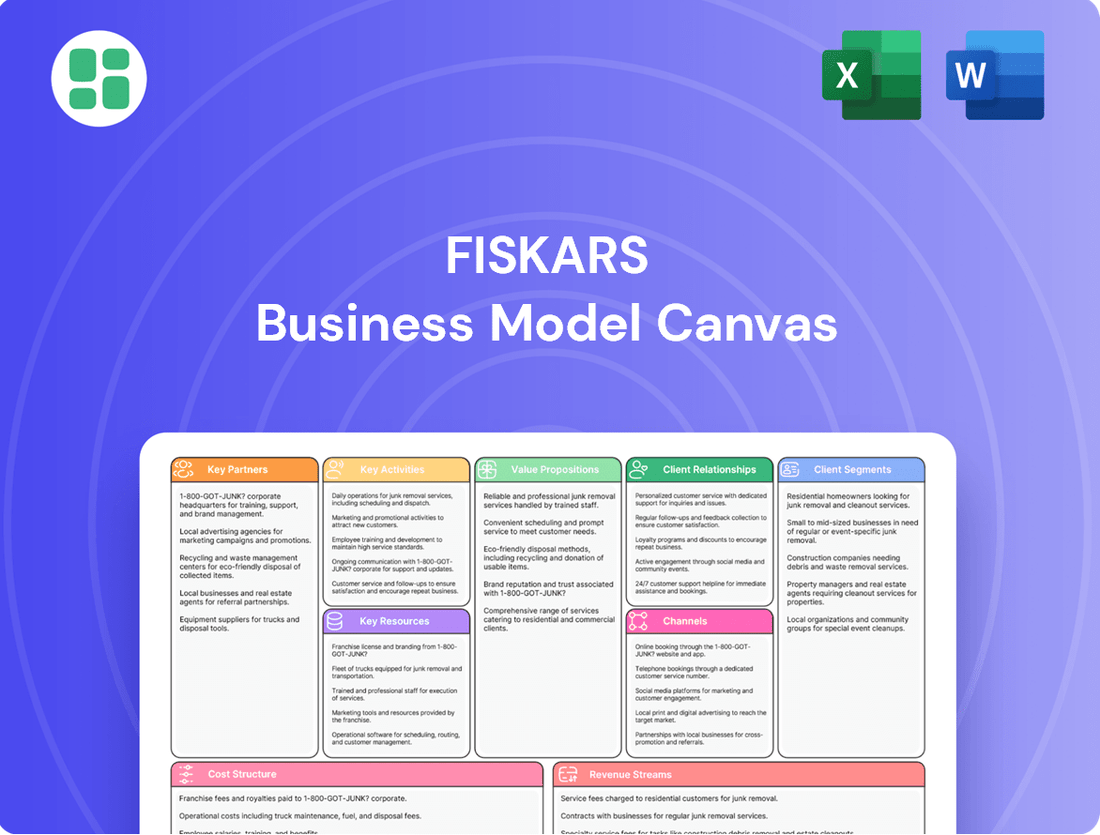

Fiskars Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fiskars Bundle

Unlock the strategic blueprint behind Fiskars's enduring success with our comprehensive Business Model Canvas. This detailed analysis reveals how Fiskars masterfully connects its value propositions to key customer segments, leveraging unique partnerships and resources. Discover the core activities and revenue streams that drive their market leadership.

Partnerships

Fiskars Group's success is deeply intertwined with its extensive network of global retailers and distributors, enabling access to consumers across more than 100 countries. These vital partnerships are the backbone of their market penetration strategy, ensuring efficient inventory management and the execution of localized sales approaches across their broad product range, which includes home, garden, and outdoor goods.

Maintaining robust relationships with major retail chains, encompassing both brick-and-mortar stores and e-commerce platforms, is paramount for guaranteeing product availability and enhancing brand visibility. For instance, in 2024, Fiskars continued to leverage key partnerships with large home improvement and garden centers, as well as major online marketplaces, to drive sales and reach a wider customer base.

Fiskars Group's digital expansion relies heavily on partnerships with e-commerce giants like Shopify. These collaborations are crucial for their direct-to-consumer (DTC) push, allowing for smooth online transactions and direct customer interaction. In 2024, Fiskars continued to enhance its online presence, leveraging these platforms to reach a broader audience.

Collaborations with technology providers are also key, enabling Fiskars to refine its digital infrastructure, elevate the online customer experience, and efficiently manage the e-commerce operations for its diverse brand portfolio. This strategic focus on digital channels is a significant driver of growth for the company, ensuring they remain competitive in the evolving retail landscape.

Fiskars Group relies on a diverse network of suppliers for raw materials, components, and finished goods, complementing its internal manufacturing capabilities. This extensive supplier base is crucial for maintaining product quality, managing costs effectively, and meeting the significant production volumes required for their broad product portfolio, which includes high-end luxury items.

In 2024, Fiskars continued to emphasize strategic sourcing and supplier diversification to build resilience against supply chain disruptions. The company actively manages these relationships to ensure competitive pricing and timely delivery, which are vital for their operational efficiency and ability to innovate across segments like gardening, cookware, and architecture.

Design Agencies and Innovators

Fiskars Group actively collaborates with external design agencies and individual innovators to infuse its product lines with cutting-edge aesthetics and functionality. These partnerships are crucial for maintaining a leadership position in product development, ensuring that brands like Iittala and Wedgwood consistently offer market-leading designs.

These collaborations provide Fiskars with access to diverse creative talent and specialized knowledge, enabling the company to explore novel materials, manufacturing techniques, and user experience concepts. For instance, in 2024, Fiskars continued to invest in research and development, with a significant portion of its budget allocated to external innovation projects aimed at enhancing product sustainability and user appeal.

- External Design Expertise: Partnerships with renowned design studios bring fresh perspectives, enhancing product innovation and brand differentiation.

- Specialized Innovation: Collaborations with individual innovators provide access to niche expertise in areas like material science or digital integration.

- Market Relevance: These alliances ensure Fiskars products remain at the forefront of consumer trends and design preferences, driving market share.

- Brand Enhancement: Working with leading designers strengthens the premium perception of brands such as Iittala and Wedgwood.

Sustainability Organizations and Certifiers

Fiskars Group's engagement with sustainability organizations and certifiers like EcoVadis and CDP is fundamental to validating their environmental and social commitments. These collaborations serve to bolster credibility and provide direction for their sustainability efforts, enabling clear communication about progress toward objectives such as reducing carbon emissions and advancing circular economy principles.

