FirstRand SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstRand Bundle

FirstRand, a leading financial services group, possesses significant strengths in its diversified business model and strong brand recognition across Africa. However, it also faces potential weaknesses related to regulatory changes and economic volatility in key markets.

Want the full story behind FirstRand's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

FirstRand's strength lies in its diversified portfolio of leading brands, including FNB, RMB, WesBank, and Aldermore, which collectively offer a wide spectrum of financial services across various client segments. This multi-brand approach ensures broad market reach and revenue diversification, mitigating risks associated with any single market. For instance, FNB's consistent market share gains in the premium retail banking sector in South Africa highlight the effectiveness of this strategy.

FirstRand has shown impressive financial resilience, with its normalised earnings growing consistently. For the first half of 2025, the group reported a 10% increase in normalised earnings per share, underscoring its ability to generate value.

The company's capital position is exceptionally strong. Its total capital adequacy ratio significantly exceeds its target, reflecting a healthy balance sheet and a solid foundation for future expansion and weathering economic uncertainties.

Furthermore, FirstRand’s return on equity (ROE) remains within its targeted range. This indicates that the company is effectively utilizing its capital to generate profits, a key indicator of operational efficiency and shareholder value creation.

FirstRand, largely driven by FNB, has cemented its position as a frontrunner in digital banking within South Africa, consistently pushing the boundaries of innovation. This commitment is evident in their substantial investments in modernizing their platforms and driving digital transformation initiatives.

The group's strategic partnerships, such as the one with Fiserv for cloud-native core banking solutions, underscore their dedication to enhancing speed to market, improving customer experience, and boosting operational efficiency. These advancements are crucial for maintaining a competitive edge in the evolving financial landscape.

This strong digital foundation not only fosters greater customer loyalty but also creates significant opportunities for cross-selling a wider array of integrated banking products and services, thereby deepening customer relationships and increasing revenue streams.

Effective Risk Management and Credit Performance

FirstRand demonstrates robust risk management, consistently keeping its credit loss ratio within or below its target. This resilience is particularly noteworthy given the prevailing consumer affordability challenges and a generally tough credit cycle.

The group’s credit performance has exceeded expectations, especially within its retail and UK segments. This success underscores a strategic and well-judged approach to lending, even in difficult economic conditions.

- Effective Risk Mitigation: FirstRand's ability to manage credit risk effectively has been a key strength.

- Strong Credit Performance: The group has maintained a credit loss ratio within or below its target range, even during challenging periods. For instance, in the first half of fiscal year 2024, FirstRand reported a credit loss ratio of 94 basis points, well within its targeted range of 90-110 basis points.

- Resilience in Retail and UK Operations: The company has shown superior credit performance in its retail and UK businesses, indicating a disciplined and tactical lending strategy.

Geographical and Segmental Diversification

FirstRand's strategic geographical spread across South Africa, various sub-Saharan African nations, and the United Kingdom inherently reduces exposure to any single market's economic or political volatility. This diversification is a significant strength, as evidenced by its continued performance even when specific regional markets face headwinds.

The group's diversified business model, encompassing retail, commercial, corporate, and investment banking, creates a robust revenue stream. This segmentation allows FirstRand to leverage different economic cycles and client needs, enhancing overall resilience. For instance, in the first half of fiscal year 2024, FirstRand reported a 12% increase in diluted headline earnings per share, demonstrating the benefits of this broad operational base.

- Geographical Reach: Operations in South Africa, key sub-Saharan markets, and the UK.

- Segmental Strength: Diversified offerings across retail, commercial, corporate, and investment banking.

- Revenue Stability: Reduced reliance on any single market or business line.

- Growth Opportunities: Ability to capture growth across varied economic environments and client segments.

FirstRand's diversified brand portfolio, including FNB, RMB, WesBank, and Aldermore, provides extensive market reach and revenue stability. This multi-brand strategy, exemplified by FNB's strong performance in South Africa's premium retail banking, effectively mitigates single-market risks.

