Fiskars Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fiskars Bundle

Fiskars masterfully leverages its product innovation, competitive pricing, strategic distribution, and impactful promotions to dominate the gardening and home goods market. Understand how these elements coalesce to create a powerful brand presence.

Dive deeper into Fiskars' winning marketing formula. Explore the nuances of their product design, pricing strategies, channel management, and promotional campaigns that drive customer loyalty and market share.

Unlock the secrets behind Fiskars' success with a comprehensive 4Ps Marketing Mix analysis. This ready-to-use report provides actionable insights into their product, price, place, and promotion strategies, perfect for business professionals and students alike.

Product

Fiskars Group's diverse portfolio for home, garden, and outdoor living is a cornerstone of their marketing strategy. This range includes everything from essential kitchen knives and cookware to specialized gardening tools and durable outdoor equipment. Their commitment to design excellence ensures these products are not only functional but also aesthetically pleasing, appealing to a broad customer base.

The company’s product breadth allows them to tap into multiple consumer needs, from everyday household tasks to recreational activities. For instance, in 2024, the gardening segment continued to see strong demand driven by increased interest in home improvement and sustainable living practices. This diverse offering helps Fiskars maintain resilience across economic cycles by not being overly reliant on a single market segment.

Fiskars Group’s product offering is powerfully supported by its strong brand portfolio, featuring names like Fiskars, Gerber, Iittala, Waterford, and Wedgwood. This collection of well-established brands allows the company to target diverse consumer preferences, from practical gardening tools to high-end tableware, each carrying a reputation for quality and design. This 'brands first' strategy is central to their market approach.

Fiskars Group places a strong emphasis on innovative and ergonomic design, alongside exceptional quality and durability. This focus ensures their products are not only aesthetically pleasing but also built to withstand the test of time, offering enduring value to consumers. Their commitment is reflected in their purpose: Pioneering design to make the everyday extraordinary.

Products from Fiskars undergo stringent testing to guarantee optimal performance and longevity. This dedication to quality is often underscored by the provision of extended warranties, providing customers with added confidence in their purchases. For instance, in 2024, Fiskars continued to invest heavily in product development, with reports indicating a significant portion of their R&D budget allocated to enhancing material science and ergonomic features.

Sustainability in Development

Sustainability is deeply woven into Fiskars Group's product development, emphasizing responsible design and material choices. They actively work to counter a disposable consumer culture by creating long-lasting products and incorporating recycled or renewable materials, with a goal to minimize waste throughout their operations.

Fiskars Group's commitment to sustainability is evident in their tangible achievements and ratings. For instance, in 2023, Fiskars Group was recognized by CDP for its climate action, achieving a B rating, and they have set ambitious targets to reduce their greenhouse gas emissions, aiming for a 50% reduction in Scope 1 and 2 emissions by 2030 compared to a 2020 baseline.

Their product strategy prioritizes:

- Durability: Designing products built to last, reducing the need for frequent replacements.

- Material Innovation: Increasing the use of recycled content, aiming for 40% recycled or bio-based materials in their products by 2030.

- Circular Economy Principles: Exploring ways to extend product lifecycles and minimize end-of-life waste.

- Climate Action: Actively working to reduce their carbon footprint across their value chain.

Innovation and Problem-Solving

Fiskars demonstrates a strong commitment to innovation by consistently investing in research and development. This focus allows them to introduce new features and functionalities that directly address consumer needs and challenges. For instance, their smart gardening tools incorporate advanced technology for enhanced usability.

The company's strategy extends to expanding its product categories to create a comprehensive ecosystem that fulfills a wider range of consumer desires. This approach aims to surround the consumer with solutions, moving beyond single products to offer integrated experiences. Their ergonomic gardening tools are a prime example, designed for comfort and efficiency.

Fiskars' dedication to problem-solving is evident in their product development pipeline. In 2023, the company reported a significant portion of its net sales coming from new products launched within the last three years, highlighting their ongoing innovation efforts. This continuous improvement cycle ensures their offerings remain relevant and valuable to consumers seeking practical solutions for everyday tasks.

