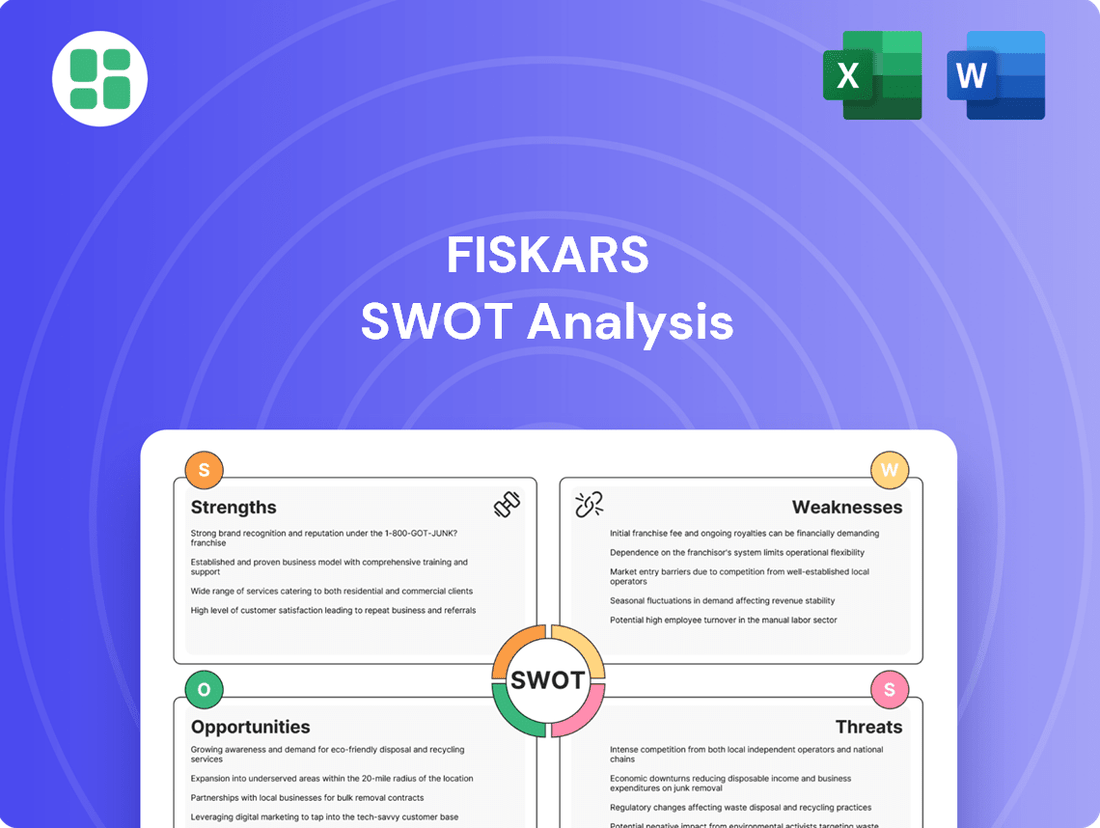

Fiskars SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fiskars Bundle

Fiskars leverages its strong brand recognition and innovative product design to capture market share, but faces intense competition and evolving consumer preferences.

Want the full story behind Fiskars' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fiskars Group commands a powerful presence with its diverse and strong brand portfolio, encompassing well-known names like Fiskars, Gerber, Iittala, Waterford, Georg Jensen, Royal Copenhagen, Wedgwood, and Moomin Arabia. This wide array of brands spans home, garden, and outdoor sectors, effectively mitigating risks associated with a single product category and attracting a broad spectrum of consumers.

The deep historical roots of many of these brands, with some tracing their origins back to 1649, foster significant brand recognition and cultivate strong consumer loyalty and trust. For instance, the Fiskars brand itself, known for its iconic orange-handled scissors, has been a staple in households for decades, demonstrating enduring consumer appeal.

