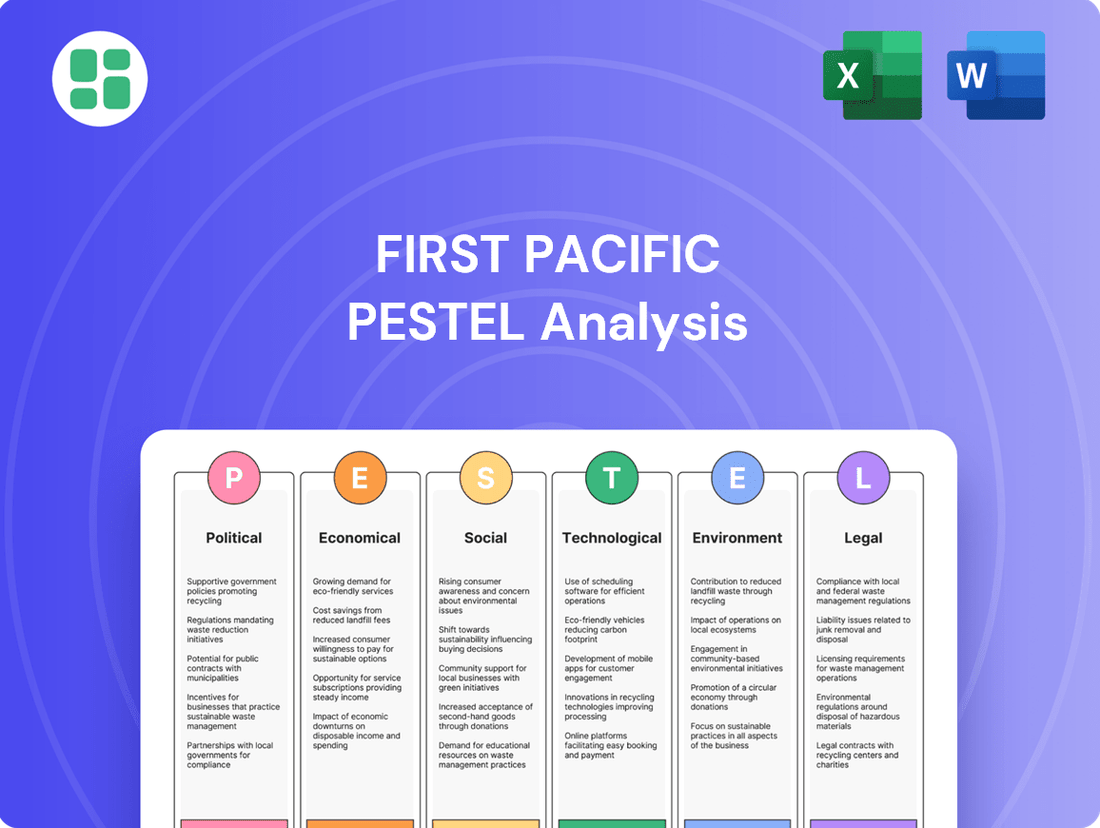

First Pacific PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Pacific Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping First Pacific's trajectory. This comprehensive PESTLE analysis provides the essential external intelligence you need to anticipate market shifts and identify strategic opportunities. Don't get left behind; download the full version now and gain a decisive advantage.

Political factors

First Pacific's operations are significantly influenced by the political landscapes of its core markets, particularly the Philippines and Indonesia. For instance, the Philippines has seen consistent economic growth, averaging around 5.9% annually in the years leading up to 2023, which generally supports investment, but shifts in government policy regarding foreign ownership or resource extraction could impact companies like First Pacific's infrastructure and natural resources segments.

Policy continuity or abrupt changes in regulatory frameworks, such as tax laws or environmental standards, directly affect the profitability and operational feasibility of First Pacific's diverse portfolio. For example, a sudden increase in corporate taxes in Indonesia, a key market for First Pacific's food and consumer goods businesses, could reduce net earnings. The stability of governments and their commitment to free market principles are therefore critical for First Pacific's long-term strategic planning and investment decisions.

First Pacific's diverse portfolio, heavily weighted in consumer food and natural resources, is significantly shaped by global trade dynamics. For instance, the company's significant presence in the Philippines, a key market for food and beverages, means that any changes in import/export regulations or tariffs with major trading partners like China or the US could impact the cost of raw materials and the competitiveness of its products.

The Asia-Pacific region, where First Pacific operates extensively, is a complex web of trade agreements. For example, the Regional Comprehensive Economic Partnership (RCEP), fully implemented in 2023, aims to reduce trade barriers among its 15 member countries, potentially benefiting First Pacific's supply chain and market access for its food products. However, ongoing geopolitical tensions or the rise of protectionist policies in specific markets could introduce non-tariff barriers, affecting market entry and operational costs.