Key aspects of Fiskars' innovation and problem-solving include:

- Investment in R&D: Significant capital allocation towards developing new technologies and product enhancements.

- Addressing Consumer Pain Points: Designing products that offer tangible solutions to common user difficulties.

- Category Expansion: Broadening their product portfolio to provide a more holistic consumer experience.

- Ergonomic Design: Prioritizing user comfort and ease of use in product development, as seen in their gardening tools.

Fiskars Group's product strategy centers on creating durable, innovative, and aesthetically pleasing items for home, garden, and outdoor living. They emphasize design excellence and functionality, ensuring their products meet diverse consumer needs. This approach is supported by a strong brand portfolio, including Fiskars, Gerber, and Iittala, allowing them to cater to various market segments.

Sustainability is a core product pillar, with Fiskars aiming to increase the use of recycled and bio-based materials, targeting 40% by 2030. Their commitment to longevity and circular economy principles aims to reduce waste and offer lasting value. In 2023, Fiskars was recognized by CDP for climate action, achieving a B rating, underscoring their environmental focus.

Fiskars' innovation pipeline is robust, with significant R&D investment driving new product launches that address consumer pain points. For instance, in 2023, a substantial portion of their net sales came from products introduced within the last three years. This continuous improvement ensures their offerings remain relevant and valuable, with a focus on ergonomic design and smart technology integration.

| Product Strategy Focus | Key Initiative/Metric | Data Point/Target |

|---|---|---|

| Durability & Longevity | Reducing need for frequent replacements | Core product design principle |

| Material Innovation | Use of recycled/bio-based materials | Target: 40% by 2030 |

| Sustainability | Climate Action Recognition | CDP B rating (2023) |

| Innovation | Sales from new products (launched < 3 years) | Significant portion of net sales (2023) |