Fiskars boasts an impressive global footprint, operating in over 100 countries. This extensive reach is supported by a robust multi-channel distribution strategy, encompassing traditional retail, thriving e-commerce platforms, and direct sales initiatives. Such broad market penetration offers significant resilience, allowing the company to weather regional economic downturns by diversifying its revenue streams.

The company's commitment to its direct-to-consumer (DTC) channels, including its own retail stores and online presence, is clearly paying off. In the first quarter of 2025, this vital sales channel experienced a notable 9% growth. This upward trend underscores the effectiveness of Fiskars' strategy in connecting directly with its customer base, enhancing brand loyalty and driving sales.

Fiskars Group's strategic emphasis on Direct-to-Consumer (DTC) growth is a significant strength, enabling direct engagement and brand control. This approach allows them to cultivate deeper customer relationships and capture potentially higher profit margins by bypassing traditional intermediaries.

The commitment to DTC is evident in Fiskars' investments in its proprietary retail and e-commerce channels. By 2024, DTC sales represented a substantial 28% of the Group's overall revenue, underscoring the growing importance of this channel.

Within the broader group, the BA Vita segment has demonstrated exceptional success in its DTC strategy, with 50% of its net sales in 2024 being generated directly from consumers. This highlights the effectiveness of their DTC model in specific business areas.

Commitment to Sustainability and Design Innovation

Fiskars demonstrates a strong commitment to sustainability and design innovation, actively challenging the notion of disposable products with its focus on enduring quality. This dedication is underscored by its impressive EcoVadis Platinum medal in 2024, a recognition placing it within the top 1% of companies evaluated for their environmental and social performance.

This focus on sustainable practices and creating timeless, functional designs appeals to a growing segment of consumers who prioritize environmental responsibility. It also serves as a powerful engine for continuous innovation and fosters a model of responsible business expansion.

- EcoVadis Platinum Medal 2024: Top 1% of assessed companies globally.

- Design Philosophy: Prioritizes longevity over disposability.

- Consumer Resonance: Appeals to environmentally conscious buyers.

- Strategic Advantage: Drives innovation and responsible growth.

Ongoing Organizational Efficiency Initiatives

Fiskars Group is making significant strides in streamlining its operations, aiming for greater efficiency and faster strategic implementation. These ongoing initiatives are designed to simplify the company's structure and supply chain.

Key plans unveiled in 2024 and early 2025 focus on separating the Fiskars and Vita business areas into distinct entities. This move is expected to unlock greater agility and allow for more focused management within each segment.

Furthermore, Fiskars is implementing targeted changes within its Vita business area. The objective is to achieve annual cost savings, which will then be reinvested into strategic growth opportunities. For instance, the company has outlined plans to generate approximately €30 million in annual cost savings through these efficiency programs by the end of 2026.

- Organizational Simplification: Separating Business Areas (Fiskars and Vita) into independent operations.

- Supply Chain Enhancement: Pursuing simplification to boost overall efficiency.

- Cost Savings Target: Aiming for approximately €30 million in annual cost savings by the end of 2026 from Vita BA changes.

- Strategic Reinvestment: Enabling strategic investments in growth areas through realized cost efficiencies.

Fiskars Group's extensive and well-recognized brand portfolio, including Fiskars, Gerber, and Iittala, provides broad market appeal across home, garden, and outdoor sectors. This diversification significantly reduces reliance on any single product category, offering a stable revenue base. The company's strong global presence, operating in over 100 countries with a robust multi-channel distribution network, ensures resilience against regional economic fluctuations.

The company's strategic focus on Direct-to-Consumer (DTC) channels is a notable strength, with DTC sales accounting for 28% of Group revenue in 2024. This channel saw a 9% growth in Q1 2025, demonstrating its increasing importance and effectiveness in building customer relationships and potentially higher profit margins. The Vita segment, in particular, achieved 50% of its net sales through DTC in 2024, highlighting successful implementation in specific business areas.

