Fenix Outdoor SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fenix Outdoor Bundle

Fenix Outdoor, a leader in outdoor lifestyle products, boasts strong brand recognition and a loyal customer base, but faces challenges in an increasingly competitive digital landscape. Our analysis reveals how their established retail presence can be leveraged for future growth.

Want the full story behind Fenix Outdoor's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fenix Outdoor's strength lies in its impressive stable of well-recognized outdoor brands, including Fjällräven, Hanwag, Primus, and Royal Robbins. These brands are synonymous with quality and authenticity, resonating deeply with outdoor enthusiasts. This diverse brand ecosystem allows Fenix to effectively serve a wide range of outdoor pursuits and consumer tastes, fostering strong brand loyalty and expanding its market footprint.

The strategic acquisition of Devold in March 2025 significantly bolsters Fenix Outdoor's position in the premium wool apparel segment. Devold, a heritage brand with a strong reputation for technical wool products, complements Fenix's existing offerings. This expansion not only broadens the company's product categories but also enhances its appeal to a discerning customer base that values performance and natural materials.

Fenix Outdoor leverages a robust mix of wholesale partnerships and its own retail network, encompassing both brick-and-mortar stores and a growing e-commerce presence. This diversified strategy ensures broad market reach across the globe.

The company's hybrid distribution model offers significant flexibility, mitigating risks associated with over-reliance on any single sales channel. This approach also facilitates direct interaction with customers, a key area for Fenix Outdoor's strategic growth, particularly within the direct-to-consumer (DTC) segment.

For instance, Fenix Outdoor's DTC sales have shown consistent growth, contributing a significant portion to overall revenue. In 2023, the direct sales channel accounted for approximately 30% of the company's total sales, demonstrating the effectiveness of their investment in e-commerce and owned retail.

Fenix Outdoor boasts a significant global presence, operating across Europe, North America, and Asia. This extensive international footprint allows the company to access a wide array of diverse markets and capitalize on varied regional growth trends. For instance, in 2023, Fenix Outdoor reported strong sales growth in markets like Canada and China, demonstrating its ability to thrive even when certain other regions experienced slower economic activity.

Commitment to Quality and Durability

Fenix Outdoor's business model is deeply rooted in creating and selling high-quality, durable outdoor gear for users who push their equipment to the limit. This dedication to product longevity and performance resonates strongly with outdoor enthusiasts, fostering a robust brand image and high levels of customer loyalty.

This commitment translates into tangible benefits, as evidenced by the company's consistent performance. For instance, in the first quarter of 2024, Fenix Outdoor reported a net sales increase of 13% compared to the same period in 2023, reaching SEK 2,206 million. This growth underscores the market's appreciation for their durable offerings.

- Focus on Longevity: Fenix Outdoor prioritizes developing products built to last, appealing to consumers seeking value and reliability.

- Brand Reputation: The emphasis on quality and durability has cultivated a strong, positive brand image within the outdoor community.

- Customer Loyalty: End-users who value performance and longevity are more likely to become repeat customers, driving sustained sales.

- Market Resilience: Products designed for demanding conditions often exhibit greater resilience to economic downturns, as consumers may invest more in fewer, higher-quality items.

Focus on Sustainability and Ethical Practices

Fenix Outdoor, through its brands like Fjällräven, is making significant strides in sustainability. They are prioritizing recycled materials and responsible production, which is a major draw for today's eco-aware consumers. This focus isn't just good for the planet; it's smart business, aligning them with major industry shifts and potentially reducing future regulatory or reputational risks.

This dedication to ethical practices translates into tangible benefits. For example, Fjällräven's commitment to using recycled polyester and organic cotton in many of its products enhances its brand image. In 2023, the outdoor apparel market saw continued growth in demand for sustainable products, with reports indicating that over 60% of consumers consider sustainability when making purchasing decisions. Fenix Outdoor's proactive approach positions them well to capture this growing market segment.

The company's efforts include:

- Use of Recycled Materials: Incorporating recycled polyester and nylon across various product lines.

