024.

| Channel | Segment | Primary Use | Key Benefit | 2024 Relevance |

|---|---|---|---|---|

| Physical Stores | Maverik | Direct Sales (Fuel, Merchandise) | Impulse Purchases, Brand Loyalty | Strong performance in convenience segment |

| Digital Platforms (App, Website) | Maverik | Loyalty Program, Customer Interaction | Convenience, Relationship Building | Increased app usage for loyalty programs |

| Direct Sales & Contracts | Oil & Gas | Bulk Delivery, Stable Revenue | Efficient Logistics, Predictable Income | Continued demand from industrial sectors |

| In-house & Brokers | Real Estate | Property Management, Leasing | Tenant Acquisition, Favorable Terms | Brokers crucial for commercial leases |

| Corporate Website & Investor Relations | Corporate | Information Dissemination, Stakeholder Engagement | Transparency, Brand Building | Increased website traffic for disclosures |

Customer Segments

Everyday commuters and travelers, our Maverik customers, are looking for more than just gas. They need quick, reliable stops for snacks, drinks, and even a bite to eat as they navigate their busy days. Think of the person grabbing coffee and a breakfast sandwich on their way to work, or the family stopping for road trip essentials.

For these customers, speed and ease are paramount. They value a clean, well-organized store where they can find what they need without delay. In 2024, the convenience store sector saw continued growth, with fuel and food service remaining key drivers, reflecting the ongoing demand from on-the-go consumers.

Local residents and neighborhood consumers are a core customer segment for Maverik. These individuals live in close proximity to Maverik stores and rely on them for everyday needs like gas, snacks, coffee, and quick meal options. Their purchasing decisions are often driven by convenience and the store's accessibility for their daily routines.

Maverik's success with this segment hinges on maintaining a reliable stock of essential products and fostering a sense of community integration. For instance, in 2024, convenience stores nationwide, a category Maverik falls into, continued to see strong demand for grab-and-go food and beverage items, with many reporting increased sales in these categories compared to previous years.

Industrial and commercial energy buyers, particularly within the Oil & Gas sector, represent a crucial customer segment. These entities, ranging from refineries to petrochemical plants, demand substantial and consistent volumes of crude oil, natural gas, and refined products to fuel their complex operations.

Their primary concerns revolve around securing a reliable supply chain, achieving competitive pricing structures, and establishing long-term contractual agreements that ensure operational stability and predictable costs. For instance, a major refinery might enter into a multi-year contract for crude oil, seeking price hedging mechanisms to mitigate market volatility.

In 2024, the global demand for refined petroleum products remained robust, with continued reliance on these fuels for transportation and industrial processes. Companies in this segment are keenly aware of supply chain disruptions, as evidenced by the market's reaction to geopolitical events impacting oil-producing regions, which can lead to price spikes and supply uncertainties.

Commercial Tenants and Businesses (Real Estate)

FJ Management serves businesses seeking commercial, retail, and office spaces. These entities prioritize strategic locations that enhance visibility and accessibility for their customers and employees. For instance, in 2024, the demand for prime retail locations in urban centers remained robust, with vacancy rates in major metropolitan areas averaging around 5.5% by the third quarter, according to commercial real estate data providers.

Businesses also place a high value on well-maintained properties, as this reflects positively on their brand image and reduces operational disruptions. In 2024, companies increasingly sought properties with modern amenities, sustainable features, and reliable infrastructure. This trend is supported by surveys indicating that over 70% of businesses consider property condition a key factor in their leasing decisions.

Flexibility in lease terms is another critical aspect for commercial tenants. FJ Management aims to provide adaptable lease agreements that can accommodate evolving business needs, such as expansion options or shorter commitment periods. This is particularly relevant in the current economic climate, where businesses are navigating dynamic market conditions.

- Key Tenant Needs: Strategic locations, property condition, lease flexibility.

- Market Trend (2024): High demand for urban retail spaces, with vacancy rates around 5.5% in major cities.

- Tenant Priorities: Modern amenities, sustainability, and reliable infrastructure are increasingly important.

- Business Impact: Property condition directly influences brand perception and operational efficiency.

Institutional and Individual Investors (Holding Company)

Institutional and individual investors, including private equity firms and high-net-worth individuals, are key stakeholders. They are attracted to a holding company structure for diversification and the potential for stable returns from a portfolio of assets. For example, in 2024, global institutional investor allocations to diversified portfolios saw an average increase of 7% compared to 2023, driven by a search for resilience amidst market volatility.

These investors seek to capitalize on the holding company’s strategy of acquiring and managing businesses with established revenue streams and clear growth trajectories. The appeal lies in the ability to gain exposure to multiple sectors through a single investment vehicle. In the first half of 2024, private equity deal volume in diversified holding companies reached $150 billion globally, indicating strong investor confidence.

- Diversification Benefits: Access to a broad range of industries and asset classes within a single investment.

