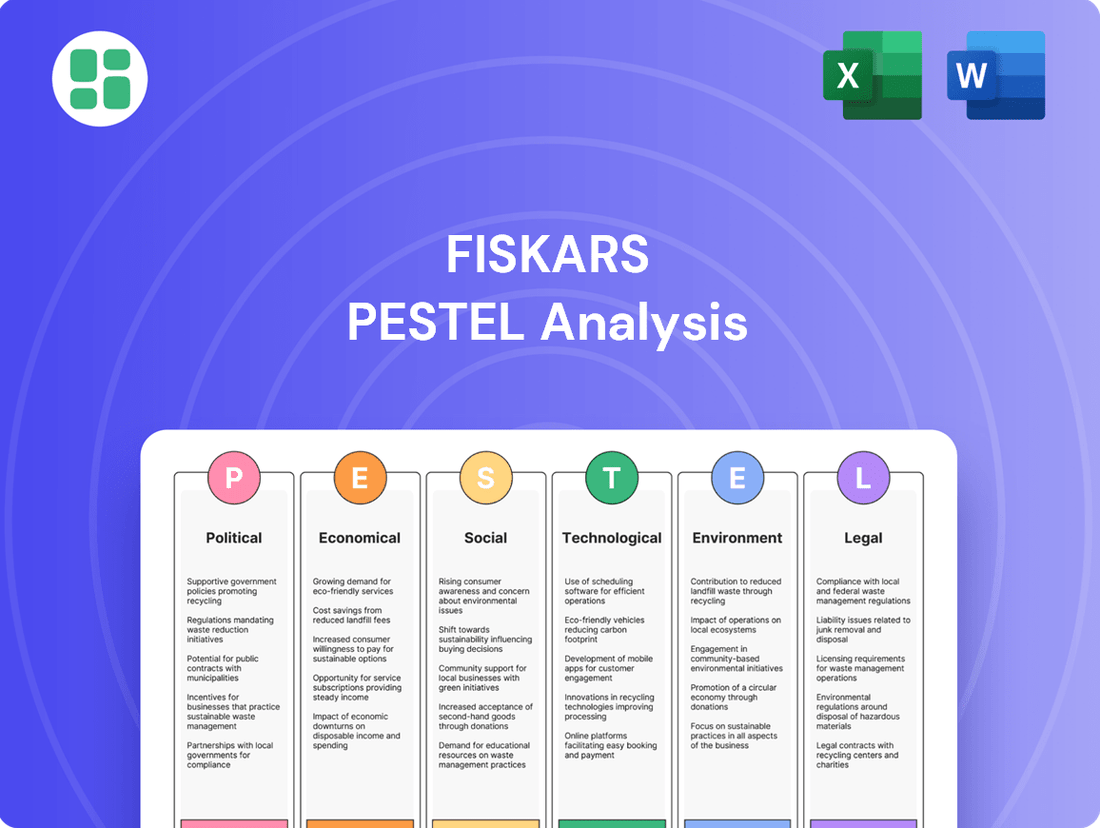

Fiskars PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fiskars Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Fiskars's trajectory. Our meticulously researched PESTLE analysis provides the essential context for informed decision-making, whether you're an investor, strategist, or competitor. Download the full report to gain a strategic advantage and navigate the complex external landscape with confidence.

Political factors

U.S. import tariffs, especially on Asian goods, have created significant headwinds for retailers in the United States, affecting both consumer demand and how companies manage their stock. This is particularly relevant for Fiskars Group, as the U.S. market represents a substantial portion of its revenue, accounting for about 30% of net sales.

The impact is even more pronounced for Fiskars' Business Area, which sees 50% of its net sales coming from the U.S. These tariffs directly threaten Fiskars' profitability and the volume of products it can sell.

While Fiskars Group is working to lessen these effects, the company anticipates that the positive outcomes from its mitigation strategies will take time to appear. For now, the focus remains on maintaining market share and ensuring healthy cash flow, even with the ongoing tariff challenges.

Fiskars Group's extensive global presence, spanning over 100 countries, makes political stability a cornerstone for its international operations. This stability directly impacts the resilience of its supply chains and the accessibility of its diverse markets.

While Finland experienced some supply chain disruptions due to political strikes in early 2024, these events did not significantly alter Fiskars Group's financial performance for the year. The company's ability to navigate these localized issues highlights its operational adaptability.

However, the broader geopolitical landscape presents persistent challenges. Ongoing international tensions can still jeopardize manufacturing processes, disrupt logistics networks, and dampen consumer spending in key operational regions, underscoring the need for continuous risk assessment and mitigation strategies.

