Fenix Outdoor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fenix Outdoor Bundle

Navigate the evolving landscape of the outdoor industry with our comprehensive PESTLE analysis of Fenix Outdoor. Uncover how political stability, economic fluctuations, and social trends are impacting their operations and strategic direction. Download the full version to gain actionable intelligence and sharpen your own market approach.

Political factors

Governments in key markets like the U.S. and Europe are increasingly acknowledging the economic and social upsides of outdoor recreation, translating into supportive policies and funding. For instance, the U.S. Congress passed the EXPLORE Act in January 2025, a significant piece of legislation designed to improve access to and infrastructure for outdoor activities. This initiative is expected to indirectly fuel demand for outdoor gear and apparel.

This governmental focus on public lands and promoting outdoor pursuits cultivates a more advantageous operational landscape for companies like Fenix Outdoor. Such policies often include investments in trail maintenance, park development, and programs encouraging participation, all of which directly benefit the outdoor recreation sector by making activities more accessible and appealing.

Global trade tensions continue to simmer, with the potential for new tariffs on outdoor gear and apparel in 2025 presenting a significant challenge for Fenix Outdoor. Such measures could directly impact production costs and subsequently consumer prices, potentially dampening sales and squeezing profit margins.

For instance, if tariffs on key materials like polyester or cotton increase by 5-10% in 2025, Fenix Outdoor's cost of goods sold could rise substantially. The company might need to proactively re-evaluate its sourcing locations and supplier relationships to build resilience against these evolving trade policies.

Fenix Outdoor is actively adapting to evolving European Union regulations, notably the Corporate Sustainability Reporting Directive (CSRD). This directive mandates detailed reporting on environmental, social, and governance (ESG) performance across its brands, including Fjällräven.

The CSRD, fully applicable from January 1, 2024, for companies already subject to the Non-Financial Reporting Directive (NFRD) and expanding to larger listed companies in 2025, requires Fenix Outdoor to provide a more granular and standardized view of its sustainability impact. This increased transparency, while beneficial for stakeholder trust, demands substantial investment in data collection and reporting systems.

Compliance with these EU directives is not merely a bureaucratic hurdle; it is essential for maintaining and expanding market access within the European Union. Furthermore, robust adherence to sustainability reporting standards significantly bolsters Fenix Outdoor's reputation among environmentally conscious consumers and investors, a critical factor in the current market landscape.

Political Stability and Geopolitical Events

Political instability and geopolitical events can significantly disrupt global supply chains, affecting Fenix Outdoor's ability to source materials and manufacture goods. These disruptions can lead to higher costs and delayed product deliveries, impacting the company's operational efficiency and profitability. For instance, the company's 2024 annual report highlighted the challenges posed by the prevailing macroeconomic and political climate.

Fenix Outdoor, with its international presence, is particularly vulnerable to these global political shifts. Events such as trade disputes, regional conflicts, or changes in government policies can create unpredictable operating environments. These factors directly influence the cost of goods sold and the timely availability of inventory for brands like Fjällräven and Tierra.

The company's reliance on diverse sourcing and manufacturing locations means that instability in any key region, such as Asia or Eastern Europe, can have a cascading effect. This necessitates robust risk management strategies to mitigate the impact of unforeseen political developments on its business operations and financial performance. The company's 2024 financial statements reflect these ongoing supply chain pressures.

- Global Supply Chain Vulnerability: Fenix Outdoor's international operations are exposed to disruptions from political instability and geopolitical events, impacting raw material sourcing and manufacturing.

- Cost and Delivery Impacts: Such disruptions can result in increased operational costs and delays in product delivery, affecting customer satisfaction and revenue streams.

- 2024 Report Insights: The company's 2024 annual report specifically mentioned challenges stemming from the macroeconomic and political landscape, underscoring the real-world impact.

Consumer Protection and Product Safety Regulations

Fenix Outdoor operates under increasingly strict consumer protection and product safety regulations, especially within key markets like the European Union and North America. These regulations directly impact how outdoor products are designed, manufactured, and marketed, requiring adherence to rigorous safety standards and clear labeling. For instance, the EU’s General Product Safety Regulation (GPSR), which came into effect in December 2024, enhances market surveillance and places greater responsibility on economic operators to ensure product safety throughout the supply chain. This means Fenix Outdoor must meticulously verify that its apparel and equipment, from tents to hiking boots, meet these evolving safety benchmarks, adding to compliance costs and influencing product development cycles.

