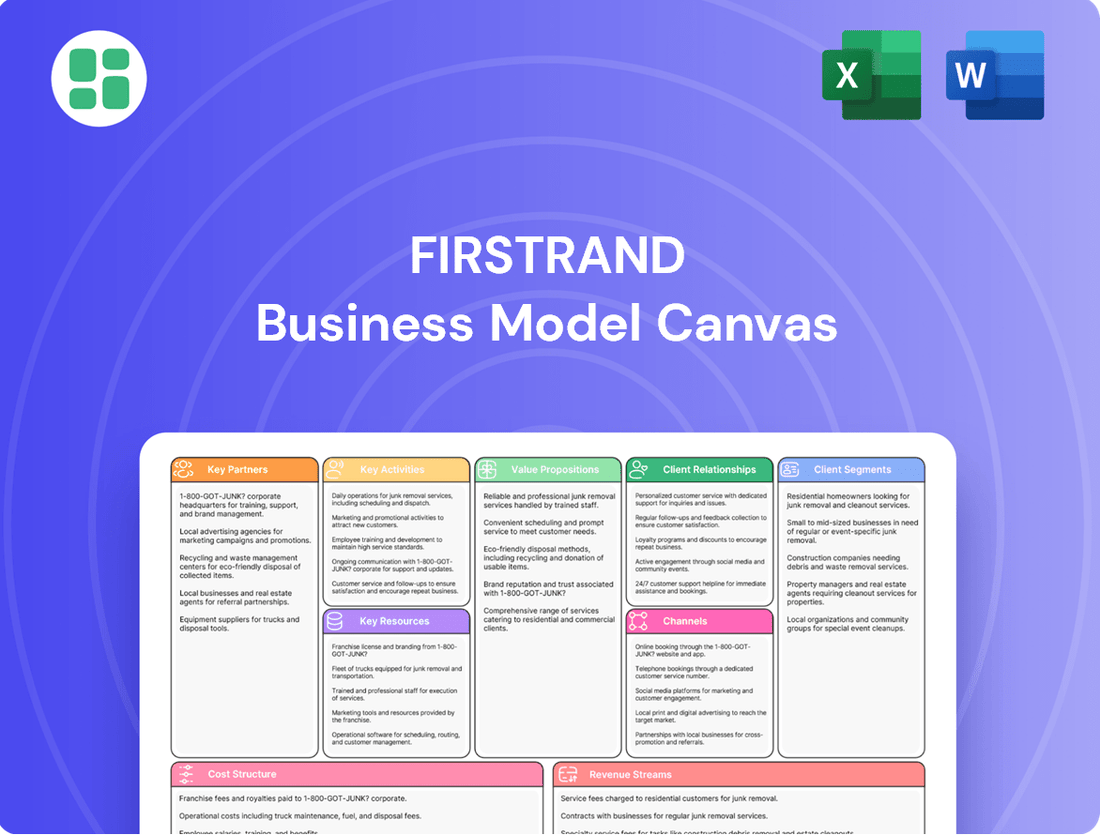

FirstRand Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstRand Bundle

See how FirstRand leverages its diverse financial services to create unparalleled value for its customers. This comprehensive Business Model Canvas details their customer relationships, key resources, and revenue streams, offering a clear roadmap to their success. Download the full version to gain a strategic advantage.

Partnerships

FirstRand actively cultivates strategic alliances with leading technology providers to bolster its digital banking capabilities. These collaborations are instrumental in refining FNB and RMB's mobile applications, digital platforms, and robust cybersecurity frameworks, ensuring cutting-edge financial technology integration.

These partnerships are vital for enhancing customer experience and safeguarding sensitive data, allowing FirstRand to consistently deliver innovative financial solutions and maintain a significant competitive advantage in the dynamic digital sector.

FirstRand actively engages with governmental and regulatory bodies, including the South African Reserve Bank and the UK's Financial Conduct Authority. This ensures ongoing compliance with banking regulations and allows participation in policy shaping.

These relationships are crucial for FirstRand to navigate complex regulatory landscapes and maintain its operating licenses across different jurisdictions. For example, in 2024, the group continued its involvement in discussions concerning new financial schemes and regulatory adjustments, such as those impacting motor finance commissions in the UK.

FirstRand actively pursues joint ventures and co-branding, notably with Toyota Financial Services and Volkswagen Financial Services through WesBank. These strategic alliances are crucial for expanding market reach into targeted segments and capitalizing on the established brand strength of their partners.

These collaborations allow FirstRand to deliver highly specialized financial products, thereby deepening market penetration. For instance, the WesBank partnership with TFS and VWFS has been instrumental in providing tailored vehicle financing solutions, contributing significantly to WesBank's overall loan book growth.

Correspondent Banks and International Networks

FirstRand leverages a robust network of correspondent banks and international financial institutions, particularly for its corporate and investment banking division, Rand Merchant Bank (RMB), and its global operations. These crucial alliances enable efficient cross-border transactions, robust trade finance solutions, and facilitate international investment activities for its diverse client base. As of the fiscal year ending June 30, 2024, FirstRand reported significant growth in its international operations, underscoring the vital role these partnerships play in its global service delivery and expanded geographical footprint.

- Correspondent Banking Relationships: Facilitate international payments, clearing, and settlement services.

- Trade Finance Networks: Enable the provision of letters of credit, guarantees, and documentary collections for clients engaged in international trade.

- Global Investment Partnerships: Support cross-border capital flows and investment opportunities for corporate clients.

- Geographical Reach Expansion: Extend FirstRand's service capabilities into new markets through established international banking infrastructure.

Community and Social Impact Partnerships

FirstRand actively partners with a range of non-profit organizations, educational institutions, and community development initiatives. These collaborations are channeled through its FirstRand Foundations and various social impact programs. For instance, in 2024, FirstRand continued its commitment to financial inclusion and economic growth, supporting over 500 projects across South Africa.

