Fiskars Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fiskars Bundle

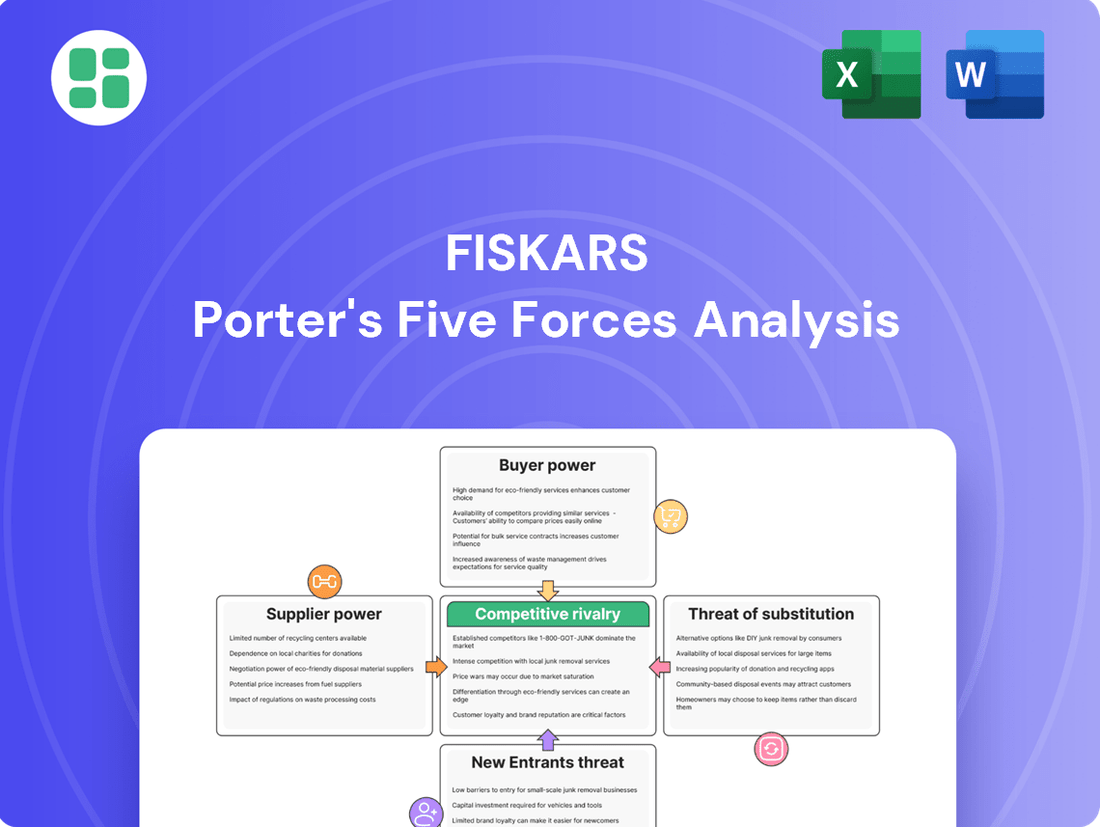

Fiskars operates in a competitive landscape shaped by the bargaining power of buyers and the threat of new entrants, influencing pricing and innovation. Understanding these dynamics is crucial for strategic planning.

The full Porter's Five Forces Analysis reveals the real forces shaping Fiskars’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fiskars' reliance on a variety of raw materials, including steel, plastics, wood, and ceramics, alongside specialized components, forms the bedrock of its manufacturing. The availability and uniqueness of these inputs directly influence supplier leverage.

When the suppliers for these critical or specialized materials are few in number, or if the materials themselves are proprietary and only available from a limited number of sources, their bargaining power naturally escalates. This concentration can lead to increased costs or potential supply disruptions for Fiskars.

Switching suppliers for critical components or raw materials can be a costly endeavor for Fiskars. These expenses can range from reconfiguring production lines and implementing new quality assurance protocols to obtaining necessary certifications for new materials. For instance, if Fiskars relies on a specialized steel alloy for its premium cutting tools, changing to a new supplier might necessitate significant investment in testing and validation to ensure the same level of durability and performance. In 2023, the global specialty steel market saw price volatility, with some key inputs experiencing increases of up to 15%, highlighting the potential financial impact of supplier changes.

