FibroGen Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FibroGen Bundle

FibroGen faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers playing crucial roles in its market landscape. Understanding these dynamics is key to navigating the biopharmaceutical industry.

The complete report reveals the real forces shaping FibroGen’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

FibroGen, like many biopharmaceutical firms, depends on a select group of suppliers for critical components such as active pharmaceutical ingredients (APIs) and specialized manufacturing services. The highly technical and regulated nature of these inputs often restricts the pool of qualified providers.

This scarcity means that these specialized suppliers, particularly those capable of handling complex biologics or novel chemical synthesis, possess considerable leverage. For instance, in 2024, the global market for contract development and manufacturing organizations (CDMOs) specializing in biologics was estimated to be worth over $20 billion, with a significant portion dominated by a few key players.

High switching costs significantly bolster supplier power in the biopharmaceutical sector. For a company like FibroGen, transitioning to a new supplier for critical raw materials or specialized manufacturing processes can be incredibly costly and time-consuming.

These costs aren't just financial; they include the immense effort and risk associated with regulatory re-approval, the meticulous re-validation of established production processes, and the potential for significant delays in bringing vital therapies to market. For instance, a change in a key active pharmaceutical ingredient (API) supplier could necessitate an entirely new drug master file submission and extensive clinical bridging studies, a process that can easily cost millions and add years to development timelines.

This reality grants existing suppliers considerable leverage. FibroGen, facing such substantial hurdles to change, becomes more reliant on its current partners, as the disruption and expense of finding and qualifying new ones can outweigh the perceived benefits of switching, thereby strengthening the bargaining position of those suppliers.

FibroGen's reliance on suppliers possessing proprietary technology or unique intellectual property can significantly bolster supplier bargaining power. When a supplier's patented components or specialized manufacturing processes are critical for FibroGen's drug development and production, it creates a dependency that limits FibroGen's negotiation leverage. This can translate into less favorable pricing, stricter supply terms, and reduced flexibility in sourcing, directly impacting cost structures and operational efficiency.

Regulatory Compliance and Quality Standards

Suppliers in the pharmaceutical sector face rigorous regulatory hurdles, such as current Good Manufacturing Practices (cGMP), mandated by bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). Meeting these stringent quality and compliance requirements involves significant investment and operational complexity, thereby restricting the number of qualified suppliers available to companies like FibroGen.

This elevated regulatory burden translates into higher operational costs for suppliers, which are frequently passed on to their clients. For instance, the cost of maintaining FDA-approved facilities can add substantial overhead. In 2024, the average cost for a pharmaceutical company to achieve and maintain cGMP compliance was estimated to be in the millions of dollars, a figure that directly impacts raw material pricing and strengthens the bargaining power of these specialized suppliers.

- Regulatory Burden: Adherence to cGMP, FDA, and EMA standards is costly and complex.

- Limited Supplier Pool: High compliance costs reduce the number of eligible suppliers.

- Cost Pass-Through: Suppliers pass increased operational expenses to pharmaceutical firms.

- Strengthened Supplier Power: The specialized nature and high entry barriers enhance supplier leverage.

Global Supply Chain Disruptions

The intricate, global nature of pharmaceutical supply chains exposes companies like FibroGen to significant vulnerabilities. Events such as geopolitical instability, extreme weather, or health crises can abruptly interrupt the flow of essential raw materials and manufacturing capabilities. For instance, the COVID-19 pandemic in 2020-2021 led to widespread shortages of active pharmaceutical ingredients (APIs) and excipients, with some regions experiencing delays of up to 60% for critical components.

These disruptions directly amplify the bargaining power of suppliers. When supply becomes scarce and demand remains high, remaining suppliers can dictate terms, including significant price increases. This situation can force companies to accept less favorable contracts or face production halts, directly impacting their ability to bring vital medicines to market. In 2024, the pharmaceutical industry continued to grapple with these issues, with reports indicating that the cost of certain essential raw materials saw an average increase of 15-20% compared to pre-pandemic levels.

- Increased Lead Times: Suppliers facing high demand due to disruptions can extend delivery times, impacting FibroGen's production schedules.

- Price Hikes: Scarcity empowers suppliers to implement higher pricing for critical raw materials and manufacturing services.

- Reduced Supplier Options: A limited number of available suppliers in a disrupted market grants them greater leverage in negotiations.

