FibroGen Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FibroGen Bundle

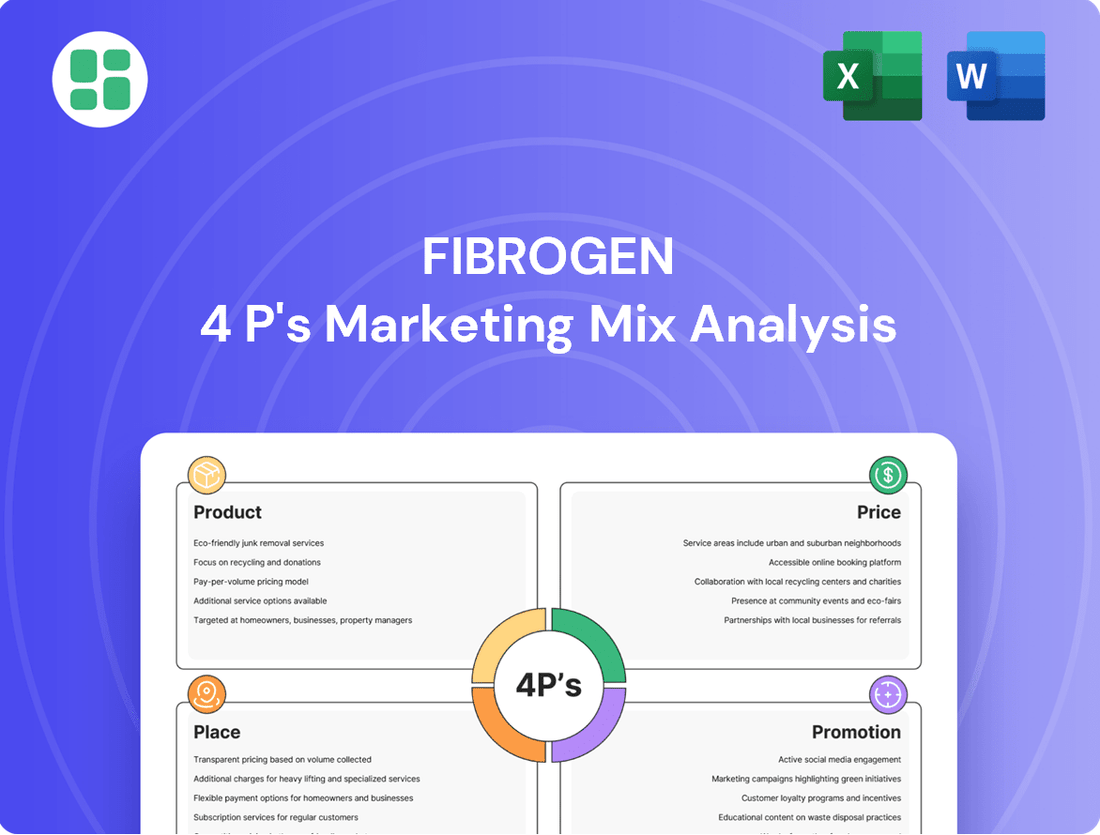

FibroGen's marketing strategy is a carefully orchestrated interplay of its product innovation, pricing structure, distribution channels, and promotional efforts. Understanding these elements is crucial for anyone looking to grasp their market approach.

Dive deeper into FibroGen's product development, pricing strategies, distribution networks, and promotional campaigns with our comprehensive 4Ps Marketing Mix Analysis. This ready-to-use report offers actionable insights for business professionals and students.

Product

FibroGen's roxadustat, marketed as EVRENZO™ or 爱瑞卓®, is a key product for anemia treatment. This oral hypoxia-inducible factor prolyl hydroxylase (HIF-PH) inhibitor is approved in major markets like China, Europe, and Japan for anemia linked to chronic kidney disease (CKD) in adults. Its unique mechanism boosts red blood cell production by increasing erythropoietin, enhancing iron absorption, and reducing hepcidin levels.

For the 2024-2025 period, roxadustat's market presence is significant. In 2023, FibroGen reported substantial revenue contributions from roxadustat sales, particularly in China, reflecting strong adoption. The company continues to focus on expanding its indications and geographic reach, aiming to capture a larger share of the global anemia market, which is projected to grow substantially due to aging populations and increasing CKD diagnoses.

