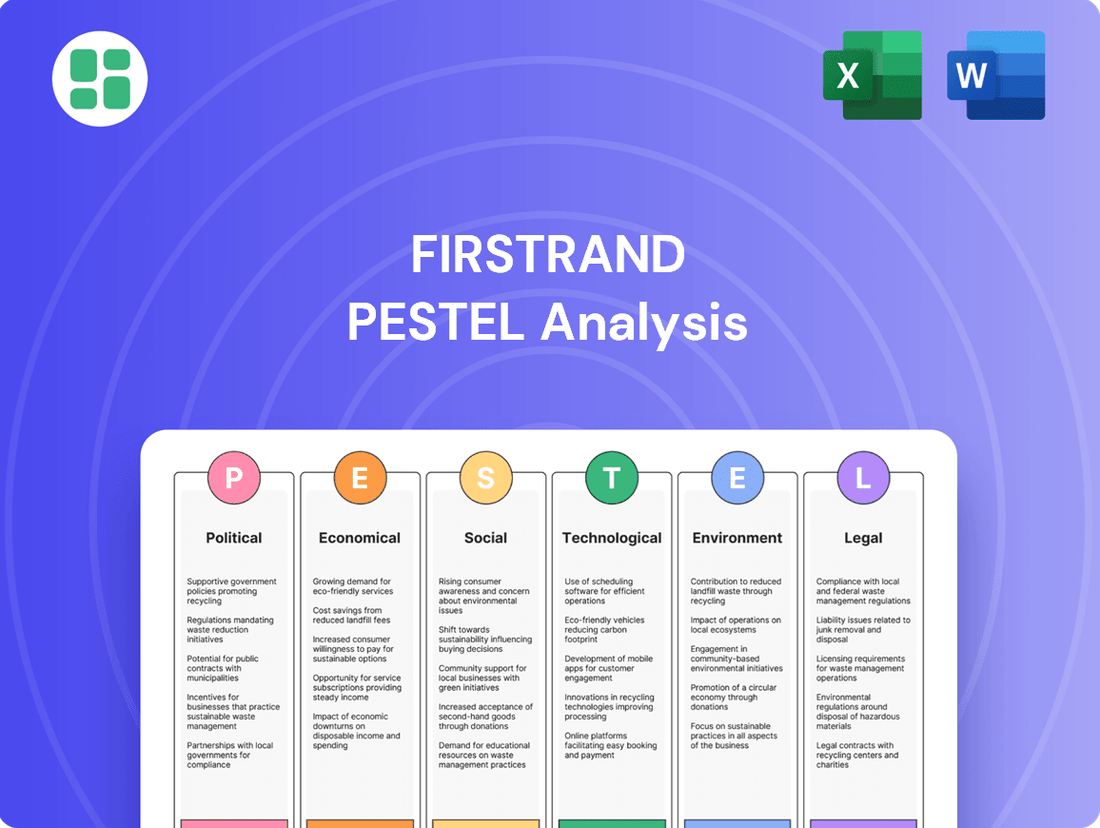

FirstRand PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstRand Bundle

Navigate the complex external environment shaping FirstRand's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the financial giant. Gain the strategic foresight needed to make informed decisions and stay ahead of the curve.

Unlock actionable intelligence on the forces impacting FirstRand's operations and growth potential. Our expert-crafted PESTLE analysis provides a deep dive into critical trends, empowering you to identify risks, capitalize on emerging opportunities, and refine your market strategy. Download the full version now for immediate insights.

Political factors

The formation of South Africa's Government of National Unity (GNU) in mid-2024 has ushered in a period of increased political stability, a welcome development for businesses like FirstRand. This stability directly translates to improved investor sentiment, as the risk of drastic policy shifts or political upheaval diminishes, creating a more predictable environment for financial planning and investment.

The GNU's stated policy objectives, including a focus on job creation, fiscal consolidation through public debt reduction, and significant infrastructure investment, are particularly relevant to FirstRand. These priorities suggest a government actively working to stimulate economic growth, which in turn can lead to increased demand for financial services, loan origination, and investment opportunities.

For instance, the South African government's Medium Term Budget Policy Statement for 2024 outlined plans to reduce the budget deficit, aiming for a more sustainable fiscal path. This fiscal discipline, coupled with investments in areas like renewable energy and digital infrastructure, signals a potentially more favorable operating environment for financial institutions that can support these growth sectors.

