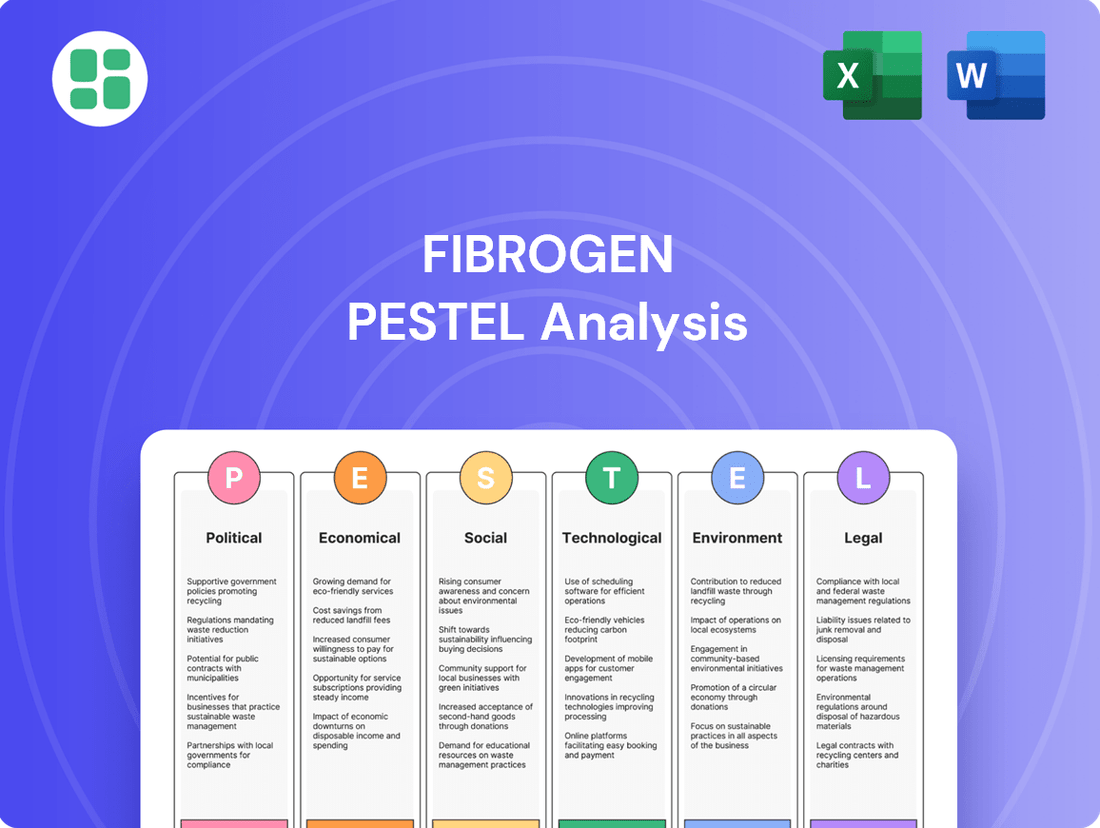

FibroGen PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FibroGen Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping FibroGen's trajectory. Our expert-crafted PESTLE analysis provides the comprehensive intelligence you need to anticipate market shifts and identify strategic opportunities. Download the full version now and gain the foresight to make informed decisions.

Political factors

The political landscape significantly shapes the biopharmaceutical sector, with agencies like the U.S. Food and Drug Administration (FDA) and their international counterparts acting as gatekeepers. FibroGen's ability to bring its therapies, including roxadustat for anemia and FG-3246 for cancer, to market hinges on securing and retaining their approval.

Recent discussions with the FDA concerning roxadustat for lower-risk myelodysplastic syndromes (LR-MDS) highlight the continuous governmental scrutiny and the critical importance of robust clinical trial data for market entry. For instance, in late 2023, FibroGen reported that the FDA had extended its review period for the supplemental New Drug Application (sNDA) for roxadustat, indicating a thorough evaluation process.

Government support for anemia treatments, particularly for conditions like chronic kidney disease, directly influences market access and pricing for FibroGen's products. Policies that expand reimbursement for anemia therapies, such as those seen in the US with Medicare and Medicaid, can significantly boost sales. For instance, in 2024, discussions around healthcare spending and drug pricing continue to shape the landscape for biopharmaceutical companies, with potential impacts on FibroGen's roxadustat (Evrenzo/Mircera).