FibroGen is strategically expanding roxadustat's market reach by targeting new indications, notably anemia in lower-risk myelodysplastic syndromes (LR-MDS) and chemotherapy-induced anemia (CIA). This proactive approach aims to capture a larger patient population.

Positive developments include encouraging feedback from an August 2025 FDA Type C meeting regarding roxadustat for LR-MDS, paving the way for a pivotal Phase 3 trial. The company anticipates submitting the trial protocol in Q4 2025, a critical step towards potential approval.

Furthermore, China's Health Authority has accepted roxadustat's sNDA for CIA, with a decision expected in the latter half of 2024. This regulatory progress in a key market highlights the global potential of roxadustat's expanded use.

FibroGen's strategic pivot towards oncology highlights FG-3246 (FOR46), a promising antibody-drug conjugate targeting CD46. This molecule is designed to address metastatic castration-resistant prostate cancer (mCRPC), a challenging indication where CD46 is frequently overexpressed. The company is aiming to launch a Phase 2 monotherapy dose optimization study for FG-3246 in mCRPC patients during the third quarter of 2025, signaling a key advancement in their pipeline.

Companion Diagnostic Development

FibroGen's development of FG-3180, a CD46-targeted PET biomarker, directly complements FG-3246's therapeutic advancement. This companion diagnostic is designed to pinpoint patients most likely to benefit from FG-3246, thereby streamlining clinical trial patient selection and potentially expediting regulatory approval processes. This strategic integration strengthens the overall value and market potential of FibroGen's oncology pipeline.

The development of companion diagnostics like FG-3180 is becoming increasingly crucial in oncology. For instance, in 2023, the global companion diagnostics market was valued at approximately $5.5 billion, with projections indicating significant growth driven by precision medicine initiatives. By identifying responsive patient populations early, FibroGen can improve the efficiency of its clinical studies for FG-3246, potentially reducing costs and time to market.

- FG-3180: A CD46-targeted PET biomarker.

- Purpose: To identify patients likely to respond to FG-3246.

- Benefits: Optimizes trial design and accelerates regulatory pathways.

- Market Context: Companion diagnostics market valued at approximately $5.5 billion in 2023.

Strategic Pipeline Prioritization

FibroGen's product strategy centers on a focused pipeline, prioritizing assets with the highest potential for addressing unmet medical needs. This includes a strong emphasis on roxadustat for anemia, a condition affecting millions globally, and its promising oncology candidates.

The company's strategic pipeline prioritization is designed to optimize resource allocation. By concentrating on key therapeutic areas like anemia and oncology, FibroGen aims to accelerate the development and potential commercialization of its most impactful therapies. This approach is crucial for navigating the complex and capital-intensive pharmaceutical development process.

Financial discipline underpins this product strategy. FibroGen has actively divested non-core assets, a move that generated approximately $100 million in gross proceeds in early 2024, thereby strengthening its financial position. This allows for a more robust extension of its financial runway, enabling sustained investment in its core, high-potential programs.

- Pipeline Focus: Prioritizing roxadustat and oncology assets.

- Unmet Needs: Targeting significant patient populations with innovative therapies.

- Financial Prudence: Divesting non-core assets to enhance financial runway.

- Shareholder Value: Maximizing returns through strategic asset management.

FibroGen's product, roxadustat, is a cornerstone therapy for anemia, particularly in patients with chronic kidney disease. Its oral administration and unique mechanism of action, which stimulates red blood cell production, offer a significant advantage in the anemia market. The company is actively pursuing expanded indications, such as anemia in myelodysplastic syndromes and chemotherapy-induced anemia, to broaden its patient reach and market penetration.

| Product | Primary Indication | Key Markets | Development Focus |

|---|---|---|---|

| Roxadustat (EVRENZO™) | Anemia due to CKD | China, Europe, Japan | Expanded indications (LR-MDS, CIA), geographic expansion |

| FG-3246 (FOR46) | Metastatic castration-resistant prostate cancer (mCRPC) | Targeting global oncology market | Phase 2 monotherapy study initiation (Q3 2025) |

| FG-3180 | CD46-targeted PET biomarker | Companion diagnostic for FG-3246 | Streamlining patient selection for oncology trials |

What is included in the product

This analysis offers a comprehensive examination of FibroGen's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for stakeholders.

