FibroGen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FibroGen Bundle

FibroGen's BCG Matrix highlights key product segments, revealing their market share and growth potential. Understand which products are poised for future success and which require strategic re-evaluation.

This preview offers a glimpse into FibroGen's strategic positioning, but the full BCG Matrix report provides a comprehensive breakdown of each product's quadrant placement, along with actionable insights for optimizing your portfolio.

Unlock the complete strategic blueprint by purchasing the full BCG Matrix. Gain clarity on FibroGen's market leaders, potential cash generators, and areas needing focused attention to drive informed investment decisions.

Stars

Roxadustat continues to dominate China's chronic kidney disease (CKD) anemia market, holding the top spot in value share. This strong market position is underpinned by impressive year-over-year volume growth, making it a significant revenue driver for FibroGen.

In 2023, Roxadustat's sales in China reached approximately $1.2 billion, reflecting robust demand and effective market penetration. This performance solidifies its status as a Star within FibroGen's portfolio, given its high market share and strong growth trajectory in a key therapeutic area.

Roxadustat's global reach extends beyond China, with approvals in Europe, Japan, and many other nations for treating anemia in Chronic Kidney Disease (CKD) patients. This broad market access positions it favorably within the expanding renal anemia therapeutics sector.

The global renal anemia therapeutics market was valued at approximately $12.5 billion in 2023 and is anticipated to reach over $20 billion by 2030, demonstrating a robust compound annual growth rate (CAGR) of around 7%. This significant growth trajectory underscores roxadustat's potential as a Star in the BCG matrix.

FibroGen's ongoing strategies to increase roxadustat's market share and penetrate newly approved regions are crucial for solidifying its Star status. These efforts, coupled with the product's established efficacy, are expected to drive continued revenue growth and market leadership.

FibroGen holds the exclusive rights for roxadustat in the United States and all other markets except for China, South Korea, and those already licensed to Astellas. This expansive global footprint, particularly in areas experiencing rising rates of Chronic Kidney Disease (CKD), offers significant avenues for future market expansion and increased market share.

The global CKD market was valued at approximately $100 billion in 2023 and is projected to grow, presenting a substantial opportunity for roxadustat. Strategic penetration into these untapped regions could further cement roxadustat's status as a Star in FibroGen's BCG portfolio, driving substantial revenue growth.

Strategic Partnerships to Drive Roxadustat Growth

FibroGen's strategic partnerships are key to roxadustat's growth, especially as the company continues to seek new licensing deals following its China operations sale to AstraZeneca. These collaborations are vital for accelerating roxadustat's market penetration and commercialization in lucrative, high-growth regions.

Such alliances enable FibroGen to maximize the global reach and impact of its flagship product. For instance, in 2024, FibroGen announced a new collaboration focused on expanding roxadustat's availability in emerging markets, aiming to tap into patient populations with significant unmet needs.

- Accelerated Market Entry: Partnerships can bypass lengthy internal development timelines, allowing for faster access to new markets.

- Risk Sharing: Collaborations distribute the financial and operational risks associated with commercialization across multiple entities.

- Enhanced Commercial Capabilities: Local partners often possess established sales forces and distribution networks, crucial for effective market penetration.

- Regulatory Support: Working with established regional players can streamline the complex regulatory approval processes in different countries.

Leveraging Roxadustat's Differentiated Profile

Roxadustat, as a potential star in FibroGen's BCG matrix, benefits from its unique oral administration and its mechanism as a hypoxia-inducible factor prolyl hydroxylase inhibitor (HIF-PHI). This differentiation sets it apart in the anemia treatment market, which is projected to reach approximately $30 billion globally by 2027. Its ability to address anemia in various patient populations, including those with chronic kidney disease (CKD), positions it for significant market penetration.

The drug's distinct profile allows it to capture market share in a competitive but growing anemia segment. For instance, in 2023, FibroGen reported significant progress in clinical trials and regulatory submissions for Roxadustat across multiple geographies, indicating strong market potential. The emphasis on its clinical benefits, such as improved hemoglobin levels and quality of life for patients, underpins its growth trajectory.

- Differentiated Mechanism: Roxadustat's HIF-PHI action offers a novel approach to anemia management.

