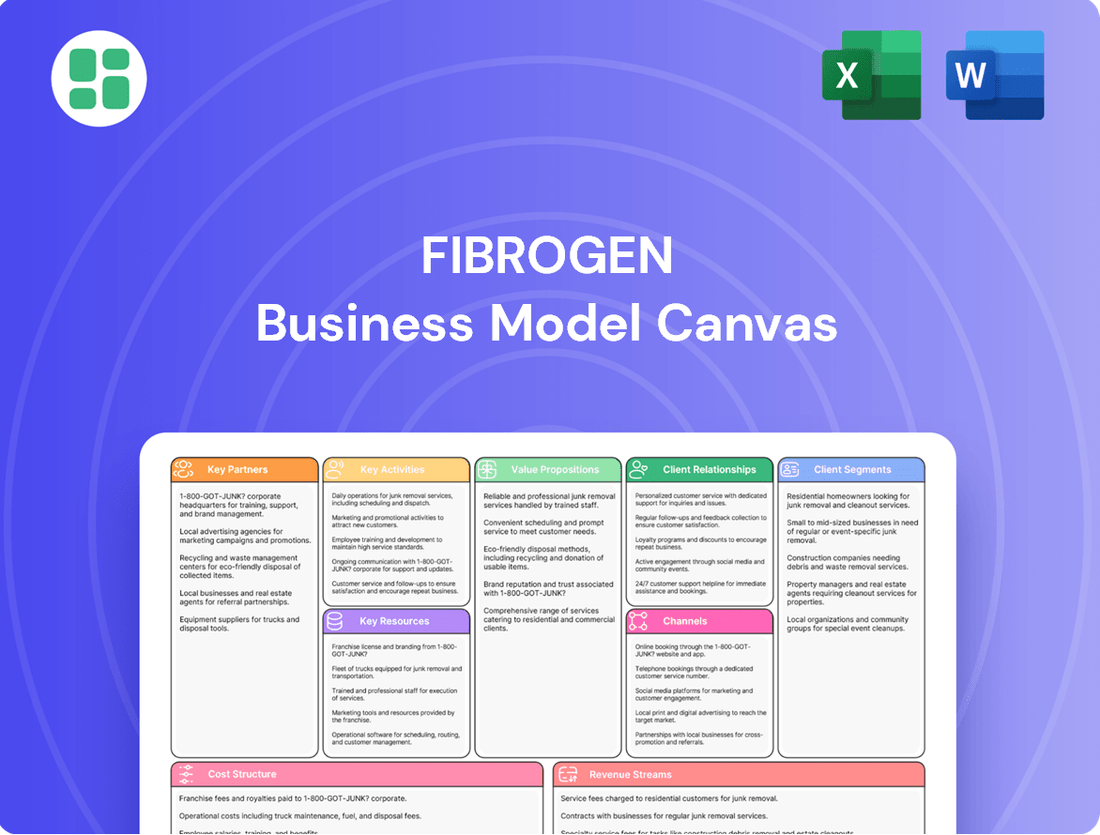

FibroGen Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FibroGen Bundle

Unlock the full strategic blueprint behind FibroGen's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

FibroGen's strategic pharmaceutical collaborations are foundational to its business model, enabling broad market access and efficient product development. A prime example is the ongoing alliance with Astellas Pharma, a partnership critical for the global commercialization of roxadustat, particularly in key markets like Japan and Europe. This collaboration leverages Astellas' established infrastructure and market expertise.

Further demonstrating this focused approach, FibroGen's divestiture of FibroGen China to AstraZeneca underscores a strategic alignment. This move allows FibroGen to sharpen its focus on its U.S. pipeline development while ensuring continued commercial success for roxadustat in China through AstraZeneca's robust market presence and capabilities.

FibroGen actively partners with prominent research and academic institutions, including the University of California San Francisco (UCSF). These collaborations are crucial for conducting investigator-sponsored trials, which explore novel indications and combination therapies for FibroGen's drug pipeline, such as FG-3246. This scientific engagement fosters advancements in cancer biology research and bolsters the validation of their therapeutic candidates.

FibroGen leverages Contract Research Organizations (CROs) to manage and execute its clinical trials, a crucial aspect of its business model. For instance, in 2024, FibroGen continued to rely on CROs for the advancement of its oncology assets, such as FG-3246. These partnerships are essential for accessing specialized expertise and the necessary infrastructure to conduct complex studies efficiently and in compliance with regulatory standards.

Manufacturing and Supply Chain Partners

FibroGen depends on manufacturing and supply chain partners to produce and distribute its innovative therapies. These relationships are vital for ensuring the consistent quality of active pharmaceutical ingredients (APIs) and finished drug products, which is paramount for patient safety and therapeutic efficacy.

The company's ability to meet market demand and successfully commercialize its products hinges on robust supply chain management. For instance, in 2023, FibroGen continued to navigate complex global supply chains, a common challenge for biopharmaceutical companies aiming for broad market access.

- API Manufacturing: Collaborations with specialized contract manufacturing organizations (CMOs) for API production.

- Finished Drug Product Manufacturing: Partnerships with CMOs for sterile filling, lyophilization, and packaging.

- Logistics and Distribution: Agreements with third-party logistics (3PL) providers for warehousing and global distribution.

- Quality Assurance: Ensuring all manufacturing partners adhere to strict Good Manufacturing Practices (GMP) and regulatory standards.

Financial and Investment Partners

FibroGen actively cultivates relationships with financial and investment partners, a crucial element for its operational and strategic advancement. Notably, institutions such as Morgan Stanley Tactical Value play a significant role in providing essential funding and guiding the company's financial management strategies.

The company's recent divestiture of FibroGen China, a move that facilitated the repayment of its term loan, underscores a deliberate strategy to streamline its capital structure and prolong its cash runway. This financial maneuver was significantly enabled by its established financial partnerships.

These collaborations are paramount for ensuring FibroGen's ongoing financial stability and securing the necessary capital to fuel its critical research and development initiatives. Such partnerships are vital for maintaining operational momentum and pursuing future growth opportunities.