The group boasts exceptional financial resilience, marked by consistent earnings growth. For the first half of fiscal 2025, normalised earnings per share saw a 10% increase, showcasing robust value generation. Its capital adequacy ratio significantly surpasses targets, ensuring a strong balance sheet for future growth and economic challenges.

FirstRand excels in digital innovation, particularly through FNB, its leading South African digital banking platform. Significant investments in platform modernization and digital transformation initiatives maintain its competitive edge. Strategic partnerships, like the one with Fiserv for cloud-native core banking, further enhance customer experience and operational efficiency.

The company demonstrates robust risk management, consistently maintaining its credit loss ratio within or below target. This resilience is evident in its strong credit performance, especially in retail and UK operations, even amidst consumer affordability challenges. For H1 2024, the credit loss ratio was 94 basis points, within the 90-110 basis point target.

| Key Strength | Description | Supporting Data (H1 FY24 unless otherwise stated) |

| Diversified Brand Portfolio | Leading brands across various financial services segments | FNB, RMB, WesBank, Aldermore |

| Financial Resilience | Consistent earnings growth and strong capital position | 10% increase in normalised EPS (H1 FY25); Capital Adequacy Ratio significantly above target |

| Digital Leadership | Pioneering digital banking solutions | Substantial investment in platform modernization; Partnership with Fiserv |

| Effective Risk Management | Credit loss ratio within target range | 94 bps credit loss ratio (H1 FY24) vs. 90-110 bps target |

What is included in the product

Delivers a strategic overview of FirstRand’s internal and external business factors, highlighting its competitive advantages and potential challenges.

Offers a clear, actionable framework for FirstRand to identify and address competitive pressures and internal weaknesses.

Weaknesses

While FirstRand boasts diversification, a substantial part of its business is still tied to South Africa's tough economic climate. This includes slow growth, disappointing investment, and high joblessness, which can limit how much the bank can lend to consumers and how the economy performs overall.

For instance, South Africa's GDP growth was projected to be around 1.5% in 2024, a figure that, while an improvement, still suggests a constrained environment for credit expansion. This directly impacts FirstRand's ability to grow its loan books and generate interest income within its home market.

FirstRand's motor finance division is navigating considerable uncertainty stemming from the UK Financial Conduct Authority's (FCA) probe into dealer commissions. This investigation prompted the company to set aside a substantial R3 billion provision in its financial year ending June 30, 2024, alongside other related expenses.

While a recent Supreme Court decision has offered some clarity on the matter, the ultimate scale of the proposed redress scheme and any potential adjustments to the existing provision remain key factors that could affect FirstRand's future profitability. These ongoing developments highlight a significant risk to the group's earnings outlook.

The anticipated interest rate cutting cycle in South Africa presents a significant challenge for FirstRand, with expectations of net interest margin compression. This could directly impact the growth of its net interest income, a key driver of profitability for banking groups.

While FirstRand benefits from a diversified revenue stream, a prolonged period of lower interest rates will inevitably squeeze margins. For instance, if deposit growth continues to outpace loan advances in certain segments, as observed in recent periods, this imbalance further exacerbates the pressure on net interest margins.

Cost-to-Income Ratio Fluctuations

While FirstRand has demonstrated effective cost control, especially in its UK ventures, its cost-to-income ratio has experienced some variability and can be higher in specific business areas. For instance, in the first half of fiscal year 2024, FirstRand's overall cost-to-income ratio stood at 51.3%, a slight increase from 50.9% in the prior year, indicating persistent cost pressures.

Ongoing investments in digital transformation and the need to navigate inflationary pressures across its diverse operations pose continuous challenges in optimizing cost efficiency. These investments are crucial for future competitiveness but naturally impact short-term cost ratios. Managing these competing demands requires careful strategic allocation of resources.

- Cost-to-Income Ratio: While improved in some segments, the overall ratio has seen minor increases, reaching 51.3% in H1 FY24.

- Technology Investment: Significant capital is being deployed into digital initiatives, impacting immediate cost efficiency.

- Inflationary Pressures: Rising operational costs due to inflation require ongoing management to maintain profitability.

- Segmental Performance: Certain business units may exhibit higher cost-to-income ratios, necessitating targeted efficiency drives.