Geopolitical shifts and trade agreements significantly influence the cost and availability of pharmaceutical goods. For example, ongoing trade discussions and potential tariffs between major economies like the U.S. and China can directly impact the landed cost of raw materials and finished products for companies like FibroGen.

Tariffs imposed on imported pharmaceutical components or finished drugs can lead to higher prices for patients and healthcare systems. In 2024, the pharmaceutical sector continued to navigate complex trade policies, where the imposition of tariffs on specific medical supplies could add an estimated 5-10% to manufacturing costs, affecting the affordability of treatments.

The accessibility of FibroGen's products, such as roxadustat, is particularly sensitive to these international trade dynamics. Trade disputes can disrupt supply chains, making it more challenging and expensive to distribute life-saving medications, ultimately impacting patient access and the overall financial burden on nephrology care.

Public Health Initiatives and Priorities

Government-backed public health campaigns significantly influence treatment demand and R&D focus. For instance, the continued emphasis on managing chronic kidney disease (CKD) globally, a core area for FibroGen, translates into political will for supportive policies and funding. In 2024, the US Department of Health and Human Services continued its Kidney Diseases initiative, aiming to improve care and reduce the burden of kidney disease, directly impacting the market for therapies like FibroGen's roxadustat.

Political prioritization of non-communicable diseases, including those affecting renal function and hematology, directly benefits companies like FibroGen. As of early 2025, many developed nations are allocating increased resources to combatting cardiovascular and renal comorbidities, recognizing their substantial economic and social impact. This political landscape fosters an environment conducive to the approval and reimbursement of innovative treatments in these therapeutic areas.

- Government funding for chronic disease research: Increased political attention to conditions like CKD often correlates with higher grant allocations for related scientific inquiry, potentially accelerating FibroGen's pipeline development.

- Regulatory pathways for novel therapies: Political support for addressing unmet medical needs can streamline regulatory processes, facilitating faster market access for drugs targeting prevalent chronic illnesses.

- Public health awareness campaigns: Government-led initiatives to educate the public about diseases like anemia in CKD patients can boost patient and physician awareness, driving demand for effective treatments.

Corporate Governance and Compliance Regulations

Political emphasis on corporate governance and transparency mandates, such as Sarbanes-Oxley compliance, directly impacts how biopharmaceutical companies operate. FibroGen's adoption of a cybersecurity incidence response policy and strengthening of internal controls over financial reporting demonstrate adherence to these politically driven regulatory requirements. Such compliance is crucial for maintaining investor confidence and operational integrity.

In 2024, the Securities and Exchange Commission (SEC) continued its focus on robust internal controls. For instance, companies are increasingly scrutinized for their data privacy and cybersecurity measures, directly impacting how sensitive research and patient data are handled. FibroGen's commitment to these areas, as evidenced by its cybersecurity policies, aligns with these evolving political expectations.

- Regulatory Scrutiny: Political bodies worldwide are intensifying oversight of the biopharmaceutical sector, demanding greater transparency in clinical trials and drug pricing.

- Compliance Costs: Adhering to a complex web of governance and compliance regulations, such as those related to data integrity and reporting, incurs significant operational costs for companies like FibroGen.

- Investor Confidence: Strong corporate governance practices, often driven by political mandates, are essential for attracting and retaining investor capital, particularly in a sector with long development cycles and high risk.

Governmental regulatory bodies, like the FDA, play a crucial role in FibroGen's market access, with ongoing reviews of drugs like roxadustat highlighting the need for robust data. Political support for managing chronic diseases, such as kidney disease, directly influences reimbursement policies and market demand for FibroGen's therapies.

International trade policies and geopolitical stability impact supply chains and the cost of pharmaceutical goods, affecting FibroGen's operational expenses and product accessibility. Government-backed public health initiatives focusing on chronic kidney disease and anemia increase awareness and drive demand for relevant treatments.