The availability of substitute inputs significantly weakens supplier power for companies like Fiskars. If alternative raw materials or components can readily fulfill similar functional needs, it reduces the reliance on any single supplier. For instance, if Fiskars, a company known for its gardening tools and home products, can easily source comparable steel alloys or plastic resins from numerous global suppliers, the bargaining leverage of a specific steel mill or petrochemical producer is considerably lessened.

Importance of supplier's input to Fiskars' product quality

For premium brands like Iittala, a Fiskars subsidiary, the quality of raw materials directly impacts brand perception and product integrity. Suppliers of specialized glass or ceramics for Iittala's high-end designs hold significant bargaining power if their materials are critical to the aesthetic and durability consumers expect. Fiskars' reliance on these specific inputs means that disruptions or quality issues from such suppliers could directly affect the perceived value and sales of its premium offerings.

This reliance translates into leverage for key suppliers. For instance, a supplier of lead-free crystal for Waterford, another Fiskars brand, can command higher prices if their production process is unique and essential for meeting the brand's stringent quality standards. In 2023, Fiskars reported that its Consumer segment, which includes Iittala, saw net sales of €1,124.5 million, highlighting the importance of maintaining the quality of inputs for this substantial part of their business.

- Critical Raw Materials: Suppliers of unique glass formulations or specialized metal alloys crucial for Fiskars' premium brands possess higher bargaining power.

- Brand Reputation Dependency: If a supplier's input is directly tied to the perceived quality and luxury of Iittala or Waterford products, their leverage increases significantly.

- Limited Alternatives: The availability of alternative suppliers for highly specialized or proprietary materials can be scarce, further empowering existing suppliers.

- Cost Impact: In 2023, Fiskars' Cost of Goods Sold was €799.6 million, indicating that the cost of raw materials is a substantial factor, giving powerful suppliers more influence over pricing.

Threat of forward integration by suppliers

The threat of suppliers integrating forward into Fiskars' finished consumer goods market is a significant concern. If suppliers possess the capability and motivation to manufacture or distribute their own branded products, they could directly compete with Fiskars. This potential competition can compel Fiskars to foster strong supplier relationships and potentially accept higher input costs to avoid being undercut by its own supply chain.

For instance, a key supplier of high-quality stainless steel for Fiskars' premium knives might consider launching its own line of cutlery. In 2024, the global cutlery market was valued at approximately $35 billion, indicating a substantial opportunity for new entrants. If such a supplier were to integrate forward, Fiskars would face a new competitor that already understands the material sourcing and production processes, potentially leveraging cost advantages.

- Supplier Forward Integration Risk: Suppliers with the capacity and incentive to enter Fiskars' finished goods market represent a direct competitive threat.

- Impact on Fiskars: This threat can necessitate maintaining favorable terms with existing suppliers, potentially leading to higher raw material costs.

- Market Dynamics: The global cutlery market, valued around $35 billion in 2024, offers significant incentive for suppliers to explore forward integration.

Suppliers of unique glass formulations or specialized metal alloys crucial for Fiskars' premium brands, like Iittala and Waterford, possess significant bargaining power. This leverage is amplified when these inputs are directly tied to brand reputation and when alternative suppliers are scarce. In 2023, Fiskars' Cost of Goods Sold was €799.6 million, underscoring the financial impact of raw material costs and the influence of powerful suppliers.

| Factor | Description | Impact on Fiskars | 2023 Data Point |

|---|---|---|---|

| Supplier Concentration | Few suppliers for critical or specialized materials. | Increased costs, potential supply disruptions. | N/A (General observation) |

| Switching Costs | Expenses associated with changing suppliers. | Can be substantial, limiting flexibility. | N/A (General observation) |

| Input Uniqueness | Materials essential for brand perception and quality. | Empowers suppliers of premium inputs. | Fiskars Consumer segment net sales: €1,124.5 million |

| Forward Integration Threat | Suppliers entering Fiskars' finished goods market. | Creates competition, potentially higher input costs. | Global cutlery market valued at ~$35 billion in 2024 |

What is included in the product

This analysis dissects the competitive landscape for Fiskars, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Effortlessly identify and address competitive threats with a visual, interactive Porter's Five Forces model that highlights areas of strategic vulnerability.