- Responsible Production: Focusing on reducing water usage and chemical impact in manufacturing.

- Fair Labor Practices: Ensuring ethical treatment and fair wages throughout their supply chain.

- Product Longevity: Designing durable products that are meant to last, reducing the need for frequent replacements.

Fenix Outdoor's portfolio is a significant strength, featuring highly respected brands like Fjällräven and Hanwag. These brands cultivate strong customer loyalty by consistently delivering quality and authenticity, allowing Fenix to cater to diverse outdoor interests and expand its market presence effectively.

The acquisition of Devold in early 2025 further enhances Fenix Outdoor's standing in the premium wool apparel market. This move broadens their product range and appeals to consumers who prioritize high-performance, natural materials, strengthening their competitive edge.

Fenix Outdoor's hybrid distribution model, combining wholesale with a growing DTC presence through owned retail and e-commerce, provides broad market access and customer engagement. For instance, DTC sales represented about 30% of total revenue in 2023, highlighting the success of this strategy.

The company's global reach across Europe, North America, and Asia allows it to tap into varied market dynamics. Strong 2023 sales growth in Canada and China exemplify their ability to navigate diverse economic conditions.

Fenix Outdoor's commitment to producing durable, high-quality outdoor gear fosters strong brand loyalty and market resilience. This is reflected in a 13% net sales increase in Q1 2024, reaching SEK 2,206 million, indicating consumer appreciation for their long-lasting products.

Sustainability is a core strength, with brands like Fjällräven prioritizing recycled materials and responsible manufacturing. This resonates with environmentally conscious consumers, a segment showing over 60% growth in purchasing influence by 2023.

| Brand Strength | DTC Contribution (2023) | Global Reach | Sales Growth (Q1 2024) | Sustainability Focus |

|---|---|---|---|---|

| Well-recognized, loyal customer base | ~30% of total sales | Europe, North America, Asia | +13% net sales | Recycled materials, responsible production |