First Pacific operates across diverse sectors, each governed by distinct regulatory landscapes. For instance, its telecommunications arm, PLDT, navigates regulations on spectrum allocation and data privacy, while its consumer food businesses, like Indofood, must adhere to stringent food safety and labeling laws. In 2024, the Philippines, where PLDT is a major player, continued to refine its digital infrastructure policies, impacting network expansion and service pricing.

Infrastructure projects, another key area for First Pacific, are heavily influenced by government tenders, environmental impact assessments, and public-private partnership frameworks. Changes in national infrastructure spending priorities or the introduction of new environmental standards for construction and operation can significantly alter project viability and timelines. For example, evolving climate change regulations in Southeast Asia are increasingly shaping the requirements for new infrastructure developments.

The natural resources sector faces regulations concerning mining permits, environmental protection during extraction, and export policies. Government decisions on resource nationalism or royalty rates directly affect profitability and investment attractiveness. As of early 2025, many resource-rich nations are reviewing their fiscal regimes for mining, potentially impacting companies like First Pacific's subsidiaries involved in this segment.

Geopolitical Risks

First Pacific's significant presence in the Asia-Pacific region makes it susceptible to geopolitical risks. Tensions in areas like the South China Sea or potential social unrest in countries where it operates can directly impact its business. For instance, in 2023, ongoing territorial disputes in the region continued to create an unpredictable operating environment for companies with substantial regional investments.

These geopolitical factors can lead to operational disruptions, affecting supply chains and potentially increasing costs. Furthermore, such instability can deter foreign investment and create an unpredictable business landscape, requiring First Pacific to maintain agile risk management strategies. The company's exposure to diverse political climates across its operating countries means that shifts in regional stability are a constant consideration for its strategic planning.

Specific geopolitical risks for First Pacific can include:

- Trade disputes and protectionist policies impacting the flow of goods and capital within the Asia-Pacific.

- Regional conflicts or border disputes that could disrupt logistics and supply chains for its subsidiaries.

- Political instability or changes in government in key operating markets, potentially leading to policy shifts affecting business operations.

- Sanctions or international relations that could indirectly impact First Pacific's access to markets or financing.

Government Incentives and Support

Government incentives play a vital role in shaping the landscape for companies like First Pacific. For instance, the Philippine government's push for digital infrastructure expansion, as seen in initiatives like the National Broadband Program, offers significant opportunities for First Pacific's telecommunications arm, PLDT. These programs often come with tax breaks or subsidies, reducing the capital expenditure burden and accelerating deployment.

Furthermore, policies promoting food security and sustainable resource development can directly impact First Pacific's investments in agriculture and infrastructure. As of early 2025, the Department of Agriculture has been actively encouraging investments in modern farming techniques and supply chain improvements, potentially benefiting First Pacific’s food and beverage segments. Understanding and strategically aligning with these governmental supports are crucial for First Pacific to gain a competitive edge and drive sustainable growth across its diverse portfolio.

- Digital Infrastructure: Philippine government targets to connect 100% of its municipalities to broadband by 2028, with significant incentives for private sector participation.

- Food Security: Increased government budget allocation for agricultural modernization and rural development in the 2025 fiscal year, aiming to boost local production.

- Sustainable Development: The Philippines' commitment to renewable energy targets, with policy support for solar and wind power projects, aligning with First Pacific's infrastructure interests.

Government stability and policy direction are paramount for First Pacific's operations across the Philippines and Indonesia. For example, the Philippine government's continued focus on infrastructure development, with significant public investment planned through 2028, creates opportunities for First Pacific's infrastructure segments. Conversely, any shifts in regulatory frameworks, such as changes to foreign investment caps or environmental regulations in Indonesia, could directly impact the profitability of its consumer goods and natural resources businesses.

Trade policies and geopolitical alignments significantly shape First Pacific's regional activities. The ongoing implementation of the Regional Comprehensive Economic Partnership (RCEP) since 2023 offers potential benefits by reducing trade barriers across its key Asian markets. However, evolving trade disputes or the rise of protectionist measures in specific countries could introduce non-tariff barriers, affecting supply chains and market access for its diverse product portfolio.

