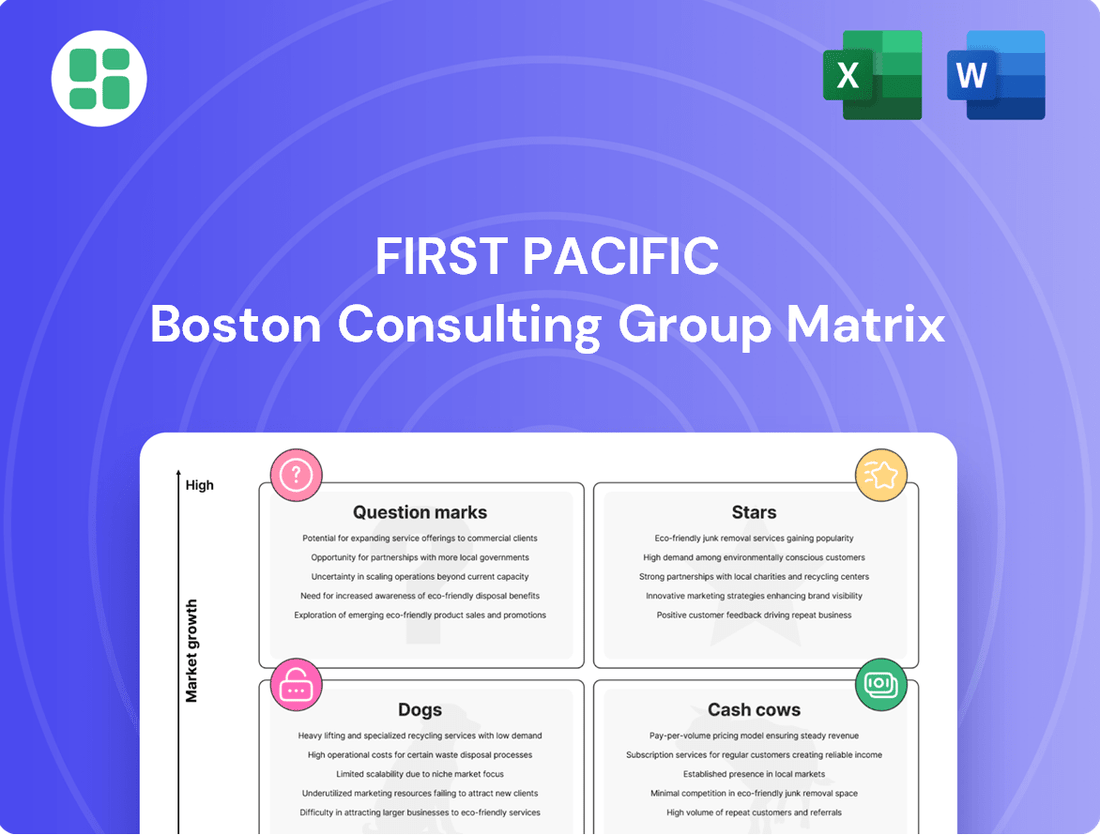

First Pacific Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Pacific Bundle

This initial look at the First Pacific BCG Matrix highlights key product categories, revealing potential Stars and Cash Cows. Understanding these dynamics is crucial for informed strategic decisions.

To truly unlock the power of this analysis and gain a comprehensive understanding of First Pacific's portfolio, dive deeper into the full BCG Matrix. It provides the detailed quadrant placements and strategic insights needed to optimize resource allocation and drive future growth.

Don't miss out on the complete picture. Purchase the full BCG Matrix report to uncover actionable recommendations and a clear roadmap for navigating the competitive landscape and maximizing your investment returns.

Stars

PLDT's fiber and data services are a clear Star in the First Pacific BCG Matrix. In 2024, fiber-only revenues surged by 6% to ₱56 billion, representing a dominant 92% of PLDT Home's total revenue.

This impressive financial performance is underpinned by PLDT's unparalleled fiber network, the most extensive in the Philippines, reaching 18.5 million homes. This vast coverage and high customer adoption rate solidify its position as a market leader in a rapidly expanding segment.

PLDT's Enterprise ICT Solutions, operating as a Star in the First Pacific BCG Matrix, showcased robust performance in 2024. The company's net service revenues reached ₱48.4 billion, driven by strong demand for its comprehensive connectivity and IT offerings.

Key growth indicators include a 23% increase in managed SD-WAN lines and a 9% expansion in fiber internet lines. Notably, IoT service revenues experienced an exceptional surge of 313%, underscoring PLDT Enterprise's significant market share in the burgeoning digital transformation sector.