Competitive Landscape and Digital Challengers

The South African banking sector is intensely competitive, with established players and agile fintech companies aggressively pursuing market share, especially in the rapidly evolving digital banking space. FirstRand, while possessing a robust digital infrastructure, faces the ongoing challenge of maintaining its leadership as competitors increasingly prioritize digital-first strategies and innovative solutions to reach previously unbanked or underbanked populations.

This dynamic environment necessitates continuous investment in digital capabilities and customer experience to counter threats from nimble challengers who are often quicker to adopt new technologies and business models. For instance, the rise of mobile-only banking platforms and specialized digital lenders presents a significant competitive pressure point.

- Digital Acceleration: Competitors are rapidly enhancing their digital offerings, potentially eroding FirstRand's market share if innovation lags.

- Fintech Disruption: The emergence of agile fintechs focused on specific digital niches poses a direct challenge to traditional banking services.

- Underserved Markets: Competitors are targeting underserved communities with digital-first solutions, a segment where FirstRand also aims to grow.

- Customer Expectations: Evolving customer demands for seamless digital experiences require constant adaptation and investment.

FirstRand faces significant headwinds from South Africa's sluggish economic growth, which limits credit expansion and impacts overall performance. The anticipated interest rate cuts also pose a threat, potentially compressing net interest margins and affecting net interest income growth.

The group's motor finance division is exposed to regulatory scrutiny in the UK, with a substantial R3 billion provision already set aside for potential redress schemes, creating ongoing earnings uncertainty.

Intense competition from agile fintechs, particularly in the digital banking space, requires continuous investment to maintain market share and meet evolving customer expectations for seamless digital experiences.

| Weakness | Description | Impact | Data Point |

|---|---|---|---|

| Economic Sensitivity | Heavy reliance on the South African economy. | Constrained lending and growth potential. | SA GDP growth projected around 1.5% for 2024. |

| UK Motor Finance Probe | Regulatory investigation into dealer commissions. | Significant provisions and potential future costs. | R3 billion provision for FY ending June 30, 2024. |

| Interest Rate Sensitivity | Anticipated rate cuts impacting margins. | Compression of net interest margins. | Deposit growth outpacing loan advances in certain segments. |

| Competitive Landscape | Rise of digital-first fintechs. | Threat to market share and requires ongoing digital investment. | Increased focus on digital solutions by competitors. |