Customers Bargaining Power

Fiskars' diverse customer base, spanning global markets through large retailers, e-commerce, and direct sales, inherently dilutes the bargaining power of any individual customer segment. This fragmentation across numerous channels and geographies means no single buyer commands significant leverage over Fiskars' pricing or terms.

For everyday items like garden tools or kitchenware, consumers can be quite price-sensitive, particularly when many brands offer similar products. In 2024, the average household spending on home improvement and gardening supplies saw fluctuations, with consumers actively seeking value. This price sensitivity means Fiskars must remain competitive on pricing for its more utilitarian product lines to attract and retain these customers.

However, for Fiskars' premium brands such as Iittala or Waterford, the situation shifts. Consumers purchasing these luxury goods often prioritize design, craftsmanship, and brand prestige over minor price differences. Brand loyalty and the perceived higher value associated with these names allow Fiskars to command higher prices, thus increasing its pricing power in these specific market segments.

Customers have a wide array of choices for home, garden, and outdoor goods, with many competitors offering similar products. This abundance of alternatives significantly boosts their bargaining power.

The ease with which consumers can switch to different brands or even generic alternatives, particularly for everyday items, directly pressures Fiskars on pricing. For instance, in the kitchenware market, a sector Fiskars operates in, the availability of numerous brands from Germany, Japan, and other regions means consumers can easily find comparable quality at different price points.

Customer's ability to backward integrate

Large retail chains, a key customer segment for Fiskars, possess the potential to backward integrate. This means they could develop their own house brands or establish direct sourcing relationships with manufacturers, bypassing Fiskars.

This capability grants these powerful customers significant leverage in price and terms negotiations. For instance, a major European home improvement retailer could decide to launch its own line of gardening tools, directly competing with Fiskars' offerings and using its purchasing volume to secure favorable manufacturing costs.

- Fiskars' reliance on large retailers: In 2023, Fiskars reported that its largest customers accounted for a significant portion of its net sales, highlighting the importance of maintaining strong relationships with these entities.

- Threat of private labels: The increasing prevalence of private label brands across various retail sectors, including home and garden, poses a direct challenge to established brands like Fiskars.

- Negotiating power: The ability of large retailers to source alternative products or develop their own allows them to push for lower prices and more favorable payment terms from Fiskars.

Importance of Fiskars' products to customers' overall purchases

For the average consumer, Fiskars' gardening tools and kitchenware constitute a minor expense in their overall household budget. This low dependency on any single Fiskars purchase dilutes the individual customer's bargaining power. For instance, a single pair of Fiskars scissors might represent less than 0.1% of a typical household's monthly discretionary spending.

However, the dynamic shifts significantly when considering large retail partners. For major home improvement stores or department chains, Fiskars' product categories can represent a substantial portion of their sales within those specific departments. In 2024, major retailers like Home Depot or Bed Bath & Beyond likely sourced a significant volume of their gardening and kitchenware inventory from Fiskars, potentially accounting for 5-10% of their respective category sales.

This reliance grants these large retailers considerable leverage. They can negotiate better pricing, demand favorable payment terms, and influence promotional strategies for Fiskars' products. Their ability to shift shelf space or prioritize competing brands gives them a distinct advantage in discussions with Fiskars.

- Individual consumer spending on Fiskars products is typically a small fraction of total household expenditures, limiting their bargaining power.

- For large retailers, Fiskars' product lines can represent a significant sales category, increasing their influence.

- In 2024, major retailers may have seen Fiskars products contribute a notable percentage to their sales within specific home and garden departments.

- Retailer leverage translates into negotiating power over pricing, payment terms, and promotional activities.

The bargaining power of customers for Fiskars is a mixed bag, influenced by the type of customer and the product category. While individual consumers have limited power due to low spending per purchase, large retail partners wield significant influence.