The onus is on Fenix Outdoor to ensure all products comply with these stringent requirements. This includes everything from the materials used in their clothing to the durability and functionality of their camping gear. Non-compliance can lead to significant penalties, including product recalls and reputational damage. For example, in 2024, numerous consumer goods recalls were initiated across the EU due to non-compliance with safety directives, highlighting the critical nature of these regulations for companies like Fenix Outdoor.

- Product Compliance Costs: Fenix Outdoor anticipates that compliance with evolving safety standards, such as those related to chemical content in textiles or the structural integrity of equipment, will continue to represent a notable portion of its operational expenditure in 2024-2025.

- Market Access: Adherence to regulations like the EU’s GPSR is crucial for maintaining market access in its primary sales regions, directly impacting revenue streams.

- Innovation and Design: Safety regulations can influence product design, potentially requiring modifications or the adoption of new materials to meet stricter safety criteria, impacting R&D investment.

Government support for outdoor recreation, exemplified by the U.S. EXPLORE Act in January 2025, is creating a more favorable environment for Fenix Outdoor. This trend, coupled with investments in public lands, directly boosts the appeal and accessibility of outdoor activities, indirectly benefiting the company's brands.

However, global trade tensions pose a risk, with potential tariffs in 2025 threatening to increase production costs and consumer prices. Fenix Outdoor must remain agile in its sourcing strategies to mitigate these geopolitical economic impacts.

Strict regulations like the EU's CSRD and GPSR are shaping Fenix Outdoor's operations, demanding greater transparency in sustainability and ensuring product safety. While compliance requires investment, it is vital for market access and brand reputation in key European markets, with broader implications for 2025 reporting.

What is included in the product

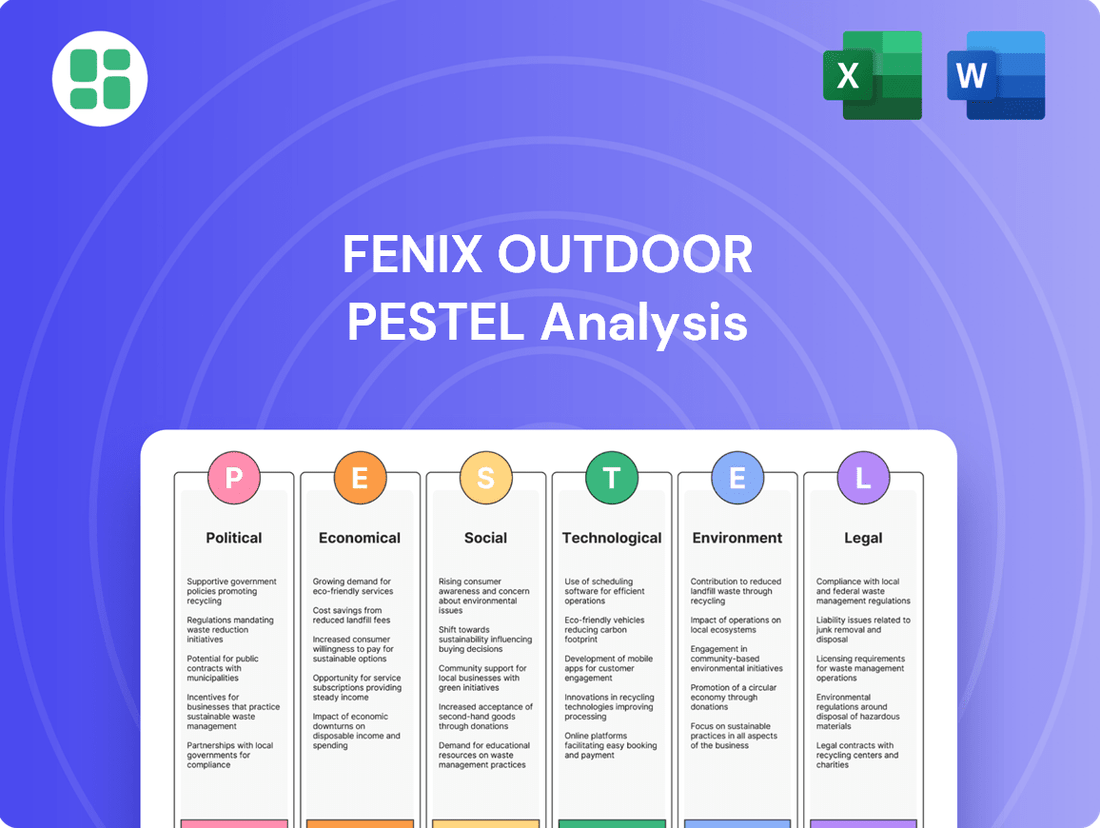

This PESTLE analysis for Fenix Outdoor examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

It provides actionable insights into how these macro-environmental forces create both opportunities and challenges for Fenix Outdoor's global business.

