FirstRand Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstRand Bundle

FirstRand navigates a dynamic financial landscape, facing significant pressure from rivals and the constant threat of new entrants. Understanding the bargaining power of both its customers and suppliers is crucial for its strategic positioning.

The complete report reveals the real forces shaping FirstRand’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

FirstRand, a major financial institution, draws its funding from various sources, including customer deposits and wholesale markets. While a broad base of retail depositors typically means less leverage for any single depositor, a significant reliance on a few large wholesale funding providers could amplify their influence.

For instance, if a substantial portion of FirstRand's wholesale funding comes from a limited number of institutions, those providers could potentially negotiate more favorable terms, increasing their bargaining power. However, FirstRand's reported strong deposit growth in its 2024 financial year, reaching R1.4 trillion, indicates a robust and diversified retail funding base, which helps to dilute the power of any single funding source.

The increasing reliance on digital transformation, cloud-based solutions, and robust cybersecurity means specialized technology providers hold significant leverage over financial institutions like FirstRand. FirstRand's substantial investments in technology, such as its approximately R2.7 billion allocated to digital initiatives in its 2024 financial year, underscore this dependence. If only a few dominant providers offer critical banking software or infrastructure, their bargaining power can be substantial, potentially driving up costs or limiting operational flexibility for FirstRand.

The financial sector, including FirstRand, is experiencing a significant surge in demand for professionals skilled in data analytics, digital platform management, cybersecurity, and customer experience design. This escalating need for specialized expertise directly impacts the bargaining power of suppliers, in this case, the skilled labor pool.

A scarcity of these highly sought-after professionals can empower employees, translating into increased wage demands and higher recruitment expenses for FirstRand. For instance, in 2023, the average salary for a data scientist in South Africa was reported to be around ZAR 750,000 annually, a figure likely to climb with continued demand and limited supply.

Developing proficiency in these critical areas is not just a trend but a fundamental requirement for future bankers in South Africa. FirstRand, like its competitors, must strategically invest in talent acquisition and development to mitigate the risks associated with a tight labor market and maintain its competitive edge.

Impact of Regulatory Bodies

Regulatory bodies like the Financial Sector Conduct Authority (FSCA) and the Prudential Authority (PA) significantly influence the bargaining power of suppliers for FirstRand by setting the operational landscape. For instance, the introduction of the Conduct of Financial Institutions Act (COFI) in South Africa, which aims to consolidate and enhance conduct regulation across the financial sector, requires substantial investment in systems and processes. This means that compliance with these evolving frameworks, often driven by global best practices, effectively elevates the influence of these regulatory entities as de facto suppliers of essential operating conditions.

The constant evolution of regulatory requirements, such as updated IT governance standards and data privacy regulations, compels financial institutions like FirstRand to continually adapt. For example, in 2024, the ongoing implementation and refinement of COFI will likely necessitate further technology upgrades and staff training, adding to operational costs. This dynamic regulatory environment means that adherence to these mandates is non-negotiable, thereby strengthening the leverage of regulatory bodies as key stakeholders whose dictates shape business strategy and resource allocation.

- Regulatory Influence: Bodies like the FSCA and PA dictate compliance requirements, acting as powerful 'suppliers' of operating frameworks.

- Investment Demands: New regulations, such as COFI and updated IT governance, necessitate significant financial and strategic investment from FirstRand.

- Evolving Standards: The continuous adaptation to changing regulations, often influenced by international norms, increases the bargaining power of these regulatory 'suppliers'.

- Cost Implications: Compliance costs and strategic adjustments stemming from regulatory changes represent an ongoing financial commitment for FirstRand.

Dependence on Data and Information Services

FirstRand's reliance on specialized data and information services significantly influences supplier bargaining power. In 2024, the financial sector's demand for real-time market data, credit scoring, and advanced analytical platforms, like those provided by Bloomberg or Refinitiv, remained exceptionally high. These providers, often possessing unique datasets and sophisticated algorithms, can command premium pricing due to the critical nature of their offerings for risk management and strategic planning.