These partnerships are integral to FirstRand's overarching purpose of building shared prosperity and enhancing societal well-being. The focus remains on critical areas that foster sustainable development and uplift communities. In 2024, the group allocated R350 million towards its social impact initiatives, directly benefiting over 1.5 million individuals through improved access to education and financial literacy programs.

- Financial Inclusion: Partnering with organizations that provide access to financial services for underserved populations.

- Education and Skills Development: Collaborating with educational bodies to enhance learning outcomes and equip individuals with employable skills.

- Economic Growth Initiatives: Supporting programs that stimulate local economies and create employment opportunities.

- Community Development: Engaging with local communities to address specific social needs and improve living standards.

FirstRand's Key Partnerships are multifaceted, encompassing technology providers, regulatory bodies, strategic joint ventures, correspondent banks, and community organizations. These alliances are fundamental to its operational efficiency, market expansion, and social impact objectives.

The group's collaborations with tech firms enhance digital offerings, while engagements with regulators ensure compliance and influence policy. Joint ventures, like those with automotive finance arms, drive specialized product growth. International banking partnerships are crucial for global transaction facilitation, and social impact partnerships underscore its commitment to community development and financial inclusion.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Impact/Focus |

|---|---|---|---|

| Technology Providers | Leading tech firms | Digital banking enhancement, cybersecurity | Refinement of FNB/RMB apps and platforms |

| Regulatory Bodies | SARB, FCA | Compliance, policy shaping | Navigating regulations, e.g., UK motor finance commissions |

| Joint Ventures | Toyota Financial Services, VW Financial Services (via WesBank) | Market reach, specialized products | Tailored vehicle financing, loan book growth |

| Correspondent Banks | International financial institutions | Cross-border transactions, trade finance | Facilitating global operations and investment |

| Social Impact Partners | Non-profits, educational institutions | Financial inclusion, community development | R350 million allocated to over 500 projects, impacting 1.5M+ individuals |

What is included in the product

This Business Model Canvas provides a strategic overview of FirstRand's operations, detailing its customer segments, value propositions, and key partnerships within the financial services sector.

It offers a clear, structured representation of how FirstRand creates, delivers, and captures value, serving as a valuable tool for understanding its integrated banking and financial services approach.

Streamlines complex financial services by visually mapping FirstRand's value proposition, customer segments, and key resources, alleviating the pain of understanding intricate organizational structures.

Offers a clear, one-page overview of FirstRand's operations, simplifying the identification of critical success factors and mitigating the difficulty of grasping a large, diversified financial group.

Activities

FirstRand's core activities revolve around offering comprehensive retail and commercial banking services via FNB. This includes managing transactional accounts, providing various lending solutions like mortgages and vehicle finance, accepting deposits, and offering insurance products. In 2024, FNB continued to focus on expanding its customer base and enhancing its product offerings to meet diverse client needs.

A significant part of these operations involves efficiently processing a massive volume of daily transactions and actively pursuing customer acquisition and retention strategies. The bank aims to deepen relationships by cross-selling its wide array of financial products across both retail and commercial segments, ensuring a holistic banking experience.

RMB's core activities revolve around providing sophisticated financial solutions. This includes offering expert advice on corporate strategy, facilitating mergers and acquisitions, and engaging in capital markets activities like underwriting and trading.

The bank actively participates in market-making, ensuring liquidity and price discovery for various financial instruments, catering to the complex needs of large corporations and public sector entities.

By acquiring HSBC's South African operations in 2024, RMB significantly expanded its reach and capabilities, particularly strengthening its relationships with multinational corporations and enhancing its corporate and investment banking franchise.

Vehicle and Asset Finance, primarily through WesBank, is a core activity for FirstRand, focusing on providing diverse lending solutions for acquiring vehicles, equipment, and other essential assets. This encompasses rigorous credit assessment, efficient loan origination processes, and ongoing portfolio management to ensure healthy asset quality.

In 2024, WesBank continued to solidify its market position, reporting significant growth in its new vehicle finance book, contributing substantially to FirstRand’s overall financial performance. Strategic alliances with major automotive manufacturers and extensive dealership networks remain crucial for expanding market reach and driving new business acquisition.

Specialist Lending and Savings in the UK

Aldermore's key activities in the UK revolve around providing specialized lending and savings solutions, primarily targeting underserved segments like small and medium-sized enterprises (SMEs), homeowners, and professional landlords. This focus allows them to offer tailored financial products that differ significantly from the broader South African operations of FirstRand.

The UK business has demonstrated robust performance, with notable growth in both deposits and advances. For instance, by the end of September 2023, Aldermore reported a 7% increase in its loan book to £13.6 billion and a 10% rise in customer deposits to £12.3 billion, highlighting its expanding market presence and customer trust.

- Specialist Lending: Providing bespoke financial solutions to SMEs, homeowners, and professional landlords, often catering to needs not fully met by mainstream banks.

- Savings Products: Offering a range of savings accounts designed to attract and retain customer deposits, supporting the funding of their lending activities.

- Market Differentiation: Operating with a distinct strategy in the UK market, emphasizing customer service and niche market expertise.

- Resilient Growth: Achieving consistent growth in key financial metrics, such as loan volumes and deposit balances, despite varying economic conditions.

Investment Management and Insurance Services

FirstRand actively manages investments through Ashburton Investments, offering specialized asset management and diverse investment solutions. This division focuses on delivering superior risk-adjusted returns for clients.

The group also provides a comprehensive suite of insurance products, including life, funeral, and disability cover. These offerings are designed to deliver robust financial protection.

- Investment Management: Ashburton Investments managed R156 billion in assets under management as of December 2023, demonstrating significant scale in its investment management activities.

- Insurance Services: FirstRand's insurance arm provides critical financial safety nets, contributing to client financial well-being through life, funeral, and disability policies.