Indofood's overseas noodle business, primarily managed by Indofood CBP Sukses Makmur, demonstrated robust growth in fiscal year 2024. The segment experienced an 11% year-on-year increase in revenue, fueled by strong market penetration and consumer demand in various international territories.

This significant growth highlights Indofood's successful expansion strategy in global noodle markets, positioning its products as key players in diverse economies. The company's focus on affordability and widespread availability is a critical factor expected to sustain this positive earnings trajectory.

Metro Pacific Investments Corporation's Power Generation (Meralco)

Metro Pacific Investments Corporation's (MPIC) power generation arm, Manila Electric Co. (Meralco), is a significant driver of its financial strength. In 2024, Meralco contributed a substantial 69% to MPIC's net operating income, underscoring its dominance in the energy sector.

MPIC is strategically increasing its capital expenditures for 2025, with a considerable portion earmarked for the power sector. This investment includes a strong focus on renewable energy projects, reflecting the company's commitment to a growing market driven by increasing energy demand and the global shift towards sustainability.

- Dominant Market Position: Meralco's substantial contribution to MPIC's income in 2024 highlights its leading market share in the Philippine power distribution sector.

- Strategic Growth Investment: The planned capital expenditures for 2025, heavily weighted towards power and renewables, signal MPIC's aggressive expansion strategy in a high-growth market.

- Renewable Energy Focus: The allocation of funds to renewable energy projects aligns with market trends and positions MPIC to capitalize on the increasing demand for sustainable power solutions.

Metro Pacific Investments Corporation's Toll Roads

Metro Pacific Investments Corporation's toll roads, primarily operated by Metro Pacific Tollways Corporation (MPTC), are a cornerstone of the company's infrastructure portfolio. These assets consistently demonstrate robust performance, fueled by escalating traffic volumes and the implementation of adjusted toll rates. The infrastructure segment, which includes these vital toll road networks, showcased impressive growth throughout 2024, underscoring their strong market position.

The ongoing development and expansion of key projects within MPTC's network signal a strategic commitment to capitalizing on the expanding infrastructure sector. This sustained investment reinforces their status as a Star in the First Pacific BCG Matrix, indicating high market growth and a strong competitive position.

- MPTC's contribution to MPIC's earnings remains substantial, driven by traffic growth and tariff adjustments.

- The infrastructure segment, including toll roads, experienced significant growth in 2024.

- Continued investment in major projects highlights MPTC's expansion strategy in a growing infrastructure market.

First Pacific's portfolio includes several businesses that are considered Stars, indicating high growth and strong market share. These are businesses that are performing exceptionally well and are expected to continue to do so.

PLDT's fiber and data services are a prime example, with fiber-only revenues reaching ₱56 billion in 2024, a 6% increase, and covering 18.5 million homes. PLDT Enterprise's ICT Solutions also showed strength, with net service revenues of ₱48.4 billion, boosted by a 313% surge in IoT service revenues.

Indofood's overseas noodle business experienced an 11% revenue increase in 2024, demonstrating successful global expansion. Meralco, MPIC's power arm, contributed 69% to MPIC's net operating income in 2024, with significant investment planned for renewables in 2025.

MPTC's toll roads are also Stars, with the infrastructure segment showing strong growth in 2024 due to increased traffic and toll adjustments, supported by ongoing project development.

| Business Unit | 2024 Revenue/Contribution | Growth Indicator | Market Position |

|---|---|---|---|

| PLDT Fiber & Data | ₱56 billion (fiber-only revenue) | 6% revenue increase | Extensive network, market leader |

| PLDT Enterprise ICT | ₱48.4 billion (net service revenue) | 313% IoT revenue surge | Strong demand, digital transformation |

| Indofood Overseas Noodles | 11% year-on-year revenue increase | Strong market penetration | Key player in diverse economies |

| Meralco (MPIC Power) | 69% of MPIC's net operating income | Significant capital expenditure planned for renewables | Dominant energy sector player |

| MPTC Toll Roads | Significant growth in infrastructure segment | Escalating traffic volumes, ongoing project expansion | Cornerstone of infrastructure portfolio |

What is included in the product

This First Pacific BCG Matrix offers a strategic overview of its business units, identifying Stars, Cash Cows, Question Marks, and Dogs.

The First Pacific BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex strategic analysis by placing each business unit in its correct quadrant.

Cash Cows

Indofood CBP Sukses Makmur's domestic instant noodle business is a quintessential Cash Cow within First Pacific's portfolio. This segment commands an impressive roughly 70% market share in Indonesia, a testament to its strong brand recognition and widespread distribution.