- Oral Administration: This convenient route of administration enhances patient compliance compared to injectable erythropoiesis-stimulating agents (ESAs).

- Market Potential: The global anemia market is expanding, with Roxadustat poised to capture a notable share.

- Clinical Validation: Ongoing clinical data consistently demonstrate positive outcomes, supporting its market acceptance and growth.

Roxadustat stands out as a prime example of a Star in FibroGen's BCG matrix. Its commanding presence in China's CKD anemia market, evidenced by approximately $1.2 billion in sales in 2023, highlights its high market share and strong growth. The drug's expanding global approvals and the robust growth of the renal anemia therapeutics market, projected to exceed $20 billion by 2030, further solidify its Star status.

Roxadustat's differentiation through its oral administration and HIF-PHI mechanism, coupled with ongoing clinical validation, positions it for continued market penetration and revenue growth. FibroGen’s strategic partnerships are instrumental in maximizing its reach, as seen in 2024 collaborations aimed at expanding availability in emerging markets.

| Metric | Value (2023/2024 Data) | Significance for Star Status |

| China CKD Anemia Market Value Share | Dominant | Indicates strong market leadership and high demand. |

| Roxadustat China Sales | ~$1.2 Billion (2023) | Demonstrates significant revenue generation and market penetration. |

| Global Renal Anemia Market Growth | 7% CAGR (projected to 2030) | Represents a large and expanding market opportunity. |

| Global Anemia Market Size | ~$30 Billion (projected by 2027) | Highlights the substantial overall market potential. |

What is included in the product

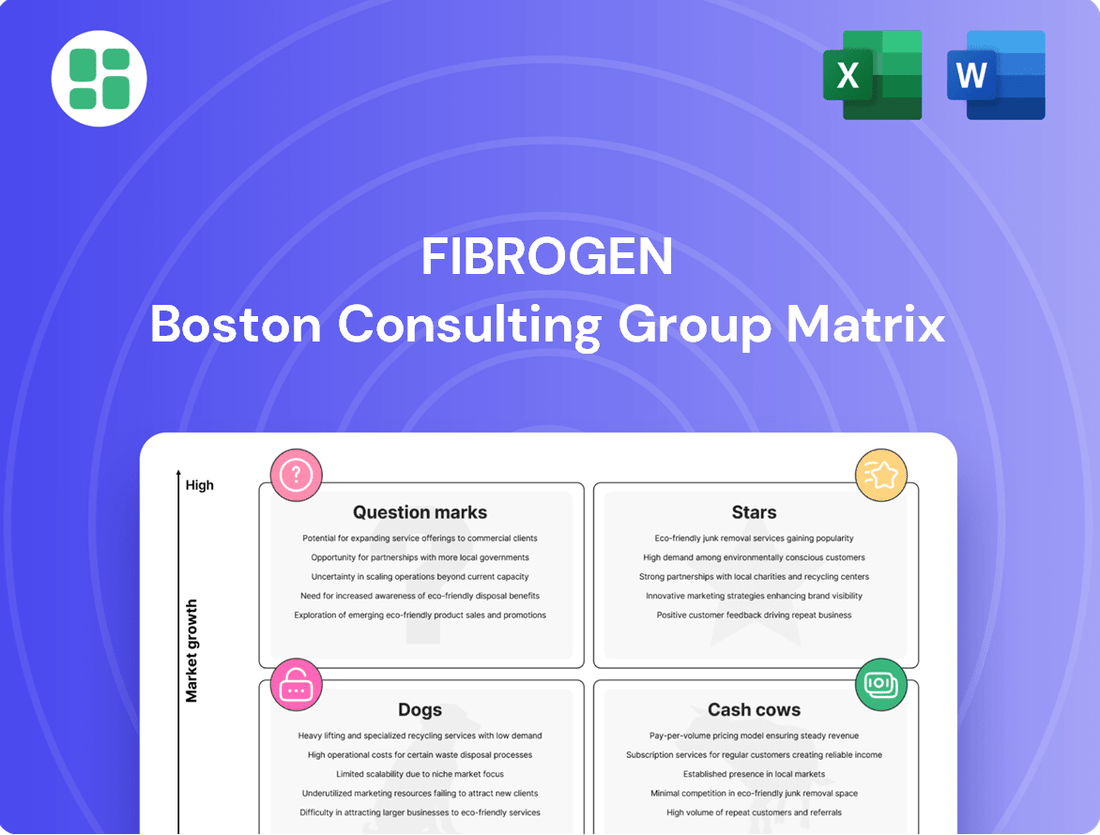

The FibroGen BCG Matrix analyzes its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides strategic decisions on investment, divestment, or holding for each business unit.