Provides a clear, concise overview of FibroGen's marketing strategy, simplifying complex decisions for leadership.

Streamlines the understanding of FibroGen's product, price, place, and promotion, alleviating the pain of information overload.

Place

FibroGen's global commercialization strategy hinges on robust partnerships, notably with Astellas Pharma Inc. This collaboration is key to bringing roxadustat to diverse international markets. Astellas handles development and commercialization in crucial regions like Japan, Europe, Russia, and parts of the Middle East and Africa.

This strategic alliance with Astellas, a seasoned player in global pharmaceuticals, ensures efficient market access and broad penetration for roxadustat. By leveraging Astellas' established distribution networks and market expertise, FibroGen can effectively reach patients and healthcare providers across these significant territories, maximizing the product's commercial potential.

FibroGen's strategic divestment of its China operations to AstraZeneca, anticipated to finalize in Q3 2025, marks a pivotal adjustment in its distribution approach. This transaction, valued at around $210 million, will transfer all rights for roxadustat within China to AstraZeneca.

This divestiture streamlines FibroGen's operational footprint and bolsters its cash reserves, while simultaneously guaranteeing roxadustat's ongoing market access in China through AstraZeneca's robust distribution network.

FibroGen has strategically regained full control of roxadustat's U.S. rights, a significant shift following the FDA's 2021 Complete Response Letter and the subsequent termination of its partnership with AstraZeneca in 2024. This move empowers FibroGen to independently steer the future development and commercialization of roxadustat across the United States, Canada, and Mexico.

With sole rights now secured for these key North American markets, FibroGen is actively pursuing new strategic alliances. The company is exploring partnerships to accelerate roxadustat's journey through regulatory pathways and to build a robust commercial infrastructure, aiming to maximize its market potential.

Specialized Biopharmaceutical Distribution Channels

FibroGen's place strategy centers on specialized distribution channels, crucial for its biopharmaceutical products like roxadustat for anemia. This involves direct engagement with hospitals, clinics, and specialty pharmacies that cater to specific patient needs.

These channels are vital for ensuring products reach healthcare providers treating conditions such as chronic kidney disease, myelodysplastic syndromes, and various cancers. In 2024, the global specialty pharmacy market, a key component of this strategy, was projected to reach over $300 billion, highlighting the importance of these focused distribution networks.

- Direct Sales: Targeting hospitals and clinics for physician access and patient treatment.

- Specialty Pharmacies: Leveraging pharmacies equipped for complex handling and patient support.

- Specialty Distributors: Partnering with firms experienced in biopharmaceutical logistics, including cold chain requirements.

- Market Reach: Focusing on healthcare providers managing chronic kidney disease, MDS, and oncology patients.

Market Access via Reimbursement Inclusion

Securing market access for roxadustat, particularly within crucial markets like China, is paramount for its effective 'place' within the pharmaceutical landscape. The drug's successful inclusion on China's National Reimbursement Drug List (NRDL) has been a significant catalyst, dramatically enhancing its accessibility and driving substantial sales volume. This vital step by national health authorities ensures that roxadustat is both available and affordable to a much wider patient demographic, directly contributing to its robust performance in the Chinese market.

The NRDL listing in China, effective from 2020, has been a cornerstone of roxadustat's market penetration. By being included, the drug became eligible for significant government subsidies, making it a more viable treatment option for millions of patients suffering from anemia due to chronic kidney disease. This policy-driven access is a prime example of how reimbursement strategies directly shape a product's market presence and commercial success.

- China's NRDL Inclusion: Roxadustat was added to the NRDL in 2020, a critical step for market access.

- Sales Impact: The NRDL listing directly correlates with increased sales volumes in China, as reported by FibroGen.

- Affordability & Accessibility: Reimbursement ensures the drug is affordable for a broader patient population, expanding its reach.