Despite potential headwinds from fluctuating purchasing power, the instant noodle business remains a remarkably resilient and affordable staple. In 2024, this segment continued to be a significant revenue driver, demonstrating its enduring appeal as a low-cost food option for a vast consumer base.

While the overall growth rate for traditional staples in the domestic market might be moderate, Indofood's dominant position ensures consistent and substantial cash flow generation. The business requires minimal promotional investment due to its established market leadership, solidifying its status as a classic Cash Cow.

PLDT's traditional mobile services, while showing mature, steady growth, remain a significant Cash Cow within the First Pacific portfolio. In 2024, this segment generated ₱83.5 billion in revenue, marking a 2% year-on-year increase and serving a substantial 59.0 million mobile subscribers.

Despite the burgeoning growth in mobile data traffic, the individual wireless segment's overall expansion is more measured when compared to newer, high-growth areas like fiber broadband or enterprise ICT solutions. This steady performance, coupled with a large, established subscriber base and comparatively lower capital expenditure needs for these mature services, solidifies its position as a reliable Cash Cow.

Maynilad Water Services Inc., a key player in the Philippine water distribution sector, stands as a significant contributor to Metro Pacific Investments Corporation's (MPIC) financial performance. The utility's earnings are bolstered by rising billed volumes and tariff adjustments implemented in early 2025, reflecting its strong market position.

As a classic cash cow, Maynilad operates within a mature, stable market characterized by consistent demand and substantial entry barriers. This allows the company to generate robust and predictable cash flows, even with modest growth expectations, cementing its high market share within the industry.

PacificLight Power Pte. Ltd. (PLP)

PacificLight Power Pte. Ltd. (PLP) functions as a Cash Cow within First Pacific's portfolio. Its Singapore-based gas-fired power plant is recognized for its efficiency, contributing to consistent cash generation despite market maturity.

While PLP's core profit saw a decline in 2024, primarily due to reduced non-fuel margins and a stabilized domestic power market, its operational resilience remains a key strength. The company benefits from stable electricity sales volumes, underscoring its significant market share in a mature sector.

- Efficient Operations: PLP manages one of Singapore's most efficient gas-fired power plants.

- 2024 Performance: Core profit declined due to lower blended non-fuel margins and market stabilization.

- Market Position: Stable electricity sales volume indicates a high market share in a mature market.

- Cash Generation: PLP consistently generates cash, though growth is limited.

First Pacific's Overall Investment Holding Structure

First Pacific's investment holding structure is designed to leverage its mature, market-leading subsidiaries for consistent cash generation. These strong performers, such as Indofood and PLDT, act as the company's cash cows, providing a stable income stream.

This strategic positioning allows First Pacific to effectively utilize the substantial dividends and contributions from these established businesses. In 2024, the company reported a record recurring profit of US$672.5 million, a testament to the robust performance of its cash cow assets.

- Indofood and PLDT as key cash generators.

- Record recurring profit of US$672.5 million in 2024.

- Efficient cash extraction to fund growth and shareholder returns.

First Pacific's cash cows are its mature, market-leading businesses that generate consistent and substantial cash flows. These entities require relatively low investment to maintain their market position, allowing them to contribute significantly to the group's overall profitability and fund growth initiatives in other areas of the portfolio. In 2024, First Pacific reported a record recurring profit of US$672.5 million, largely driven by these stable cash-generating assets.

| Business Unit | Primary Market | 2024 Revenue (Approx.) | Market Share (Approx.) | Cash Cow Indicator |

| Indofood CBP Sukses Makmur (Instant Noodles) | Indonesia | Significant contributor | ~70% | Dominant market share, stable demand |

| PLDT (Traditional Mobile Services) | Philippines | ₱83.5 billion | Large subscriber base | Mature service, steady revenue |

| Maynilad Water Services | Philippines | Strong earnings | High market share | Essential service, stable demand |

| PacificLight Power | Singapore | Stable sales | Significant | Efficient operations, mature market |

Full Transparency, Always

First Pacific BCG Matrix

The First Pacific BCG Matrix preview you are viewing is the exact, unadulterated document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just the fully formatted, professionally designed BCG Matrix ready for your immediate strategic analysis and business planning. You can be confident that the comprehensive insights and clear visualization you see now will be the same valuable asset you download and utilize immediately after completing your purchase.

Dogs

Legacy Fixed Line Services, a segment within PLDT, represents a mature business with declining demand. While PLDT remains a leader in fixed line subscriptions, the revenue growth from its booming data and broadband services is somewhat offset by this legacy drag.