A concise Fenix Outdoor PESTLE analysis that highlights key external factors impacting the outdoor industry, serving as a pain point reliever by offering clarity and strategic direction for decision-making.

Economic factors

Global economic growth is a critical driver for Fenix Outdoor. A robust global economy generally translates to higher disposable incomes, encouraging consumers to spend on discretionary items like high-quality outdoor apparel and equipment. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, with a slight uptick to 3.5% anticipated for 2025, signaling a potentially more favorable spending environment.

Consumer spending patterns are directly tied to economic health. While 2024 presented some challenges for the retail sector, including outdoor gear, there's a growing sentiment of improved consumer confidence heading into 2025. This is particularly beneficial for premium and niche brands like those within the Fenix Outdoor portfolio, as consumers with greater financial security are more likely to invest in durable, high-performance products.

Inflationary pressures significantly impact Fenix Outdoor by increasing the cost of essential inputs like raw materials, manufacturing processes, and logistics. This directly elevates the company's operational expenses.

Fenix Outdoor's 2024 annual report explicitly recognized the tangible effects of prevailing inflation on its business operations and financial performance.

Effectively managing these escalating costs is paramount for Fenix Outdoor to sustain its profitability, which may necessitate strategic price adjustments for its consumer product offerings.

Fenix Outdoor, with its global presence, faces significant risks from fluctuating exchange rates. For instance, in 2023, a strengthening US Dollar against the Euro could have made Fenix's European-sourced products more expensive for US consumers, potentially impacting sales volume. Conversely, if Fenix's reporting currency is the Euro, a weaker US Dollar would reduce the value of its US sales when translated back, impacting overall revenue.

These currency shifts directly influence the cost of goods sold and the profitability of international operations. For example, if Fenix sources a substantial portion of its materials or finished products from countries with currencies that appreciate against its primary sales currencies, its margins will likely shrink. This was a notable concern in early 2024 as global economic uncertainties continued to drive currency volatility.

Retail Market Dynamics and Channels

The outdoor retail landscape is seeing significant shifts, with established large retailers encountering headwinds in 2024. Conversely, the direct-to-consumer (DTC) online segment and the burgeoning resale market are projected for robust growth in 2025, especially for premium outdoor brands.

Fenix Outdoor's diversified approach, leveraging both wholesale partnerships and its proprietary retail network, positions it effectively to navigate these evolving market dynamics. This dual strategy offers flexibility in adapting to changing consumer purchasing habits and channel preferences.

- DTC Growth: The global online retail market is expected to reach $7.5 trillion by 2025, with DTC channels playing a crucial role in brand engagement and sales.

- Resale Market Expansion: The secondhand apparel market is projected to double in value by 2025, reaching an estimated $77 billion, indicating a strong consumer interest in sustainable and value-driven purchases.

- Fenix Outdoor's Channel Mix: Fenix Outdoor's ability to serve customers through its own stores and online platforms, alongside traditional wholesale, provides resilience against sector-specific downturns.

Adventure Tourism and Outdoor Participation Growth

The outdoor recreation sector is experiencing robust expansion, with a notable 175.8 million Americans participating in outdoor activities in 2024. This significant increase in engagement directly translates to a heightened demand for specialized apparel and equipment, creating a favorable market environment for companies like Fenix Outdoor.

This trend is largely propelled by a growing emphasis on health, wellness, and a desire for experiences that connect individuals with nature. Fenix Outdoor, with its broad range of products catering to various outdoor pursuits, is well-positioned to capitalize on this sustained consumer interest.

- Record Participation: 175.8 million Americans engaged in outdoor recreation in 2024.

- Market Driver: Increased health and wellness focus fuels demand for outdoor goods.

- Fenix Outdoor's Position: The company's diverse portfolio benefits from this growing market.

Global economic growth is a key factor for Fenix Outdoor, with the IMF projecting 3.2% growth in 2024 and an expected 3.5% in 2025, indicating a potentially stronger consumer spending environment. This growth supports increased discretionary spending on premium outdoor goods. However, persistent inflation, as noted in Fenix Outdoor's 2024 report, continues to pressure operational costs, necessitating strategic pricing adjustments to maintain profitability.

