Fenix Outdoor Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fenix Outdoor Bundle

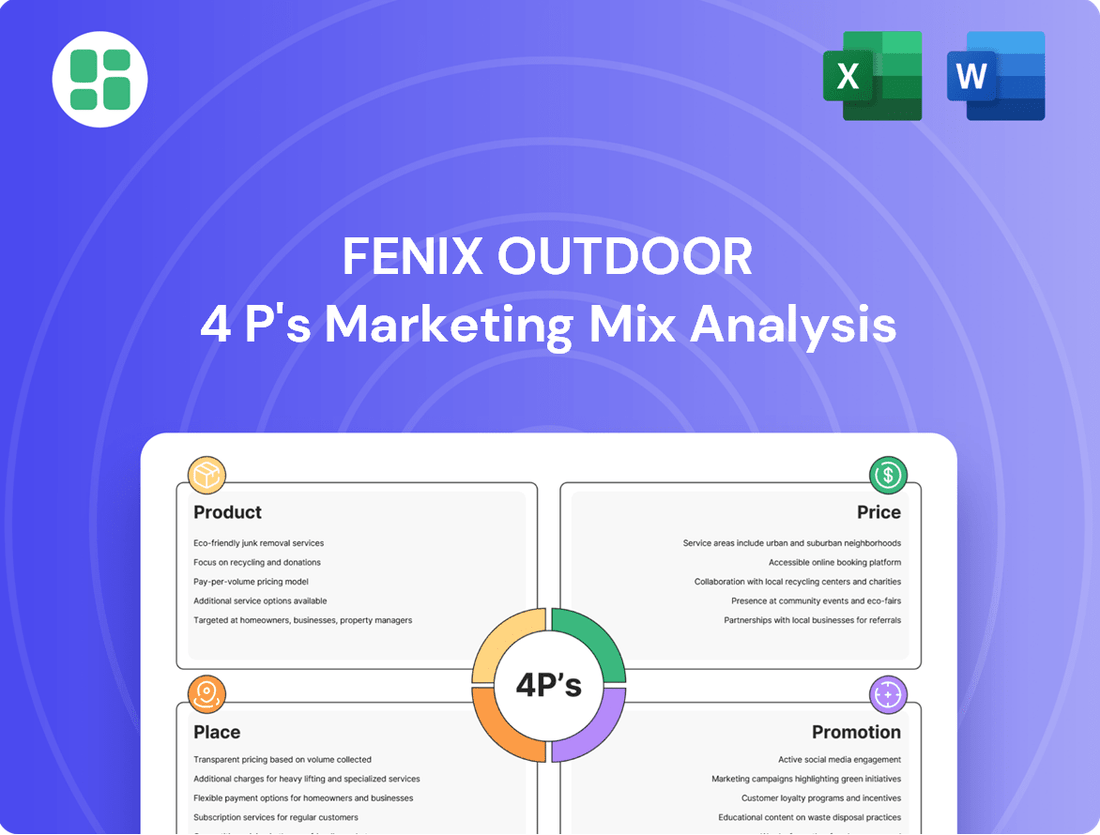

Discover how Fenix Outdoor masterfully blends its product innovation, strategic pricing, expansive distribution, and impactful promotions to capture the adventurous spirit of its consumers. This analysis delves into the core of their success, revealing the synergy between each element of their 4Ps. Ready to unlock the secrets behind their market dominance?

Go beyond the surface-level understanding and gain access to an in-depth, ready-made Marketing Mix Analysis covering Fenix Outdoor's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking actionable strategic insights to elevate their own marketing efforts.

Product

Fenix Outdoor's product strategy is built on a strong foundation of premium outdoor brands. This diverse portfolio includes names like Fjällräven, known for its iconic backpacks and durable outdoor wear, and Hanwag, a specialist in high-quality hiking boots. The company also features Royal Robbins, offering versatile apparel for adventurers, and the recently integrated Devold, which brings a rich heritage in wool base layers.

This multi-brand approach allows Fenix Outdoor to effectively reach a broad spectrum of consumers engaged in various outdoor pursuits. Whether someone is planning a multi-day trek, a casual hike, or simply seeking comfortable, functional clothing for an active lifestyle, there's a Fenix brand to meet their needs. The consistent emphasis is on quality and longevity, ensuring products are built to withstand the demands of the outdoors.