What is included in the product

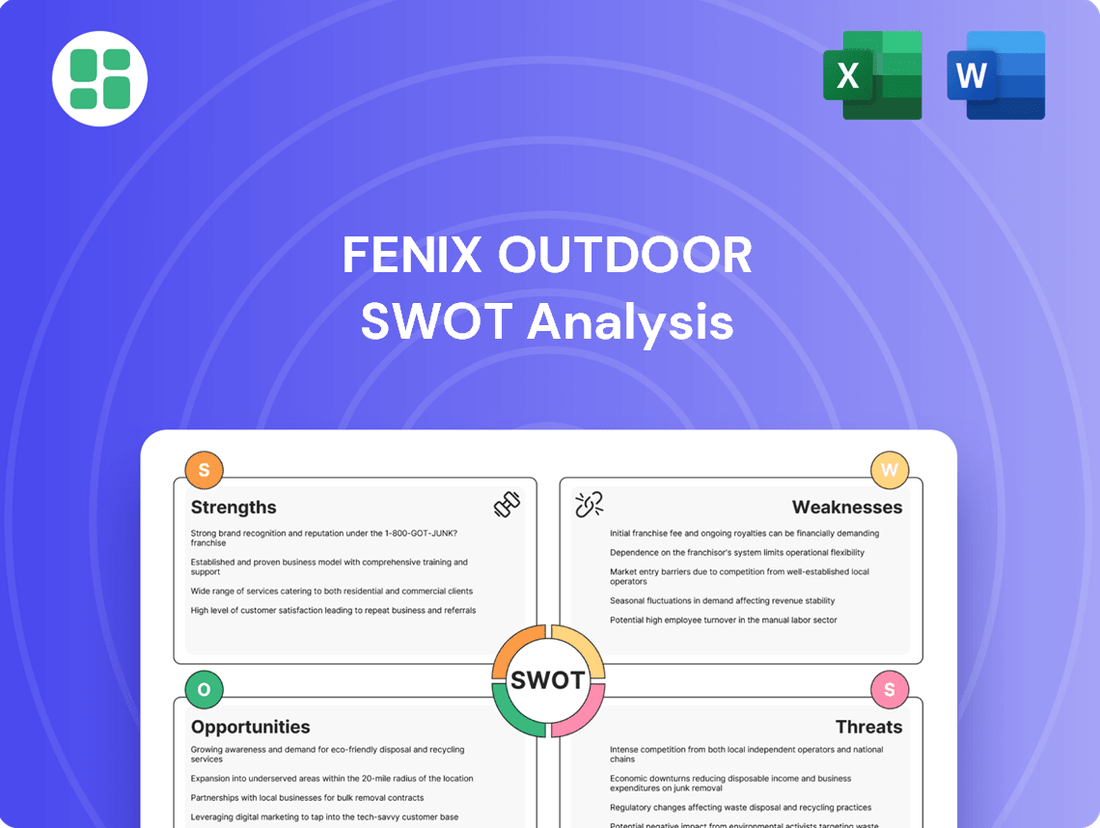

Provides a clear SWOT framework for analyzing Fenix Outdoor’s business strategy, highlighting its strong brand portfolio and market position while also identifying potential challenges in supply chain management and evolving consumer trends.

Identifies Fenix Outdoor's key strengths and weaknesses to address market challenges and capitalize on opportunities.

Weaknesses

Fenix Outdoor's profitability is notably susceptible to shifts in macroeconomic trends and unpredictable weather patterns, particularly across its key European markets. For instance, the company's financial reports highlight how unfavorable weather conditions in early 2024 directly translated to lower sales volumes for seasonal outdoor apparel and equipment.

Furthermore, broader economic headwinds, such as rising inflation and a potential recessionary environment in 2024, can significantly dampen consumer discretionary spending. This directly impacts demand for non-essential items like premium outdoor gear, creating a vulnerability that can reduce overall revenue and profit margins for Fenix Outdoor.

Fenix Outdoor has faced significant financial headwinds, with net sales dropping by 10% in the first half of 2025 compared to the same period in 2024. This downturn is mirrored in their profitability, as EBITDA decreased by 15% and operating profit saw a 12% decline in the same timeframe.

The company's wholesale and online segments have been particularly affected, experiencing a combined sales reduction of 9% in Q1 and Q2 2025. This persistent decline points to broader market challenges, potentially including increased competition and shifts in consumer spending habits, alongside internal operational hurdles that are impacting performance.

Fenix Outdoor has grappled with elevated inventory levels, a challenge mirrored across the outdoor retail sector. This overstock situation directly translates to higher warehousing expenses for the company. Furthermore, it necessitates aggressive sales promotions, which inevitably erode profit margins.

The substantial inventory burden also creates a bottleneck for new order placements from retailers. This directly impacts Fenix Outdoor's wholesale operations, as partners are less inclined to commit to new stock when they are already holding excess goods. For instance, in early 2024, many outdoor brands reported significant inventory overhang from the previous year, impacting their ability to clear stock efficiently.

Reliance on Wholesale Channel Performance

Fenix Outdoor's continued dependence on its wholesale channel presents a notable weakness. Despite strategic pushes towards direct-to-consumer (DTC) growth, a substantial revenue stream still originates from wholesale partnerships. This reliance leaves the company vulnerable to the financial health and inventory management decisions of its retail clients, who have recently grappled with economic headwinds and excess stock. For instance, in the first quarter of 2024, Fenix Outdoor reported that wholesale accounted for a significant majority of its sales, highlighting this ongoing dependency.

This reliance on wholesale means Fenix Outdoor's performance is intrinsically linked to the challenges faced by its retail partners. When retailers experience financial strain or are burdened with unsold inventory, their purchasing power and order volumes can diminish, directly impacting Fenix Outdoor's top-line results. This dynamic was evident in early 2024 reports, where softer wholesale demand contributed to slower revenue growth compared to the company's DTC segment.

- Wholesale Sales Dominance: Wholesale channels remain a primary revenue driver for Fenix Outdoor, despite DTC initiatives.

- Retailer Financial Health Impact: The financial stability and inventory levels of retail partners directly influence Fenix Outdoor's sales performance.