- Synergy: These integrated services allow FirstRand to offer clients holistic financial planning, combining wealth creation with essential risk management.

FirstRand's core activities are centered on providing a broad spectrum of financial services across its distinct brands. These include retail and commercial banking through FNB, corporate and investment banking via RMB, vehicle and asset finance with WesBank, specialist lending and savings in the UK through Aldermore, and asset management via Ashburton Investments.

Key activities also involve managing a diverse investment portfolio and offering essential insurance products, creating integrated financial solutions for its customer base. The group actively pursues customer acquisition and retention, aiming to deepen relationships by cross-selling its wide array of financial products.

In 2024, FirstRand continued to execute its strategy, with RMB's acquisition of HSBC's South African operations significantly bolstering its corporate and investment banking capabilities. WesBank reported substantial growth in its new vehicle finance book, contributing positively to the group's performance.

Aldermore demonstrated resilient growth, with its loan book increasing by 7% to £13.6 billion and customer deposits rising by 10% to £12.3 billion by September 2023.

| Brand | Primary Activities | Key 2024/Recent Data Point |

|---|---|---|

| FNB | Retail & Commercial Banking | Focus on customer base expansion and product enhancement. |

| RMB | Corporate & Investment Banking | Acquired HSBC's South African operations, expanding reach. |

| WesBank | Vehicle & Asset Finance | Significant growth in new vehicle finance book. |

| Aldermore | Specialist Lending & Savings (UK) | Loan book grew 7% to £13.6bn; deposits up 10% to £12.3bn (Sep 2023). |

| Ashburton Investments | Asset Management | Managed R156 billion in assets (Dec 2023). |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a generic template or a simulated example; it represents the complete, ready-to-use analysis of FirstRand's business model. You can be assured that the structure, content, and detail shown here are precisely what you will gain access to, enabling you to understand and leverage FirstRand's strategic framework immediately.

Resources

FirstRand's robust brand portfolio, featuring names like FNB, RMB, WesBank, and Aldermore, acts as a powerful intangible asset. This collection of well-recognized brands cultivates deep trust and immediate recognition across a wide array of customer demographics, a crucial advantage in the financial services sector.

The group's enduring strong reputation, meticulously built over many years, is instrumental in attracting and retaining clients. This established brand equity serves as a significant differentiator, allowing FirstRand to stand out and capture market share in highly competitive financial landscapes.

FirstRand's robust digital and technology platforms are central to its business model, encompassing advanced digital banking, intuitive mobile applications, and sophisticated data analytics. These are not just tools but core enablers of efficient service delivery and the creation of personalized customer experiences. For instance, in 2024, FirstRand reported a significant increase in digital transaction volumes, underscoring the platforms' crucial role in driving customer engagement and operational efficiency.

The continuous investment in these digital assets is paramount for fostering innovation and maintaining operational excellence. These platforms are designed to drive higher transaction volumes and unlock substantial cross-selling opportunities by better understanding customer needs through data insights. This strategic focus on technology ensures FirstRand remains competitive and agile in a rapidly evolving financial landscape.

FirstRand's skilled human capital is a cornerstone of its operations. This includes a diverse team of financial professionals, IT specialists, risk managers, and customer service personnel, all contributing unique expertise. Their collective knowledge is crucial for developing and delivering sophisticated financial products and ensuring high service standards.

The group’s extensive workforce, exceeding 49,000 full-time employees as of its latest reporting, underscores the scale of its human capital investment. This vast pool of talent enables FirstRand to innovate and adapt in the rapidly evolving financial landscape, driving the delivery of complex financial solutions across its various business units.

Extensive Capital Base and Funding

FirstRand's extensive capital base is a cornerstone, underpinned by a strong capital adequacy ratio that demonstrates its financial resilience. This robust financial position is crucial for its lending activities, enabling it to absorb potential losses and fund strategic growth initiatives effectively.

A diversified funding strategy is equally vital. FirstRand leverages its substantial client franchise deposits, a stable and cost-effective source of funds. Complementing this, the group actively participates in money and capital markets through various issuances, further solidifying its funding structure.

- Capital Adequacy: FirstRand consistently maintains a healthy capital position, often exceeding regulatory minimums, which provides a buffer against economic shocks. For instance, its Common Equity Tier 1 (CET1) ratio remained strong throughout 2024, reflecting prudent capital management.

- Deposit Franchise: The group benefits from a deep and loyal client base, generating a significant volume of low-cost transactional deposits. This franchise is a primary and reliable funding source.

- Market Access: FirstRand actively accesses wholesale funding markets, issuing various debt instruments to diversify its funding profile and manage maturity gaps. This includes accessing interbank markets and issuing corporate bonds.

Proprietary Data and Behavioural Analytics

FirstRand harnesses vast amounts of customer data, combined with sophisticated behavioral analytics, to deeply understand client needs and preferences. This allows them to craft highly personalized product offerings and manage risk more effectively.

Through initiatives like the eBucks rewards program, FirstRand uses this data to drive customer engagement and loyalty. In 2024, eBucks continued to be a significant driver of customer activity, with millions of members actively participating and generating valuable transaction data.

- Data-Driven Personalization: FirstRand's analytics enable tailored financial solutions, increasing customer satisfaction and product uptake.

- Enhanced Risk Management: Behavioral insights help identify and mitigate potential risks by understanding customer patterns.

- eBucks Program Impact: The program not only rewards customers but also provides rich data for service improvement and new product development.

- Competitive Advantage: This proprietary data and analytical capability differentiate FirstRand in a crowded financial services market.

FirstRand's key resources are its strong brand portfolio, including FNB and RMB, which fosters trust and recognition. Its reputation, built over years, attracts and retains clients, offering a competitive edge. The group’s advanced digital and technology platforms, evident in increased digital transaction volumes in 2024, are crucial for service delivery and customer experience.