The ability of these data service providers to differentiate themselves through proprietary insights or exclusive data access grants them considerable leverage. For instance, the market for AI-driven financial analytics is rapidly expanding, with a few key players dominating the landscape by offering unique predictive capabilities. This concentration of specialized knowledge means FirstRand, like its peers, must carefully manage its relationships with these essential suppliers.

- Data Dependency: FirstRand requires accurate and timely market data, credit information, and analytical tools for effective risk management and decision-making.

- Supplier Leverage: Providers of specialized or proprietary data and information services possess significant bargaining power due to their unique offerings.

- Market Dynamics: The 2024 financial landscape shows a strong demand for real-time data and AI-driven analytics, concentrating power among a few key providers.

- Strategic Importance: Building robust internal data capabilities and fostering strategic partnerships are vital for FirstRand to mitigate supplier bargaining power.

FirstRand's bargaining power with its suppliers is influenced by several factors, including the concentration of providers in critical areas like technology and data services. The increasing demand for specialized skills in areas such as data analytics and cybersecurity also empowers these labor suppliers. Furthermore, regulatory bodies, by setting compliance standards, act as powerful de facto suppliers whose dictates shape operational costs and strategies.

The financial sector's dependence on specialized technology providers and data services means these entities hold significant leverage. For example, FirstRand's investment in digital initiatives, around R2.7 billion in 2024, highlights its reliance on technology suppliers. Similarly, the market for AI-driven financial analytics in 2024 was dominated by a few key players, granting them pricing power.

The bargaining power of suppliers for FirstRand is shaped by the concentration of key service providers in technology and data analytics, coupled with the high demand for specialized skills in these fields. Regulatory bodies also exert considerable influence by mandating compliance, which necessitates significant investment from FirstRand. This dynamic elevates the leverage of these regulatory entities as essential providers of operating frameworks.

The increasing demand for specialized skills in data analytics and cybersecurity in 2024, for instance, has driven up recruitment costs for financial institutions like FirstRand. The average salary for a data scientist in South Africa in 2023 was approximately ZAR 750,000, a figure likely to rise. This scarcity of talent empowers employees and thus suppliers of labor.

| Supplier Category | Key Influencing Factors | Impact on FirstRand | 2024/2023 Data Points | Mitigation Strategies |

|---|---|---|---|---|

| Technology Providers | Concentration of providers, proprietary solutions | Potential for increased costs, dependence on critical infrastructure | R2.7 billion invested in digital initiatives (2024) | Diversifying vendor relationships, developing in-house capabilities |

| Data & Information Services | Unique datasets, advanced algorithms, AI capabilities | Premium pricing, reliance on external insights for decision-making | High demand for real-time data and AI analytics (2024) | Strategic partnerships, building internal data analytics capacity |

| Skilled Labor (Talent) | Scarcity of specialized skills (data, cybersecurity) | Higher recruitment costs, wage inflation, retention challenges | ZAR 750,000 average data scientist salary (2023) | Investment in training and development, competitive compensation packages |

| Regulatory Bodies (FSCA, PA) | Evolving compliance requirements, new legislation (COFI) | Mandatory investments in systems and processes, increased operational costs | Ongoing implementation of COFI (2024) | Proactive compliance, strategic planning for regulatory changes |