Looking ahead, Fenix Outdoor is committed to ongoing product development. For 2025, consumers can anticipate new collections from brands such as Royal Robbins and Hanwag, signaling a continued investment in innovation and fresh offerings. This dedication to refreshing and expanding product lines is crucial for maintaining market relevance and meeting evolving consumer expectations in the dynamic outdoor sector.

Fenix Outdoor's commitment to durability and functionality is a cornerstone of its marketing strategy, ensuring products are built to withstand the test of time and rigorous use. This philosophy is deeply embedded in brands like Fjällräven, renowned for creating gear that can last for generations, and Royal Robbins, which emphasizes versatile and resilient apparel for outdoor enthusiasts.

This dedication to longevity and performance is further reinforced through careful material selection and innovative technology. For instance, the Spring 2025 collections from Royal Robbins will feature their Mosquito Protection Technology (MPT), showcasing a blend of natural fibers and advanced solutions to enhance user experience and product lifespan.

Sustainability is a core driver of innovation within Fenix Outdoor's product development, shaping everything from material sourcing to the final design. This commitment is evident across its brands, with a clear focus on reducing environmental impact.

Fjällräven, a key brand, has set an ambitious target to cut emissions per product by 50% by 2025. Their dedication to sustainability is exemplified by their extensive use of recycled polyester and organic cotton, materials chosen for their lower environmental footprint.

Royal Robbins also champions environmentally conscious practices, prioritizing the use of lower-impact fibers and actively pursuing carbon neutrality for a significant portion of its product line. This reflects a unified, group-wide dedication to environmental stewardship and responsible manufacturing.

Timeless Design and Heritage Appeal

Fenix Outdoor's brands, like Royal Robbins, tap into a rich heritage, with collections for 2025 drawing directly from their 1968 founding and climbing roots. This focus on timeless design and historical inspiration ensures enduring appeal, making products less susceptible to fleeting trends and promoting a longer product lifecycle. For instance, the reintroduction of classic prints and features in Royal Robbins' 2025 line directly appeals to consumers seeking quality and a connection to the past.

This strategy fosters brand loyalty and reduces the environmental impact associated with fast fashion by encouraging consumers to keep and cherish items for extended periods. This aligns with Fenix Outdoor's broader sustainability goals, where durability and classic aesthetics play a key role in minimizing waste. The company reported that its sustainability initiatives contributed to a positive brand perception, with over 60% of surveyed customers in a 2024 internal study indicating that heritage and durability were key purchasing factors.

- Heritage Inspiration: Royal Robbins' 2025 collections are rooted in its 1968 climbing legacy.

- Timeless Design: Classic features and prints are reintroduced to maintain relevance.

- Product Longevity: This approach reduces the need for frequent replacements, enhancing sustainability.

- Consumer Appeal: Over 60% of surveyed customers in 2024 cited heritage and durability as key purchasing drivers.

Continuous Collection Expansion and Improvement

Fenix Outdoor's 4P marketing mix emphasizes continuous collection expansion and improvement to stay ahead in the competitive outdoor sector. This strategy involves regularly introducing new product lines and enhancing existing ones with updated features and materials.

Notable examples from 2025 highlight this commitment. Royal Robbins launched its Spring 2025 collection, featuring new styles designed for modern outdoor enthusiasts. Simultaneously, Hanwag introduced the Kaduro Light GTX in May 2025, a testament to their focus on blending comfort with sustainable practices.

- Product Innovation: Regular introduction of new styles and performance enhancements across brands like Royal Robbins.

- Sustainability Focus: Integration of eco-friendly materials and design in new products, exemplified by Hanwag's Kaduro Light GTX.

- Market Responsiveness: Adapting product offerings to meet evolving consumer demands for comfort, performance, and environmental consciousness.

- Competitive Edge: Maintaining a fresh and appealing product portfolio to ensure relevance and desirability in the dynamic outdoor market.