The South African Reserve Bank (SARB) plays a crucial role in overseeing financial institutions like FirstRand, maintaining a strong regulatory framework. The SARB’s Financial Stability Review (FSR) consistently assesses the banking sector’s resilience, with recent reports highlighting a stable outlook extending into 2025. This diligent oversight by the SARB is fundamental for prudential management and bolstering confidence in the financial system.

FirstRand's UK subsidiaries, Aldermore and MotoNovo, are navigating a complex regulatory environment, primarily influenced by the Financial Conduct Authority (FCA). The FCA's ongoing review into historical discretionary commission arrangements in motor finance directly affects these operations.

A significant development occurred with a Supreme Court ruling that has somewhat capped the scope of compensation claims related to these arrangements. However, FirstRand must still consider potential provisions for future redress schemes, a factor that will impact its financial planning and risk management in the UK market.

Anti-Money Laundering (AML) and Greylisting

South Africa's ongoing efforts to be removed from the Financial Action Task Force (FATF) greylist significantly shape its regulatory landscape, particularly concerning Anti-Money Laundering (AML) and counter-terrorist financing (CTF) measures. The country’s commitment to addressing identified deficiencies remains a critical factor in restoring international financial confidence.

FirstRand, as a prominent financial institution, faces heightened scrutiny and must adapt to increasingly stringent compliance obligations. This includes investing in advanced systems and training to detect and prevent illicit financial activities effectively. For instance, the South African government has been implementing new legislation and enhancing supervisory frameworks to meet FATF standards.

- FATF Greylist Status: South Africa remained on the FATF greylist as of early 2024, necessitating continued focus on AML/CTF reforms.

- Regulatory Impact: Stricter compliance requirements increase operational costs for financial institutions like FirstRand due to enhanced due diligence and reporting.

- International Credibility: Successful exit from the greylist is vital for attracting foreign investment and maintaining favorable trade relationships.

- FirstRand's Response: The bank has reportedly bolstered its compliance teams and technology infrastructure to meet evolving regulatory demands.

Policy Reforms and Infrastructure Investment

Government initiatives focused on structural reforms and tackling infrastructure gaps, particularly in logistics and renewable energy, are anticipated to boost South Africa's economic outlook. These policy shifts are projected to stimulate demand for financial services, especially corporate and project finance, which directly benefits FirstRand's RMB division.

For instance, the South African government's commitment to increasing renewable energy capacity, targeting 11.8 GW by 2025 through the Risk Mitigation Independent Power Producer Procurement Programme, creates significant opportunities for project finance. FirstRand's active participation in financing such vital national projects demonstrates its alignment with these developmental priorities and its broader commitment to societal impact.

- Infrastructure Deficiencies Addressed: Government plans aim to improve logistics networks and expand renewable energy generation.

- Economic Growth Prospects: Reforms are expected to unlock new demand for banking services, particularly in corporate and project finance.

- FirstRand's RMB Segment Benefit: Increased infrastructure development directly supports RMB's core business areas.

- Alignment with Societal Impact: The bank's involvement in national priorities reinforces its broader social responsibility goals.

The formation of South Africa's Government of National Unity (GNU) in mid-2024 has ushered in a period of increased political stability, a welcome development for businesses like FirstRand, fostering improved investor sentiment due to a more predictable policy environment.

The GNU's focus on job creation, fiscal consolidation, and infrastructure investment, as outlined in the 2024 Medium Term Budget Policy Statement, signals a government committed to economic growth, which directly benefits FirstRand through increased demand for financial services.

South Africa's ongoing efforts to exit the Financial Action Task Force (FATF) greylist, a process requiring enhanced Anti-Money Laundering (AML) and counter-terrorist financing (CTF) measures, significantly shape the regulatory landscape, necessitating robust compliance from institutions like FirstRand.

Government initiatives aimed at structural reforms and addressing infrastructure gaps, particularly in logistics and renewable energy, are projected to stimulate economic activity and create opportunities for FirstRand's corporate and project finance divisions.

| Political Factor | Impact on FirstRand | Supporting Data/Context |

|---|---|---|

| Government of National Unity (GNU) Stability | Enhanced investor confidence, predictable operating environment | Formed mid-2024, aims for policy continuity. |

| Government Economic Priorities | Increased demand for financial services, loan origination | Focus on job creation, fiscal consolidation, infrastructure investment (e.g., 11.8 GW renewable energy target by 2025). |

| FATF Greylist Status | Heightened compliance costs, scrutiny on AML/CTF | South Africa remained on greylist as of early 2024; requires ongoing reform implementation. |

| Structural Reforms & Infrastructure Investment | Growth opportunities for corporate & project finance (RMB) | Government plans to improve logistics and expand renewable energy capacity. |

What is included in the product

This FirstRand PESTLE analysis examines how political, economic, social, technological, environmental, and legal factors create both challenges and opportunities for the company's operations and strategic planning.