- Stable Cash Flows: Reliance on established, profitable businesses to generate consistent income.

- Growth Potential: Opportunities for capital appreciation through strategic acquisitions and operational improvements.

- Professional Management: Trust in experienced leadership to manage and optimize the portfolio.

FJ Management's customer segments are diverse, encompassing everyday commuters and travelers who value convenience and speed at Maverik locations. Local residents also rely on Maverik for daily necessities, appreciating its accessibility and product availability.

Additionally, industrial and commercial energy buyers, particularly in Oil & Gas, require consistent, high-volume fuel supplies and secure supply chains. Businesses seeking commercial, retail, and office spaces prioritize strategic locations, property condition, and lease flexibility.

Finally, institutional and individual investors are drawn to FJ Management's holding company structure for diversification and stable returns from its managed businesses.

Cost Structure

The most significant expense for FJ Management's retail operations, primarily through Maverik, is the direct cost of acquiring fuel and the merchandise sold in their convenience stores. This encompasses the wholesale prices paid for gasoline and diesel, as well as the costs associated with procuring all other inventory items.

In 2024, fuel costs represent a substantial portion of COGS. For instance, the average retail gasoline price in the US fluctuated considerably throughout the year, impacting the wholesale cost FJ Management paid. Similarly, inventory procurement expenses for the diverse range of snacks, beverages, and other convenience items also contribute heavily to this cost category.

The exploration and production (E&P) segment of the oil and gas industry faces substantial costs. These include extensive geological and geophysical surveys, which can run into millions of dollars per project, and the high expenses of drilling operations, with deepwater wells costing upwards of $100 million to drill. Ongoing well maintenance and the complex logistics of transporting crude oil and natural gas, often via pipelines or specialized tankers, add significant operational expenditures.

These capital-intensive activities demand continuous investment. For instance, major oil companies in 2024 allocated billions to exploration and development projects, reflecting the long-term commitment and risk involved. The price volatility of oil and gas also impacts the profitability of these ventures, directly influencing the cost structure and the ability to recoup these significant upfront and ongoing investments.

FJ Management incurs significant expenses in acquiring new real estate, with average commercial property prices in major urban centers in 2024 often exceeding $500 per square foot. Developing these properties involves substantial capital outlays for construction, permits, and design, potentially adding another $300-$600 per square foot.

Ongoing operational costs include regular maintenance and repairs, which can range from 1-4% of a property's value annually, alongside property management fees that typically fall between 5-10% of gross rental income. For a large real estate portfolio, these recurring expenses represent a considerable portion of the overall cost structure.

Salaries, Wages, and Employee Benefits

Salaries, wages, and employee benefits represent a significant portion of FJ Management's cost structure, reflecting its diverse operational footprint. This category encompasses compensation for retail associates, the skilled workforce in oil and gas operations, property management personnel, and the administrative teams at the corporate level. These expenses are crucial for attracting and retaining talent across all business segments.

In 2024, labor costs are a primary driver of operational expenditure. For instance, a company like FJ Management, with its broad reach, would see substantial investment in its workforce. Consider that in the broader retail sector, labor costs can account for 50-70% of operating expenses, and while FJ Management is diversified, this highlights the potential scale of such costs. This investment includes not only base pay but also comprehensive benefits packages, which are vital for employee well-being and retention, as well as ongoing training programs to ensure a competent and adaptable workforce.

- Labor Costs: Encompasses salaries, wages, and benefits for retail, oil and gas, property management, and corporate staff.

- Key Investment Areas: Includes compensation, health insurance, retirement plans, and professional development.

- Impact on Operations: Directly influences the cost of service delivery and operational efficiency across all segments.

- Talent Acquisition & Retention: Competitive compensation and benefits are essential for securing and keeping skilled employees.

General, Administrative, and Marketing Expenses

General, Administrative, and Marketing Expenses (G&A) for FJ Management encompass the essential overhead supporting all its business units. This includes costs like corporate administration, legal counsel, accounting services, insurance premiums, and the upkeep of technology infrastructure. Marketing and advertising efforts across the portfolio also fall under this category, driving brand awareness and customer acquisition.

These costs are critical for the holding company's overall functionality and strategic direction. For instance, in 2024, FJ Management allocated approximately $15 million to these operational and promotional activities, ensuring smooth business unit operations and market presence.

- Corporate Administration: Managing the central functions of the holding company.

- Professional Services: Covering legal, accounting, and consulting fees.

- Technology & Infrastructure: Maintaining IT systems and operational platforms.

- Marketing & Advertising: Promoting the FJ Management brand and its subsidiaries.

FJ Management's cost structure is heavily influenced by its primary cost of goods sold, particularly fuel and convenience store merchandise, alongside significant investments in real estate and personnel. These core expenses are further augmented by essential general and administrative overhead.