Same Document Delivered

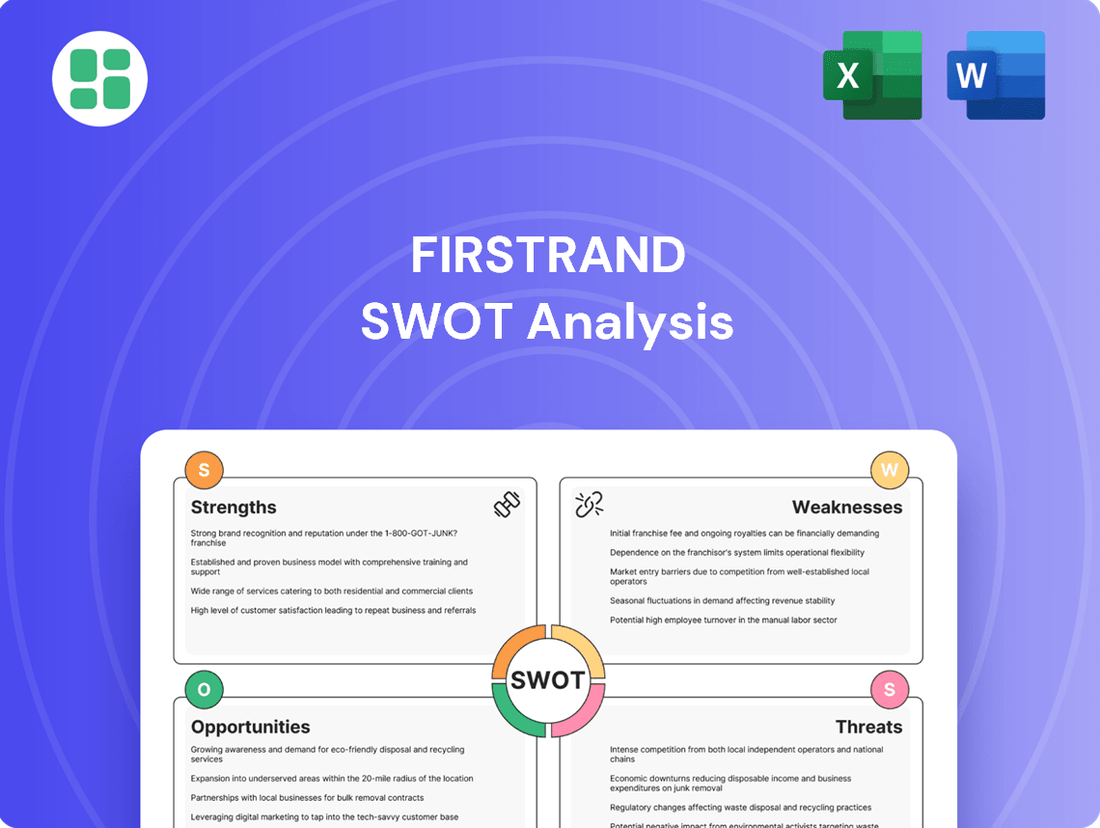

FirstRand SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details FirstRand's Strengths, Weaknesses, Opportunities, and Threats comprehensively.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing actionable insights into FirstRand's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, allowing you to tailor the analysis to your specific needs.

Opportunities

FirstRand is actively pursuing expansion across broader African markets, a core part of its strategy to build a stronger on-the-ground presence and competitive edge. This includes a focus on growing customer bases in existing markets, particularly in deposit gathering and transactional banking, which are vital for sustainable growth.

The group is exploring strategic acquisitions and new market entries, with East Africa identified as a key region for future development. This expansion aims to leverage FirstRand's expertise and scale to tap into the continent's growing economic potential.

FirstRand's commitment to digital transformation, including its adoption of cloud-native core banking solutions like Finxact, presents a prime opportunity to craft highly personalized digital banking experiences. This technological shift is key to rapidly launching innovative new products and services, keeping pace with evolving customer demands.

Further strategic investments in cutting-edge technologies such as open banking and artificial intelligence are poised to unlock substantial operational efficiencies for FirstRand. These advancements will also fuel a surge in cross-selling opportunities and foster a culture of continuous innovation across its financial services offerings, directly impacting revenue streams and customer engagement.

FirstRand is actively channeling funds into a low-carbon economy, emphasizing sustainable and transition financing across vital industries. This strategic focus positions the bank to benefit from the increasing global demand for green financial products.

The issuance of green bonds and enhancements to its sustainable finance framework are key opportunities. These initiatives not only align FirstRand with international climate objectives but also attract dedicated green investment, bolstering its market presence in environmentally conscious finance.

In 2023, FirstRand's sustainable finance portfolio saw significant growth, with green bond issuances totaling R5 billion, demonstrating a tangible commitment to this expanding market segment. This aligns with a broader trend where sustainable finance is projected to reach over $50 trillion globally by 2025.

Improving South African Economic Prospects

Improving macroeconomic conditions in South Africa present a significant opportunity. Anticipated interest rate cuts by the South African Reserve Bank, potentially starting in late 2024 or early 2025, are expected to alleviate pressure on household finances and stimulate credit demand. This shift could lead to increased lending activity for institutions like FirstRand.

The formation of a Government of National Unity signals a potential commitment to economic reforms and stability. Focus areas such as job creation and infrastructure development, if effectively implemented, could foster a more robust economic environment. For instance, government plans to boost infrastructure spending could indirectly support business investment and, consequently, banking sector growth.

- Economic Reforms: South Africa's ongoing efforts to implement structural economic reforms aim to improve investor confidence and attract foreign direct investment, which could positively impact the financial sector.

- Interest Rate Outlook: Projections for interest rate cuts in 2024/2025, following a period of high rates, are anticipated to stimulate borrowing and economic activity.