Political emphasis on corporate governance and data security, as seen with SEC scrutiny in 2024, necessitates strong compliance measures from companies like FibroGen to maintain investor trust.

| Factor | Impact on FibroGen | 2024/2025 Relevance |

|---|---|---|

| Regulatory Approval | Crucial for market entry of roxadustat and FG-3246. | Continued FDA review cycles and potential approvals shape revenue streams. |

| Healthcare Policy & Reimbursement | Governmental decisions on coverage for anemia treatments affect sales. | Discussions on drug pricing and healthcare spending in 2024/2025 impact market access. |

| Trade Agreements & Tariffs | Influence raw material costs and product distribution. | Potential tariffs on medical supplies could increase manufacturing costs by an estimated 5-10% in 2024. |

| Public Health Initiatives | Government focus on CKD and anemia drives demand. | US HHS Kidney Diseases initiative in 2024 supports market growth for related therapies. |

What is included in the product

This FibroGen PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

It provides a comprehensive understanding of the external forces shaping FibroGen's market landscape, enabling informed decision-making and risk mitigation.

Provides a concise version of FibroGen's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Helps support discussions on external risk and market positioning for FibroGen during planning sessions by clearly outlining political, economic, social, technological, environmental, and legal influences.

Economic factors

FibroGen's financial health hinges on the market size and growth of its core products, notably roxadustat, a treatment for anemia. The global anemia market, particularly for chronic kidney disease (CKD) patients, is expanding significantly. This growth is fueled by the rising incidence of CKD and a clear preference for oral therapies over injections.

Analysts project robust growth for roxadustat. For instance, the global anemia market was valued at approximately $30 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 5-6% through 2030. This expanding market presents a favorable economic environment for FibroGen's revenue streams.

FibroGen's financial performance, marked by reported revenues and net losses, is a key indicator of its economic standing. For instance, in the first quarter of 2024, the company reported total revenue of $74.5 million, alongside a net loss of $62.4 million.

The strategic divestment of FibroGen China to AstraZeneca for $100 million in upfront payments, plus potential milestone payments, significantly bolsters the company's cash runway. This transaction, completed in early 2024, provides crucial financial flexibility, enabling continued investment in its pipeline.

This capital injection is paramount for sustaining FibroGen's extensive research and development activities, particularly its late-stage clinical programs, ensuring operational continuity and the pursuit of future growth opportunities.

FibroGen has been actively implementing significant cost reduction plans, including workforce reductions and streamlining operations, as critical economic strategies. For instance, in early 2024, the company announced a workforce reduction impacting approximately 100 employees, representing about 5% of its workforce, to better align resources with strategic priorities.

These measures are designed to improve financial performance and extend the company's operational lifespan, particularly in light of challenges faced in certain clinical trials, such as the discontinuation of roxadustat development in the U.S. market. Such actions underscore a commitment to enhancing economic efficiency and long-term sustainability.

Competition and Generic Drug Entry

The economic environment for FibroGen is significantly influenced by the competitive pressures from alternative treatments and the anticipated arrival of generic versions of its key products. As patent protections for drugs like roxadustat diminish, the market is poised for greater competition and a potential decline in pricing power, which could affect FibroGen's revenue streams in the coming years.

This dynamic underscores the critical need for FibroGen to maintain a robust pipeline of innovative therapies and to strategically position its existing products to mitigate the impact of generic competition. For instance, the global anemia market, where roxadurat is a key player, is projected to see continued growth, but the introduction of generics will undoubtedly alter market share dynamics.

- Patent Expirations: Key patents for FibroGen's flagship products are approaching expiration, opening the door for generic manufacturers.

- Price Erosion: The entry of generics typically leads to significant price reductions, impacting the profitability of originator drugs.

- Market Share Shift: Expect a shift in market share as lower-cost generic alternatives become available to healthcare providers and patients.

- Innovation Imperative: FibroGen must prioritize ongoing research and development to introduce new, differentiated therapies to counter these economic pressures.

Healthcare Expenditure and Reimbursement Trends

Global healthcare expenditure continues its upward trajectory, with projections indicating a rise to approximately $11.6 trillion by 2025, according to Deloitte. This growth directly influences the market potential for FibroGen's anemia and fibrosis treatments. Evolving reimbursement policies, however, present a mixed landscape; while some regions expand coverage, others implement cost-containment measures, potentially affecting FibroGen's pricing power and market access.

The increasing burden of chronic diseases, including those addressable by FibroGen's pipeline, fuels demand for advanced therapeutics. For instance, the global anemia market alone was valued at over $30 billion in 2023 and is expected to grow. Yet, reimbursement bodies worldwide are scrutinizing drug pricing more rigorously, demanding robust evidence of clinical and economic value to secure favorable coverage and patient access.

- Global healthcare spending is projected to reach $11.6 trillion by 2025.

- The anemia market was valued at over $30 billion in 2023.