- Quality Control Concerns: In urgent situations, companies might face pressure to accept materials from less vetted suppliers, potentially compromising quality.

Suppliers to FibroGen, particularly those providing specialized APIs and manufacturing services, wield significant bargaining power due to the limited number of qualified providers. This is exacerbated by high switching costs, involving regulatory re-approvals and process validation, which can cost millions and delay market entry. Furthermore, suppliers with proprietary technology or unique intellectual property create a dependency that strengthens their negotiating position, often leading to less favorable pricing and terms for FibroGen.

| Factor | Impact on FibroGen | Example Data (2024) |

| Supplier Specialization & Scarcity | Limited qualified suppliers for critical inputs like APIs. | Global biologics CDMO market over $20 billion, dominated by a few key players. |

| Switching Costs | High financial and operational risks associated with changing suppliers. | API supplier change can cost millions and add years to development timelines due to regulatory re-submissions. |

| Proprietary Technology/IP | Dependency on suppliers with unique, patented components or processes. | Restricts negotiation leverage, potentially increasing costs and reducing flexibility. |

| Regulatory Compliance | Stringent cGMP, FDA, EMA standards limit supplier pool and increase costs. | Maintaining FDA-approved facilities can add millions in overhead, passed on to clients. |

What is included in the product

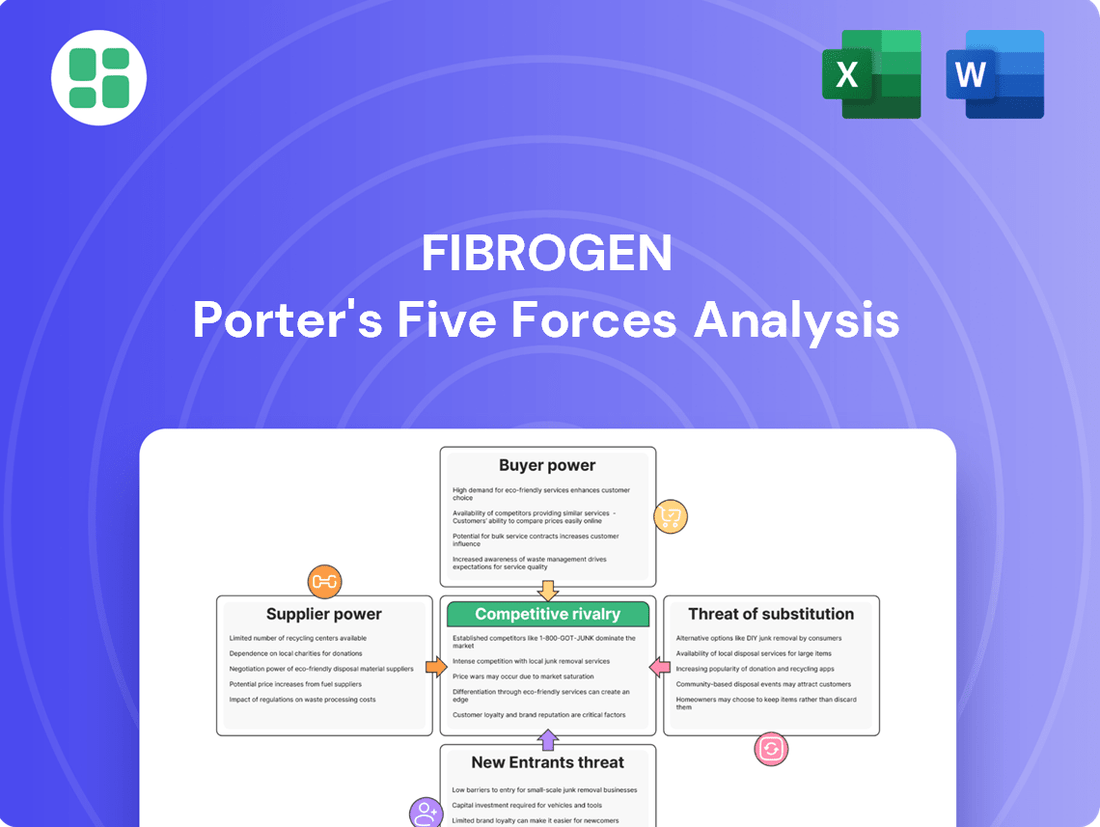

This analysis unpacks the competitive forces impacting FibroGen, assessing the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its specific market segments.