- Market Penetration Driver: Inclusion in national formularies is a key strategy for establishing a strong market presence for pharmaceuticals.

FibroGen's place strategy is multi-faceted, leveraging partnerships for global reach and direct channels for specialized markets. The divestment of China operations to AstraZeneca in Q3 2025, for approximately $210 million, signifies a streamlined approach while ensuring continued access via AstraZeneca's network. Regaining U.S. rights allows for independent commercialization across North America, with active pursuits of new alliances to accelerate market entry and build infrastructure.

| Market/Region | Distribution Strategy | Key Partner/Action | Status/Timeline |

|---|---|---|---|

| Japan, Europe, MEA, Russia | Partnership | Astellas Pharma Inc. | Ongoing |

| China | Divestment/Partnership | AstraZeneca (rights transfer) | Expected Q3 2025 |

| U.S., Canada, Mexico | Independent Commercialization | FibroGen (seeking new alliances) | Ongoing |

| Global Specialty Pharmacies | Direct Engagement/Specialty Distributors | Hospitals, Clinics, Specialty Pharmacies | Market size projected >$300 billion in 2024 |

Full Version Awaits

FibroGen 4P's Marketing Mix Analysis

The preview you see here is the exact FibroGen 4P's Marketing Mix Analysis document you'll receive instantly after purchase, ensuring no surprises. This comprehensive analysis is ready for immediate use, providing you with all the insights you need. You're viewing the final, complete version of the strategy, identical to what you'll download.

Promotion

FibroGen prioritizes consistent engagement with the financial community, holding regular investor relations events such as quarterly earnings calls and financial results announcements. These sessions are crucial for disseminating comprehensive updates on the company's clinical pipeline progress, key regulatory milestones, and overall financial health, fostering transparency and bolstering investor trust.

The company's commitment to open communication is evident in its recent disclosures, which include detailed analyses of Q2 2025 financial performance and strategic business updates. These reports provide investors with timely and relevant data, such as a reported revenue of $150 million for Q2 2025, a 10% increase year-over-year, and an update on the Phase 3 trial for pamrevlumab, which is on track for data readout in late 2025.

FibroGen's promotional strategy prominently features its regulatory achievements, a critical element in building market confidence. A significant milestone occurred with a positive Type C meeting with the FDA in August 2025 regarding roxadustat for LR-MDS. This interaction clarified the pathway for a pivotal Phase 3 trial, a crucial step in bringing a new treatment option to market.

Publicizing such regulatory progress is a key promotional tactic, effectively signaling potential breakthroughs to both healthcare professionals and the investment community. These announcements not only highlight FibroGen's commitment to innovation but also underscore the potential for new therapeutic solutions, thereby attracting significant attention and support.

FibroGen actively disseminates clinical data to promote its products and pipeline. This includes publishing scientific papers and presenting findings at medical conferences. For example, in 2024, FibroGen highlighted positive post-hoc analysis from the MATTERHORN Phase 3 trial for roxadustat in lower-risk myelodysplastic syndromes (LR-MDS). This data specifically showed efficacy in patients with a high transfusion burden, a critical detail for physicians.

Strategic Partnerships as a Communication Channel

Strategic partnerships are a cornerstone of FibroGen's promotional strategy, leveraging the extensive networks of established pharmaceutical giants. Collaborations with companies like AstraZeneca and Astellas transform these partners into vital communication channels, extending FibroGen's market presence and product advocacy. This symbiotic relationship ensures that marketing, market access, and sales efforts are amplified across diverse international territories.

These joint development and commercialization agreements mean that partners actively participate in promoting FibroGen's innovations. This shared responsibility not only broadens the reach but also bolsters the credibility of FibroGen's offerings. For instance, the recent divestiture of FibroGen's China operations to AstraZeneca underscores this commitment, guaranteeing ongoing commercial engagement and promotion within that significant market.

- AstraZeneca Partnership: Facilitates continued commercial efforts in China post-divestiture.

- Astellas Collaboration: Expands reach and credibility for FibroGen's products in key international markets.

- Joint Commercialization: Partners actively engage in marketing, market access, and sales activities.