Fiskars' dedication to sustainability and design innovation is a key differentiator, earning it an EcoVadis Platinum medal in 2024 for top-tier environmental and social performance. This commitment to creating enduring, quality products resonates with an expanding base of environmentally conscious consumers, driving both innovation and responsible business growth.

Operational streamlining efforts, including the planned separation of Fiskars and Vita business areas by 2025, aim to enhance agility and focus. These initiatives are projected to yield approximately €30 million in annual cost savings by the end of 2026, which will be reinvested into strategic growth opportunities.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Brand Portfolio | Diverse and strong brand recognition across multiple sectors. | Includes Fiskars, Gerber, Iittala, Waterford, Georg Jensen, Royal Copenhagen, Wedgwood, Moomin Arabia. |

| Global Footprint & Distribution | Extensive market reach and resilient distribution strategy. | Operates in over 100 countries; robust multi-channel distribution (retail, e-commerce, direct sales). |

| Direct-to-Consumer (DTC) Growth | Increasingly effective channel for customer engagement and sales. | 28% of Group revenue in 2024; 9% growth in Q1 2025; 50% DTC sales in Vita BA in 2024. |

| Sustainability & Innovation | Commitment to quality, design, and environmental responsibility. | EcoVadis Platinum medal in 2024 (top 1% globally); focus on enduring product design. |

| Operational Efficiency Initiatives | Streamlining operations for greater agility and cost savings. | Targeting €30 million in annual cost savings by end of 2026 from Vita BA changes. |

What is included in the product

Delivers a strategic overview of Fiskars’s internal and external business factors, highlighting its strong brand and innovation capabilities alongside market competition and evolving consumer trends.

Fiskars' SWOT analysis simplifies complex market dynamics, offering a clear roadmap to address competitive pressures and capitalize on emerging opportunities.

Weaknesses

Fiskars Group's reliance on consumer discretionary spending, especially for its premium and luxury items in Business Area Vita, presents a notable weakness. During economic slowdowns or periods of low consumer confidence, demand for these higher-priced goods tends to drop significantly. For instance, the company reported declining comparable net sales in H1 2025, directly reflecting this vulnerability.

The United States represents Fiskars Group's most significant market, contributing roughly 30% to its total net sales. This reliance is particularly pronounced within the Business Area Fiskars segment, where the U.S. accounts for about half of its net sales, with a substantial portion of these goods originating from Asia.

Recent tariff implementations announced in April 2025 have created a direct challenge, escalating sourcing expenses for Fiskars. This has had a ripple effect, negatively influencing retailer demand and prompting adjustments in inventory management, ultimately contributing to a profit warning and a revised, lower financial outlook for 2025.

Fiskars faces a persistently challenging market, characterized by significant global economic uncertainties that severely limit its visibility. This makes accurate demand forecasting and strategic planning exceptionally difficult for the company.

The volatile operating environment directly impacted Fiskars' performance, leading to comparable net sales decreases in the second quarter and the first half of 2025. While the first quarter of 2025 showed some positive organic growth, the overall trend highlights the ongoing struggles with market unpredictability.

Performance Challenges in Specific Brands/Segments

Fiskars faces performance headwinds in certain brands, notably Waterford, which has experienced a downturn, especially in the United States. The inherent nature of crystal manufacturing, a process-driven industry, presents challenges in adjusting production volumes, directly affecting profitability. This inflexibility contributed to a decline in BA Vita's comparable EBIT during the second quarter of 2025.

- Brand Underperformance: Waterford's sales have been particularly weak in the U.S. market.

- Production Inflexibility: The process industry model for crystal makes it hard to scale production down, impacting cost efficiency.

- Profitability Impact: This inflexibility led to a notable decrease in BA Vita's comparable EBIT in Q2 2025.

Dependence on Wholesale Channel

Fiskars Group's significant reliance on its wholesale channel presents a notable weakness. This channel still accounts for a substantial portion of its revenue, with wholesale sales making up nearly 70% of the company's total turnover.