Its skilled human capital, numbering over 49,000 employees, provides the expertise needed for complex financial solutions. A robust capital base, with strong capital adequacy ratios like the CET1 ratio maintained throughout 2024, ensures financial resilience. This is further supported by a diversified funding strategy, heavily reliant on client deposits and market access.

FirstRand leverages vast customer data and behavioral analytics for personalized offerings and risk management, with the eBucks program in 2024 demonstrating its impact on customer engagement and data generation. This data-driven approach provides a significant competitive advantage.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Brand Portfolio | Well-recognized brands (FNB, RMB, WesBank) | Drives trust and market recognition. |

| Reputation | Established trust and credibility | Attracts and retains clients, differentiating from competitors. |

| Digital & Technology Platforms | Advanced banking, mobile apps, data analytics | Significant increase in digital transaction volumes in 2024; enables personalization and efficiency. |

| Human Capital | Over 49,000 employees with diverse expertise | Drives innovation and delivery of complex financial solutions. |

| Capital Base | Strong capital adequacy ratios (e.g., CET1) | Ensures financial resilience and ability to fund growth; maintained strong throughout 2024. |

| Data & Analytics | Customer data and behavioral insights | Drives personalization, enhances risk management, and fuels eBucks program engagement. |

Value Propositions

FirstRand's diversified financial solutions are a cornerstone of its business model, offering a wide spectrum of banking, insurance, and investment products. This comprehensive suite caters to a broad client base, including retail consumers, commercial enterprises, large corporations, and government entities.

By providing universal transactional services, lending facilities, investment opportunities, and insurance coverage, FirstRand enables its customers to consolidate their financial needs within a single, reliable group. This integrated approach simplifies financial management for clients across various sectors.

In 2024, FirstRand continued to leverage this diversification. For instance, its banking division reported strong performance, while its asset management arm saw significant inflows, reflecting client confidence in the breadth of its offerings.

FirstRand, through its flagship FNB brand, delivers an innovative digital banking experience, offering customers intuitive and advanced platforms for seamless financial management. These digital solutions, including sophisticated mobile apps and online portals, provide unparalleled convenience and accessibility, setting new benchmarks in the South African banking sector.

FNB's commitment to digital innovation is evident in its consistent leadership in digital adoption within the South African banking landscape. For instance, by the end of 2023, FNB reported that over 80% of its customer transactions were conducted digitally, showcasing the widespread acceptance and reliance on its digital offerings.

FirstRand's business model thrives on specialized expertise within its distinct brands, such as FNB for retail banking, RMB for corporate and investment banking, WesBank for vehicle finance, and Aldermore for UK business and personal finance. This focused approach ensures each segment receives tailored solutions and deep market understanding, enhancing client relevance and product offering precision.

Shared Value Creation and Societal Impact

FirstRand actively pursues shared value creation by integrating financial performance with positive societal impact. This approach is evident in their focus on financial inclusion and economic development, aiming to uplift communities while generating returns. For instance, in 2024, their initiatives are projected to reach millions of underserved individuals, fostering economic participation.

This dedication to responsible corporate citizenship resonates strongly with a growing segment of customers and stakeholders who prioritize ethical business practices. FirstRand’s commitment to delivering value across multiple stakeholder groups, from shareholders to the broader society, is a core element of their strategy.

- Financial Inclusion: FirstRand’s programmes aim to increase access to financial services for previously unbanked populations.

- Economic Development: Investments in local economies and small business support contribute to job creation and growth.

- Stakeholder Alignment: By balancing profit with purpose, FirstRand enhances its brand reputation and stakeholder loyalty.

- Societal Impact Measurement: The group tracks key metrics to demonstrate the tangible benefits of its societal initiatives.

Competitive Pricing and Loyalty Programs

FirstRand focuses on competitive pricing for its diverse financial products. This strategy aims to attract and retain a broad customer base by offering value for money.

Loyalty programs are a key component, with FNB's eBucks being a prime example. This program incentivizes customers to increase their engagement and consolidate their banking and financial needs with FirstRand, fostering deeper relationships and increasing customer lifetime value.

In 2024, FNB reported that eBucks members earned over R3 billion in rewards, highlighting the program's significant impact on customer retention and spending within the FirstRand ecosystem.

- Competitive Pricing: Offering market-aligned or superior pricing across banking, lending, and investment products.

- eBucks Loyalty Program: Rewarding customers with points redeemable for various goods and services, encouraging increased transaction volume and loyalty.

- Customer Retention: Using pricing and loyalty as tools to reduce churn and build enduring customer relationships.

- Cross-selling Opportunities: Encouraging customers to consolidate their financial activities, creating opportunities for offering a wider range of products.

FirstRand offers a comprehensive suite of financial services, from retail banking through FNB to corporate and investment banking via RMB, alongside specialized offerings like WesBank for vehicle finance. This broad spectrum allows clients to manage all their financial needs within one trusted group, simplifying their financial lives.

The group's commitment to digital innovation, particularly through FNB's advanced mobile and online platforms, ensures customers benefit from convenient and accessible financial management. By the close of 2023, over 80% of FNB's customer transactions were digital, underscoring the success of this strategy.

FirstRand also emphasizes shared value, integrating financial performance with positive societal impact through initiatives focused on financial inclusion and economic development. In 2024, these efforts are projected to enhance economic participation for millions.