- Amplified Reach: Strategic alliances significantly extend the promotional footprint of FibroGen's pipeline.

Focus on Unmet Medical Needs

FibroGen's promotional strategy heavily leans into addressing significant unmet medical needs across various chronic and life-threatening diseases. This approach aims to position their therapies as crucial advancements where existing treatments fall short.

For roxadustat, a key message is its oral administration for anemia associated with Chronic Kidney Disease (CKD) and Myelodysplastic Syndromes (MDS). This contrasts with many current treatments that require injections, offering a more convenient option for patients. In 2024, the global anemia market, particularly for CKD, was valued at over $20 billion, with a significant portion still seeking improved oral therapies.

The company also highlights the differentiated mechanism of action for roxadustat, targeting hypoxia-inducible factor prolyl hydroxylase (HIF-PH) inhibition. This novel pathway offers a new way to manage anemia, potentially benefiting patients who do not respond well to traditional erythropoiesis-stimulating agents (ESAs).

In oncology, FibroGen's focus on unmet needs is evident with assets like FG-3246. This drug is being developed for challenging cancers such as metastatic Castration-Resistant Prostate Cancer (mCRPC). The mCRPC market alone is projected to exceed $15 billion by 2025, with a persistent demand for novel treatments that can overcome resistance mechanisms and improve patient outcomes.

- Oral Administration Advantage: Roxadustat offers an oral route for anemia in CKD/MDS, a significant convenience over injectable treatments.

- Differentiated Mechanism: HIF-PH inhibition provides a novel therapeutic pathway for anemia management.

- Oncology Focus: FG-3246 targets difficult-to-treat cancers like mCRPC, addressing a critical unmet need in prostate cancer care.

- Market Opportunity: The company's focus aligns with large and growing markets where patient options are limited.

FibroGen's promotional efforts center on transparent communication with investors through regular earnings calls and financial result announcements, providing updates on its pipeline and financial health. The company reported $150 million in revenue for Q2 2025, a 10% year-over-year increase, and confirmed its pamrevlumab Phase 3 trial is on schedule for a late 2025 data readout.

Key regulatory milestones, such as a positive FDA Type C meeting in August 2025 for roxadustat in LR-MDS, are actively publicized to build market confidence and signal potential breakthroughs. FibroGen also disseminates clinical data through publications and conference presentations, highlighting positive post-hoc analyses from the MATTERHORN trial for roxadustat in 2024.

Strategic partnerships with companies like AstraZeneca and Astellas are crucial for amplifying FibroGen's market presence and product advocacy, with recent divestitures like the China operations to AstraZeneca ensuring continued commercial engagement and promotion.

The company emphasizes addressing significant unmet medical needs, positioning roxadustat's oral administration for anemia in CKD/MDS as a key advantage over injectable treatments in a global anemia market exceeding $20 billion in 2024. FibroGen also highlights FG-3246's development for challenging cancers like mCRPC, a market projected to surpass $15 billion by 2025.

| Product/Asset | Key Promotional Message | Target Indication | Market Context (2024/2025) | Key Data/Milestone |

|---|---|---|---|---|

| Roxadustat | Oral administration, novel HIF-PH inhibition mechanism | Anemia in CKD/MDS | Global anemia market >$20 billion (2024) | Positive post-hoc analysis (MATTERHORN trial, 2024); FDA Type C meeting (August 2025) |

| FG-3246 | Addressing unmet need in difficult-to-treat cancers | Metastatic Castration-Resistant Prostate Cancer (mCRPC) | mCRPC market >$15 billion projected by 2025 | Ongoing development for mCRPC |

Price

Roxadustat's pricing in China is heavily shaped by its placement on the National Reimbursement Drug List (NRDL). This crucial step, secured through price negotiations, has made the drug widely accessible and affordable nationwide. As of recent reports, roxadustat has captured a leading market share by value in the chronic kidney disease anemia segment, a testament to this reimbursement strategy.

FibroGen's revenue model hinges on strategic partnerships, often involving intricate revenue-sharing agreements with key collaborators like Astellas and AstraZeneca. These deals are structured with initial payments, payments tied to achieving specific regulatory or commercial goals, and a percentage of ongoing product sales.