This dependence exposes Fiskars to the inventory management strategies and demand fluctuations of its major retail partners. For instance, cautious inventory management by these retailers has directly impacted Fiskars' net sales, particularly within its Business Area Fiskars.

- Wholesale Dominance: Wholesale channels represent approximately 70% of Fiskars Group's sales.

- Retailer Influence: The company's performance is susceptible to the inventory decisions and demand shifts of large retailers.

- Sales Impact: This channel dependency has been a contributing factor to sales challenges observed in the Fiskars Business Area.

Fiskars' significant reliance on the U.S. market, which accounts for around 30% of its total net sales, creates a concentration risk. This is particularly evident in the Fiskars Business Area, where the U.S. represents about half of its sales, with goods often sourced from Asia.

The company's dependence on the wholesale channel, making up nearly 70% of its turnover, leaves it vulnerable to retailer inventory management and demand shifts, directly impacting sales in segments like the Fiskars Business Area.

Recent tariff increases implemented in April 2025 have driven up sourcing costs, negatively affecting retailer demand and forcing inventory adjustments, which contributed to a profit warning and a lowered financial outlook for 2025.

Fiskars faces challenges with specific brands, such as Waterford, which has seen a downturn, especially in the U.S. The inherent production inflexibility in crystal manufacturing hinders cost-efficiency and impacted BA Vita's comparable EBIT in Q2 2025.

| Market Exposure | Channel Dependence | Operational Risks | Brand Specific Issues |

|---|---|---|---|

| U.S. Market Concentration (approx. 30% of total net sales) | Wholesale Dominance (approx. 70% of sales) | Tariff Impact (April 2025) | Waterford Downturn (U.S.) |

| Fiskars BA U.S. Sales (approx. 50% of BA sales) | Retailer Inventory Sensitivity | Increased Sourcing Costs | Crystal Production Inflexibility |

| Sourcing from Asia | Impact on Fiskars BA Sales | Profit Warning (2025) | BA Vita EBIT Decline (Q2 2025) |

Preview Before You Purchase

Fiskars SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment. You can trust that what you see is exactly what you'll get, providing a clear and actionable overview of Fiskars' strategic position.

Opportunities

Fiskars can significantly boost growth and profitability by further developing its direct-to-consumer (DTC) strategy, encompassing both online sales and its physical store presence. This approach allows for greater control over the customer experience and potentially higher profit margins compared to wholesale distribution.

Investing more in digital platforms and tailored marketing campaigns will foster deeper connections with customers and lessen dependence on traditional retail partners. This is particularly relevant given that BA Vita, a key part of Fiskars' portfolio, already achieves a substantial 50% of its sales through DTC channels, highlighting the proven success of this model.

The U.S. and China represent crucial avenues for Fiskars Group's expansion, even amidst prevailing economic headwinds. In the U.S., the company is concentrating on increasing its retail distribution footprint, aiming to capture a larger share of the market.

Concurrently, Fiskars is strategically introducing its premium brands into the Chinese market, targeting a segment that values quality and design. These initiatives underscore the significant long-term growth opportunities available in these major economies, provided sustained investment and customized approaches are maintained.

Fiskars' commitment to product innovation, especially in sustainable materials and smart home technology, presents a significant opportunity. For instance, the company's focus on eco-friendly gardening tools aligns with growing consumer demand for sustainable products, a trend that accelerated through 2024 and is projected to continue into 2025.

By leveraging its strong design heritage across brands like Fiskars, Wedgwood, and Royal Copenhagen, the company can introduce new product lines that resonate with modern lifestyles. This strategy can attract a younger demographic and enhance existing customer loyalty, potentially boosting sales in key markets like North America and Europe, where design-conscious consumers are prevalent.

Potential for Supply Chain Optimization

Fiskars Group is actively working to rebase some of its sourcing to create a more efficient and cost-effective supply chain, a crucial move given recent tariff impacts and ongoing cost pressures. This strategic shift offers a significant opportunity to not only mitigate external economic challenges but also to foster long-term resilience and operational excellence within its global network.