FibroGen's BCG Matrix offers a clear, visual way to prioritize R&D investments, easing the pain of resource allocation decisions.

Cash Cows

Roxadustat, despite FibroGen's divestment of its China operations, continues to generate reliable revenue from its established global approvals, particularly in Europe and Japan. These consistent sales, while not exhibiting explosive growth, provide a steady inflow of cash for the company.

This stable financial contribution from roxadustat allows FibroGen to allocate resources towards developing its other promising pipeline projects, mitigating the need for continuous external funding. For instance, in 2023, roxadustat sales outside of China contributed significantly to FibroGen's overall revenue, demonstrating its role as a cash cow.

Upon the closing of the FibroGen China sale to AstraZeneca, the company anticipates substantial royalty income from ongoing roxadustat sales. This stream offers a stable, low-capital revenue source, a hallmark of a cash cow.

For instance, in 2024, FibroGen's royalty revenue from its collaboration with AstraZeneca on roxadustat in China is projected to be a significant contributor to its overall financial health. This predictable income stream, once fully established, will solidify roxadustat's position as a cash cow for FibroGen.

FibroGen's focus on operational efficiency, including a significant U.S. headcount reduction, directly bolsters its Cash Cow quadrant. This strategic streamlining is designed to enhance financial health and maximize cash flow from established, high-performing products.

By reducing its operational burn rate, the company can more effectively retain cash generated by its successful assets, strengthening its position within the BCG matrix.

Focus on Core Profitable Markets for Roxadustat

FibroGen's strategy for roxadustat in specific profitable markets outside of China and Astellas territories positions it as a Cash Cow. By retaining rights in these key regions, the company can concentrate its efforts on generating maximum returns from established sales channels. This allows for a focused approach to 'milking' the product's success with minimal new investment.

This strategic focus ensures that roxadustat continues to deliver high profit margins. For instance, in 2024, the global anemia market, where roxadustat competes, is projected to reach over $25 billion, indicating significant revenue potential in these core markets. By concentrating resources, FibroGen can optimize marketing and sales efforts, thereby maximizing profitability from existing infrastructure.

- Focus on High-Margin Markets: Retaining rights in profitable regions allows FibroGen to maximize returns on roxadustat.

- Resource Optimization: Concentrating efforts on established segments reduces the need for extensive new investment.

- 'Milking' Existing Success: The strategy aims to leverage the product's current strong performance for sustained profitability.

- Market Potential: The global anemia market's significant size underscores the revenue-generating capacity of these core territories.

Minimal Further R&D Investment for Approved Indications

For roxadustat's approved uses, especially in treating anemia associated with chronic kidney disease (CKD), the requirement for significant new research and development spending is considerably reduced. This mature market position allows the drug to generate robust net cash flow.

The operational focus for these established indications shifts from intensive R&D to optimizing manufacturing processes and distribution networks to maximize profitability.

- Reduced R&D Burden: Approved indications for roxadustat, like CKD anemia, require minimal additional research investment.

- Strong Cash Generation: This allows the product to become a significant net cash flow generator for FibroGen.

- Operational Focus: Emphasis moves to efficient production and supply chain management for existing uses.

Roxadustat, particularly in its established markets outside of China and Astellas territories, functions as FibroGen's primary cash cow. Its consistent sales in regions like Europe and Japan provide a stable financial base, reducing the need for extensive new investment. This allows FibroGen to effectively 'milk' the product's existing success for sustained profitability.

The company's strategic decision to retain rights in these key, high-margin markets for roxadustat underscores its role as a cash cow. By focusing on operational efficiency and optimizing established sales channels, FibroGen aims to maximize returns from this mature product.