Achieving strong performance in these assessments, such as EcoVadis ratings, underscores Fiskars' commitment to responsible business practices. For instance, in 2023, Fiskars Group achieved a Gold rating from EcoVadis, placing them in the top 5% of companies assessed globally, highlighting their dedication to sustainability across their operations.

- EcoVadis Gold Rating: In 2023, Fiskars Group received a Gold rating from EcoVadis, signifying a high level of performance in sustainability and placing them among the top 5% of companies evaluated worldwide.

- CDP Disclosure: Fiskars actively participates in CDP (formerly the Carbon Disclosure Project) to report on its environmental impact, particularly concerning climate change and water security, demonstrating transparency and a commitment to improvement.

- Guidance for Initiatives: Partnerships with these organizations provide frameworks and benchmarks that guide Fiskars in developing and refining its sustainability strategies, ensuring alignment with global best practices.

- Enhanced Credibility: Certifications and ratings from recognized sustainability bodies enhance Fiskars' reputation and build trust with stakeholders, including customers, investors, and employees, by validating their responsible business conduct.

Fiskars Group's key partnerships extend to a global network of retailers and distributors, crucial for market access and sales. Collaborations with e-commerce platforms enhance their direct-to-consumer strategy, while partnerships with technology providers bolster digital operations. The company also relies on a robust supplier base for materials and components, ensuring quality and cost management.

In 2024, Fiskars continued to strengthen its relationships with major retail chains and online marketplaces to ensure product availability and brand visibility. Their digital expansion was further supported by collaborations with e-commerce technology providers, aiming to improve customer experience and operational efficiency.

Fiskars also partners with external design agencies and innovators to drive product development and maintain a competitive edge. These alliances provide access to specialized knowledge and new ideas, ensuring their product lines remain relevant and appealing to consumers.

Furthermore, Fiskars engages with sustainability organizations like EcoVadis and CDP to validate its environmental and social commitments. These partnerships offer guidance for sustainability initiatives and enhance the company's credibility in responsible business practices.

What is included in the product

A detailed breakdown of Fiskars' strategy, outlining key customer segments, value propositions, and channels to deliver innovative and sustainable tools and living products.

Fiskars' Business Model Canvas acts as a pain point reliver by providing a clear, one-page snapshot of their core components, enabling quick identification of strengths and areas for improvement.

It streamlines strategic planning by condensing complex company operations into a digestible format, saving valuable time and facilitating efficient internal discussions.

Activities

Fiskars Group's core activity revolves around relentless product design and innovation, aiming to craft items that are not only beautiful but also enduring and highly functional. This commitment fuels the development of new offerings and the improvement of existing products within their home, garden, and outdoor segments.

The company actively seeks to address everyday challenges and elevate user experiences through thoughtful design. For instance, in 2024, Fiskars continued to invest in research and development, with a significant portion of their innovation pipeline focused on sustainable materials and user-centric enhancements for their gardening tools.

This dedication to innovation is crucial for Fiskars to maintain its strong brand identity and leading position in competitive markets. Their focus on creating purposeful beauty ensures that products resonate with consumers seeking quality and longevity, a strategy that has historically driven sales and market share.

Fiskars Group's manufacturing and supply chain management is a core function, involving the oversight of a global network of owned factories and external suppliers. This intricate process focuses on streamlining production, upholding stringent quality standards, and ensuring the efficient procurement of necessary raw materials and components.

In 2024, Fiskars continued its strategic investments in upgrading its manufacturing facilities, aiming to boost efficiency and sustainability. For instance, the company has been centralizing its distribution operations to enhance logistical performance and reduce its environmental impact across its global supply chain.

Fiskars actively develops and strengthens its diverse brand portfolio, including well-known names like Fiskars, Gerber, Iittala, and Waterford. This involves significant marketing efforts to position these brands and utilize their heritage to resonate with consumers worldwide.

In 2024, Fiskars continued to invest strategically in marketing and demand creation. For instance, the company highlighted its focus on driving growth in its Business Area Vita through these initiatives, aiming to enhance brand visibility and consumer engagement across its product categories.

Sales and Distribution

Fiskars Group's sales and distribution strategy is a cornerstone of its operations, focusing on a robust multi-channel approach. This includes managing relationships with wholesale partners, expanding its own retail footprint, and significantly investing in e-commerce capabilities. The company's reach extends across more than 100 countries, necessitating efficient logistics and supply chain management to ensure timely product delivery.

A key strategic focus for Fiskars is the growth of its direct-to-consumer (DTC) channels, particularly its own e-commerce platforms. This direct engagement allows for better customer relationships and data capture. In 2023, Fiskars reported a notable increase in its e-commerce sales, demonstrating the success of these initiatives. For instance, the company saw a substantial uplift in online sales, contributing to its overall revenue growth.

- Multi-channel Network: Fiskars operates through wholesale, owned retail stores, and e-commerce, serving over 100 countries.

- DTC Focus: Strategic priority on expanding direct-to-consumer sales, especially through owned e-commerce platforms.

- Logistics Optimization: Continuous efforts to streamline logistics for efficient product distribution globally.

- E-commerce Growth: Significant investment and reported increases in online sales performance, contributing to overall business strategy.

Sustainability Initiatives and Reporting

Fiskars actively implements and reports on a range of sustainability initiatives, a crucial aspect of its business model. This includes concrete actions like reducing carbon emissions, fostering circular economy principles, and ensuring ethical practices throughout its supply chain. For instance, Fiskars aims to achieve carbon neutrality by 2030, a significant undertaking in its operational strategy.

- Carbon Emission Reduction: Setting science-based targets to lower greenhouse gas emissions across operations and value chains.

- Circular Economy: Promoting product longevity, repairability, and the use of recycled materials to minimize waste.

- Ethical Supply Chain: Conducting thorough assessments and audits to ensure fair labor practices and environmental responsibility from suppliers.

- Transparency and Reporting: Disclosing progress on sustainability goals and performance, often validated by external ratings such as EcoVadis.

The company's commitment is underscored by achievements like attaining the EcoVadis Platinum rating, placing it among the top 1% of assessed companies for sustainability performance. This focus on sustainability is not just about compliance but is integrated into product development and business strategy, driving long-term value.

Fiskars' key activities encompass relentless product design and innovation, focusing on functional and enduring items for home, garden, and outdoor use. They also manage a global manufacturing and supply chain network, ensuring quality and efficiency. Furthermore, Fiskars actively develops and markets its diverse brand portfolio, including Fiskars, Gerber, Iittala, and Waterford, through strategic marketing and demand creation efforts.