- Key Financial Partners: Morgan Stanley Tactical Value

- Strategic Financial Action: Sale of FibroGen China to repay term loan

- Objective: Simplify capital structure and extend cash runway

- Importance: Crucial for financial stability and R&D funding

FibroGen's key partnerships are vital for its global reach and pipeline advancement. The collaboration with Astellas Pharma for roxadustat commercialization, especially in Japan and Europe, highlights the reliance on established market players. Furthermore, the divestiture of FibroGen China to AstraZeneca demonstrates a strategic move to focus on U.S. development while leveraging AstraZeneca's strong Chinese presence.

Research collaborations, such as those with UCSF, are critical for exploring new indications and advancing FibroGen's drug candidates like FG-3246 through investigator-sponsored trials. The company also heavily utilizes Contract Research Organizations (CROs) for clinical trial execution, as seen with FG-3246 in 2024, ensuring specialized expertise and regulatory compliance.

Manufacturing and supply chain partners are essential for producing and distributing FibroGen's therapies, ensuring consistent quality and meeting market demand. Financial partnerships, like that with Morgan Stanley Tactical Value, are crucial for funding R&D and maintaining financial stability, as demonstrated by the use of funds from the FibroGen China sale to repay debt and extend the cash runway.

| Partner Type | Key Partner Example | Strategic Role | Impact/Data Point |

| Commercialization | Astellas Pharma | Global commercialization of roxadustat | Key markets: Japan, Europe |

| Development/Commercialization | AstraZeneca | FibroGen China divestiture, continued roxadustat access | Focus on U.S. pipeline |

| Research & Development | University of California San Francisco (UCSF) | Investigator-sponsored trials, novel indications | Exploration of FG-3246 |

| Clinical Trial Execution | Contract Research Organizations (CROs) | Clinical trial management and execution | Essential for oncology assets like FG-3246 (2024) |

| Financial | Morgan Stanley Tactical Value | Funding, financial strategy guidance | Enabled debt repayment and cash runway extension |

What is included in the product

This FibroGen Business Model Canvas provides a comprehensive overview of their strategy, detailing customer segments, value propositions, and key resources. It is designed for informed decision-making and presents a clear picture of their operations for stakeholders.

FibroGen's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex drug development and commercialization strategy, simplifying communication and alignment across diverse teams.

Activities

FibroGen's cornerstone activity is the discovery of new medicines, with a strong emphasis on understanding how hypoxia-inducible factor (HIF) pathways impact diseases like cancer. This involves early-stage scientific exploration to pinpoint promising drug targets and identify potential therapeutic compounds.

The company dedicates significant resources to preclinical research, meticulously assessing the effectiveness and safety of these new drug candidates. This rigorous testing phase is crucial before any potential new treatments can move into human clinical trials, a critical step in the drug development process.

FibroGen's core activities center on the meticulous design, execution, and oversight of clinical trials for its promising drug candidates. This crucial phase involves advancing therapies like roxadustat for novel applications such as lower-risk myelodysplastic syndromes (LR-MDS) in the United States.

The company is also actively progressing its oncology asset, FG-3246, through multiple stages of clinical development, a process demanding substantial investment and scientific rigor. These trials are the bedrock for generating the essential data needed to secure regulatory approvals from health authorities.

Navigating the intricate global regulatory pathways is a core activity for FibroGen. This involves meticulously preparing and submitting extensive data dossiers to health authorities like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). For instance, securing approval for roxadustat (Evrenzo) in various markets required significant effort in compiling clinical trial data and addressing regulatory queries.

FibroGen actively engages in ongoing dialogue with these regulatory bodies. These discussions are crucial for shaping the development strategies of its investigational compounds and for clarifying the specific requirements needed to gain market authorization. This proactive engagement helps to de-risk the development process and expedite potential approvals.

Successful interactions with regulators are absolutely vital for FibroGen to achieve market access for its innovative therapies. The company's ability to effectively communicate its scientific findings and address regulatory concerns directly impacts its commercialization efforts and ultimately its revenue generation potential.

Intellectual Property Management

FibroGen's intellectual property management is centered on safeguarding its groundbreaking drug candidates and proprietary technologies. This crucial activity involves the ongoing process of filing and meticulously managing patents across significant global markets, ensuring robust protection for its innovations.

A strong and expansive patent portfolio is fundamental to FibroGen's strategy for maintaining a distinct competitive edge and securing its long-term revenue generation capabilities.

- Patent Filing and Prosecution: FibroGen actively pursues patent protection for its novel compounds, formulations, and methods of treatment related to its core therapeutic areas, such as fibrotic and anemic diseases.

- Portfolio Defense: The company engages in strategies to defend its existing patents against potential challenges and infringements, which is critical for preserving market exclusivity.

- Licensing and Collaboration: Managing intellectual property also involves evaluating opportunities for licensing its patented technologies to other entities or entering into collaborations that leverage its IP assets.

- Freedom-to-Operate Analysis: FibroGen conducts thorough analyses to ensure its product development and commercialization activities do not infringe on existing third-party patents.

Commercialization and Market Access

FibroGen's commercialization strategy heavily relies on partnerships to bring its therapies, like roxadustat, to global markets. This collaborative approach allows for broader reach and expertise in diverse regulatory and market landscapes.

Crucially, FibroGen actively manages market access for its products, focusing on securing favorable pricing and reimbursement. This involves intricate negotiations with payers and healthcare systems to ensure patient affordability and product uptake.

Establishing a commercial presence in regions where FibroGen retains direct rights is another key activity. This entails building sales forces, marketing teams, and distribution networks to effectively serve patient populations.

- Global Commercialization Partnerships: FibroGen collaborates with established pharmaceutical companies for the commercialization of its products in various international markets, maximizing reach and leveraging partner expertise.

- Market Access Strategies: The company actively pursues market access by developing and executing strategies for pricing, reimbursement, and health technology assessments to ensure its therapies are accessible to patients.

- Regional Commercial Operations: For territories where FibroGen retains commercial rights, it focuses on building and managing its own commercial infrastructure, including sales and marketing teams, to drive product adoption.

- Patient Access to Therapies: The ultimate goal of these activities is to ensure that approved and innovative therapies, such as roxadustat, can effectively reach and benefit the patients who need them.

FibroGen's key activities are centered on the rigorous scientific discovery and development of novel therapeutics, particularly those targeting hypoxia-inducible factor (HIF) pathways. This includes extensive preclinical research and the meticulous execution of clinical trials for compounds like roxadustat and FG-3246. A significant portion of their efforts is dedicated to navigating complex global regulatory landscapes and robust intellectual property management to protect their innovations.