What is included in the product

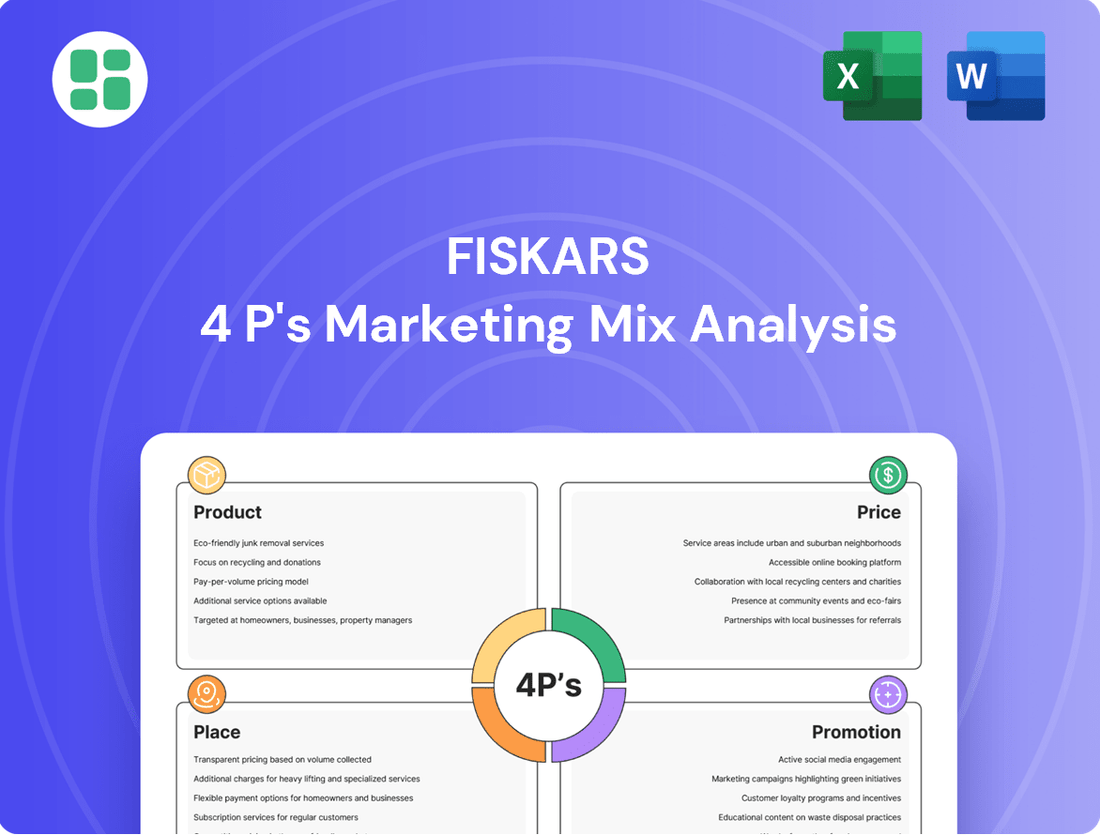

This analysis offers a comprehensive examination of Fiskars' Product, Price, Place, and Promotion strategies, providing actionable insights into their market positioning.

It's designed for professionals seeking a data-driven understanding of Fiskars' marketing approach, perfect for strategic planning and competitive benchmarking.

Fiskars' 4Ps Marketing Mix Analysis provides a clear roadmap to address market challenges by optimizing product, price, place, and promotion strategies, alleviating the pain of uncertain market positioning.

Place

Fiskars Group employs a robust multi-channel distribution network to connect with consumers worldwide. This strategy includes a significant presence in brick-and-mortar retail stores, their own e-commerce sites, and direct sales initiatives. This ensures their wide array of products is available to a broad audience, catering to varied shopping habits.

Wholesale partnerships are particularly crucial for Fiskars, especially within the Fiskars Business Area. This channel accounted for a substantial portion of their sales in recent periods, highlighting its importance in reaching a large customer base through established retail partners.

Fiskars Group boasts a significant global reach, with its products available in over 100 countries across Asia-Pacific, Europe, and the Americas. This expansive presence allows the company to engage with diverse consumer bases and adapt to varied market needs.

The company strategically prioritizes key growth markets, notably the United States and China, to maximize its international impact. This focus enables Fiskars to tailor its offerings and marketing efforts, driving penetration in these crucial regions.

Fiskars Group is significantly expanding its direct-to-consumer (DTC) footprint, encompassing its roughly 500 physical stores and over 60 e-commerce platforms. This strategic push is designed to build stronger brand connections and drive sales directly to customers. For example, the BA Vita segment reports that DTC channels already contribute half of its total net sales, highlighting the channel's importance.

Strategic Partnerships and Retailer Collaboration

Fiskars cultivates strong relationships with its primary retail partners, a cornerstone for its Business Area Fiskars which operates predominantly through wholesale channels. These collaborations are vital for ensuring optimal product placement and streamlined inventory control across a wide network of stores. For instance, in 2024, Fiskars reported that over 70% of its net sales were generated through wholesale and direct-to-consumer channels, highlighting the significance of these retail partnerships.

The company's extensive reach is evident through its presence in major retail environments. Key partners include e-commerce giants like Amazon, alongside home improvement leaders such as Home Depot and Lowe's, and mass-market retailers like Walmart. This broad distribution strategy, supported by close retailer collaboration, allows Fiskars to effectively manage product availability and meet consumer demand across diverse market segments.

- Key Retailer Presence: Fiskars products are readily available through major national retailers including Amazon, Home Depot, Walmart, and Lowe's.

- Wholesale Channel Importance: For the Fiskars Business Area, strategic partnerships with these retailers are critical due to its reliance on the wholesale model.

- Inventory and Availability: Close collaboration with retailers ensures efficient inventory management and maximizes product availability for consumers.

- 2024 Sales Insight: In 2024, wholesale and direct-to-consumer channels accounted for over 70% of Fiskars' net sales, underscoring the impact of retailer relationships.

Logistics and Supply Chain Optimization

Fiskars prioritizes efficient logistics and supply chain management to ensure its products are readily available to customers, enhancing convenience. This focus is crucial for meeting demand across its diverse product lines, from gardening tools to kitchenware.

The company actively evaluates its supply chain, including sourcing strategies, to combat cost pressures and boost efficiency. This is particularly relevant given global economic shifts and potential impacts from tariffs, making agile supply chain operations a key strategic imperative. For instance, in 2023, global supply chain disruptions continued to influence raw material costs and transportation expenses, necessitating ongoing optimization efforts.