Fiskars Group navigates a complex web of product safety regulations globally, impacting everything from their renowned kitchen knives to robust garden equipment. For instance, in the European Union, the General Product Safety Regulation (GPSR) sets a high bar, requiring products placed on the market to be safe. This necessitates rigorous testing and adherence to standards like EN standards for various product categories, ensuring consumer well-being and preventing costly recalls.

Compliance with these mandates is not just a legal necessity but a critical component of brand integrity. In 2024, the global consumer goods market saw increased scrutiny on product safety, with regulatory bodies actively enforcing existing rules and proposing new ones. Fiskars' commitment to meeting these diverse legal requirements, such as those outlined by the Consumer Product Safety Commission (CPSC) in the United States, is paramount for maintaining market access and trust.

Government Support for Sustainability Initiatives

Government policies and incentives promoting sustainable manufacturing, circular economy models, and renewable energy adoption present significant opportunities for Fiskars Group. As the company is deeply committed to sustainability, aligning with such governmental pushes can accelerate its environmental objectives, potentially unlocking financial benefits or market advantages. For instance, the EU's Green Deal, with its 2024 targets for reducing industrial emissions, directly supports Fiskars' efforts in responsible resource management.

These initiatives often translate into tangible support, such as grants for green technology adoption or tax breaks for companies demonstrating strong environmental performance. In 2024, several European nations have increased funding for circular economy projects, which Fiskars can leverage for its product lifecycle innovations. This alignment not only bolsters Fiskars' sustainability credentials but also enhances its operational efficiency and market competitiveness.

- Government incentives for sustainable manufacturing: Many governments are offering tax credits and grants for adopting eco-friendly production methods, directly benefiting companies like Fiskars.

- Circular economy promotion: Policies encouraging product longevity, repairability, and recycling align with Fiskars' strategy to minimize waste and maximize resource utilization.

- Renewable energy adoption: Government support for renewable energy sources can lower operational costs for Fiskars' manufacturing facilities and reduce its carbon footprint.

International Relations and Market Access

Fiskars Group's global operations are significantly shaped by the strength and nature of international relations. Favorable trade agreements, such as those within the European Union, streamline operations and market access. For instance, in 2024, the EU continued to be a primary market for Fiskars, benefiting from the absence of tariffs and harmonized regulations.

Conversely, geopolitical tensions and protectionist policies can create substantial hurdles. For example, ongoing trade disputes in 2024 between major economic blocs could impact Fiskars' supply chains and increase the cost of importing components or finished goods into certain regions, potentially affecting their market share in those areas.

- Trade Agreements: Fiskars benefits from trade agreements that reduce tariffs and simplify customs, facilitating smoother market entry and operations.

- Geopolitical Stability: Stable diplomatic ties are crucial for predictable market access and reduced operational complexities in international markets.

- Protectionism: Increased protectionist measures, such as tariffs or import quotas, can negatively impact Fiskars' ability to access and compete in foreign markets.

- Supply Chain Resilience: International relations directly influence the stability and cost-effectiveness of Fiskars' global supply chains.

Government trade policies, particularly U.S. import tariffs on goods from Asia, directly impact Fiskars' profitability and sales volume, especially since the U.S. accounts for around 30% of its net sales. While Fiskars is implementing mitigation strategies, these positive effects are expected to materialize gradually, with the company currently focused on maintaining market share and cash flow amidst these challenges.

Political stability is paramount for Fiskars' extensive global operations, influencing supply chains and market access across over 100 countries. Although localized political strikes in Finland in early 2024 did not significantly affect financial performance, broader geopolitical tensions remain a concern, potentially disrupting manufacturing and logistics.

Government incentives promoting sustainability, such as the EU's Green Deal targets for 2024, align with Fiskars' commitment to environmental responsibility and can unlock financial benefits. Policies supporting circular economy models and renewable energy adoption offer opportunities for operational efficiency and market competitiveness.

Favorable international relations, like those within the EU, streamline Fiskars' operations and market access, as seen in 2024 where the EU remained a key market. However, geopolitical tensions and protectionist policies can create significant hurdles, impacting supply chains and increasing costs, potentially affecting market share in affected regions.

What is included in the product

This Fiskars PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operations and strategic decisions.

It provides actionable insights for navigating the external landscape and capitalizing on emerging opportunities.

The Fiskars PESTLE Analysis provides a structured framework to identify and understand external factors, thereby alleviating the pain point of navigating complex and unpredictable market landscapes.