The company also focuses on strategic commercialization through partnerships and building direct commercial operations where applicable, alongside securing market access via pricing and reimbursement negotiations. For instance, in 2023, FibroGen continued to advance its clinical programs, with significant focus on oncology and anemia indications.

| Key Activity | Description | Recent Focus/Data (as of early 2024) |

|---|---|---|

| Drug Discovery & Preclinical Research | Identifying and validating new drug targets, early-stage compound screening. | Continued research into HIF pathways for fibrotic diseases and oncology. |

| Clinical Development | Designing, executing, and managing clinical trials for investigational drugs. | Advancing FG-3246 in oncology trials; ongoing studies for roxadustat in new indications like LR-MDS. |

| Regulatory Affairs | Interacting with health authorities (FDA, EMA) for approvals and market authorization. | Navigating regulatory submissions and discussions for existing and pipeline assets. |

| Intellectual Property Management | Filing, prosecuting, and defending patents for novel compounds and technologies. | Maintaining a strong patent portfolio to secure market exclusivity and competitive advantage. |

| Commercialization & Market Access | Partnering for global sales, building regional commercial infrastructure, securing pricing and reimbursement. | Working with partners like Astellas and AstraZeneca for roxadustat; focusing on market access strategies. |

Full Document Unlocks After Purchase

Business Model Canvas

The FibroGen Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, ready-to-use strategic framework, not a sample or mockup. Once your order is processed, you will gain full access to this exact Business Model Canvas, allowing you to immediately leverage its insights for FibroGen's strategic planning and operations.

Resources

FibroGen's most critical asset is its proprietary drug pipeline, featuring promising investigational candidates like roxadustat and FG-3246. These represent substantial investments in research and development, targeting areas with significant unmet medical needs, including anemia associated with chronic kidney disease and myelodysplastic syndromes, as well as oncology.

The value of these proprietary compounds is immense, underpinning the company's future growth and market position. For instance, roxadustat, a HIF-PHI inhibitor, has already seen approvals in various regions for anemia treatment, demonstrating the pipeline's commercial viability. As of late 2024, FibroGen continues to advance its pipeline, with ongoing clinical trials for FG-3246 in oncology showing encouraging early results, further solidifying the pipeline's importance.

FibroGen's extensive intellectual property portfolio, encompassing patents for drug compounds, formulations, and manufacturing methods, serves as a foundational resource. This robust IP acts as a significant competitive advantage, underpinning the company's valuation and its ability to forge strategic alliances.

The company's commitment to safeguarding its innovations is evident in its continuous filing and maintenance of patents across major global markets. For instance, as of early 2024, FibroGen held a substantial number of granted patents and pending applications, reflecting its ongoing investment in R&D and intellectual property protection.

FibroGen's scientific expertise and talent are its bedrock. A highly skilled team of scientists, researchers, and clinical development professionals drives its innovation. Their deep knowledge in drug discovery, clinical trials, and regulatory affairs, particularly in areas like HIF biology and oncology, is crucial for advancing therapeutic programs.

This human capital is the engine behind FibroGen's scientific advancements. For instance, in 2023, the company continued to invest heavily in its R&D personnel, a key factor in navigating the complex drug development landscape and bringing novel therapies to market.

Clinical Data and Regulatory Approvals

FibroGen's accumulated clinical trial data and existing regulatory approvals for roxadustat outside the U.S. are critical assets. These approvals, such as those in China and Japan for anemia due to chronic kidney disease (CKD), represent immediate revenue streams and provide robust validation of roxadustat's efficacy and safety. For instance, by the end of 2023, roxadustat had achieved significant market penetration in China, contributing substantially to FibroGen's revenue, underscoring the value of these early approvals.

This wealth of clinical data is instrumental in supporting roxadustat's further development and market expansion efforts globally. It also serves as a foundational element for informing future development strategies for other pipeline candidates, potentially accelerating their path to approval by leveraging existing knowledge and trial designs. The insights gleaned from roxadustat's journey help de-risk subsequent research and development investments.

- Clinical Data: Extensive Phase 1, 2, and 3 trial data for roxadustat, demonstrating safety and efficacy profiles.

- Regulatory Approvals: Marketing authorizations for roxadustat in key ex-U.S. markets, including China and Japan, for anemia associated with CKD.

- Market Penetration: Successful commercialization of roxadustat in approved territories, generating revenue and real-world evidence.

- Pipeline Support: Data and regulatory insights from roxadustat informing the development of other HIF-PHI candidates.

Financial Capital and Cash Position

FibroGen’s financial capital, encompassing cash, cash equivalents, and accounts receivable, is the bedrock for its extensive research and development initiatives, alongside daily operational needs.

Strategic moves, like the divestiture of FibroGen China, have markedly boosted the company's financial runway, providing crucial liquidity. For instance, as of March 31, 2024, FibroGen reported cash, cash equivalents, and restricted cash totaling approximately $1.1 billion. This substantial cash position is vital for maintaining operational momentum and funding future pipeline advancements.

- Cash and Equivalents: Approximately $1.1 billion as of March 31, 2024, providing a strong liquidity buffer.

- Accounts Receivable: While specific figures fluctuate, this represents income yet to be collected, contributing to working capital.

- Strategic Financial Management: The sale of FibroGen China was a key transaction to enhance financial flexibility and extend the cash runway.

- Operational Funding: This capital directly supports ongoing R&D, clinical trials, and general administrative expenses.

FibroGen's key resources are its innovative drug pipeline, extensive intellectual property, skilled scientific team, valuable clinical data, and robust financial capital. These assets collectively enable the company to pursue its mission of developing novel therapies for serious unmet medical needs.

The company's proprietary drug pipeline, featuring candidates like roxadustat and FG-3246, is its most critical asset, representing significant R&D investment. Roxadustat, a HIF-PHI inhibitor, has already gained approvals in several regions for anemia treatment, demonstrating commercial potential. By late 2024, FG-3246 continued its promising early-stage oncology trials, reinforcing the pipeline's value.