Fluctuating exchange rates also pose a risk, impacting the cost of goods sold and international revenue translation. For example, currency volatility in early 2024 could have affected margins for companies like Fenix Outdoor. The outdoor retail sector is also evolving, with strong growth anticipated in direct-to-consumer (DTC) and the resale market by 2025, while established large retailers face challenges.

The outdoor recreation sector itself is booming, with 175.8 million Americans participating in outdoor activities in 2024, driving demand for specialized gear. Fenix Outdoor's diversified strategy, encompassing its own retail channels and wholesale partnerships, positions it well to benefit from these trends and adapt to changing consumer preferences.

| Economic Factor | 2024 Projection/Status | 2025 Projection | Impact on Fenix Outdoor | Supporting Data |

| Global Economic Growth | 3.2% | 3.5% | Positive impact on discretionary spending | IMF Projection |

| Inflation | Persistent pressure | Continued concern | Increased operational costs, potential price adjustments | Fenix Outdoor 2024 Annual Report |

| Exchange Rates | Volatile | Continued volatility | Impact on COGS and international revenue | Early 2024 market observations |

| Consumer Spending | Improving confidence | Continued improvement | Increased demand for premium outdoor products | General retail sentiment |

Full Version Awaits

Fenix Outdoor PESTLE Analysis

The Fenix Outdoor PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Fenix Outdoor.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

Younger demographics, including Millennials and Gen Z, are showing a significant uptick in outdoor pursuits. This trend is fueled by a strong emphasis on environmental responsibility, a desire for inclusive experiences, and a craving for adventure. For instance, in 2024, reports indicated a 15% year-over-year increase in participation in eco-tourism activities among individuals under 30.

Fenix Outdoor must adapt its product development and marketing strategies to connect with these evolving consumer groups. This means looking beyond the established outdoor enthusiast base to appeal to a broader audience that prioritizes ethical consumption and diverse recreational opportunities. By 2025, brands that successfully integrate sustainability messaging into their campaigns are projected to see a 10% higher engagement rate with these younger segments.

The global focus on health and wellness, amplified by the pandemic, has positioned outdoor activities as crucial for both physical and mental rejuvenation. This societal trend directly fuels demand for high-quality, comfortable, and functional outdoor gear, benefiting companies like Fenix Outdoor.

In 2024, the global wellness market is projected to reach $5.6 trillion, underscoring the significant economic impact of these health-conscious behaviors. This growth indicates a sustained consumer interest in products that support an active and healthy lifestyle, a core offering for Fenix Outdoor.

The increasing popularity of 'urban outdoor' style, where performance gear seamlessly integrates into everyday city wear, presents a significant opportunity. This trend, often seen in the rise of athleisure, means consumers are actively looking for apparel that transitions effortlessly from hiking trails to coffee shops. Fenix Outdoor's brands are well-positioned to meet this demand by developing products that blend technical functionality with modern urban aesthetics.

This blending is fueled by a desire for versatility and value. For instance, a 2024 report indicated a 15% year-over-year growth in the global athleisure market, reaching an estimated $326 billion. Fenix Outdoor can leverage this by highlighting the dual utility of its offerings, appealing to a broader consumer base that prioritizes both an active lifestyle and stylish, practical clothing for urban environments.

Sustainability and Ethical Consumption Consciousness

Consumers are increasingly prioritizing brands that demonstrate genuine commitment to environmental and social responsibility. This trend, often termed ethical consumption, means shoppers are actively seeking transparency regarding a company's supply chain, labor practices, and environmental footprint. For instance, a 2024 survey indicated that over 60% of European consumers consider sustainability when making purchasing decisions, with a significant portion willing to pay a premium for eco-friendly products.

Fenix Outdoor's established dedication to sustainability, which includes initiatives like traceable materials and responsible manufacturing processes, directly resonates with this heightened consumer awareness. This focus not only meets evolving customer expectations but also serves as a powerful competitive advantage in the outdoor gear market. The company's 2024 sustainability report highlighted a 15% reduction in carbon emissions across its operations compared to 2022, a tangible outcome of its ethical consumption alignment.

- Growing Consumer Demand: Over 60% of European consumers consider sustainability in purchasing decisions as of 2024.

- Brand Differentiation: Fenix Outdoor's sustainability efforts provide a key competitive edge.

- Transparency is Key: Consumers expect clear information on supply chains and production methods.

- Tangible Impact: Fenix Outdoor achieved a 15% reduction in carbon emissions by 2024.

Community Building and Experiential Marketing

Modern consumers increasingly desire authentic connections, not just with products, but with the ethos and community surrounding a brand. Fenix Outdoor can tap into this by cultivating vibrant communities around its brands like Fjällräven and Hanwag.