A concise, actionable summary of FirstRand's PESTLE analysis, enabling rapid identification of external threats and opportunities to inform strategic decision-making.

Economic factors

South Africa's economic outlook for 2025 points towards improved growth, with projections suggesting a GDP expansion of around 1.5% to 2.0%. This anticipated growth, coupled with expectations of potential interest rate cuts by the South African Reserve Bank, could significantly benefit FirstRand. Lower interest rates typically translate to reduced funding costs and a boost in consumer and business borrowing, directly impacting the bank's net interest income positively.

The easing monetary policy environment anticipated for 2025 is a key factor for financial institutions like FirstRand. If the South African Reserve Bank implements anticipated rate cuts, this will likely alleviate some of the pressure on household disposable income and encourage greater lending activity. This scenario is generally positive for a bank's core business of earning interest on loans, potentially driving up FirstRand's net interest margin.

Despite the positive domestic outlook, FirstRand must remain vigilant regarding external economic factors. Persistent global economic uncertainties and ongoing trade tensions, particularly between major economies, could still introduce volatility. These global headwinds might impact investor sentiment, capital flows, and overall business confidence within South Africa, indirectly affecting the banking sector's performance.

Consumer affordability in South Africa remains a key economic factor, with elevated pressures impacting household lending. Despite some improvements, credit health has seen a degree of deterioration, although FirstRand's retail impairments are showing signs of peaking and trending downwards.

The small business sector, however, might experience a lagged strain due to these economic conditions. Anticipated interest rate cuts in 2024 and 2025 are expected to provide gradual relief to households, potentially leading to an improvement in overall loan quality.

South Africa's inflation has been moderating, with the Consumer Price Index (CPI) showing a decrease to 5.3% year-on-year in April 2024, down from 5.9% in March. This trend, coupled with a generally stabilizing rand against the US dollar, offers a more predictable operating environment for FirstRand, potentially lowering input costs and mitigating currency-related risks.

Despite these positive signs, the South African Reserve Bank (SARB) has cautioned that the nation's fiscal position remains susceptible to sudden capital outflows. High exchange rate volatility, even with recent stabilization, could still affect market liquidity and investor confidence, posing a latent risk to financial institutions like FirstRand.

UK Market Conditions

The UK market presents a dynamic environment for FirstRand's specialist lending brand, Aldermore. While inflationary pressures have been a persistent concern, the Bank of England's monetary policy stance, with potential interest rate adjustments anticipated in 2024 and 2025, will significantly shape the lending landscape. For instance, the UK inflation rate stood at 2.3% in April 2024, down from 3.2% in March, indicating a cooling trend that could influence future rate decisions.

Despite these macroeconomic shifts, Aldermore has showcased resilience and growth. The company reported a strong financial performance in its fiscal year ending September 30, 2023, with underlying profit before tax increasing by 43% to £320.5 million. This performance was driven by a 13% growth in its loan book, reaching £13.4 billion, as Aldermore strategically focused on niche market segments offering higher yields.

The economic backdrop directly impacts Aldermore's profitability through its lending margins. As interest rates potentially decline, the net interest margin could face pressure, necessitating continued operational efficiency and strategic pricing. However, Aldermore's focus on specialist lending, often characterized by less commoditized products and stronger customer relationships, provides a degree of insulation against pure rate competition.

- Inflationary Environment: UK inflation moderated to 2.3% in April 2024, impacting borrowing costs and consumer spending power.

- Interest Rate Outlook: Potential rate cuts in 2024-2025 will influence Aldermore's net interest margins.

- Portfolio Growth: Aldermore's loan book expanded by 13% to £13.4 billion in FY23, demonstrating successful market penetration.

- Profitability Drivers: Strategic focus on niche segments and operational efficiency are key to maintaining margins amidst economic shifts.

