FirstRand Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstRand Bundle

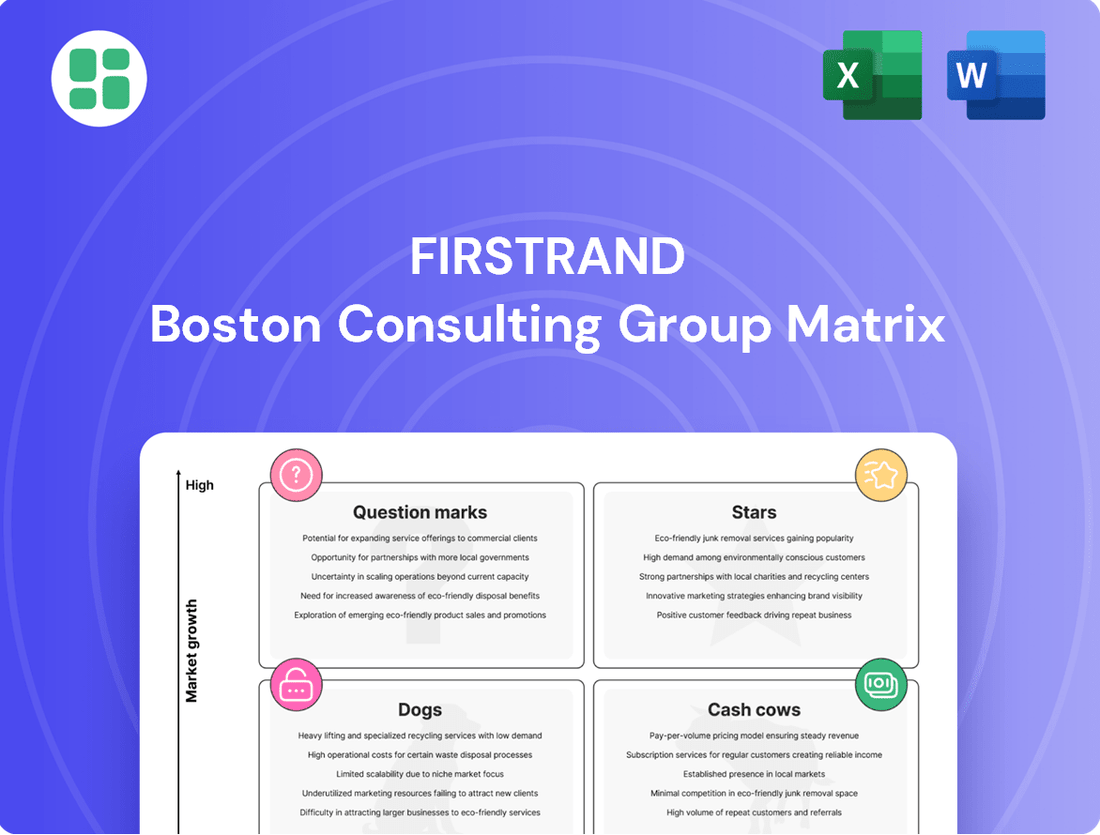

FirstRand's BCG Matrix reveals a dynamic portfolio, showcasing which business units are fueling growth and which require careful management. Understand the interplay between market share and growth rate to unlock strategic opportunities.

This preview offers a glimpse into FirstRand's strategic positioning. For a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, and to gain actionable insights for your own portfolio, purchase the full BCG Matrix report today.

Stars

FNB's digital banking ecosystem, encompassing its highly adopted banking app and the popular eBucks loyalty program, demonstrates substantial user engagement and a growing volume of transactions. This strong performance points to a significant market share within the expanding digital banking sector.

The bank's proactive approach to digital innovation and its focus on fostering customer loyalty through features like eBucks firmly establish this segment as a primary engine for future growth. FNB's commitment to technological advancement, including the introduction of digital wallets and virtual cards, solidifies its position as a leader in the digital banking space.

FNB's operations in broader Africa are demonstrating strong momentum, with profit before tax (PBT) showing significant year-on-year growth. For the six months ending December 31, 2023, FNB's PBT from its Rest of Africa operations increased by 19% to R2.7 billion, highlighting a healthy expansion in these markets. This growth signals increasing market penetration and a positive reception to FNB's digital offerings.