Effortlessly navigate competitive pressures with a visual breakdown of FibroGen's market landscape, allowing for agile strategic adjustments.

Customers Bargaining Power

FibroGen's key customers, including national healthcare systems and large insurance providers, wield significant bargaining power. For instance, the pricing of drugs like roxadustat for chronic kidney disease anemia is heavily influenced by these entities, especially in regions with well-defined reimbursement frameworks.

These powerful payers can dictate formulary access and reimbursement levels, directly impacting FibroGen's market penetration and revenue generation. Their ability to negotiate bulk purchases and favorable terms means FibroGen must carefully consider pricing strategies to secure market share.

Physicians and other healthcare providers are crucial gatekeepers for FibroGen's products, even though they aren't the ones paying. Their decisions on what to prescribe are heavily swayed by how well a drug works, its safety, how likely patients are to stick with it, and how it stacks up against other available treatments. For instance, if a competitor's drug shows similar or better results, doctors might switch their prescriptions, directly impacting FibroGen's sales.

The availability of alternative treatments significantly impacts customer bargaining power. When healthcare providers and payers have multiple effective options for conditions like chronic kidney disease (CKD) anemia or fibrosis, their ability to negotiate prices and terms with FibroGen increases. For instance, the market for CKD anemia treatments includes established therapies like erythropoiesis-stimulating agents (ESAs) alongside newer oral options.

Clinical guidelines also play a crucial role in shaping treatment protocols and, consequently, customer power. Organizations like the Kidney Disease: Improving Global Outcomes (KDIGO) issue recommendations for anemia management in CKD patients. These guidelines influence physician prescribing habits and payer reimbursement decisions, directly affecting the market penetration and pricing leverage of drugs like FibroGen's roxadustat.

Price Sensitivity and Cost-Effectiveness Demands

Customers, especially payers like insurance companies and government health programs, are acutely aware of healthcare expenses. This heightened price sensitivity means FibroGen faces significant pressure to justify its drug prices by demonstrating clear cost-effectiveness. For instance, in 2024, many payers are scrutinizing the overall economic value of new therapies, pushing for data that shows long-term savings or superior outcomes compared to existing treatments.

FibroGen needs to prove that its innovative treatments offer substantial benefits that outweigh their cost, particularly in crowded therapeutic markets. This often involves presenting robust clinical trial data that highlights improved patient quality of life, reduced hospitalizations, or fewer concomitant medications. Without such evidence, pricing negotiations can become more challenging, potentially impacting market access and sales volume.

- Price Sensitivity: Payers are increasingly demanding evidence of value for money, impacting pricing strategies.

- Cost-Effectiveness Data: FibroGen must present compelling data to justify its drug prices against alternatives.

- Negotiation Leverage: Demonstrating cost-effectiveness strengthens FibroGen's position in pricing discussions.

- Outcomes-Based Contracts: The demand for value may lead to contracts tied to patient outcomes, sharing risk and reward.

Patient Advocacy and Awareness

Patient advocacy groups, while not direct purchasers, wield considerable indirect influence. Their efforts in raising awareness about treatment options can shape patient demand and behavior regarding FibroGen's products. For instance, increased patient understanding of conditions like myelofibrosis and anemia can lead them to seek out specific therapies.

These informed patient communities often advocate not only for the efficacy of certain treatments but also for their affordability and accessibility. This collective voice can exert subtle but significant pressure on pricing strategies and the overall market acceptance of FibroGen's drugs. This is especially true for chronic conditions where sustained patient adherence is paramount for long-term success.

- Informed Patients Drive Demand: Growing patient awareness campaigns can lead individuals to actively seek out specific treatments, impacting prescription patterns for FibroGen's therapies.

- Advocacy for Affordability: Patient groups frequently lobby for lower drug costs and better insurance coverage, indirectly pressuring manufacturers like FibroGen on pricing.

- Chronic Condition Impact: For conditions requiring long-term management, patient adherence, often bolstered by advocacy, is critical for sustained revenue streams.

The bargaining power of customers, particularly large healthcare systems and payers, significantly impacts FibroGen's pricing and market access. These entities, often responsible for substantial drug purchases, can leverage their volume and influence to negotiate favorable terms. For instance, in 2024, payers are increasingly focused on demonstrating the cost-effectiveness of new therapies like roxadustat for anemia in chronic kidney disease (CKD) patients, putting pressure on FibroGen to justify its pricing against established treatments like erythropoiesis-stimulating agents (ESAs).