Diversified Revenue Streams and Profitability

FirstRand's strength lies in its diversified revenue streams, with a significant portion derived from non-interest income. This broad base, encompassing banking, insurance, and investment products, acts as a crucial buffer against economic downturns, mitigating the impact of shocks in any single sector. The group's robust capital buffers further enhance its resilience, allowing it to navigate challenging economic landscapes effectively.

In 2024, FirstRand demonstrated impressive financial performance, maintaining strong profitability and a healthy return on equity (ROE). This sustained success underscores the effectiveness of its diversified strategy in delivering consistent results even when economic conditions are less than ideal. For instance, the group reported a notable ROE in the fiscal year 2024, reflecting its ability to generate value across its varied business segments.

- Diversified Income: Significant contributions from non-interest income sources.

- Resilient Profitability: Maintained strong profitability and ROE in 2024.

- Risk Mitigation: Diversification across banking, insurance, and investments reduces single-sector dependency.

- Capital Strength: Robust capital buffers provide a solid foundation for performance.

South Africa's economic trajectory for 2025 is projected to see GDP growth between 1.5% and 2.0%, a positive signal for FirstRand. Anticipated interest rate cuts by the South African Reserve Bank could lower funding costs and stimulate borrowing, bolstering the bank's net interest income.

The anticipated easing of monetary policy in 2025, with potential rate cuts by the South African Reserve Bank, is a significant positive for FirstRand. This environment is expected to ease pressure on household finances, encouraging lending and potentially improving the bank's net interest margin.

Global economic uncertainties and trade tensions remain a concern, potentially impacting investor sentiment and capital flows into South Africa, which could indirectly affect FirstRand's performance.

Consumer affordability in South Africa continues to be a challenge, impacting household lending, though FirstRand's retail impairments are showing signs of stabilizing and trending downwards.

Inflation in South Africa has been moderating, with CPI at 5.3% year-on-year in April 2024. This, along with a stabilizing rand, creates a more predictable operating environment for FirstRand.

The UK's inflation rate stood at 2.3% in April 2024, down from 3.2% in March. This cooling trend, alongside potential Bank of England rate adjustments in 2024-2025, will shape Aldermore's lending landscape and net interest margins.

Aldermore demonstrated strong growth in its fiscal year ending September 30, 2023, with its loan book expanding by 13% to £13.4 billion, contributing to a 43% increase in underlying profit before tax.

| Economic Indicator | Value/Projection | Impact on FirstRand |

|---|---|---|

| South Africa GDP Growth (2025 Projection) | 1.5% - 2.0% | Potential for increased lending and economic activity. |

| South Africa Inflation (April 2024) | 5.3% | Moderating inflation supports a more stable operating environment. |

| UK Inflation (April 2024) | 2.3% | Influences interest rate decisions affecting Aldermore's margins. |

| Aldermore Loan Book Growth (FY23) | 13% to £13.4 billion | Demonstrates successful market penetration and portfolio expansion. |

Same Document Delivered

FirstRand PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive FirstRand PESTLE analysis covers all critical political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain immediate access to this insightful report upon completing your purchase.

Sociological factors

South African consumers are demonstrating a heightened focus on value, actively seeking out discounted products, promotional offers, and leveraging loyalty programs to optimize their budgets. This trend reflects a broader pattern of discretionary spending cuts, particularly noticeable in sectors such as dining out and entertainment.

For instance, data from early 2024 indicated that a significant portion of South African households were prioritizing essential goods over non-essential purchases, a sentiment echoed in retail sales figures. This behavioral shift necessitates that FirstRand's retail banking arm, FNB, recalibrates its product development and marketing strategies to align with these evolving consumer priorities and the prevailing affordability challenges.

FirstRand is committed to enhancing financial inclusion and literacy, with a particular focus on underserved populations. Their initiatives include facilitating social grant distribution, a critical service for many South Africans, and promoting the digitization of cash transactions to bring more people into the formal financial system.

The bank deploys community advisors to provide essential financial education and support, directly addressing literacy gaps. For instance, in 2023, FirstRand's digital platforms saw a significant increase in usage by previously unbanked individuals, demonstrating the impact of these outreach programs.

These efforts not only foster economic empowerment and societal upliftment but also strategically broaden FirstRand's customer base and deepen its market penetration across South Africa.

South Africa's evolving demographics, with a growing youth population and an expanding middle class, present significant opportunities for FirstRand. The bank must adapt its offerings to cater to diverse needs, from accessible financial products for lower-income segments to sophisticated solutions for the increasingly affluent. For instance, a substantial portion of South Africa's population remains unbanked or underbanked, highlighting a critical area for FirstRand to expand its reach and services.

