First Pacific Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Pacific Bundle

Curious about the engine driving First Pacific's success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. Discover the strategic framework that fuels their market position.

Partnerships

First Pacific's strategic partnerships are anchored by its significant equity stakes in major operating companies. These include controlling interests in Indofood, a leading Indonesian consumer food producer, and PLDT, the Philippines' largest telecommunications provider. As of the first half of 2024, Indofood reported revenue of approximately IDR 128 trillion, demonstrating its market strength.

These relationships are not merely investments; they are the bedrock of First Pacific's revenue and value creation. The company's primary income stream is directly tied to the operational performance and strategic growth of entities like Metro Pacific Investments Corporation (MPIC), a major infrastructure conglomerate in the Philippines. MPIC's diverse portfolio, encompassing water, power, and toll roads, provides stable, recurring revenue streams.

First Pacific cultivates robust ties with banks and financial institutions to secure essential capital for new ventures and manage its existing debt. These relationships are the bedrock for accessing credit facilities and a suite of financial services crucial for ongoing investment activities and maintaining operational steadiness.

In 2023, First Pacific reported total debt of approximately $3.5 billion, underscoring its reliance on lenders to fund its diverse portfolio. Access to a varied range of funding sources, including syndicated loans and corporate bonds, provides the company with the necessary agility to pursue strategic growth opportunities and adapt to market dynamics.

First Pacific frequently partners with other entities through joint ventures and co-investments, particularly for significant infrastructure and natural resource initiatives. These collaborations are crucial for sharing the substantial capital requirements and risks associated with such large-scale endeavors.

By pooling resources and expertise, First Pacific can effectively enter new markets or develop complex projects that would be prohibitive to undertake alone. For instance, its involvement in Metro Pacific Investments Corporation (MPIC) often includes co-investment structures within its diverse portfolio companies.

These strategic alliances allow First Pacific to access specialized knowledge and operational capabilities, enhancing project execution and mitigating financial exposure. For example, in 2023, MPIC, a key First Pacific investment, reported significant capital expenditures across its water, power, and infrastructure segments, often facilitated by co-financing arrangements.

Regulatory Bodies and Governments

First Pacific’s operations span diverse Asia-Pacific markets, necessitating strong ties with regulatory bodies and governments. For example, in 2024, the company’s significant presence in the Philippines, a key market, means navigating regulations set by agencies like the Securities and Exchange Commission (SEC) and various sector-specific regulators.

Maintaining cooperative relationships with these entities is crucial for obtaining and retaining operating licenses, ensuring compliance with evolving legal frameworks, and fostering a stable environment for its portfolio companies. This includes proactive engagement on policy matters that could impact its businesses in sectors such as telecommunications, food, and infrastructure.

- Navigating Diverse Regulatory Landscapes: First Pacific operates in countries like Indonesia and the Philippines, each with unique compliance requirements.

- Securing Operating Licenses: Positive government relations are vital for obtaining and maintaining essential licenses for its diverse business units.

- Ensuring Favorable Operating Conditions: Constructive engagement helps shape policies that support business growth and stability within the region.

- Compliance and Risk Mitigation: Adherence to local laws and regulations, supported by government partnerships, minimizes operational risks.

Suppliers and Service Providers for Portfolio Companies

First Pacific's strategic approach involves ensuring its portfolio companies maintain strong relationships with their key suppliers and service providers. This focus is crucial for operational efficiency and profitability, even though First Pacific doesn't directly manage these day-to-day interactions.

These partnerships are vital for securing essential inputs and services, directly influencing the cost structure and quality of products or services offered by the subsidiaries. For instance, in 2024, many companies across various sectors experienced supply chain disruptions, highlighting the critical need for resilient supplier networks.

- Supply Chain Resilience: Building diversified and reliable supplier bases mitigates risks associated with single-source dependency.

- Service Level Agreements (SLAs): Establishing clear SLAs with service providers ensures consistent quality and performance, impacting customer satisfaction.

- Cost Optimization: Negotiating favorable terms with suppliers and service providers directly contributes to the bottom line of portfolio companies.

- Innovation Partnerships: Collaborating with suppliers can lead to the development of new materials or technologies, fostering innovation within the portfolio.

First Pacific's key partnerships are primarily with its major operating companies, where it holds significant equity. These include Indofood in Indonesia and PLDT in the Philippines, providing substantial revenue streams. The company also relies on financial institutions for capital and manages relationships with suppliers to ensure operational efficiency.

| Partner Type | Key Examples | 2024 Data/Context |

|---|---|---|

| Major Operating Companies | Indofood, PLDT, Metro Pacific Investments Corporation (MPIC) | Indofood revenue ~IDR 128 trillion (H1 2024); PLDT's market dominance in Philippine telecom. |

| Financial Institutions | Various banks and lenders | First Pacific's total debt was ~ $3.5 billion in 2023, highlighting reliance on lenders. |

| Suppliers & Service Providers | Diverse range across all business units | Critical for cost structure and quality; supply chain resilience is a key focus in 2024. |