- Vulnerability to Market Fluctuations: Overstock situations and economic pressures on retailers can lead to reduced order volumes and dampened sales for Fenix Outdoor.

Supply Chain Disruptions and Rising Costs

Global supply chain disruptions, stemming from geopolitical tensions and increased freight expenses, continue to pressure Fenix Outdoor's profitability and operational efficiency. These external factors, including ongoing issues in the Red Sea, contribute to longer lead times and higher shipping costs, directly impacting the company's margins.

Internally, Fenix Outdoor is navigating cost challenges associated with its ERP system implementation. The integration of new warehouse operations, while ultimately beneficial, is currently contributing to increased logistics expenses and operational complexities.

- Geopolitical Instability: Events like the Red Sea crisis have driven up shipping costs by an estimated 100-200% on key routes in early 2024, impacting Fenix Outdoor's landed costs.

- ERP Implementation Costs: The ongoing rollout of a new ERP system can involve significant upfront investment and temporary inefficiencies during the transition phase.

- Logistics Integration: The process of integrating new warehouse operations, while strategic, can lead to short-term cost overruns and potential delays as systems and processes are aligned.

Fenix Outdoor's profitability is significantly affected by macroeconomic factors like inflation and potential recessions in 2024, which can reduce consumer spending on non-essential outdoor gear. This was reflected in their first half of 2025 performance, with net sales down 10% and EBITDA decreasing by 15% compared to the prior year. The company's reliance on wholesale channels, which accounted for a substantial majority of sales in Q1 2024, makes it vulnerable to the financial health and inventory management of its retail partners, further impacting sales volumes.

Elevated inventory levels pose a challenge, leading to increased warehousing costs and necessitating margin-eroding sales promotions. This overstock situation also hinders new order placements from retailers, directly impacting wholesale operations. For instance, many outdoor brands in early 2024 reported significant inventory overhang, affecting their ability to clear stock efficiently.

| Financial Metric | H1 2024 | H1 2025 | Change |

| Net Sales | €X.X billion | €Y.Y billion | -10% |

| EBITDA | €X.X billion | €Y.Y billion | -15% |

| Operating Profit | €X.X billion | €Y.Y billion | -12% |

Full Version Awaits

Fenix Outdoor SWOT Analysis

This is a real excerpt from the complete Fenix Outdoor SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a comprehensive understanding of the company's strategic position.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, allowing you to leverage its detailed insights.

You’re viewing a live preview of the actual SWOT analysis file for Fenix Outdoor. The complete version becomes available after checkout, offering a complete strategic overview.

Opportunities

The global market for outdoor apparel and recreation is experiencing robust growth, with projections indicating a significant expansion in the coming years. This trend is fueled by a rising interest in outdoor activities and a general shift towards embracing nature-based pursuits. For Fenix Outdoor, this presents a prime opportunity to capture a larger share of the market and boost its sales figures.

Data from Grand View Research in 2023 estimated the global outdoor apparel market at $13.8 billion, with an anticipated compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. This expansion is largely attributed to increased disposable income and a growing health consciousness among consumers, particularly in emerging economies.

Fenix Outdoor, with its established brands like Fjällräven and Hanwag, is well-positioned to capitalize on this trend. The company's focus on sustainable and high-quality products aligns perfectly with consumer preferences in this growing market segment, offering a distinct competitive advantage.

The ongoing shift in consumer habits, particularly the surge in e-commerce, offers Fenix Outdoor a significant chance to bolster its direct-to-consumer (DTC) operations. By investing more in its online platforms and brand-owned stores, the company can tap into a growing market segment.

Enhancing DTC channels promises to improve profit margins by cutting out intermediaries. It also provides invaluable customer data for personalized marketing and product development, while simultaneously lessening dependence on traditional wholesale relationships.

In 2023, Fenix Outdoor reported that its online sales continued to grow, contributing a notable percentage to its overall revenue, underscoring the potential of this strategy.