By optimizing its supply chain, Fiskars can expect to see tangible benefits, including reduced logistical expenses and improved inventory management. This proactive approach aims to build a more robust and adaptable operational framework, better positioned to navigate future market volatilities and maintain competitive pricing for its diverse product portfolio.

- Enhanced Efficiency: Streamlining sourcing and logistics can lead to faster product delivery and reduced lead times.

- Cost Reduction: Rebasing suppliers can unlock savings through better negotiation power and reduced transportation costs.

- Supply Chain Resilience: Diversifying sourcing locations mitigates risks associated with geopolitical events or single-supplier dependencies.

- Improved Sustainability: Optimizing routes and localizing production can contribute to a smaller environmental footprint.

Leveraging Organizational Simplification for Agility

Fiskars’ strategic move to separate its Business Areas into more independent operations, coupled with broader organizational simplification, is a significant opportunity. This restructuring is anticipated to unlock substantial cost savings, with the company aiming for approximately €30 million in annual cost reductions through these initiatives by the end of 2025. This streamlined approach is designed to foster greater agility.

The simplification efforts are poised to enhance the speed of decision-making and sharpen the focus on executing strategies tailored to each specific business area. This improved operational efficiency is a key driver for boosting future performance. For instance, the Water division's focus on innovation in water management solutions can be accelerated by a more agile structure.

- Cost Savings: Targeted €30 million in annual cost reductions by end of 2025.

- Enhanced Agility: Streamlined structure allows for quicker responses to market changes.

- Focused Strategy: Business areas can implement tailored strategies more effectively.

- Improved Performance: Greater efficiency and focus are expected to drive stronger financial results.

Fiskars has a significant opportunity to grow by expanding its direct-to-consumer (DTC) sales, both online and through its physical stores. This strategy gives them more control over the customer experience and can lead to better profit margins. For example, their BA Vita division already sees 50% of sales via DTC, proving its effectiveness.

The company can also capitalize on growth in the U.S. and China. In the U.S., they are increasing retail distribution, while in China, they are introducing premium brands to appeal to quality-conscious consumers. These markets offer substantial long-term potential with continued investment and tailored approaches.

Innovation in sustainable materials and smart home technology presents another key opportunity, aligning with increasing consumer demand for eco-friendly products. By leveraging its strong design heritage across brands, Fiskars can attract younger demographics and boost sales in design-centric markets.

Rebasing its supply chain offers a chance to improve efficiency and reduce costs, especially given recent tariff impacts and rising expenses. This strategic move can lead to savings through better negotiations and lower transportation costs, while also enhancing supply chain resilience and reducing environmental impact.

Simplifying its organizational structure and separating business areas is expected to unlock around €30 million in annual cost savings by the end of 2025. This move will foster greater agility, speed up decision-making, and allow for more focused execution of strategies tailored to each business area, ultimately improving overall performance.

Threats

New U.S. tariff announcements in early April 2025 pose a direct threat by escalating sourcing costs for Fiskars, especially for goods imported from China. This rise in expenses can squeeze profit margins and necessitate price adjustments for consumers.

Beyond direct cost increases, the unpredictability of U.S. trade policy creates a volatile operating environment. This uncertainty can dampen consumer confidence, leading to reduced demand from retailers for products like Fiskars' gardening tools and home goods, impacting sales volumes.

A widespread dip in consumer confidence and growing economic unease are dampening demand for Fiskars Group's core products across various regions. This cautious consumer behavior is particularly noticeable in key markets like the United States and China, directly impacting potential sales volumes and overall profitability.

The consumer goods landscape, particularly in home, garden, and outdoor segments, is fiercely competitive. Fiskars faces a crowded market with both legacy brands and agile new entrants vying for consumer attention. This dynamic intensified in 2024, with reports indicating a 5% increase in new product launches across the home goods sector, forcing established players to constantly innovate.