What is included in the product

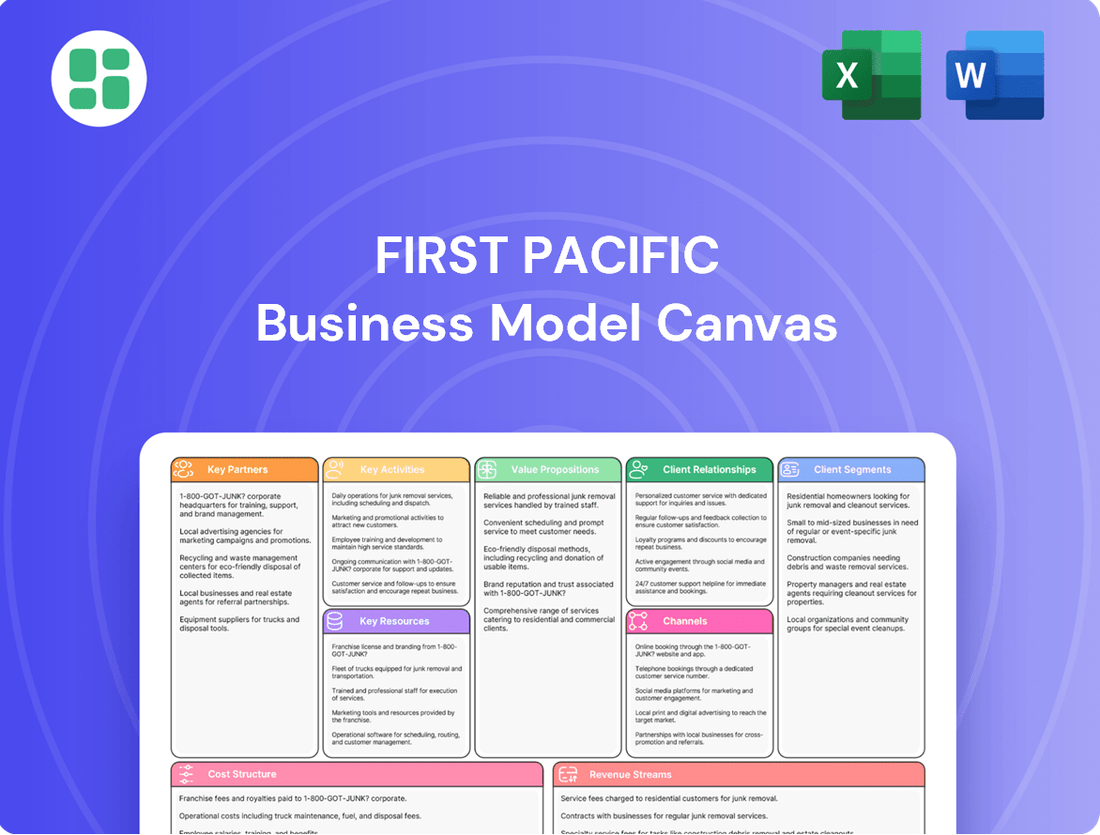

A detailed, pre-built Business Model Canvas for First Pacific, outlining its strategic approach across all nine key blocks.

This canvas provides a clear and comprehensive overview of First Pacific's operations, customer focus, and value delivery for strategic planning and stakeholder communication.

Eliminates the confusion and wasted time of trying to articulate complex business strategies by providing a clear, structured framework.

Replaces the frustration of scattered ideas and unstructured planning with a single, comprehensive visual representation of your business.

Activities

First Pacific's core activity revolves around strategically identifying and acquiring stakes in promising companies, particularly within Asia's dynamic markets. This involves rigorous due diligence and skillful negotiation to ensure long-term shareholder value. For instance, in 2023, First Pacific continued its focus on infrastructure and consumer staples, sectors demonstrating resilience and growth potential across the region.

First Pacific doesn't just invest and walk away. They actively engage with their portfolio companies, often through board seats, to steer strategic decisions and provide ongoing guidance. This hands-on approach is crucial for unlocking potential.

This oversight includes approving key business plans and budgets, a critical step in ensuring alignment with the company's overall strategy. They also keep a close eye on financial and operational performance, making sure everything is on track.

A strong emphasis on corporate governance is also a hallmark of their approach. For example, as of December 31, 2023, First Pacific's consolidated net income attributable to shareholders was $104.5 million, reflecting the positive impact of such diligent oversight on its diverse investments.

Capital allocation and financial management are paramount for First Pacific, involving the strategic deployment of resources across its varied businesses and maintaining robust financial health. This encompasses diligent debt management, optimizing cash flow generation, and upholding a progressive dividend policy to enhance shareholder returns.

Key decisions revolve around identifying lucrative new investment opportunities, divesting underperforming assets, and executing strategic refinancing to secure favorable terms. For instance, in 2023, First Pacific reported a net profit attributable to shareholders of $152.4 million, underscoring the importance of these financial management activities.

Risk Management and Compliance

First Pacific actively monitors significant risks inherent in its diverse investment portfolio, encompassing market volatility, operational disruptions, and evolving regulatory landscapes. This diligent oversight is crucial for maintaining the integrity of its operations and investments.

Ensuring strict adherence to all relevant laws and regulations across the various countries where First Pacific operates is a core function. This commitment to compliance is non-negotiable for sustained business activity.

By proactively identifying and mitigating these risks, First Pacific safeguards its valuable assets and protects its corporate reputation. This strategic approach underpins the company's stability and strengthens investor trust.

- Market Risk Monitoring: First Pacific continuously assesses potential impacts from economic downturns, interest rate fluctuations, and currency exchange rate volatility on its holdings.

- Operational Risk Management: The company implements robust internal controls and processes to prevent and manage risks arising from day-to-day operations, including fraud, system failures, and human error.

- Regulatory Compliance: First Pacific maintains dedicated teams to ensure all business activities comply with local and international legal frameworks, including financial reporting standards and anti-corruption laws.

- Reputation Protection: By prioritizing risk management and compliance, First Pacific aims to avoid reputational damage that could arise from legal breaches or operational failures, thereby fostering long-term stakeholder confidence.

Investor Relations and Stakeholder Engagement

First Pacific's investor relations team actively engages with its shareholder base, which includes a significant portion of institutional investors. In 2024, the company continued its practice of providing detailed updates through its annual reports and regular press releases, ensuring transparency regarding its financial performance and strategic direction across its diverse portfolio of businesses.