This involves creating spaces, both physical and digital, where customers can connect with each other and the brand. For instance, organizing local hiking meetups, online forums for gear discussions, or workshops on outdoor skills can foster a sense of belonging. User-generated content, such as sharing trip photos or gear reviews, further strengthens these bonds.

Experiential marketing plays a crucial role here. By offering events like Fjällräven Polar, an annual dog-sledding expedition, Fenix Outdoor provides unforgettable experiences that build deep loyalty. In 2023, the Fjällräven Classic events saw significant participation across Europe and North America, demonstrating the strong demand for such brand-led adventures.

- Community Engagement: Fenix Outdoor's brands can leverage social media platforms and dedicated online forums to facilitate customer interaction and shared experiences.

- Experiential Events: Organizing or sponsoring outdoor events, workshops, and expeditions provides tangible brand experiences that foster loyalty.

- User-Generated Content: Encouraging customers to share their adventures and product usage amplifies brand reach and builds authentic community narratives.

- Brand Loyalty: By focusing on meaningful connections and shared passion for the outdoors, Fenix Outdoor can cultivate a highly engaged and loyal customer base.

Younger demographics, particularly Millennials and Gen Z, are increasingly drawn to outdoor activities, driven by a focus on environmental responsibility and a desire for adventure. This trend saw a 15% year-over-year increase in eco-tourism participation among those under 30 in 2024. By 2025, brands that effectively communicate their sustainability efforts are expected to see a 10% higher engagement rate with these younger consumers.

The global emphasis on health and wellness, heightened since the pandemic, positions outdoor pursuits as vital for both physical and mental well-being. This societal shift directly boosts demand for high-quality outdoor gear. The global wellness market was projected to reach $5.6 trillion in 2024, reflecting sustained consumer interest in products supporting active lifestyles.

The rise of 'urban outdoor' style, where performance apparel blends with everyday city wear, offers a significant opportunity. This trend, exemplified by the athleisure market's 15% year-over-year growth to an estimated $326 billion in 2024, highlights consumer demand for versatile, stylish, and functional clothing.

Consumers increasingly favor brands demonstrating genuine environmental and social responsibility, with over 60% of European consumers considering sustainability in their purchasing decisions in 2024. Fenix Outdoor's commitment to sustainability, including a 15% reduction in carbon emissions by 2024, aligns with this trend and serves as a competitive advantage.

Technological factors

Technological advancements in textiles are a significant driver for Fenix Outdoor, directly impacting product functionality and sustainability. Innovations like recycled synthetic insulation and PFC-free water repellents are key to developing gear that is both high-performing and environmentally conscious.

The company is seeing a growing consumer demand for these advanced materials. For instance, the market for sustainable outdoor apparel, which heavily relies on these innovations, is projected to grow significantly. By 2025, the global sustainable apparel market is expected to reach over $9 billion, highlighting the commercial importance of Fenix Outdoor's investment in material science.

Further developments in plant-based laminates and smart fabrics, offering features such as temperature regulation, represent the next frontier. These technologies allow for lighter, more durable, and adaptable outdoor equipment, meeting the evolving needs of adventurers.

The ongoing digital transformation in retail, particularly the surge in e-commerce, significantly impacts Fenix Outdoor. Companies like Fenix must invest heavily in their online infrastructure and digital marketing to keep pace. In 2024, global e-commerce sales are projected to reach over $7 trillion, highlighting the immense opportunity and competitive pressure in the digital space.

Fenix Outdoor's success hinges on its direct-to-consumer (DTC) strategy, requiring seamless e-commerce platforms and effective digital engagement. The ability to leverage social commerce, which is expected to grow substantially in the coming years, will be crucial for Fenix to expand its reach and connect with a wider audience, driving sales through engaging online experiences.

Smart clothing and wearable technology are increasingly common in outdoor activities, offering enhanced functionality. For instance, the global wearable technology market was valued at approximately $116 billion in 2021 and is projected to reach over $330 billion by 2029, indicating significant growth. Fenix Outdoor can leverage this trend by integrating features like biometric sensors in their apparel to monitor user health during strenuous activities or embedding GPS capabilities in headwear for improved navigation. This not only elevates the user experience but also provides valuable data for product development and personalized performance insights.

Supply Chain Technology and Traceability

Technological advancements are significantly reshaping supply chain management for companies like Fenix Outdoor. Innovations such as blockchain and sophisticated data analytics platforms are crucial for achieving greater transparency and traceability. This allows for better monitoring of product origins and production processes, which is vital for meeting increasing consumer demand for ethically sourced and sustainable goods.