FibroGen's intellectual property portfolio, including patents for drug compounds and manufacturing methods, provides a strong competitive edge and facilitates strategic partnerships. The company actively maintains and expands this portfolio, holding numerous granted patents and pending applications as of early 2024.

The company's financial strength is a vital resource, with cash and equivalents of approximately $1.1 billion as of March 31, 2024. This liquidity, bolstered by strategic financial management such as the divestiture of FibroGen China, is crucial for funding ongoing research, clinical trials, and overall operations.

| Key Resource | Description | Significance | Data Point (as of late 2024/early 2025) |

| Proprietary Drug Pipeline | Investigational candidates like roxadustat and FG-3246 targeting anemia and oncology. | Underpins future growth and market position; roxadustat has ex-U.S. approvals. | Ongoing clinical trials for FG-3246 in oncology showing encouraging early results. |

| Intellectual Property | Patents for drug compounds, formulations, and manufacturing methods. | Provides competitive advantage and enables strategic alliances. | Substantial number of granted patents and pending applications globally. |

| Scientific Expertise | Highly skilled team of scientists and researchers driving innovation. | Crucial for advancing therapeutic programs and navigating drug development. | Continued investment in R&D personnel in 2023 to enhance scientific capabilities. |

| Clinical Data & Approvals | Extensive trial data and regulatory approvals for roxadustat outside the U.S. | Generates immediate revenue streams and validates therapeutic efficacy. | Roxadustat achieved significant market penetration in China by end of 2023. |

| Financial Capital | Cash, cash equivalents, and accounts receivable. | Funds R&D, operations, and strategic initiatives. | Approximately $1.1 billion in cash, cash equivalents, and restricted cash as of March 31, 2024. |

Value Propositions

Roxadustat, a novel oral treatment for anemia in chronic kidney disease (CKD) patients, offers a significant advantage over traditional injectable erythropoiesis-stimulating agents (ESAs). This innovative approach targets a key unmet need by mimicking the body's natural response to low oxygen levels.

As a hypoxia-inducible factor prolyl hydroxylase (HIF-PH) inhibitor, roxadustat offers a convenient oral administration route, potentially improving patient adherence and quality of life. This oral option addresses a crucial aspect of patient care, moving away from the more burdensome injectable treatments.

FibroGen's oncology pipeline, notably FG-3246 for metastatic castration-resistant prostate cancer (mCRPC), is designed to offer novel therapeutic choices for challenging cancers. This approach directly tackles significant unmet medical needs in patient groups with few viable treatment avenues.

FG-3246's mechanism of action, targeting CD46, positions it as a potential first-in-class antibody-drug conjugate. This innovation is crucial for patients facing aggressive disease progression and limited response to existing therapies, addressing a critical gap in oncology care.

FibroGen is actively pursuing the development of roxadustat for anemia in lower-risk myelodysplastic syndromes (LR-MDS) in the United States. This specific indication represents a significant unmet medical need, making it a high-value target for the company.

The potential for orphan drug designation in the U.S. for LR-MDS is a key aspect of this strategy. Such a designation offers valuable market exclusivity and other incentives, which can significantly de-risk and accelerate the development process.

Orphan drug status is designed to encourage the development of treatments for rare diseases. In 2024, the U.S. Food and Drug Administration (FDA) continued to grant orphan drug designations, underscoring the ongoing importance of this pathway for companies like FibroGen looking to address specific patient populations.

Improved Patient Outcomes and Quality of Life

FibroGen's core value proposition centers on significantly enhancing patient well-being by developing innovative treatments for debilitating chronic and life-threatening diseases. Their work in anemia management, for instance, directly combats fatigue and bolsters cardiovascular health, as seen in patient data indicating reduced hospitalizations for heart failure events in certain treated populations. This commitment to alleviating suffering and improving daily living is the driving force behind their research and development efforts.

Beyond anemia, FibroGen's pipeline targets critical areas like oncology, aiming to extend survival and provide better disease control for patients facing aggressive cancers. By focusing on therapies that address the root causes of these conditions, they strive to reduce the overall burden of disease, allowing patients to lead more fulfilling lives. This patient-centric approach underpins the company's mission and shapes its strategic direction.

- Improved Patient Outcomes: Therapies designed to manage chronic conditions effectively, leading to better health metrics.

- Enhanced Quality of Life: Reducing symptoms like fatigue and pain, enabling greater daily function.

- Disease Burden Reduction: Aiming to slow progression and improve prognosis for serious illnesses.

- Extended Survival and Control: Particularly in oncology, offering hope through advanced treatment options.

Strategic Value Through Partnerships

FibroGen's strategic value through partnerships is exemplified by its collaboration model, notably with Astellas. This approach allows FibroGen to tap into partners' extensive global commercial capabilities and deep market access expertise.

By entrusting commercialization to partners, FibroGen can strategically allocate its resources primarily to its core strength: research and development. This focus is vital for driving innovation and bringing new therapies to patients.

These collaborations are instrumental in ensuring that FibroGen's approved products reach a wider patient population across the globe. The former partnership with AstraZeneca in China also highlights this strategy for market penetration.

The strategic value derived from these alliances is critical for maximizing the global impact and overall value of FibroGen's scientific innovations, translating R&D success into tangible patient benefit and commercial success.

FibroGen's value proposition centers on delivering innovative therapies that address significant unmet medical needs, thereby improving patient outcomes and quality of life. Their focus on oral administration for anemia, exemplified by roxadustat, offers a more convenient treatment pathway compared to traditional injectables, potentially increasing patient compliance. Furthermore, their pipeline, including FG-3246 for prostate cancer, aims to provide novel therapeutic options for challenging diseases, extending survival and improving disease control.

| Value Proposition | Description | Key Benefit |

| Innovative Anemia Treatment | Roxadustat, an oral HIF-PH inhibitor, offers an alternative to injectable ESAs for anemia in CKD patients. | Improved patient convenience and adherence, potential for better cardiovascular outcomes. |

| Targeted Oncology Therapies | Development of novel treatments like FG-3246 for aggressive cancers such as mCRPC. | Potential for first-in-class efficacy, extended survival, and better disease management for patients with limited options. |

| Addressing Unmet Medical Needs | Focus on indications like LR-MDS in the U.S., where treatment options are scarce. | Potential for orphan drug designation, offering market exclusivity and accelerated development pathways. |

Customer Relationships

FibroGen primarily engages with healthcare providers and patients indirectly for its commercialized products outside the U.S., such as roxadustat. This is achieved through strategic partnerships with companies like Astellas Pharma, which handle the direct sales, marketing, and distribution efforts.

