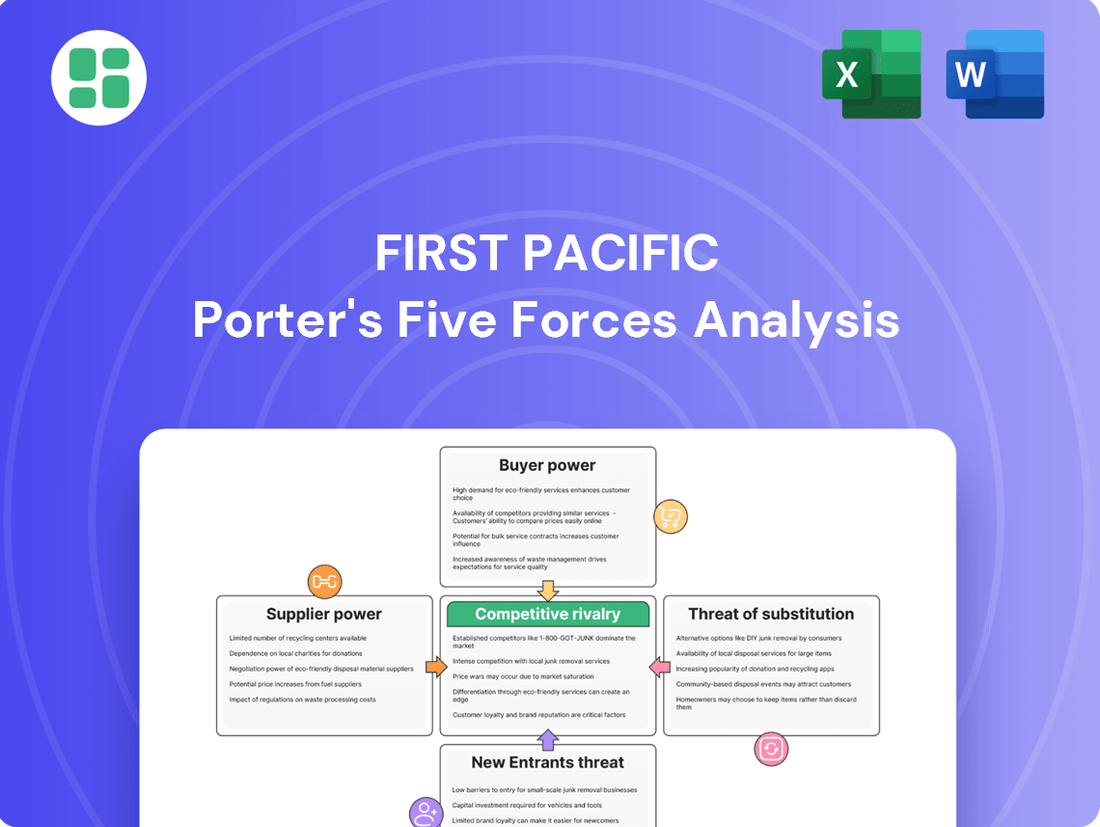

First Pacific Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Pacific Bundle

First Pacific operates in a landscape shaped by intense rivalry and the constant threat of new entrants, impacting its pricing power and profitability. Understanding these forces is crucial for any strategic evaluation of the company.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore First Pacific’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for First Pacific is influenced by the concentration of suppliers and the costs associated with switching. In sectors like telecommunications, specialized network equipment from a limited number of global manufacturers can create significant supplier leverage. For instance, if a key component for its Philippine telecom subsidiary, PLDT, comes from only two or three providers, First Pacific faces higher input costs and reduced negotiation power.

Switching costs can also be substantial. For example, in the consumer food products segment, changing a primary supplier for a critical ingredient might necessitate extensive product reformulation, regulatory re-approvals, and new supply chain logistics, all of which are time-consuming and expensive. This difficulty in switching reinforces the supplier's position, impacting First Pacific's profitability and operational agility across its varied business interests.

The uniqueness of inputs significantly influences supplier bargaining power for companies like First Pacific. If First Pacific relies on highly specialized or patented technologies, like proprietary network infrastructure in its telecommunications ventures, suppliers of these inputs hold considerable leverage. For example, in 2024, the global semiconductor shortage highlighted how critical unique chip designs can be, giving semiconductor manufacturers substantial pricing power.