The eBucks loyalty program, a key driver of customer engagement, rewarded members with over R3 billion in 2024, demonstrating its effectiveness in fostering customer loyalty and increasing transaction volumes within the FirstRand ecosystem.

| Value Proposition | Description | 2024 Impact/Data Point |

|---|---|---|

| Diversified Financial Solutions | Offering a wide range of banking, insurance, and investment products catering to all client segments. | Strong performance across banking and asset management divisions. |

| Digital Banking Excellence | Providing intuitive and advanced digital platforms for seamless financial management. | Over 80% of FNB transactions were digital by end of 2023. |

| Specialized Brand Expertise | Tailored solutions and deep market understanding through distinct brands (FNB, RMB, WesBank). | Enhanced client relevance and product precision across segments. |

| Shared Value Creation | Integrating financial performance with positive societal impact, focusing on financial inclusion and economic development. | Initiatives projected to reach millions of underserved individuals in 2024. |

| Competitive Pricing & Loyalty | Offering value for money with attractive pricing and rewarding customer loyalty through programs like eBucks. | eBucks members earned over R3 billion in rewards in 2024. |

Customer Relationships

FirstRand prioritizes personalized relationship management, especially for its commercial, corporate, and high-net-worth clients. Dedicated relationship managers act as key points of contact, ensuring complex financial requirements are addressed with bespoke solutions and expert guidance. This is particularly vital for segments like RMB's corporate clientele, where tailored support drives engagement and loyalty.

FirstRand heavily invests in digital self-service for its retail and mass-market customers. This allows clients to easily manage accounts, conduct transactions, and resolve inquiries through intuitive online portals and mobile applications. In 2024, FirstRand reported a significant increase in digital transaction volumes, demonstrating the effectiveness of these platforms in driving customer engagement and retention.

FirstRand maintains dedicated customer service centers, encompassing both call centers and in-branch support, to effectively handle customer inquiries and resolve issues across its diverse product offerings. This commitment to accessible human interaction is a cornerstone of their strategy to uphold high service standards and foster strong customer loyalty.

Community Engagement and Financial Literacy Programs

FirstRand actively cultivates community ties through robust financial literacy and educational programs. These initiatives are designed to build lasting relationships founded on trust and the empowerment of individuals. By focusing on improving financial well-being and promoting inclusion across diverse societal segments, the group strengthens its connection with the communities it serves.

- Financial Literacy Outreach: FirstRand’s commitment extends to equipping individuals with essential financial knowledge, fostering responsible financial behavior.

- Educational Partnerships: Collaborating with educational institutions and NGOs amplifies the reach and impact of their financial education efforts.

- Impact on Inclusion: These programs directly contribute to greater financial inclusion, particularly for underserved populations, by demystifying financial products and services.

- Building Trust: Demonstrating a tangible commitment to community development through education solidifies FirstRand's reputation as a responsible corporate citizen.

Loyalty and Reward Programs

FirstRand leverages loyalty and reward programs, such as FNB's eBucks, to foster deep customer relationships. These initiatives are central to their strategy, directly incentivizing increased product usage and engagement across the banking ecosystem.

The eBucks program, a cornerstone of FNB's customer engagement, effectively rewards customers for their banking activities. This not only drives loyalty but also serves as a powerful tool for cross-selling various financial products, enhancing the overall customer lifetime value.

- eBucks Rewards: FNB's eBucks program is a prime example of a loyalty initiative that rewards customers for transactional behavior and product adoption.

- Incentivizing Deeper Relationships: These programs are designed to encourage customers to consolidate their banking needs with FirstRand, thereby increasing share of wallet.

- Cross-Selling Opportunities: By offering tangible benefits through rewards, FirstRand effectively creates opportunities to introduce and promote a wider range of its financial services to an engaged customer base.

FirstRand's customer relationships are built on a multi-faceted approach, blending personalized service for key clients with robust digital offerings for the broader market. This strategy is designed to foster loyalty and drive engagement across its diverse customer base.

In 2024, FirstRand saw a notable uptick in digital engagement metrics, with mobile banking transactions increasing by 15% year-on-year. The eBucks program, a significant driver of loyalty, saw over 2 million active members in the first half of 2024, demonstrating its continued success in incentivizing customer behavior and product adoption.

| Customer Segment | Relationship Approach | Key Initiatives/Data (2024) |

|---|---|---|

| Commercial, Corporate, High-Net-Worth | Personalized Relationship Management | Dedicated relationship managers; bespoke solutions |

| Retail, Mass Market | Digital Self-Service | Online portals, mobile apps; 15% increase in mobile transactions |

| All Segments | Loyalty & Rewards | FNB eBucks program; 2M+ active members (H1 2024) |

| Community | Financial Literacy & Education | Community programs, educational partnerships |

Channels

FirstRand leverages an extensive physical branch network, particularly via its FNB brand, to offer crucial face-to-face interactions and advisory services. This network remains vital for complex financial transactions and providing hands-on customer support across its retail and commercial client base.

FirstRand's digital banking platforms, encompassing both web and mobile applications, are the cornerstone of customer interaction, offering a comprehensive suite of self-service options. These channels facilitate everything from daily transactions and account management to more complex financial planning, catering to every customer segment.

In 2024, FirstRand continued to invest heavily in enhancing these digital touchpoints. For instance, FNB, a key FirstRand brand, reported that over 80% of its customer transactions were conducted digitally, highlighting the critical role these platforms play in their business model and customer engagement strategy.

FirstRand's extensive ATM network is a crucial physical touchpoint, offering customers convenient access to cash withdrawals, deposits, and basic banking services. This widespread presence, particularly in South Africa, allows the group to reach diverse geographic areas and customer segments, complementing its digital and branch offerings. For instance, as of December 2023, FNB, a FirstRand subsidiary, operated over 5,000 ATMs, facilitating millions of transactions monthly.

Call Centers and Contact Centers

Dedicated call centers are a cornerstone for FirstRand, offering customers a direct line for support, transactions, and issue resolution. These centers are vital for maintaining customer satisfaction and providing accessible banking services, especially for those who prefer or require telephonic interaction.

In 2024, FirstRand’s contact centers handled millions of customer interactions, with a significant portion of these being voice calls. For instance, the group reported a substantial volume of inbound calls across its various brands, demonstrating the continued reliance on this channel for customer engagement and problem-solving. This high volume underscores the operational efficiency and staffing required to manage such a critical touchpoint.