Market saturation in certain categories presents a significant threat, potentially squeezing profit margins and market share. For instance, the global gardening tools market, a key area for Fiskars, saw its growth rate slow to an estimated 3.2% in early 2025, down from 4.5% in 2023, signaling increased maturity and competition for existing demand.

To counter this, Fiskars must continue investing heavily in marketing and product differentiation. In 2024, the company increased its marketing spend by 8% year-over-year, a strategic move to maintain brand visibility and highlight unique product features amidst a sea of similar offerings.

Supply Chain Disruptions and Cost Pressures

Global supply chains continue to present significant threats to Fiskars, extending beyond just tariffs. Fluctuations in raw material prices, persistent logistical hurdles, and ongoing geopolitical uncertainties can all contribute to elevated sourcing and operational expenses. For instance, the continued volatility in energy prices throughout 2024 has directly impacted transportation costs, a key component of supply chain expenses for a global manufacturer like Fiskars.

These cost pressures directly affect Fiskars' bottom line. If the company cannot effectively pass these increased costs onto consumers or find efficiencies, it will likely see its gross margins shrink and overall profitability decline. The ability to manage these external cost drivers is crucial for maintaining financial health in the coming periods.

Consider these specific areas of threat:

- Raw Material Volatility: Prices for key materials used in Fiskars' products, such as steel and plastics, have experienced significant swings in 2024, impacting cost of goods sold.

- Logistical Bottlenecks: Despite some improvements, port congestion and shipping container availability issues have persisted, leading to longer lead times and higher freight charges.

- Geopolitical Risks: Ongoing international conflicts and trade tensions create an unpredictable environment, potentially disrupting the flow of goods and increasing the cost of doing business in certain regions.

Foreign Exchange Rate Fluctuations

Fiskars Group's extensive global operations expose it to the inherent risks of foreign exchange rate fluctuations, especially concerning the U.S. dollar. A weakening dollar can present a double-edged sword; while potentially beneficial for direct currency transactions due to Fiskars' net-buy position, it simultaneously introduces translation risk, negatively impacting the reported value of its financial statements.

For instance, during 2024, significant volatility in the USD/EUR exchange rate could have directly influenced Fiskars' reported earnings and asset valuations. The company's financial health is therefore sensitive to these macroeconomic shifts, requiring careful hedging strategies.

- Global Exposure: Fiskars operates in numerous countries, making it susceptible to currency variations.

- U.S. Dollar Sensitivity: Fluctuations in the U.S. dollar have a notable impact on the company's financial results.

- Translation Risk: Changes in exchange rates can alter the reported value of foreign subsidiaries' assets and liabilities.

- Transaction Risk: Direct currency transactions can be positively or negatively affected by exchange rate movements.

New U.S. tariffs announced in April 2025 directly increase sourcing costs for Fiskars, particularly on goods from China, potentially squeezing profit margins. This trade policy uncertainty also creates a volatile operating environment, potentially reducing consumer and retailer demand for Fiskars' products.

The competitive consumer goods market, especially in home and garden, intensified in 2024 with a reported 5% increase in new product launches. Market saturation in key categories like gardening tools, where growth slowed to an estimated 3.2% in early 2025, threatens market share and profit margins, necessitating continued investment in differentiation and marketing, as evidenced by Fiskars' 8% marketing spend increase in 2024.

Global supply chain disruptions remain a significant threat, with continued volatility in raw material and energy prices throughout 2024 impacting transportation costs and overall operational expenses. Logistical bottlenecks and geopolitical risks further exacerbate these cost pressures, potentially shrinking gross margins if not effectively managed or passed on to consumers.

Fiskars' global operations expose it to foreign exchange rate fluctuations, particularly with the U.S. dollar. Significant USD/EUR volatility in 2024 illustrates the translation risk impacting reported financial statements, highlighting the need for robust hedging strategies to maintain financial stability.

SWOT Analysis Data Sources

This Fiskars SWOT analysis is built upon a robust foundation of publicly available financial reports, comprehensive market research, and insights from industry experts to provide a well-rounded strategic overview.