The company prioritizes clear and consistent communication to build and maintain trust with the financial community. This involves not only disseminating information but also actively soliciting and responding to feedback from shareholders and analysts. For instance, First Pacific held several investor calls and presentations throughout 2024 to discuss its quarterly results and its outlook in key markets.

- Shareholder Communication: Dissemination of annual reports, interim financial statements, and press releases.

- Investor Presentations: Conducting regular investor briefings and conference calls to discuss performance and strategy.

- Stakeholder Feedback: Responding to inquiries from shareholders, analysts, and the broader financial community.

- Market Information: Keeping the market informed about strategic decisions, operational updates, and financial results.

First Pacific's key activities are centered on strategic investment and active management of its portfolio companies. This includes identifying growth opportunities, particularly in Asia, and providing operational and financial oversight to enhance shareholder value.

The company actively engages in capital allocation, financial management, and risk mitigation to ensure the stability and profitability of its diverse investments.

Investor relations are a crucial activity, focusing on transparent communication with shareholders and the financial community to build trust and provide clear insights into performance and strategy.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Strategic Investment & Acquisition | Identifying and acquiring stakes in promising companies, especially in Asian markets. | Continued focus on infrastructure and consumer sectors. |

| Portfolio Management & Oversight | Actively guiding portfolio companies through board representation and strategic input. | Approving key business plans and monitoring financial performance. |

| Capital Allocation & Financial Management | Strategic deployment of resources, debt management, and optimizing cash flow. | Maintaining a progressive dividend policy; reported net profit of $152.4 million in 2023. |

| Risk Management & Compliance | Monitoring market, operational, and regulatory risks, ensuring adherence to laws. | Proactive mitigation to protect assets and reputation. |

| Investor Relations | Engaging with shareholders through detailed reports and presentations. | Providing regular updates on financial performance and strategic direction. |

Preview Before You Purchase

Business Model Canvas

The First Pacific Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it is a direct representation of the complete, ready-to-use file. You can be confident that the structure, content, and formatting you see here will be identical in the version you download, ensuring a seamless experience.

Resources

First Pacific's core strength lies in its significant financial capital, a vital asset for strategic acquisitions and bolstering its diverse portfolio companies. This capital is raised through a mix of equity and debt, allowing for substantial investments in capital-heavy industries.

As of the first half of 2024, First Pacific reported consolidated revenues of $1.04 billion, underscoring the scale of its operations and the capital deployed. The company's ability to access and manage this financial capital is paramount to its function as an investment holding company.

First Pacific's diversified investment portfolio, a cornerstone of its business model, comprises significant equity interests in market leaders across telecommunications, consumer food products, infrastructure, and natural resources. This strategic diversification across sectors aims to mitigate risk and capture growth opportunities.

These holdings are designed to generate stable income through dividends and offer potential for capital appreciation, forming the bedrock of First Pacific's financial strategy. For instance, as of its latest reporting in 2024, the company's investments in telecommunications, such as its stake in PLDT, continue to be a significant contributor to its revenue streams, demonstrating the resilience of its diversified approach.

First Pacific's experienced management team and board of directors are a cornerstone of its business model. Their deep expertise in investment analysis, strategic planning, corporate governance, and understanding of regional market dynamics provides critical intellectual capital. This collective wisdom is essential for identifying opportunities and navigating the complexities of the diverse businesses First Pacific manages.

The active guidance and oversight provided by this seasoned leadership team directly contribute to value creation across the group's portfolio. For instance, their strategic direction in 2024 has been instrumental in optimizing operations within its telecommunications and infrastructure segments, areas where robust governance and market insight are paramount for sustained growth and investor confidence.

Reputation and Network in Asia-Pacific

First Pacific's decades-long commitment to the Asia-Pacific region, dating back to its founding, has cultivated a deeply entrenched and invaluable network. This extensive reach allows the company to identify and capitalize on opportunities that might elude less established players.

The company's sterling reputation as a strategic and dependable investor acts as a significant enabler, smoothing the path for new ventures, fostering robust partnerships, and creating favorable operating environments for its diverse portfolio of subsidiaries across the region.

For instance, in 2024, First Pacific continued to leverage this network to support its infrastructure and telecommunications businesses. Its strong relationships facilitated regulatory approvals and access to key talent for projects in markets like the Philippines and Indonesia, underpinning their growth trajectories.

- Established Presence: First Pacific has operated in Asia-Pacific for over 40 years, building a comprehensive understanding of diverse markets.

- Strategic Partnerships: The company's reputation attracts joint venture partners and strategic allies, enhancing its investment capacity and operational efficiency.

- Favorable Operating Conditions: A trusted name in the region often translates to smoother dealings with governments, regulators, and local communities for its subsidiaries.

Access to Key Markets and Infrastructure

First Pacific leverages its subsidiaries to gain significant indirect access to essential markets and infrastructure across Indonesia, the Philippines, and Singapore. This strategic positioning provides a foundation for its diverse operations.

These vital assets include extensive telecommunications networks, robust food production facilities, critical power generation plants, and well-established toll road systems. Such infrastructure is fundamental to the group's ability to operate efficiently and serve its customer base.

For instance, in 2024, First Pacific’s telecommunications arm, PLDT, continued to expand its fiber network, reaching over 17 million fiber ports by the end of the first quarter. This ongoing investment underscores the importance of its infrastructure access.

The group’s infrastructure access also translates into tangible financial benefits. In 2024, First Pacific reported consolidated revenues of $3.0 billion for the first nine months, with its infrastructure and infrastructure-related businesses contributing significantly to this figure.

- Telecommunications: Access to extensive mobile and fixed-line networks in key Southeast Asian markets.

- Infrastructure: Control over essential utilities like power generation and toll roads, facilitating efficient operations and revenue generation.

- Food Production: Ownership of food processing and distribution networks, ensuring market penetration and supply chain control.