Employment and Income Pressures

High unemployment and income pressures in South Africa significantly affect consumers' ability to manage debt. Recent data indicates that a substantial portion of the population struggles with bill payments, directly impacting FirstRand's credit performance and the need for provisioning.

These socio-economic realities are a critical consideration for FirstRand. For instance, the unemployment rate in South Africa remained elevated, hovering around 32.9% in the first quarter of 2024, according to Stats SA. This economic backdrop directly influences consumer spending power and loan repayment capabilities.

- Unemployment Impact: Elevated unemployment rates directly reduce the pool of creditworthy borrowers and increase the risk of defaults.

- Income Strain: Persistent income pressures mean consumers have less disposable income, making it harder to meet financial obligations.

- Government Initiatives: Government efforts aimed at job creation, if successful, could gradually ease these pressures and improve credit market conditions.

Digital Adoption and Customer Expectations

The rapid acceleration of digital adoption across South Africa is fundamentally reshaping customer expectations in the banking sector. Consumers now demand intuitive, convenient, and integrated digital experiences, pushing financial institutions to innovate continuously.

FirstRand, through its FNB brand, has been a frontrunner in this digital transformation. FNB's strategic focus on digital platforms has fostered significant customer loyalty, often referred to as 'stickiness', by offering a comprehensive suite of integrated solutions and rewarding programs like eBucks. This approach directly addresses the growing demand for seamless, value-added digital banking services.

Meeting these evolving digital expectations is paramount for FirstRand's continued success. For instance, in 2024, FNB reported that over 80% of its customer transactions were conducted digitally, highlighting the critical nature of these channels for both customer retention and attracting new clients in a competitive market.

- Digital Channel Dominance: Over 80% of FNB transactions were digital in 2024, underscoring the shift in customer behavior.

- Customer Loyalty Programs: eBucks continues to be a key differentiator, driving engagement and retention through digital integration.

- Seamless Experience Demand: Customers expect integrated services, from everyday banking to investment and insurance, all accessible digitally.

- Competitive Imperative: Failure to meet these digital expectations risks customer attrition in a rapidly digitizing financial landscape.

South African consumers are increasingly value-conscious, prioritizing essential spending and seeking discounts, which impacts discretionary sectors. FirstRand's retail arm, FNB, must adapt its offerings to align with these affordability challenges, as evidenced by early 2024 retail sales data showing a shift towards essential goods.

FirstRand is actively promoting financial inclusion and literacy, particularly for underserved populations, by facilitating social grant distribution and encouraging digital transactions. Their community advisors provide crucial financial education, and in 2023, digital platform usage by previously unbanked individuals saw a notable increase.

South Africa's evolving demographics, including a growing youth population and middle class, present opportunities for FirstRand to tailor products for diverse income segments. However, high unemployment, around 32.9% in Q1 2024, and income pressures significantly affect consumers' ability to manage debt and impact FirstRand's credit performance.

The rapid digital adoption in South Africa means customers expect seamless, integrated digital banking experiences. FNB has been a leader in this, with over 80% of its transactions being digital in 2024, driven by loyalty programs like eBucks.

Technological factors

FirstRand is heavily invested in digital transformation, aiming to boost customer experience and streamline operations across its various brands. This commitment is crucial for staying competitive in the rapidly evolving financial landscape.

FNB, a key part of FirstRand, has distinguished itself as a pioneer in digital banking within South Africa. The bank actively integrates comprehensive banking solutions and employs behavioural analytics to deepen customer engagement and personalize offerings.

By the end of 2024, FirstRand reported that digital channels accounted for over 80% of its customer transactions, a testament to its successful digital strategy. This ongoing innovation is vital for adapting to changing consumer preferences and maintaining market leadership.

The South African banking landscape is undergoing significant transformation, with digital-only banks and embedded finance providers increasingly challenging established players like FirstRand. This surge in fintech competition forces traditional banks to constantly innovate their digital services to remain competitive and relevant.

In 2024, the growth of embedded finance is expected to accelerate, with estimates suggesting it could capture a substantial portion of the financial services market by 2026. This trend necessitates FirstRand to strategically adapt its business model, focusing on enhancing digital capabilities and exploring partnerships to unlock new value streams and maintain its market position.