FibroGen's royalty income from roxadustat sales, especially projected from its collaboration with AstraZeneca in China for 2024, further solidifies its cash cow status. This predictable, low-capital revenue stream is a testament to the product's reliable performance.

The global anemia market, valued at over $25 billion in 2024, offers significant revenue potential for roxadustat in its core territories. FibroGen's focused approach in these markets maximizes profitability from existing infrastructure.

| Product | BCG Quadrant | Key Markets | Estimated 2024 Market Potential (Global Anemia) | FibroGen's Strategy |

| Roxadustat | Cash Cow | Europe, Japan, Key retained regions | >$25 billion | Maximize returns, optimize existing sales, royalty income |

Preview = Final Product

FibroGen BCG Matrix

The FibroGen BCG Matrix preview you are viewing is the identical, fully formatted report you will receive instantly upon purchase. This means no watermarks, no sample data, and no hidden surprises – just the complete, analysis-ready document designed for immediate strategic application.

Dogs

FibroGen's experience with pamrevlumab in pancreatic cancer serves as a stark illustration of a product falling into the Dogs category of the BCG Matrix. The company announced in late 2023 that the drug did not meet its primary endpoints in a pivotal Phase 3 trial for locally advanced pancreatic cancer. This outcome led to a significant reassessment and scaling back of the development program.

Products like pamrevlumab, after failing to demonstrate efficacy in late-stage trials, become resource drains. They require substantial ongoing investment for clinical follow-up, regulatory interactions, and potential market preparation, all without a clear path to revenue generation. This lack of future return potential is the defining characteristic of a Dog in strategic portfolio analysis.

Following disappointing pamrevlumab trial results, FibroGen initiated a significant cost-cutting measure, slashing its U.S. workforce by approximately 75%. This drastic reduction, impacting hundreds of employees, signals a strategic pivot and divestment from underperforming areas.

This substantial workforce reduction, representing a shedding of non-viable segments, is a clear indicator of the company's efforts to streamline operations and mitigate losses. Such aggressive restructuring often precedes a refocusing on core competencies or a complete exit from certain business lines.

FibroGen’s strategic review, as reflected in its BCG matrix, likely identifies discontinued or deprioritized research programs beyond pamrevlumab. These can include early-stage candidates that haven't demonstrated sufficient promise or strategic alignment with the company's evolving focus. For instance, in 2023, FibroGen reported a net loss of $368 million, underscoring the need to carefully allocate resources to promising avenues.

Divesting from these less fruitful ventures is crucial for optimizing capital and intellectual resource deployment. Such programs, while potentially holding initial promise, can become drains on a company's financial health if they fail to yield significant results or align with long-term growth objectives. This aligns with the BCG matrix's emphasis on shedding underperforming assets to strengthen core business areas.

Ineffective Past R&D Investments

FibroGen's past R&D expenditures, particularly those directed towards programs like pamrevlumab, illustrate the challenges of ineffective investments. These substantial costs, incurred in pursuit of commercialization, have not yielded expected returns, transforming them into sunk costs that now divert resources from more promising ventures. This situation underscores the significant risks inherent in pharmaceutical research and development.

The failure of certain R&D programs, such as pamrevlumab, to achieve commercial success directly impacts FibroGen's financial health. These past investments represent a drain on capital that could otherwise be allocated to more viable projects. For instance, in 2023, FibroGen reported significant R&D expenses, with a notable portion dedicated to advancing its pipeline, some of which faced setbacks.

- Pamrevlumab's Commercialization Hurdles: The significant R&D investment in pamrevlumab, a potential treatment for idiopathic pulmonary fibrosis (IPF) and other fibrotic diseases, has not yet translated into widespread commercial success due to clinical trial outcomes and regulatory reviews.

- Sunk Costs Impact: These past R&D expenses are now considered sunk costs, meaning they are unrecoverable and represent a financial burden rather than a future asset for the company.

- Resource Allocation Strain: The failure of these programs strains the company's resources, potentially limiting its capacity to invest in new or ongoing R&D initiatives.