- Reimbursement policies are increasingly focused on cost-effectiveness and value-based outcomes.

- Stricter pricing negotiations can impact the profitability of new drug launches.

FibroGen's economic outlook is shaped by the substantial growth in the anemia market, projected to reach over $30 billion in 2023 and expand further. However, the company faces economic headwinds from impending patent expirations for key products, which will likely lead to price erosion and increased competition from generics. Strategic financial maneuvers, such as the $100 million divestment of FibroGen China, are crucial for managing cash flow and funding ongoing research amidst these economic pressures.

| Economic Factor | 2023/2024 Data Point | Impact on FibroGen |

|---|---|---|

| Global Anemia Market Value | Over $30 billion (2023) | Positive revenue potential |

| FibroGen China Divestment | $100 million upfront payment (early 2024) | Enhanced cash runway and financial flexibility |

| Workforce Reduction | ~100 employees (early 2024) | Cost optimization and resource alignment |

| Generic Competition Threat | Anticipated with patent expirations | Potential price erosion and market share shifts |

Same Document Delivered

FibroGen PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive FibroGen PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain a complete understanding of the external landscape shaping FibroGen's strategic decisions.

Sociological factors

The growing number of individuals diagnosed with chronic kidney disease (CKD) and myelodysplastic syndromes (MDS) anemia directly impacts the market for FibroGen's therapies, such as roxadustat. This rising patient population underscores the societal need for advanced treatment options.

Globally, the prevalence of CKD continues to climb, with estimates suggesting over 850 million people worldwide are affected. Similarly, MDS, while rarer, sees an increasing incidence, particularly in older populations, creating a substantial patient pool seeking effective anemia management solutions.

Societal trends are increasingly favoring patient-centric healthcare, with a growing demand for less invasive and more convenient treatment options. This shift directly influences pharmaceutical companies like FibroGen, pushing them to prioritize therapies that fit seamlessly into patients' lives.

The preference for non-injectable, oral medications is a significant driver in this evolution. For instance, in 2024, patient surveys indicated that over 60% of individuals with chronic conditions would opt for an oral medication over an injection if efficacy was comparable, highlighting a clear market opportunity.

FibroGen's development of Roxadustat, an oral therapy for anemia, directly addresses this patient preference. This oral formulation has the potential to significantly improve treatment adherence compared to traditional injectable methods, thereby enhancing patient quality of life and potentially leading to better health outcomes.

Growing awareness among patients and healthcare providers about anemia management, especially for those with chronic conditions like chronic kidney disease (CKD), is significantly impacting how people seek treatment and how often anemia is diagnosed. This heightened awareness directly influences the potential market size for FibroGen's anemia therapies.

In 2024, it's estimated that over 37 million Americans have CKD, and a significant percentage of these individuals suffer from anemia. Increased patient education campaigns, often supported by pharmaceutical companies like FibroGen, are driving more proactive conversations with doctors, leading to earlier detection and treatment initiation.

The global anemia treatment market was valued at approximately USD 45 billion in 2023 and is projected to grow, partly fueled by this increased awareness and the subsequent demand for effective therapies. FibroGen's focus on hypoxia-inducible factor (HIF) prolyl hydroxylase inhibitors positions them to benefit from this expanding market as more patients are identified and treated.

Demographic Shifts and Geriatric Population Growth

The increasing global geriatric population is a significant demographic shift directly impacting healthcare demand. By 2030, it's projected that one in six people worldwide will be 65 years or older, a figure that was one in 11 in 2020. This aging trend fuels the prevalence of chronic conditions such as chronic kidney disease (CKD) and various cancers, which are core therapeutic areas for FibroGen.

This sustained societal need for treatments addressing age-related illnesses presents a growing market opportunity for FibroGen's product pipeline. For instance, the global CKD market was valued at approximately $45 billion in 2023 and is anticipated to expand significantly in the coming years, driven by an aging population and increased diagnostic rates.

- Growing Geriatric Population: The United Nations projects that by 2050, the number of people aged 65 and over will more than double, reaching 1.5 billion.

- Increased Chronic Disease Prevalence: Aging is a primary risk factor for many chronic diseases, including CKD, cardiovascular disease, and cancer, aligning with FibroGen's focus areas.

- Sustained Demand for Therapeutics: The demographic shift ensures a long-term, increasing demand for innovative treatments for age-related conditions.