What is included in the product

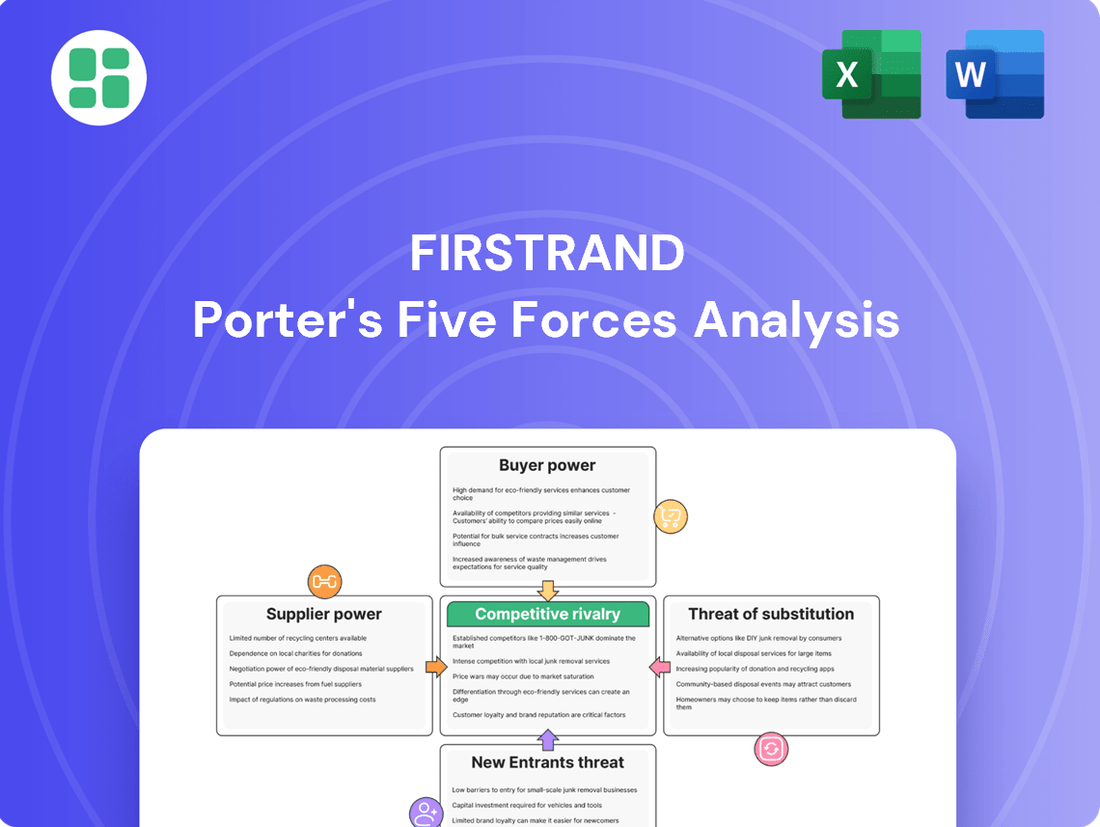

This Porter's Five Forces analysis offers a comprehensive examination of FirstRand's competitive environment, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes, and their impact on the group's profitability.

Quickly identify and address competitive threats with a visual breakdown of FirstRand's market pressures, enabling proactive strategic adjustments.

Customers Bargaining Power

While FirstRand's eBucks program encourages loyalty, the digital banking landscape generally makes it easier and cheaper for customers to switch. The ability to open accounts and move money online with minimal hassle empowers customers to explore better offerings from competitors.

In 2024, the growth of digital-only banks and the increasing sophistication of fintech solutions further reduce the friction associated with switching financial providers. This heightened flexibility means customers can more readily compare and move to institutions offering superior interest rates or more convenient services, thereby increasing their bargaining power.

Customers today possess vast amounts of information about financial products and services. Online resources and comparison websites allow them to easily see pricing and features across different providers, including banks and newer fintech companies. This heightened transparency means FirstRand must constantly offer competitive pricing and excellent service to retain clients.

The ability to compare options readily diminishes a customer's reliance on a single provider. For instance, in 2024, digital channels saw a significant increase in customer acquisition for challenger banks, often driven by superior rates or lower fees, directly impacting traditional players like FirstRand. Informed customers are more discerning and less willing to accept less favorable terms, thereby amplifying their bargaining power.

South Africa experienced significant inflation in 2023, with the consumer price index (CPI) averaging 6.0%. This, coupled with higher interest rates, squeezed household budgets, making consumers more attuned to the cost of financial services. For FirstRand, this translates to customers scrutinizing fees and interest charges more closely.