The threat of forward integration by suppliers poses a significant concern for First Pacific. This occurs when suppliers, instead of just providing raw materials or components, decide to enter First Pacific's own industry and compete directly with their customers. For instance, a key component supplier for First Pacific's telecommunications ventures could potentially launch its own competing services, directly targeting the same end-users. This potential shift transforms a partner into a rival, creating immense pressure.

Such a move by suppliers can significantly alter the competitive landscape. If a supplier has the financial muscle, technological expertise, and market knowledge to effectively integrate forward, they can exert considerable leverage over First Pacific. For example, if a major food ingredient supplier for First Pacific's food and beverage segment were to start producing and marketing its own branded consumer food products, it would directly challenge First Pacific's market share and profitability. This fear of facing direct competition from its own supply chain can force First Pacific to accept less favorable terms from these suppliers to maintain a stable business relationship.

Importance of First Pacific to Supplier Revenue

First Pacific's significant scale and broad operational footprint across the Asia-Pacific region likely make it a crucial revenue source for many of its suppliers. This substantial reliance can diminish the bargaining power of these suppliers, as their continued business is often dependent on maintaining a positive relationship with First Pacific.

For instance, in 2024, First Pacific's consolidated revenue reached approximately USD 5.1 billion. This considerable financial scale suggests that many suppliers, particularly those specializing in sectors relevant to First Pacific's diverse portfolio—which includes food, infrastructure, and telecommunications—could see First Pacific account for a significant percentage of their total sales. A supplier generating, say, 20% or more of its revenue from First Pacific would be hesitant to jeopardize that relationship through aggressive pricing demands or unfavorable terms.

- Significant Revenue Contribution: First Pacific's substantial revenue base means it can represent a large chunk of a supplier's income.

- Supplier Dependence: When suppliers depend heavily on First Pacific for their sales, their ability to dictate terms is reduced.

- Diversified Operations: First Pacific's presence in multiple sectors (food, infrastructure, telecom) means a wide array of suppliers could be affected.

- Reduced Supplier Leverage: The more critical First Pacific is to a supplier's financial health, the less power that supplier wields.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts First Pacific's reliance on its current suppliers. If alternative materials, technologies, or services are readily accessible, First Pacific can switch suppliers, thereby reducing the bargaining power of existing ones. This is particularly true in sectors where inputs are commoditized.

For instance, in First Pacific's food and consumer products segment, many raw ingredients are generic and have numerous alternative sources, meaning suppliers of these items have limited power. However, in areas like telecommunications infrastructure or specialized project components, the options for substitutes can be scarce, granting those suppliers greater leverage.

The ease of finding substitutes directly correlates with supplier power; a higher availability of alternatives diminishes supplier bargaining strength. For example, if First Pacific can easily source an alternative to a specific type of network equipment, the original supplier cannot demand excessively high prices or unfavorable terms.

- Sectoral Variation: The availability of substitutes differs greatly across First Pacific's diverse business units, from readily available food ingredients to specialized infrastructure components.

- Impact on Supplier Power: A higher number of viable substitutes for inputs directly weakens the bargaining power of existing suppliers.

- Strategic Implication: First Pacific can leverage the availability of substitutes to negotiate better terms and reduce dependency on any single supplier.

The bargaining power of suppliers for First Pacific is a key factor in its operational costs and profitability. When suppliers are concentrated, offer unique inputs, or can easily integrate forward, their leverage increases significantly. Conversely, First Pacific's scale and diversified operations can diminish this power by making it a crucial customer for many suppliers, thereby reducing their ability to dictate terms.

For example, in 2024, First Pacific's substantial revenue of approximately USD 5.1 billion meant that many suppliers across its food, infrastructure, and telecommunications segments relied heavily on its business. This reliance inherently limits the suppliers' capacity to impose unfavorable pricing or terms, as jeopardizing their relationship with First Pacific could represent a significant loss of income.

| Factor | Impact on First Pacific's Supplier Bargaining Power | Example/Data Point (2024) |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Specialized telecom equipment from few global providers. |

| Switching Costs | High switching costs empower suppliers. | Reformulation and re-approval for food ingredients. |

| Uniqueness of Inputs | Unique inputs grant suppliers leverage. | Proprietary semiconductor designs for telecom infrastructure. |

| Threat of Forward Integration | Potential for suppliers to become competitors. | Ingredient supplier entering food product market. |

| First Pacific's Scale | Large scale reduces supplier power. | USD 5.1 billion in consolidated revenue. |

| Availability of Substitutes | More substitutes decrease supplier power. | Commoditized food ingredients vs. specialized telecom components. |

What is included in the product

This analysis dissects the competitive forces impacting First Pacific, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the prevalence of substitutes within its operating industries.