The company prioritizes a multi-channel sales and distribution strategy, leveraging wholesale partners, owned retail, and a growing e-commerce presence to reach over 100 countries. A significant focus is on expanding direct-to-consumer (DTC) channels, particularly its own e-commerce platforms, to foster direct customer relationships and gather valuable data. This strategy has shown success, with notable increases in e-commerce sales reported in 2023, contributing to overall revenue growth.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Product Design & Innovation | Crafting beautiful, enduring, and functional items for home, garden, and outdoor segments. | Continued R&D investment, focus on sustainable materials and user-centric enhancements for gardening tools. |

| Manufacturing & Supply Chain | Overseeing a global network of factories and suppliers, streamlining production, and ensuring quality. | Upgrading manufacturing facilities for efficiency and sustainability; centralizing distribution for improved logistics and reduced environmental impact. |

| Brand Development & Marketing | Strengthening and marketing a diverse brand portfolio to resonate with global consumers. | Investing in marketing and demand creation, particularly to drive growth in the Business Area Vita. |

| Sales & Distribution | Managing multi-channel sales (wholesale, retail, e-commerce) across over 100 countries. | Prioritizing DTC growth via e-commerce platforms; reported significant uplift in online sales in 2023. |

What You See Is What You Get

Business Model Canvas

The Fiskars Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This isn't a generic template or a simplified example; it's a direct representation of the comprehensive analysis that will be delivered to you. You can be assured that the structure, content, and formatting you see here are precisely what you'll gain access to, ready for your immediate use and customization.

Resources

Fiskars' strong brand portfolio, featuring names like Fiskars, Gerber, Iittala, Wedgwood, and Waterford, is a cornerstone of its business model. These globally recognized brands are not just names; they represent design excellence and consumer trust, allowing Fiskars to connect with a broad customer base across different markets and price points.

In 2024, the company continued to leverage this brand equity. For instance, Fiskars' focus on sustainable design, a key brand differentiator, resonated well with consumers. The company reported that its premium brands, such as Iittala and Waterford, contributed significantly to its revenue growth, demonstrating the enduring value and appeal of its curated brand collection.

Fiskars Group's intellectual property is a significant asset, with a portfolio that includes numerous patents and trademarks. Their iconic orange-handled scissors, a testament to their design prowess, are protected by these rights, ensuring brand recognition and market exclusivity. This strong IP foundation is critical for maintaining their competitive edge.

The company's deep internal design expertise fuels its innovation pipeline. Fiskars has a long-standing commitment to pioneering design, which is evident in its award-winning products. This heritage of creating functional and aesthetically pleasing items is a core differentiator that resonates with consumers and supports their premium brand positioning.

Fiskars leverages a robust global manufacturing and distribution network, comprising its own production facilities and strategically positioned distribution centers across Europe, Asia, and the Americas. This extensive physical infrastructure is crucial for maintaining efficient production processes, effective inventory control, and ensuring prompt product delivery to diverse global markets, thereby supporting the company's expansive reach and operational strength.

In 2023, Fiskars continued to invest in modernizing and optimizing these vital assets, a testament to their ongoing commitment to operational excellence. This network is fundamental to their ability to manage supply chains effectively and respond to market demands across different regions.

Skilled Workforce and Management Team

Fiskars' business model relies heavily on its approximately 7,000 employees spread across 29 countries. This diverse and skilled workforce is the backbone of operations, bringing expertise in critical areas like design, manufacturing, sales, marketing, and supply chain management. Their collective knowledge is essential for executing Fiskars' strategic vision and achieving strong performance.

The company’s success is also significantly influenced by its experienced management team. This leadership group provides the strategic direction and operational oversight necessary to navigate the complexities of the global market. Their ability to foster innovation and drive efficiency is paramount.

Fiskars recognizes the importance of its human capital and invests in employee development and engagement. These initiatives are crucial for retaining top talent and ensuring the workforce remains motivated and equipped with the skills needed to meet evolving business demands. For instance, in 2023, employee engagement surveys showed positive trends, indicating effective management of human resources.

- Global Workforce: Approximately 7,000 employees operating in 29 countries.

- Core Competencies: Expertise spans design, manufacturing, sales, marketing, and supply chain management.

- Strategic Importance: Human resources are key to executing company strategy and driving performance.

- Talent Retention: Investments in employee development and engagement are prioritized.

Financial Capital and Investor Confidence

Fiskars' robust financial capital is a cornerstone of its business model, providing the necessary fuel for growth and stability. This includes substantial cash reserves and access to credit facilities, which are vital for funding strategic initiatives and ensuring operational continuity. In 2023, Fiskars reported a strong financial position, with net sales of €3.5 billion and a healthy cash flow from operations.

Attracting and maintaining investor confidence is paramount. Fiskars' commitment to a consistent dividend policy, which has historically provided reliable returns to shareholders, plays a significant role in this. This financial strength not only supports current operations but also positions Fiskars to capitalize on future opportunities, such as market expansion or strategic acquisitions.

- Financial Strength: Fiskars maintains significant cash reserves and credit facilities to support its business operations and strategic investments.

- Investor Confidence: A consistent dividend tradition enhances investor appeal and reinforces confidence in the company's financial health.

- Strategic Funding: This financial capital enables Fiskars to fund innovation, expand its market presence, and navigate economic uncertainties.

- Acquisition Potential: The company's financial robustness provides the capacity to pursue strategic acquisitions that align with its growth objectives.

Fiskars' key resources are its powerful brand portfolio, including Fiskars, Gerber, Iittala, Wedgwood, and Waterford, which drive consumer trust and market access. The company's intellectual property, such as patents and trademarks, protects its innovations, like the iconic orange-handled scissors. Deep internal design expertise fuels a continuous stream of award-winning, functional products, solidifying its premium brand positioning.

The company's operational backbone consists of a robust global manufacturing and distribution network, ensuring efficient production and timely delivery worldwide. As of 2023, Fiskars operated numerous production facilities and distribution centers across key continents. This infrastructure is vital for managing complex supply chains and meeting diverse market demands effectively.

Fiskars' human capital, comprising approximately 7,000 employees in 29 countries, is a critical resource. This diverse workforce brings essential expertise in design, manufacturing, sales, marketing, and supply chain management. The experienced management team provides strategic direction, crucial for navigating global markets and fostering innovation.