Large retailers, by representing a substantial portion of Fiskars' sales in their respective departments, can negotiate favorable terms and pricing. For example, in 2023, Fiskars noted that its largest customers accounted for a significant share of net sales, underscoring this dynamic. This leverage is further amplified by the threat of private labels and the retailers' ability to source alternatives, as seen in the competitive kitchenware and home improvement markets.

Conversely, for premium brands like Iittala, customer bargaining power is reduced as consumers prioritize brand prestige and design over price. This allows Fiskars to maintain stronger pricing power in these segments.

| Customer Segment | Influence Level | Reasoning |

|---|---|---|

| Individual Consumers (Everyday Items) | Low | Small purchase value relative to household budget; high availability of alternatives. |

| Premium Brand Consumers (e.g., Iittala) | Low | Focus on brand, design, and quality over price; brand loyalty. |

| Large Retailers (e.g., Home Improvement Stores) | High | Significant sales volume contribution; potential for private labels and backward integration; ability to shift shelf space. |

Same Document Delivered

Fiskars Porter's Five Forces Analysis

You're previewing the final version of the Fiskars Porter's Five Forces Analysis—precisely the same document that will be available to you instantly after buying. This comprehensive analysis meticulously details each of the five forces impacting Fiskars' competitive landscape, providing actionable insights for strategic decision-making. You'll receive the complete, professionally formatted report, ready for immediate download and application to your business strategy.

Rivalry Among Competitors

Fiskars faces intense competition due to highly fragmented markets. The company competes with a wide array of players, from large global corporations to specialized local businesses, across its core segments like kitchenware, gardening tools, and outdoor equipment.

This broad competitive spectrum means Fiskars must constantly innovate and differentiate to capture market share. For instance, in the European garden tools market alone, hundreds of brands, many with strong regional presence, actively compete for consumer attention and sales.

Fiskars leverages its robust brand portfolio, including names like Fiskars, Gerber, Iittala, and Waterford, to create distinct product offerings and justify premium pricing. This strong brand identity is a key differentiator in a competitive market.

The extent to which Fiskars can differentiate its products and foster brand loyalty directly influences the intensity of rivalry. When products are highly differentiated, they are less susceptible to direct price-based competition, thereby mitigating competitive pressures.

For instance, in 2023, Fiskars reported net sales of €4.0 billion, with its Consumer segment, which includes many of its core differentiated brands, showing resilience. The company's ability to maintain this sales level, despite competitive pressures, underscores the effectiveness of its product differentiation and branding strategies.

Many of Fiskars' core product areas, like gardening equipment and kitchenware, are situated in mature markets. These markets typically experience slower growth rates, which naturally escalates the intensity of competition as companies vie for their existing share. For instance, the global gardening tools market, a significant segment for Fiskars, was projected to grow at a CAGR of around 3.5% from 2023 to 2028, indicating a relatively stable but not rapidly expanding environment.

This slower market expansion often compels competitors to engage in more aggressive strategies. Expect to see a greater emphasis on price reductions, promotional offers, and increased marketing spend as businesses try to capture a larger piece of the pie. In 2024, for example, many home and garden retailers reported increased promotional activity to drive sales in these established categories.

Switching costs for customers

For many of Fiskars' products, customer switching costs are quite low. This means consumers can easily move from one brand to another for items like garden shears or kitchen knives without much hassle or significant expense.

These low switching costs directly fuel competitive rivalry. When it's easy for customers to switch, competitors can more aggressively try to win them over, often through competitive pricing or small but appealing product updates.

- Low Switching Costs: Customers can readily switch between brands for products like garden tools and kitchenware.

- Intensified Rivalry: This ease of switching allows competitors to more easily attract customers away from Fiskars.

- Competitive Tactics: Competitors can leverage pricing strategies or minor product improvements to capture market share.

High fixed costs and exit barriers

Fiskars, like many in the consumer goods manufacturing sector, faces intense competition fueled by substantial fixed costs. These costs span production facilities, research and development, and extensive marketing campaigns. For instance, establishing and maintaining a global manufacturing footprint requires significant capital investment, making it difficult for new entrants to compete on scale.