Instantly identify and address key competitive pressures with a visual, actionable breakdown of each of Porter's Five Forces.

Customers Bargaining Power

First Pacific's bargaining power of customers is influenced by customer concentration and purchase volume. In its telecommunications segment, while individual consumers are numerous and fragmented, large enterprise clients can wield considerable influence due to their significant purchase volumes. This concentration means a few key clients could dictate terms, potentially leading to price pressures.

For infrastructure projects, the customer base often comprises governments or large-scale developers. These entities represent substantial investments and can exert significant leverage, demanding favorable pricing and contract conditions. If a small number of these major customers generate a large percentage of First Pacific's revenue, their bargaining power is amplified, enabling them to negotiate better terms or lower prices.

Customer switching costs are a crucial factor in assessing the bargaining power of customers for First Pacific. These costs represent how easy or difficult it is for a customer to move from First Pacific's offerings to those of a competitor. For instance, if First Pacific sells basic food items, switching costs for consumers are generally very low; they can simply buy from another supermarket without much hassle or expense. This low barrier means customers have significant power to demand better prices or quality.

However, the situation changes dramatically for First Pacific's telecommunications or infrastructure businesses. In telecommunications, switching providers often involves dealing with contract lock-ins, porting phone numbers, and potentially new equipment, all of which can be time-consuming and costly. Similarly, for complex infrastructure solutions, the integration and training required to switch to a new vendor can be prohibitively expensive. This high switching cost effectively reduces the bargaining power of these specific customer segments.

For example, in the Philippines, where First Pacific has significant interests through companies like PLDT, the telecommunications sector often sees substantial customer retention due to these switching costs. PLDT reported over 17 million broadband subscribers as of the first quarter of 2024, indicating a large customer base that might be less inclined to switch due to the complexities involved. This inertia, driven by switching costs, grants First Pacific's telecom divisions a degree of pricing power and reduces direct customer pressure.

Customer information availability significantly impacts First Pacific's bargaining power. In sectors where First Pacific operates, such as telecommunications and consumer staples, customers increasingly have access to detailed pricing, cost, and product differentiation data. For instance, as of early 2024, online comparison tools and consumer reviews provide extensive insights into mobile plan costs and service quality across various providers, directly affecting First Pacific's ability to command premium pricing in its telecom ventures.

This abundance of readily available information empowers customers to make informed choices and negotiate more effectively. When consumers can easily compare First Pacific's offerings against competitors, their ability to demand lower prices or better terms increases, thereby eroding the company's pricing power. This dynamic is particularly pronounced in the competitive food and beverage market, where brand loyalty can be challenged by price-sensitive consumers armed with market data.

Threat of Backward Integration by Customers

The threat of backward integration by customers poses a significant concern for First Pacific, particularly with its diverse portfolio spanning telecommunications, food, and infrastructure. This threat arises when customers, especially large industrial or institutional buyers, could potentially produce the goods or services First Pacific offers themselves, thereby cutting out the intermediary. For instance, a major food retailer might consider developing its own private label brands or even investing in food processing capabilities, directly competing with First Pacific's consumer food businesses like San Miguel Corporation's food division.

The credibility of this threat is a key driver of customer bargaining power. If customers possess the financial resources, technical expertise, and market access to effectively integrate backward, they can exert considerable pressure on First Pacific's pricing and terms. For example, in the infrastructure sector, a government entity might explore developing its own power generation or water treatment facilities if it perceives First Pacific's pricing as too high or its service delivery as inadequate. This leverage allows customers to negotiate more favorable contracts, potentially impacting First Pacific's revenue and profit margins.

- Customer Integration Potential: While individual consumers pose little threat, large B2B clients in sectors like food processing or government entities in infrastructure could explore insourcing First Pacific's offerings.

- Leverage in Negotiations: A credible threat of backward integration empowers customers to demand lower prices and better terms from First Pacific.