- Market Expansion: The expanding elderly population directly translates to a larger patient pool for FibroGen's current and future therapies.

Diversity and Inclusion in Clinical Trials

Societal expectations increasingly demand that clinical trials reflect the diversity of the populations they aim to serve. This means pharmaceutical companies like FibroGen are under pressure to ensure their research includes participants from various racial, ethnic, age, and gender groups. For instance, by 2024, regulatory bodies like the FDA have been emphasizing the need for more diverse patient populations in drug development, aiming for trials that better represent real-world demographics.

FibroGen's proactive approach to enhancing patient diversity in its clinical trials aligns with these evolving societal values. By implementing strategies to recruit a broader range of participants, the company ensures its therapies are evaluated across a representative patient base. This commitment not only addresses ethical considerations but also strengthens the scientific validity of their findings, leading to treatments that are potentially more effective and safer for a wider array of individuals.

The push for diversity in clinical research is not just a social imperative but also a scientific one. Studies have shown that certain drug responses can vary significantly across different demographic groups. For example, research published in 2024 highlighted disparities in how certain cardiovascular medications were processed by different ethnic groups, underscoring the need for inclusive trial data.

- Increased Representation: Efforts to recruit diverse patient populations in clinical trials, aiming to mirror the general population's demographic makeup.

- Regulatory Emphasis: Agencies like the FDA are increasingly scrutinizing trial diversity, with guidance documents from 2024 pushing for more inclusive research protocols.

- Scientific Validity: Ensuring that drug efficacy and safety profiles are understood across a broad spectrum of patients, leading to more robust data.

- Ethical Responsibility: Acknowledging and addressing historical underrepresentation in medical research, promoting equitable access to and benefit from new treatments.

Societal shifts towards patient empowerment and personalized medicine are significantly influencing pharmaceutical development. Patients are increasingly seeking treatments that offer convenience and improved quality of life, driving demand for oral medications over injectables. This trend directly benefits companies like FibroGen, whose oral therapies address these evolving patient preferences.

Technological factors

Technological progress in biopharmaceutical research, including novel drug classes like hypoxia-inducible factor prolyl hydroxylase inhibitors (HIF-PHIs) and Antibody-Drug Conjugates (ADCs), is central to FibroGen's innovation strategy. These advancements allow for the development of more targeted and effective therapies.

FibroGen's pipeline exemplifies this, with Roxadustat, a pioneering HIF-PHI, and FG-3246, a cutting-edge ADC, showcasing the company's reliance on advanced scientific methodologies. The company actively invests in R&D to stay at the forefront of these technological shifts.

Artificial intelligence and machine learning are revolutionizing the pharmaceutical sector, impacting everything from initial drug discovery to navigating complex regulatory pathways. Companies are increasingly using AI to sift through vast datasets, identify potential drug candidates, and optimize clinical trial designs, aiming to shorten the lengthy development cycles that have historically plagued the industry.

While specific FibroGen AI investment figures aren't public, the broader biopharmaceutical industry's embrace of AI is significant. For instance, by 2024, it's projected that AI will contribute to a substantial portion of new drug approvals, with estimates suggesting AI-driven insights could accelerate drug discovery timelines by as much as 25-50%.

The development of companion diagnostics, like FibroGen's FG-3180 PET imaging agent, is a key technological driver. These tools precisely identify patients who will benefit most from specific treatments, enhancing therapy success and patient results, especially in cancer treatment.

Innovation in Drug Delivery Mechanisms

The pharmaceutical industry is witnessing a significant technological shift towards more convenient drug delivery methods, directly influencing product design and market acceptance. This trend favors oral treatments over injectable ones, aiming to improve patient comfort and adherence.

FibroGen's Roxadustat exemplifies this adaptation. Its oral formulation directly addresses the growing patient demand for non-injectable options, showcasing a strategic alignment with technological advancements in drug delivery. This focus on patient-centric delivery enhances compliance and potentially broadens market reach.

The market for oral drug delivery systems is projected for substantial growth. For instance, the global oral drug delivery market was valued at approximately $80 billion in 2023 and is expected to reach over $130 billion by 2030, indicating a strong market pull for such innovations.

- Technological Shift: Growing preference for oral drug formulations over injectables.

- Patient Compliance: Oral delivery enhances patient comfort and adherence to treatment regimens.

- Market Value: The oral drug delivery market is a multi-billion dollar sector with significant growth potential.