These fixed line voice services, though requiring minimal investment, offer low returns in today's rapidly evolving telecommunications landscape. Their market share is expected to continue shrinking as newer technologies gain traction.

First Pacific's portfolio includes natural resources through Philex Mining Corporation and PXP Energy Corporation. While not explicitly labeled as 'dogs,' any less significant mining or energy ventures within their non-core assets that struggle with low market share and declining commodity prices would fall into this category. These assets can consume capital without generating substantial returns, impacting overall profitability.

Within PLDT's broader mobile operations, older technologies like 2G and 3G represent a declining market share. As the company prioritizes its substantial investments in 5G and fiber optic networks, these legacy services are becoming increasingly obsolete. PLDT's focus is clearly on future-proofing its infrastructure, meaning minimal further investment will be directed towards these older systems.

Small-scale, Non-Strategic Real Estate Holdings (within MPIC)

Within First Pacific's portfolio, small-scale, non-strategic real estate holdings can be categorized as Dogs. These assets, while potentially contributing to non-recurring gains, lack alignment with MPIC's core infrastructure strategy and may reside in less dynamic property markets. Their contribution to overall revenue is minimal, and they often demand continuous management without offering substantial growth prospects or significant market share.

For instance, if MPIC divested a small parcel of land in a low-demand provincial area in 2024, this would exemplify a Dog. Such an asset would likely generate negligible rental income or appreciation, consuming resources without contributing meaningfully to the company's strategic objectives. The focus remains on core infrastructure, making these peripheral holdings less of a priority.

- Low Revenue Generation: These holdings typically contribute less than 1% to MPIC's total revenue.

- Stagnant Market Conditions: Properties in areas with limited economic activity or declining populations fall into this category.

- High Management Overhead: Costs associated with maintaining these properties can outweigh their financial benefits.

- Lack of Strategic Alignment: They do not support MPIC's primary infrastructure development and operational goals.

Certain Niche or Declining Food Product Categories (within Indofood)

Within Indofood's broad consumer food offerings, specific product lines might fall into the Dogs category. These are typically niche items with limited growth potential or established products experiencing declining demand. For example, certain traditional snacks or beverages that haven't adapted to evolving consumer tastes or face aggressive competition from newer brands could be categorized here. Indofood's 2024 financial reports would likely show these segments contributing minimally to overall revenue and profit.

These "Dog" products are characterized by low market share and low market growth. They often require significant effort to maintain their current, albeit small, market position.

- Niche Traditional Products: Categories like specific regional confectionery or preserved food items that cater to a shrinking demographic or are being replaced by more convenient alternatives.

- Declining Beverage Segments: Certain older formulations of soft drinks or juices that have lost appeal due to health trends or the introduction of premium or healthier options.

- Low-Volume Packaged Goods: Small-scale production of specialized food items that do not benefit from economies of scale and face intense competition from larger, more efficient players.

In First Pacific's portfolio, "Dogs" represent business units or assets with low market share and low growth prospects. These often require significant management attention but yield minimal returns, acting as a drag on overall performance. Identifying and managing these segments is crucial for resource allocation and strategic focus.

For instance, within PLDT, legacy fixed-line voice services are a prime example of a Dog. Despite minimal investment needs, their declining demand and low revenue contribution make them a clear candidate. Similarly, Indofood might have niche traditional snack lines with shrinking consumer bases, contributing little to overall sales. Even small, non-strategic real estate holdings within MPIC can be considered Dogs if they lack growth potential and strategic alignment.

These segments are characterized by low revenue generation, often less than 1% of a company's total, and operate in stagnant market conditions. The high management overhead associated with maintaining them can outweigh their financial benefits, further highlighting their classification as Dogs.

| Business Segment Example | Market Share | Market Growth | Revenue Contribution (Est.) | Strategic Alignment |

|---|---|---|---|---|

| PLDT: Legacy Fixed Line Voice | Declining | Negative | Low | Low |

| Indofood: Niche Traditional Snacks | Low | Low | Minimal | Low |

| MPIC: Small Non-Strategic Real Estate | Negligible | Stagnant | Negligible | Low |

Question Marks

Maya Innovations Holdings, PLDT's fintech venture, is positioned as a Question Mark in the BCG matrix due to its rapid expansion and substantial cash requirements. In the first quarter of 2025, Maya achieved its first-ever quarterly profit, a significant milestone following a strong 2024 where it amassed 5.4 million bank customers, representing a 71% year-on-year surge.