Physicians, as key prescribers, also hold considerable sway. Their treatment decisions are influenced by drug efficacy, safety profiles, and comparative effectiveness against alternatives. If competing drugs offer similar or superior outcomes, physicians may opt for those, impacting FibroGen's market share. Clinical guidelines from bodies like KDIGO further shape prescribing patterns, influencing which drugs gain traction and at what price points.

Patient advocacy groups, though indirect customers, contribute to this dynamic by raising awareness and advocating for affordability and accessibility. This can shape patient demand and indirectly influence payer and physician decisions, adding another layer to FibroGen's market strategy.

| Customer Segment | Influence Factor | Impact on FibroGen | Example (2024 Focus) |

|---|---|---|---|

| Payers (e.g., Insurers, Gov't Programs) | Volume Purchasing, Reimbursement Control | Pricing Pressure, Market Access Restrictions | Demand for robust cost-effectiveness data for roxadustat vs. ESAs. |

| Healthcare Providers (Physicians) | Prescribing Decisions, Formulary Influence | Market Penetration, Sales Volume | Preference for drugs with superior efficacy/safety or favorable comparative studies. |

| Patient Advocacy Groups | Patient Demand, Affordability Advocacy | Indirect Influence on Pricing & Market Acceptance | Campaigns for accessible treatments for CKD anemia and myelofibrosis. |

Preview the Actual Deliverable

FibroGen Porter's Five Forces Analysis

This preview showcases the comprehensive FibroGen Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the company. The document you see here is the exact, fully formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. Gain immediate access to this in-depth analysis of industry rivalry, buyer and supplier power, threat of new entrants, and substitute products to inform your business strategy.

Rivalry Among Competitors

FibroGen faces intense competition in its core therapeutic areas, particularly in anemia associated with chronic kidney disease (CKD) and myelodysplastic syndromes (MDS). Established pharmaceutical giants like AstraZeneca, Astellas, GlaxoSmithKline, and Akebia Therapeutics are major players in this space, each with their own promising pipelines and approved treatments.

For instance, GlaxoSmithKline's daprodustat and Akebia Therapeutics' vadadustat are direct competitors to FibroGen's roxadustat in the anemia market. While FibroGen has strategic partnerships, these companies also possess their own extensive research and development capabilities, allowing them to innovate and expand their market presence, creating a dynamic and challenging competitive landscape.

The biopharmaceutical sector, where FibroGen operates, is defined by massive R&D expenditures and a protracted, unpredictable path to drug approval. Companies in this space, including FibroGen's rivals, routinely commit billions to research, fueling fierce competition to be the first to market with novel treatments and secure significant market share.

This intense R&D environment necessitates aggressive marketing strategies and a robust pipeline of potential new drugs. For instance, in 2023, the top pharmaceutical companies globally reported R&D spending in the tens of billions of dollars, underscoring the capital-intensive nature of innovation and the pressure to achieve breakthroughs.

Competitive rivalry in the anemia treatment market, particularly for FibroGen, is intensely driven by product differentiation. This differentiation hinges on critical factors like efficacy, safety profiles, the specific mechanism of action, and patient convenience, such as the shift from injectables to oral medications.

Roxadustat, FibroGen's flagship product, benefits from its oral administration, offering a distinct convenience advantage over the traditional injectable erythropoiesis-stimulating agents (ESAs). However, this advantage is not exclusive, as competitors are actively developing their own oral alternatives, intensifying the competitive landscape.

Ultimately, superior clinical outcomes or a demonstrably more favorable side-effect profile can significantly sway market adoption. For instance, if roxadustat can consistently show better patient response or fewer adverse events compared to emerging oral competitors, it would strongly bolster its market position.

Patent Expirations and Biosimilar/Generic Threats

The eventual expiration of patents on FibroGen's key products presents a significant threat, paving the way for biosimilar or generic competition. This intensified price competition can rapidly erode market share and profitability, a common challenge in the biopharmaceutical sector.

While FibroGen's roxadustat patents remain active, the looming prospect of biosimilar or generic entry is a persistent strategic concern. This dynamic underscores the importance of continuous innovation and lifecycle management within the industry.

- Patent Cliff Risk: The expiry of patents on blockbuster drugs can lead to a dramatic drop in revenue, as seen with many pharmaceutical companies facing generic competition after patent expiry.