The elevated cost of borrowing, with the South African Reserve Bank raising its policy rate to 8.25% by mid-2024, directly impacts the affordability of loans and credit products. Customers are therefore more likely to shop around for better rates or delay major financial commitments, directly affecting FirstRand's lending margins and transaction volumes.

This heightened price sensitivity forces FirstRand to carefully consider its pricing strategies. Offering competitive rates and transparent fee structures becomes crucial to retain customers who might otherwise switch to competitors perceived as offering better value, especially in a challenging economic climate where every rand counts.

Diversified Financial Needs Across Segments

FirstRand's diverse client base, spanning retail, corporate, and public sectors, presents a complex dynamic in customer bargaining power. While this broad reach offers resilience, different segments exhibit varying levels of influence. For instance, large corporate and public sector entities, by virtue of their substantial transaction volumes and sophisticated financial requirements, often wield greater bargaining power. They can negotiate for more favorable terms, customized product offerings, and competitive pricing structures, directly impacting FirstRand's margins.

This disparity is evident when considering the needs of these different groups. Retail customers, while numerous, typically have less individual leverage. Their bargaining power is often aggregated through market competition and regulatory oversight rather than direct negotiation. In contrast, major corporate clients might leverage their significant deposit balances or loan volumes to secure preferential rates or bespoke financial solutions. For example, in 2024, South Africa's banking sector saw intense competition for large corporate deposits, with interest rates on these deposits fluctuating based on market liquidity and demand, illustrating the power these clients hold.

- Retail Customers: Generally possess lower individual bargaining power, influenced more by market-wide offerings and regulatory protections.

- Corporate Clients: Exhibit higher bargaining power due to larger transaction volumes, complex financial needs, and the ability to negotiate tailored solutions and pricing.

- Public Sector Entities: Similar to corporate clients, these large organizations can leverage their financial scale and strategic importance to negotiate favorable terms.

- Impact on FirstRand: The varying bargaining power across segments necessitates flexible product development and pricing strategies to cater to diverse client expectations and maintain competitiveness.

Availability of Alternative Financial Service Providers

The increasing availability of alternative financial service providers significantly boosts customer bargaining power. The rise of fintech, with companies like PayFast and Ozow in South Africa, offers specialized solutions for payments and other financial needs, giving customers more options beyond traditional banks.

Customers can now unbundle financial services, picking best-of-breed providers for specific functions like lending or investments. This fragmentation challenges incumbents like FirstRand, forcing them to ensure their integrated offerings remain competitive and attractive against these specialized alternatives.

For instance, the growth in South Africa's digital payment sector, which saw transaction volumes increase significantly in 2024, highlights how easily customers can switch to more convenient or cost-effective platforms for specific needs.

- Increased Choice: Fintech startups and specialized providers offer niche services, fragmenting the market and empowering customers.

- Unbundling of Services: Customers can select individual financial products from different providers, rather than relying on a single, integrated offering.

- Competitive Pressure: This trend forces established institutions like FirstRand to innovate and maintain competitive pricing and service quality to retain customers.

The bargaining power of customers for FirstRand is amplified by the ease of switching and access to information, particularly in 2024 with the growth of digital banking and fintech. Customers can readily compare rates and services, forcing FirstRand to maintain competitive pricing and excellent service to retain them. This is further exacerbated by economic conditions like inflation and higher interest rates, making consumers more price-sensitive and likely to seek better value elsewhere.

| Factor | Impact on FirstRand | Supporting Data (2024 Context) |

|---|---|---|

| Ease of Switching | Increases customer leverage | Growth in digital-only banks and fintech solutions reduces friction. |

| Information Availability | Empowers customers to compare | Online comparison sites and readily available product information. |

| Economic Sensitivity | Heightens price scrutiny | Inflationary pressures and interest rate hikes (e.g., SARB policy rate at 8.25% by mid-2024) squeeze household budgets. |

| Segmented Power | Varies by customer type | Corporate clients leverage larger volumes for better terms compared to retail customers. |

Same Document Delivered

FirstRand Porter's Five Forces Analysis

This preview showcases the complete FirstRand Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently proceed with your acquisition, knowing you're getting the full, ready-to-use analysis.