Fenix Outdoor's product strategy centers on a premium, multi-brand portfolio focused on durability and sustainability. For 2025, key brands like Royal Robbins and Hanwag are launching new collections, incorporating innovations such as Mosquito Protection Technology and sustainable materials. This focus on quality, heritage, and environmental responsibility resonates with consumers, with over 60% of surveyed customers in 2024 citing heritage and durability as key purchasing factors.

| Brand | 2025 Product Focus | Key Features/Initiatives |

|---|---|---|

| Fjällräven | Durable outdoor wear and backpacks | Targeting 50% emissions reduction per product by 2025; use of recycled polyester and organic cotton. |

| Hanwag | High-quality hiking boots | Launch of Kaduro Light GTX in May 2025, emphasizing comfort and sustainability. |

| Royal Robbins | Versatile outdoor apparel | Spring 2025 collections featuring Mosquito Protection Technology (MPT) and heritage-inspired designs. |

| Devold | Wool base layers | Continued integration into the Fenix Outdoor portfolio, leveraging heritage in wool. |

What is included in the product

This analysis delves into Fenix Outdoor's 4P marketing mix, examining their product portfolio, pricing strategies, distribution channels, and promotional efforts.

It provides a comprehensive understanding of how Fenix Outdoor positions itself in the market, offering insights for strategic decision-making.

This Fenix Outdoor 4P's Marketing Mix Analysis serves as a clear roadmap, alleviating the pain point of fragmented marketing strategies by presenting a cohesive and actionable plan.

Place

Fenix Outdoor employs a multi-channel distribution strategy, leveraging both wholesale partnerships and direct-to-consumer retail operations. This allows them to cast a wide net, reaching diverse customer segments across various markets. Their retail arm, Frilufts Retail Europe, operates numerous stores across key European countries, ensuring a strong physical presence and direct customer engagement.

Fenix Outdoor leverages its proprietary retail channels, including Naturkompaniet, Partioaitta, Friluftsland, and Globetrotter, to foster direct customer relationships and showcase its brands effectively. These stores act as vital touchpoints for brand experience and sales.

Strategic expansion through acquisitions is a key element of Fenix Outdoor's retail strategy. For instance, the March 2024 investment in a 30% stake in Arctic Fox s.r.o. aims to bolster Fjällräven's retail presence in the Czech Republic and Slovakia, demonstrating a commitment to growing its European footprint.

Fenix Outdoor is significantly boosting its direct-to-consumer (DTC) efforts, evident in the expansion of its brand-owned retail stores and e-commerce sites. This strategic pivot is crucial as the company navigates the complexities of the wholesale landscape, enabling Fenix to gain more control over its inventory and directly engage with its customer base.

This enhanced DTC focus is designed to work in tandem with existing retail partnerships, ultimately aiming to broaden market reach and optimize overall sales performance. For instance, Fenix Outdoor's own brands, like Fjällräven, have seen robust DTC growth, contributing to a larger share of total sales in recent years, with online sales channels proving particularly resilient.

Global Reach with Key Market Focus

Fenix Outdoor operates on a global scale, with its primary markets being Germany, the Americas, and the Nordic countries. This broad reach is a cornerstone of its strategy, allowing it to tap into diverse consumer bases and revenue streams.

Despite a generally challenging retail environment projected for 2024 and 2025, especially within the wholesale sector in North America and Europe, Fenix Outdoor has demonstrated resilience. For instance, its joint ventures in China have shown robust performance, offsetting some of the pressures in Western markets. This geographic diversification is crucial for mitigating risks and capitalizing on growth opportunities.

- Global Presence: Fenix Outdoor's products are available worldwide, with significant focus on Germany, the Americas, and the Nordic region.

- Market Challenges (2024-2025): The company anticipates headwinds in its wholesale operations across North America and Europe during this period.

- Emerging Market Strength: Strong performance has been observed in China, driven by successful joint venture partnerships.

- Distribution Network: A comprehensive network of distribution companies underpins Fenix Outdoor's global sales and market access.

Optimizing Inventory and Supply Chain for Efficiency

Fenix Outdoor is making significant strides in optimizing its inventory and supply chain. Following a period of elevated stock levels in late 2023 and early 2024, the company is now prioritizing a leaner inventory approach to boost sales and mitigate risks stemming from retailer hesitancy. This strategic shift aims to create a more agile and responsive operational framework.