- Government Focus: The new government's stated priorities on job creation and infrastructure investment could create a more favorable operating landscape for businesses, including banks.

- Credit Growth Potential: Easing economic pressures and potential rate cuts are expected to unlock pent-up demand for credit, benefiting financial institutions.

Strategic Acquisitions and Partnerships

FirstRand's strategic pursuit of acquisitions, particularly targeting other African banks, offers a significant avenue for inorganic growth and market consolidation. This approach allows for rapid expansion into new territories and customer segments, bypassing the lengthy and complex process of organic market entry. For instance, the group has historically shown interest in expanding its footprint across the continent, a strategy that aligns with the ongoing consolidation trends observed in African banking sectors throughout 2024 and into 2025.

Furthermore, FirstRand's openness to strategic partnerships, exemplified by its collaboration with Fiserv for digital transformation, unlocks opportunities for technological advancement and service enhancement. These alliances enable access to cutting-edge solutions and expertise, thereby improving customer experience and operational efficiency. Such partnerships can also facilitate entry into adjacent financial services markets, broadening the group's revenue streams and competitive positioning without the need for extensive capital investment in new licenses.

- Inorganic Growth: FirstRand's acquisition strategy aims to expand its African banking presence, potentially increasing its market share in key growth regions.

- Technological Advancement: Partnerships like the one with Fiserv provide access to advanced digital capabilities, enhancing service delivery and customer engagement.

- Market Reach Expansion: Collaborations can open doors to new customer segments and financial service offerings, diversifying income sources.

- Efficiency Gains: Integrating new technologies and expanding through acquisitions can lead to economies of scale and improved operational efficiencies.

FirstRand's strategic expansion into broader African markets, coupled with a focus on digital transformation and sustainable finance, presents significant growth avenues. The group's commitment to leveraging technologies like AI and open banking, alongside potential interest rate cuts in South Africa expected in late 2024 or early 2025, positions it to capitalize on economic recovery and increased credit demand.

The bank's proactive approach to inorganic growth through acquisitions and strategic partnerships, such as its collaboration with Fiserv, offers substantial opportunities for market consolidation and technological enhancement. These moves are designed to broaden its reach, improve customer experience, and unlock new revenue streams in a dynamic financial landscape.

FirstRand's investment in a low-carbon economy, evidenced by its R5 billion in green bond issuances in 2023, aligns with global trends and attracts dedicated green investment, positioning the bank favorably in the rapidly growing sustainable finance sector. This focus is expected to yield benefits as sustainable finance globally is projected to exceed $50 trillion by 2025.

The potential for economic reforms and stability under South Africa's Government of National Unity, with stated priorities on job creation and infrastructure, could foster a more supportive operating environment. This, combined with anticipated interest rate reductions, is expected to stimulate borrowing and economic activity, creating a more favorable climate for banking sector growth.

Threats

FirstRand faces significant regulatory and compliance risks, as evidenced by the UK motor finance investigation which resulted in substantial provisions impacting profitability. The financial services industry's inherent complexity means that evolving regulations, such as the ongoing implementation of remaining Basel reforms in South Africa, demand continuous adaptation and investment in operational capabilities to ensure compliance.

Global and regional macroeconomic uncertainty, amplified by ongoing geopolitical tensions, presents a significant threat to FirstRand. This instability can dampen business and household confidence, directly impacting system growth and deterring crucial investment decisions. For instance, the International Monetary Fund (IMF) in its October 2024 World Economic Outlook projected global growth to slow to 2.9% in 2025, down from 3.2% in 2024, highlighting a challenging operating environment.

The persistence of global inflationary pressures or a more gradual unwinding of interest rate hikes by central banks could further prolong difficult operating conditions for financial institutions like FirstRand. This prolonged period of higher borrowing costs and economic caution would likely continue to constrain lending and investment activities, affecting profitability.

The financial landscape in South Africa is rapidly evolving, with FinTechs and digital banks emerging as significant competitive forces. These agile players are particularly adept at reaching underserved communities, offering innovative and cost-effective digital solutions that directly challenge traditional banking models. This intensified competition puts pressure on established institutions like FirstRand to continuously adapt and innovate their product and service offerings to retain market share and customer loyalty.