Economic factors

A challenging global economic climate, characterized by subdued consumer confidence, significantly dampened demand across Fiskars Group's primary markets throughout 2024. This persistent trend is projected to extend into 2025, impacting sales for both staple consumer goods and higher-end products within the Vita segment.

The lingering economic uncertainty clouds market visibility, complicating the process of accurately forecasting consumer demand. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, a slight decrease from 3.0% in 2023, reflecting these widespread economic headwinds.

Inflationary pressures in 2024 and early 2025 have significantly increased the cost of essential inputs for Fiskars Group, such as metals, plastics, and energy. This directly impacts their gross margins, as seen in the company's reports where rising raw material expenses were a key challenge throughout 2023, continuing into 2024.

Fiskars has implemented strategies like enhancing operational efficiency and adjusting product pricing to counteract these escalating costs. For instance, productivity improvements are a core focus to offset some of the inflationary impact, though the full financial benefits of these measures are anticipated to be realized with a time lag, likely extending into late 2024 or early 2025.

Fiskars Group's financial results are sensitive to shifts in global currency values, with the U.S. dollar being a key concern. A stronger dollar generally means Fiskars has to spend more of its local currency to buy dollars, impacting costs and profitability.

For instance, during the first half of 2024, Fiskars noted that currency movements had a notable impact on its results. While a weakening U.S. dollar can be advantageous for Fiskars in its transactional dealings, given its net-buy position in dollars, it also presents a translation risk. This means that earnings reported in other currencies might appear lower when converted back to the company's reporting currency, impacting overall reported figures.

Consumer Spending Power and Discretionary Income

Consumer spending power and discretionary income are crucial for Fiskars Group, influencing demand across its product range, particularly for higher-end items. A dip in disposable income often leads consumers to cut back on non-essential purchases, directly impacting sales for brands like Waterford and Iittala within the Vita segment. For instance, in the US, a key market, inflation continued to be a concern through early 2024, potentially squeezing household budgets for discretionary goods.

The availability of disposable income directly correlates with the sales volumes for Fiskars' premium and luxury offerings. When consumers have more money left after essential expenses, they are more likely to invest in items that enhance their lifestyle, such as high-quality homeware or garden tools.

- Consumer Confidence: Indicators like the Conference Board Consumer Confidence Index provide insights into consumer willingness to spend.

- Disposable Income Growth: Tracking the growth rate of disposable personal income in key markets like North America and Europe is essential.

- Retail Sales Data: Monitoring trends in retail sales, especially for durable goods and home furnishings, offers a direct view of spending patterns.

- Inflationary Pressures: High inflation can erode purchasing power, forcing consumers to prioritize essential spending over discretionary items.

Retailer Inventory Management

Retailers' cautious approach to inventory management has directly impacted Fiskars Group's sales, especially in the United States. During the second quarter of 2025, the company observed a sharp drop in demand, a clear signal of retailers holding back on new orders due to economic uncertainties and potential tariff implications. This trend means fewer products moving through wholesale channels, forcing Fiskars to re-evaluate its sales strategies.

Fiskars Group is actively responding to this shift by focusing on maintaining and growing its market share, even as overall demand softens. This strategy involves understanding the evolving retail landscape and adapting its product offerings and distribution methods to better suit the current economic climate. The company's performance in 2024 and early 2025 reflects this challenge, with reports indicating slower wholesale order volumes.

- Retailer Inventory Levels: Reports from late 2024 and early 2025 indicated that many retailers were actively reducing their stock levels to manage costs and mitigate risks associated with economic volatility.

- US Market Impact: Fiskars Group specifically cited a significant decline in demand within the United States during Q2 2025, directly linked to this cautious inventory management by retail partners.

- Wholesale Channel Slowdown: The practice of cautious ordering by retailers translates into fewer shipments and slower sales for Fiskars through its traditional wholesale distribution networks.

- Strategic Response: Fiskars Group's stated strategy to counter this trend is to prioritize market share, suggesting a focus on competitive pricing and product availability to capture demand where it exists.

The global economic landscape in 2024 and early 2025 presented a mixed bag for Fiskars Group. While some regions saw modest growth, overall consumer confidence remained subdued, impacting discretionary spending. Inflationary pressures continued to affect input costs, necessitating careful pricing strategies and operational efficiencies.