This expansion beyond South Africa is a key strategic pillar for FirstRand, allowing the group to tap into high-growth African economies. FNB's established brand and advanced digital platforms are crucial in capturing new customer segments across these developing markets. The diversification into these regions is not just about growth; it's about building a sustainable, pan-African financial services presence.

The contribution of these broader African operations to FirstRand's overall performance is substantial and growing. For the fiscal year 2023, FNB's Rest of Africa segment contributed R4.7 billion to group PBT, a notable increase from previous years. This strategic diversification is a testament to FirstRand's ability to leverage its strengths in new and evolving markets, solidifying its position as a leading financial services provider on the continent.

Rand Merchant Bank's (RMB) corporate and investment banking activities across broader Africa are showing robust profit before tax (PBT) growth, signaling a dynamic and expanding market for these services. This strong performance underscores the high-growth potential RMB is tapping into across the continent.

RMB's success in generating substantial corporate finance and structuring fees from mergers and acquisitions (M&A) in these regions is a clear indicator of its established market presence and significant growth prospects. For example, in 2024, RMB advised on several key cross-border M&A deals in sectors like telecommunications and consumer goods, contributing to its fee income growth in Africa.

By concentrating on knowledge-based fees and fostering strategic relationships with clients in these rapidly developing African markets, RMB is solidifying its position as a star performer. This approach, focused on specialized advisory and complex deal structuring, leverages RMB's expertise to capture value in high-potential African economies.

Aldermore's Specialist Lending in the UK

Aldermore, FirstRand's UK specialist lender, has demonstrated strong performance, with profit before tax growing significantly. This growth is driven by an increase in customer lending, especially within higher-return market niches.

Despite economic headwinds, Aldermore's strategic focus on specialist lending segments, coupled with its ability to expand its loan book and attract deposits, highlights its potential as a star within the UK financial landscape.

- Robust Profit Growth: Aldermore reported a substantial increase in profit before tax for the fiscal year ending September 30, 2023, reaching £226.9 million, a notable rise from £134.6 million in the prior year.

- Lending Portfolio Expansion: The bank saw its total customer lending grow to £14.7 billion as of September 30, 2023, up from £13.5 billion a year earlier, indicating successful expansion in its target markets.

- Deposit Growth: Aldermore also experienced a healthy increase in customer deposits, reaching £11.1 billion, up from £10.6 billion, reflecting customer confidence and its appeal in the specialist lending space.

- Focus on Niches: The lender continues to concentrate on specific, profitable sub-segments of the UK market, such as buy-to-let mortgages and business finance, which contribute to its strong performance.

FirstRand's Fintech and Digital Innovation Initiatives

FirstRand's commitment to digital transformation is evident in its significant annual IT investments, with a notable allocation towards cloud-native banking solutions. This strategic focus on future-proofing its digital infrastructure positions its fintech and digital innovation initiatives as strong contenders for future growth.

The partnership with Fiserv to implement Finxact is a key move, enabling real-time banking capabilities and accelerating the development of personalized digital experiences. This initiative is designed to drive innovation across FNB and RMB, fostering rapid deployment of new services.

- Significant IT Investment: FirstRand consistently invests heavily in its IT infrastructure, underscoring the strategic importance of digital capabilities.

- Finxact Partnership: The collaboration with Fiserv for Finxact aims to deliver cloud-native, real-time banking, a critical component for future growth.

- Accelerated Innovation: These initiatives are geared towards speeding up the creation and rollout of new, customer-centric digital banking solutions.

- Future-Proofing Digital Capabilities: The focus on advanced technology ensures FirstRand remains competitive and adaptable in the evolving digital landscape.

FNB's digital banking platform, including its popular app and the eBucks loyalty program, shows strong customer engagement and transaction volumes, indicating a significant market share in the growing digital banking sector. This digital focus, coupled with investments in new features like digital wallets, positions FNB as a leader poised for future expansion.

Rand Merchant Bank's (RMB) corporate and investment banking services in Africa are experiencing robust profit growth, driven by strong performance in corporate finance and advisory services, particularly in cross-border mergers and acquisitions. RMB's strategic focus on knowledge-based fees and client relationships in high-growth African economies solidifies its star status.