The increasing reliance on digital platforms makes robust cybersecurity and cyber resilience absolutely critical for FirstRand. New regulations, like South Africa's Joint Standard 2 of 2024, which takes effect in June 2025, will mandate comprehensive cybersecurity strategies and frameworks for all financial institutions, including FirstRand.

This means FirstRand needs to significantly invest in proactive measures to prevent cyber threats and ensure the continuous availability of its essential applications and services. Failure to do so could result in substantial financial losses and reputational damage.

Adoption of Emerging Technologies

FirstRand is actively embracing emerging technologies, notably artificial intelligence (AI) and cloud-based solutions. These strategic investments are geared towards optimizing operational efficiency and elevating customer service experiences. In 2024, the group continued to highlight its commitment to digital transformation, with significant allocations towards AI-driven analytics and cloud infrastructure to support its growth ambitions.

These technological advancements are central to FirstRand's strategy for achieving greater cost efficiencies and unlocking deeper insights from customer data. By leveraging AI, the bank aims to personalize financial product offerings and improve risk management, a critical factor in the evolving financial landscape. For instance, the bank's focus on data analytics is expected to yield more targeted marketing campaigns and improved customer retention rates.

- AI Investment: FirstRand is channeling resources into AI for enhanced data analysis and personalized customer interactions.

- Cloud Adoption: The group is migrating key operations to cloud platforms to boost scalability and operational agility.

- Efficiency Gains: Technological integration is a core driver for improving cost-to-income ratios across the group.

- Product Innovation: Emerging tech enables the development of new, data-driven financial products tailored to individual customer needs.

Platform-Based Banking and Ecosystems

FirstRand's strategy heavily relies on its platform-based banking model, exemplified by FNB's digital ecosystem. This approach aims to boost transaction volumes and unlock cross-selling and up-selling potential within its customer base.

By offering a suite of integrated financial and non-financial services, FirstRand cultivates strong customer loyalty, often referred to as customer stickiness. This strategy directly contributes to the profitability derived from its existing customer relationships.

For instance, FNB's integrated digital platform allows customers to manage various aspects of their financial lives, from banking and investments to insurance and telecommunications, all within a single ecosystem.

- Digital Ecosystem Growth: FNB reported a significant increase in digital engagement, with a substantial portion of customer transactions occurring on its digital platforms in 2024.

- Cross-selling Success: The platform approach has demonstrably improved cross-selling ratios, with customers holding multiple FNB products showing higher engagement and profitability.

- Customer Retention: Data from 2024 indicates that customers utilizing the integrated ecosystem exhibit higher retention rates compared to those using only basic banking services.

- Revenue Diversification: Non-interest revenue streams, often driven by services offered through the platform, are a growing contributor to FirstRand's overall financial performance.

FirstRand's technological strategy centers on digital transformation and leveraging emerging technologies like AI and cloud computing. By the close of 2024, over 80% of customer transactions occurred through digital channels, highlighting the success of this approach.

The group is investing in AI to enhance data analysis and personalize customer interactions, aiming for greater efficiency and deeper customer insights. Cloud adoption is also a priority, boosting scalability and operational agility.

This technological focus is crucial for combating competition from fintechs and digital-only banks, which are rapidly reshaping the financial landscape. FirstRand's platform-based banking model, particularly through FNB, fosters customer loyalty and drives revenue diversification.

| Technology Focus | 2024 Data/Trend | Impact |

|---|---|---|

| Digital Transactions | Over 80% of customer transactions via digital channels | Enhanced customer experience, operational efficiency |

| AI Investment | Continued significant allocations for AI-driven analytics | Personalized offerings, improved risk management |

| Cloud Adoption | Migration of key operations to cloud platforms | Increased scalability, operational agility |

| Embedded Finance | Expected accelerated growth, potential market share capture by 2026 | Necessitates strategic adaptation and partnerships |

Legal factors

FirstRand navigates a complex web of banking regulations, with South Africa's Prudential Authority (PA) enforcing strict capital and liquidity standards. The ongoing implementation of Basel III reforms, set to continue evolving through 2025, mandates that FirstRand maintains robust risk-based capital ratios. For instance, as of Q1 2024, South African banks, including FirstRand, are required to meet a Common Equity Tier 1 (CET1) ratio of at least 4.5% of risk-weighted assets, alongside additional capital buffers.

New banking laws in South Africa, effective May 2025, significantly bolster consumer protections. These include more rigorous identity verification processes and enhanced security measures for digital banking platforms. FirstRand must adapt to these changes, ensuring greater transparency in fee structures and streamlining complaint resolution for its customers.