- Strategic Locations: Presence in Indonesia, the Philippines, and Singapore provides access to high-growth economies and established trade routes.

First Pacific's key resources include its substantial financial capital, a diversified portfolio of market-leading companies, an experienced management team, an extensive regional network, and direct access to critical infrastructure in its operating markets.

The company's financial strength, evidenced by its ability to raise capital through equity and debt, fuels its strategic investments. Its portfolio, spanning telecommunications, consumer food, infrastructure, and natural resources, provides stable income and growth potential.

The expertise of its management team is crucial for strategic decision-making and value creation. Furthermore, its long-standing presence in Asia-Pacific has built a valuable network and a strong reputation, facilitating partnerships and favorable operating conditions.

Access to essential infrastructure, such as telecommunications networks and power generation facilities, underpins its operational efficiency and market reach.

| Resource Category | Specific Examples | 2024 Data/Significance |

|---|---|---|

| Financial Capital | Equity and Debt Financing | Enables strategic acquisitions and capital-intensive investments. |

| Investment Portfolio | PLDT (Telecommunications), Metro Pacific Investments Corporation (Infrastructure, Food) | PLDT's fiber network expansion (over 17 million ports by Q1 2024) highlights infrastructure access. Consolidated revenues reached $3.0 billion for the first nine months of 2024, with infrastructure contributing significantly. |

| Human Capital | Experienced Management & Board | Deep expertise in investment analysis, strategic planning, and corporate governance, crucial for value creation in 2024 operations. |

| Network & Reputation | Long-standing Asia-Pacific presence | Facilitates partnerships and smooth regulatory dealings; leveraged in 2024 for projects in the Philippines and Indonesia. |

| Infrastructure Access | Telecommunications Networks, Power Plants, Toll Roads | Supports efficient operations and revenue generation; vital for subsidiaries' growth trajectories. |

Value Propositions

First Pacific is dedicated to building enduring shareholder value by making smart investments and actively managing its diverse portfolio. The company's strategy focuses on delivering consistent cash returns and growing the value of its shares over time.

This commitment is reflected in its recent performance, with First Pacific achieving record earnings and distributions, demonstrating its ability to translate strategic execution into tangible shareholder benefits.

For instance, in 2024, the company's strategic initiatives are projected to further enhance its financial resilience and growth potential, aiming for sustained capital appreciation and increased dividend payouts.

First Pacific provides investors with a strategic pathway to capitalize on the dynamic growth of emerging Asian economies, specifically focusing on Indonesia and the Philippines. This approach targets essential and resilient sectors, offering a diversified investment profile that inherently reduces the risks associated with over-reliance on a single industry or nation.

In 2024, First Pacific's commitment to these key markets is underscored by its significant presence in sectors like telecommunications and consumer goods. For instance, its stake in Telkomsel, Indonesia's largest mobile operator, positions it to benefit from the country's expanding digital economy, which saw mobile data consumption rise significantly in the preceding years.

First Pacific actively guides its portfolio companies, fostering operational improvements and market expansion to drive growth. This hands-on strategy is designed to unlock and maximize the intrinsic value of each investment. For instance, in 2024, First Pacific's strategic interventions in its infrastructure segment contributed to a notable increase in operational efficiency, with one key utility company reporting a 7% reduction in energy waste through implemented best practices.

Access to Capital and Management Expertise for Investees

First Pacific provides more than just financial backing to its investee companies; it injects valuable management expertise and guidance on governance. This dual approach is vital for fostering sustainable growth and operational excellence within its portfolio. For instance, in 2024, First Pacific's involvement in its telecommunications and infrastructure segments has been instrumental in navigating complex regulatory environments and driving operational efficiencies.

The company acts as a strategic partner, offering investees access to its extensive regional network. This connectivity can open doors to new markets, supply chain opportunities, and synergistic collaborations. Such a supportive ecosystem is particularly beneficial for companies aiming to scale their operations across Asia, a key focus for First Pacific's strategic investments.

- Capital Infusion: Direct financial investment to fuel growth initiatives.

- Management Expertise: Strategic guidance and operational support from experienced professionals.

- Governance Best Practices: Implementation of robust corporate governance frameworks.

- Network Access: Leveraging First Pacific's broad regional connections for business development.

Sustainable and Responsible Investment Practices

First Pacific actively integrates sustainability and responsible business practices across its diverse portfolio. This dedication to environmental, social, and governance (ESG) principles is designed to foster enduring value, extending beyond financial returns to encompass positive societal and environmental impacts.

This approach resonates strongly with a growing segment of investors prioritizing ethical and sustainable investments. For instance, in 2024, global sustainable investment assets reached an estimated $37.5 trillion, highlighting the significant market demand for ESG-aligned businesses.

- ESG Integration: First Pacific embeds ESG considerations into its investment analysis and portfolio management, seeking companies with strong sustainability credentials.

- Long-Term Value Creation: The focus on responsible practices aims to enhance resilience and generate sustainable financial performance over the long haul.

- Investor Appeal: This commitment attracts investors who are increasingly aligning their capital with their values, seeking both financial growth and positive impact.

First Pacific offers investors a unique opportunity to participate in the growth of emerging Asian economies, particularly Indonesia and the Philippines, by investing in resilient, essential sectors. The company's strategic focus on telecommunications and consumer goods, exemplified by its stake in Telkomsel, positions it to capitalize on strong demographic trends and increasing digital adoption. This approach aims for both capital appreciation and consistent cash returns.

First Pacific actively enhances the value of its portfolio companies through operational improvements and strategic management, ensuring sustainable growth and profitability. Its hands-on approach, including providing management expertise and governance guidance, unlocks intrinsic value and drives operational efficiencies, as seen in its infrastructure segment in 2024. The company also leverages its extensive regional network to foster synergistic collaborations and market access for its investees.