- Roxadustat's Patent Status: FibroGen's roxadustat, a key product, has patents that are still active, providing a period of market exclusivity.

- Biosimilar/Generic Entry Impact: The introduction of biosimilars or generics typically results in substantial price reductions, often exceeding 50%, impacting revenue streams for the originator.

- Industry Trend: The biopharma industry consistently faces the challenge of patent expirations, necessitating robust pipelines and strategies to mitigate the impact of generic or biosimilar competition.

Global Market Dynamics and Regulatory Approvals

Competitive rivalry for FibroGen is significantly shaped by global market dynamics and the intricate process of regulatory approvals. The intensity of competition can differ greatly from one geographic area to another, influenced by varying healthcare systems, pricing strategies, and the specific regulatory frameworks in place. For example, while FibroGen's roxadustat has seen strong market penetration in China, its competitive position in markets like the United States encounters a different set of hurdles and established competitors.

Securing and maintaining regulatory approvals is paramount for a company like FibroGen to compete effectively on a global scale. This process is not uniform across all regions, meaning a drug that is approved and widely used in one country might face a more challenging or lengthy approval pathway elsewhere. This disparity directly impacts market access and the ability to gain market share against existing treatments.

- Geographic Variance: Roxadustat's success in China contrasts with its competitive landscape in the U.S., highlighting how regulatory and healthcare system differences intensify rivalry.

- Regulatory Hurdles: Navigating diverse and often stringent regulatory approval processes across different countries is a critical factor in FibroGen's global competitive standing.

- Market Performance: The differing market performances of its key drugs in various regions underscore the impact of localized competition and regulatory success.

FibroGen faces robust competition from established pharmaceutical giants like AstraZeneca, Astellas, GlaxoSmithKline, and Akebia Therapeutics, particularly in the anemia treatment market. These rivals offer both approved therapies and promising pipelines, directly challenging FibroGen's roxadustat. The biopharmaceutical sector's high R&D costs, often in the tens of billions annually for major players, fuel this intense rivalry as companies strive for market leadership through innovation and speed to market.

The competitive edge hinges on factors like efficacy, safety, and patient convenience, with oral administration, like roxadustat's, being a key differentiator. However, competitors are also developing oral alternatives. The looming threat of patent expirations and subsequent biosimilar or generic entry further intensifies this rivalry, potentially leading to significant price erosion, a common industry challenge.

Global market dynamics and varying regulatory approval processes also shape competitive rivalry. Roxadustat's market performance, for instance, differs significantly between regions like China and the United States, highlighting how localized competition and regulatory landscapes impact market share and overall competitive standing.

SSubstitutes Threaten

For conditions like chronic kidney disease (CKD) anemia, traditional treatments such as erythropoiesis-stimulating agents (ESAs) like epoetin alfa and darbepoetin alfa, along with iron supplementation, represent significant substitutes for FibroGen's roxadustat. These established therapies are widely used and reimbursed, even if they require injections unlike roxadustat's oral formulation.

The biopharmaceutical industry is a hotbed of innovation, with new treatments constantly emerging that tackle diseases like anemia, fibrosis, and cancer using entirely different approaches. This dynamic environment presents a significant threat of substitutes for companies like FibroGen.

For instance, in the realm of fibrosis, researchers are actively developing drugs that target distinct biological pathways beyond those addressed by current FibroGen offerings. Similarly, in oncology, the rapid advancements in targeted therapies and immunotherapies provide patients and physicians with alternative treatment options that could bypass or compete with FibroGen's pipeline candidates.

While not direct pharmaceutical competitors, lifestyle and dietary changes can act as indirect substitutes for FibroGen's products. For example, managing chronic kidney disease through specific diets can slow the progression of anemia, potentially reducing the need for erythropoiesis-stimulating agents (ESAs) in earlier stages. This approach can influence the overall demand for pharmacological treatments.

Surgical Interventions or Medical Devices

In specific disease contexts, particularly those involving fibrosis or certain cancers, surgical procedures and advanced medical devices can function as viable alternatives or complementary options to pharmaceutical treatments. For instance, organ transplantation is a definitive intervention for severe organ fibrosis, directly substituting for drug therapies that aim to decelerate disease advancement. In 2024, the global organ transplantation market was valued at approximately $1.4 billion, showcasing the scale of these alternative interventions.