Financially, Fiskars is well-positioned with substantial cash reserves and credit facilities, enabling strategic investments and operational stability. In 2023, the company reported net sales of €3.5 billion, underscoring its financial strength. A consistent dividend policy further bolsters investor confidence and supports future growth initiatives.

| Key Resource | Description | 2023/2024 Data Point |

| Brand Portfolio | Globally recognized brands (Fiskars, Gerber, Iittala, Wedgwood, Waterford) | Premium brands contributed significantly to revenue growth in 2024. |

| Intellectual Property | Patents and trademarks protecting design and innovation | Iconic orange-handled scissors protected by IP rights. |

| Design Expertise | Internal talent driving product innovation and award-winning designs | Long-standing commitment to pioneering design. |

| Manufacturing & Distribution | Global network of facilities and distribution centers | Continued investment in modernization and optimization in 2023. |

| Human Capital | Approximately 7,000 employees across 29 countries | Positive trends in employee engagement surveys in 2023. |

| Financial Capital | Cash reserves, credit facilities, strong net sales | Net sales of €3.5 billion in 2023; consistent dividend policy. |

Value Propositions

Fiskars Group consistently delivers products recognized for their exceptional design, user-friendly functionality, and comfortable ergonomic qualities. This focus elevates everyday activities, transforming them into more pleasant experiences for users.

The company's dedication to pioneering, user-centric design ensures their offerings are not only visually appealing but also highly practical and built to last. This approach is a key differentiator in today's competitive marketplace.

For instance, Fiskars is widely celebrated for its innovative solutions, such as its renowned orange-handled scissors, which have become an iconic example of combining superior aesthetics with practical utility and user comfort.

Fiskars offers products engineered for exceptional longevity, often designed with the intention of being passed down through families. This commitment to enduring quality directly counters disposable consumer habits, providing customers with dependable, long-term value. This resonates with the growing consumer preference for sustainable and premium goods, a trend evident in their heritage lines of luxury tableware and garden tools.

Fiskars Group presents a wide array of products for home, garden, and outdoor activities. This extensive selection, which includes everything from cooking utensils and gardening equipment to fine dining ware and camping supplies, offers customers a convenient way to meet various needs with reliable brands.

The company's portfolio is designed to appeal to different tastes and requirements, ensuring there's something for everyone. For example, in 2023, Fiskars Group's net sales reached €4.2 billion, showcasing the broad market reach of their diverse product categories.

Brand Heritage and Trust

Fiskars Group cultivates deep consumer trust by drawing on a rich brand heritage that stretches back centuries. Brands such as Fiskars, established in 1649, and Royal Copenhagen, with over 250 years of history, communicate a powerful sense of tradition and enduring quality. This legacy allows Fiskars to connect emotionally with customers who value authenticity and proven reliability in their purchases.

This long-standing reputation is a significant asset, fostering strong brand loyalty and a perception of inherent value. For instance, in 2024, Fiskars Group continued to emphasize its heritage in marketing campaigns, reinforcing the idea that its products are not just functional but also heirlooms. This approach helps differentiate its offerings in a crowded marketplace.

- Brand Heritage: Fiskars (founded 1649), Royal Copenhagen (over 250 years).

- Consumer Perception: Trust, reliability, established quality, authenticity.

- Impact: Fosters emotional connection and brand loyalty.

- Market Differentiation: Leverages history to stand out in competitive sectors.

Sustainability and Responsible Sourcing

Fiskars Group's commitment to sustainability and responsible sourcing is a core value proposition, resonating strongly with consumers who seek to align their purchases with their ethical and environmental concerns. This dedication is not just a statement; it's embedded in their product development and supply chain management, aiming to minimize ecological footprints and uphold fair labor practices.

This focus on responsible business operations directly attracts a growing segment of the market that actively seeks out brands demonstrating genuine environmental and social stewardship. For these consumers, a company's sustainability credentials are a significant factor in their purchasing decisions, often outweighing other considerations.

Fiskars Group's strong performance, evidenced by its high EcoVadis rating, serves as tangible proof of this commitment. In 2023, Fiskars was recognized with a Gold medal by EcoVadis, placing it among the top 5% of companies assessed globally for sustainability performance. This rating validates their efforts in areas such as environmental management, labor and human rights, ethics, and sustainable procurement.

- Environmental Stewardship: Fiskars actively works to reduce its environmental impact across its value chain, from material selection to product end-of-life.

- Ethical Sourcing: The company prioritizes responsible sourcing of raw materials, ensuring fair treatment of workers and adherence to ethical standards throughout its supply network.

- Consumer Appeal: This dedication appeals to a significant and growing consumer base that values sustainability and seeks to support companies with strong environmental and social governance (ESG) credentials.

- EcoVadis Recognition: Fiskars' Gold medal from EcoVadis in 2023 highlights its leading position in corporate sustainability, reinforcing its value proposition to conscious consumers and stakeholders.

Fiskars Group offers a compelling blend of superior design and user-centric functionality, making everyday tasks more enjoyable. Their products are crafted for longevity, often becoming cherished items passed down through generations, directly appealing to consumers seeking quality over disposability. This commitment to enduring value is exemplified by their heritage lines, which continue to be popular.

The company's extensive product portfolio caters to a wide range of home, garden, and outdoor needs, providing customers with a convenient one-stop solution. With net sales reaching €4.2 billion in 2023, Fiskars demonstrates a broad market appeal across its diverse offerings.

Fiskars leverages a deep brand heritage, with foundational brands like Fiskars (1649) and Royal Copenhagen (over 250 years), to build significant consumer trust and loyalty. This history fosters an emotional connection, positioning their products as authentic and reliable, a key differentiator in today's market.

Sustainability is a cornerstone of Fiskars' value proposition, attracting environmentally conscious consumers. Their commitment to responsible operations is validated by a Gold medal from EcoVadis in 2023, placing them in the top 5% of global companies for sustainability performance.

| Value Proposition | Description | Key Brands/Examples | Supporting Data (2023/2024) |

|---|---|---|---|

| Superior Design & Functionality | Products known for exceptional design, ease of use, and ergonomic comfort. | Fiskars orange-handled scissors, kitchenware, gardening tools. | Focus on user-centric innovation. |

| Durability & Longevity | Items engineered for lasting use, often intended as heirlooms. | Heritage lines of tableware and garden tools. | Counters disposable consumerism, providing long-term value. |

| Extensive Product Range | Comprehensive selection for home, garden, and outdoor activities. | Cooking utensils, dining ware, camping supplies, gardening equipment. | Net sales of €4.2 billion in 2023 indicate broad market reach. |

| Brand Heritage & Trust | Cultivating trust through centuries-old brands and a legacy of quality. | Fiskars (est. 1649), Royal Copenhagen (250+ years). | Strong brand loyalty and perceived authenticity. |

| Commitment to Sustainability | Focus on environmental stewardship and ethical sourcing. | Eco-friendly product development, responsible supply chain. | Gold medal from EcoVadis in 2023 (top 5% globally). |

Customer Relationships

Fiskars Group cultivates direct connections with its customers via its branded retail locations and online stores. This approach enables tailored customer journeys, facilitates instant feedback, and strengthens brand loyalty by fostering dedicated communities.