Rivalry Among Competitors

The South African banking landscape is highly concentrated, with FirstRand, Absa, Nedbank, and Standard Bank collectively controlling a substantial portion of the market. This oligopolistic environment fuels intense competition as these major institutions battle for customer acquisition and retention across all service areas.

This intense rivalry means that strategic decisions made by one of the big four are closely monitored and often met with similar responses from their competitors, particularly in core banking products and services. For instance, in 2023, these four banks accounted for over 75% of total banking assets in South Africa, underscoring their market dominance and the fierce nature of their competition.

The financial services sector is in the throes of a significant digital transformation. Banks are pouring substantial resources into cutting-edge technologies like artificial intelligence and advanced digital platforms. The primary aims are to enhance customer experiences and streamline internal operations. For instance, in 2023, South African banks collectively invested billions in digital initiatives, with FirstRand’s FNB often cited as a frontrunner in adopting these new technologies.

This intense focus on digital innovation fuels a fierce competitive rivalry. While FirstRand, particularly through its FNB brand, has established a strong digital presence, its competitors are not standing still. They are also aggressively upgrading their digital capabilities and launching new tech-driven products. This ongoing race means that continuous innovation is not just an advantage but a necessity for survival, as staying ahead requires constant updates to service offerings and technological infrastructure.

Competitive rivalry in the South African banking sector, including for FirstRand, is intensifying, putting significant pressure on net interest margins (NIMs). Despite a generally improving economic outlook, factors like moderating inflation and anticipated interest rate cuts are expected to squeeze profitability. This environment necessitates a strong focus on non-interest revenue streams and stringent cost management.

FirstRand's own H1 2025 results highlighted this industry-wide challenge, with group NIMs remaining flat. This lack of expansion in NIMs underscores the fierce competition for both lending opportunities and customer deposits, forcing banks to operate with tighter margins.

Diversified Business Models and Cross-Selling

Major banks, including FirstRand, operate with highly diversified business models. They offer a broad spectrum of financial services, encompassing banking, insurance, and investment products. These services cater to various customer segments, from individual retail clients to large corporate entities.

This extensive diversification naturally leads to significant cross-selling opportunities. By offering multiple products, banks can deepen relationships with their existing customer base. However, this also intensifies competition, as each bank vies for customer loyalty across numerous product lines. For instance, in 2024, the South African banking sector saw continued efforts by major players to integrate digital platforms, enhancing their ability to cross-sell effectively.

- Diversification across retail, commercial, and corporate segments.

- Cross-selling capabilities as a key competitive driver.

- Competition intensifies across multiple product offerings.

- Leveraging integrated solutions and existing customer bases provides an advantage.

Regulatory Compliance and Capital Buffers

The banking sector faces intense rivalry driven by stringent regulatory compliance and capital buffer requirements. Mandates like the Basel III reforms and evolving IT risk regulations necessitate significant investment, creating a substantial barrier for new entrants. For established players, these ongoing compliance costs and capital demands intensify competition as they must continuously allocate resources to meet these evolving standards.

Banks with robust capital positions, such as FirstRand, are inherently better equipped to manage these regulatory pressures. For instance, as of the first half of 2024, FirstRand maintained a strong Common Equity Tier 1 (CET1) ratio, a key indicator of capital strength, well above regulatory minimums. This financial resilience allows them to absorb compliance costs more effectively and continue investing in innovation and growth, thereby outmaneuvering less capitalized competitors.

- Regulatory Burden: Basel III and new IT risk regulations increase operational costs for all banks.

- Barrier to Entry: High compliance costs and capital requirements deter new competitors.

- Incumbent Rivalry: Existing banks compete fiercely to meet and exceed regulatory standards.

- Capital Strength Advantage: Banks like FirstRand, with strong capital buffers, are better positioned for sustained competitiveness.