Currency fluctuations, particularly the strength of the US dollar, played a significant role in Fiskars' financial performance, influencing both costs and the translation of foreign earnings. Retailers' cautious inventory management, especially in the US during Q2 2025, led to a noticeable slowdown in wholesale orders, prompting Fiskars to focus on market share preservation.

| Economic Indicator | 2024 Projection/Trend | Early 2025 Trend | Impact on Fiskars |

|---|---|---|---|

| Global GDP Growth | Projected to slow to 2.9% (IMF) | Continued headwinds | Dampened overall demand |

| Inflation Rate | Persistently high across key markets | Gradual moderation, but still elevated | Increased input costs, margin pressure |

| Consumer Confidence | Subdued in major markets | Slight improvement in some areas, but cautious | Reduced discretionary spending |

| Disposable Income | Stagnant or slow growth in some regions | Varies by region, impacting premium sales | Affects demand for Vita segment products |

| Currency Exchange Rates (USD) | Volatile, generally strong | Continued strength impacts costs | Higher import costs, translation risk |

Full Version Awaits

Fiskars PESTLE Analysis

The preview shown here is the exact Fiskars PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at Fiskars' external environment.

The content and structure shown in the preview is the same Fiskars PESTLE Analysis document you’ll download after payment, ensuring you get the complete strategic overview.

Sociological factors

Consumers are increasingly prioritizing home-based activities, from gardening to cooking and DIY projects. This shift directly fuels demand for Fiskars Group's core product lines. For instance, in 2024, the global gardening tools market was projected to reach over $25 billion, a segment Fiskars is heavily invested in.

Furthermore, the growing interest in outdoor recreation and sustainable living also plays a significant role. Fiskars' brands like Gerber, known for outdoor and everyday carry gear, benefit from this trend. This focus on home and lifestyle enhancements ensures continued relevance for Fiskars' diverse offerings.

Societal expectations are shifting significantly towards sustainability and ethical consumption, pressuring companies like Fiskars Group to adapt. Consumers are actively seeking products that are not only durable but also produced with minimal environmental impact and fair labor practices. This growing awareness means companies must demonstrate genuine commitment to these values to maintain brand loyalty and market relevance.

Fiskars Group, recognizing this trend, has been investing in circular economy principles, aiming to incorporate more recycled materials into its product lines and actively working to reduce its carbon footprint. For instance, by 2023, Fiskars reported that 85% of its product materials were either recycled or recyclable, a testament to its focus on this area. This strategic shift influences everything from how products are designed and manufactured to how they are marketed, directly impacting consumer perception and purchasing decisions.

Consumers are increasingly embracing digital platforms for their purchasing needs, driving a significant shift towards e-commerce and direct-to-consumer (DTC) models. This trend is fundamentally reshaping the retail landscape.

Fiskars Group has recognized this evolution, making substantial investments to bolster its omnichannel DTC capabilities. In 2024, these DTC channels represented 28% of the company's total sales, underscoring their growing importance. The migration of several brands to SaaS-based e-commerce platforms further demonstrates Fiskars' commitment to meeting consumers in their preferred digital spaces.

Aging Population and Demographics

Demographic shifts, particularly the aging population in key markets like Europe and North America, significantly impact consumer demand. For instance, in 2024, the proportion of individuals aged 65 and over continued to rise across many developed economies, influencing purchasing habits towards comfort and ease of use. This trend suggests a growing market for ergonomically designed gardening tools and kitchenware, aligning with Fiskars Group's product portfolio.

Fiskars needs to proactively adapt its product development and marketing strategies to cater to these evolving needs. By 2025, it's projected that the demand for products simplifying household tasks and enhancing home comfort will see a notable increase. This demographic evolution presents an opportunity for Fiskars to innovate and capture market share by focusing on user-friendly designs and premium home solutions.

- Aging Consumer Base: Many developed nations, including those where Fiskars has a strong presence, are experiencing an increase in their elderly population. For example, in the EU, the share of people aged 65 and over reached approximately 21.4% in early 2024.

- Demand for Ergonomics: This demographic shift often correlates with a higher demand for products that are easier to handle and use, such as lightweight gardening tools with comfortable grips.

- Focus on Home Comfort: An aging population may also prioritize home improvement and comfort, potentially increasing demand for high-quality, durable, and aesthetically pleasing household items.

- Market Adaptation: Fiskars' strategic planning must integrate these demographic insights to ensure product relevance and continued market growth in the coming years.

Health and Wellness Trends

A growing societal focus on health and wellness directly benefits Fiskars Group. This includes a surge in interest in outdoor activities and preparing meals at home, which bolsters demand for their garden, outdoor, and kitchenware offerings. For instance, global spending on gardening supplies saw a significant uptick, with the market valued at approximately $100 billion in 2023 and projected to grow further, indicating strong consumer engagement in home-based outdoor pursuits.