Aldermore, FirstRand's UK specialist lender, has shown impressive profit growth, fueled by an expanding loan book and strong performance in niche lending segments. With a profit before tax of £226.9 million for the year ending September 30, 2023, and total customer lending at £14.7 billion, Aldermore is a clear star performer in the UK market.

FirstRand's substantial IT investments, particularly in cloud-native banking solutions and the Finxact partnership, are accelerating digital innovation. This strategic commitment to advanced technology ensures the group's digital initiatives are well-positioned for sustained growth and market leadership.

| Business Unit | Performance Indicator | 2023 Data | Trend | BCG Category |

| FNB Digital | Market Share in Digital Banking | Significant | Growing | Star |

| RMB Africa | Profit Before Tax (PBT) Growth | Robust | Increasing | Star |

| Aldermore (UK) | Profit Before Tax (PBT) | £226.9 million | Up from £134.6 million | Star |

| FirstRand IT/Digital Initiatives | IT Investment | Substantial | Increasing Focus | Star |

What is included in the product

This BCG Matrix overview highlights FirstRand's strategic positioning of its business units, identifying growth opportunities and areas for optimization.

The FirstRand BCG Matrix offers a clear, one-page overview, alleviating the pain of complex portfolio analysis by placing each business unit in a quadrant.

Cash Cows

FNB, FirstRand's core South African retail and commercial banking arm, is a prime example of a cash cow. Despite operating in a mature market with ongoing credit challenges, FNB consistently delivers robust cash flows. This is largely due to its substantial market share and the stability of its transactional banking volumes.

In the first half of fiscal year 2024, FNB reported a notable increase in net interest income, reflecting its strong lending base. The bank's ability to maintain high customer engagement and leverage its extensive branch and digital network ensures consistent revenue generation, even with moderate overall earnings growth.

WesBank's vehicle and asset finance division is a classic cash cow for FirstRand. It holds a dominant market share in South Africa's mature vehicle and asset finance sector, consistently generating substantial cash flow.

Despite a challenging economic climate impacting new car sales, WesBank saw advances growth of 7.5% in the first half of 2024, contributing significantly to FirstRand's net interest income. This stable, high-volume operation allows for efficient cash generation, even with moderating market growth.

RMB's traditional corporate and investment banking operations in South Africa are a cornerstone of FirstRand's portfolio, firmly positioned as a cash cow. These activities, deeply entrenched in established sectors, command a significant market share within a mature, albeit occasionally unpredictable, economic environment.

While growth can be cyclical, RMB consistently delivers robust fee income and manages a substantial loan portfolio, ensuring a stable and considerable cash flow for the broader group. For instance, FirstRand's interim results for the six months ended December 31, 2023, showed that RMB's normalized headline earnings grew by 11% to R10.6 billion, underscoring its strong performance and cash-generating capability.

The bank's leading role in South Africa's corporate finance landscape solidifies its status as a reliable and significant cash generator, contributing a steady stream of earnings that supports other ventures within FirstRand.

FirstRand's Deposit-Taking Franchises (across brands)

FirstRand's deposit-taking franchises, encompassing brands like FNB, WesBank, and Aldermore, represent significant cash cows. Their ability to consistently attract and grow client deposits highlights a commanding market share within the mature, low-growth banking funding sector.

These stable and expanding deposit bases are crucial. They offer a cost-effective funding source, directly boosting the group's net interest income and ensuring ample liquidity across all operations. This financial stability is the bedrock of their robust cash generation.

- Deposit Growth: FirstRand reported a 10.5% increase in total customer deposits for the six months ended December 31, 2023, reaching R1.2 trillion.

- Funding Cost Advantage: The group's focus on transactional accounts and a diversified deposit mix allows for a lower average cost of funds compared to wholesale funding.

- Net Interest Income Contribution: Deposits are a primary driver of net interest income, which stood at R31.4 billion for the same period, up 16% year-on-year.

FirstRand's Insurance and Investment Products

FirstRand's insurance and investment products, primarily delivered through brands like FNB, form a significant part of its diversified non-interest revenue. These mature offerings leverage FirstRand's vast customer base and strong cross-selling abilities, ensuring a steady flow of fee and commission income, as well as investment profits.