The competitive rivalry within South Africa's banking sector remains exceptionally high, primarily due to the concentrated market structure dominated by a few large players like FirstRand. This intense competition is further amplified by significant investments in digital transformation, forcing all participants to continuously innovate to attract and retain customers. For instance, in 2023, South African banks collectively poured billions into digital initiatives, with FirstRand's FNB often leading the charge.

This digital arms race means that banks are constantly updating their offerings, leading to compressed net interest margins (NIMs) as they compete for lending and deposit business. FirstRand's H1 2025 results, showing flat NIMs, exemplify this industry-wide pressure. The drive for diversification across retail, commercial, and corporate segments also intensifies rivalry, as each bank seeks to maximize cross-selling opportunities.

Furthermore, stringent regulatory compliance, such as Basel III, acts as both a barrier to new entrants and a driver of ongoing competition among incumbents. Banks with strong capital positions, like FirstRand, which maintained a robust CET1 ratio in H1 2024, are better equipped to absorb these costs and invest in growth, thereby gaining a competitive edge.

| Key Competitive Factors | Impact on Rivalry | FirstRand's Position |

| Market Concentration | High rivalry among major banks | One of the dominant players |

| Digital Transformation | Constant innovation required | Strong digital capabilities (FNB) |

| Net Interest Margins (NIMs) | Pressure on profitability | NIMs remained flat in H1 2025 |

| Diversification & Cross-selling | Intensified competition across products | Leverages broad service offerings |

| Regulatory Compliance | High costs, barrier to entry | Strong capital position (CET1 in H1 2024) |

SSubstitutes Threaten

The rise of digital-only banks and neo-banks presents a substantial threat of substitutes for traditional financial institutions. These agile players, such as TymeBank, which saw its customer base grow to over 8 million by early 2024 in South Africa, offer streamlined, mobile-first services that often undercut established banks on fees and convenience.

By focusing on accessibility and user experience, neo-banks directly substitute core banking functions, from account management to lending, attracting customers who prioritize digital interaction and cost savings. This shift challenges the traditional branch-based models and fee structures that have long been the bedrock of incumbent banks.

The surge in mobile payment solutions and digital wallets presents a significant threat of substitutes for traditional banking transactions. These platforms, like Apple Pay and Google Pay, offer convenient alternatives for everyday purchases, bypassing traditional card networks and potentially reducing transaction volumes for banks.

In 2024, the global digital payments market was valued significantly, with projections indicating continued strong growth. This expansion means more consumers are comfortable with and actively using these non-bank payment methods, directly impacting how banks like FirstRand’s FNB process transactions.

While FNB has invested in its own digital offerings, the broader competitive landscape includes numerous fintech companies and tech giants offering seamless payment experiences. This ecosystem can siphon off transaction-based revenue streams, forcing traditional banks to innovate rapidly to stay relevant in the payment value chain.

Decentralized finance (DeFi) and crypto-assets present a growing threat of substitutes for traditional financial services. While not legal tender in South Africa, these digital alternatives offer peer-to-peer transactions and financial services bypassing conventional banking infrastructure.

Globally, crypto adoption is rising, with over 420 million crypto users reported by TripleA in 2024. This trend signifies a long-term potential shift away from traditional banking and investment products, impacting entities like FirstRand.

Specialized Lending Platforms

Specialized lending platforms, encompassing peer-to-peer (P2P) lenders and alternative credit providers, present a significant threat of substitution to FirstRand's traditional loan offerings. These platforms often cater to specific market segments or provide more agile and customized financing, attracting customers who may not meet conventional banking requirements or who prioritize speed. For instance, the P2P lending market globally saw substantial growth, with platforms facilitating billions in loans by 2024, offering a direct alternative for individuals and businesses seeking funding.

These alternative providers can bypass some of the regulatory overhead faced by established banks, allowing for potentially lower costs or faster processing times. This competitive pressure forces FirstRand to continually innovate its product suite and customer experience to retain market share. The increasing sophistication and reach of these platforms highlight the evolving competitive landscape in financial services.

- Niche Market Appeal: Specialized platforms often focus on underserved or niche customer segments, offering tailored solutions that traditional banks might overlook.