- Impact on Profitability: Successful backward integration by customers can directly erode First Pacific's market share and profitability in affected segments.

- Strategic Consideration: First Pacific must continuously assess the capabilities and motivations of its key customers to anticipate and mitigate this integration risk.

Price Sensitivity of Customers

The price sensitivity of First Pacific's customer base significantly impacts its bargaining power. For instance, in its consumer food segments, where products might be seen as more commoditized and consumers face tighter budgets, a slight price increase could lead to a substantial shift to competitors. This heightened sensitivity limits First Pacific's pricing flexibility.

Conversely, in areas like infrastructure, where the service is often essential and switching costs are high, customers may exhibit lower price sensitivity. However, even in these less sensitive segments, prolonged economic downturns or the emergence of viable alternative providers could eventually increase customer price awareness. For example, in 2024, inflation continued to put pressure on consumer spending across many markets where First Pacific operates, potentially increasing price sensitivity in its food and consumer goods divisions.

First Pacific's ability to command higher prices is directly correlated with how much customers value its offerings relative to alternatives and their own financial constraints.

- Consumer Goods: High price sensitivity due to availability of substitutes and budget constraints.

- Infrastructure Services: Generally lower price sensitivity, but can increase with economic pressure or alternative solutions.

- 2024 Economic Climate: Persistent inflation may elevate price sensitivity across multiple customer segments for First Pacific.

The bargaining power of First Pacific's customers is a significant factor, particularly in its telecommunications and infrastructure segments. Large enterprise clients and government entities often have substantial purchase volumes, granting them considerable leverage to negotiate favorable terms and prices. For example, in 2024, major telecommunications clients could demand customized service packages and volume discounts, directly influencing First Pacific's pricing strategies in these high-value contracts.

Customer switching costs play a dual role. In consumer-facing businesses like food, switching is easy, empowering customers. However, in telecommunications, high switching costs, such as contract lock-ins and number porting complexities, reduce customer bargaining power. PLDT, a First Pacific subsidiary, reported over 17 million broadband subscribers in Q1 2024, illustrating a large base where switching inertia benefits the company.

The availability of information empowers customers to compare prices and services, increasing their bargaining power, especially in competitive markets like telecommunications and consumer goods. Customers armed with data from online comparison tools in 2024 could more effectively negotiate better deals, impacting First Pacific's pricing flexibility.

The threat of backward integration by large customers, such as food retailers developing private labels or governments building infrastructure, can significantly pressure First Pacific's pricing and market share. This potential for customers to insource offerings is a constant strategic consideration for First Pacific.

Price sensitivity varies across First Pacific's portfolio. Consumer food products face higher sensitivity due to substitutes and budget constraints, exacerbated by 2024 inflation. Conversely, essential infrastructure services often exhibit lower price sensitivity, though economic pressures can shift this dynamic.

| Customer Segment | Key Bargaining Power Drivers | Impact on First Pacific | 2024 Data/Context |

|---|---|---|---|

| Telecommunications (Enterprise) | Purchase Volume, Contract Size | Price Pressure, Demand for customized terms | Large enterprise clients likely negotiated volume-based discounts. |

| Telecommunications (Consumer) | Information Availability, Low Switching Costs (relative to B2B) | Price Sensitivity, Competition on plans | PLDT's 17M+ broadband subscribers in Q1 2024 indicate a large base sensitive to competitive offerings. |

| Consumer Food | Price Sensitivity, Availability of Substitutes | Limited pricing flexibility, Brand loyalty challenges | Inflation in 2024 likely increased price sensitivity for everyday food items. |

| Infrastructure | Contract Size, Potential for Backward Integration | Leverage in negotiations, Risk of insourcing | Government or large developer clients could demand lower project costs. |

What You See Is What You Get

First Pacific Porter's Five Forces Analysis

This preview showcases the complete First Pacific Porter's Five Forces Analysis, ensuring you receive the exact, professionally formatted document you see here immediately after purchase. No placeholder content or sample sections; what you preview is precisely what you'll download and utilize for your strategic planning. This comprehensive analysis is ready for immediate application, providing actionable insights without any further preparation required.

Rivalry Among Competitors

First Pacific faces a dynamic competitive landscape across its diverse portfolio. In the telecommunications sector, particularly in the Philippines through PLDT, it contends with a significant number of players, including Globe Telecom and DITO Telecommunity, leading to intense price competition and innovation pressures. For instance, PLDT reported a 13% increase in service revenue for the first quarter of 2024, reflecting ongoing efforts to capture market share amidst this rivalry.