Cybersecurity and Technology Risks

FirstRand's increasing reliance on digital platforms and cloud solutions exposes it to heightened cybersecurity and technology risks. A significant data breach could lead to substantial financial losses and irreparable reputational damage, impacting customer trust and market standing. In 2023, the financial services sector globally experienced a notable rise in sophisticated cyberattacks, with the average cost of a data breach reaching millions of dollars, a trend expected to continue into 2024 and 2025.

Maintaining advanced cybersecurity defenses and ensuring the resilience of its complex IT infrastructure are paramount for FirstRand. Failure to do so could result in service disruptions, regulatory penalties, and a loss of competitive advantage. The ongoing evolution of cyber threats necessitates continuous investment in technology and expertise to stay ahead of malicious actors.

- Cybersecurity threats: Increasing sophistication of attacks targeting financial institutions.

- Technology disruptions: Potential for outages impacting service delivery and customer access.

- Data protection: Critical need to safeguard sensitive customer information against breaches.

- Reputational damage: Compromised security can severely erode customer trust and brand image.

Sovereign Creditworthiness and FATF Grey Listing

The South African banking sector, including FirstRand, faces ongoing threats related to sovereign creditworthiness. A downgrade in South Africa's credit rating could increase borrowing costs for the nation and its entities, impacting overall financial stability and investor confidence.

A significant concern is the potential for prolonged inclusion on the Financial Action Task Force (FATF) grey list. If South Africa misses key deadlines for improving its anti-money laundering and counter-terrorist financing frameworks, this could severely damage investor sentiment. For instance, as of mid-2024, South Africa remained on the FATF grey list, with ongoing assessments of its progress. Failure to demonstrate substantial improvements could lead to capital flight and currency depreciation, directly affecting the operating environment for banks.

- Sovereign Credit Rating Impact: A lower credit rating for South Africa can increase FirstRand's cost of capital, making it more expensive to fund operations and expand.

- FATF Grey List Consequences: Continued grey listing, as observed through mid-2024, can deter foreign investment and increase compliance burdens for financial institutions.

- Investor Sentiment Deterioration: Negative perceptions stemming from sovereign creditworthiness issues or FATF status can trigger capital outflows, weakening the Rand and impacting profitability.

- Currency Volatility: Capital outflows and reduced foreign investment can lead to significant currency depreciation, affecting the value of foreign assets and liabilities for FirstRand.

FirstRand faces a dynamic threat landscape, with increasing competition from agile FinTechs and digital banks challenging traditional models. The ongoing global economic slowdown, projected by the IMF to be 2.9% in 2025, coupled with persistent inflation and higher interest rates, creates a challenging operating environment that constrains lending and investment.

Cybersecurity risks are escalating, with sophisticated attacks posing a significant threat to data protection and customer trust, a trend that saw the average cost of a data breach in the financial sector reach millions of dollars in 2023. Furthermore, South Africa's sovereign creditworthiness and its continued presence on the FATF grey list as of mid-2024 present substantial risks, potentially increasing borrowing costs and deterring foreign investment.

| Threat Category | Specific Threat | Impact on FirstRand | Supporting Data/Context |

|---|---|---|---|

| Competitive Landscape | FinTech and Digital Bank Disruption | Erosion of market share, pressure on margins | Agile players targeting underserved segments with innovative digital solutions |

| Macroeconomic Uncertainty | Global Economic Slowdown & Inflation | Reduced lending demand, higher borrowing costs, constrained profitability | IMF projects global growth at 2.9% in 2025 (down from 3.2% in 2024) |

| Operational & Security Risks | Cybersecurity Breaches | Financial losses, reputational damage, regulatory penalties | Average cost of data breach in finance sector reached millions in 2023; trend expected to continue |

| Sovereign & Regulatory Risk | FATF Grey List Status | Deterred foreign investment, increased compliance burden, potential capital flight | South Africa remained on FATF grey list as of mid-2024, with ongoing assessments |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from FirstRand's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and insightful assessment.