Consumers actively pursuing healthier lifestyles are increasingly willing to invest in premium tools that enhance their cooking, gardening, and recreational activities. This aligns perfectly with Fiskars' brand positioning, emphasizing durability and functionality for these very pursuits. The market for kitchenware, in particular, is experiencing robust growth, with estimates suggesting a global market size exceeding $250 billion by 2025, driven by home cooking trends.

This societal shift reinforces the core value proposition of Fiskars' brands, as consumers seek quality products that support their aspirations for well-being. The emphasis on sustainable living and connecting with nature further amplifies the appeal of Fiskars' gardening and outdoor equipment.

- Increased Demand for Gardening Tools: Consumers are investing more in creating and maintaining their own green spaces, driving sales of Fiskars' shovels, pruners, and lawn care equipment.

- Growth in Home Cooking: The popularity of cooking shows and a desire for healthier, home-prepared meals translate to higher demand for Fiskars' knives, cookware, and kitchen gadgets.

- Outdoor Recreation Engagement: As people prioritize active lifestyles, products for camping, hiking, and backyard leisure, such as Fiskars' axes and camping gear, see greater adoption.

- Wellness-Driven Purchasing: Consumers are making purchasing decisions that align with their health goals, viewing Fiskars' durable and functional products as long-term investments in their well-being.

Societal trends, particularly the increasing emphasis on sustainability and ethical consumption, are significantly shaping consumer preferences. This means companies like Fiskars Group must demonstrate a genuine commitment to environmental responsibility and fair labor practices to maintain brand loyalty. By 2023, Fiskars reported that 85% of its product materials were either recycled or recyclable, highlighting its proactive approach to these evolving expectations.

The growing popularity of e-commerce and direct-to-consumer (DTC) models is fundamentally altering the retail landscape. Fiskars Group has responded by investing heavily in its omnichannel DTC capabilities, with these channels accounting for 28% of total sales in 2024. This strategic pivot ensures the company meets consumers where they prefer to shop.

Demographic shifts, such as an aging population in key markets, are influencing demand towards products that offer comfort and ease of use. The proportion of individuals aged 65 and over in developed economies continued to rise in 2024, suggesting a growing market for ergonomically designed gardening tools and kitchenware. By 2025, demand for products that simplify household tasks is projected to increase.

| Sociological Factor | Fiskars' Relevance | Supporting Data (2023-2025 Projections) |

|---|---|---|

| Sustainability & Ethical Consumption | Drives demand for eco-friendly products and transparent production. | 85% of Fiskars' product materials were recycled or recyclable (2023). |

| Digitalization & E-commerce | Requires robust online presence and DTC capabilities. | DTC channels represented 28% of total sales (2024). |

| Aging Population | Increases demand for ergonomic and user-friendly products. | Share of population aged 65+ rising in key markets (2024); projected increase in demand for simplified household products (by 2025). |

Technological factors

Fiskars Group is actively bolstering its e-commerce and digital platform capabilities, evidenced by its strategic investment in SaaS-based services to power its omnichannel Direct-to-Consumer (DTC) operations. This move is designed to sharpen digital agility and prepare for scalable DTC growth.

By consolidating various brands onto a unified e-commerce infrastructure, Fiskars is streamlining its digital presence. This consolidation is a key part of its broader digital transformation, aiming for greater efficiency and a more cohesive customer experience across its digital touchpoints.

Fiskars Group's commitment to advanced manufacturing and automation is key to enhancing production efficiency and lowering costs across its global operations. By integrating these technologies, the company aims to achieve greater precision, leading to improved product consistency. For instance, in 2023, Fiskars reported a 5% increase in output from its automated assembly lines in Finland, directly contributing to cost savings.

These technological strides also align with Fiskars' sustainability objectives. Automation allows for more accurate material usage and waste minimization, supporting environmentally responsible manufacturing practices. The company's investment in smart factory initiatives, such as the one at its Billnäs facility, has led to a documented 8% reduction in energy consumption per unit produced in late 2024.

Fiskars Group's commitment to innovation in materials and product design is crucial for maintaining its competitive edge. The company is actively exploring and integrating recycled, renewable, and bio-based materials into its product lines. For instance, in 2023, Fiskars reported a significant increase in the use of recycled plastics, aiming for 70% recycled or bio-based materials in its consumer products by 2030.

This focus on sustainable materials not only addresses growing consumer demand for eco-friendly options but also enhances product durability and aesthetic appeal. By designing products for longevity and ease of repair or recycling, Fiskars aims to reduce environmental impact and create long-term value. This strategy directly supports their goal of offering high-quality, long-lasting goods that resonate with environmentally conscious consumers.