The company's commitment to ESG principles makes it an attractive investment for those seeking both financial returns and positive societal impact. By integrating sustainability into its investment strategy, First Pacific aims to build long-term resilience and appeal to a growing market of ethically-minded investors. This focus on responsible practices is projected to further enhance its financial performance and market positioning throughout 2024 and beyond.

Customer Relationships

First Pacific actively engages with its investors, both individual and institutional, through direct communication channels. This commitment to transparency is demonstrated by the regular publication of detailed annual and interim financial reports, alongside timely press releases that keep stakeholders informed.

The company further fosters this relationship by hosting shareholder meetings, providing a platform for direct dialogue and addressing investor queries. For instance, in 2023, First Pacific held its Annual General Meeting, a key event for its investor relations strategy.

First Pacific cultivates a deeply collaborative and strategic relationship with the management teams of its portfolio companies. This partnership is central to driving value and ensuring alignment with the overarching investment strategy.

First Pacific's directors actively engage in board meetings, offering critical oversight and guidance. They work hand-in-hand with company management on key strategic decisions, the development of robust business plans, and the rigorous monitoring of performance metrics.

For instance, in 2024, First Pacific's active involvement in its infrastructure and telecommunications investments, such as those in the Philippines, involved detailed discussions around capital allocation for network expansion and digital transformation initiatives. This hands-on approach ensures that management teams are supported in executing their strategic vision, directly impacting operational efficiency and long-term growth potential.

First Pacific actively cultivates relationships with financial analysts and advisors to transparently communicate its financial performance, strategic initiatives, and future market outlook. This proactive engagement is crucial for shaping positive market perception and ensuring the investment community accurately grasps the company's evolving value proposition.

In 2024, First Pacific continued its commitment to investor relations, participating in numerous analyst briefings and investor conferences. For instance, their H1 2024 earnings call saw significant analyst participation, with discussions focusing on the performance of their infrastructure and consumer staples segments, which are key drivers of their business.

Regulatory Compliance and Reporting

First Pacific's commitment to regulatory compliance is paramount for maintaining trust and operational integrity. This involves meticulous adherence to the reporting requirements of various stock exchanges, such as the Philippine Stock Exchange (PSE) and the Hong Kong Stock Exchange (HKEX), where its shares are listed.

In 2024, the company continued to focus on timely and accurate financial disclosures. For instance, First Pacific's interim financial results for the first half of 2024 were released in accordance with regulatory timelines, demonstrating ongoing diligence. This proactive approach ensures that investors and stakeholders have access to up-to-date information, fostering transparency.

Maintaining robust corporate governance standards is also a cornerstone of these relationships. This includes clear board oversight, ethical conduct, and effective risk management frameworks. By upholding these principles, First Pacific reinforces its legitimacy and strengthens its standing within the global financial community.

- Timely Filings: Adherence to deadlines for interim and annual financial reports.

- Governance Standards: Implementation of best practices in corporate governance and board accountability.

- Regulatory Engagement: Proactive communication and cooperation with regulatory bodies and exchanges.

- Transparency: Ensuring clear and accurate disclosure of financial performance and material information.

Stakeholder Communication and Transparency

First Pacific actively engages with a wide array of stakeholders beyond its direct investors. This includes maintaining open lines of communication with the media, employees across its diverse portfolio companies, and the general public. This proactive approach ensures a steady and clear dissemination of information regarding the company's operational activities and its broader societal impact.

Transparency is a cornerstone of First Pacific's stakeholder relationships. The company utilizes various communication channels to provide timely updates and foster trust. For instance, in 2024, First Pacific continued its practice of regular investor relations updates and public disclosures, highlighting its commitment to keeping all parties informed.

- Media Engagement: Regular press releases and media briefings are conducted to share company news and financial performance.

- Employee Communication: Internal newsletters and town hall meetings are utilized to keep employees of portfolio companies informed about group strategies and performance.

- Public Relations: Sustainability reports and corporate social responsibility initiatives are communicated to the public to showcase the company's broader impact.

- Financial Transparency: First Pacific's 2024 interim report, released in August 2024, detailed a revenue of approximately USD 1.1 billion, underscoring its commitment to financial clarity.

First Pacific cultivates strong customer relationships through consistent communication and a focus on delivering value within its diverse portfolio. This involves maintaining transparency with investors and stakeholders by providing regular financial updates and engaging in direct dialogue through shareholder meetings and analyst briefings.

The company's commitment extends to its portfolio companies, where it fosters collaborative partnerships with management teams to drive strategic growth and operational efficiency. This hands-on approach is evident in 2024 discussions regarding capital allocation for infrastructure and telecommunications projects.

First Pacific also prioritizes regulatory compliance and robust corporate governance, ensuring trust and operational integrity. Their adherence to listing requirements on exchanges like the PSE and HKEX, exemplified by timely filings such as the H1 2024 interim report, reinforces stakeholder confidence.

Furthermore, the company actively engages with a broader audience, including media, employees, and the public, through various communication channels to ensure clear dissemination of information about its operations and societal contributions.

| Relationship Type | Key Engagement Methods | 2024 Focus/Examples |

|---|---|---|

| Investors | Annual/Interim Reports, Press Releases, Shareholder Meetings | H1 2024 earnings call participation, focus on infrastructure and consumer staples performance |

| Portfolio Company Management | Board Meetings, Strategic Discussions, Performance Monitoring | Capital allocation for network expansion and digital transformation in infrastructure/telecom |

| Financial Analysts & Advisors | Analyst Briefings, Investor Conferences | Communicating financial performance, strategic initiatives, and market outlook |

| Regulators & Exchanges | Timely Filings, Compliance Adherence | Adherence to PSE and HKEX reporting requirements, timely release of interim financial results |

| Broader Stakeholders (Media, Employees, Public) | Press Releases, Internal Communications, CSR Initiatives | Regular investor relations updates, public disclosures, sustainability reporting |

Channels

First Pacific's investor relations website is a crucial digital hub, offering a wealth of information for stakeholders. It features key documents like annual and interim reports, alongside press releases and investor presentations, ensuring transparency and accessibility.