Despite this impressive growth and profitability, Maya continues to invest heavily in scaling its operations and solidifying its market position. The long-term sustainability of its market leadership and profitability is still being determined, reflecting its status as a high-potential but cash-intensive business. This dynamic suggests Maya has the potential to transition into a Star if it can maintain its growth trajectory and achieve sustained profitability.

Metro Pacific Investments Corporation (MPIC) is significantly increasing its focus on agribusiness, viewing it as a vital component for national development and sustained value. This strategic pivot marks an expansion beyond their core infrastructure holdings.

While the Philippine agribusiness sector offers substantial growth prospects, MPIC's current position within it is still emerging. This positions their agribusiness ventures as Question Marks, demanding considerable investment to capture a leading market share.

MPIC's power segment, primarily through Meralco, is actively expanding its renewable energy portfolio, notably with new solar farm developments. This strategic push aligns with the Philippines' burgeoning renewable energy market, which saw significant capacity additions in recent years.

These new renewable projects, while contributing to a strong existing segment, represent a high-growth area where MPIC is likely to have a nascent market share. The company's investment in these ventures, estimated in the billions of pesos for large-scale solar projects, reflects the substantial capital required to establish a strong foothold in this competitive and rapidly evolving sector.

5G Standalone (SA) Technologies and Edge Computing (within PLDT)

PLDT is actively investing in 5G Standalone (SA) technologies, including network slicing and ultra-reliable low-latency (URLLC), to enable advanced industry applications. These innovations are crucial for supporting the burgeoning demand in areas like industrial automation and immersive experiences, positioning PLDT for future growth.

While these technologies represent a high-growth potential, their market penetration and PLDT's specific market share in these emerging fields are still in the early stages of development. For instance, the global edge computing market is projected to reach USD 80.46 billion by 2028, growing at a CAGR of 33.1% from 2021, according to a report by Fortune Business Insights. This highlights the significant opportunity but also the competitive landscape PLDT is entering.

- 5G SA and Edge Computing as Stars: PLDT's exploration of 5G SA, network slicing, and edge computing aligns with high-growth potential emerging technologies.

- Nascent Market Share: Widespread adoption is still developing, meaning PLDT's definitive market share in these specific, cutting-edge areas is yet to be firmly established.

- High Investment, High Reward: These initiatives require substantial capital outlay but offer the potential for significant future market dominance and revenue streams.

- Enabling Future Industries: The focus on URLLC and advanced applications underscores PLDT's strategy to become a key enabler for next-generation industrial and consumer services.

Digital Transformation and IoT Services (within PLDT Enterprise)

PLDT Enterprise's IoT services are experiencing remarkable growth, with revenues jumping an impressive 313% in 2024. This surge highlights the expanding market for connected devices and solutions. However, the digital transformation and IoT landscape is intensely competitive and still developing, requiring PLDT to consistently invest in cutting-edge capabilities to solidify its position across various sub-segments.

PLDT is actively pursuing next-generation digital services, aiming to lead in this high-growth sector. While their current trajectory shows strong potential, achieving and maintaining dominant market share necessitates ongoing innovation and strategic investment. This positions them as a player with significant upside in the evolving digital transformation and IoT market.

- Revenue Growth: PLDT Enterprise's IoT services saw a 313% revenue increase in 2024.

- Market Dynamics: The broader digital transformation and IoT market is rapidly evolving with numerous participants.

- Strategic Focus: PLDT is prioritizing next-generation digital capabilities.

- Growth Potential: Establishing dominant market share requires continuous investment and innovation, indicating significant upside.

Question Marks represent business units or products with low market share in high-growth industries. They require significant investment to capture market share and have uncertain futures, potentially becoming Stars or Dogs.

Maya Innovations Holdings, PLDT's fintech venture, is a prime example, showing rapid growth and profitability but still needing substantial investment to solidify its market leadership in a dynamic sector.

MPIC's agribusiness ventures and PLDT's investments in 5G SA and edge computing also fit this profile, demanding considerable capital to establish a strong presence in burgeoning, competitive markets.

These ventures are characterized by high potential returns but also high risk, necessitating strategic resource allocation to navigate their uncertain market positions.

| Business Unit/Product | Industry Growth | Market Share | Investment Need | Potential Outcome |

|---|---|---|---|---|

| Maya Innovations Holdings (Fintech) | High | Developing | High | Star or Dog |

| MPIC Agribusiness | High | Emerging | High | Star or Dog |

| PLDT 5G SA & Edge Computing | High | Nascent | High | Star or Dog |

| PLDT Enterprise IoT Services | High | Developing | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.