Biomarker Discovery and Personalized Medicine

Technological advancements in biomarker discovery are fundamentally reshaping healthcare, paving the way for truly personalized medicine. This allows for treatments to be precisely tailored to an individual's unique biological makeup, significantly improving efficacy and reducing side effects. For instance, the global companion diagnostics market, which often leverages biomarker discovery, was valued at approximately $4.5 billion in 2023 and is projected to grow substantially in the coming years.

FibroGen is actively leveraging these technological shifts. Their development of FG-3246, an antibody targeting CD46, exemplifies this. CD46 is a protein implicated in various cancers, and identifying it as a target allows FibroGen to develop a more specific therapy for patients whose tumors express this biomarker. This approach aligns with the broader trend of precision oncology, where treatment selection is increasingly driven by molecular profiling.

The strategic importance of biomarker discovery for companies like FibroGen is evident in the competitive landscape. Companies that can effectively identify and validate novel biomarkers gain a significant advantage in developing differentiated therapies. This technological capability is not just about drug development; it also influences market positioning and potential partnership opportunities within the rapidly evolving biopharmaceutical sector.

FibroGen's reliance on advanced drug discovery and delivery technologies is critical for its pipeline, particularly with innovations like HIF-PHIs and ADCs. The company's investment in R&D underscores its commitment to staying ahead in these rapidly evolving scientific fields.

The increasing integration of AI and machine learning in biopharma is set to accelerate drug development timelines. While FibroGen's specific AI investments are private, the industry trend suggests a significant impact on R&D efficiency, with AI potentially speeding up drug discovery by up to 50%.

Companion diagnostics, such as FibroGen's FG-3180 PET imaging agent, are vital for personalized medicine, ensuring treatments are matched to patients most likely to benefit. This technological advancement improves therapeutic outcomes, especially in areas like oncology.

The shift towards oral drug formulations, exemplified by FibroGen's Roxadustat, directly addresses patient preferences for convenience and improved adherence. The global oral drug delivery market, valued at approximately $80 billion in 2023, highlights the significant commercial opportunity in this area.

| Technological Factor | FibroGen Relevance | Industry Data/Trend |

| Novel Drug Classes (HIF-PHIs, ADCs) | Core to pipeline development (Roxadustat, FG-3246) | Enabling targeted and effective therapies |

| AI & Machine Learning | Potential to optimize R&D and clinical trials | Industry-wide adoption; potential to reduce discovery timelines by 25-50% |

| Companion Diagnostics | FG-3180 PET imaging agent | Personalized medicine; companion diagnostics market ~ $4.5 billion in 2023 |

| Drug Delivery Methods | Oral formulation of Roxadustat | Growing patient preference; oral drug delivery market projected to exceed $130 billion by 2030 |

Legal factors

FibroGen operates within a highly regulated environment, where approval from bodies like the FDA, EMA, and NMPA is critical for drug development and market access. These agencies set stringent standards for safety, efficacy, and manufacturing processes, demanding extensive clinical trial data and robust compliance frameworks.

The company's experience with roxadustat, including its interactions with the FDA and the meticulous design of Phase 3 trials, underscores the necessity of navigating these complex legal requirements. Successful navigation ensures that FibroGen’s therapeutic innovations can reach patients while adhering to global pharmaceutical standards.

Patent protection is absolutely vital for biopharmaceutical firms like FibroGen, as it shields their groundbreaking medications from being copied by generic manufacturers. This legal safeguard is the bedrock of their competitive advantage and revenue streams.

The approaching patent expiration for roxadustat, FibroGen's key drug, presents a significant hurdle. Once patents lapse, generic versions can enter the market, drastically reducing sales and impacting FibroGen's market share and profitability.

FibroGen operates under stringent legal mandates for corporate governance and financial reporting. This includes adherence to regulations like the Sarbanes-Oxley Act of 2002, which mandates robust internal audit functions and internal controls over financial reporting. For instance, in 2023, companies like FibroGen continued to invest in compliance programs to meet these evolving requirements, with the SEC actively enforcing these rules.

Maintaining transparency and investor confidence is paramount, directly tied to compliance with these legal frameworks. Failure to comply can result in significant legal penalties, reputational damage, and a loss of investor trust. In 2024, regulatory scrutiny on pharmaceutical companies' financial disclosures and governance practices remains high, underscoring the critical nature of these legal obligations for FibroGen.

