First Pacific SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Pacific Bundle

First Pacific's strengths lie in its diversified portfolio and strong regional presence, but are they enough to navigate upcoming market shifts? Our initial look reveals potential vulnerabilities that could impact future growth.

Want to understand the full strategic picture and how First Pacific is positioned for success? Purchase the complete SWOT analysis to uncover critical insights, actionable strategies, and a detailed roadmap for navigating the competitive landscape.

Strengths

First Pacific's diversified investment portfolio is a significant strength, encompassing telecommunications, consumer food products, infrastructure, and natural resources. This spread across vital sectors in the Asia-Pacific region, including major holdings like Indofood, PLDT, and MPIC, reduces exposure to any single market's volatility. For instance, as of early 2025, Indofood's continued strong performance in the Indonesian food market, coupled with PLDT's expansion in the Philippine digital infrastructure space, demonstrates the resilience derived from this strategic diversification.

First Pacific boasts a robust operational presence throughout Asia, especially in rapidly developing markets such as Indonesia and the Philippines. This strategic positioning enables the company to leverage significant growth opportunities stemming from increasing consumer spending power and demand for vital services in these vibrant economies.

The company's subsidiaries, including Indofood in Indonesia and PLDT and Metro Pacific Investments Corporation (MPIC) in the Philippines, hold leading market positions. For instance, as of early 2024, Indofood is a dominant force in Indonesia's food industry, and PLDT continues to be the leading telecommunications provider in the Philippines, demonstrating First Pacific's strong foothold.

First Pacific distinguishes itself through active management, not merely holding investments but actively steering its portfolio companies toward growth and value enhancement. This proactive strategy involves critical decision-making, operational enhancements, and strategic capital deployment to maximize the performance of its varied assets.

The company's commitment to value creation is evident in its financial performance. For instance, in its 2024 reporting, First Pacific demonstrated a consistent ability to boost recurring profits and increase shareholder distributions, a testament to its effective management approach.

Solid Financial Performance and Shareholder Returns

First Pacific has showcased robust financial health, achieving record contributions, recurring profits, net profits, and distributions to shareholders in 2024. The company’s net profit saw a significant 20% surge, reaching US$600.3 million, alongside an 11% increase in its full-year distribution to shareholders. This consistent financial strength, underscored by a stable credit rating, reflects effective financial stewardship and a dedication to rewarding its investors.

- Record Financial Achievements: First Pacific reported record highs in contribution, recurring profit, net profit, and shareholder distributions for 2024.

- Profitability Growth: Net profit increased by 20% to US$600.3 million in 2024.

- Shareholder Returns: The company raised its full-year distribution to shareholders by 11%.

- Financial Stability: A stable credit rating reinforces the company's sound financial management and commitment to investor returns.

Robust Corporate Governance

First Pacific demonstrates a commitment to robust corporate governance, underpinned by a well-defined committee structure and a dedication to transparency. This is evident in recent actions like the restructuring of its Ad Hoc Selection Committee and the proactive scheduling of its Annual General Meeting for 2025, signaling a continuous effort to refine decision-making and oversight.

This emphasis on strong governance is crucial for building investor trust and improving overall operational effectiveness. For instance, companies with strong governance practices often see better access to capital and lower cost of equity, as investors perceive reduced risk. While specific 2024/2025 governance metric data for First Pacific is still emerging, their proactive approach suggests a strategic focus on these areas.

- Structured Committee Framework: Committees ensure specialized oversight and efficient decision-making.

- Commitment to Transparency: Open communication builds trust with stakeholders.

- Proactive Governance Enhancements: Actions like committee reviews and AGM scheduling demonstrate ongoing commitment.

- Investor Confidence: Strong governance is a key factor in attracting and retaining investment.

First Pacific's diversified business model across essential sectors like food, telecommunications, and infrastructure in the Asia-Pacific region is a key strength. This diversification, exemplified by strong performances from subsidiaries like Indofood and PLDT in early 2025, mitigates risks associated with any single market. The company's leading market positions in key territories further solidify its competitive advantage.

The company's robust financial health is another significant strength, marked by record contributions, recurring profits, and net profits in 2024. A 20% surge in net profit to US$600.3 million and an 11% increase in shareholder distributions highlight effective financial management. This financial stability, supported by a stable credit rating, underpins investor confidence.

| Metric | 2024 Value | Change |

|---|---|---|

| Net Profit | US$600.3 million | +20% |

| Shareholder Distribution | +11% | |

| Contribution | Record High |

What is included in the product

Analyzes First Pacific’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address strategic vulnerabilities, alleviating the pain of uncertainty.