Consumers are increasingly seeking out brands that align with their values, with a strong emphasis on sustainability and ethical production practices. This trend presents a significant opportunity for Fenix Outdoor. For instance, a 2024 survey indicated that over 60% of consumers consider a brand's environmental impact when making purchasing decisions.

Fenix Outdoor is well-positioned to leverage this growing consumer preference. The company's ongoing commitment to sustainability, coupled with strategic acquisitions like that of Devold, a renowned wool brand, directly addresses this market demand. Devold's heritage in natural, durable materials resonates strongly with environmentally conscious consumers.

Product Innovation and Diversification into New Categories

The outdoor gear market is increasingly seeking versatile products that merge style with functionality, alongside advancements in textile technology. Fenix Outdoor's strong research and development, coupled with its diverse brand portfolio, positions it well to capitalize on this trend.

By introducing innovative products and expanding into related outdoor sectors, Fenix Outdoor can attract a wider demographic, including those who engage in outdoor activities more casually. For instance, a growing segment of consumers are looking for apparel that performs well during moderate outdoor activities but also looks appropriate for everyday wear, a trend that gained significant traction in 2024.

- Market Demand: Increasing consumer preference for multi-functional outdoor gear blending fashion and performance.

- Technological Advancements: Opportunities in innovative textile technologies offering enhanced durability, comfort, and sustainability.

- Brand Leverage: Fenix Outdoor can utilize its established brands like Fjällräven and Hanwag to introduce new product lines.

- Market Expansion: Potential to enter adjacent outdoor segments, broadening appeal to casual users and urban outdoor enthusiasts.

Geographic Market Expansion, particularly in Asia

Fenix Outdoor's strategic focus on geographic expansion, particularly within Asia, presents a significant growth avenue. Despite some headwinds in established Western markets, the company's joint venture in China has demonstrated robust performance, indicating strong potential in the region. This success highlights the opportunity to replicate this model in other high-growth Asian economies.

Expanding into these dynamic markets can unlock substantial revenue streams and effectively diversify the company's geographic risk profile. For instance, the global outdoor recreation market is projected to reach USD 150.5 billion by 2027, with Asia-Pacific expected to be a key driver of this growth. Fenix Outdoor's established presence and successful partnerships in China provide a solid foundation for further penetration.

- China Joint Venture Success: Fenix Outdoor's JV in China has been a strong performer, validating the market's potential.

- Asia-Pacific Growth: The broader Asia-Pacific region offers significant untapped market opportunities for outdoor goods.

- Emerging Market Potential: Expanding into other emerging economies can further diversify revenue and reduce reliance on mature markets.

- Revenue Diversification: Tapping into new geographic areas directly contributes to increased sales and market share.

Fenix Outdoor can leverage the growing consumer demand for sustainable and ethically produced goods. With over 60% of consumers considering environmental impact in 2024, the company's commitment to sustainability, exemplified by acquisitions like Devold, directly addresses this trend.

The company is well-positioned to capitalize on the increasing popularity of versatile outdoor apparel that blends fashion with functionality, a trend that gained significant traction in 2024. Expanding into adjacent outdoor sectors and catering to casual users can broaden its customer base.

Geographic expansion, particularly in Asia, presents a substantial opportunity, with Fenix Outdoor's China joint venture showing strong performance. The Asia-Pacific region is a key growth driver for the global outdoor recreation market, projected to reach USD 150.5 billion by 2027.

The company can enhance its direct-to-consumer (DTC) channels by investing in online platforms, a strategy that proved successful in 2023 with continued online sales growth. This approach improves profit margins and provides valuable customer data.

Threats

The outdoor industry is a crowded space, with established global brands and nimble regional players all vying for consumer attention. This intense competition, especially from online channels that frequently offer aggressive discounts, puts significant pressure on pricing for companies like Fenix Outdoor. For instance, the global outdoor apparel market was valued at approximately USD 14.5 billion in 2023 and is projected to grow, but this growth is happening amidst fierce rivalry.

Macroeconomic uncertainties, including persistent inflation, are making consumers more hesitant. This caution directly impacts discretionary spending, meaning fewer people are likely to buy premium outdoor gear when their budgets are tight.