This platform is vital for communicating corporate governance practices and financial performance. For instance, in 2024, the website would have been updated with the latest financial disclosures, providing real-time insights into the company's operational and financial standing.

Formal financial reports, such as annual and interim reports, alongside other regulatory filings, serve as crucial channels for First Pacific to communicate its detailed financial performance and strategic direction. These documents are publicly accessible, providing vital information for investors and stakeholders to conduct thorough analysis and make informed decisions.

In 2024, First Pacific, like many companies, would have continued to rely on these filings to disclose key financial metrics. For instance, their interim reports would highlight revenue, profit margins, and debt levels, offering a snapshot of their operational health and financial stability during the year, crucial for valuation models like DCF.

Annual General Meetings (AGMs) are crucial touchpoints for First Pacific, directly connecting shareholders with the Board of Directors. During these events, shareholders can pose questions and cast votes on significant company matters, ensuring transparency and accountability. In 2024, First Pacific continued this tradition, facilitating direct dialogue and shareholder participation.

Beyond AGMs, First Pacific leverages investor briefings, both physical and virtual, to communicate its performance and strategic direction. These sessions allow management to present financial results and future plans to a broad spectrum of investors, including institutional and retail participants. This proactive communication strategy is vital for maintaining investor confidence and fostering a well-informed market presence.

Press Releases and News Media

First Pacific leverages press releases to communicate crucial information, such as its financial performance and strategic shifts, to investors and the broader market. For instance, in its 2024 fiscal year, the company reported a net profit attributable to shareholders of US$134.5 million, a significant increase from the previous year, highlighting the impact of these announcements.

Active engagement with financial news media is a cornerstone of First Pacific's communication strategy, ensuring that its developments reach a wide audience. This outreach helps to build and maintain investor confidence by providing timely and transparent updates on the company's operations and outlook.

- Financial Reporting: Disseminates quarterly and annual financial results to keep stakeholders informed.

- Strategic Announcements: Communicates major corporate actions, such as acquisitions or divestitures.

- Market Engagement: Facilitates dialogue with financial journalists and analysts to ensure accurate reporting.

- Investor Relations: Provides a direct channel for conveying company news and strategic direction.

Stock Exchanges and Trading Platforms

As a publicly traded entity on the Hong Kong Stock Exchange (HKEX), First Pacific leverages established stock exchanges and a wide array of trading platforms. This infrastructure ensures that its shares are readily accessible to a global investor base, facilitating the buying and selling of its securities and contributing to market liquidity.

The accessibility provided by these platforms is crucial for attracting and retaining investors. For instance, in 2024, the HKEX continued to be a major hub for Asian capital, with significant trading volumes across various sectors, underscoring the importance of these channels for companies like First Pacific.

- Accessibility: Investors can easily buy and sell First Pacific shares through numerous brokerage accounts and online trading platforms connected to major exchanges.

- Liquidity: The presence on the HKEX ensures a ready market for First Pacific's stock, allowing for efficient price discovery and transaction execution.

- Market Reach: Trading platforms provide access to both institutional and retail investors worldwide, broadening the potential shareholder base.

First Pacific utilizes its investor relations website and formal financial reports as primary channels for transparency and information dissemination. These platforms are critical for communicating financial performance, strategic direction, and corporate governance to a global audience. In 2024, the company continued to update these resources with timely disclosures, ensuring stakeholders had access to the latest operational and financial insights, vital for valuation analysis.

Customer Segments

Institutional investors, encompassing major players like pension funds and mutual funds, represent a crucial customer segment for First Pacific. These entities are actively seeking robust, long-term growth opportunities coupled with dependable returns, often achieved through diversified investment portfolios.

First Pacific's strategic emphasis on resilient sectors and its significant exposure to emerging markets are key attractors for these sophisticated investors. For instance, in 2024, First Pacific's portfolio continued to show strength in its telecommunications and infrastructure holdings, sectors known for their stability and potential for consistent cash flow generation, appealing directly to the risk-return profiles favored by institutional capital.

First Pacific's retail investor segment comprises individual shareholders who directly own shares or invest via American Depositary Receipts (ADRs). These investors are typically motivated by the prospect of receiving dividend income and achieving capital appreciation on their investments.

The company prioritizes transparency and delivering tangible value to this diverse group, recognizing their significant role in its ownership structure. As of the first half of 2024, First Pacific reported a robust performance, which directly benefits these individual shareholders through potential stock price increases and sustained dividend payouts.

Financial analysts and research firms are key customers for First Pacific. These professionals, from institutions like Moody's and S&P Global, rely on timely and accurate financial data, including First Pacific's 2024 earnings reports and debt ratings, to conduct their valuations and issue investment recommendations.

First Pacific facilitates this by providing them with detailed financial statements, operational updates, and strategic outlooks. For instance, in 2024, First Pacific's disclosures on its infrastructure and telecommunications segments, such as its investments in the Philippines and Indonesia, are vital for analysts assessing the company's growth prospects and risk profile.

Potential Investee Companies

First Pacific targets companies within key industries like telecommunications, consumer food products, infrastructure, and natural resources. These are businesses actively looking for more than just funding; they seek strategic partnerships and expert guidance to fuel their expansion and operational improvements.

The company acts as a value-adding partner, providing the capital, management expertise, and strategic direction that these companies need to thrive. This approach is evident in their portfolio, which includes significant investments in sectors experiencing robust growth. For instance, as of the first half of 2024, First Pacific's infrastructure segment, which includes investments in utilities and infrastructure projects, continued to demonstrate resilience and potential for future development.