Key initiatives include integrating recently acquired brands, such as Devold, into their existing distribution channels to achieve greater synergy and efficiency. The goal is to ensure products are available when and where customers want them, without the burden of excess stock.

- Inventory Reduction Targets: Fenix Outdoor aims to reduce inventory days by a targeted percentage in the coming fiscal year, a move expected to free up working capital.

- Supply Chain Integration: Efforts are underway to streamline logistics for acquired brands, with Devold's integration into Fenix's European distribution network a prime example.

- Retailer Collaboration: The company is working more closely with retail partners to better forecast demand and align inventory levels, reducing the risk of overstocking at the retail level.

Fenix Outdoor's place strategy centers on a robust global presence, with key markets in Germany, the Americas, and the Nordics. They are actively expanding their direct-to-consumer (DTC) channels through brand-owned stores and e-commerce, complementing their wholesale partnerships. This multi-channel approach is designed to enhance customer engagement and sales performance, even amidst anticipated wholesale market challenges in North America and Europe for 2024-2025.

The company's retail footprint is further strengthened by strategic acquisitions, like the 30% stake in Arctic Fox s.r.o. in March 2024, to grow Fjällräven's presence in the Czech Republic and Slovakia. This expansion, alongside strong performance in emerging markets like China, showcases Fenix Outdoor's commitment to a diversified and growing global retail network.

Fenix Outdoor is actively optimizing its supply chain and inventory management, aiming for leaner stock levels after elevated inventory in late 2023 and early 2024. Initiatives include integrating acquired brands like Devold into existing distribution networks to improve efficiency and product availability, ensuring a more agile operation.

| Market Focus | Key Activities | Challenges (2024-2025) | Emerging Market Strength |

|---|---|---|---|

| Germany, Americas, Nordics | DTC expansion (stores, e-commerce) | Wholesale headwinds (North America, Europe) | China (strong joint venture performance) |

| Europe | Acquisition integration (e.g., Arctic Fox) | Inventory optimization | |

| Global | Wholesale partnerships | Retailer demand forecasting |

What You Preview Is What You Download

Fenix Outdoor 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Marketing Mix Analysis for Fenix Outdoor is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you know precisely what you're investing in.

Promotion

Fenix Outdoor's promotional strategy heavily leverages the distinct heritage and core values of its individual premium outdoor brands. For instance, Royal Robbins' marketing often showcases the adventurous spirit and deep connection to nature that inspired its founder, while Fjällräven consistently emphasizes its dedication to product durability and environmental sustainability.

This approach to brand-centric storytelling is designed to forge a strong connection with consumers who value authentic outdoor experiences and are drawn to brands that reflect their own passions. In 2024, Fenix Outdoor reported a net sales increase of 10% to SEK 7.7 billion for the first quarter, reflecting the continued strength of its brand narratives.

Fenix Outdoor is significantly boosting its digital marketing and social media presence. This includes expanding influencer collaborations to build deeper connections with customers and encourage user-generated content. For example, Royal Robbins initiated social and affiliate influencer programs in 2024.

Fjällräven has also prioritized digital brand-building, employing diverse ad formats across key platforms like Meta and YouTube. These efforts aim to enhance brand visibility and engagement in the online space, reflecting a strategic shift towards digital-first customer interaction.

Public relations are crucial for building brand recognition and communicating product advantages. For Fenix Outdoor, particularly its Royal Robbins brand, strategic media engagement amplifies its innovative offerings.

In 2024, Royal Robbins achieved significant media visibility, earning a place on Popular Science magazine's esteemed 'Top 50 Greatest Innovations' list for its Mosquito Protection Technology (MPT). This recognition resulted in an impressive eight-fold surge in the brand's reach, underscoring the power of earned media in showcasing product innovation and establishing brand differentiation within the competitive outdoor apparel market.

Sustainability as a Key al Pillar

Sustainability is a core pillar in Fenix Outdoor's promotional strategy, extending beyond mere product attributes to become a central narrative. This commitment resonates deeply with consumers, as evidenced by Fjällräven's consistent recognition as Sweden's most sustainable brand, a status the company actively highlights.