Fiskars Group prioritizes robust relationships with its major wholesale partners, recognizing them as crucial for widespread market penetration. This involves a strategic focus on collaborating with leading retailers, a strategy they term 'winning with the winners'.

By investing in these key partnerships, Fiskars aims to secure prime product placement and dedicated promotional activities. For instance, in 2023, Fiskars reported that a significant portion of its net sales were generated through wholesale channels, underscoring the importance of these relationships for their overall revenue stream.

Furthermore, efficient supply chain integration with these partners is a cornerstone of the strategy, ensuring timely delivery and inventory management. This collaborative approach benefits both Fiskars by maximizing sales opportunities and retailers by providing reliable access to popular products.

Fiskars actively builds brand communities, fostering a sense of belonging among users of its iconic brands like Iittala and Fiskars tools. This strategy encourages shared passion and cultivates deep loyalty.

Engagement happens through vibrant social media channels, exclusive events, and compelling content that highlights the design, craftsmanship, and aspirational lifestyle associated with their products. For example, in 2023, Fiskars reported a significant increase in social media engagement across its key brands, with user-generated content contributing to a 25% rise in brand mentions.

These initiatives are designed to forge stronger emotional connections with customers, transforming them into enthusiastic brand advocates who actively promote Fiskars' offerings. This community-driven approach enhances brand equity and drives organic growth.

Customer Service and Support

Fiskars prioritizes responsive and effective customer service to address inquiries and resolve issues, fostering long-term satisfaction. This commitment extends to managing product warranties, offering guidance on product use and care, and ensuring a positive experience across all sales channels. In 2024, Fiskars reported a significant increase in customer engagement through its digital support platforms, aiming to enhance brand perception.

- Customer Support Channels: Fiskars offers support via phone, email, and online chat, with a focus on quick response times.

- Warranty Management: Streamlined processes for handling product warranties ensure customer trust and loyalty.

- Product Guidance: Expert advice on product usage and maintenance helps customers maximize their Fiskars experience.

- Post-Purchase Experience: A dedicated focus on the entire customer journey, from purchase to long-term use, reinforces brand value.

Digital Interaction and Personalization

Fiskars Group is enhancing customer relationships by leveraging digital tools and data for personalized interactions. This includes targeted marketing campaigns and tailored product recommendations, aiming to provide relevant content and services that enrich the online shopping journey. For instance, in 2024, many consumer brands are investing heavily in AI-driven personalization engines to understand individual customer preferences, leading to higher engagement rates.

Consolidating various brands onto unified e-commerce platforms, such as Shopify, is a key strategy to facilitate this personalized approach. This consolidation allows for a more cohesive customer experience and streamlines data collection, enabling deeper insights into consumer behavior. By 2024, a significant number of retail companies reported increased conversion rates after migrating to integrated e-commerce solutions.

- Digital Personalization: Utilizing data analytics and AI to tailor marketing messages and product suggestions to individual customer needs.

- E-commerce Consolidation: Streamlining brand presence onto single platforms like Shopify to create a unified and efficient customer interface.

- Enhanced Online Experience: Offering relevant content and services to improve customer satisfaction and build stronger brand loyalty.

- Data-Driven Insights: Collecting and analyzing customer data to better understand preferences and inform future engagement strategies.

Fiskars Group actively nurtures its customer relationships through a multi-faceted approach, blending direct engagement with strategic wholesale partnerships. This commitment is evident in their investment in community building and digital personalization, aiming to foster loyalty and enhance the overall customer experience. By 2024, Fiskars continued to emphasize data-driven strategies to better understand and cater to individual customer needs.

| Relationship Aspect | Description | 2023/2024 Focus |

|---|---|---|

| Direct Engagement | Branded retail and online stores for tailored experiences and feedback. | Strengthening online community and personalized digital interactions. |

| Wholesale Partnerships | Collaborating with key retailers for market penetration. | Securing prime placement and dedicated promotions with leading partners. |

| Brand Communities | Fostering loyalty through social media, events, and content. | Increasing user-generated content and brand mentions across platforms. |

| Customer Service | Responsive support for inquiries, warranties, and product guidance. | Enhancing digital support platforms for increased customer engagement. |

Channels

Wholesale retailers are the backbone of Fiskars Group's sales strategy, making up almost 70% of their total revenue. This includes partnerships with major department stores, home improvement giants, and niche specialty shops.

These collaborations are crucial because they grant Fiskars access to a vast physical footprint and a wide customer audience. Retailers' existing distribution systems and high foot traffic are key advantages that Fiskars leverages effectively.

Fiskars Group leverages its approximately 500 own retail stores worldwide as a crucial direct-to-consumer (DTC) channel. These locations, particularly prominent in the Asia-Pacific region, are designed to offer an immersive brand experience, showcasing product demonstrations and fostering direct engagement with customers, especially for their high-end and luxury offerings.

This retail footprint is a strategic imperative for Fiskars, acting as a significant growth driver by enabling them to control the customer journey and gather valuable direct feedback. In 2024, Fiskars continued to invest in optimizing this channel, focusing on enhancing the in-store experience and integrating it with their online presence to create a seamless omnichannel strategy.

E-commerce is a crucial and expanding direct-to-consumer avenue for Fiskars Group, encompassing both their own brand websites and significant partnerships with major online retailers.

This digital presence offers unparalleled global reach and continuous availability, allowing for direct engagement with today's digitally connected consumers. In 2023, Fiskars Group reported a notable increase in their e-commerce sales, reflecting a strategic focus on this channel.

The company is actively investing in and streamlining its e-commerce infrastructure to enhance customer experience and operational efficiency, aiming to capture a larger share of the growing online market.

Direct Sales (B2B and Hospitality)

Fiskars Group leverages direct sales channels to serve business-to-business (B2B) and hospitality clients. This approach allows them to supply commercial customers who integrate Fiskars products into their operations, such as equipping hotels, restaurants, or professional workspaces. This strategy diversifies revenue and strengthens market presence by reaching sectors beyond typical consumer retail.

In 2024, Fiskars continued to focus on these B2B relationships, recognizing their importance for volume and brand visibility in professional settings. For instance, the hospitality sector often requires durable, high-quality kitchenware and tools, areas where Fiskars excels. This direct engagement bypasses intermediaries, potentially improving margins and allowing for tailored product offerings to meet specific commercial needs.