- Telecommunications: Companies requiring capital for network upgrades and expansion.

- Consumer Food Products: Businesses aiming to scale production and distribution.

- Infrastructure: Projects needing long-term investment and development expertise.

- Natural Resources: Companies seeking to optimize extraction and market access.

Financial Media and Business Publications

Financial media and business publications are crucial in shaping public understanding and perception of First Pacific's operations and financial health. By providing timely and accurate information, First Pacific enables journalists and outlets to report on its performance, fostering market transparency and informed investor sentiment. For instance, in 2024, major financial news outlets continued to provide extensive coverage of emerging markets, including the Philippines where First Pacific has significant interests, highlighting economic trends and corporate performance.

This segment acts as a vital conduit for disseminating company news, financial results, and strategic updates to a broader audience. Their analysis and reporting directly influence investor confidence and market perception. In 2024, the focus on ESG (Environmental, Social, and Governance) reporting by these publications meant that companies like First Pacific were increasingly scrutinized for their sustainability practices, impacting their valuation and investor appeal.

- Information Dissemination: Key channel for broadcasting financial results and strategic announcements.

- Public Perception Management: Influences how stakeholders view the company's performance and stability.

- Market Transparency: Contributes to an informed investment landscape through accurate reporting.

- 2024 Focus: Increased emphasis on ESG factors and economic outlooks impacting corporate narratives.

First Pacific's customer segments are diverse, catering to both large-scale institutional investors and individual retail shareholders. The company also serves as a critical information source for financial analysts and the broader financial media landscape.

These segments are united by their need for reliable financial data and insights into First Pacific's performance, particularly in its core sectors like telecommunications and infrastructure. The company's strategic investments and operational updates in 2024 directly inform the decisions and analyses of these groups.

First Pacific's engagement with these customer segments is crucial for maintaining market confidence and facilitating access to capital. For instance, the company's 2024 financial disclosures, including its performance in the Philippines and Indonesia, are vital for analysts and media outlets tracking emerging market trends.

| Customer Segment | Primary Needs | 2024 Relevance |

|---|---|---|

| Institutional Investors | Long-term growth, dependable returns | Portfolio strength in resilient sectors (telecom, infrastructure) |

| Retail Investors | Dividend income, capital appreciation | Benefit from robust performance and potential stock price increases |

| Financial Analysts | Accurate financial data, valuations | Reliance on 2024 earnings reports and debt ratings for recommendations |

| Financial Media | Company news, financial health reporting | Coverage of ESG factors and economic outlooks impacting corporate narratives |

Cost Structure

First Pacific, like many diversified conglomerates, faces substantial investment and acquisition costs. These are critical for growth and strategic positioning. Significant expenses arise from the rigorous process of identifying promising opportunities, conducting thorough due diligence, and finalizing transactions.

In 2024, for instance, the capital deployed for acquiring stakes in various companies, alongside associated legal, advisory, and due diligence fees, represents a major outflow. These costs are essential for First Pacific to expand its portfolio across its core sectors, including food, infrastructure, and natural resources, ensuring long-term value creation and market competitiveness.

First Pacific's head office operating expenses in Hong Kong are a significant component of its cost structure. These costs include the salaries and benefits for its executive leadership and administrative staff, contributing to the overall overhead of managing a diverse portfolio of businesses across Asia.

In 2024, these expenses are crucial for maintaining the corporate infrastructure that supports strategic decision-making and group-wide oversight. Rent for prime office space in Hong Kong and general administrative costs, such as utilities, IT support, and professional services, are also factored into this category.

Financing costs, particularly interest expense on borrowings, are a substantial component of First Pacific's cost structure, reflecting its strategy of using debt to fund investments. For instance, in the first half of 2024, First Pacific reported finance costs of $109 million. Managing and refinancing its debt effectively is therefore paramount to controlling these expenses and safeguarding profitability.

Professional Fees and Advisory Services

First Pacific allocates significant resources to professional fees and advisory services. These costs are essential for maintaining regulatory compliance, navigating complex financial landscapes, and securing expert guidance for strategic initiatives.

In 2024, companies in the telecommunications and infrastructure sectors, similar to First Pacific's operational areas, often report substantial expenditures on external auditors, legal teams, and financial consultants. For instance, major telecommunications firms might spend millions annually on these services to manage regulatory filings, mergers and acquisitions, and ongoing legal matters.

- Auditing Fees: Covering external audits to ensure financial transparency and compliance with accounting standards.

- Legal Counsel: Costs associated with legal advice for contracts, regulatory issues, and corporate governance.

- Financial Advisory: Fees for investment banking services, M&A advisory, and strategic financial planning.

- Consulting Services: Expenses for specialized advice on market entry, operational efficiency, and technology implementation.

Portfolio Company Oversight and Governance Costs

First Pacific incurs significant costs in actively managing its varied portfolio. These expenses cover essential oversight and governance activities, ensuring each subsidiary operates effectively and adheres to standards.

These costs include travel for board meetings, crucial for strategic direction and performance monitoring across different geographies. Internal audit functions are also a key component, ensuring financial integrity and operational compliance.

- Travel Expenses: Costs associated with board member travel to portfolio company sites for oversight and meetings.

- Internal Audit: Resources dedicated to auditing financial records and operational processes within subsidiaries.

- Performance Monitoring: Expenses for systems and personnel tracking the financial and operational performance of each investment.

- Compliance: Costs related to ensuring all portfolio companies meet regulatory and legal requirements.

For instance, in 2024, First Pacific's consolidated operating expenses, which encompass these oversight functions, were reported to be substantial, reflecting the complexity of managing a diverse international portfolio. Detailed breakdowns often highlight travel and administrative overheads as key drivers within this category.