For many oncological conditions, surgical tumor removal or radiation therapy remain the primary treatment modalities, often preceding or replacing drug-based approaches. This can significantly limit the market penetration of new pharmacological agents if these procedures offer comparable or superior outcomes with fewer systemic side effects. For example, the global cancer surgery market size was estimated to be around $180 billion in 2023, indicating a substantial existing infrastructure for non-pharmacological cancer treatment.

- Organ Transplantation: A direct substitute for pharmacological fibrosis management, with a market value around $1.4 billion in 2024.

- Cancer Surgery: A primary treatment for many cancers, representing a significant alternative to drug therapies, with a market size of approximately $180 billion in 2023.

- Radiation Therapy: Another key non-pharmacological intervention for cancer, impacting the demand for oncology drugs.

Off-label Use of Other Drugs

Physicians may prescribe drugs off-label for conditions not explicitly approved, if evidence suggests benefit. This practice, while not a direct substitute for FibroGen's approved indications, can indirectly impact its pipeline products by fragmenting the market or shifting treatment approaches. For instance, if a competitor's drug, approved for a broader range of inflammatory conditions, gains traction for a similar use case as a FibroGen candidate, it could limit market penetration.

The off-label use of existing medications can create a competitive dynamic that extends beyond direct drug-to-drug comparisons. This can influence treatment paradigms, potentially fragmenting the market for FibroGen's future therapies. For example, in 2024, the market for treatments targeting anemia of chronic kidney disease, an area where FibroGen has significant presence with roxadustat, also saw continued use of erythropoiesis-stimulating agents (ESAs), some of which might be used in ways that could be considered off-label for specific patient subgroups or treatment protocols.

- Indirect Competition: Off-label prescribing of existing drugs can serve as an indirect substitute, potentially fragmenting the market for FibroGen's pipeline candidates.

- Market Fragmentation: The widespread adoption of off-label uses for other approved medications can dilute the potential patient pool for FibroGen's drugs targeting similar or overlapping conditions.

- Shifting Treatment Paradigms: Successful off-label use can influence physician prescribing habits, creating a competitive landscape that goes beyond direct head-to-head comparisons of approved indications.

The threat of substitutes for FibroGen's products is substantial, encompassing both direct pharmaceutical alternatives and non-pharmacological interventions. Established treatments like ESAs for anemia, alongside surgical options and radiation therapy for cancers, represent significant competitive forces. The biopharmaceutical industry's rapid innovation also introduces novel therapeutic approaches that could bypass FibroGen's pipeline. Furthermore, lifestyle modifications can indirectly reduce the demand for certain pharmaceutical interventions.

| Substitute Category | Example | Market Relevance (2023-2024 Data) | Impact on FibroGen |

|---|---|---|---|

| Established Pharmaceutical Treatments | Erythropoiesis-Stimulating Agents (ESAs) | Widely used for anemia, significant market share. | Direct competition for anemia treatments. |

| Non-Pharmacological Interventions | Organ Transplantation | Global market ~ $1.4 billion (2024) | Direct substitute for severe fibrosis. |

| Non-Pharmacological Interventions | Cancer Surgery | Global market ~ $180 billion (2023) | Primary treatment for many cancers, limiting drug penetration. |

| Emerging Therapies | Novel fibrosis targets, immunotherapies | Rapidly growing R&D investment. | Potential to render current approaches obsolete. |

Entrants Threaten

The biopharmaceutical sector, including companies like FibroGen, faces a significant threat from new entrants due to the immense capital required. Developing a single drug from discovery through FDA approval can cost upwards of $2.6 billion, a figure that includes extensive research, rigorous preclinical testing, and multi-phase clinical trials.

Furthermore, establishing compliant manufacturing facilities for biologics or complex small molecules demands hundreds of millions of dollars in investment. These high upfront costs create a substantial financial barrier, effectively deterring many potential competitors from entering the market and challenging established players.

The threat of new entrants into the biopharmaceutical industry, particularly for companies like FibroGen, is significantly dampened by extensive regulatory hurdles and a complex approval process. Agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and China's National Medical Products Administration (NMPA) impose stringent requirements. For instance, bringing a new drug to market typically involves years of preclinical research and multiple phases of human clinical trials, which can cost hundreds of millions, if not billions, of dollars. In 2024, the average cost to develop a new drug was estimated to be over $2 billion, with a success rate of less than 10% from initial discovery to market approval.