South Africa's new deposit insurance scheme, operational since April 2024, mandates that all licensed banks, including FirstRand, must join the Corporation for Deposit Insurance (CoDI). This requires banks to pay annual levies and monthly premiums, with the aim of bolstering depositor confidence and the overall stability of the banking sector.

UK Motor Finance Commission Litigation

FirstRand's UK motor finance division, notably MotoNovo Finance, faces ongoing legal scrutiny over past discretionary commission arrangements. This has led to significant litigation, impacting the financial sector.

A pivotal Supreme Court decision in 2024 clarified that motor dealers typically do not owe fiduciary duties to customers in these arrangements. However, this does not entirely resolve the issue for lenders like FirstRand.

Despite the Supreme Court's ruling, FirstRand may still need to revise its financial provisions. This adjustment would be to account for potential customer redress claims based on the broader concept of unfairness under consumer protection laws.

The potential financial impact remains a key concern. While exact figures for FirstRand's specific provision adjustments for 2024/2025 are still emerging, the UK motor finance industry as a whole has set aside billions for potential compensation related to these commission structures.

- Legal Challenges: FirstRand's UK operations, particularly MotoNovo Finance, are embroiled in litigation concerning historical discretionary commission arrangements in motor finance.

- Supreme Court Ruling Impact: A 2024 Supreme Court decision largely absolved dealers of fiduciary duties, offering some clarity but not a complete resolution for lenders.

- Accounting Provision Adjustments: FirstRand may need to adjust its accounting provisions to reflect potential redress liabilities based on unfairness criteria, even without fiduciary breaches.

- Industry-Wide Provisions: The wider UK motor finance sector has made substantial provisions, with estimates suggesting billions set aside to cover potential customer compensation related to these commission models.

Data Privacy and IT Governance Regulations

South Africa's financial sector is increasingly shaped by stringent data privacy and IT governance regulations. The Joint Standard for IT Governance and Risk Management, set to become effective in November 2024, places significant obligations on institutions like FirstRand. This standard necessitates a robust enhancement of IT risk management frameworks, directly impacting how customer data is handled and protected.

Key requirements under this new standard include the development and implementation of comprehensive data loss prevention policies. Furthermore, financial entities must ensure that advanced cybersecurity measures are actively in place to safeguard sensitive customer information. This proactive approach is crucial for maintaining trust and compliance in an evolving digital landscape.

- Enhanced IT Risk Management: The Joint Standard mandates a review and upgrade of existing IT risk management frameworks by November 2024.

- Data Loss Prevention: Financial institutions must establish clear policies to prevent unauthorized data disclosure.

- Cybersecurity Measures: Robust cybersecurity protocols are essential to protect customer data from breaches.

- Regulatory Compliance: Adherence to these regulations is critical for maintaining operational licenses and customer confidence.

FirstRand must adhere to evolving South African banking regulations, including Basel III reforms continuing through 2025, which require strong capital ratios. New consumer protection laws effective May 2025 will necessitate greater transparency and streamlined complaint processes.

The introduction of South Africa's deposit insurance scheme in April 2024 mandates participation and levies for banks like FirstRand, aiming to boost depositor confidence.

FirstRand's UK motor finance arm faces legal challenges regarding past commission structures, with potential impacts on financial provisions even after a 2024 Supreme Court ruling. The broader UK motor finance sector has provisioned billions for similar claims.

New IT governance standards from November 2024 will require FirstRand to enhance data loss prevention and cybersecurity measures, crucial for protecting customer data and maintaining trust.

Environmental factors

FirstRand is intensifying its focus on Environmental, Social, and Governance (ESG) strategy, acknowledging its crucial position as a systemic financial institution in fostering sustainable economic growth. The group's commitment is evident in its 'Report to Society,' which details its progress in achieving positive societal and environmental impacts, adhering to international responsible banking standards.

In its 2023 Report to Society, FirstRand highlighted a 12% reduction in its financed emissions intensity compared to its 2020 baseline, demonstrating tangible progress in its climate action initiatives. The bank also reported a 15% increase in its green finance portfolio, reaching R75 billion by the end of FY23, underscoring its dedication to channeling capital towards environmentally beneficial projects.

The South African Reserve Bank views climate change as a persistent threat to financial stability, directly impacting institutions like FirstRand. This means the bank faces potential losses from physical climate events and the shift to a lower-carbon economy affecting its loan portfolio and investments.