Fenix Outdoor, through its prominent brand Fjällräven, is actively investing in these technologies. The company has set a clear target to ensure full traceability of its key materials by the year 2027. This commitment reflects a broader industry trend where technology is leveraged to build trust and demonstrate accountability in complex global supply chains.

The implementation of these technologies enables Fenix Outdoor to:

- Enhance supply chain visibility: Track materials from raw source to finished product.

- Verify ethical sourcing: Ensure compliance with labor and environmental standards.

- Improve operational efficiency: Optimize logistics and reduce waste through better data management.

- Meet sustainability targets: Provide verifiable data to support environmental claims.

Manufacturing Process Innovations (e.g., 3D Printing)

New manufacturing techniques, such as 3D printing, offer significant advantages for companies like Fenix Outdoor. For instance, 3D printing can be used to create intricate components like breathable back panels for backpacks, leading to reduced material waste and enhanced product design. This innovation could allow Fenix Outdoor to improve product performance and offer more customized options to its customers, streamlining production.

The adoption of advanced manufacturing processes can also lead to cost efficiencies. By minimizing material waste, companies can lower their raw material expenses. In 2024, the global 3D printing market was valued at approximately $20.5 billion, with projections indicating continued growth, suggesting a mature and accessible technology for integration.

Fenix Outdoor can leverage these advancements to:

- Enhance product performance: Utilize 3D printing for specialized components that improve functionality, such as lightweight yet durable structures.

- Customize offerings: Develop personalized gear by adapting designs through additive manufacturing, catering to individual customer needs.

- Streamline production: Reduce lead times and the complexity of assembly for certain product lines.

Technological advancements in materials science are crucial for Fenix Outdoor, driving innovation in product durability and sustainability. The company is observing a strong consumer preference for eco-friendly materials, evidenced by the sustainable apparel market's projected growth to over $9 billion by 2025.

Digital transformation, particularly in e-commerce, is reshaping Fenix Outdoor's retail strategy. With global e-commerce sales expected to exceed $7 trillion in 2024, a robust online presence and digital engagement are paramount for reaching a wider customer base.

The integration of wearable technology and smart fabrics presents new opportunities for enhanced product functionality. The wearable technology market, valued at approximately $116 billion in 2021, is anticipated to grow significantly, allowing Fenix Outdoor to incorporate features like biometric sensors for improved user experience.

Supply chain transparency is being bolstered by technologies like blockchain and advanced data analytics. Fenix Outdoor's commitment to achieving full traceability of key materials by 2027 underscores the industry's move towards greater accountability and ethical sourcing, supported by technology.

Legal factors

Fenix Outdoor, via its parent company, must adhere to the European Corporate Sustainability Reporting Directive (CSRD). This means they need to provide in-depth reports on their environmental and social impacts, a significant undertaking that began with reporting periods starting in 2024 for large public interest entities.

Meeting CSRD requirements involves extensive data gathering, rigorous auditing, and a commitment to transparency. For Fenix Outdoor, this translates to enhanced corporate governance and a more complex reporting framework, impacting how they manage and communicate their sustainability efforts.

Increasing regulations on harmful chemicals, particularly PFAS, are a significant legal consideration for Fenix Outdoor. For instance, several US states and the EU have implemented or are planning bans on PFAS in consumer products, including textiles and outdoor apparel, by 2024 and 2025. This necessitates a careful review and potential reformulation of materials used in their gear to ensure compliance.

Fenix Outdoor must proactively adapt its supply chain and product development processes to meet these evolving chemical guidelines. Failure to do so could result in substantial legal penalties, product recalls, and damage to brand reputation, impacting consumer trust and market access. For example, the EU's REACH regulation continues to update its list of restricted substances, requiring constant vigilance.

Global labor laws and the intensifying focus on supply chain due diligence, particularly concerning forced labor, mean Fenix Outdoor must rigorously ensure fair working conditions and ethical practices throughout its manufacturing base. This includes robust oversight to prevent human rights abuses. For instance, in 2024, the European Union continued to advance its proposed Corporate Sustainability Due Diligence Directive, which will impose significant obligations on companies to identify and mitigate human rights and environmental risks in their value chains, impacting companies like Fenix Outdoor with operations or sourcing within the EU.

Fenix Outdoor's commitment is demonstrated through its Code of Conduct for suppliers, which explicitly outlines expectations regarding human rights and anti-corruption measures. This framework is crucial for maintaining brand reputation and mitigating legal and operational risks associated with non-compliance in a globalized market, where consumer and regulatory pressure for ethical sourcing is at an all-time high.