The biopharmaceutical industry, including companies like FibroGen, requires a deep bench of specialized talent. Developing and bringing new drugs to market isn't like manufacturing a simple product; it involves complex scientific research, rigorous clinical trials, navigating intricate regulatory pathways, and sophisticated commercialization strategies. Attracting and keeping the best minds in fields like molecular biology, drug discovery, clinical trial management, and regulatory affairs is a constant challenge.

For new entrants, this need for specialized expertise is a significant barrier. Without an established reputation or the financial resources to compete for top-tier talent, emerging companies struggle to build the necessary teams. For instance, in 2024, the demand for experienced biostatisticians and regulatory affairs specialists in the biotech sector saw salary increases of up to 15% year-over-year, reflecting the scarcity and high value of these skills.

Intellectual Property and Patent Landscape

The biopharmaceutical sector, where FibroGen operates, is intensely guarded by intellectual property rights. Patents are crucial, covering everything from the core drug molecules and how they are made to their specific therapeutic applications.

Established players like FibroGen possess substantial patent portfolios. This creates significant hurdles for newcomers, as developing and launching comparable products often means infringing on existing patents or facing the expense of licensing agreements. For instance, in 2023, the global biopharmaceutical patent filings continued to show robust activity, underscoring the ongoing importance of IP protection in this industry.

- Dominance of Patent Protection: Biopharma relies heavily on patents for drug compounds, manufacturing, and usage.

- FibroGen's IP Strength: FibroGen's extensive patent portfolio acts as a barrier to entry.

- Barriers for New Entrants: New companies must navigate patent infringement risks or costly licensing.

- 2023 IP Landscape: Continued high levels of patent filings in 2023 highlight the sector's IP-centric nature.

Brand Recognition, Distribution Channels, and Established Relationships

New entrants into the biopharmaceutical market, particularly those targeting areas where FibroGen operates, face significant hurdles in establishing brand recognition and securing crucial distribution channels. Building trust and awareness among healthcare professionals, payers, and patient advocacy groups takes considerable time and investment, a challenge that established players have already overcome.

Incumbent firms, such as FibroGen, often benefit from deep-rooted relationships with key stakeholders, including pharmaceutical giants like AstraZeneca and Astellas, who provide established commercial infrastructure and market access. These existing partnerships and commercial networks create a formidable barrier for new companies attempting to penetrate the market and gain traction for their products.

- Brand Loyalty: Established brands in the pharmaceutical sector often enjoy high levels of physician and patient loyalty, making it difficult for new entrants to displace them.

- Distribution Networks: Access to established pharmaceutical distribution networks, which are complex and often exclusive, is a significant barrier for new companies.

- Key Opinion Leader (KOL) Relationships: Cultivating relationships with Key Opinion Leaders in relevant medical fields is essential for product adoption, and incumbents have years of established rapport.

- Market Access and Reimbursement: Navigating the complex landscape of market access and securing favorable reimbursement from payers is a lengthy and expensive process that established companies are better equipped to handle.

The threat of new entrants for FibroGen is considerably low due to the immense capital required to enter the biopharmaceutical market. Developing and gaining approval for a single drug can cost upwards of $2.6 billion, a figure that encompasses extensive research, preclinical testing, and multi-phase clinical trials. In 2024, the average cost to develop a new drug remained over $2 billion, with a success rate of less than 10% from discovery to market approval.

Furthermore, the industry is heavily protected by intellectual property rights, with patents covering drug compounds, manufacturing processes, and therapeutic applications. FibroGen's substantial patent portfolio creates significant hurdles for newcomers, who risk patent infringement or costly licensing agreements. Global biopharmaceutical patent filings in 2023 continued to demonstrate robust activity, reinforcing the sector's IP-centric nature.

The specialized talent pool required for drug development, clinical trials, and regulatory affairs also acts as a substantial barrier. In 2024, demand for experienced biostatisticians and regulatory affairs specialists saw salary increases of up to 15% year-over-year, highlighting the scarcity and high value of these skills.

Finally, established players benefit from strong brand recognition and existing distribution channels. FibroGen's deep-rooted relationships with key stakeholders and pharmaceutical giants provide established commercial infrastructure, making it difficult for new companies to gain market traction.

Porter's Five Forces Analysis Data Sources

Our FibroGen Porter's Five Forces analysis is built upon a robust foundation of data, including FibroGen's SEC filings, investor presentations, and annual reports. We supplement this with industry-specific market research reports and data from reputable financial information providers to gain a comprehensive view of the competitive landscape.