- B2B Engagement: Supplying professional kitchens, corporate gifting, and facility management with durable goods.

- Hospitality Focus: Providing cutlery, cookware, and gardening tools to hotels, restaurants, and resorts.

- Strategic Importance: Expanding market reach and securing bulk orders from commercial entities.

Brand Showrooms and Flagship Stores

Fiskars Group leverages brand showrooms and flagship stores in prime urban locations for its premium and luxury offerings. These curated spaces act as experiential hubs, immersing visitors in the brand's narrative, design ethos, and comprehensive product portfolio. This strategy significantly elevates brand prestige and draws in a discerning clientele.

For instance, in 2024, Fiskars Group continued to invest in its flagship retail presence, aiming to create memorable brand interactions. These physical touchpoints are crucial for conveying the quality and craftsmanship associated with brands like Fiskars and Wedgwood. The company’s focus on experiential retail aims to differentiate its premium products in a competitive market.

- Experiential Marketing: Flagship stores offer immersive brand experiences, showcasing heritage and design.

- Brand Prestige: These premium channels enhance the perceived value and exclusivity of Fiskars' luxury brands.

- Customer Engagement: They provide a direct avenue for connecting with discerning customers and fostering brand loyalty.

- Product Showcase: Full product ranges are displayed in an aesthetically pleasing and informative environment.

Fiskars Group utilizes a multi-channel approach, with wholesale retailers forming the core of its sales, accounting for nearly 70% of revenue. This is complemented by a growing e-commerce presence and a network of approximately 500 owned retail stores globally, which facilitate direct customer engagement and brand experience.

The company also actively pursues direct sales to business-to-business clients, particularly in the hospitality sector, and leverages premium brand showrooms for its luxury offerings. This diverse channel strategy aims to maximize market reach, enhance brand perception, and drive sales across different customer segments.

| Channel | Description | 2024 Focus/Data |

|---|---|---|

| Wholesale Retailers | Partnerships with department stores, home improvement, and specialty shops. | Backbone of sales, accessing broad customer base and physical presence. |

| Owned Retail Stores (DTC) | Approximately 500 stores worldwide, offering immersive brand experiences. | Investment in optimizing in-store experience and omnichannel integration. |

| E-commerce (DTC) | Own brand websites and partnerships with major online retailers. | Continued investment in infrastructure to enhance customer experience and operational efficiency; notable sales increase in 2023. |

| Direct Sales (B2B) | Supplying commercial customers like hotels, restaurants, and professional workspaces. | Focus on strengthening relationships for volume and brand visibility in professional settings. |

| Brand Showrooms/Flagship Stores | Experiential hubs for premium and luxury offerings in prime urban locations. | Investment in creating memorable brand interactions and differentiating premium products. |

Customer Segments

Home and Garden Enthusiasts are a core customer segment for Fiskars, comprising individuals deeply invested in their living spaces and outdoor environments. These customers actively seek out products that offer superior performance, long-lasting durability, and thoughtful ergonomic design, reflecting their passion for gardening, home improvement, and enhancing their outdoor lifestyles.

Fiskars directly addresses this demographic by offering a wide array of tools and products designed for both functionality and user comfort. The brand's commitment to innovation resonates with these consumers, who appreciate advancements that make their projects more efficient and enjoyable. For instance, in 2024, the gardening tools market continued to see strong demand, with consumers prioritizing sustainable and well-crafted items.

Design-Conscious Consumers are individuals who prioritize beauty, enduring quality, and meticulous craftsmanship in their home goods. They see their tableware, glassware, and decorative items not just as functional objects, but as extensions of their personal aesthetic and statements of refined taste. This segment actively seeks out premium and luxury pieces that elevate their living environments.

These consumers are often willing to pay a premium for products that embody timeless design principles and superior artistry. For instance, brands like Iittala, known for its Scandinavian minimalist aesthetic, and Wedgwood, with its heritage of fine bone china, directly appeal to this discerning market. In 2024, the global luxury home decor market was valued at approximately $284 billion, with a significant portion attributed to consumers seeking high-design, quality pieces.

Professional users and serious hobbyists are a key segment for Fiskars, particularly those engaged in crafts, cooking, and specialized outdoor activities. These individuals demand tools that offer exceptional reliability and high performance to support their passions. For instance, in 2024, the global market for gardening tools, a significant area for Fiskars, was valued at approximately $16.5 billion, indicating a strong demand for quality equipment.

Precision, durability, and the availability of specialized features are paramount for this customer base. They are willing to invest in tools that enhance their craft or outdoor pursuits, expecting them to withstand rigorous use and deliver consistent results. This is evident in the continued growth of the premium cookware market, which saw a global valuation of over $20 billion in 2024, reflecting consumer preference for high-quality, specialized kitchenware.

Fiskars effectively targets this segment through its distinct brands. The Gerber brand, for example, is well-established in the outdoor gear market, appealing to those who need robust and dependable equipment for camping, survival, and other demanding activities. Similarly, specific Fiskars tools designed for crafting, such as precision cutting tools and ergonomic implements, cater directly to the needs of dedicated crafters seeking superior performance and control.

Gift Givers and Collectors

Gift givers and collectors represent a crucial customer segment for Fiskars, particularly for its premium brands like Royal Copenhagen and Moomin Arabia. These consumers seek items that convey thoughtfulness and exclusivity for special occasions. For instance, Royal Copenhagen's heritage tableware, known for its intricate hand-painted designs, is often purchased as wedding gifts or anniversary presents, with sales in the luxury tableware market showing steady growth.

This segment values craftsmanship, brand heritage, and the potential for items to become cherished collectibles. Limited-edition releases, such as special Moomin Arabia mugs or unique art glass pieces, tap directly into the collector's desire for rarity and distinctiveness. In 2024, the global collectibles market, encompassing art, antiques, and memorabilia, continued to demonstrate resilience, indicating strong demand for unique and heritage-backed products.

- Gift Occasions: Purchases often tied to holidays, birthdays, weddings, and anniversaries.

- Brand Loyalty: High value placed on heritage brands like Royal Copenhagen and Moomin Arabia.

- Collector Appeal: Interest in limited editions, unique designs, and items with artistic merit.

- Market Value: The global market for luxury goods and collectibles shows consistent consumer spending.

Wholesale Businesses and Commercial Clients

Fiskars Group's wholesale and commercial clients are a cornerstone of its distribution strategy. This segment encompasses large retail chains, prominent e-commerce players, and various commercial enterprises that procure Fiskars products for either resale to end consumers or for direct operational use. For instance, in 2024, Fiskars continued to strengthen its partnerships with major home improvement retailers and garden centers across North America and Europe, ensuring broad availability of its gardening tools and kitchenware.