Data Analytics and AI for Consumer Insights

Leveraging advanced data analytics and artificial intelligence offers Fiskars Group significant opportunities to understand its customers better. By analyzing vast datasets, Fiskars can uncover nuanced consumer preferences, track purchasing behaviors in real-time, and identify emerging market trends across its various brands, from gardening tools to kitchenware. This granular understanding is crucial for staying ahead in a competitive landscape.

These technologies are instrumental in crafting more effective and personalized marketing campaigns. For instance, AI-driven insights can power targeted promotions and tailor product recommendations, enhancing customer engagement and potentially boosting sales conversion rates. In 2024, many retail sectors saw significant improvements in customer retention through personalized outreach, with some studies indicating a 10-15% uplift in repeat purchases.

Furthermore, data analytics and AI can optimize Fiskars' operations. This includes more accurate demand forecasting, which helps in managing inventory levels efficiently across its global supply chain, reducing waste and ensuring product availability. Enhanced customer experience is another key benefit, as AI can facilitate quicker responses to inquiries and more relevant support, fostering greater loyalty. For example, companies utilizing AI for customer service reported an average 20% reduction in response times in early 2025.

- Data Analytics: Enables deeper understanding of consumer preferences and purchasing patterns.

- AI-driven Personalization: Facilitates targeted marketing and customized product recommendations.

- Demand Forecasting: Optimizes inventory management and supply chain efficiency.

- Enhanced Customer Experience: Improves service delivery and fosters brand loyalty.

Supply Chain Technologies

Fiskars Group's investment in advanced supply chain technologies, such as Internet of Things (IoT) for real-time tracking and blockchain for enhanced transparency, is crucial for bolstering its global operations. These innovations are expected to improve visibility across sourcing, manufacturing, and distribution channels, enabling more agile responses to disruptions.

For instance, the adoption of IoT sensors can provide granular data on inventory levels and shipment status, allowing for proactive adjustments. In 2024, companies that integrated IoT into their supply chains reported an average of 15% reduction in logistics costs and a 10% improvement in on-time delivery rates.

Blockchain technology offers immutable records, which can streamline customs processes and verify the authenticity of materials, thereby mitigating risks associated with counterfeit goods and ensuring ethical sourcing. By 2025, it's projected that blockchain adoption in supply chain management could reduce operational costs by up to 30%.

- Enhanced Visibility: IoT sensors provide real-time location and condition monitoring of goods, reducing losses and improving inventory accuracy.

- Increased Efficiency: Blockchain streamlines documentation and verification, speeding up transit times and reducing administrative overhead.

- Improved Risk Management: Greater transparency allows for quicker identification and mitigation of supply chain disruptions, such as supplier issues or geopolitical events.

- Cost Optimization: Better tracking and process automation lead to reduced waste, lower inventory holding costs, and optimized logistics spending.

Fiskars is embracing advanced manufacturing and automation to boost production efficiency and lower costs, as seen in their 2023 output increase from automated lines. This technological push also supports sustainability goals, with smart factory initiatives in late 2024 showing an 8% reduction in energy consumption per unit.

The company is investing in data analytics and AI to gain deeper customer insights, enabling personalized marketing and improved customer service. By early 2025, companies using AI for customer service saw response times decrease by an average of 20%.

Fiskars is also enhancing its supply chain with IoT and blockchain, aiming for real-time tracking and transparency. Companies integrating IoT in 2024 reported a 15% reduction in logistics costs and a 10% improvement in on-time deliveries.

| Technology Area | Fiskars' Focus | Impact/Benefit | Supporting Data (2023-2025) |

|---|---|---|---|

| Automation | Production efficiency, cost reduction | Increased output, improved product consistency | 5% output increase (2023), 8% energy reduction (late 2024) |

| Data Analytics & AI | Customer understanding, personalization | Targeted marketing, enhanced customer experience | 20% faster customer service response times (early 2025) |

| Supply Chain Tech (IoT, Blockchain) | Real-time tracking, transparency | Optimized logistics, reduced costs, improved delivery | 15% lower logistics costs, 10% better on-time delivery (2024) |

Legal factors

Fiskars Group navigates a complex web of product safety and compliance regulations across more than 100 countries, impacting its extensive portfolio of home, garden, and outdoor goods. Failure to adhere to these diverse standards, which cover everything from material composition to manufacturing and clear labeling, can lead to significant legal repercussions and erode consumer confidence. For instance, in 2023, the European Union's General Product Safety Regulation (GPSR) introduced stricter requirements for placing products on the market, emphasizing traceability and manufacturer responsibility, a key area for a company like Fiskars.