Government incentives and regulatory environments for specific sectors are critical. In 2024, the Philippine government's push for digital transformation, including broadband expansion targets, directly benefits First Pacific's telecommunications arm, PLDT. Simultaneously, policies aimed at enhancing food security and promoting sustainable resource extraction, as observed in increased agricultural budgets for 2025, provide a supportive backdrop for First Pacific's investments in these areas.

| Political Factor | Impact on First Pacific | Supporting Data/Trend (2023-2025) |

| Government Stability & Policy Continuity | Influences investment climate, regulatory predictability, and operational costs in core markets like the Philippines and Indonesia. | Philippines' average GDP growth around 5.9% (pre-2023) indicates a generally stable economic environment conducive to investment. |

| Trade Agreements & Protectionism | Affects supply chain efficiency, raw material costs, and market access for consumer goods and natural resources. | RCEP implementation (2023) aims to liberalize trade in Asia; however, ongoing trade tensions could introduce non-tariff barriers. |

| Sector-Specific Regulations & Incentives | Shapes opportunities and challenges in telecommunications, food, infrastructure, and natural resources. | Philippine National Broadband Program targets municipal connectivity by 2028; increased agricultural budgets in 2025 support food security initiatives. |

What is included in the product

This First Pacific PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The First Pacific PESTLE Analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations and alleviating the pain of sifting through extensive data.

Economic factors

First Pacific's financial health is intrinsically linked to the economic vitality of the Asia-Pacific region. For instance, in 2023, many of its key operating markets, such as the Philippines and Indonesia, experienced strong GDP growth, with the Philippines projecting around 6% growth for the year and Indonesia around 5%. This expansion fuels consumer spending, particularly in First Pacific's core sectors like food and telecommunications, as well as driving demand for infrastructure projects.

This regional economic momentum directly translates into increased revenue streams and enhanced profitability for First Pacific's diverse portfolio companies. Higher disposable incomes and greater business activity in these markets lead to more robust demand for the goods and services provided by its subsidiaries, such as food products from San Miguel Corporation and telecommunication services from PLDT.

Rising inflation presents a significant challenge for First Pacific's diverse operations. For instance, in 2024, global inflation rates remained elevated in many regions, directly impacting the cost of raw materials for its food and consumer products businesses, as well as energy expenses for its infrastructure and telecommunications segments. This necessitates careful cost management and potential price adjustments across its portfolio.

Interest rate volatility further complicates First Pacific's financial landscape. As of mid-2024, central banks in key markets continued to navigate inflation with varying monetary policies, leading to fluctuating borrowing costs. This directly affects the feasibility and expense of capital-intensive projects, such as infrastructure development, and influences consumer spending power through mortgage and loan rates, thereby impacting the performance of its consumer-facing businesses and overall investment attractiveness.

Currency exchange rate volatility presents a significant challenge for First Pacific, a Hong Kong-based entity with extensive operations throughout Asia-Pacific. Fluctuations in local currencies against the Hong Kong dollar and the US dollar directly influence the company's reported profits and the valuation of its overseas assets. For instance, a strengthening Philippine Peso against the US dollar could reduce the reported USD value of its investments in Metro Pacific Investments Corporation, while a weakening Indonesian Rupiah would have a similar effect on its Indonesian ventures.

In 2024, the Indonesian Rupiah experienced notable depreciation against the US dollar, trading around IDR 16,000 per USD for much of the year, impacting the translated value of First Pacific's Indonesian assets. Similarly, the Philippine Peso saw some fluctuations, trading in the range of PHP 57-59 against the USD. These movements directly affect First Pacific’s consolidated financial statements, altering the perceived value of its holdings and the cost of repatriating earnings.

Consumer Disposable Income and Spending Trends

Consumer disposable income in the Asia-Pacific region is a key driver for First Pacific. For instance, in 2024, many economies in the region saw a rebound in consumer spending, with disposable incomes showing modest growth. This directly impacts demand for First Pacific's food and telecommunications offerings.

Evolving spending trends are also critical. Consumers are increasingly seeking value and convenience, which First Pacific's diverse portfolio aims to address. The shift towards digital services, particularly in telecommunications, continues to accelerate, presenting both opportunities and challenges.

- Disposable Income Growth: Projections for 2025 indicate continued, albeit varied, growth in disposable income across key Asia-Pacific markets, supporting consumer spending.

- Premiumization Trend: In certain segments, there's a noticeable trend towards premiumization, with consumers willing to spend more on higher-quality food products and advanced telecommunication services.

- Digital Service Adoption: The uptake of digital services, from online food ordering to mobile data consumption, is a significant trend influencing revenue streams for First Pacific's subsidiaries.

- Inflationary Impact: While disposable incomes may rise, persistent inflation in some markets in 2024 has put pressure on real purchasing power, potentially moderating discretionary spending on non-essential goods and services.

Infrastructure Spending and Investment Cycles

First Pacific's infrastructure segment thrives on the ebb and flow of investment in essential projects, both from governments and private entities. Economic strategies that champion infrastructure growth, encourage public-private collaborations, or attract foreign capital into this vital area directly translate into substantial opportunities for the company.