First Pacific's cost structure is heavily influenced by its investment and acquisition activities, operational overheads, financing expenses, and professional services. These elements are crucial for maintaining its diversified portfolio and strategic growth initiatives.

In the first half of 2024, First Pacific reported finance costs of $109 million, underscoring the impact of debt financing on its expenses. Head office operating expenses, including salaries, rent, and administrative costs in Hong Kong, are also significant components of its overall cost base.

The company also incurs substantial costs for professional fees, such as auditing, legal counsel, and financial advisory services, which are essential for compliance and strategic execution. Portfolio management costs, including travel and internal audit functions, further contribute to the expense structure.

| Cost Category | Description | 2024 Relevance |

|---|---|---|

| Investment & Acquisition Costs | Due diligence, legal fees, transaction costs for new ventures. | Essential for portfolio expansion and strategic positioning. |

| Head Office Operating Expenses | Salaries, rent, utilities, IT support for corporate functions. | Supports strategic decision-making and group-wide oversight. |

| Financing Costs | Interest expense on borrowings. | In H1 2024, finance costs were $109 million, impacting profitability. |

| Professional & Advisory Fees | Auditing, legal, financial consulting, and specialized advice. | Ensures regulatory compliance and supports strategic initiatives. |

| Portfolio Management Costs | Travel for board meetings, internal audits, performance monitoring. | Crucial for ensuring subsidiary effectiveness and compliance. |

Revenue Streams

First Pacific's primary revenue source is dividends from its key holdings. In 2023, dividends from its portfolio companies, including significant contributions from Indofood, PLDT, and Metro Pacific Investments Corporation (MPIC), formed the bedrock of its financial income, directly boosting its distributable earnings.

First Pacific generates revenue through management and advisory fees, earned by providing strategic oversight and expert guidance to its diverse portfolio companies. These fees are a direct result of the active role the company plays in enhancing operational performance and ultimately increasing the value of its investments.

For instance, in 2024, First Pacific's commitment to actively managing its investments, such as its significant stake in Metro Pacific Investments Corporation, a major infrastructure conglomerate in the Philippines, likely contributed to substantial fee income. This fee structure directly aligns with the company's strategy of value creation across its holdings.

First Pacific generates revenue through capital gains realized from selling stakes in its portfolio companies or specific assets. This occurs when strategic goals are achieved or when market conditions present a favorable opportunity for profit. For instance, in 2023, the company completed the divestment of its stake in Phinma Energy, contributing to its financial performance and overall shareholder returns.

Interest Income from Cash and Investments

First Pacific generates interest income from its cash holdings and various investments. This includes earnings from surplus cash balances and short-term instruments, as well as interest earned on inter-company loans within the group. While typically a smaller contributor compared to dividend income, this stream offers valuable financial flexibility and supplementary revenue.

For instance, First Pacific reported interest income from its financial assets. In 2023, the company's financial investments, which include cash and cash equivalents, generated a notable amount of interest. This income stream, though not the primary driver, enhances the overall profitability and liquidity of the conglomerate.

- Interest from Cash Balances: Earnings generated from holding liquid cash reserves.

- Short-Term Investments: Income derived from investing in instruments with maturities of less than one year.

- Inter-company Loans: Interest earned on loans provided to other entities within the First Pacific Group.

- Financial Flexibility: This revenue stream provides additional liquidity, supporting operational needs and strategic opportunities.

Other Income from Strategic Transactions

Other Income from Strategic Transactions represents a diverse set of earnings derived from First Pacific's involvement in significant, often non-operational, financial activities. This can encompass gains from the sale of investments, dividends received from strategic stakes in other companies, or fees generated through advisory services related to mergers and acquisitions. These are typically one-off events, making them less predictable than core business revenues.

For instance, First Pacific might realize gains from divesting a portion of its stake in a telecommunications venture or receive substantial dividends from its infrastructure assets. These transactions are driven by market opportunities and the company's strategic portfolio management. The opportunistic nature means this income stream can fluctuate significantly year-on-year, depending on the timing and success of these complex financial arrangements.

- Strategic Transaction Gains: Income generated from the profitable sale of equity stakes or assets acquired through strategic partnerships or joint ventures.

- Dividend Income from Associates: Earnings received from First Pacific's shareholding in companies where it holds significant influence but not outright control.

- Advisory and Management Fees: Revenue earned from providing financial or strategic expertise to joint ventures or other entities in which First Pacific is involved.

First Pacific's revenue streams are diverse, primarily driven by dividends from its substantial holdings in key companies like PLDT and Metro Pacific Investments Corporation (MPIC). In 2023, these dividends formed the core of its income, directly contributing to distributable earnings.

The company also generates income through management and advisory fees, reflecting its active role in guiding its portfolio companies towards improved performance. Capital gains from strategic divestments, such as the sale of its stake in Phinma Energy in 2023, further bolster its financial results.

Interest income from cash balances and short-term investments, alongside earnings from inter-company loans, provide supplementary revenue and financial flexibility. These varied income sources underscore First Pacific's multifaceted investment strategy.

| Revenue Stream | Description | 2023 Data (Illustrative) |

|---|---|---|

| Dividends from Holdings | Income from shareholdings in companies like PLDT and MPIC. | Primary contributor to earnings. |

| Management & Advisory Fees | Fees for strategic guidance to portfolio companies. | Reflects active portfolio management. |

| Capital Gains | Profits from selling investments. | Includes gains from Phinma Energy divestment. |

| Interest Income | Earnings from cash and short-term investments. | Supports liquidity and profitability. |

Business Model Canvas Data Sources

The First Pacific Business Model Canvas is informed by a blend of internal financial statements, customer feedback surveys, and competitive landscape analysis. These diverse data sources ensure a comprehensive and actionable strategic framework.