High exit barriers further exacerbate this competitive rivalry. Specialized machinery, brand reputation tied to long-term investments, and contractual obligations can make it economically unfeasible for companies to withdraw from the market. This often leads to prolonged periods of aggressive competition, even when market demand is weak, as firms are compelled to continue operating to cover their fixed costs. In 2023, Fiskars reported capital expenditures of €114 million, underscoring the ongoing investment in its operational base.

- Significant Capital Investment: Manufacturing consumer goods necessitates heavy upfront and ongoing investment in factories, equipment, and technology.

- R&D and Marketing Expenses: Continuous innovation and brand building require substantial financial commitment, adding to fixed cost burdens.

- Operational Continuity: High fixed costs pressure companies to maintain production levels, even in challenging economic conditions, intensifying rivalry.

- Market Persistence: Specialized assets and long-term commitments create high exit barriers, keeping firms engaged in competitive battles.

Fiskars operates in highly fragmented markets with numerous competitors, ranging from global giants to niche local players. The company's strategy of differentiating through strong brands like Fiskars, Gerber, and Iittala helps mitigate direct price competition. However, the mature nature of many of its markets, such as gardening tools and kitchenware, fosters intense rivalry as companies vie for existing market share, often through increased promotional activities observed in 2024.

Low customer switching costs in product categories like kitchen knives and garden tools mean competitors can more easily attract Fiskars' customers, frequently employing price-based strategies or minor product enhancements. This dynamic is further amplified by significant fixed costs associated with manufacturing, R&D, and marketing, alongside high exit barriers that keep firms invested in competitive battles even during economic downturns. Fiskars' 2023 capital expenditures of €114 million highlight the ongoing investment required to maintain its operational base in this competitive landscape.

| Metric | Value (2023) | Implication for Rivalry |

| Fiskars Net Sales | €4.0 billion | Indicates significant market presence despite competition. |

| Fiskars Capital Expenditures | €114 million | Reflects ongoing investment in operational capacity, contributing to high fixed costs. |

| Global Gardening Tools Market Growth (2023-2028 est.) | ~3.5% CAGR | Suggests mature market conditions, intensifying competition for market share. |

SSubstitutes Threaten

Consumers often find functionally equivalent alternative products that can perform similar tasks to those offered by Fiskars. For example, while Fiskars is known for its gardening tools, consumers might choose to use less specialized tools or even manual labor for certain tasks, thereby reducing the demand for Fiskars' specific product lines. This can be seen in the DIY home improvement sector where readily available, less expensive tools can substitute for specialized gardening equipment.

The appeal of substitute products for Fiskars largely depends on their price-performance ratio. Consumers often weigh how much they get for their money when considering alternatives.

Cheaper, less specialized tools or even do-it-yourself solutions can present a significant threat, particularly to Fiskars' more budget-conscious customer base. For instance, generic gardening tools might be available at a fraction of the cost, even if they lack the durability or specific features of Fiskars products.

In 2024, the global market for gardening tools saw a rise in private-label brands offering lower price points, directly challenging established brands like Fiskars, especially in entry-level product categories.

Technological advancements are a significant threat, as they can spawn entirely new product categories that fulfill the same basic customer needs. For instance, the rise of smart home technology and sophisticated automated gardening systems could eventually displace demand for some of Fiskars' traditional garden tools and home décor products. In 2024, the global smart home market was valued at approximately $115 billion, demonstrating a strong and growing consumer acceptance of technologically advanced alternatives.

Changes in consumer preferences and lifestyles

Shifts in consumer preferences, like a growing embrace of minimalism and sustainability, can steer demand away from traditional, single-purpose products. For instance, in 2024, the global sustainable products market is projected to reach over $150 billion, indicating a strong consumer pull towards eco-conscious alternatives. This trend could diminish the appeal of some of Fiskars' established product lines if they are perceived as less sustainable or multi-functional compared to emerging substitutes.

Furthermore, evolving lifestyles, such as an increased reliance on digital experiences and a desire for convenience, may lead consumers to seek integrated solutions rather than individual tools. A rise in subscription services for home goods or the adoption of smart home technology that consolidates functions could present viable substitutes for certain Fiskars offerings. In 2023, the global subscription box market alone was valued at approximately $22.7 billion, showcasing a significant shift in how consumers acquire and utilize goods.