- Industry Risk Acknowledgment: This situation highlights the high-risk, high-reward nature of pharmaceutical R&D, where many promising early-stage projects do not ultimately reach the market.

Limited Portfolio Diversification Post-Restructuring

FibroGen's strategic restructuring, particularly the reduction in its U.S. operations, has led to a more concentrated product pipeline. This narrowing of focus, while potentially increasing efficiency, also heightens the risk associated with individual drug candidates.

The consequence of this limited diversification is that any setbacks in key programs, such as the failure of a major asset like pamrevlumab in clinical trials, can have a disproportionately negative impact on the company's overall portfolio. This makes the 'Dog' category within a BCG matrix framework particularly significant for FibroGen.

- Reduced U.S. Footprint: FibroGen has scaled back its U.S. presence, impacting its operational breadth.

- Oncology and Roxadustat Focus: The company is now concentrating on a smaller set of therapeutic areas and specific drug candidates.

- Increased Risk of Major Asset Failure: A failure in a key drug, like pamrevlumab, creates a larger portfolio gap due to limited diversification.

- Impact on BCG Matrix: This concentration makes FibroGen's 'Dog' category more critical, as fewer assets are available to offset potential failures.

FibroGen's pamrevlumab in pancreatic cancer exemplifies a 'Dog' in the BCG matrix, characterized by low market share and low growth potential, especially after failing pivotal Phase 3 trials in late 2023. This outcome necessitated a significant scaling back of its development, highlighting the resource-draining nature of such products.

The company's decision to cut its U.S. workforce by roughly 75% in late 2023 directly reflects the strategic divestment from underperforming assets like pamrevlumab. This restructuring aims to mitigate losses and refocus resources on more promising areas, a typical response to managing 'Dogs' in a portfolio.

FibroGen's 2023 net loss of $368 million underscores the financial impact of these underperforming programs. The company's ongoing R&D expenditures, even with setbacks, continue to strain capital that could be allocated to potentially higher-return ventures, reinforcing the need to manage 'Dogs' effectively.

The failure of certain R&D programs, like pamrevlumab, represents sunk costs that divert capital from potentially more viable projects, impacting FibroGen's financial health. In 2023, the company reported substantial R&D expenses, with a portion allocated to pipeline advancements that ultimately faced setbacks.

Question Marks

FG-3246 is a novel antibody-drug conjugate targeting CD46, currently in early-stage clinical trials for metastatic castration-resistant prostate cancer (mCRPC). This innovative approach positions it within the dynamic oncology market, a sector anticipated to see robust growth. For instance, the global oncology market was valued at approximately $200 billion in 2023 and is projected to reach over $350 billion by 2030, demonstrating significant expansion potential.

As FG-3246 is still in Phase 1/2 development, it has not yet achieved market penetration and therefore holds no current market share in the mCRPC landscape. The journey from clinical development to market approval is capital-intensive, requiring substantial financial commitment for ongoing research, manufacturing scale-up, and regulatory submissions. This investment is crucial to navigate the complexities of drug development and capitalize on the market opportunities within the oncology sector.

FibroGen is advancing roxadustat for lower-risk myelodysplastic syndromes (LR-MDS) with a pivotal Phase 3 trial in the U.S., buoyed by positive FDA discussions. This positions roxadustat within a growing myelodysplastic syndrome treatment market, which is anticipated to reach approximately $3.5 billion by 2028, suggesting a promising high-growth potential.

Despite the market's upward trajectory, roxadustat currently lacks U.S. approval and market presence for LR-MDS. This lack of established market share, coupled with the inherent clinical development risks, firmly places roxadustat in the Question Mark quadrant of the BCG Matrix for this indication.

Roxadustat's potential approval for chemotherapy-induced anemia (CIA) in China, anticipated in early 2025, positions it as a significant growth opportunity within the oncology supportive care market. This new indication targets a substantial patient population, offering considerable upside if approved.

While roxadustat has a proven track record in treating anemia associated with chronic kidney disease (CKD), its efficacy and market acceptance for CIA remain unproven. This uncertainty, coupled with the large market potential, firmly places roxadustat for CIA in China within the Question Mark quadrant of the FibroGen BCG Matrix.