However, these challenges also present significant opportunities. FirstRand can capitalize on the growing demand for green financing by supporting renewable energy projects and other climate-friendly initiatives, aligning with global sustainability trends and potentially unlocking new revenue streams.

For instance, in 2023, South Africa's renewable energy sector saw substantial investment, with projects totaling over R100 billion reaching financial close, highlighting the market's potential for financial institutions willing to finance the transition.

FirstRand's approach to lending and investment is increasingly shaped by sustainability imperatives. The company is actively assessing the environmental footprint of the projects it funds and is committed to assisting clients in their transition towards more sustainable operations. This strategic pivot is particularly evident in their focus on infrastructure development, with a growing emphasis on renewable energy projects.

In 2024, FirstRand announced a significant commitment to sustainable finance, aiming to mobilize R100 billion towards green and social projects by 2027. This initiative underscores their dedication to aligning their portfolio with environmental, social, and governance (ESG) principles, reflecting a broader industry trend towards responsible investing and lending practices.

Resource Efficiency and Operational Footprint

FirstRand, like many large organizations, is increasingly focused on its operational environmental footprint. This involves actively managing resource efficiency across its extensive network of branches and corporate offices. Key areas of focus include reducing energy consumption, minimizing waste generation, and optimizing water usage. Such initiatives not only align with broader sustainability objectives but also contribute directly to cost savings through improved operational efficiency.

For instance, a commitment to reducing energy consumption can translate into significant operational cost reductions. Many financial institutions are setting targets for renewable energy sourcing and improving building energy efficiency. While specific figures for FirstRand's 2024/2025 operational footprint reductions are not publicly detailed in the provided context, industry trends indicate a strong push in this direction.

- Energy Consumption: Financial institutions are investing in energy-efficient lighting, HVAC systems, and smart building technologies to lower electricity usage.

- Waste Management: Implementing robust recycling programs and reducing paper consumption through digitalization are common strategies.

- Water Usage: Water-saving fixtures and landscaping practices are employed to minimize water consumption in facilities.

- Carbon Footprint: These operational efficiencies collectively contribute to reducing the overall carbon footprint of the organization.

Stakeholder Expectations for Green Finance

Investors, regulators, and the public are increasingly demanding that financial institutions show tangible progress on environmental sustainability. This pressure is reshaping how companies like FirstRand operate and report their environmental impact. For instance, as of early 2024, the global sustainable finance market is projected to reach trillions of dollars, highlighting the significant capital flowing towards environmentally conscious businesses.

FirstRand's dedication to Environmental, Social, and Governance (ESG) principles and transparent reporting on its environmental performance are vital for its standing and ability to draw in socially responsible investors. In 2023, a significant portion of new investment funds were directed towards ESG-focused strategies, demonstrating a clear market preference.

- Investor Demand: Growing preference for investments aligned with climate goals and sustainable practices.

- Regulatory Scrutiny: Increased focus on climate-related financial disclosures and risk management.

- Public Perception: Enhanced awareness and expectation for corporate environmental responsibility.

- Market Trends: Significant inflows into sustainable investment funds, indicating a shift in capital allocation.

FirstRand is actively managing its environmental impact, focusing on operational efficiency to reduce energy consumption and waste. The bank is also a significant player in green finance, aiming to mobilize R100 billion by 2027 for sustainable projects. This aligns with growing investor demand for ESG-compliant investments and increasing regulatory scrutiny on climate-related financial disclosures.

| Environmental Factor | FirstRand's Action/Target | Relevant Data/Context (as of early 2024/2025) |

|---|---|---|

| Financed Emissions | 12% reduction in intensity (vs. 2020 baseline) | Demonstrates progress in climate action initiatives. |

| Green Finance Portfolio | R75 billion (by end of FY23) | Represents a 15% increase, showing growth in environmentally beneficial lending. |

| Sustainable Finance Mobilization | R100 billion by 2027 | Aims to channel capital towards green and social projects. |

| Operational Efficiency | Focus on energy, waste, and water reduction | Industry trend for cost savings and improved environmental footprint. |

| Market Demand for Green Finance | Global sustainable finance market projected to reach trillions | Highlights significant capital flow towards environmentally conscious businesses. |

PESTLE Analysis Data Sources

Our FirstRand PESTLE Analysis is built on a robust foundation of data from official South African government publications, reputable financial institutions, and leading economic forecasting agencies. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the group.