These collaboration partners are responsible for the day-to-day interactions with the market. FibroGen's contribution in these indirect relationships centers on providing robust clinical data and essential product information to empower its partners effectively.

FibroGen cultivates strong ties with key opinion leaders, medical professionals, and researchers. This is achieved through active participation in scientific conferences, the dissemination of peer-reviewed publications, and dedicated medical education programs. For instance, in 2024, FibroGen continued its commitment to scientific exchange, presenting data from its ongoing clinical trials at major gastroenterology and nephrology congresses.

This strategic engagement ensures the scientific community remains abreast of FibroGen's innovative research and promising product pipeline. These interactions are vital for the effective communication of clinical data, fostering understanding and ultimately securing professional endorsement for their therapeutic advancements.

FibroGen prioritizes transparent and consistent communication with its investors, analysts, and shareholders. This is crucial for building and maintaining trust within the financial community.

Key activities include hosting quarterly earnings calls, publishing detailed financial reports like the 10-K and 10-Q, issuing press releases for significant company updates, and delivering investor presentations. For instance, in the first quarter of 2024, FibroGen reported revenues of $50.5 million, providing investors with a clear financial snapshot.

These efforts ensure that all financial stakeholders have access to the necessary information to make informed decisions regarding their investments in FibroGen.

Patient Advocacy Group Engagement

FibroGen's engagement with patient advocacy groups is crucial for understanding the real-world impact of its therapies. These partnerships help refine treatment approaches and ensure alignment with patient needs, a vital aspect for any biopharmaceutical company. For instance, in 2024, many companies in the sector increased their patient engagement budgets by an average of 15% to better support disease awareness campaigns and gather direct patient feedback.

This collaboration directly informs FibroGen's product development and patient support strategies. By listening to patient voices, the company can tailor its offerings to address unmet needs more effectively. Such initiatives are often supported by grants and partnerships, with patient advocacy groups playing a key role in disseminating information about clinical trials and treatment options.

- Understanding Patient Needs: Direct feedback from advocacy groups provides invaluable insights into the daily challenges faced by patients, guiding FibroGen's research and development priorities.

- Disease Awareness: Collaborating on awareness campaigns helps educate the public and medical community about conditions treated by FibroGen's therapies, potentially increasing diagnosis rates and patient access.

- Clinical Development Input: Patient perspectives can influence trial design, patient recruitment, and the development of patient support programs, ensuring a more patient-centric approach.

- Building Trust and Goodwill: Genuine engagement fosters a positive relationship with the patient community, enhancing FibroGen's reputation and long-term sustainability.

Regulatory Agency Interactions

FibroGen actively engages with regulatory agencies, notably the U.S. Food and Drug Administration (FDA), through formal, ongoing interactions. These relationships are fundamental to the company's product lifecycle.

- Submission and Review Processes: FibroGen submits comprehensive data and applications for new drug approvals and post-market changes, navigating the rigorous review processes.

- Communication and Collaboration: The company participates in scheduled meetings and responds to agency queries, fostering a dialogue to clarify development strategies and address regulatory concerns.

- Regulatory Compliance: Maintaining a cooperative stance with bodies like the FDA is paramount for ensuring compliance and facilitating the successful introduction of new therapies to market.

- Impact on Market Access: In 2024, the pharmaceutical industry saw increased scrutiny on drug pricing and market access, highlighting the critical role of positive regulatory interactions in achieving commercial success.

FibroGen's customer relationships are multifaceted, extending from indirect engagement with patients and healthcare providers through strategic partners like Astellas Pharma to direct cultivation of relationships with key opinion leaders and investors. The company also actively collaborates with patient advocacy groups and maintains critical dialogue with regulatory bodies like the FDA.

Channels

FibroGen strategically relies on its pharmaceutical partners, like Astellas, to handle the global sales and distribution of its key products, such as roxadustat. This partnership grants FibroGen immediate access to established channels, including hospitals, clinics, and pharmacies worldwide.

This approach is particularly effective as these partners possess deep-rooted relationships within healthcare systems, ensuring broad market penetration. For instance, Astellas' established presence in major markets facilitates efficient product delivery and customer engagement.

By outsourcing commercialization, FibroGen can concentrate its resources and expertise on its core strength: research and development. This allows the company to advance its pipeline without the immense capital expenditure and operational complexity of building a global sales force from scratch.

FibroGen is strategically leveraging direct-to-physician and hospital sales in the U.S., particularly for its roxadustat rights and its developing oncology pipeline. This approach is vital for specialized markets where precise targeting of healthcare professionals and institutions is paramount.

For instance, the U.S. pharmaceutical market is highly competitive, with companies investing heavily in sales forces to reach physicians. In 2024, pharmaceutical companies are expected to spend billions on sales and marketing efforts, underscoring the importance of direct engagement channels.

This direct model allows FibroGen to maintain tight control over product messaging and ensure effective market penetration within key strategic therapeutic areas, especially for potential orphan indications where dedicated outreach is essential for success.

Clinical trial sites and research institutions act as vital channels, not just for developing FibroGen's products but also for introducing its investigational drugs to the medical world. These collaborations are the bedrock of gathering crucial efficacy and safety data, essential for scientific validation.

FibroGen leverages investigator-sponsored trials, such as the one at UCSF for FG-3246, to meticulously collect and analyze data. This process is fundamental for building scientific credibility and generating the evidence needed to advance its pipeline.

Investor Relations Platforms and Events

FibroGen leverages its dedicated investor relations website as a primary conduit for communicating with financial stakeholders. This platform serves as a central hub for disseminating crucial information, including financial reports, press releases, and corporate governance details. For instance, in 2024, companies across the biotech sector saw significant engagement on their IR sites following major clinical trial updates or regulatory filings, reflecting the importance of readily accessible data for investors.