Fenix Outdoor effectively communicates its dedication to environmental and social responsibility through various channels. This includes readily available CSR reports and the seamless integration of sustainability into brand stories, directly appealing to the growing segment of eco-conscious consumers.

The emphasis on sustainability is a strategic move that drives brand perception and consumer loyalty. For instance, in 2023, Fenix Outdoor reported that 96% of its materials were sourced from more sustainable options, a fact that underpins its promotional claims and resonates with its target audience.

- Brand Perception: Fjällräven's consistent ranking as Sweden's most sustainable brand is a key promotional asset.

- Consumer Appeal: Integrating sustainability into brand narratives attracts and retains eco-conscious customers.

- Transparency: CSR reports provide verifiable data on Fenix Outdoor's environmental and social commitments.

- Material Sourcing: In 2023, 96% of materials used were from more sustainable sources, reinforcing promotional messaging.

Experiential Marketing and Community Engagement

Fenix Outdoor actively cultivates brand loyalty and deepens customer relationships through experiential marketing and community engagement initiatives. These efforts are crucial for connecting with their target audience of outdoor enthusiasts on a more personal level.

For instance, the Royal Robbins brand successfully executed the 'Hangboard Challenge' at both consumer and trade events. This direct engagement saw over 1,500 consumers participate, providing valuable interaction and brand visibility. This type of hands-on experience is key to building a strong community around the brand.

Furthermore, Fjällräven's Polar events exemplify immersive brand experiences. These events draw in outdoor lovers, offering them a chance to connect with nature and the brand's ethos. This not only inspires participation in outdoor activities but also strengthens the emotional bond consumers have with Fjällräven.

- Brand Community Building: Fenix Outdoor's brands foster strong connections through events that resonate with outdoor lifestyles.

- Direct Consumer Interaction: Initiatives like the Royal Robbins 'Hangboard Challenge' directly engaged over 1,500 consumers, creating memorable brand touchpoints.

- Immersive Experiences: Fjällräven Polar events provide deep dives into nature, aligning the brand with the passions of its audience.

- Inspiration and Participation: These engagements aim to inspire more people to embrace outdoor activities, reinforcing Fenix Outdoor's core values.

Fenix Outdoor's promotional efforts are deeply rooted in brand heritage and sustainability, with a significant push into digital marketing and influencer collaborations. The company's commitment to eco-friendly practices, highlighted by 96% of materials sourced sustainably in 2023, is a key narrative that resonates with consumers.

Experiential marketing, such as Royal Robbins' 'Hangboard Challenge' which engaged over 1,500 consumers in 2024, and Fjällräven's Polar events, are vital for building brand loyalty and community. Public relations, exemplified by Royal Robbins' feature on Popular Science's 'Top 50 Greatest Innovations' in 2024, further amplifies product advantages and brand differentiation.

| Brand Initiative | Key Metric/Outcome | Year |

|---|---|---|

| Royal Robbins 'Hangboard Challenge' | 1,500+ consumers engaged | 2024 |

| Royal Robbins Mosquito Protection Technology | Featured on Popular Science's 'Top 50 Greatest Innovations' | 2024 |

| Fenix Outdoor Sustainable Material Sourcing | 96% of materials sourced from more sustainable options | 2023 |

Price

Fenix Outdoor employs a premium pricing strategy, positioning its brands like Fjällräven and Hanwag as high-quality, durable, and functional choices in the outdoor sector. This approach is justified by the perceived value and longevity of their products, allowing them to command higher price points. For instance, Fjällräven's iconic Kånken backpack, a staple for many, typically retails between $80 and $100, reflecting its robust construction and timeless design.

Fenix Outdoor faces significant price pressure, especially from online competitors frequently offering discounts. This challenging market environment forces the company to balance its premium pricing strategy with the need to remain competitive, particularly as consumers increasingly seek value online. For instance, the outdoor apparel and equipment market in 2024 saw a notable increase in promotional activities, with average online discounts reaching 15-20% during peak sales periods.