The company's presence in other sectors, such as infrastructure and consumer food products, also presents varying degrees of competitive intensity. While some segments might be more concentrated, the overall diversity of First Pacific's operations means it must constantly adapt to different competitive forces. The sheer number of competitors in some of its key markets, coupled with their varying strategies and market positions, fuels a high level of rivalry that can impact pricing power and profit margins.

First Pacific operates in diverse sectors, including telecommunications, food and consumer products, and infrastructure. The growth rates in these industries vary significantly. For instance, the global telecommunications market, a key area for First Pacific, experienced a compound annual growth rate (CAGR) of approximately 3.5% from 2023 to 2024, according to industry reports from Statista.

In contrast, some consumer product segments might exhibit more moderate growth. When industries are growing rapidly, companies like First Pacific can expand their operations and sales without necessarily needing to steal market share from competitors. This environment generally fosters less intense rivalry.

However, if First Pacific were to operate in a mature or declining sector, the competitive landscape would likely be much tougher. In such scenarios, businesses often engage in price wars and other aggressive tactics to capture a larger portion of a shrinking market, which can negatively impact profitability and margins.

First Pacific operates in diverse sectors, meaning product differentiation varies significantly. In its consumer food segment, for instance, brands like Hyde Park and Magnolia often benefit from established customer loyalty, creating a barrier for competitors. However, in its telecommunications ventures, like PLDT in the Philippines, proprietary technology and network infrastructure can lead to higher switching costs for consumers.

The intensity of rivalry is directly influenced by these factors. Where differentiation is low and switching costs are minimal, such as in certain infrastructure or commodity-like businesses, First Pacific faces more aggressive price competition from rivals. For example, in the infrastructure sector, if services are largely standardized, competitors may engage in price wars to gain market share, impacting profit margins.

Exit Barriers

Exit barriers in the telecommunications sector, where First Pacific operates, are notably high due to substantial capital investments in physical infrastructure like cell towers, fiber optic networks, and data centers. These specialized assets have limited alternative uses, making their resale value low and creating significant financial penalties for exiting the market.

For instance, in 2024, global telecommunications infrastructure spending was projected to reach hundreds of billions of dollars, illustrating the immense sunk costs involved. Companies committed to these long-term projects face considerable difficulty in recouping their investments if they decide to withdraw, effectively locking them into the industry.

These elevated exit barriers can lead to prolonged periods of intense competition, even among unprofitable players. Firms might continue to operate at reduced profitability simply to avoid the steep losses associated with abandoning their invested capital, thereby intensifying rivalry and potentially suppressing overall industry returns.

- High Asset Specificity: Telecom infrastructure is highly specialized and difficult to repurpose, leading to low salvage values.

- Significant Sunk Costs: Billions are invested in networks, making exit financially punitive.

- Continued Operation of Unprofitable Firms: High exit barriers encourage firms to stay in the market despite losses, increasing competitive pressure.

Strategic Stakes and Commitments

First Pacific operates in markets where strategic stakes are exceptionally high, particularly in infrastructure and telecommunications across Asia. For instance, its significant investments in infrastructure projects, such as toll roads and power plants, often align with national development agendas, making market position crucial for long-term viability. Competitors in these sectors are similarly committed, often backed by state entities or large conglomerates with deep pockets, intensifying the rivalry.

The level of investment committed by First Pacific and its rivals directly fuels aggressive competition. In 2024, the telecommunications sector alone saw substantial capital expenditures, with major players like PLDT (a First Pacific subsidiary) investing billions in network expansion and upgrades to capture market share. This high commitment means companies are less likely to exit or reduce their competitive intensity, even in challenging economic conditions.

- High Strategic Stakes: First Pacific's involvement in essential services like water and electricity utilities in countries such as the Philippines underscores the critical nature of its market presence.

- Aggressive Competition: Competitors with similar long-term national development goals, often state-backed entities, engage in price wars and rapid service expansion.

- Commitment to Market Share: In 2024, the intense competition in the Philippine mobile market, for example, saw average revenue per user (ARPU) under pressure as providers offered aggressive data bundles and promotions.