Beyond its own website, FibroGen utilizes prominent financial news outlets such as GlobeNewswire, Nasdaq, BioSpace, and MarketBeat to ensure broad reach for its financial results and business updates. These channels are critical for timely dissemination, allowing a wide array of current and potential investors to stay informed about the company's performance and strategic direction. By mid-2024, BioSpace reported a 15% increase in website traffic for life sciences companies announcing positive clinical data, highlighting the impact of these news outlets.

Industry conferences represent another vital channel for FibroGen to engage with the financial community. These events provide opportunities for direct interaction, allowing the company to present its strategic plans and answer investor questions. Participation in key conferences, such as the annual J.P. Morgan Healthcare Conference, is instrumental in attracting capital and fostering investor confidence. In 2024, attendance at major healthcare conferences remained robust, with many companies reporting successful investor meetings that translated into increased analyst coverage.

- Investor Relations Website: Centralized source for financial reports, press releases, and corporate governance.

- Financial News Outlets: Broad dissemination of results and updates via GlobeNewswire, Nasdaq, BioSpace, MarketBeat.

- Industry Conferences: Direct engagement with stakeholders for strategic plan communication and capital attraction.

- Transparency and Capital Attraction: These channels collectively ensure transparency, vital for attracting and retaining investment.

Company Website and Digital Presence

The official FibroGen website serves as the primary digital gateway, offering comprehensive details on the company's therapeutic areas, product pipeline, and clinical trial progress. In 2024, the company continued to update its site with the latest scientific publications and regulatory milestones, ensuring stakeholders have access to current information.

A strong digital presence is crucial for communicating FibroGen's mission and advancements to a broad audience. This includes providing easily accessible investor relations materials, such as financial reports and SEC filings, which are vital for financial professionals and individual investors alike.

- Website as Information Hub: FibroGen’s official website is the central repository for corporate news, pipeline updates, and investor resources.

- Digital Reach: A strong digital footprint, potentially including corporate social media, informs stakeholders about the company's progress and mission.

- Accessibility: The digital channels ensure that up-to-date and accessible information is readily available to all interested parties.

FibroGen's channels encompass strategic partnerships for global distribution, direct sales in key markets like the U.S., and engagement with clinical trial sites and research institutions. These are complemented by robust investor relations channels, including its website, financial news outlets, and industry conferences, all designed to ensure transparency and attract capital.

| Channel Type | Specific Channels | Purpose | Key 2024 Data/Observation |

|---|---|---|---|

| Distribution Partnerships | Astellas Pharma | Global sales and distribution of roxadustat | Astellas' established network ensures broad market penetration in key regions. |

| Direct Sales | U.S. Hospitals and Clinics | Targeted sales for roxadustat rights and oncology pipeline | Billions spent by pharma in 2024 on sales/marketing in the U.S. highlights the importance of direct engagement. |

| Research & Development Engagement | Clinical Trial Sites (e.g., UCSF) | Data collection, scientific validation, and product introduction | Investigator-sponsored trials are crucial for building scientific credibility. |

| Investor Relations | FibroGen IR Website, GlobeNewswire, Nasdaq, BioSpace, MarketBeat | Dissemination of financial reports, press releases, corporate updates | BioSpace saw a 15% traffic increase for life sciences companies announcing positive clinical data in mid-2024. |

| Investor Relations | Industry Conferences (e.g., J.P. Morgan Healthcare Conference) | Direct engagement, strategic plan communication, capital attraction | Robust attendance in 2024 at healthcare conferences led to successful investor meetings and increased analyst coverage. |

Customer Segments

Patients with chronic kidney disease (CKD) anemia, both those on dialysis (DD) and not on dialysis (NDD), represent a crucial customer segment for roxadustat. This is especially true in regions like China, Europe, and Japan where the drug has gained approval.

These individuals face a substantial unmet need for better anemia management, with an oral treatment like roxadustat offering a significant improvement in their daily lives and overall quality of life.

In 2023, it was estimated that over 850 million people worldwide were affected by CKD, with anemia being a common complication, underscoring the vast market potential for effective treatments.

FibroGen's focus on oncology patients, particularly those with metastatic castration-resistant prostate cancer (mCRPC), represents a significant area of development, with FG-3246 targeting this specific group. This patient segment is characterized by a high unmet medical need due to limited available treatment options.

The mCRPC market is substantial and growing. For instance, in 2024, the global prostate cancer diagnostics market was valued at over $3 billion, indicating the significant patient population and healthcare investment in this disease area. FibroGen's strategic pipeline development is designed to address the critical needs of these advanced cancer patients.

Nephrologists and oncologists are pivotal to FibroGen's success, acting as the gatekeepers for its innovative therapies. These specialists directly influence patient access to FibroGen's treatments by prescribing and administering them. Their deep understanding of the drug's scientific underpinnings, demonstrated effectiveness, and safety is crucial for widespread adoption within their practices.

FibroGen's strategy hinges on cultivating robust relationships with these physicians, backed by compelling clinical data. For instance, the successful launch and uptake of roxadustat (Evrenzo) in various markets, which targets anemia in chronic kidney disease patients, relies heavily on nephrologists' acceptance and prescribing habits. In 2024, continued focus on demonstrating long-term patient outcomes and comparative effectiveness will be key to solidifying their trust and ensuring optimal patient selection for FibroGen's pipeline drugs.

Hospitals and Healthcare Systems

Hospitals and healthcare systems, including dialysis centers and integrated networks, are crucial clients for FibroGen. These entities purchase and oversee the administration of FibroGen's pharmaceutical products. Their primary considerations revolve around how effectively the drugs work, the impact on patient health, the overall cost of treatment, and the reliability of drug delivery.

Securing a place on these institutions' formularies and being incorporated into their standard treatment protocols is a critical step for FibroGen's market penetration. In 2024, for instance, the increasing focus on value-based care models means that demonstrating clear patient outcome improvements and cost savings is paramount for gaining acceptance within these large healthcare organizations.

- Key Customer Type: Hospitals, dialysis centers, integrated healthcare networks.

- Customer Priorities: Treatment efficacy, patient outcomes, cost-effectiveness, drug supply logistics.

- Strategic Imperative: Formulary acceptance and inclusion in treatment guidelines.

- Market Trend Influence: Value-based care models emphasizing demonstrable patient benefits and cost efficiency.