Weaknesses

First Pacific's financial performance is quite sensitive to changes in currency exchange rates. Since many of its operations are in countries like Indonesia and the Philippines, the value of the Indonesian Rupiah and Philippine Peso against the U.S. dollar directly impacts how its results look in its financial reports. This means even if a subsidiary is doing well locally, a weaker local currency can make its contribution appear smaller when converted to U.S. dollars.

For instance, in 2024, First Pacific reported foreign exchange losses, highlighting this vulnerability. The depreciation of the Indonesian Rupiah and Philippine Peso led to a negative impact on its reported turnover and profits. This currency fluctuation introduces an element of unpredictability into the company's consolidated financial statements, making it harder to gauge the true underlying operational strength.

First Pacific's financial performance is significantly tethered to the success of its key subsidiaries. For instance, Indofood, a major contributor, saw its revenue grow by 11.3% to IDR 111.7 trillion in 2023, but any disruption here directly impacts First Pacific. Similarly, PLDT's performance, with its 2023 core business revenue up 4% year-on-year, is crucial.

The company's reliance on these major investees, even across diverse sectors like food, telecommunications, and infrastructure, creates a concentration risk. A substantial underperformance by, say, Metro Pacific Investments Corporation (MPIC), which reported a net income attributable to equity holders of PHP 14.7 billion for the nine months ended September 30, 2023, can have a ripple effect across First Pacific's consolidated financials.

First Pacific's intricate web of subsidiaries and associates, spanning diverse geographies, presents a significant weakness. This complexity can impede efficient oversight and streamline inter-company dealings, potentially slowing down crucial decision-making compared to more streamlined corporate setups.

Managing the varied regulatory landscapes and minority stakes inherent in such a dispersed structure adds another layer of difficulty. For instance, navigating different tax laws and corporate governance requirements across its many ventures requires substantial resources and expertise, as seen in its diverse portfolio including telecommunications in the Philippines and food products in Indonesia.

Debt and Gearing Ratio

First Pacific's consolidated gearing ratio saw a slight uptick in 2024, reaching 53.6% compared to 52.1% in 2023. While no significant debt maturities are scheduled until 2026, and the company has proactively refinanced some existing facilities, this upward trend in leverage warrants attention.

An increasing debt level, even with managed maturities, can amplify financial risk, particularly if the company faces economic headwinds or a sustained rise in interest rates. This heightened gearing ratio could potentially impact future borrowing costs and financial flexibility.

- Gearing Ratio (2024): 53.6% (up from 52.1% in 2023)

- Debt Maturities: No significant maturities until 2026

- Refinancing Activities: Some loans have been refinanced

- Potential Risk: Increased financial risk in volatile economic or rising interest rate environments

Regulatory and Geopolitical Risks

Operating across diverse Asia-Pacific markets, First Pacific faces significant regulatory and geopolitical headwinds. Changes in government policies, trade agreements, or political instability in key regions like the Philippines or Indonesia can directly impact its operations and investment climate. For instance, the Philippines, a major market for First Pacific, experienced a GDP growth of 5.9% in Q1 2024, but ongoing political developments and potential shifts in foreign investment policies present ongoing risks. Navigating these varied legal landscapes and political sensitivities requires constant vigilance and adaptability.

The company's exposure to multiple jurisdictions means it must comply with a patchwork of local laws and regulations, which can be complex and costly. Furthermore, geopolitical tensions within the Asia-Pacific region could disrupt supply chains, affect consumer demand, or lead to unexpected operational challenges. For example, trade disputes between major economies in the region could indirectly affect First Pacific's subsidiaries by altering import/export costs or market access.

- Diverse Regulatory Exposure: First Pacific must adhere to varying legal and compliance standards across its operating countries, increasing administrative burden and potential for non-compliance penalties.

- Geopolitical Instability: Political unrest or significant policy shifts in countries like the Philippines or Indonesia, where the company has substantial investments, pose a direct threat to its business continuity and profitability.

- Trade Policy Uncertainty: Evolving trade regulations and potential protectionist measures within the Asia-Pacific region can impact the cost of goods, market access for its subsidiaries, and overall international trade dynamics.

- Compliance Costs: The need to manage complex and often changing regulatory environments across multiple nations contributes to higher operational and legal expenses.

First Pacific's complex structure, with numerous subsidiaries and associates across diverse geographies, can lead to inefficiencies in oversight and inter-company dealings. This complexity makes swift decision-making more challenging compared to less diversified organizations. Managing varied regulatory environments and minority stakes in each venture demands significant resources and specialized expertise, increasing operational costs and potential compliance risks.