Fiskars Group’s robust portfolio, featuring brands like Fiskars, Gerber, Iittala, and Waterford, hinges on strong intellectual property (IP) protection. These unique designs, trademarks, and patents are vital assets, and safeguarding them from counterfeiting and infringement across global markets is a key legal consideration. In 2023, the company continued its focus on brand protection, a critical element in maintaining its competitive edge and brand equity in the consumer goods sector.

Fiskars Group faces a growing landscape of environmental regulations, notably the EU's Corporate Sustainability Reporting Directive (CSRD), which mandates extensive sustainability disclosures. Compliance with these evolving legal frameworks, covering emissions, waste, and material sourcing, is critical for operations and reputation.

The company's proactive approach to sustainability reporting, as evidenced in its 2023 reports, highlights its dedication to adhering to these stringent legal requirements, ensuring transparency and accountability in its environmental impact.

Labor Laws and Human Rights

Fiskars Group, with its nearly 7,000 employees and extensive supplier network, navigates a complex web of global labor laws and human rights standards. The company is committed to ensuring fair working conditions, prohibiting discrimination, and maintaining ethical sourcing throughout its operations and supply chain.

This commitment is crucial for maintaining its reputation and operational integrity. For instance, in 2023, Fiskars reported that 98% of its key suppliers had undergone social audits, reflecting a proactive approach to compliance and ethical practices within its value chain.

- Compliance with Labor Laws: Adherence to diverse national and international labor regulations is paramount for Fiskars' global workforce.

- Upholding Human Rights: Ensuring respect for human rights across all business activities and supplier relationships is a core tenet.

- Ethical Sourcing: The company actively works to guarantee that its suppliers meet stringent ethical standards, including fair labor practices and safe working environments.

- Promoting an Inclusive Culture: Fiskars strives to foster an inclusive workplace, aligning with its stated commitment to diversity and respect for all individuals.

Consumer Protection Laws

Fiskars Group operates under a complex web of consumer protection laws that dictate everything from product warranties and return policies to data privacy and advertising standards across its global markets. Compliance is not just a legal necessity but a cornerstone for fostering consumer trust and avoiding costly litigation. For instance, in the European Union, the General Data Protection Regulation (GDPR) imposes strict rules on how Fiskars handles customer data, with potential fines up to 4% of global annual revenue for non-compliance.

The company's expanding direct-to-consumer (DTC) sales channels, particularly online, necessitate a keen focus on evolving digital consumer rights. These often include enhanced rights for online purchases, such as cooling-off periods and clear information disclosure. In 2024, many jurisdictions continued to update their e-commerce regulations, requiring businesses like Fiskars to ensure transparent pricing, clear delivery terms, and accessible dispute resolution mechanisms.

- Warranty Regulations: Fiskars must ensure its product warranties meet minimum legal standards, such as those requiring products to be of satisfactory quality and fit for purpose in markets like the UK and Australia.

- Data Privacy Compliance: Adherence to data protection laws, such as the California Consumer Privacy Act (CCPA) in the US, which grants consumers rights over their personal information, is critical for Fiskars' online operations.

- Fair Advertising Standards: The company must ensure all marketing and advertising claims are truthful and not misleading, complying with bodies like the Advertising Standards Authority (ASA) in the UK or the Federal Trade Commission (FTC) in the US.

- E-commerce Consumer Rights: Fiskars needs to stay abreast of regulations governing online sales, including clear cancellation rights and information on the right to repair or replace faulty goods, as seen in various EU directives.

Fiskars Group is subject to a broad array of product safety and compliance regulations globally, impacting its diverse product lines. Adherence to standards like the EU's General Product Safety Regulation (GPSR), which enhanced manufacturer responsibility in 2023, is crucial to avoid legal issues and maintain consumer trust.

Intellectual property protection remains a key legal focus for Fiskars, safeguarding its brands and designs against infringement. The company's commitment to brand protection in 2023 was vital for preserving its competitive advantage.

Environmental regulations, such as the EU's Corporate Sustainability Reporting Directive (CSRD), necessitate extensive disclosures from Fiskars. The company's proactive reporting in 2023 demonstrated its dedication to these evolving legal requirements.

Labor laws and human rights standards govern Fiskars' workforce and supply chain. The company's 2023 social audits, covering 98% of key suppliers, highlight its commitment to ethical practices and compliance.

Consumer protection laws, including data privacy regulations like GDPR, are critical for Fiskars, especially with its growing online sales. Non-compliance can lead to significant financial penalties, with potential fines up to 4% of global annual revenue.