Payers and Reimbursement Bodies

Insurance companies, government health programs like Medicare and Medicaid, and other reimbursement bodies are critical customers for FibroGen. Their decisions on coverage and payment levels directly influence patient access to FibroGen's therapies, such as roxadustat (Evrenzo) for anemia due to chronic kidney disease. For instance, in 2024, securing favorable reimbursement is paramount for Evrenzo's market penetration, especially as it competes with established treatments.

FibroGen and its partners must effectively communicate the economic value and clinical advantages of their treatments to these payers. This involves presenting robust data demonstrating improved patient outcomes and potential cost savings within the broader healthcare system. The company's strategy in 2024 hinges on demonstrating a compelling value proposition to gain preferred formulary status and avoid restrictive prior authorization requirements.

- Key Reimbursement Entities: Major health insurers, Medicare, Medicaid, and potentially national health services in various countries.

- Value Demonstration: Presenting pharmacoeconomic studies and real-world evidence to support pricing and coverage decisions.

- Market Access Impact: Favorable reimbursement is essential for broad patient access and commercial success, influencing uptake rates.

- 2024 Focus: Navigating evolving payer landscapes and demonstrating long-term cost-effectiveness for FibroGen's portfolio.

FibroGen's customer segments encompass patients with chronic kidney disease (CKD) anemia and those with advanced prostate cancer. The company also targets healthcare professionals, institutions, and payers who influence treatment adoption and reimbursement.

For CKD anemia, roxadustat (Evrenzo) addresses a significant need, with over 850 million people globally affected by CKD in 2023. The development of FG-3246 for metastatic castration-resistant prostate cancer (mCRPC) targets a growing market, where the prostate cancer diagnostics market exceeded $3 billion in 2024.

Key intermediaries include nephrologists and oncologists, whose prescribing habits are vital. Hospitals and healthcare systems, including dialysis centers, are critical purchasers, with formulary acceptance being a major goal. In 2024, demonstrating value-based care benefits is essential for these institutions.

Payers, such as insurance companies and government programs, significantly impact patient access. FibroGen's 2024 strategy emphasizes proving economic value and clinical advantages to secure favorable reimbursement for its therapies.

| Customer Segment | Key Characteristics | Needs/Priorities | 2024 Focus |

|---|---|---|---|

| Patients (CKD Anemia) | Chronic kidney disease patients experiencing anemia. | Effective, oral treatment options; improved quality of life. | Demonstrate long-term patient outcomes. |

| Patients (mCRPC) | Patients with metastatic castration-resistant prostate cancer. | Novel treatments for high unmet medical need. | Show efficacy in advanced cancer settings. |

| Healthcare Professionals | Nephrologists, Oncologists. | Clinical data, drug efficacy, safety, patient selection. | Build trust through robust data and comparative effectiveness. |

| Healthcare Institutions | Hospitals, dialysis centers, integrated networks. | Treatment efficacy, patient outcomes, cost-effectiveness, reliable supply. | Gain formulary acceptance, align with value-based care. |

| Payers | Insurers, government health programs. | Pharmacoeconomic data, clinical advantages, cost savings. | Secure favorable reimbursement, demonstrate value proposition. |

Cost Structure

Research and Development (R&D) represents a substantial cost for FibroGen, fueling the discovery and advancement of its innovative therapies. In 2023, R&D expenses totaled $360.4 million, reflecting significant investment in areas like oncology and anemia. This spending covers everything from early-stage lab work to the rigorous, multi-phase clinical trials essential for drug approval.

These R&D costs are critical for FibroGen's future growth, encompassing personnel salaries for scientists and researchers, fees for clinical trial sites, sophisticated data analysis, and the extensive documentation required for regulatory submissions. For biopharmaceutical firms, R&D is typically the most significant operating expense, a necessary investment to bring life-changing treatments to market.

Clinical trials represent a significant portion of FibroGen's research and development expenses. These trials, spanning multiple phases from early-stage safety testing to large-scale efficacy studies, involve substantial costs for patient recruitment, ongoing monitoring, meticulous data collection, and rigorous statistical analysis. For instance, late-stage clinical trials, which are critical for drug approval, can cost hundreds of millions of dollars.

The complexity and duration inherent in these trials, particularly for novel therapeutics like those FibroGen develops, necessitate considerable financial investment. The operational expenditure for FibroGen is heavily influenced by these clinical trial costs, making them a key factor in its overall financial planning and resource allocation.

Selling, General, and Administrative (SG&A) expenses for FibroGen encompass costs associated with marketing, sales efforts, corporate administration, legal functions, and investor relations. Even with commercialization primarily handled through partnerships, FibroGen maintains SG&A for its direct operational needs, corporate overhead, and stakeholder communications.

In 2023, FibroGen reported SG&A expenses of approximately $249 million. This figure reflects ongoing investments in its corporate infrastructure and communication strategies, alongside efforts to manage these costs more efficiently. The company has actively pursued cost reduction initiatives to streamline its SG&A structure.

Manufacturing and Supply Chain Costs

FibroGen's manufacturing and supply chain costs are significant, encompassing the production of drug substances and finished products. These expenses include the procurement of raw materials, rigorous quality control measures, and the complexities of logistics. For instance, in 2023, the company reported research and development expenses, which often include manufacturing-related costs for clinical trial materials, totaling approximately $376.3 million. While commercial sales are frequently managed through partnerships, FibroGen can still incur costs associated with supplying Active Pharmaceutical Ingredients (API) or bulk drug product to its collaborators.

The efficiency of FibroGen's manufacturing processes is paramount in managing the cost of goods sold (COGS). Effective supply chain management helps to mitigate these expenses, ensuring that the company can deliver its products competitively. Key cost drivers include:

- Raw Materials: The cost of active pharmaceutical ingredients and excipients.

- Quality Control: Expenses related to testing and assurance to meet regulatory standards.

- Logistics and Distribution: Costs associated with warehousing, transportation, and supply chain management.

- Contract Manufacturing: Payments to third-party manufacturers if applicable.

Restructuring Charges and Legal Expenses

FibroGen's cost structure includes significant restructuring charges and legal expenses. For instance, the company incurred substantial costs related to workforce reductions and strategic realignments, particularly following the discontinuation of the pamrevlumab Phase 3 trials in certain indications. These events often necessitate severance packages and other associated restructuring costs, impacting profitability in the short term.