The company's consolidated gearing ratio increased slightly to 53.6% in 2024 from 52.1% in 2023, indicating a growing reliance on debt. While no major debt maturities are due until 2026, this upward trend in leverage could amplify financial risks, especially during economic downturns or periods of rising interest rates, potentially impacting future borrowing costs and financial flexibility.

| Weakness | Description | Impact |

|---|---|---|

| Operational Complexity | Managing a vast network of subsidiaries and associates across different regions. | Slower decision-making, increased administrative burden, and potential for inter-company inefficiencies. |

| Increased Gearing Ratio | Consolidated gearing rose to 53.6% in 2024 from 52.1% in 2023. | Heightened financial risk, particularly in volatile economic conditions or with rising interest rates, potentially affecting borrowing costs. |

| Regulatory & Geopolitical Exposure | Operating in multiple jurisdictions with varying laws and political landscapes. | Increased compliance costs, potential for policy shifts impacting operations, and vulnerability to regional instability. |

What You See Is What You Get

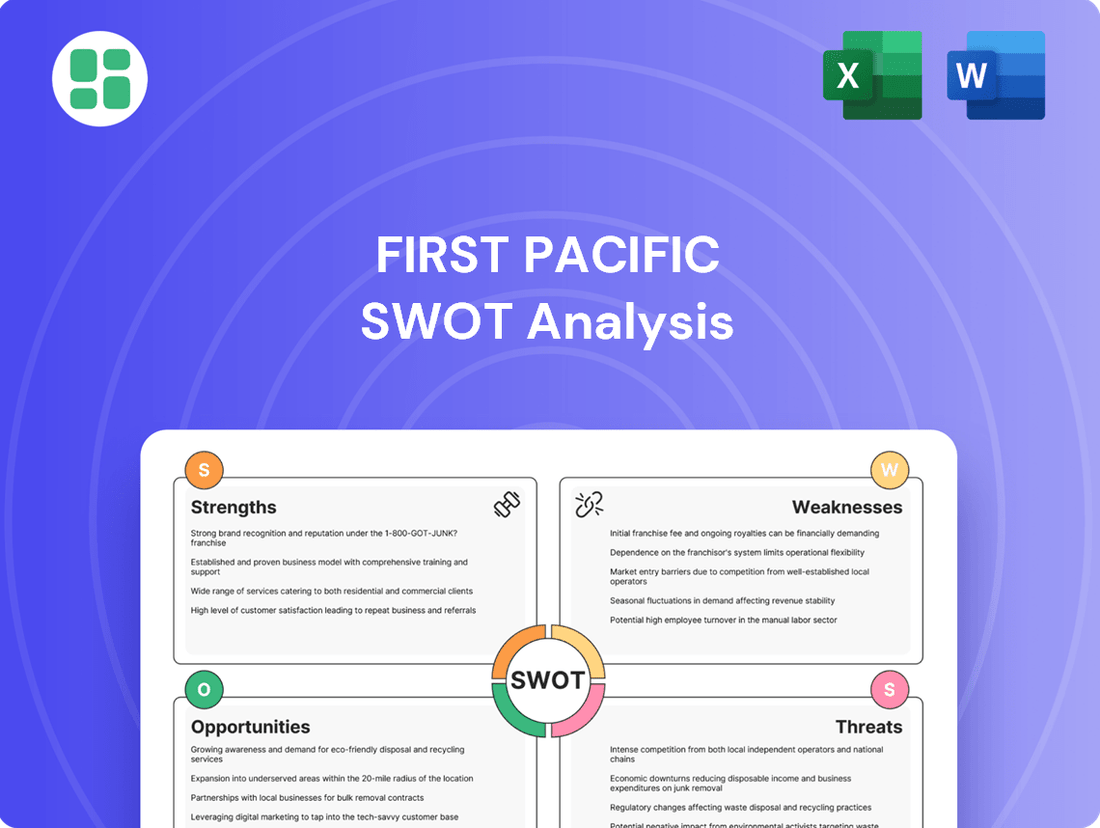

First Pacific SWOT Analysis

The preview you see is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of First Pacific's strategic landscape.

Opportunities

First Pacific's telecommunications subsidiary, PLDT, is well-positioned to capitalize on the burgeoning digital economy. The company can leverage its existing infrastructure and customer base to expand its digital services portfolio, particularly in areas like digital banking and other emerging technologies. This strategic move could unlock substantial new revenue streams and broaden its market penetration.

A key indicator of this potential is the performance of Maya Innovations Holdings, an associate of PLDT. Maya reported its first-ever profitability in December 2024, a testament to its robust growth. The company saw a significant increase in bank customers and loan disbursements, highlighting a strong demand for digital financial services and validating First Pacific's investment strategy in this sector.