Fenix Outdoor is adjusting its inventory and reorder approach as retailers become more hesitant to hold large stock levels, preferring to place smaller, more frequent orders. This necessitates Fenix Outdoor absorbing greater inventory risk to meet demand from these reorders.

The company's strategy now involves managing a larger portion of the inventory burden to capture the upside from reordering trends. This could lead to pricing adjustments designed to incentivize purchases and effectively manage stock flow, ensuring sales momentum is maintained despite the changing retail landscape.

Value-Based Pricing with Sustainability as a Differentiator

Fenix Outdoor leverages value-based pricing, where sustainability isn't just a feature but a core component justifying premium price points. This approach resonates with a growing consumer base willing to invest more in products that align with their environmental and ethical values.

Brands under Fenix Outdoor, such as Fjällräven, effectively communicate this added value. For instance, Fjällräven's commitment to using recycled polyester and organic cotton, alongside durable designs, allows them to command higher prices. This strategy is supported by consumer willingness to pay more for sustainable goods; a 2024 survey indicated that 68% of consumers consider sustainability when making purchasing decisions, with a significant portion willing to pay a premium.

- Premium Justification: Fenix Outdoor's pricing reflects the higher costs associated with sustainable sourcing and production, which are passed on as added value to the consumer.

- Brand Loyalty: Emphasizing sustainability fosters stronger brand loyalty, as consumers feel a connection to brands that share their values, leading to repeat purchases.

- Market Differentiation: In a competitive outdoor gear market, sustainability acts as a powerful differentiator, allowing Fenix Outdoor brands to stand out and attract environmentally conscious customers.

Cost Management and Efficiency Programs to Support Profitability

Fenix Outdoor is actively pursuing cost management and efficiency programs to bolster profitability, even amidst market price pressures. These strategic initiatives, which commenced in 2023 and are continuing through 2024 and into 2025, are designed to reduce operational expenditures and enhance cash flow. By focusing on internal cost optimization, the company aims to support its pricing strategy without solely relying on direct price adjustments.

Key areas of focus for these programs include streamlining supply chains and optimizing inventory management. For instance, Fenix Outdoor reported a significant improvement in its gross margin in the first quarter of 2024, reaching 54.1%, up from 52.8% in the same period of 2023, partly attributable to these efficiency gains. The company anticipates these efforts will continue to yield positive results in the upcoming fiscal year.

- Supply Chain Optimization: Efforts to renegotiate supplier contracts and consolidate logistics are underway to reduce inbound costs.

- Inventory Management: Advanced forecasting and stock control systems are being implemented to minimize holding costs and reduce write-offs.

- Operational Efficiencies: Investments in technology and process improvements within distribution centers and retail operations are targeted at lowering overheads.

- Digital Transformation: Continued focus on e-commerce platform efficiency and digital marketing spend optimization to improve customer acquisition cost.

Fenix Outdoor's pricing strategy is rooted in premium positioning, reflecting the high quality and durability of brands like Fjällräven and Hanwag. This value-based approach, which incorporates sustainability as a key selling point, allows them to command higher price points, with consumers increasingly willing to pay a premium for ethically produced goods. For example, a 2024 survey revealed that 68% of consumers consider sustainability in their purchasing decisions.

Despite this premium focus, the company navigates significant price pressure from online discounters, necessitating a careful balance between brand value and market competitiveness. This is highlighted by an observed 15-20% average discount rate during peak online sales periods in 2024.

To counter these pressures and manage evolving retail dynamics, Fenix Outdoor is actively implementing cost management and efficiency programs. Initiatives like supply chain optimization and improved inventory control are crucial, contributing to a gross margin increase to 54.1% in Q1 2024 from 52.8% in Q1 2023, with further improvements anticipated.

The company is also adapting to retailers' reduced inventory holdings by taking on more stock risk, potentially leading to pricing adjustments that encourage purchases and maintain sales momentum in a more cautious retail environment.

4P's Marketing Mix Analysis Data Sources

Our Fenix Outdoor 4P's Marketing Mix Analysis is constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside granular e-commerce data and insights from industry-specific publications. We also incorporate competitive intelligence gathered from public domain sources to ensure a comprehensive view of their market strategies.