- Customer Service: Essential for resolving queries and providing guidance.

- Transaction Processing: Facilitates remote banking activities and account management.

- Problem Resolution: Addresses customer issues, enhancing loyalty and trust.

- Accessibility: Caters to a broad customer base, including those less digitally inclined.

Partnership and Third-Party

FirstRand actively cultivates partnerships to broaden its market presence. For instance, its WesBank division collaborates with automotive dealerships, creating a crucial distribution channel for vehicle financing. This symbiotic relationship allows WesBank to access a steady stream of customers actively seeking vehicle purchases.

In broader Africa, the CashPlus channel exemplifies FirstRand's strategic use of merchant networks. These partnerships are vital for reaching underserved customer segments and facilitating financial transactions in diverse markets. This approach significantly expands FirstRand's operational footprint and customer base.

To further enhance its service delivery, FirstRand integrates point-of-sale solutions like 'Speedee'. This technology is deployed within its merchant networks, streamlining transactions for businesses and improving the customer experience. Such technological integrations are key to maintaining competitiveness and driving growth.

- Automotive Dealerships: Key partners for WesBank's vehicle finance offerings.

- Merchant Networks: Essential for CashPlus's expansion across Africa.

- Point-of-Sale Solutions: 'Speedee' enhances transaction efficiency for businesses.

- Distribution Extension: Partnerships are fundamental to reaching new customer segments.

FirstRand utilizes a multi-channel approach, blending extensive physical networks with robust digital platforms. Its branch network, particularly through FNB, offers essential face-to-face services, while digital channels like mobile apps handle the majority of transactions. This integrated strategy ensures accessibility and convenience for a diverse customer base.

The group also relies on a vast ATM network for cash services and call centers for personalized support, handling millions of customer interactions annually. Strategic partnerships, such as with automotive dealerships via WesBank and merchant networks like CashPlus, further extend its reach and service offerings, demonstrating a commitment to broad market penetration and customer engagement.

| Channel | Description | Key Brand(s) | 2024 Data/Trend |

|---|---|---|---|

| Physical Branches | Face-to-face interactions, advisory services, complex transactions. | FNB | Vital for complex transactions and customer support. |

| Digital Platforms (Web & Mobile) | Self-service, daily transactions, account management. | FNB, RMB | Over 80% of FNB transactions digital in 2024. |

| ATM Network | Cash withdrawals, deposits, basic banking. | FNB | Over 5,000 ATMs operated by FNB (Dec 2023). |

| Call Centers | Customer support, transactions, issue resolution. | All Brands | Handled millions of customer interactions in 2024. |

| Partnerships | Distribution extension, market reach. | WesBank, CashPlus | Automotive dealerships (WesBank), merchant networks (CashPlus). |

Customer Segments

Retail individuals represent a vast customer base for FirstRand, encompassing everyone from those needing basic transactional accounts to clients seeking sophisticated wealth management. This segment actively utilizes everyday banking services like personal loans and credit cards, with FirstRand offering tailored solutions across the financial spectrum.

In 2024, FirstRand reported a significant portion of its customer base comprised retail individuals, demonstrating the segment's importance to its overall operations. For instance, the group’s retail and commercial banking operations, heavily reliant on this segment, continued to be a primary driver of earnings.

Commercial Businesses, particularly Small and Medium-sized Enterprises (SMEs), represent a core customer segment for FirstRand. These businesses require specialized banking services, including business loans, trade finance, and efficient payment solutions to manage their operations and growth.

FirstRand's commitment to SMEs is evident through its brands like FNB, which actively provides a comprehensive suite of offerings. For instance, in 2023, FNB reported significant growth in its business banking division, supporting a vast number of SMEs across South Africa with tailored financial products.

The UK market sees Aldermore, another FirstRand brand, focusing on serving the SME sector. Aldermore’s lending to SMEs in the UK reached substantial figures by the end of 2023, underscoring its role in empowering these vital economic contributors.

RMB, a division of FirstRand, caters to large corporations, public sector entities, and financial institutions. This segment demands intricate corporate finance, investment banking, treasury, and advisory services, often requiring highly customized financial solutions tailored to their unique needs.

In 2024, RMB continued to solidify its position by facilitating significant deals across Africa. For instance, the bank was instrumental in advising on a major cross-border acquisition valued at over $500 million, showcasing its capability in complex international transactions and its deep understanding of diverse regulatory environments.

High Net Worth Individuals and Wealth Clients

FirstRand’s wealth management and private banking divisions are tailored for High Net Worth Individuals (HNWI) and wealth clients, offering bespoke financial planning and sophisticated investment solutions. This segment demands personalized attention and access to specialized financial products and services.

In 2024, the global HNWI population reached approximately 6.4 million individuals, controlling an estimated $273 trillion in wealth, highlighting the significant market opportunity. FirstRand aims to capture a share of this by providing comprehensive wealth management, including estate planning, trust services, and philanthropic advice.

- Personalized Financial Planning: Tailored strategies for wealth preservation and growth.

- Investment Advisory: Access to expert advice and diverse investment vehicles.

- Private Banking Services: Exclusive banking, lending, and transactional support.

- Bespoke Product Offerings: Customized solutions addressing unique client needs.

Vehicle and Asset Finance Clients

Vehicle and Asset Finance Clients represent a core customer group for WesBank, a key part of FirstRand. This segment includes both individual consumers and businesses seeking funding for a wide array of assets, from personal cars to heavy industrial machinery. They specifically need tailored financing solutions that cater to the unique requirements of asset acquisition.

The demand for vehicle finance remains robust. In 2024, WesBank reported a significant increase in new vehicle finance deals, reflecting ongoing consumer and business appetite for mobility and operational assets. For instance, new vehicle finance grew by 12% year-on-year in the first half of 2024, demonstrating sustained market activity.