These business clients prioritize a dependable supply chain, robust brand equity, and attractive pricing structures. They rely on Fiskars to provide high-quality products that resonate with their own customer bases or fulfill specific operational requirements, such as outfitting hospitality venues with durable cookware. In 2023, Fiskars reported that its Wholesale segment accounted for a significant portion of its net sales, underscoring the importance of these relationships in driving overall revenue and market penetration.

- Key Retail Partners: Major home improvement stores, department stores, and online marketplaces form a significant part of this segment.

- Commercial End-Users: Businesses in the hospitality, landscaping, and professional services sectors utilize Fiskars products in their operations.

- Value Proposition: Clients seek consistent product availability, strong brand recognition, and competitive wholesale pricing.

- 2024 Focus: Continued expansion of distribution networks and enhanced collaboration with key e-commerce platforms to meet evolving consumer purchasing habits.

Fiskars' customer segments are diverse, ranging from passionate home and garden enthusiasts who value performance and durability to design-conscious consumers seeking aesthetic appeal and quality craftsmanship. The company also caters to professional users and serious hobbyists who demand reliability and specialized features, as well as gift givers and collectors drawn to heritage brands and unique items. Additionally, wholesale and commercial clients, including major retailers and businesses, form a crucial segment, relying on Fiskars for consistent supply and strong brand equity.

These segments are united by a demand for quality, functionality, and often, a connection to brand heritage or design. For example, the global market for home and garden products saw continued growth in 2024, with consumers increasingly investing in durable and well-designed items. Similarly, the luxury goods market, which includes many of Fiskars' premium offerings, remained robust, indicating a willingness to pay for perceived value and brand prestige.

The company's strategy involves tailoring its product offerings and marketing efforts to resonate with the specific needs and preferences of each segment. This approach is supported by data showing strong consumer spending in categories where Fiskars has a significant presence, such as gardening tools and kitchenware. In 2023, Fiskars' wholesale segment alone contributed substantially to its net sales, highlighting the importance of these business relationships.

| Customer Segment | Key Characteristics | Fiskars' Approach | 2024 Market Insight |

|---|---|---|---|

| Home & Garden Enthusiasts | Value performance, durability, ergonomics | Wide array of functional tools | Strong demand for sustainable, well-crafted items |

| Design-Conscious Consumers | Prioritize beauty, quality, craftsmanship | Premium brands with timeless design | Global luxury home decor market valued ~$284 billion |

| Professional Users & Hobbyists | Demand reliability, high performance, specialized features | Specialized tools, robust brands (e.g., Gerber) | Premium cookware market valued >$20 billion |

| Gift Givers & Collectors | Seek exclusivity, heritage, artistic merit | Limited editions, heritage brands (e.g., Royal Copenhagen) | Resilient collectibles market |

| Wholesale & Commercial Clients | Require dependable supply, brand equity, competitive pricing | Strengthened retail partnerships, e-commerce focus | Wholesale segment significant revenue driver in 2023 |

Cost Structure

The Cost of Goods Sold (COGS) is a fundamental element for Fiskars, encompassing direct materials, manufacturing labor, and factory overheads for their wide array of consumer products. For instance, in 2023, Fiskars reported a COGS of €1,343.4 million, highlighting the significant investment in producing their goods.

Key drivers of COGS include the volatile prices of raw materials like steel and plastic, energy costs essential for operations such as their glass factories, and labor expenses. Managing these fluctuations is paramount to maintaining profitability.

Fiskars actively pursues strategies to optimize sourcing and enhance production efficiency. These efforts are critical for effectively controlling and reducing COGS, thereby improving overall financial performance.

Fiskars dedicates substantial resources to marketing and sales, encompassing advertising, brand building, and sales team operations to champion its diverse brands and worldwide presence. This involves digital campaigns, in-store activities, and a multi-channel brand strategy.

For instance, in 2023, Fiskars Group's marketing and sales expenses amounted to €276.5 million, representing a notable portion of their overall operational costs, underscoring their commitment to driving consumer engagement and market penetration.

The company strategically allocates marketing investments, with a particular emphasis noted for the Vita business area, aiming to enhance brand visibility and consumer connection within specific market segments.

Fiskars' commitment to innovation is reflected in its significant Research and Development (R&D) expenditures. These costs encompass everything from initial product design and engineering to the meticulous prototyping and rigorous testing of new materials and cutting-edge technologies. This investment is crucial for developing novel products and enhancing existing ones, ensuring Fiskars maintains its competitive edge in the market.

In 2024, Fiskars continued to prioritize R&D as a key driver of growth. While specific figures for R&D as a percentage of revenue can fluctuate, the company has historically allocated substantial resources to this area. For instance, in prior years, R&D spending has been a notable component of their operational costs, supporting their strategy of offering innovative and high-quality solutions to consumers.

Distribution and Logistics Costs

Fiskars incurs significant expenses related to warehousing, global transportation, and the intricate management of its worldwide distribution network. These costs encompass the operation of numerous distribution centers, the considerable freight charges for moving products across continents, and the ongoing effort to efficiently manage inventory levels across diverse geographical markets.

In 2024, optimizing these substantial distribution and logistics costs remains a key focus for Fiskars. Initiatives aimed at centralizing distribution operations are actively being pursued to streamline processes and reduce overall expenditure.

- Warehousing Expenses: Costs associated with maintaining and operating facilities for product storage.

- Transportation Fees: Charges for shipping products via various modes of transport globally.

- Inventory Management: Expenses incurred in tracking, storing, and controlling stock levels across different regions.

Administrative and Overhead Expenses

Fiskars' administrative and overhead expenses encompass essential corporate functions like executive compensation, finance, human resources, legal services, and IT infrastructure. These costs are fundamental to operating a global enterprise with diverse brands and business segments, ensuring smooth day-to-day operations and strategic oversight.

The company's commitment to streamlining its organizational structure and enhancing operational efficiency is a key strategy to manage and potentially reduce these administrative overheads. For instance, in 2023, Fiskars reported that its administrative expenses represented a significant portion of its overall operating costs, reflecting the complexities of managing its international footprint and diverse product portfolio.

- G&A Costs: Cover executive salaries, finance, HR, legal, and IT infrastructure.

- Global Operations: Necessary for managing multiple brands and business areas worldwide.

- Efficiency Drive: Efforts to simplify structure aim to reduce these overheads.

- 2023 Impact: Administrative expenses were a notable component of operating costs, underscoring the need for ongoing efficiency initiatives.