- Flexibility and Speed: Many alternative lenders provide more flexible repayment terms and quicker loan approval processes compared to incumbent banks.

- Technological Advancement: Digital-first platforms leverage technology for streamlined operations, potentially leading to cost efficiencies and better customer interfaces.

- Market Growth: The global alternative lending market, projected to reach hundreds of billions by 2025, indicates a growing customer preference for these substitute services.

Internal Corporate Treasury Management

Sophisticated internal treasury management systems and direct access to capital markets present a significant threat of substitutes for FirstRand's corporate and investment banking services, particularly for large clients. Companies can bypass traditional banking intermediaries by issuing their own bonds or securing capital directly. For instance, in 2024, the global bond issuance market continued to be robust, with corporations actively tapping into this avenue for funding, potentially reducing their need for syndicated loans or other bank-facilitated financing.

This trend means that while RMB offers comprehensive treasury solutions, a large corporation with a well-developed internal treasury function might opt to manage its liquidity, foreign exchange exposure, and funding needs independently. This can include utilizing sophisticated in-house treasury management systems that integrate with capital markets platforms. Such direct engagement with capital markets allows for greater control and potentially lower costs for certain financial activities, directly substituting services that might otherwise be provided by FirstRand.

The ability for large corporates to self-manage or access alternative funding sources directly impacts the demand for specific banking products. For example, if a company can issue commercial paper at a competitive rate, it reduces its reliance on a bank for short-term working capital financing. This strategic choice by clients directly substitutes a portion of the revenue stream that FirstRand's corporate banking division might otherwise capture.

The threat of substitutes is significant for FirstRand, as digital-only banks and payment solutions offer compelling alternatives. TymeBank's rapid growth to over 8 million customers by early 2024 in South Africa highlights the appeal of streamlined, low-fee digital banking. Similarly, the increasing adoption of mobile payment platforms like Apple Pay and Google Pay bypasses traditional banking channels for everyday transactions.

Decentralized finance (DeFi) and the growing global crypto user base, estimated at over 420 million in 2024, represent longer-term substitutes that could disrupt traditional financial services. Specialized lending platforms also provide alternative funding avenues, with the global alternative lending market projected for substantial growth, offering tailored and faster financing options.

Large corporations increasingly utilize sophisticated internal treasury systems and direct access to capital markets, such as robust global bond issuance markets in 2024, to manage funding and liquidity, thereby substituting traditional corporate banking services.

Entrants Threaten

The financial services industry, especially in a mature market like South Africa where FirstRand operates, demands enormous upfront investment. This includes setting up sophisticated IT infrastructure, establishing a physical presence, and meeting stringent regulatory capital requirements, making it exceptionally difficult for newcomers to gain a foothold.

For instance, South African banks are required to maintain capital adequacy ratios, and established players like FirstRand often hold reserves significantly exceeding these minimums to ensure stability and competitiveness. As of the latest available data, major South African banks consistently report CET1 ratios well above the Basel III minimums, underscoring the substantial capital base needed to even consider entry.

New entrants aiming to offer a comprehensive suite of financial products, from banking to asset management, would need to mobilize billions of dollars to match the scale and credibility of incumbents. This high capital barrier effectively deters many potential competitors from challenging established firms like FirstRand.

The South African financial sector presents a significant barrier to new entrants due to its stringent regulatory environment. Complex legislation like the Financial Sector Regulation Act (FSR Act), alongside evolving frameworks such as COFI and Basel reforms, dictates operational standards. Meeting these requirements, including new IT governance and risk management protocols, necessitates substantial investment in legal, operational, and financial resources, making it difficult for new players to establish themselves.

Established brand loyalty and customer trust represent a significant barrier for new entrants looking to challenge incumbent banks like FirstRand. FirstRand, through its prominent brands such as FNB and RMB, has cultivated decades of brand recognition and deep customer trust, augmented by a widespread physical branch network. For a new player, replicating this level of confidence and loyalty is a substantial undertaking, particularly in an industry where security and reliability are non-negotiable. In 2024, FirstRand's continued investment in customer-centric digital platforms and personalized banking solutions further enhances this customer stickiness, making it even harder for newcomers to gain traction.