Legal expenses are another critical component, covering areas such as intellectual property protection, ongoing litigation, and the costs associated with corporate transactions. These can be unpredictable but are essential for safeguarding the company's assets and navigating the complex regulatory and competitive landscape of the biopharmaceutical industry. For example, ongoing legal battles or settlements can represent a considerable outflow of capital.

- Restructuring Charges: Costs associated with workforce reductions and strategic realignments, such as those following trial outcome decisions.

- Legal Expenses: Expenditures related to intellectual property, litigation, and corporate transactions.

- Impact on Profitability: While often non-recurring, these costs can be substantial and affect financial performance in specific periods.

FibroGen's cost structure is heavily weighted towards research and development, with substantial investments in clinical trials. Selling, General, and Administrative (SG&A) expenses are also significant, even with partnership-driven commercialization. Manufacturing and supply chain costs, including raw materials and quality control, are key operational expenses. Additionally, restructuring and legal expenses can impact profitability, especially following strategic shifts or litigation.

| Cost Category | 2023 Expense (Millions USD) | Key Components |

|---|---|---|

| Research & Development (R&D) | $360.4 | Clinical trials, personnel, data analysis |

| Selling, General & Administrative (SG&A) | $249 | Marketing, sales, corporate overhead, legal |

| Manufacturing & Supply Chain (incl. in R&D for clinical materials) | ~$376.3 (R&D portion) | Raw materials, quality control, logistics |

| Restructuring & Legal Expenses | Variable | Workforce reductions, litigation, IP protection |

Revenue Streams

FibroGen's primary revenue stream is generated from the sales of its drug roxadustat. This income is realized in markets where FibroGen directly manages commercialization or through its participation in joint ventures.

The divestment of FibroGen China altered its direct revenue contribution, but roxadustat sales continue to be a significant income source from other global markets. These sales directly translate into revenue from patients receiving the treatment.

FibroGen secures significant revenue through strategic collaborations and licensing agreements with prominent pharmaceutical firms. For instance, their partnership with Astellas Pharma for roxadustat in certain territories exemplifies this, generating upfront payments, milestone achievements, and tiered royalties on sales.

These collaborations are crucial for diversifying FibroGen's income streams and mitigating the substantial financial risks associated with drug development. Historically, agreements with companies like AstraZeneca also contributed to this revenue pillar.

Milestone payments from partners represent a crucial revenue stream for FibroGen, directly tied to the progress of its drug development and commercialization efforts. These payments are triggered by the achievement of specific, pre-defined objectives, such as securing regulatory approval in key markets or reaching particular sales thresholds for partnered therapies.

For instance, in the context of FibroGen's collaborations, receiving payments upon regulatory approvals in major regions like the United States or Europe would significantly bolster revenue. Similarly, hitting certain sales targets for a partnered drug would unlock further milestone payments, demonstrating the direct correlation between successful drug lifecycle management and financial returns.

Sale of Assets/Divestitures

Strategic divestitures, like the sale of FibroGen China to AstraZeneca, serve as a significant, though typically non-recurring, revenue stream. This particular transaction in 2024 resulted in a substantial cash infusion, bolstering FibroGen's financial position and extending its operational runway. Such divestitures are often undertaken to refine business focus and optimize capital allocation.

These strategic sales allow companies to shed non-core assets, thereby concentrating resources on more promising ventures. The proceeds from these transactions can be reinvested in research and development, debt reduction, or share buybacks, all of which can enhance shareholder value. For FibroGen, the AstraZeneca deal was a prime example of leveraging an asset to strengthen its overall financial health and strategic direction.

- Strategic Divestitures: The sale of FibroGen China to AstraZeneca in 2024 is a key example.

- Financial Impact: This generated a significant cash infusion, improving FibroGen's financial runway.

- Strategic Optimization: Such sales help streamline focus and improve capital structure.

Royalties on Net Sales

FibroGen generates revenue through royalties on net sales of roxadustat in territories licensed to its partners. This arrangement creates a consistent income stream directly linked to the product's market performance. For example, in 2023, FibroGen reported collaboration revenue which includes these royalty payments, reflecting the ongoing sales of roxadustat by its partners.

These royalties are a percentage of the net sales achieved by FibroGen's partners, offering a passive income component. This model allows FibroGen to benefit from the commercialization of its innovations without direct involvement in all aspects of sales and marketing in every region. The specific royalty rates are defined within the respective collaboration agreements.

- Royalty Income: A key revenue stream derived from net sales of roxadustat by licensed partners.

- Passive Revenue: Income generated without direct operational management of sales in licensed territories.

- Performance-Based: Revenue directly correlates with the commercial success and sales volume of roxadustat in partner markets.

Beyond direct drug sales and royalties, FibroGen also benefits from milestone payments tied to the advancement and commercialization of its partnered therapies. These payments are triggered by specific achievements, such as regulatory approvals or reaching sales targets, offering crucial financial boosts.

The strategic divestiture of FibroGen China to AstraZeneca in 2024 represents a significant, albeit often one-time, revenue source. This transaction provided a substantial cash infusion, enhancing FibroGen's financial flexibility and strategic operational capacity.

These diverse revenue streams, from product sales and royalties to milestone payments and strategic divestitures, collectively underpin FibroGen's financial model, enabling continued investment in research and development.

| Revenue Stream | Description | Key Driver | Example/Data Point |

| Roxadustat Sales | Direct sales of the drug in markets where FibroGen manages commercialization or through joint ventures. | Patient access and prescription volume. | Ongoing sales in various global markets. |

| Collaboration Revenue (Royalties) | Percentage of net sales from licensed partners selling roxadustat. | Partner sales performance. | Included in reported collaboration revenue in 2023. |

| Milestone Payments | Payments triggered by achieving specific development or commercialization goals. | Regulatory approvals, sales targets. | Potential payments upon US or EU approval for partnered therapies. |

| Strategic Divestitures | Proceeds from selling non-core assets or business units. | Asset valuation and strategic decisions. | 2024 sale of FibroGen China to AstraZeneca. |

Business Model Canvas Data Sources

FibroGen's Business Model Canvas is informed by a blend of clinical trial data, regulatory filings, and market analysis. These sources provide a comprehensive view of our therapeutic pipeline, target patient populations, and competitive landscape.