These changes can directly impact the demand for Fiskars' core products, potentially leading to a decline in sales volume if the company doesn't adapt its product development and marketing strategies. For example, if consumers increasingly opt for plant-based or biodegradable materials in their gardening tools, traditional metal or plastic options might face substitution pressure. The market for eco-friendly gardening supplies, a direct substitute area, saw a notable uptick in consumer interest throughout 2024.

The threat is amplified when these new preferences are met by innovative substitutes that offer greater versatility or a reduced environmental footprint. Consider the growing popularity of multi-use kitchen gadgets that combine several functions, potentially replacing the need for individual Fiskars kitchenware items. This segment of the kitchen appliance market has shown consistent growth, with innovation driving consumer adoption of space-saving and efficient alternatives.

DIY culture and multi-purpose solutions

The growing DIY culture presents a significant threat to Fiskars. Consumers are increasingly inclined to tackle projects themselves, often seeking multi-purpose tools that can substitute for several specialized items. This trend could diminish the demand for Fiskars' dedicated gardening and crafting tools, as individuals opt for versatile, all-in-one solutions.

For instance, a single, high-quality multi-tool might replace the need for a specific Fiskars pruning shear, a saw, and a lopper. This shift towards consolidation in toolboxes directly impacts sales volumes for products designed for niche applications. In 2024, the global DIY market was estimated to be worth over $1.1 trillion, with a significant portion driven by consumers seeking efficiency and space-saving solutions.

- DIY Market Growth: The global DIY market continues to expand, indicating a strong consumer interest in self-sufficiency and home improvement.

- Multi-purpose Tool Adoption: There's a noticeable trend towards consumers purchasing versatile tools that can perform multiple functions, reducing the need for a wide array of specialized equipment.

- Impact on Specialized Products: This preference for multi-use items poses a threat to companies like Fiskars that offer a broad range of single-purpose tools, potentially cannibalizing sales of their more specialized offerings.

The threat of substitutes for Fiskars is significant, driven by the availability of functionally equivalent alternatives across its product categories. Consumers can often find less specialized or lower-cost tools for gardening and home tasks, impacting demand for Fiskars' specific offerings.

The price-performance ratio of substitutes heavily influences consumer choices, with cheaper, generic alternatives often appealing to budget-conscious buyers. For example, private-label gardening tools in 2024 offered lower price points, directly challenging established brands.

Technological advancements are also creating new substitutes, such as automated gardening systems, which could displace demand for traditional tools. The global smart home market, valued at approximately $115 billion in 2024, highlights consumer acceptance of such innovations.

Shifting consumer preferences towards minimalism and sustainability further amplify this threat, favoring eco-friendly alternatives. The sustainable products market, projected to exceed $150 billion in 2024, demonstrates this growing demand.

| Substitute Type | Key Driver | 2024 Data Point |

| Generic/Private Label Tools | Lower Price Point | Increased market share in entry-level gardening tools. |

| DIY Solutions | Versatility & Cost Savings | Global DIY market over $1.1 trillion, with focus on multi-purpose items. |

| Smart Home/Automated Systems | Convenience & Efficiency | Global smart home market valued at ~$115 billion. |

| Sustainable/Eco-friendly Products | Environmental Consciousness | Sustainable products market projected to exceed $150 billion. |

Entrants Threaten

Entering the consumer products sector, particularly for companies aiming for manufacturing and global reach like Fiskars, demands significant upfront capital. This includes setting up production plants, establishing robust supply chains, and funding extensive marketing campaigns. For instance, a new entrant might need hundreds of millions of dollars just to build a competitive manufacturing base and secure distribution channels.

Established companies such as Fiskars already leverage considerable economies of scale. This means they can produce goods at a lower per-unit cost due to high production volumes. In 2023, Fiskars reported net sales of €3.4 billion, indicating a scale that new competitors would struggle to match initially, making it difficult to compete on price and profitability.

Fiskars benefits from robust brand loyalty and significant brand equity across its portfolio, including well-known names like Fiskars, Gerber, Iittala, and Waterford. This deep-seated customer trust, cultivated over many years, acts as a formidable barrier to new entrants. For any newcomer to gain traction, they would need to invest heavily in marketing and brand building to even begin to rival Fiskars' established market presence and consumer recognition.