Fiskars' cost structure is significantly influenced by its Cost of Goods Sold (COGS), which in 2023 stood at €1,343.4 million, reflecting substantial investments in raw materials, manufacturing labor, and factory overheads. The company actively manages volatile input prices and production efficiencies to maintain profitability.

Marketing and sales expenses, totaling €276.5 million in 2023, are crucial for brand penetration and consumer engagement across Fiskars' diverse portfolio. Research and Development (R&D) is also a key cost area, vital for innovation and maintaining a competitive edge, with continued prioritization in 2024 to drive growth through new product development.

Logistics and distribution costs, encompassing warehousing and global transportation, are substantial operational expenditures that Fiskars aims to optimize through initiatives like centralizing distribution. General and administrative (G&A) expenses, covering corporate functions, were also a notable cost in 2023, prompting ongoing efforts to enhance organizational efficiency.

| Cost Category | 2023 (EUR Million) | Key Drivers | Strategic Focus |

| Cost of Goods Sold (COGS) | 1,343.4 | Raw material prices, energy, labor | Sourcing optimization, production efficiency |

| Marketing & Sales | 276.5 | Advertising, brand building, sales operations | Digital campaigns, in-store activities |

| Research & Development (R&D) | (Not specified as a single figure for 2023, but a priority) | Product design, engineering, testing | Innovation, new product development |

| Distribution & Logistics | (Not specified as a single figure for 2023, but substantial) | Warehousing, transportation, inventory management | Centralization, process streamlining |

| General & Administrative (G&A) | (Not specified as a single figure for 2023, but notable) | Executive compensation, finance, HR, IT | Organizational streamlining, efficiency enhancement |

Revenue Streams

Wholesale product sales represent the bedrock of Fiskars Group's revenue, forming the largest segment by a significant margin. This channel involves supplying their extensive range of products, from high-quality kitchenware and durable garden tools to specialized outdoor equipment and elegant tableware, to major retail chains and distributors worldwide.

In 2023, this wholesale segment was instrumental in generating the lion's share of Fiskars' income, accounting for approximately 70% of their total sales. This reliance on indirect sales channels underscores the importance of strong relationships with key retail partners and efficient supply chain management to reach a broad consumer base.

Fiskars Group generates revenue from selling products directly to consumers through its approximately 500 owned retail stores globally. This direct-to-consumer channel is a key part of their strategy, allowing them to control the customer experience and brand presentation.

These stores are particularly concentrated in the Asia-Pacific region, serving as a vital sales avenue for all of Fiskars' brands. In 2023, Fiskars reported a net sales of €4,280.5 million, with their retail presence playing a substantial role in achieving this figure, especially for higher-end product lines.

Fiskars is increasingly seeing revenue come from customers buying directly through its own websites. This direct-to-consumer approach, often called D2C, is a big deal for the company. It means they can connect with shoppers all over the world without relying on other stores.

This e-commerce channel is important because it usually means Fiskars keeps more of the money from each sale, leading to better profit margins. The company is putting a lot of effort and money into growing these online sales, seeing it as a key area for future success. In 2023, Fiskars reported a significant increase in its e-commerce sales, highlighting the channel's growing importance.

Licensing and Brand Partnerships

Fiskars Group can generate revenue through licensing agreements, allowing other companies to use its well-recognized brand names and product designs. This approach capitalizes on Fiskars' strong brand equity, such as its iconic orange-handled scissors, without requiring direct manufacturing or distribution by Fiskars itself.

While specific figures for licensing are not always granularly reported, the overall strength of Fiskars' brands, which include names like Fiskars, Gerber, and Wedgwood, underpins the potential for lucrative partnerships. For example, in 2023, Fiskars Group reported net sales of €4.2 billion, demonstrating the substantial market presence and brand value that can be leveraged.

- Brand Licensing: Agreements where third parties pay to use Fiskars' brand names on complementary products, expanding reach and generating royalty income.

- Design Licensing: Opportunities for companies to license specific Fiskars product designs, particularly for items in home decor or gardening, ensuring brand consistency and quality.

- Partnership Leverage: Strategic collaborations that utilize the established trust and recognition of Fiskars brands to co-create or distribute new product lines, sharing in the revenue generated.

After-Sales Services and Accessories

Fiskars generates revenue beyond the initial purchase through its After-Sales Services and Accessories segment. This includes the sale of spare parts, replacement components, and a variety of complementary accessories designed to enhance the functionality and lifespan of their core products, such as gardening tools and kitchenware.

This strategy not only extends the product lifecycle, fostering greater customer satisfaction and loyalty, but also cultivates a valuable stream of recurring income. For instance, in 2023, Fiskars reported that its Consumer business, which heavily relies on these after-sales revenues, demonstrated robust performance, contributing significantly to the company's overall financial health.

- Accessory Sales: Offering specialized attachments and enhancements for existing tools.

- Spare Parts: Providing replacement components to ensure product longevity and repairability.

- Maintenance Services: Potential for repair or upkeep offerings for select durable goods.

- Extended Product Value: Increasing customer lifetime value and brand affinity through ongoing support.

Fiskars Group's revenue is primarily driven by wholesale product sales, which accounted for approximately 70% of their total sales in 2023, showcasing its central role in reaching a broad consumer base through retail partners.

Direct-to-consumer (D2C) channels, including around 500 owned retail stores globally and a growing e-commerce presence, are vital for controlling brand experience and improving profit margins, as seen in the significant increase in e-commerce sales in 2023.

Beyond initial sales, Fiskars leverages its strong brand equity through licensing agreements and generates recurring revenue from after-sales services and accessories, such as spare parts and complementary items, which enhance product value and customer loyalty.

| Revenue Stream | Description | 2023 Significance (Approx.) |

|---|---|---|

| Wholesale Product Sales | Selling products to retailers and distributors worldwide. | ~70% of total sales |

| Direct-to-Consumer (Retail Stores) | Sales through Fiskars' owned retail outlets. | Substantial contributor to net sales of €4,280.5 million |

| Direct-to-Consumer (E-commerce) | Online sales directly to consumers. | Growing importance, significant increase in sales |

| Brand/Design Licensing | Allowing third parties to use Fiskars' brands and designs. | Leverages strong brand equity |

| After-Sales Services & Accessories | Sales of spare parts, accessories, and maintenance. | Contributes to recurring income and customer loyalty |

Business Model Canvas Data Sources

The Fiskars Business Model Canvas is built upon a foundation of comprehensive market research, detailed financial disclosures, and internal operational data. These diverse sources provide the necessary insights to accurately define customer segments, value propositions, and revenue streams.