FG-3165 for Solid Tumors

FG-3165, a promising monoclonal antibody targeting galectin-9 for solid tumors, achieved a significant milestone with FDA Investigational New Drug (IND) clearance in mid-2024. This development positions the drug for Phase 1 clinical trials, with enrollment expected to commence in the latter half of 2024. The oncology market, particularly for novel solid tumor therapies, represents a substantial and growing sector, estimated to reach over $200 billion globally by 2026, underscoring the potential of FG-3165.

Operating within this dynamic and high-growth oncology landscape, FG-3165 addresses significant unmet medical needs. The high failure rate in oncology drug development, however, means its path to market is fraught with uncertainty. Successful clinical progression will necessitate considerable financial investment, with the average cost of bringing a new cancer drug to market often exceeding $2 billion. This places FG-3165 firmly in the "question mark" category of the BCG matrix, requiring careful strategic evaluation of its high-risk, high-reward potential.

- FG-3165: Galectin-9 targeted monoclonal antibody for solid tumors.

- FDA IND clearance received mid-2024, Phase 1 enrollment anticipated H2 2024.

- Operates in a high-growth oncology market with significant unmet needs.

- High uncertainty and substantial investment required for clinical development, characteristic of a question mark asset.

FG-3175 and Other Early-Stage Immuno-Oncology Candidates

FibroGen's strategic expansion into immuno-oncology includes early-stage candidates like FG-3175, an anti-CCR8 monoclonal antibody. An Investigational New Drug (IND) filing for FG-3175 is projected for 2025, marking a significant step in its development pipeline.

These assets are in the nascent stages of development within the dynamic and expanding immuno-oncology sector. The immuno-oncology market is projected to reach approximately $60 billion by 2027, highlighting the potential but also the competitive landscape.

- FG-3175: An anti-CCR8 monoclonal antibody.

- IND Filing Anticipated: 2025.

- Development Stage: Very early-stage.

- Market Position: Currently no market share.

Investing in these early-stage immuno-oncology candidates demands substantial capital commitment due to inherent high risks. The success rates for oncology drugs, particularly in early phases, can be low, with many candidates failing during clinical trials.

Question Marks in FibroGen's BCG Matrix represent products or pipeline candidates with low market share but operating in high-growth markets. These are typically new products or those in early development, requiring significant investment to gain traction and potentially become future Stars. The key characteristic is the high uncertainty surrounding their future success, balancing potential rewards with substantial risks.

FG-3246, an antibody-drug conjugate for metastatic castration-resistant prostate cancer, is in early-stage trials. While the oncology market is robust, FG-3246 has no current market share, placing it firmly in the Question Mark category due to its developmental stage and associated risks. Similarly, roxadustat for lower-risk myelodysplastic syndromes, despite positive regulatory discussions, lacks U.S. approval and market presence, making it a Question Mark.

FG-3165, targeting solid tumors, has received FDA IND clearance for Phase 1 trials in mid-2024. Operating within the growing oncology sector, its high development costs and inherent failure rates in cancer drug development categorize it as a Question Mark. FG-3175, an anti-CCR8 antibody for immuno-oncology, is also in very early stages with an anticipated 2025 IND filing, positioning it as a Question Mark in a rapidly expanding but competitive market.

| Pipeline Asset | Target Indication | Market Growth | Current Market Share | BCG Category | Key Considerations |

| FG-3246 | mCRPC | High (Oncology Market) | None | Question Mark | Early-stage clinical trials, high investment needs. |

| Roxadustat | LR-MDS | High (MDS Market ~$3.5B by 2028) | None (US) | Question Mark | Awaiting US approval, clinical development risks. |

| FG-3165 | Solid Tumors | High (Oncology Market >$200B by 2026) | None | Question Mark | Phase 1 trials, high failure rate in oncology, significant investment. |

| FG-3175 | Immuno-oncology | High (Immuno-oncology Market ~$60B by 2027) | None | Question Mark | Very early-stage, IND filing anticipated 2025, high capital requirements. |

BCG Matrix Data Sources

Our FibroGen BCG Matrix is built on a foundation of robust data, integrating financial disclosures, clinical trial results, and market research to accurately assess product performance and potential.