Fiskars benefits from deeply entrenched relationships with a vast array of global retailers, e-commerce platforms, and direct sales channels, spanning over 100 countries. These established networks are critical for product reach and market penetration.

New entrants face a formidable barrier in replicating Fiskars' access to these distribution channels. Gaining entry often requires significant investment, lengthy negotiations, and overcoming existing exclusivity agreements.

For instance, in 2023, Fiskars reported that its sales through key retail partners contributed to a substantial portion of its revenue, highlighting the importance of these established relationships. New competitors would find it challenging to secure comparable shelf space or online visibility without comparable leverage.

Proprietary technology and design expertise

Fiskars benefits from proprietary technology and design expertise, which significantly deters new entrants. The company likely holds numerous patents covering unique product designs and advanced manufacturing processes, particularly for its specialized gardening tools and kitchenware. This intellectual property creates a substantial hurdle for newcomers aiming to replicate Fiskars' quality and functionality without incurring considerable research and development costs.

This deep-seated design and engineering knowledge is not easily acquired. It represents years of innovation and refinement, making it challenging for potential competitors to match Fiskars' product performance and brand reputation. For example, Fiskars' award-winning functional design, evident in products like the PowerGear™ lopper, showcases an integration of ergonomics and cutting-edge mechanics that requires specialized expertise to emulate.

- Patented Innovations: Fiskars holds patents on key product designs and manufacturing techniques, safeguarding its market position.

- Design Expertise: Years of accumulated knowledge in ergonomics and functional design create a high barrier to entry for competitors.

- R&D Investment: New entrants would need substantial investment in research and development to replicate Fiskars' product innovation and quality.

- Product Differentiation: Unique product features and performance, like those in their gardening tools, are difficult for rivals to match without similar proprietary knowledge.

Regulatory hurdles and product certifications

Regulatory hurdles and product certifications present a substantial barrier for new entrants in Fiskars' markets. For instance, in the kitchenware sector, compliance with food safety regulations, such as those from the U.S. Food and Drug Administration (FDA) or the European Food Safety Authority (EFSA), is critical. Outdoor safety gear, on the other hand, requires adherence to stringent standards like CE marking in Europe or ANSI certifications in the United States. These certifications can be time-consuming and costly to obtain, deterring smaller or less capitalized new companies. For example, obtaining a new safety certification for a power tool can cost tens of thousands of dollars and take over a year.

The threat of new entrants for Fiskars is moderate, primarily due to high capital requirements for manufacturing and global distribution, coupled with established brand loyalty. While the consumer goods market offers attractive margins, the sheer scale of investment needed to compete with a company like Fiskars, which reported €3.4 billion in net sales for 2023, creates a significant deterrent.

Fiskars' strong brand equity and extensive distribution networks, reaching over 100 countries, further solidify its market position. Newcomers face substantial challenges in replicating these established relationships and securing prime shelf space or online visibility. Furthermore, proprietary technology and design expertise, protected by patents, require significant R&D investment for rivals to match.

Regulatory compliance and product certifications also add layers of complexity and cost for potential entrants, acting as a substantial barrier. For instance, obtaining necessary safety certifications for outdoor gear can be both time-consuming and expensive, potentially costing tens of thousands of dollars per product.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Setting up manufacturing, supply chains, and marketing requires substantial investment. | High |

| Brand Loyalty & Equity | Fiskars' established brands (Fiskars, Gerber, Iittala, Waterford) foster strong customer trust. | High |

| Distribution Channels | Extensive global retail and e-commerce relationships are difficult to replicate. | High |

| Proprietary Technology & Design | Patented innovations and design expertise create a competitive edge. | Medium |

| Regulatory Hurdles | Product certifications and compliance with safety standards add cost and time. | Medium |

Porter's Five Forces Analysis Data Sources

Our Fiskars Porter's Five Forces analysis is built upon a foundation of robust data, including Fiskars' own annual reports and investor presentations, alongside industry-specific market research from firms like IBISWorld and Statista. This blend of internal and external data allows for a comprehensive understanding of the competitive landscape.