For instance, the Philippine government's "Build, Better, More" program, a cornerstone of its economic agenda, aims to significantly boost infrastructure development. In 2024, the Philippines allocated approximately PHP 1.14 trillion (around $20 billion USD) for infrastructure projects, a testament to the government's commitment. This focus on upgrading transportation networks, utilities, and digital infrastructure creates a fertile ground for First Pacific's operations, particularly through its subsidiaries involved in telecommunications and water utilities.

- Government Infrastructure Spending: The Philippine government's 2024 infrastructure budget represents a substantial portion of its GDP, signaling a strong commitment to development.

- Private Sector Investment: Increased foreign direct investment in infrastructure, often facilitated by public-private partnerships, directly benefits companies like First Pacific.

- Economic Policy Impact: Policies favoring infrastructure development can lead to a more robust pipeline of projects, enhancing revenue streams for First Pacific's infrastructure-related businesses.

The economic outlook for the Asia-Pacific region significantly shapes First Pacific's performance. With projected GDP growth in key markets like the Philippines and Indonesia remaining robust through 2025, consumer spending on food and telecommunications is expected to rise, directly benefiting subsidiaries like San Miguel Corporation and PLDT.

However, persistent inflation in 2024 and 2025 continues to be a concern, impacting raw material costs for food businesses and energy expenses for infrastructure and telco segments, necessitating careful cost management. Currency fluctuations, particularly the Indonesian Rupiah and Philippine Peso against the USD, will continue to affect the reported value of overseas assets and earnings repatriation.

The trend of increasing disposable incomes across the region, coupled with a growing adoption of digital services, presents a strong tailwind for First Pacific's consumer-facing businesses. This is further supported by government initiatives focused on infrastructure development, such as the Philippines' ongoing investment in transportation and digital networks, creating a pipeline of opportunities for the company's infrastructure segment.

| Economic Factor | 2024/2025 Projection/Trend | Impact on First Pacific |

|---|---|---|

| GDP Growth (Asia-Pacific) | Projected continued strong growth in key markets (e.g., Philippines ~6%, Indonesia ~5%) | Increased consumer spending, higher demand for goods and services |

| Inflation | Elevated in many regions, though potentially moderating | Increased operating costs, pressure on profit margins |

| Interest Rates | Volatile, influenced by central bank policies | Impacts borrowing costs for capital-intensive projects, consumer spending |

| Currency Exchange Rates | Continued volatility expected (e.g., PHP, IDR vs. USD) | Affects reported profits and asset valuations |

| Disposable Income | Modest growth expected, supporting consumer demand | Positive for food and telecommunications segments |

Preview Before You Purchase

First Pacific PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive First Pacific PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

Sociological factors

Demographic shifts are reshaping the Asia-Pacific landscape, a key region for First Pacific. For instance, the United Nations projects that by 2050, Asia's population will reach 5.3 billion, with a significant portion residing in urban centers. This ongoing urbanization fuels demand for essential services and infrastructure that First Pacific's subsidiaries, like Metro Pacific Investments Corporation in the Philippines, are well-positioned to address.

Furthermore, the evolving age distribution presents distinct market opportunities. A burgeoning middle class and a youthful demographic, prevalent across many Asian nations, are increasingly driving consumption for telecommunications services, as seen in the growth of PLDT in the Philippines, and consumer goods. This demographic dividend translates into higher spending power and a greater appetite for modern services and products.

Consumer tastes are shifting, with a growing demand for healthier food choices and environmentally friendly products. This trend significantly impacts First Pacific's food segment, requiring them to innovate and adapt their product lines to meet these evolving preferences. For instance, the global health and wellness food market was valued at approximately $800 billion in 2023 and is projected to grow steadily, presenting both challenges and opportunities for companies like First Pacific.

Furthermore, lifestyles are increasingly centered around digital-first services, affecting how consumers interact with telecommunications providers. First Pacific's telco businesses must prioritize seamless digital experiences and robust connectivity to remain competitive. The digital economy continues its rapid expansion, with mobile data consumption rising globally, underscoring the importance of adapting to these digital-native consumer behaviors for sustained growth.

First Pacific's operations span diverse Asia-Pacific cultures, making adaptation to local norms crucial. For instance, in 2023, its food businesses, like those in the Philippines, had to navigate varying dietary preferences and religious observances to ensure product acceptance and market reach. This requires careful consideration of everything from ingredient sourcing to marketing campaigns.

Effective market penetration for First Pacific's diverse portfolio, including telecommunications in countries like Indonesia, hinges on understanding consumer behaviors shaped by cultural values. In 2024, initiatives aimed at bridging digital divides often needed to be tailored to community structures and communication styles, demonstrating a direct link between cultural understanding and business success.