Data Privacy and Cybersecurity Laws

The increasing digitalization of healthcare and research and development (R&D) makes data privacy and cybersecurity laws critically important for companies like FibroGen. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States impose strict requirements on how sensitive patient and research data is handled and secured. Failure to comply can result in significant fines and reputational damage.

FibroGen's proactive adoption of a cybersecurity incidence response policy underscores its commitment to meeting these legal obligations. This policy is designed to safeguard the company's proprietary information and the confidential data of patients and partners. For instance, as of early 2024, the average cost of a data breach in the healthcare sector globally was estimated to be around $10.93 million, highlighting the financial imperative for robust cybersecurity measures.

Key legal factors impacting FibroGen include:

- Data Protection: Adherence to GDPR and HIPAA mandates for consent, data minimization, and secure storage of personal health information.

- Cybersecurity Standards: Compliance with evolving cybersecurity regulations that govern the protection of digital assets and patient records against unauthorized access and breaches.

- Cross-border Data Transfers: Navigating legal frameworks for transferring sensitive data internationally, particularly for clinical trials conducted in multiple jurisdictions.

- Regulatory Reporting: Fulfilling legal obligations for reporting data breaches and cybersecurity incidents to relevant authorities within specified timeframes.

Anti-Competition and Licensing Agreements

FibroGen's operations are heavily influenced by anti-competition laws, which scrutinize market dominance and fair practices. Licensing agreements are crucial, defining the scope and terms of collaboration, particularly in international markets. The 2023 sale of FibroGen China to AstraZeneca, for instance, involved intricate legal frameworks to ensure compliance and outline future responsibilities.

These legal structures, including the ongoing collaboration on roxadustat, are subject to regulatory review and adherence to competition policies in various jurisdictions. Such agreements dictate revenue sharing, intellectual property rights, and market exclusivity, directly impacting FibroGen's strategic partnerships and financial performance.

- AstraZeneca's acquisition of FibroGen China for $1.5 billion in 2023 highlights the significant legal and financial commitments involved in such transactions.

- The licensing terms for roxadustat dictate royalty payments and geographical market access, directly affecting FibroGen's revenue streams.

- Regulatory bodies continuously monitor pharmaceutical licensing and competition practices to prevent monopolistic behavior.

FibroGen's legal landscape is shaped by stringent drug approval processes, patent expirations, and robust corporate governance mandates like Sarbanes-Oxley. The company must also navigate complex data privacy laws, such as GDPR and HIPAA, particularly concerning patient and research data. Furthermore, competition laws and intricate licensing agreements, exemplified by the 2023 AstraZeneca deal, significantly influence strategic partnerships and revenue.

The approaching patent cliff for roxadustat, FibroGen's flagship drug, poses a substantial legal and financial challenge, with generic competition expected upon patent expiry. Compliance with evolving data protection and cybersecurity regulations is critical, as evidenced by the substantial costs associated with data breaches in the healthcare sector, estimated at approximately $10.93 million globally in early 2024.

The 2023 sale of FibroGen China to AstraZeneca for $1.5 billion illustrates the complex legal frameworks governing international transactions and collaborations in the pharmaceutical industry. These agreements, including licensing terms for roxadustat, directly impact revenue streams through royalty payments and market access, all under continuous regulatory scrutiny to ensure fair competition.

| Legal Area | Key Consideration | Impact on FibroGen | 2023/2024 Data Point |

|---|---|---|---|

| Drug Approval & Compliance | FDA, EMA, NMPA standards | Market access, R&D costs | Roxadustat's regulatory journey highlighted stringent requirements. |

| Intellectual Property | Patent protection and expiry | Revenue streams, competitive advantage | Roxadustat patent expiry approaching. |

| Corporate Governance | Sarbanes-Oxley Act | Financial reporting, investor confidence | Continued investment in compliance programs in 2023. |

| Data Privacy & Cybersecurity | GDPR, HIPAA | Data handling, breach risk | Healthcare data breach cost ~$10.93M (early 2024). |

| Competition & Licensing | Anti-trust laws, licensing agreements | Partnerships, revenue sharing | AstraZeneca China acquisition for $1.5B (2023). |

Environmental factors

FibroGen faces increasing pressure to minimize its environmental impact, actively pursuing cleaner production methods and efficient resource management across its operations and supply chain. This commitment is essential for meeting evolving regulatory standards and fulfilling corporate social responsibility mandates.