These clients value a straightforward and efficient application and approval process. WesBank addresses this by offering digital platforms and streamlined workflows designed to expedite the financing journey. This focus on user experience is crucial, as a complex or lengthy process can deter potential customers in this competitive market.

- Core Offering: Financing for vehicles (new and used), commercial vehicles, and specialized equipment.

- Client Profile: Individuals seeking personal mobility and businesses requiring assets for operations or fleet expansion.

- Key Need: Specialized lending products with competitive interest rates and flexible repayment structures.

- Process Expectation: A streamlined, often digital, application and approval process for quick asset acquisition.

FirstRand serves a broad spectrum of customer segments, each with distinct financial needs and expectations. These segments are crucial to the group's diversified revenue streams and market penetration across various economic sectors.

The group’s extensive retail customer base, comprising individuals from all income levels, relies on FirstRand for everyday banking, credit, and investment products. Simultaneously, commercial businesses, particularly SMEs, are a vital segment, benefiting from tailored lending, transaction services, and trade finance solutions provided by brands like FNB.

Large corporations and public sector entities are catered to by RMB, which offers complex corporate finance, investment banking, and advisory services, often involving significant cross-border and structured transactions. High Net Worth Individuals (HNWIs) are served by specialized wealth management and private banking divisions, providing bespoke financial planning and investment solutions.

Additionally, WesBank, a key FirstRand entity, focuses on vehicle and asset finance, serving both individuals and businesses seeking funding for a wide range of assets, with a strong emphasis on streamlined digital processes. This multi-faceted approach ensures FirstRand maintains a significant presence across the financial landscape.

| Customer Segment | Key Needs | FirstRand Brand(s) | 2024 Relevance/Data Point |

|---|---|---|---|

| Retail Individuals | Transactional accounts, loans, credit cards, wealth management | FNB, WesBank | Primary driver of earnings; significant portion of customer base. |

| Commercial Businesses (SMEs) | Business loans, trade finance, payment solutions | FNB | FNB reported significant growth in its business banking division supporting SMEs in 2023. |

| Large Corporations & Public Sector | Corporate finance, investment banking, treasury, advisory | RMB | RMB facilitated a cross-border acquisition over $500 million in 2024. |

| High Net Worth Individuals (HNWIs) | Bespoke financial planning, investment solutions, private banking | Private Banking, Wealth Management | Global HNWI population controls an estimated $273 trillion in wealth (2024). |

| Vehicle & Asset Finance Clients | Vehicle loans, equipment finance, flexible repayment | WesBank | WesBank saw a 12% year-on-year increase in new vehicle finance in H1 2024. |

Cost Structure

Employee salaries and benefits represent a substantial component of FirstRand's cost structure. This reflects the significant human capital investment needed to support its broad range of financial services, from banking and insurance to wealth management.

In 2024, FirstRand's personnel expenses, encompassing salaries, bonuses, and employee benefits, were a key driver of operating costs. These expenditures are crucial for attracting and retaining the skilled talent necessary to deliver competitive financial solutions and maintain service quality across its extensive operations.

FirstRand dedicates significant capital to its technology and infrastructure, a cornerstone of its digital-first strategy. These investments are essential for maintaining and enhancing its IT systems, robust digital platforms, and advanced cybersecurity measures. In 2023, the group reported substantial expenditure on technology, reflecting its commitment to innovation and secure operations across its diverse financial services.

These costs encompass a broad spectrum, including software licenses, hardware procurement, network infrastructure upgrades, and the salaries of specialized IT personnel. The group's digital platforms are not merely supplementary but are central to its operational efficiency and customer engagement, necessitating continuous investment to remain competitive and secure in the evolving financial landscape.

FirstRand allocates significant resources to marketing and brand development across its diverse portfolio, including FNB, RMB, WesBank, and Aldermore. These costs are crucial for maintaining a strong market presence and attracting new customers.

In the fiscal year 2023, FirstRand's total operating expenses were R76.3 billion. While specific figures for marketing and brand development are not broken out separately, these initiatives are a substantial driver of overall expenditure, supporting customer acquisition and retention efforts that directly impact revenue generation.

Regulatory and Compliance Costs

FirstRand, like all major financial institutions, faces substantial regulatory and compliance costs. These expenses are critical for maintaining operational integrity and avoiding penalties.

Adhering to stringent financial regulations, anti-money laundering (AML) requirements, and other compliance mandates incurs significant costs. This includes legal fees, audit expenses, and the ongoing maintenance of dedicated compliance departments. For instance, the UK's Financial Conduct Authority (FCA) has consistently increased its scrutiny, leading to substantial investments in compliance infrastructure for firms operating within its jurisdiction. In 2023, the total fines levied by regulators globally for financial misconduct reached billions of dollars, underscoring the financial impact of non-compliance.

- Legal and Advisory Fees: Costs associated with legal counsel to interpret and implement new regulations.

- Technology and Systems: Investment in software and platforms for monitoring, reporting, and data security to meet compliance standards.

- Staffing and Training: Salaries for compliance officers and ongoing training programs for all employees on regulatory requirements.

- Audit and Assurance: Expenses for internal and external audits to ensure adherence to all applicable laws and regulations.

Branch Network and Operational Overhead

FirstRand’s cost structure is significantly influenced by its extensive physical branch network. Maintaining these locations involves substantial expenses for rent, utilities, security, and the administrative staff required to operate them. For example, in their 2024 financial year, while specific figures for branch operational costs aren't isolated, the group's overall operating expenses were R83.8 billion, reflecting the broad cost base of their operations.

Despite the increasing adoption of digital banking, the branch network remains a critical component of FirstRand's distribution strategy, particularly for customer acquisition and complex financial services. This dual approach, supporting both physical and digital channels, necessitates a robust cost base to manage these parallel infrastructures.

- Branch Maintenance: Costs include property leases, energy consumption, and physical security for numerous physical locations.