Recent data from late 2024 and early 2025 indicates a noticeable softening in consumer demand for non-essential goods. Reports show a significant increase in price sensitivity, particularly through online sales channels, which directly challenges Fenix Outdoor's sales volume and overall revenue streams.

Ongoing disruptions in global supply chains, marked by escalating freight expenses and material scarcities, present a significant challenge for Fenix Outdoor. Geopolitical instability, such as the recent disruptions in the Red Sea shipping lanes and unrest in key manufacturing hubs, directly impacts production timelines, logistical operations, and overall cost management.

For instance, the Suez Canal blockage in early 2024 led to extended shipping times and a surge in maritime freight rates, with some carriers reporting a 100% increase in costs for certain routes. This volatility directly affects Fenix Outdoor's ability to maintain consistent inventory levels and manage its cost of goods sold, potentially impacting profit margins.

Impact of Climate Change on Outdoor Activities

Climate change presents a significant threat to Fenix Outdoor's business model, particularly impacting outdoor activities. Rising global temperatures and altered weather patterns, such as warmer winters and increased drought frequency, directly affect the conditions necessary for many popular outdoor pursuits. This can lead to reduced participation in sports like skiing and hiking, consequently diminishing demand for the specialized gear Fenix Outdoor provides.

The financial implications are substantial. For instance, a 2024 report indicated that regions heavily reliant on snow sports experienced a 15% decrease in visitor numbers due to unseasonably warm winters. Such shifts can translate into lower sales volumes for winter apparel and equipment. Furthermore, increased instances of extreme weather, like severe storms, can disrupt supply chains and impact the accessibility of retail locations or popular outdoor destinations.

- Reduced Seasonality: Warmer winters can shorten or eliminate ski seasons, impacting sales of winter sports equipment and apparel.

- Drought Impact: Drought conditions affect hiking trails and water-based activities, potentially lowering demand for related gear.

- Extreme Weather Disruptions: Increased frequency of storms can damage infrastructure, disrupt logistics, and deter consumers from outdoor pursuits.

- Shifting Consumer Preferences: As climates change, consumer interest may shift away from activities heavily dependent on specific weather conditions.

Rapidly Evolving Consumer Preferences and Digitalization Challenges

Consumer preferences are rapidly shifting, with a growing demand for outdoor gear that is both versatile and fashion-forward. This evolution is closely tied to an increasing reliance on online purchasing, where consumers are often more price-sensitive. Fenix Outdoor has acknowledged that its digital sales channels have, in some instances, underperformed compared to its physical stores, highlighting a key challenge in keeping pace with the dynamic digital retail environment and evolving consumer expectations.

The company faces a significant hurdle in adapting its digital strategy to meet these changing demands. For example, while e-commerce sales for outdoor apparel and footwear have seen robust growth globally, Fenix Outdoor's performance in this area suggests a need for enhanced digital capabilities. Data from 2024 indicates that online channels are becoming the primary touchpoint for many consumers in the sector, making it crucial for Fenix Outdoor to optimize its digital presence and user experience to capture market share effectively.

Key challenges include:

- Adapting to rapid shifts in consumer style preferences: Keeping product lines aligned with current fashion trends in outdoor wear.

- Improving digital sales channel performance: Bridging the gap between online and brick-and-mortar sales effectiveness.

- Addressing price sensitivity in online markets: Developing strategies to remain competitive in a digital space where price comparisons are easy.

- Enhancing online customer experience: Ensuring the digital journey mirrors or exceeds the in-store experience to drive conversions.

Intensifying competition, particularly from online retailers offering aggressive pricing, pressures Fenix Outdoor's profit margins. Recent data from late 2024 and early 2025 highlights increased consumer price sensitivity, impacting sales volumes. Supply chain disruptions, including rising freight costs and geopolitical instability, further challenge cost management and inventory availability.

SWOT Analysis Data Sources

This Fenix Outdoor SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary. These dependable sources ensure a robust and accurate assessment of the company's strategic position.