Intellectual Property Rights Protection

Fenix Outdoor's ability to safeguard its valuable brand portfolio, including Fjällräven, Hanwag, Primus, and Royal Robbins, hinges on strong intellectual property (IP) rights protection. This is crucial for preventing unauthorized use and maintaining the premium perception of their products.

The company relies on robust IP laws and their effective enforcement to combat the growing threat of counterfeiting, which can significantly erode brand equity and market share. For instance, in 2024, reports indicated a global increase in counterfeit goods across various sectors, underscoring the importance of vigilant IP management for brands like Fenix Outdoor.

- Brand Protection: Fenix Outdoor actively protects its trademarks and designs, which are foundational to its market identity and customer trust.

- Counterfeit Deterrence: Strong legal frameworks and proactive enforcement are vital to deterring counterfeiters and safeguarding revenue streams.

- Market Integrity: Ensuring the authenticity of products maintains market integrity and prevents consumer deception, supporting fair competition.

Import/Export Regulations and Trade Compliance

Fenix Outdoor, as a global entity, must diligently manage diverse import and export regulations. These include varying customs duties and trade compliance requirements across its operational markets. For instance, in 2024, the European Union continued to refine its trade agreements, impacting the cost of goods for companies like Fenix.

Adapting to shifts in these legal frameworks is crucial for maintaining efficient logistics and market access. Failure to comply can lead to significant delays and increased operational expenses.

- Customs Duties: Tariffs on outdoor equipment can fluctuate, impacting landed costs. For example, a 2024 report indicated a 5% average increase in duties for certain textile imports into North America.

- Trade Agreements: Fenix Outdoor benefits from trade pacts but must also navigate potential disruptions, such as those discussed in late 2024 regarding renegotiations of existing trade deals.

- Product Standards: Compliance with varying product safety and environmental standards in different regions is mandatory, affecting product design and manufacturing processes.

Fenix Outdoor faces evolving legal landscapes, particularly concerning sustainability reporting and chemical regulations. The EU's Corporate Sustainability Reporting Directive (CSRD), effective from 2024, mandates detailed environmental and social impact disclosures. Concurrently, increasing restrictions on chemicals like PFAS by 2024-2025 in regions like the EU and US necessitate product material reviews to avoid non-compliance penalties.

Global supply chain due diligence laws, like the proposed EU Corporate Sustainability Due Diligence Directive in 2024, require rigorous oversight of labor practices to prevent human rights abuses. Fenix Outdoor's intellectual property protection is critical against rising counterfeiting trends, with global reports in 2024 highlighting an increase in fake goods. Navigating diverse import/export rules and fluctuating customs duties, such as a potential 5% average increase on certain textile imports into North America in 2024, also presents ongoing legal challenges.

| Legal Factor | 2024/2025 Impact/Trend | Fenix Outdoor Relevance |

| Sustainability Reporting (CSRD) | Mandatory detailed disclosures from 2024. | Requires enhanced data gathering and transparency in operations. |

| Chemical Regulations (PFAS) | Bans and restrictions by 2024-2025 in key markets. | Necessitates review and potential reformulation of product materials. |

| Supply Chain Due Diligence | Increased focus on human rights and forced labor prevention (e.g., EU directive). | Requires robust supplier oversight and ethical practice enforcement. |

| Intellectual Property Protection | Rising global counterfeiting trends. | Crucial for safeguarding brand equity and revenue streams. |

| Trade Compliance | Fluctuating customs duties (e.g., 5% rise in textile imports noted for North America in 2024). | Impacts logistics efficiency and operational costs. |

Environmental factors

The escalating threat of climate change demands that companies actively work to shrink their carbon footprint. Fenix Outdoor demonstrates this commitment, with its brand Fjällräven achieving a notable 24% decrease in total net carbon emissions since 2019. This progress is part of a broader goal to reach net zero by 2050, a target that shapes both operational strategies and supply chain management.

Growing concern over dwindling natural resources is pushing consumers and industries alike towards sustainable and recycled materials. This trend directly impacts companies like Fenix Outdoor, influencing sourcing strategies and product development.

Fenix Outdoor is actively responding by incorporating materials such as recycled polyamide, organic cotton, and wool sourced responsibly. For instance, their commitment to using recycled materials in products like Fjällräven's Kånken Re-Kånken demonstrates a tangible effort to reduce waste and reliance on virgin resources. This aligns with a broader market shift where eco-conscious purchasing decisions are becoming more prevalent, with a significant portion of consumers willing to pay a premium for sustainable goods.