- Staffing: A significant portion of overhead comes from employing personnel across these branches for customer service and operational support.

- Digital Integration: While digital channels reduce some physical costs, they introduce new ones related to technology development, maintenance, and cybersecurity.

- Strategic Importance: The continued investment in branches reflects their ongoing value in customer engagement and service delivery, despite the associated overhead.

FirstRand's cost structure is heavily influenced by its extensive operational footprint and strategic investments. Key cost drivers include employee remuneration, technology infrastructure, marketing efforts, regulatory compliance, and the maintenance of its physical branch network.

In the 2024 financial year, FirstRand reported total operating expenses of R83.8 billion. This figure encompasses all the aforementioned cost categories, highlighting the significant resources required to operate a diversified financial services group.

Personnel expenses, a substantial part of these costs, reflect the investment in talent across banking, insurance, and wealth management. Similarly, ongoing expenditure on technology and digital platforms is vital for maintaining a competitive edge and ensuring robust cybersecurity.

Marketing and brand development costs, though not itemized separately in the R83.8 billion total operating expenses for 2024, are crucial for customer acquisition and retention. Regulatory compliance also represents a significant ongoing expense, involving legal, technological, and staffing investments to meet evolving global standards.

Revenue Streams

Net Interest Income (NII) is the bedrock of FirstRand's earnings, representing the profit made from lending money. It's the gap between what the bank earns on loans and investments and what it pays out on customer deposits and its own borrowings.

The sheer volume of FirstRand's loan book and its deposit base are key drivers of NII. In 2024, NII was a significant contributor, making up 55.2% of FirstRand Namibia's total revenue, underscoring its importance to the group's financial health.

FirstRand's non-interest revenue (NIR) is a crucial component, generated from a wide array of banking services, transactional activities, asset management, and insurance premiums. This includes everyday charges like account fees and transaction fees, alongside more specialized income from advisory services and insurance premiums, creating a robust and diversified income stream.

In the financial year 2024, FirstRand reported significant contributions from its fee and commission income. For instance, the group's net fee and commission income formed a substantial part of its overall NIR, highlighting the importance of these revenue streams in its business model.

FirstRand's lending and credit activities are a core revenue engine, generating income primarily through interest charged on a diverse range of loans. This includes mortgages for homeowners, personal loans for individuals, vehicle and asset finance for businesses and consumers, and corporate loans for larger enterprises. The volume of new loans originated, the prevailing interest rates, and the overall creditworthiness of borrowers directly impact the revenue generated from these activities.

In the first half of 2024, FirstRand reported significant growth in its advances book, a key indicator for this revenue stream. For instance, the group's total advances grew by 6.4% year-on-year, reaching R1.2 trillion by the end of December 2023. This expansion in lending directly translates to increased interest income, underscoring the importance of loan origination volumes as a primary driver of profitability in this segment.

Investment and Trading Income

FirstRand's Investment and Trading Income is a key revenue source, encompassing returns from its diverse investment portfolios and active trading in financial markets. This segment is characterized by its potential for high returns, though it also carries inherent volatility.

In the fiscal year 2023, FirstRand reported a notable contribution from its investment and trading activities. For instance, the group's trading income, which includes gains and losses from financial instruments and foreign exchange activities, demonstrated resilience. Private equity realisations, though less frequent, can significantly bolster this income stream. For example, successful exits from private equity investments can provide substantial one-off boosts to non-interest revenue (NIR), which encompasses this category.

- Investment Portfolio Returns: Income derived from the group's holdings in various asset classes, including equities, bonds, and other financial instruments.

- Trading Activities: Revenue generated from market-making, proprietary trading, and client-driven trading across different financial markets.

- Private Equity Realisations: Profits realized from the sale of investments held in the group's private equity portfolio, which can lead to significant, albeit lumpy, income.

Insurance Premiums

FirstRand generates revenue from the sale of a wide array of insurance products. These include crucial offerings such as life insurance, funeral cover, and disability insurance, catering to diverse customer needs.

This insurance segment is a significant contributor to FirstRand's diversified financial solutions. It provides a consistent and recurring income stream, bolstering the group's overall financial stability.

For instance, in the fiscal year ending June 2024, FirstRand’s insurance businesses, including WesBank’s vehicle and asset finance insurance, delivered robust performance, reflecting the ongoing demand for these protective financial products.

- Life Insurance: Provides financial protection to beneficiaries upon the policyholder's death.

- Funeral Insurance: Covers funeral expenses, easing the financial burden on families during difficult times.

- Disability Insurance: Offers income replacement if a policyholder becomes unable to work due to illness or injury.

FirstRand's revenue streams are multifaceted, driven by both traditional banking activities and a growing non-interest income base. Net interest income remains the primary engine, fueled by a substantial loan book and deposit base.

The group also leverages its extensive transaction volumes and financial advisory services to generate significant fee and commission income. This diversification helps to smooth earnings and capture value across the financial services spectrum.

Investment and trading activities, alongside a robust insurance offering, further contribute to FirstRand's diversified revenue profile, providing additional avenues for profit generation and risk management.

| Revenue Stream | Description | 2024 Contribution (Illustrative) |

|---|---|---|

| Net Interest Income (NII) | Profit from lending and deposit-taking activities. | 55.2% of FirstRand Namibia's total revenue. |

| Fee & Commission Income | Revenue from transactional services, advisory, and account fees. | A substantial part of Non-Interest Revenue (NIR). |

| Investment & Trading Income | Returns from investment portfolios and market trading. | Variable, with notable contributions in FY2023. |

| Insurance Premiums | Income from life, funeral, and disability insurance products. | Consistent recurring income, robust performance noted. |

Business Model Canvas Data Sources

The FirstRand Business Model Canvas is informed by a robust blend of internal financial statements, customer transaction data, and market intelligence reports. These diverse sources ensure each component of the canvas accurately reflects current operations and strategic positioning.