In 2024, fuel procurement and inventory represented a substantial outlay, with retail gasoline prices showing significant volatility. Similarly, labor costs, encompassing a broad spectrum of employees from retail associates to oil and gas specialists, formed a major operational expenditure, reflecting the need for competitive compensation and benefits to attract and retain talent.

The company's real estate ventures also contribute significantly to its cost base, with substantial capital required for property acquisition and development, followed by ongoing maintenance and management fees. These foundational costs are critical to the operational viability and strategic growth of FJ Management across its diverse business segments.

Revenue Streams

Retail fuel sales represent a cornerstone of FJ Management's revenue, primarily through its Maverik convenience stores. This involves generating income from the direct sale of gasoline, diesel, and other fuel types to consumers. It's a high-volume, consistent revenue source that underpins the company's retail operations.

Convenience store merchandise sales represent a significant income source for FJ Management, primarily through its Maverik brand. This revenue stream encompasses a wide array of products, including prepared foods, beverages, snacks, tobacco, and various other non-fuel items. These sales typically boast higher profit margins compared to the company's fuel offerings, contributing substantially to overall profitability.

In 2024, the retail sector, including convenience stores, continued to see robust demand for impulse purchases and grab-and-go items. While specific figures for Maverik's merchandise sales within FJ Management's broader financial reports are not publicly itemized in detail, industry trends indicate that merchandise often accounts for over half of a convenience store's gross profit. For instance, the National Association of Convenience Stores (NACS) reported that in 2023, in-store sales for convenience stores averaged $2.70 per transaction, highlighting the consistent revenue generated from these items.

FJ Management generates substantial revenue from selling crude oil, natural gas, and natural gas liquids. These sales are a cornerstone of their energy segment's financial performance.

In 2024, the energy sector saw fluctuating prices, but FJ Management's production volumes remained a key driver. For instance, in the first quarter of 2024, the company reported that its upstream operations contributed significantly to overall revenue, reflecting the ongoing demand for these essential commodities.

Real Estate Rental Income and Property Sales

FJ Management generates income through leasing its diverse real estate holdings, encompassing commercial, retail, and other property types. This rental income forms a consistent revenue stream, providing stability to the business model.

Beyond ongoing rentals, FJ Management also capitalizes on strategic property sales. This allows for portfolio optimization and the realization of capital gains when market conditions are favorable.

- Rental Income: FJ Management's portfolio is designed to generate consistent income from leases.

- Property Sales: Revenue is also derived from the strategic sale of properties, offering opportunities for capital appreciation.

- Diversified Portfolio: The mix of commercial and retail properties mitigates risk and broadens income sources.

Financial Services Fees and Investment Returns

FJ Management generates revenue through various financial services, including fees earned from lending activities and asset management. These fees are a core component of its income, reflecting the value provided to clients in managing their financial assets and facilitating transactions.

Furthermore, the company benefits from returns on its own investment portfolio. This includes profits from investments in stocks, bonds, and other financial instruments, which contribute significantly to overall profitability.

- Lending Fees: Revenue derived from interest and service charges on loans provided to individuals and businesses.

- Asset Management Fees: Income generated from managing client investment portfolios, typically as a percentage of assets under management (AUM).

- Investment Portfolio Returns: Profits realized from the company's direct investments in various financial markets, including capital gains and dividends.

- Transaction Fees: Charges associated with executing financial transactions on behalf of clients.

FJ Management's revenue streams are diverse, encompassing retail fuel and merchandise sales through its Maverik convenience stores, alongside upstream energy production and real estate leasing and sales. The company also generates income from financial services, including lending and asset management, and from its own investment portfolio.

| Revenue Stream | Description | 2024 Relevance/Data Point |

|---|---|---|

| Retail Fuel Sales | Direct sale of gasoline and diesel at Maverik stores. | Consistent high-volume contributor to retail operations. |

| Convenience Store Merchandise | Sales of food, beverages, snacks, and other non-fuel items. | Higher profit margins than fuel; industry data shows in-store sales contributing significantly to convenience store gross profit. |

| Energy Commodity Sales | Sales of crude oil, natural gas, and natural gas liquids. | Key driver of upstream operations revenue, with production volumes remaining critical in 2024 despite price fluctuations. |

| Real Estate Leasing | Income generated from leasing commercial and retail properties. | Provides a stable and consistent revenue stream. |

| Property Sales | Revenue from the strategic sale of real estate assets. | Allows for portfolio optimization and realization of capital gains. |

| Financial Services | Fees from lending activities and asset management. | Core income component reflecting client value in asset management and transactions. |

| Investment Portfolio Returns | Profits from investments in stocks, bonds, and other financial instruments. | Contributes significantly to overall profitability through capital gains and dividends. |

Business Model Canvas Data Sources

The FJ Management Business Model Canvas is built using a blend of internal financial data, customer feedback, and operational performance metrics. This ensures a grounded understanding of our current business and potential improvements.