Labor Market Dynamics and Workforce Skills

First Pacific's operational efficiency and cost structure are significantly influenced by the availability of skilled labor, prevailing wage rates, and labor relations across its diverse operating countries. For instance, in 2024, the Philippines, a key market for First Pacific, experienced a 4.3% unemployment rate, indicating a generally available labor pool, though specific skill shortages can still impact operations.

Access to specialized talent in critical sectors such as digital technology, advanced engineering, and sophisticated supply chain management is paramount for First Pacific's sustained growth and its capacity for innovation. As of early 2025, the demand for cybersecurity professionals in Southeast Asia, where First Pacific has substantial investments, continues to outstrip supply, potentially driving up recruitment costs and impacting project timelines.

- Skilled Labor Availability: Fluctuations in the availability of specialized skills, particularly in technology and logistics, can directly affect project execution and operational costs for First Pacific's diverse subsidiaries.

- Wage Rate Pressures: Rising minimum wage legislation and competitive market pressures in countries like Indonesia and the Philippines in 2024-2025 are increasing labor expenses, requiring careful cost management.

- Labor Relations: Maintaining positive labor relations is crucial for uninterrupted operations; instances of industrial action, though infrequent, can disrupt supply chains and production schedules for companies like First Pacific.

- Talent Acquisition Challenges: The global and regional competition for talent in high-demand fields like data analytics and renewable energy engineering presents ongoing challenges for First Pacific in securing the necessary human capital for future expansion.

Social Responsibility and Community Expectations

There's a significant and increasing demand for businesses to act as responsible corporate citizens. First Pacific, through its diverse portfolio of companies, finds itself under a microscope concerning its environmental impact, how it treats its workforce, and its involvement with local communities. To keep its social license to operate, the company must show robust Environmental, Social, and Governance (ESG) performance.

This societal pressure translates into tangible expectations. For instance, in 2024, consumer surveys indicated that over 70% of individuals consider a company's social and environmental practices when making purchasing decisions. First Pacific's subsidiaries, operating in sectors like telecommunications and food manufacturing, are particularly vulnerable to public perception regarding sustainability and ethical labor. Meeting these expectations is crucial for brand reputation and long-term viability.

- Growing Consumer Demand: A 2024 study revealed that 72% of consumers actively seek out brands with strong social responsibility initiatives.

- ESG Scrutiny: Investors and stakeholders are increasingly evaluating companies based on their ESG performance, with many institutional investors now integrating ESG factors into their valuation models.

- Reputational Risk: Negative publicity stemming from poor labor practices or environmental damage can significantly impact a company's market share and brand loyalty, as seen in past incidents affecting major corporations.

- Community Relations: Proactive community engagement and investment, such as First Pacific's initiatives in the Philippines, are vital for fostering goodwill and ensuring smooth operations.

Societal expectations are increasingly shaping business operations, pushing companies like First Pacific to prioritize corporate social responsibility. Consumer preferences are shifting, with a growing emphasis on ethical sourcing and sustainable practices, influencing purchasing decisions for over 70% of individuals in 2024. This heightened awareness necessitates robust ESG performance to maintain public trust and a social license to operate.

Technological factors

Rapid advancements in telecommunications, like the widespread deployment of 5G and fiber optics, are reshaping the landscape for First Pacific's telecom ventures. This technological evolution, including the expansion of satellite internet services, directly influences the demand for and capabilities of their infrastructure investments.

The ongoing rollout of 5G, for instance, promises significantly faster speeds and lower latency, creating fertile ground for new digital services and enhanced connectivity for consumers and businesses alike. In 2024, global 5G subscriptions are projected to surpass 1.5 billion, underscoring the scale of this transformation and its potential impact on companies like First Pacific.

However, these opportunities come with the imperative for continuous, substantial capital expenditure to upgrade and maintain competitive infrastructure. First Pacific must strategically invest to leverage these technological leaps, ensuring their telecom assets remain at the forefront of network capabilities and service offerings to capture market share in this dynamic sector.

The rapid digitalization and growing e-commerce penetration in the Asia-Pacific region are fundamentally reshaping how First Pacific interacts with its consumer base and manages its product distribution. This shift necessitates a robust online presence, efficient digital payment systems, and sophisticated data analytics to effectively reach and understand consumers, as well as to streamline supply chain operations.

In 2024, e-commerce sales in Southeast Asia were projected to reach $211 billion, a significant increase from previous years, underscoring the immense potential for companies like First Pacific to tap into this expanding digital marketplace. For instance, First Pacific's food subsidiaries can leverage platforms like Shopee and Lazada to broaden their market reach and offer more convenient purchasing options to a digitally-savvy population.