First Pacific's substantial stake in Metro Pacific Investments Corporation (MPIC) positions it favorably to benefit from the robust infrastructure development pipeline across the Asia-Pacific. This region's ongoing urbanization and economic expansion fuel a continuous demand for essential services like power, water, and transportation networks, such as toll roads.

The company can explore emerging opportunities in advanced infrastructure, including smart city solutions and sustainable projects, aligning with global trends. MPIC's demonstrated consistent growth in core profits underscores the sector's inherent profitability and First Pacific's capacity to leverage these trends.

First Pacific's strategy of making targeted investments opens doors for growth via mergers, acquisitions, and partnerships within its key sectors and related fields. This approach allows the company to continually expand its reach and capabilities.

By acquiring businesses that complement its existing strengths, First Pacific can solidify its market position and unlock new revenue streams. For instance, in 2023, the company continued to explore opportunities to enhance its infrastructure and consumer goods segments, building on its established operational expertise.

Leveraging ESG and Sustainability Trends

The increasing global focus on Environmental, Social, and Governance (ESG) criteria presents a significant opportunity for First Pacific. By bolstering its sustainability efforts, the company can align with investor preferences and enhance its market standing. First Pacific's 2024 ESG report highlights its dedication to these principles, demonstrating a proactive approach to integrating sustainability across its operations.

Investing in green technologies, fostering sustainable supply chains, and embedding socially responsible practices within its varied business segments can attract a growing pool of ESG-conscious investors. This strategic alignment not only bolsters brand reputation but also opens avenues for new capital infusions. For instance, the global sustainable investment market reached an estimated $35.3 trillion in 2024, a substantial increase from previous years, indicating strong investor appetite for ESG-aligned companies.

- Attract ESG Investors: Capitalize on the expanding global market for sustainable investments, which saw significant growth in 2024.

- Enhance Brand Reputation: Demonstrate commitment to responsible business practices, resonating with consumers and stakeholders.

- Access New Funding: Tap into green bonds and sustainability-linked loans, offering potentially favorable financing terms.

- Mitigate Risks: Proactively address environmental and social risks, reducing potential operational and reputational liabilities.

Growth in Consumer Demand in Emerging Markets

The burgeoning middle class and rising disposable incomes across emerging Asian markets, particularly in Indonesia, present a significant opportunity for First Pacific's consumer food products segment, spearheaded by Indofood. This demographic shift fuels increasing consumer spending, creating a fertile ground for growth. Indofood's robust EBIT margins, which stood at 15.2% in 2024, underscore its capacity to capitalize on this trend.

These evolving consumer preferences, including a growing demand for healthier and more convenient food options, offer avenues for product line expansion and market penetration into new geographical areas.

- Indonesia's middle class is projected to grow by over 50 million people by 2030, driving significant consumption growth.

- Indofood's market share in Indonesia's instant noodle market remains dominant, providing a strong base for further expansion.

- The company is well-positioned to introduce innovative products catering to health-conscious consumers.

First Pacific can leverage its telecommunications arm, PLDT, to expand digital services like digital banking, building on the profitability of its associate Maya Innovations. The company is also poised to benefit from infrastructure development across Asia-Pacific through its stake in MPIC, with opportunities in smart city solutions. Additionally, First Pacific can pursue strategic acquisitions and partnerships to enhance its market reach and capabilities.

Threats

First Pacific operates in sectors like telecommunications, consumer goods, and infrastructure, all experiencing fierce competition. For instance, in the telecommunications arena, players like PLDT, a First Pacific subsidiary, face ongoing challenges from rivals such as Globe Telecom, which in 2023 continued to invest heavily in network upgrades, aiming to capture market share.

This heightened rivalry, both from established local entities and emerging international players, can exert significant downward pressure on pricing, potentially eroding market share and impacting the profitability of First Pacific's diverse portfolio companies. For example, in the consumer goods segment, intensified competition can lead to increased marketing expenses and necessitate aggressive promotional activities, as seen with various brands in the Philippine food and beverage market.

To navigate this challenging landscape, First Pacific must champion continuous innovation and operational efficiency across its holdings. Strategic differentiation is paramount; for example, in infrastructure, focusing on sustainable and technologically advanced projects can provide a competitive edge, as demonstrated by ongoing investments in renewable energy infrastructure development in the Asia-Pacific region.

Economic slowdowns in key markets like the Philippines and Indonesia, where First Pacific has significant investments, pose a considerable threat. For instance, a projected GDP growth slowdown in the Philippines to around 5.5% in 2024, down from previous estimates, could dampen consumer demand for products and services offered by its subsidiaries.