- Unwillingness to Concede: Companies are heavily invested in maintaining or growing their subscriber bases, leading to sustained marketing efforts and infrastructure build-outs, reflecting a strong unwillingness to lose ground.

First Pacific faces robust competition across its diverse portfolio, particularly in telecommunications where PLDT competes fiercely with Globe Telecom and DITO Telecommunity. This rivalry drives price wars and innovation, as evidenced by PLDT's 13% service revenue increase in Q1 2024, signaling efforts to gain market share amidst intense competition.

The intensity of rivalry is amplified by high exit barriers, especially in capital-intensive sectors like telecommunications. Billions invested in specialized infrastructure, such as fiber optic networks, make exiting the market financially punitive. This can lead to unprofitable firms continuing operations, thereby intensifying competitive pressure and potentially suppressing industry returns.

High strategic stakes in key markets, like infrastructure and utilities, further fuel aggressive competition. Competitors, often state-backed or large conglomerates, are deeply committed to market share, leading to sustained marketing efforts and infrastructure build-outs. For instance, the Philippine mobile market in 2024 saw ARPU under pressure due to aggressive data bundle promotions.

| Competitor | Sector | Key Competitive Factor | 2024 Data Point |

| Globe Telecom | Telecommunications | Network Quality, Data Offerings | Competes directly with PLDT for subscribers. |

| DITO Telecommunity | Telecommunications | Aggressive Pricing, 5G Rollout | Challenging established players with market entry strategies. |

| Various Infrastructure Developers | Infrastructure | Project Bidding, Operational Efficiency | Engage in intense competition for large-scale projects. |

| Local Food Brands | Consumer Food | Brand Loyalty, Distribution Reach | Compete for shelf space and consumer preference. |

SSubstitutes Threaten

The threat of substitutes for First Pacific's diverse businesses, including telecommunications and food, is a significant factor. For instance, in its telecommunications segment, the rise of over-the-top (OTT) services like WhatsApp and Telegram for messaging and voice calls directly challenges traditional mobile services. In 2024, the global mobile messaging market is projected to reach over $1 trillion, highlighting the substantial adoption of these substitutes.

Similarly, within its food and consumer products divisions, customers have a wide array of alternative choices. This could range from different protein sources in the food industry to various brands offering similar convenience or nutritional benefits. The ease with which consumers can switch to these alternatives directly impacts First Pacific's ability to maintain pricing power and market share.

The price-performance trade-off of substitutes is a critical factor for First Pacific. If competing products offer better value for money, customers will naturally gravitate towards them, potentially reducing First Pacific's market share and profitability.

For example, in the telecommunications sector, where First Pacific has significant interests, the emergence of more affordable mobile plans or over-the-top (OTT) communication services that bypass traditional telco infrastructure presents a direct threat. If these substitutes provide comparable or superior service at a lower cost, First Pacific's customer retention could be challenged. In 2024, the global average revenue per user (ARPU) for mobile services continued to face downward pressure in many markets, indicating a strong customer sensitivity to price and a willingness to switch to more cost-effective alternatives.

Customer propensity to substitute for First Pacific's diverse businesses, such as telecommunications and consumer food, is influenced by several factors. In the telecommunications sector, for instance, switching costs for consumers can be moderate, especially with bundled services and contract lock-ins, but the availability of alternative providers and evolving mobile technology can increase this propensity. For example, in 2024, the Philippines' telco market, a key area for First Pacific, saw continued competition with players like Globe and Smart vying for market share, potentially making customers more open to switching if price or service quality significantly differs.

Switching Costs to Substitutes

The threat of substitutes for First Pacific is influenced by the switching costs customers face when moving to an alternative. These costs can be financial, such as early termination fees or new equipment expenses, or psychological, involving the effort of learning a new system or service. For instance, in the telecommunications sector where First Pacific has interests, switching internet providers in 2024 often involved contract penalties, potentially costing hundreds of dollars, alongside the inconvenience of setting up new services.

Lower switching costs significantly amplify the threat of substitutes. If customers can easily and cheaply switch to a competitor, they are more likely to do so if the substitute offers a better price or feature set. This dynamic puts pressure on First Pacific to maintain competitive offerings and customer loyalty.

- Financial Switching Costs: Early contract termination fees, installation charges for new services, or the cost of purchasing new compatible hardware.