Technological Investment and Infrastructure

Developing and maintaining the sophisticated technological infrastructure essential for contemporary banking, encompassing digital platforms, robust cybersecurity, and advanced data analytics, necessitates substantial and continuous capital outlay. For instance, in 2024, major South African banks like FirstRand continued to invest billions in digital transformation initiatives, with a significant portion allocated to upgrading core banking systems and enhancing cybersecurity defenses to combat evolving threats.

While agile fintech startups can adopt cutting-edge technologies quickly, replicating the sheer scale, integration, and proven resilience of established players like FirstRand's complex systems and extensive legacy infrastructure poses a formidable hurdle for potential new entrants aiming to compete effectively in the market.

- Massive Capital Requirements: The ongoing investment in digital platforms, cybersecurity, and data analytics runs into billions of dollars annually for leading financial institutions.

- Infrastructure Scale and Integration: New entrants struggle to match the seamless integration and operational robustness of established, large-scale banking infrastructures.

- Cybersecurity Stakes: The high cost and complexity of maintaining state-of-the-art cybersecurity are significant deterrents for smaller, less capitalized competitors.

Access to Distribution Channels and Talent

New entrants to the financial services sector, including those competing with FirstRand, face significant hurdles in establishing robust distribution networks. Building a widespread physical presence or achieving broad digital adoption requires substantial investment, often necessitating costly partnerships or the creation of entirely new infrastructure.

The competitive landscape for specialized talent presents another formidable barrier. Financial institutions need skilled professionals in areas like risk management, digital transformation, and customer analytics. In 2024, the demand for these roles remained high, with reports indicating significant salary increases in key financial hubs, making it difficult for new players to attract and retain top talent against established firms.

- Distribution Channel Investment: New entrants must invest heavily in physical or digital channels to reach customers, a process that can take years and significant capital.

- Talent Acquisition Costs: Securing experienced financial professionals is expensive, with specialized roles seeing competitive salary growth, impacting profitability for new firms.

- Brand Recognition and Trust: Overcoming the established trust and brand recognition of incumbents like FirstRand requires substantial marketing and a proven track record, which new entrants lack initially.

The threat of new entrants for FirstRand remains relatively low, primarily due to the immense capital investment required to establish a competitive presence in the South African financial services sector. These costs encompass not only regulatory capital but also significant outlays for advanced technology and cybersecurity. Furthermore, the deep-seated brand loyalty and trust enjoyed by incumbents like FirstRand, built over decades, present a formidable challenge for newcomers seeking to gain market share.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024/Latest Available) |

|---|---|---|---|

| Capital Requirements | High upfront investment for infrastructure, technology, and regulatory compliance. | Deters most potential entrants. | Major South African banks consistently maintain CET1 ratios well above Basel III minimums, indicating the substantial capital base required. |

| Brand Loyalty & Trust | Established reputation and customer relationships of incumbents. | Difficult to replicate, requiring significant time and marketing. | FirstRand's continued investment in customer-centric digital platforms enhances customer retention. |

| Technology & Infrastructure | Need for sophisticated, integrated, and secure IT systems. | Requires massive, ongoing investment and expertise. | Billions invested annually by leading banks in digital transformation and cybersecurity. |

| Regulatory Environment | Stringent compliance with laws like FSR Act, COFI, and Basel reforms. | Demands substantial legal, operational, and financial resources. | New IT governance and risk management protocols add to compliance costs. |

| Distribution & Talent | Building extensive distribution networks and attracting skilled professionals. | Costly and time-consuming, with high competition for talent. | Reports of significant salary increases in key financial roles in 2024. |

Porter's Five Forces Analysis Data Sources

Our FirstRand Porter's Five Forces analysis leverages data from FirstRand's annual reports, investor presentations, and regulatory filings, supplemented by industry-specific reports from reputable financial data providers and macroeconomic indicators.