Recessionary pressures globally or within the Asia-Pacific region could directly impact infrastructure development, a sector where First Pacific through Metro Pacific Investments Corporation is heavily involved. Reduced government spending or private sector investment in infrastructure projects would curtail revenue streams and project pipeline growth.

A downturn would likely squeeze the profitability of First Pacific's diverse portfolio, from consumer goods to telecommunications. For example, if consumer spending on essential goods declines due to job losses or reduced disposable income, companies like San Miguel Corporation (partially owned by First Pacific) could see their sales volumes and margins shrink, impacting overall group earnings and potentially shareholder returns.

First Pacific operates in sectors like telecommunications and infrastructure, which are subject to significant government oversight. Potential threats include unexpected shifts in regulatory frameworks or increased government intervention that could negatively affect its subsidiaries' performance. For instance, changes in foreign ownership limits or new environmental standards could directly impact operational costs and strategic planning.

The company must remain vigilant regarding potential new taxes or utility rate caps, as these could directly reduce profitability. In 2024, several emerging markets where First Pacific has interests saw governments review or implement new digital taxes and data privacy regulations, posing a direct challenge to revenue streams in its telecom segment.

Geopolitical Instability and Trade Tensions

Geopolitical instability and ongoing trade tensions, particularly within the Asia-Pacific region, pose a significant threat to First Pacific's operations. These factors can disrupt critical supply chains, hindering the flow of goods and impacting manufacturing and distribution networks. For instance, heightened tensions between major trading blocs could lead to increased tariffs and trade barriers, directly affecting the cost of goods and the profitability of international ventures.

The uncertain investment climate fostered by such instability can deter foreign direct investment, a crucial component for growth in many of the markets where First Pacific operates. This could lead to a devaluation of local currencies, eroding the value of repatriated earnings and negatively impacting the company's financial performance. In 2024, the IMF projected that escalating trade protectionism could shave 0.5% off global GDP growth, underscoring the tangible economic impact of these tensions.

- Supply Chain Disruptions: Increased risk of delays and higher costs due to trade disputes and political unrest.

- Reduced Foreign Investment: Geopolitical uncertainty can deter capital inflows, impacting expansion plans.

- Currency Volatility: Devaluation of regional currencies can negatively affect First Pacific's reported earnings.

- Market Access Limitations: Trade barriers may restrict access to key markets for First Pacific's diverse portfolio of businesses.

Technological Disruption and Obsolescence

Rapid technological advancements present a significant threat to First Pacific, especially within its telecommunications and consumer food product segments. For instance, the telecommunications industry is constantly evolving with new generations of mobile technology, like the ongoing rollout and refinement of 5G services, which require substantial and continuous capital expenditure to remain competitive. Failure to keep pace with these innovations or adapt to shifting consumer preferences influenced by digital trends could render existing infrastructure and service offerings obsolete, demanding costly upgrades or replacements.

The risk of disruptive innovations from competitors is also a major concern. Companies that fail to invest adequately in research and development or are slow to adopt emerging technologies risk losing market share and facing obsolescence of their current business models. This necessitates proactive strategic planning and substantial investment to ensure First Pacific's offerings remain relevant and competitive in dynamic markets.

- Telecommunications Sector: Ongoing investment required for 5G network expansion and future technologies.

- Consumer Food Products: Need to adapt to changing consumer preferences driven by digital platforms and new product development.

- Competitive Landscape: Risk of being outpaced by competitors with more agile technological adoption strategies.

- Investment Requirements: Significant capital allocation needed for R&D and technological upgrades to avoid obsolescence.

Intense competition across its core sectors, including telecommunications and consumer goods, poses a significant threat, potentially pressuring pricing and eroding market share. For example, in 2023, Globe Telecom continued aggressive network investments to challenge PLDT, a First Pacific subsidiary.

Economic downturns in key markets like the Philippines and Indonesia could dampen consumer demand and impact infrastructure investment. The IMF projected a global GDP growth slowdown in 2024 due to escalating trade protectionism, impacting regional economic stability.

Regulatory shifts and increased government intervention, such as new digital taxes or data privacy regulations seen in emerging markets in 2024, could negatively affect subsidiary performance and increase operational costs.

Geopolitical instability and trade tensions in the Asia-Pacific region risk supply chain disruptions and reduced foreign investment, potentially devaluing repatriated earnings. The IMF estimated trade protectionism could reduce global GDP growth by 0.5% in 2024.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from First Pacific's official financial reports, comprehensive market intelligence, and insights from industry experts. These sources collectively provide a clear and accurate picture of the company's current standing and future potential.