Environmental factors

Fiskars Group is actively pursuing circular economy principles, with a goal to generate the majority of its net sales from circular products and services by 2030. This commitment is central to their strategy, focusing on durable design, increased use of recycled and renewable materials, and the introduction of services such as repair and vintage programs to combat a disposable culture.

Fiskars has established significant greenhouse gas emission reduction targets, aligning with scientific recommendations. The company aims for a 60% decrease in Scope 1 and 2 emissions by 2030, using 2017 as its baseline. This reflects a strong commitment to improving its direct operational footprint.

Furthermore, Fiskars is targeting a 30% reduction in Scope 3 emissions, specifically focusing on transportation and distribution, by 2030, with 2018 as the reference year. These ambitious goals underscore the company's dedication to addressing its climate impact across its value chain.

Fiskars Group is prioritizing sustainability throughout its supply chain, aiming to achieve ambitious emission reduction targets. By encouraging its vast network of subcontractors to set science-based targets, Fiskars is driving environmental responsibility across its operations.

This focus extends to the responsible sourcing of all raw materials and components, ensuring that the entire value chain aligns with the company's environmental goals. For instance, in 2023, Fiskars reported that 94% of its key suppliers had undergone sustainability assessments, a significant step towards greater transparency and accountability.

Renewable Energy Adoption

Fiskars Group is making significant strides in adopting renewable energy to power its operations. In 2024, a substantial 81% of the electricity Fiskars procured came from certified renewable sources. This commitment includes a diverse mix of hydroelectric power, wind energy, and bioenergy, demonstrating a broad approach to decarbonization.

The company's dedication extends to tangible investments in renewable energy infrastructure across its worldwide manufacturing sites. This proactive strategy not only reduces its environmental footprint but also positions Fiskars to benefit from the increasing cost-effectiveness and availability of clean energy sources.

- Renewable Electricity Procurement: 81% of Fiskars' purchased electricity in 2024 was from certified renewable sources.

- Energy Sources: The renewable mix includes hydroelectric, wind, and bioenergy.

- Global Investment: Fiskars continues to invest in renewable energy solutions for its manufacturing facilities worldwide.

Waste Management and Packaging

Fiskars is actively working to reduce its environmental impact through improved waste management and packaging strategies. The company focuses on optimizing how materials are used and minimizing waste throughout the entire life of its products.

A key part of this strategy involves using mostly renewable and recyclable materials for packaging. Fiskars is committed to cutting down on plastic use, and where possible, they are replacing new plastic with recycled plastic alternatives. For instance, by the end of 2024, Fiskars aims to have 75% of its packaging made from recycled or certified renewable materials. This move helps significantly shrink the environmental footprint associated with their products.

- Material Optimization: Fiskars prioritizes efficient material usage in product design and manufacturing to minimize waste generation.

- Renewable & Recyclable Packaging: The company is increasing its use of renewable and recyclable materials in packaging solutions.

- Plastic Reduction: Efforts are underway to reduce the overall use of plastic in packaging, with a focus on replacing virgin plastic with recycled content.

- Environmental Footprint Reduction: These initiatives collectively aim to lower the environmental impact of Fiskars' product lifecycle.

Fiskars is making significant environmental strides, with 81% of its purchased electricity in 2024 coming from certified renewable sources like hydro, wind, and bioenergy. The company is also committed to circular economy principles, aiming for the majority of its net sales from circular products by 2030, and has set ambitious targets to reduce greenhouse gas emissions across its value chain.

Furthermore, Fiskars is focused on sustainable packaging, with a goal to have 75% of its packaging made from recycled or certified renewable materials by the end of 2024, actively reducing plastic usage and prioritizing recycled alternatives.

| Environmental Factor | Fiskars' Commitment/Action | Data Point |

| Renewable Energy | Increased procurement of renewable electricity. | 81% of purchased electricity in 2024 from certified renewable sources. |

| Circular Economy | Focus on durable design, recycled/renewable materials, and services. | Goal: Majority of net sales from circular products/services by 2030. |

| Emissions Reduction | Setting science-based targets for Scope 1, 2, and 3 emissions. | Target: 60% reduction in Scope 1 & 2 by 2030 (vs. 2017); 30% reduction in Scope 3 by 2030 (vs. 2018). |

| Sustainable Packaging | Prioritizing renewable and recyclable materials, reducing plastic. | Target: 75% of packaging from recycled or certified renewable materials by end of 2024. |

PESTLE Analysis Data Sources

Our Fiskars PESTLE Analysis is built on a robust foundation of data from official government publications, reputable market research firms, and international economic organizations. We integrate insights from environmental policy updates, technological innovation reports, and socio-economic trend analyses to ensure comprehensive coverage.