Technological advancements in food processing, like AI-driven quality control and advanced packaging, are boosting efficiency and reducing spoilage for First Pacific. Automation in manufacturing and warehousing, exemplified by robotics in distribution centers, is streamlining operations. For instance, the global food automation market was valued at approximately $15.5 billion in 2023 and is projected to reach over $30 billion by 2030, indicating significant investment in this area.

Improvements in cold chain logistics, including smart temperature monitoring and optimized transportation routes, are crucial for maintaining product integrity and extending shelf life in First Pacific's consumer food segment. The global cold chain market was estimated to be worth around $260 billion in 2023, with ongoing technological integration driving growth.

Embracing cutting-edge agricultural technologies, such as precision farming and IoT sensors, can enhance crop yields and resource management, directly benefiting First Pacific's sourcing and supply chain. The adoption of advanced supply chain management systems, incorporating blockchain for traceability and predictive analytics for demand forecasting, is vital for operational excellence and consumer trust.

Smart Infrastructure and Renewable Energy Technologies

The push towards smart infrastructure, including advanced transportation and smart city initiatives, offers First Pacific significant avenues for growth in its infrastructure segment. For instance, the global smart cities market was valued at approximately $400 billion in 2023 and is projected to reach over $1 trillion by 2030, indicating substantial investment opportunities. These advancements can enhance operational efficiency and sustainability across First Pacific's portfolio.

However, the integration of these sophisticated technologies poses capital expenditure challenges. Developing and implementing smart city solutions and modernizing transportation networks demand substantial upfront investment. For example, major smart city projects often run into billions of dollars, requiring careful financial planning and risk assessment, which First Pacific must navigate.

Renewable energy technologies are also a key technological factor. The International Energy Agency (IEA) reported that renewable energy sources accounted for over 80% of new electricity capacity additions globally in 2023. First Pacific's engagement in renewable energy projects, such as solar and wind farms, aligns with this trend, presenting opportunities for revenue generation and contribution to sustainability goals.

- Smart City Market Growth: The global smart cities market is expected to surpass $1 trillion by 2030, presenting significant investment opportunities for infrastructure development.

- Renewable Energy Dominance: Renewables constituted over 80% of new electricity capacity additions worldwide in 2023, highlighting a strong market for renewable energy investments.

- Capital Investment Needs: Implementing smart infrastructure and advanced transportation systems requires substantial capital, posing a key financial consideration for First Pacific.

Cybersecurity and Data Privacy Technologies

As First Pacific's diverse portfolio, encompassing telecommunications, consumer food, and infrastructure, increasingly relies on digital operations, cybersecurity and data privacy technologies are absolutely critical. The company must invest heavily in protecting sensitive customer information and maintaining the integrity of its vast networks. Failure to do so could lead to significant financial penalties and a severe erosion of public trust.

In 2024, global cybersecurity spending was projected to reach $215 billion, highlighting the escalating threat landscape. First Pacific's commitment to robust data protection is essential, especially with the growing complexity of cyber threats and the increasing volume of data handled across its operations. Compliance with regulations like the EU's GDPR and similar frameworks in Asia is non-negotiable.

- Increased Digital Footprint: First Pacific's expansion into digital services necessitates advanced cybersecurity to safeguard against breaches.

- Regulatory Compliance: Adherence to evolving data privacy laws, such as those in the Philippines and other operating regions, is paramount.

- Reputational Risk: Data breaches can severely damage First Pacific's brand image and customer loyalty.

- Technological Investment: Continuous investment in cutting-edge security solutions is required to stay ahead of sophisticated cyberattacks.

Technological advancements are reshaping First Pacific's core businesses, from 5G deployment in telecom to AI in food processing. The rapid growth of e-commerce in Asia, projected to reach $211 billion in Southeast Asia in 2024, presents significant opportunities for its consumer segment. Investment in smart infrastructure and renewable energy also offers substantial growth potential, though requiring considerable capital outlay.

| Technology Area | 2024/2025 Projection/Data | Impact on First Pacific |

|---|---|---|

| 5G Deployment | Global 5G subscriptions projected to exceed 1.5 billion in 2024. | Drives demand for telecom infrastructure, enabling new digital services. |

| E-commerce Growth (SEA) | Projected to reach $211 billion in 2024. | Expands market reach for consumer food subsidiaries through digital platforms. |

| Food Automation | Global market valued at ~$15.5 billion in 2023, growing rapidly. | Enhances efficiency, reduces spoilage, and streamlines operations in food processing. |

| Smart Cities Market | Projected to exceed $1 trillion by 2030. | Offers growth avenues for infrastructure segment through smart city initiatives. |

| Renewable Energy Capacity | Over 80% of new electricity capacity additions globally in 2023. | Aligns with renewable energy investments, generating revenue and supporting sustainability. |

| Cybersecurity Spending | Projected global spending of $215 billion in 2024. | Necessitates significant investment to protect data and networks across all operations. |

Legal factors

First Pacific's substantial operations in diverse Asia-Pacific markets necessitate careful adherence to a patchwork of antitrust and competition laws. These regulations are designed to prevent monopolies and ensure fair play, directly influencing how the company can expand and operate.