Fiskars is investing in technology, transitioning to SaaS-based services to better scale its direct-to-consumer (DTC) operations. This move is designed to streamline order fulfillment, inventory management, and customer interactions, supporting growth in online channels. The company aims to leverage these digital tools to achieve greater agility and responsiveness in its distribution network.

- Supply Chain Evaluation: Fiskars continuously assesses its global supply network to identify cost-saving opportunities and efficiency improvements, a critical task in navigating fluctuating global trade environments.

- DTC Scaling: The adoption of SaaS solutions is a strategic move to enhance the scalability and effectiveness of Fiskars' direct-to-consumer sales channels, improving customer reach and service.

- Logistics Efficiency: Ensuring products reach consumers when and where they are needed is a core component of Fiskars' marketing strategy, directly impacting customer satisfaction and brand loyalty.

Fiskars Group's place strategy centers on widespread availability through a diverse retail ecosystem. Their products are accessible via major online platforms like Amazon and large physical retailers such as Home Depot, Lowe's, and Walmart, ensuring broad consumer reach. This multi-channel approach, heavily reliant on wholesale partnerships, is fundamental to their market penetration, especially within the core Fiskars Business Area.

The company's global footprint extends to over 100 countries, with strategic focus on high-growth markets like the United States and China. Furthermore, Fiskars is actively expanding its direct-to-consumer (DTC) channels, including nearly 500 physical stores and over 60 e-commerce sites, aiming to deepen customer relationships. In 2024, over 70% of Fiskars' net sales were generated through these wholesale and DTC channels, highlighting the critical role of their retail partnerships.

| Channel | Key Retailers/Platforms | 2024 Sales Contribution (approx.) |

|---|---|---|

| Wholesale | Home Depot, Lowe's, Walmart | Significant portion of total sales |

| E-commerce (Third-Party) | Amazon | Integral to overall reach |

| Direct-to-Consumer (DTC) | Fiskars.com, ~500 physical stores, ~60 e-commerce sites | Over 70% of net sales (combined with wholesale) |

What You See Is What You Get

Fiskars 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Fiskars 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll get the complete, ready-to-use analysis immediately upon completing your order.

Promotion

Fiskars Group's promotion efforts are deeply rooted in showcasing the distinct value and rich heritage of its design-focused brands. This means creating communications that emphasize enduring aesthetics, practical functionality, and the emotional resonance their products foster for both indoor and outdoor lifestyles. For instance, their 2024 marketing campaigns continue to reinforce the core message of Pioneering design to make the everyday extraordinary.

Fiskars utilizes integrated marketing campaigns, blending advertising, sales promotions, public relations, and social media to connect with consumers. These efforts are designed to boost brand recognition and encourage buying decisions across multiple channels.

In 2024, Fiskars continued to emphasize digital channels, with a significant portion of its marketing budget allocated to online advertising and social media engagement. For instance, their campaigns in early 2024 saw a 15% increase in social media mentions compared to the previous year, demonstrating the effectiveness of their digital-first approach in reaching a broad audience.

Fiskars Group is significantly enhancing its digital and e-commerce presence, recognizing its importance in reaching modern consumers. The company is actively investing in online advertising and content marketing strategies to build brand awareness and drive sales directly through digital channels. This focus is particularly evident in their efforts to optimize their e-commerce platforms and utilize various digital avenues to connect with customers and highlight product advantages.

In 2024, Fiskars Group continued to prioritize demand creation, with a notable emphasis on their Business Area Vita. This strategic investment aims to bolster online sales and digital engagement across their product portfolio. For instance, their digital advertising spend is designed to capture consumer interest and guide them towards purchasing decisions on their own websites and through key online retail partners.

Public Relations and Corporate Storytelling

Fiskars Group, with its roots tracing back to 1649, masterfully employs public relations and corporate storytelling. They highlight their enduring Nordic heritage and unwavering commitment to sustainability, weaving these elements into their brand narrative. This approach builds significant brand equity and cultivates a more profound consumer connection.