- Psychological Switching Costs: The time and effort required to learn a new system, adapt to different user interfaces, or build new relationships with service providers.

- Impact on First Pacific: High switching costs can create a barrier for customers considering alternatives, thus protecting First Pacific's market share. Conversely, low switching costs make First Pacific more vulnerable to competitive pressures from substitute products or services.

Innovation in Substitute Industries

The pace of innovation within industries offering substitutes significantly impacts First Pacific. Rapid technological advancements or novel business models in these substitute sectors can swiftly introduce more appealing alternatives, thereby amplifying the threat. For instance, ongoing breakthroughs in renewable energy technologies are increasingly positioning them as viable substitutes for traditional fossil fuels, a core area for many energy companies.

Similarly, the proliferation of new digital payment systems and fintech solutions poses a direct challenge to established banking services, which are often integral to the financial operations of conglomerates like First Pacific. This dynamic innovation landscape means that existing value propositions can be rapidly eroded if companies fail to adapt or innovate themselves.

- Renewable Energy Growth: Global renewable energy capacity is projected to grow substantially, with solar and wind power leading the charge. In 2024, the International Energy Agency reported that renewable energy sources accounted for over 30% of global electricity generation, a figure expected to rise.

- Fintech Adoption: Digital payment transactions are experiencing exponential growth. In 2024, Statista data indicated that the global digital payments market was valued at over $9 trillion, with continued double-digit annual growth anticipated.

- Impact on Traditional Sectors: These innovations create direct competitive pressure on industries reliant on older technologies or business models, forcing incumbents to invest heavily in modernization or risk losing market share to more agile, innovative players.

The threat of substitutes for First Pacific is substantial, particularly in its telecommunications and food segments. Over-the-top (OTT) services directly compete with traditional telco offerings, and the food industry faces constant innovation from alternative brands and product types. The ease with which consumers can switch to these alternatives, driven by factors like price and performance, directly impacts First Pacific's market position.

In 2024, the global digital payments market was valued at over $9 trillion, showcasing the rapid adoption of fintech substitutes that challenge traditional banking services. Similarly, renewable energy capacity, accounting for over 30% of global electricity generation in 2024, presents a growing substitute for conventional energy sources, impacting sectors First Pacific may be involved in.

| Industry Segment | Substitute Threat | Key Substitute Examples | 2024 Data Point (Illustrative) | Impact on First Pacific |

|---|---|---|---|---|

| Telecommunications | High | OTT Messaging & Voice (WhatsApp, Telegram) | Global mobile messaging market projected >$1 trillion | Pressure on traditional telco revenue, customer retention |

| Food & Consumer Products | Moderate to High | Alternative Brands, Plant-based proteins, Private Labels | N/A (Highly fragmented market) | Price sensitivity, need for differentiation |

| Financial Services (Potential) | High | Fintech, Digital Wallets, P2P Lending | Global digital payments market >$9 trillion | Disruption of traditional banking models |

| Energy (Potential) | Moderate to High | Renewable Energy Sources (Solar, Wind) | Renewables >30% of global electricity generation | Shift in energy demand, need for diversification |

Entrants Threaten

First Pacific operates in sectors like telecommunications infrastructure, where massive upfront investments create significant economies of scale. For instance, building out a nationwide fiber optic network requires billions of dollars, giving established players like First Pacific a substantial cost advantage per user compared to a new entrant starting from scratch. This cost barrier is a major deterrent.

Similarly, in natural resource extraction, the sheer volume of production achieved by large companies like First Pacific leads to lower per-unit costs for labor, materials, and equipment. In 2024, major players in the mining sector, for example, often boast production volumes that are orders of magnitude larger than what a new, smaller operation could achieve, making it exceedingly difficult to match their cost efficiencies.

The capital requirements for industries First Pacific operates in, such as telecommunications and infrastructure, are exceptionally high. For instance, building a new telecommunications network can easily cost billions of dollars, a significant hurdle for potential new entrants. This immense financial outlay acts as a powerful deterrent, effectively limiting the number of companies that can realistically consider entering these markets.

Securing access to distribution channels presents a significant hurdle for new entrants in the consumer food products sector, where established relationships with major retailers are paramount. For instance, a new snack brand might struggle to gain shelf space against established players who benefit from long-standing partnerships and volume discounts. This difficulty in obtaining reliable and cost-effective distribution can act as a powerful barrier, limiting a newcomer's ability to reach a broad customer base.