The outdoor industry is increasingly embracing circular economy principles, pushing for longer-lasting products, repair services, and robust recycling programs. This shift directly impacts how companies like Fenix Outdoor operate, encouraging a move away from linear "take-make-dispose" models.

Fenix Outdoor, through its brands like Fjällräven, is actively participating in this trend. Fjällräven's 'Pre-Loved' initiative, for instance, allows customers to buy and sell used Fjällräven items, extending product lifecycles. This not only reduces waste but also taps into a growing consumer demand for sustainable and pre-owned goods.

In 2023, Fjällräven reported a significant increase in participation in its repair services, with over 10,000 items repaired globally, demonstrating a tangible commitment to product longevity. This focus on durability and resale is crucial for Fenix Outdoor to align with evolving environmental regulations and consumer expectations for a more sustainable future.

Biodiversity and Animal Welfare Concerns

Consumers and regulators are increasingly focused on biodiversity and how animals are treated, especially when it comes to materials like down and wool. This means companies need to be really open about where they get these materials and prove they're sourced ethically. Fenix Outdoor is actively working on this, with policies like their Down Promise demonstrating a commitment to animal welfare.

The company is also tackling challenges within its wool supply chain to make sure its practices are responsible. For instance, in 2023, Fenix Outdoor reported that 96% of its down was certified to RDS (Responsible Down Standard), showing significant progress in meeting these ethical sourcing demands.

- Consumer Awareness: A 2024 survey indicated that over 70% of outdoor gear consumers consider animal welfare when making purchasing decisions.

- Regulatory Pressure: Upcoming EU regulations in 2025 are expected to place stricter requirements on the traceability and ethical sourcing of animal-derived products.

- Supply Chain Initiatives: Fenix Outdoor's ongoing efforts to improve wool sourcing transparency aim to address concerns about land management and animal handling practices.

Water Usage and Pollution Control

Water scarcity and pollution stemming from manufacturing processes represent critical environmental challenges for companies like Fenix Outdoor. Addressing these requires a proactive approach to resource management and pollution prevention.

Fenix Outdoor must prioritize the adoption of water-efficient production methods across its supply chain. This includes investing in technologies that minimize water consumption during dyeing, finishing, and washing stages of textile production. For example, the textile industry globally uses an estimated 93 billion cubic meters of water annually, highlighting the scale of this issue.

Furthermore, stringent wastewater management is essential to prevent harmful substances from entering natural water systems. This involves implementing advanced filtration and treatment processes to remove chemicals and microplastics before discharging any water. In 2024, many regions are facing increased regulatory scrutiny on industrial wastewater discharge, with fines for non-compliance becoming more substantial.

- Water Efficiency: Implementing water-saving technologies in manufacturing, aiming to reduce per-unit water consumption by a targeted percentage by 2025.

- Wastewater Treatment: Ensuring all manufacturing partners meet or exceed local and international wastewater discharge standards, with regular audits.

- Chemical Management: Adhering to strict chemical guidelines to prevent the release of hazardous substances into water bodies, aligning with initiatives like the Zero Discharge of Hazardous Chemicals (ZDHC) program.

- Supply Chain Transparency: Working with suppliers to track and report water usage and pollution data, fostering accountability and continuous improvement.

Fenix Outdoor's environmental strategy is heavily influenced by climate change, leading to a 24% reduction in Fjällräven's net carbon emissions since 2019 as part of its net-zero by 2050 goal. The increasing demand for sustainable materials, such as recycled polyamide and organic cotton, is reshaping sourcing and product development, with consumers increasingly prioritizing eco-friendly options.

The company is actively embracing circular economy principles, exemplified by Fjällräven's 'Pre-Loved' initiative, which saw over 10,000 items repaired globally in 2023, extending product lifecycles and reducing waste. Ethical sourcing of animal-derived materials is also paramount, with 96% of Fenix Outdoor's down certified to the Responsible Down Standard in 2023, addressing growing consumer and regulatory concerns about animal welfare.

Water scarcity and pollution are critical challenges, prompting Fenix Outdoor to prioritize water-efficient production and advanced wastewater treatment. By 2025, the company aims to reduce per-unit water consumption, ensuring manufacturing partners meet stringent discharge standards and adhering to chemical management guidelines like the ZDHC program.

PESTLE Analysis Data Sources

Our Fenix Outdoor PESTLE Analysis is built on a robust foundation of data from official government publications, reputable industry associations, and leading financial news outlets. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the outdoor industry.