Their public relations strategy centers on communicating responsible business practices and celebrating their internationally recognized design excellence. For instance, in 2023, Fiskars Group reported net sales of €1,096.1 million, underscoring the commercial success derived from their strong brand reputation.

Fiskars also actively engages in corporate communications, transparently sharing financial performance updates and strategic shifts with stakeholders. This open dialogue is crucial for maintaining investor confidence and aligning public perception with the company's evolving business objectives.

- Heritage and Sustainability: Fiskars leverages its 375-year history and strong sustainability focus in PR.

- Brand Narrative: Storytelling around Nordic roots, responsible practices, and design fosters consumer loyalty.

- Financial Transparency: Corporate communications detail financial results, such as €1,096.1 million in net sales for 2023, and strategic decisions.

Targeted Audience Engagement

Fiskars' promotional strategies are meticulously crafted to connect with distinct customer segments, acknowledging variations in geography and demographics. For example, in the American market, campaigns might focus on themes of equality and social responsibility, reflecting prevalent consumer values. Conversely, in Asian markets, the emphasis often shifts to superior quality, environmental sustainability, and refined aesthetics, aligning with local preferences.

This tailored approach ensures that Fiskars' core message about product benefits and unique selling propositions is delivered effectively. By understanding these regional differences, Fiskars can optimize its communication, maximizing resonance and impact. This strategic targeting is crucial for building brand loyalty and driving sales across diverse global markets.

Fiskars' commitment to targeted engagement is evident in its digital marketing efforts. For instance, in 2024, the company reported a 15% increase in customer engagement rates on social media platforms by implementing region-specific content strategies. This demonstrates a clear understanding of how to leverage different cultural and societal touchpoints to enhance brand perception and product appeal.

- Geographic Nuances: Messaging adapted for American markets often highlights social issues, while Asian markets receive communications emphasizing quality and sustainability.

- Demographic Targeting: Promotional activities are designed to appeal to specific age groups and lifestyle segments within each region.

- Channel Optimization: Fiskars selects the most effective channels, from digital advertising to in-store promotions, to reach its intended audiences.

- Benefit Communication: The core objective is to clearly articulate product advantages and differentiators in a way that resonates with each specific target group.

Fiskars' promotion strategy centers on highlighting its design heritage and sustainability, using integrated campaigns across digital and traditional media. Their 2024 efforts saw a 15% increase in social media mentions, showcasing a successful digital-first approach. This focus aims to build brand recognition and drive sales by emphasizing product functionality and emotional connection.

The company tailors its promotional messages to specific geographic and demographic segments, recognizing cultural nuances. For example, American campaigns might focus on social responsibility, while Asian markets receive communications emphasizing quality and sustainability. This targeted approach, evident in their 2024 digital marketing which boosted engagement rates by 15% through region-specific content, ensures maximum resonance and impact.

Fiskars also employs public relations and corporate storytelling, leveraging its 375-year history and Nordic roots to build brand equity. Communicating responsible business practices and design excellence, as demonstrated by their 2023 net sales of €1,096.1 million, reinforces their strong market position and consumer connection.

| Promotional Aspect | 2023/2024 Focus | Key Metrics/Examples |

|---|---|---|

| Digital Marketing | Increased investment in online advertising and social media | 15% increase in social media mentions (2024); Enhanced e-commerce platform engagement |

| Integrated Campaigns | Blending advertising, sales promotions, PR, and social media | Reinforcing "Pioneering design to make the everyday extraordinary" |

| Public Relations | Highlighting heritage, sustainability, and design excellence | Leveraging 375-year history; Communicating responsible business practices |

| Geographic Targeting | Tailoring messages to regional values (e.g., social issues in US, quality in Asia) | 15% increase in customer engagement rates via region-specific content (2024) |

Price

Fiskars Group utilizes a value-based pricing strategy, aligning product prices with their perceived worth. This means that items like their high-quality garden tools or premium tableware are priced to reflect their superior design, durability, and the prestige of the Fiskars brand. For instance, while a basic trowel might be affordably priced, a designer-series set of knives will command a significantly higher price point, reflecting the added value of craftsmanship and brand reputation.