This segment acts as a stable, high-margin contributor to the group's overall profitability, demonstrating its cash cow status within the BCG matrix. For instance, in the first half of 2024, FirstRand reported a substantial increase in its insurance and investment income, underscoring the segment's consistent performance.

- Diversified Revenue: Insurance and investment products contribute significantly to FirstRand's non-interest revenue, providing a stable income stream.

- Customer Leverage: The group effectively utilizes its extensive customer base for cross-selling opportunities within this segment.

- Profitability: These mature product lines offer high-margin contributions to FirstRand's overall earnings.

- 2024 Performance: FirstRand saw a notable uplift in insurance and investment income during the first half of 2024, reinforcing its role as a cash cow.

Cash cows in FirstRand's portfolio, like FNB and WesBank, are characterized by their strong market positions in mature sectors, consistently generating substantial and stable cash flows. These businesses benefit from high customer engagement and significant market share, which allows them to maintain robust net interest income and fee-based earnings even in slower-growth environments.

The deposit-taking franchises across the group are particularly strong cash cows, providing a cost-effective funding base that directly enhances net interest income. FirstRand's insurance and investment products also fit this category, leveraging the extensive customer base for consistent fee and commission income.

| Business Unit | BCG Category | Key Performance Indicator (H1 2024) | Contribution to Group |

|---|---|---|---|

| FNB (Retail & Commercial Banking) | Cash Cow | Net interest income increase | Robust cash flows, stable revenue |

| WesBank (Vehicle & Asset Finance) | Cash Cow | Advances growth of 7.5% | Significant contribution to net interest income |

| RMB (Corporate & Investment Banking) | Cash Cow | Normalized headline earnings grew 11% (H1 2024) | Steady fee income and loan portfolio management |

| Deposit Franchises | Cash Cow | Total customer deposits R1.2 trillion (Dec 2023) | Cost-effective funding, boosts net interest income |

| Insurance & Investment Products | Cash Cow | Substantial increase in income (H1 2024) | Stable fee and commission income, high margins |

Full Transparency, Always

FirstRand BCG Matrix

The FirstRand BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This detailed analysis, meticulously prepared by industry experts, offers a comprehensive overview of FirstRand's business units, categorized by market share and growth rate, ready for immediate strategic application.

Dogs

Underperforming legacy product lines represent areas within FirstRand, such as older banking products within FNB, that are experiencing low customer engagement and declining revenue. These offerings, often hampered by technological limitations or evolving consumer demands, continue to draw resources without yielding substantial returns. For instance, if a legacy savings account product saw a 15% year-over-year decline in active accounts in 2024, it would fit this description.

Niche, stagnant market segments with low penetration within FirstRand's portfolio would represent the 'Dogs' in the BCG matrix. These are areas where the group has a limited market share, and the overall market itself isn't growing much. For instance, imagine a specific, small digital lending product in a region with limited internet access; its growth potential is likely capped, and FirstRand's share within that small market might also be minimal.

These segments often require significant resources or management focus for very little return. Consider a hypothetical scenario where FirstRand maintains a presence in a legacy financial product catering to a shrinking demographic, perhaps a specific type of fixed-term deposit that has seen a decline in demand. While FirstRand might have a small but stable share, the overall market for such products in 2024, for example, could be contracting by 2-3% annually, making it difficult to justify continued investment.

MotoVantage, a short-term insurance partnership, is classified as held for sale, signaling its divestment by FirstRand. This strategic move suggests MotoVantage is considered a low-growth, low-market share asset that no longer aligns with FirstRand's core objectives or profitability targets.

The designation of MotoVantage as held for sale strongly implies it has been a cash trap or an underperforming segment within FirstRand's portfolio. For instance, in the first half of 2024, FirstRand's disclosed results showed a continued focus on optimizing its portfolio, with specific mentions of non-core asset disposals contributing to capital efficiency.

Specific Geographic Regions with Limited Scale and Growth

Within FirstRand's extensive African footprint, certain niche geographic markets might be categorized as Dogs in the BCG Matrix. These are typically regions where the bank has a smaller presence, faces formidable competition from established local and international players, and sees very little expansion in its customer base or transaction volumes. For instance, a market where FirstRand holds less than 1% market share and where overall economic growth is projected to be below 2% annually, as seen in some smaller West African economies, would fit this description.