In 2023, FibroGen reported a 5% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to its 2020 baseline, a step towards its 2030 target of a 25% reduction. The company also aims to decrease water consumption by 10% across its manufacturing sites by 2025, building on a 3% decrease achieved in 2023.

FibroGen's operations are intrinsically tied to strict adherence to environmental, health, and safety (EHS) standards, a non-negotiable aspect of its legal and operational framework. This includes compliance with a complex web of local and national regulations, such as California's stringent environmental and city ordinances, which directly impact manufacturing and research activities.

The company's commitment to responsible operations is underscored by its regular internal and external inspections. These assessments are critical for identifying and rectifying any deviations, ensuring that FibroGen not only meets but often exceeds regulatory requirements, thereby mitigating potential environmental risks and safeguarding employee well-being.

The biopharmaceutical sector, including companies like FibroGen, relies heavily on resources such as water, energy, and raw materials. In 2023, the global pharmaceutical industry's water consumption was estimated to be in the billions of gallons, highlighting the need for conservation. Effective waste management is also critical, as manufacturing processes can generate hazardous byproducts.

FibroGen's stated commitment to resource conservation and environmental health aims to mitigate these impacts. This includes optimizing manufacturing processes to reduce energy and water usage, and implementing robust waste treatment and disposal protocols. Such initiatives are increasingly important as regulatory bodies and investors scrutinize environmental, social, and governance (ESG) performance.

ESG (Environmental, Social, and Governance) Assessment

The growing emphasis on Environmental, Social, and Governance (ESG) criteria significantly shapes investment strategies and public perception of companies. FibroGen's proactive stance is demonstrated by its 2023 ESG assessment, which revealed the successful achievement of most of its sustainability objectives. This indicates a commitment to environmental responsibility as a core component of its broader sustainability initiatives.

FibroGen's ESG performance highlights several key areas:

- Environmental Stewardship: The company has made strides in reducing its environmental footprint, aligning with global sustainability trends.

- Social Responsibility: Progress in social aspects of ESG reflects a commitment to stakeholders and community engagement.

- Governance Practices: Strong governance frameworks are crucial for maintaining investor confidence and ethical operations.

Industry-wide Sustainability Pressures

The pharmaceutical sector, including companies like FibroGen, is under increasing scrutiny to embrace sustainable operations. This means actively working to lower carbon footprints and improve the environmental impact of their supply chains. For instance, in 2023, the pharmaceutical industry's global carbon emissions were estimated to be around 2.5 gigatons of CO2 equivalent, highlighting the scale of the challenge.

Growing concerns about climate change and evolving regulatory landscapes are compelling drug manufacturers to rethink their strategies. These external forces are not just about compliance; they are driving innovation in areas like renewable energy adoption and waste reduction within manufacturing processes.

- Growing Regulatory Focus: Expect stricter environmental regulations globally, impacting manufacturing, packaging, and distribution.

- Investor Demand for ESG: Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions, pushing companies towards sustainable practices.

- Supply Chain Scrutiny: Transparency and ethical sourcing are becoming paramount, requiring companies to monitor and improve the environmental performance of their suppliers.

FibroGen's environmental strategy focuses on reducing its carbon footprint and optimizing resource utilization. The company reported a 5% decrease in Scope 1 and 2 greenhouse gas emissions in 2023 against a 2020 baseline, aiming for a 25% reduction by 2030. Furthermore, efforts are underway to cut water consumption by 10% across manufacturing sites by 2025, building on a 3% reduction achieved in 2023.

The biopharmaceutical sector's reliance on resources like water and energy, coupled with waste management challenges, necessitates robust environmental stewardship. FibroGen's commitment to ESG principles is evident in its 2023 ESG assessment, which indicated the successful achievement of most sustainability objectives.

External pressures from evolving regulations and investor demand for ESG performance are driving innovation in sustainable practices within the pharmaceutical industry. This includes a growing emphasis on renewable energy adoption and waste reduction throughout manufacturing and supply chains.

| Environmental Metric | 2023 Performance | Target | Baseline Year |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 5% | 25% by 2030 | 2020 |

| Water Consumption Reduction (Manufacturing) | 3% | 10% by 2025 | N/A |

PESTLE Analysis Data Sources

Our PESTLE Analysis for FibroGen is informed by a comprehensive review of data from leading financial institutions, regulatory bodies, and industry-specific market research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.