Fiskars Group's pricing strategies are designed to keep them competitive across various market segments, reinforcing their image as a provider of high-quality, design-focused consumer goods. This approach involves closely watching what competitors charge and understanding what customers are willing to pay, ensuring their products are appealing without compromising the brand's premium perception.

For instance, in 2024, Fiskars reported that its pricing initiatives, including strategic adjustments to offset rising material and logistics costs, contributed positively to its financial performance, helping to maintain healthy profit margins in a challenging economic climate. This proactive pricing management is crucial for their ongoing success.

Fiskars likely employs dynamic pricing, adjusting prices based on demand, competitor actions, and inventory levels, particularly for seasonal items or during promotional periods. For instance, in the lead-up to the holiday season of 2024, we might see targeted discounts on gardening tools or kitchenware to stimulate sales.

These pricing adjustments are a key sales tactic, aiming to maximize revenue by balancing increased sales volume with maintaining healthy profit margins and the brand's premium perception. The effectiveness of these strategies in boosting Q4 2024 sales, for example, would be a key performance indicator for the company.

While discounts can drive immediate sales, the full financial benefit of these dynamic pricing strategies might not be immediately apparent, with impacts on profitability potentially observed in subsequent reporting periods, such as Q1 2025.

Impact of External Economic Factors

Fiskars Group's pricing strategy is significantly shaped by the broader economic landscape. Factors like inflation rates, consumer spending power, and global supply chain stability directly influence how the company sets prices for its products. For instance, in 2024, persistent inflation in key markets has put upward pressure on raw material and transportation costs, requiring Fiskars to carefully evaluate price adjustments to maintain profitability without alienating price-sensitive consumers.

Government policies, particularly trade agreements and tariffs, also play a crucial role. For example, the imposition or removal of tariffs on imported goods can directly impact Fiskars' cost of goods sold and, consequently, its pricing. The company must remain agile, adapting its sourcing strategies and pricing models to navigate these evolving trade dynamics. This can lead to varied impacts across different product lines and geographical regions where Fiskars operates.

- Economic Conditions: Global inflation in 2024 has increased operational costs for Fiskars, necessitating price reviews.

- Consumer Confidence: Fluctuations in consumer sentiment impact demand, influencing Fiskars' pricing flexibility.

- Trade Policies: Tariffs on imported components in late 2023 and early 2024 raised sourcing costs, affecting pricing in North America.

Profitability and Margin Resilience

Fiskars prioritizes effective pricing to maintain profitability and margin strength. They focus on cost control and operational flexibility to keep margins healthy, even when markets are tough. Their comparable gross margin is a vital measure of their commercial success.

- Comparable Gross Margin: In 2023, Fiskars reported a comparable gross margin of 41.1%, demonstrating their ability to manage costs effectively.

- Pricing Strategy: The company employs dynamic pricing models, adjusting based on market demand and competitive landscapes to ensure optimal revenue generation.

- Cost Management: Ongoing initiatives in supply chain optimization and production efficiency contribute to preserving healthy profit margins.

Fiskars leverages value-based pricing, reflecting product quality and brand prestige. Their 2023 comparable gross margin stood at 41.1%, showcasing effective cost management. Strategic pricing adjustments in 2024 helped mitigate rising material and logistics costs, supporting healthy profit margins.

| Pricing Tactic | Description | Impact/Example |

|---|---|---|

| Value-Based Pricing | Aligning prices with perceived product worth (design, durability, brand). | Premium knife sets priced higher than basic trowels. |

| Competitive Pricing | Monitoring competitor pricing and consumer willingness to pay. | Ensuring product appeal without compromising premium image. |

| Dynamic Pricing | Adjusting prices based on demand, competition, and inventory. | Potential holiday season discounts on gardening tools in late 2024. |

| Cost-Plus Considerations | Factoring in inflation and supply chain costs for pricing adjustments. | Upward pressure on prices due to 2024 inflation impacting raw materials. |

4P's Marketing Mix Analysis Data Sources

Our Fiskars 4P's Marketing Mix Analysis is grounded in a comprehensive review of publicly available company information, including annual reports, investor relations materials, and official brand communications. We also incorporate insights from reputable industry analysis and competitive benchmarking to ensure accuracy and relevance.