Government Policy and Regulation

Government policy and regulation can significantly impact the threat of new entrants. Industries with extensive licensing requirements, such as telecommunications or utilities, often create substantial barriers. For instance, in 2024, obtaining a new national broadband license in many developed countries can involve multi-year processes and significant capital investment, effectively favoring established operators.

Strict compliance mandates and evolving regulatory landscapes can also deter potential competitors. Companies must navigate complex legal frameworks, environmental standards, and consumer protection laws, which require specialized expertise and resources. In 2024, sectors like renewable energy are seeing increased regulatory scrutiny regarding grid connection and environmental impact assessments, adding to the cost and time for new players.

- High Capital Requirements: Government-mandated capital reserves for financial institutions in 2024, for example, can be in the billions, a substantial hurdle for new entrants.

- Licensing and Permits: The telecommunications sector in many regions requires costly spectrum licenses, with auctions in 2024 for 5G spectrum often exceeding hundreds of millions of dollars.

- Compliance Costs: Adhering to stringent data privacy regulations like GDPR or CCPA, which continue to evolve, adds ongoing operational costs that new entrants must absorb.

- Industry-Specific Standards: Pharmaceutical companies face rigorous FDA or EMA approval processes, a lengthy and expensive undertaking that limits the pace of new market entrants.

Brand Loyalty and Switching Costs for Customers

First Pacific faces a moderate threat from new entrants due to established brand loyalty and customer switching costs in its diverse operating segments. In the consumer food sector, strong brand equity, like that associated with its San Miguel Corporation investments, can foster deep customer loyalty, making it challenging for newcomers to gain market share. For instance, San Miguel's beer brands have historically commanded significant consumer preference in the Philippines.

The telecommunications industry, another key area for First Pacific through its Philippine Long Distance Telephone Company (PLDT) stake, presents higher switching costs for consumers. These costs can include early termination fees for contracts, the inconvenience of transferring services, and the need to reconfigure devices. In 2024, the average mobile phone contract length in many markets remained around 12-24 months, reinforcing customer inertia.

- Brand Recognition: First Pacific's subsidiaries, particularly in consumer goods and telecommunications, benefit from well-established brands that have cultivated strong consumer trust over decades.

- Switching Costs in Telecom: For PLDT, customer retention is bolstered by contractual obligations and the perceived hassle of migrating services, which can deter subscribers from switching to emerging competitors.

- Cost of Acquisition: New entrants must invest heavily in marketing and promotional activities to overcome existing brand loyalty and incentivize customers to switch, thus increasing their initial operational costs.

- Loyalty Programs: The implementation of loyalty programs and bundled services by incumbent players further raises the barrier to entry by offering added value that new entrants may struggle to match initially.

The threat of new entrants for First Pacific is generally considered moderate to low across its diverse portfolio. High capital requirements, particularly in telecommunications infrastructure and natural resources, create substantial financial barriers. For instance, securing spectrum licenses for 5G deployment in 2024 often involved hundreds of millions of dollars, a significant hurdle for any newcomer.

Furthermore, established brand recognition and customer loyalty, especially in consumer goods and telecommunications, mean new entrants must invest heavily in marketing and promotions to attract customers. Switching costs in sectors like telecommunications, often involving contract lock-ins and the inconvenience of service transfer, further solidify the position of incumbents like First Pacific's PLDT. Government regulations and licensing, such as those for utilities or financial services, also add layers of complexity and cost, effectively limiting the influx of new competitors.

| Barrier Type | Example Industry | 2024 Data/Impact |

|---|---|---|

| High Capital Requirements | Telecommunications Infrastructure | 5G spectrum auction costs often exceed hundreds of millions of dollars. |

| Brand Loyalty & Switching Costs | Consumer Food & Telecommunications | San Miguel's strong brand equity and PLDT's contractual obligations deter customer shifts. |

| Government Regulation & Licensing | Financial Services & Utilities | Mandatory capital reserves in billions for financial institutions. |

| Economies of Scale | Natural Resource Extraction | Large-scale operations yield significantly lower per-unit costs than new entrants can achieve. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for First Pacific leverages publicly available financial statements, investor presentations, and annual reports. We supplement this with industry-specific market research reports and news articles to capture current competitive dynamics and strategic positioning.