Regulatory bodies actively monitor mergers, acquisitions, and market conduct, posing a significant hurdle for First Pacific's strategic growth. For instance, in 2023, the Philippine Competition Commission (PCC) reviewed several major transactions across industries, highlighting the rigorous oversight companies like First Pacific face.

Failure to comply can result in substantial fines and operational restrictions, impacting everything from pricing strategies to market entry. This scrutiny means First Pacific must proactively assess the competitive impact of its business decisions to avoid regulatory challenges and maintain its growth trajectory.

First Pacific operates under rigorous consumer protection and product liability regulations across its diverse markets, impacting both its food products and telecommunications offerings. For instance, in the Philippines, the Department of Trade and Industry (DTI) enforces standards for product safety and fair advertising, with potential fines for non-compliance. Failure to meet these mandates, such as those concerning food safety or clear telecommunication service terms, could lead to significant legal repercussions and damage consumer confidence.

First Pacific's operations, particularly in natural resources and infrastructure, are significantly shaped by environmental regulations. These rules cover everything from pollution control and waste disposal to how sustainably resources are extracted. For instance, in 2023, the Philippines, where First Pacific has substantial investments, saw increased scrutiny on mining practices, leading to stricter compliance requirements for resource extraction companies.

Staying compliant with these ever-changing environmental laws is crucial for First Pacific's ongoing business. Failure to meet these standards can result in substantial fines and operational disruptions. The company's commitment to sustainability, as highlighted in its 2024 sustainability reports, focuses on minimizing its environmental footprint across its diverse portfolio.

Labor and Employment Laws

First Pacific navigates a complex web of labor and employment regulations across its diverse operating regions. These laws dictate critical aspects such as minimum wage standards, acceptable working conditions, mandatory employee benefits, and the framework for union engagement. For instance, in 2024, the Philippines, where First Pacific has significant operations, saw discussions and potential adjustments to minimum wage rates in various regions, impacting labor costs.

Failure to adhere to these varied legal mandates can result in significant repercussions. These include costly legal battles, damage to the company's public image, and interruptions to ongoing business activities. As of early 2025, several countries in Southeast Asia are also reviewing and updating their labor laws to align with international standards, posing an ongoing compliance challenge.

- Jurisdictional Diversity: First Pacific must manage compliance with distinct labor laws in each country of operation.

- Compliance Risks: Non-adherence can lead to lawsuits, fines, and reputational harm.

- Evolving Regulations: Labor laws are subject to change, requiring continuous monitoring and adaptation.

- Union Relations: Managing relationships with labor unions is a key component of employment law compliance.

Telecommunications Licensing and Data Privacy Laws

The telecommunications industry operates under a dense web of regulations. For First Pacific's telecom ventures, this means securing and maintaining various operating licenses, which are critical for providing services. These licenses often involve adherence to specific spectrum allocation rules and operational standards. For instance, in 2024, many Asian countries continued to refine their 5G spectrum auction processes and licensing frameworks, impacting how telcos deploy new technologies.

Data privacy is another paramount legal consideration. First Pacific's subsidiaries must comply with increasingly stringent data protection laws, similar to the European Union's GDPR, which are being adopted or enhanced across Asia. These laws dictate how customer data is collected, stored, processed, and shared. Non-compliance can lead to significant fines and reputational damage, making continuous adaptation to evolving privacy statutes a core operational necessity. For example, the enforcement of data localization requirements in several key markets necessitates careful management of data flows and storage solutions.

- Licensing Complexity: Navigating diverse national licensing regimes for mobile, broadband, and other telecom services.

- Data Protection Compliance: Adhering to evolving privacy laws like the Personal Data Protection Act (PDPA) in Singapore and similar regulations across the region.

- Spectrum Management: Managing the legal and financial aspects of acquiring and utilizing radio frequency spectrum, crucial for network expansion.

- Regulatory Updates: Proactively monitoring and adapting to changes in telecommunications policies, including net neutrality rules and cybersecurity mandates.