The rationale for classifying such regions as Dogs stems from the significant capital and strategic effort needed to achieve meaningful market penetration. The potential return on investment in these areas is often perceived as low, especially when compared to more dynamic markets where FirstRand already possesses a stronger competitive advantage. For example, in 2024, a market with a banking penetration rate below 30% and where regulatory hurdles are particularly high could represent a Dog if FirstRand's current operations there are minimal.

- Limited Market Share: Regions where FirstRand's banking operations represent a small fraction of the total market, potentially under 2% in 2024.

- Intense Competition: Markets characterized by the presence of multiple strong local and international banks, making it difficult to gain traction.

- Stagnant Growth: Geographic areas with low projected economic growth rates, typically below 2-3% annually, limiting opportunities for expansion.

- High Investment Threshold: Locations where the cost of acquiring customers and building infrastructure to compete effectively is disproportionately high relative to potential revenue.

Outdated Technology Platforms or Infrastructure

FirstRand's legacy IT infrastructure represents a significant challenge, potentially classifying as dogs in its business portfolio. These systems are not only expensive to maintain, with reports in 2024 indicating that banks globally spend an average of 70% of their IT budget on maintaining existing systems, but they also hinder innovation.

The limited functionality of these outdated platforms restricts FirstRand's ability to offer cutting-edge digital services, directly conflicting with its stated digital transformation goals. This misalignment means these assets are consuming considerable operational expenses without generating a competitive edge or driving new revenue streams.

The eventual replacement or phased decommissioning of these legacy systems is a strategic imperative. For instance, in 2023, several major financial institutions announced multi-billion dollar investments in modernizing their core banking systems to improve efficiency and customer experience.

- High Maintenance Costs: Legacy systems often incur disproportionately high operational expenses due to specialized support needs and integration complexities.

- Limited Functionality: Outdated infrastructure restricts the development and deployment of new digital products and services.

- Strategic Misalignment: These platforms do not support FirstRand's digital-first strategy, acting as a drag on growth initiatives.

- Future Investment Drain: Continued reliance on these systems diverts resources that could be better allocated to forward-looking technologies.

Dogs within FirstRand's portfolio represent business units or products with low market share in slow-growing industries. These segments often consume resources without generating significant returns, requiring careful management to avoid becoming a drain on overall profitability. For example, a niche product with declining customer adoption, where FirstRand holds a minimal market position, would be a prime candidate for this classification.

FirstRand's divestment of MotoVantage, a short-term insurance partnership, strongly suggests its classification as a Dog. This move indicates the asset had limited growth potential and a small market share, no longer aligning with the group's strategic objectives. Such divestitures are common for businesses that are cash traps or underperformers, freeing up capital for more promising ventures.

Certain niche geographic markets within FirstRand's African operations could also be considered Dogs. These are regions with low banking penetration, intense competition, and minimal economic expansion, making it difficult to achieve significant market share. In 2024, markets with less than 1% banking penetration and projected economic growth below 2% annually would exemplify such Dog segments.

Legacy IT infrastructure presents another area likely classified as Dogs. These systems are costly to maintain, often consuming a large portion of IT budgets, and hinder innovation. For instance, reports in 2024 indicated that banks globally spend around 70% of their IT budget on maintaining existing systems, a figure that highlights the resource drain of outdated technology.

Question Marks

Within FirstRand's digital ecosystem, which generally performs as a Star, newer payment solutions like PayShap are navigating their initial adoption stages. While the digital payments market itself is experiencing robust growth, PayShap's current market share is likely modest compared to more entrenched payment methods.

These initiatives represent a high-growth market segment. However, their position is akin to a Question Mark on the BCG matrix, demanding substantial investment to scale effectively and capture significant market share. Success could propel them into Star status, while failure might relegate them to Dog territory.