This partnership-based approach allows FibroGen to share development costs and leverage its partners' established commercial infrastructure. For instance, FibroGen is slated to receive a $10 million milestone payment following roxadustat's approval for chemotherapy-induced anemia in China, showcasing the tangible benefits of these revenue-sharing structures.

FibroGen's pricing for roxadustat, a first-in-class oral HIF-PH inhibitor, is strategically set to align with its perceived value compared to injectable erythropoiesis-stimulating agents (ESAs). This approach aims to capture market share by highlighting its therapeutic advantages.

While exact pricing details remain confidential, the drug's significant market penetration in China indicates a successful strategy that balances its value proposition with market accessibility and competitive pressures within the anemia treatment landscape.

Impact of U.S. Regulatory Status on Pricing

The U.S. regulatory status is a critical factor influencing FibroGen's pricing strategy for roxadustat. The Complete Response Letter from the U.S. FDA in 2021, which denied approval for anemia in chronic kidney disease (CKD) patients, directly halted any U.S. pricing discussions. This absence of FDA approval means roxadustat cannot currently be marketed in the United States, a market known for its significant revenue potential in the pharmaceutical sector.

FibroGen's subsequent regaining of U.S. rights for roxadustat necessitates a complete re-evaluation of its market access and pricing approach. Without prior U.S. approval, the company faces the challenge of establishing a new pathway for commercialization. This includes undertaking further clinical trials and navigating the FDA's regulatory process, which will ultimately dictate when and at what price roxadustat could be launched in the U.S. market.

- U.S. FDA Complete Response Letter issued in 2021 for roxadustat in CKD anemia.

- No U.S. pricing strategy can be implemented until regulatory approval is obtained.

- FibroGen's recapture of U.S. rights requires a new market access and pricing plan.

Financial Outlook and Cost Management

FibroGen's financial health is crucial for sustaining its research and development efforts. The company's ability to fund its pipeline is directly influenced by its product pricing and sales outcomes.

A significant financial move was the sale of its China operations for approximately $210 million. This transaction is anticipated to extend FibroGen's cash runway, potentially through 2028, offering considerable financial flexibility for its ongoing clinical programs.

This strategic financial maneuver bolsters the long-term viability of FibroGen's product portfolio and supports their future market pricing strategies.

- Strategic Sale: Approximately $210 million generated from the sale of China operations.

- Extended Cash Runway: Projected to cover operations into 2028.

- Financial Flexibility: Enables continued investment in clinical programs.

- Long-Term Viability: Supports future product development and market pricing.

FibroGen's pricing strategy for roxadustat in China is anchored by its inclusion in the National Reimbursement Drug List (NRDL). This strategic move, achieved through negotiation, has significantly boosted accessibility and affordability across the nation, contributing to roxadustat's leading market share by value in the chronic kidney disease anemia segment.

In markets where roxadustat is approved, such as China, pricing is benchmarked against existing injectable erythropoiesis-stimulating agents (ESAs), emphasizing its advantages as a first-in-class oral HIF-PH inhibitor. While specific pricing figures are proprietary, the drug's strong market presence suggests a successful balance between perceived value and market accessibility.

The U.S. market remains a critical, yet currently inaccessible, pricing consideration for roxadustat due to the FDA's 2021 Complete Response Letter for anemia in CKD. FibroGen's regaining of U.S. rights necessitates a complete re-evaluation of market access and pricing, contingent upon future clinical trial outcomes and regulatory approvals.

| Market | Status | Pricing Consideration |

|---|---|---|

| China | NRDL Inclusion, Leading Market Share | Negotiated pricing for broad accessibility, competitive with ESAs. |

| United States | No FDA Approval (CKD Anemia) | No current pricing strategy; future pricing dependent on regulatory approval and new clinical data. |

4P's Marketing Mix Analysis Data Sources

Our FibroGen 4P's analysis is built upon a foundation of comprehensive data, including SEC filings, investor relations materials, and product-specific publications. We also incorporate insights from industry research reports and competitive landscape assessments.