First Pacific's diverse operations necessitate strict adherence to varied legal frameworks, including antitrust, consumer protection, and environmental regulations across its Asia-Pacific markets. For instance, in 2024, the Philippine Competition Commission's ongoing review of market practices underscores the importance of fair competition compliance, while environmental regulations, like those tightened on mining in the Philippines in 2023, demand proactive sustainability efforts.

Environmental factors

First Pacific's extensive infrastructure and agricultural holdings, particularly in regions prone to tropical cyclones, face significant risks from intensifying extreme weather. For instance, the Philippines, a key market for First Pacific's infrastructure and food businesses, experienced an average of 20 typhoons annually in recent years, with climate models projecting an increase in the intensity of these storms. This vulnerability translates to potential operational disruptions, damage to vital assets like power lines and ports, and significant costs for repair and adaptation measures.

First Pacific's reliance on natural resources, especially for its consumer food businesses, faces headwinds from increasing scarcity of water and arable land. For instance, global freshwater stress is projected to affect over 5 billion people by 2050, impacting agricultural yields. This reality demands that First Pacific proactively adapt its sourcing strategies to ensure long-term operational resilience and meet growing consumer expectations for sustainability.

First Pacific's extensive operations in natural resources and manufacturing, particularly in sectors like food and infrastructure, face growing environmental regulations concerning pollution. Stricter standards on air emissions, water discharge, and land contamination are becoming the norm, impacting operational costs and requiring significant investment in control technologies.

Effective waste management is paramount for First Pacific to ensure regulatory compliance and safeguard its environmental image. For instance, in 2024, the company's infrastructure projects are expected to adhere to updated national waste disposal guidelines, aiming to reduce landfill dependency by 15% through increased recycling and material reuse initiatives.

Growing Demand for Sustainable Practices and ESG Reporting

There's a significant and growing expectation from investors, consumers, and regulators for companies to embed sustainable practices into their operations and to offer clear, transparent ESG (Environmental, Social, and Governance) reporting. This trend is reshaping how businesses are evaluated and how capital is allocated.

For First Pacific, demonstrating a strong commitment to sustainability initiatives is becoming increasingly crucial. This can translate into tangible benefits such as an enhanced brand reputation, which in turn can attract a wider pool of responsible investors. Furthermore, proactively addressing ESG concerns helps mitigate potential regulatory risks and can lead to more efficient resource management.

The financial markets are reflecting this shift, with ESG-focused investment funds experiencing substantial growth. For instance, global sustainable investment assets reached an estimated $35.3 trillion in early 2024, according to the Global Sustainable Investment Alliance. This highlights the increasing financial weight behind sustainable practices.

- Investor Scrutiny: Investors are increasingly integrating ESG factors into their due diligence, seeking companies with robust sustainability strategies.

- Consumer Preference: Consumers are showing a preference for brands that align with their environmental and social values, influencing purchasing decisions.

- Regulatory Landscape: Governments worldwide are implementing stricter environmental regulations and disclosure requirements, making ESG compliance a necessity.

Biodiversity Protection and Land Use Regulations

First Pacific's operations, particularly those involving natural resources and extensive infrastructure development, are significantly influenced by biodiversity protection mandates and evolving land use regulations. These frameworks are designed to safeguard ecosystems and manage the allocation of land resources, directly impacting project feasibility and timelines.

The company must navigate environmental impact assessments, especially for projects encroaching on or affecting sensitive habitats. For instance, in 2024, the Philippines, a key market for First Pacific, continued to strengthen its environmental protection laws, with increased scrutiny on large infrastructure projects. Failure to comply can lead to project delays, fines, or outright cancellation, as seen in past instances where development plans faced public opposition due to ecological concerns.

Careful planning and robust mitigation strategies are therefore essential. This includes:

- Conducting thorough biodiversity surveys before project initiation to identify protected species and critical habitats.

- Implementing land use plans that minimize ecological disruption and prioritize sustainable development practices.

- Engaging with local communities and environmental stakeholders to address concerns and build consensus around land use.

- Investing in conservation efforts or biodiversity offsets as part of project development to compensate for unavoidable impacts.

First Pacific's infrastructure and agricultural ventures face significant risks from climate change, particularly in typhoon-prone regions like the Philippines, where an average of 20 typhoons annually can cause operational disruptions and asset damage. Furthermore, the increasing scarcity of water and arable land, projected to affect over 5 billion people by 2050 due to freshwater stress, necessitates adaptive sourcing strategies for its food businesses to ensure long-term resilience and meet sustainability demands.

PESTLE Analysis Data Sources

Our PESTLE analysis for First Pacific is meticulously constructed using data from reputable financial institutions like the IMF and World Bank, alongside official government publications and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.