FirstRand's strategic entries into new, high-growth geographic markets, such as potential expansions into Southeast Asia or specific African nations beyond its current strongholds, would be classified as Question Marks. These initiatives demand significant upfront capital, with projections indicating an initial investment of hundreds of millions of dollars for establishing a robust operational footprint and marketing campaigns. For instance, a hypothetical entry into Vietnam might require an estimated $500 million over five years to build brand recognition and secure market share.

Aldermore's strategic expansion into new specialist lending sub-segments, aiming for attractive returns where its market share is currently small, aligns with a Stars or Question Marks positioning within the FirstRand BCG Matrix. These ventures represent potential growth areas requiring dedicated capital and operational expertise to mature.

For instance, Aldermore's focus on niche areas like invoice finance for specific industries or asset finance for emerging technologies could be seen as nascent Stars or Question Marks. In 2024, the UK specialist lending market continued to show resilience, with sectors like asset finance experiencing robust growth, presenting opportunities for Aldermore to capture market share.

Innovations in Green and Sustainable Finance

FirstRand is actively participating in the burgeoning green and sustainable finance sector. Their issuance of green bonds, such as the R1.1 billion sustainability bond in 2023, demonstrates a commitment to funding environmentally sound projects. The recent launch of FNB Energy Solutions further solidifies this focus, aiming to capitalize on the growing demand for renewable energy financing.

These initiatives align with a global trend, with sustainable finance markets experiencing significant expansion. For instance, the global green bond market reached an estimated $700 billion in issuance during 2023. While FirstRand's specific market share in these relatively new segments is still developing, this strategic focus positions them for future growth as environmental, social, and governance (ESG) considerations become increasingly central to investment decisions.

- Green Bond Issuance: FirstRand's R1.1 billion sustainability bond in 2023 highlights their engagement in this growing market.

- FNB Energy Solutions: This new offering targets the increasing demand for financing in the renewable energy sector.

- Market Growth: The global green bond market's estimated $700 billion issuance in 2023 underscores the rapid expansion of sustainable finance.

- Strategic Positioning: These initiatives are designed to capture growth in a sector driven by environmental awareness and regulatory support.

Ashburton Investments' Newer Niche Funds or Products

Ashburton Investments, a key player within the FirstRand group, is actively exploring and launching new, specialized investment products. These often focus on emerging asset classes or cater to specific investor needs, placing them in a category that, while holding significant growth potential, currently has a limited market presence. This strategic positioning requires substantial investment in marketing and a strong emphasis on performance to build traction and scale.

- Emerging Asset Focus: Ashburton's newer offerings might include funds targeting areas like renewable energy infrastructure or private credit, asset classes that saw significant investor interest in 2024.

- Niche Market Penetration: These products are designed for specific investor segments, aiming to capture market share in areas not traditionally served by broader fund offerings.

- Growth Potential vs. Current Share: While these funds are positioned for future growth, their initial market share is naturally low, necessitating a period of development and capital accumulation.

- Strategic Imperative for FirstRand: The success of these niche products is crucial for FirstRand's overall growth strategy, as they represent opportunities to diversify revenue streams and capture new market segments.

Question Marks within FirstRand represent new ventures or markets with high growth potential but currently low market share. These require significant investment to develop and gain traction. Success in these areas can transform them into Stars, while underperformance could lead to them becoming Dogs.

Examples include niche digital payment solutions like PayShap, or strategic geographic expansions into markets like Vietnam, which might need hundreds of millions in investment. Aldermore's entry into new specialist lending sub-segments, such as invoice finance for specific industries, also fits this category, needing capital to mature.

These initiatives are crucial for FirstRand's long-term diversification and growth, aiming to capture future market opportunities. The success of these ventures hinges on strategic execution and substantial capital allocation.

| Business Unit/Initiative | BCG Category | Market Growth Potential | Current Market Share | Investment Needs (Illustrative) |

|---|---|---|---|---|

| PayShap (New Payment Solutions) | Question Mark | High (Digital Payments) | Low | Significant |

| Geographic Expansion (e.g., Vietnam) | Question Mark | High | Negligible | Hundreds of millions |

| Aldermore Specialist Lending (Niche Segments) | Question Mark | High (e.g., Asset Finance) | Low | Substantial |

| Ashburton Investments (New Specialized Products) | Question Mark | High (Emerging Asset Classes) | Low | High Marketing & Performance Investment |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.