Fenix Outdoor Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fenix Outdoor Bundle

Discover the strategic core of Fenix Outdoor's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key activities, offering a clear roadmap for understanding their market dominance. Ready to gain a competitive edge?

Partnerships

Fenix Outdoor's key partnerships with raw material suppliers are foundational to its commitment to sustainability and product excellence. They work closely with suppliers to source high-quality materials like organic cotton and recycled polyester, which are vital for creating durable outdoor apparel and gear.

These collaborations are instrumental in Fenix Outdoor achieving its ambitious sustainability goals, ensuring that the materials used not only meet stringent quality and performance standards but also align with the company's environmental ethos. For instance, Fenix Outdoor has set a target to significantly increase its use of recycled materials by 2025, a goal heavily reliant on these supplier relationships.

Fenix Outdoor collaborates with numerous manufacturing facilities to ensure efficient production and supply chain management. A notable recent development is their partnership with Maloja to operate apparel production at Viomoda in Bulgaria. This move is significant as it bolsters Fenix Outdoor's European production capabilities, allowing for greater control and responsiveness.

These strategic alliances in manufacturing are crucial for Fenix Outdoor's business model. By investing in and partnering with production facilities, the company can better guarantee product availability and maintain stringent quality control standards across its diverse product lines. This proactive approach to manufacturing is key to meeting customer demand and upholding brand reputation.

Fenix Outdoor leverages a robust network of wholesale distributors and independent outdoor retailers worldwide to significantly expand its market presence. These crucial partnerships enable the distribution of its well-known brands, including Fjällräven, Hanwag, and Royal Robbins, to a diverse and extensive customer base. This strategy is particularly effective in reaching consumers in geographical areas where Fenix Outdoor does not operate its own physical retail stores.

Technology and Logistics Providers

Fenix Outdoor’s strategic alliances with technology and logistics providers, including its internal entity Fenix Outdoor Logistics, are fundamental to its operational success. These partnerships are crucial for maintaining a robust and efficient supply chain, enabling seamless order fulfillment, and supporting its expanding e-commerce presence.

These collaborations are designed to optimize critical business functions. They help streamline inventory management, ensuring accurate stock levels across all sales channels. Furthermore, they enhance warehousing efficiency and refine delivery processes, which is vital for getting products to customers quickly and reliably, whether they shop online or in-store.

Key aspects of these partnerships include:

- Technology Integration: Leveraging advanced logistics and e-commerce platforms to improve visibility and control over the supply chain.

- Logistics Optimization: Working with providers to ensure timely and cost-effective delivery, including last-mile solutions.

- Inventory Management: Implementing systems that provide real-time inventory data to prevent stockouts and overstocking.

- Scalability: Ensuring that logistics and technology infrastructure can adapt to growing sales volumes and market demands.

Sustainability Organizations & Industry Initiatives

Fenix Outdoor actively collaborates with key sustainability organizations to drive progress. These include partnerships with the Swedish Textile Initiative for Climate Action (STICA) and Textile Exchange, fostering a collective approach to environmental stewardship within the industry.

These collaborations are crucial for advancing Fenix Outdoor's sustainability goals. Through initiatives like the Microfiber Consortium, the company gains access to vital research and shares best practices aimed at minimizing environmental impact, particularly concerning microfiber pollution.

By engaging with these industry leaders, Fenix Outdoor benefits from shared expertise in critical areas. This includes efforts to reduce carbon emissions, implement responsible chemical management throughout the supply chain, and promote circular economy principles.

- STICA Collaboration: Fenix Outdoor is a signatory to the Swedish Textile Initiative for Climate Action, aligning with its goal to reduce the fashion industry's climate footprint by 50% by 2030.

- Textile Exchange Membership: The company leverages Textile Exchange's platforms and standards to improve its use of preferred fibers and drive broader industry change towards more sustainable materials.

- Microfiber Consortium Involvement: Participation in the Microfiber Consortium allows Fenix Outdoor to contribute to and benefit from research focused on understanding and mitigating microfiber shedding from textiles.

- Industry-Wide Impact: These partnerships enable Fenix Outdoor to influence and implement best practices across the value chain, contributing to a more responsible and sustainable textile industry overall.

Fenix Outdoor's key partnerships with raw material suppliers are crucial for its commitment to sustainability and product quality, enabling the sourcing of materials like recycled polyester. These collaborations are vital for achieving ambitious sustainability targets, such as increasing recycled material use, which the company aims to significantly boost by 2025.

What is included in the product

A detailed Fenix Outdoor Business Model Canvas that outlines its strategy for serving outdoor enthusiasts through a multi-brand approach and direct-to-consumer channels.

It comprehensively covers customer segments, value propositions, and key resources, reflecting Fenix Outdoor's commitment to quality and sustainability.

Fenix Outdoor's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, simplifying complex strategies for easier understanding and collaborative refinement.

Activities

Fenix Outdoor's commitment to product design and development is central to its success. In 2024, the company continued its robust investment in R&D, focusing on creating innovative, functional, and exceptionally durable outdoor gear and apparel. This dedication to material science and ergonomic design ensures their products meet the rigorous demands of outdoor enthusiasts.

The company regularly introduces new collections and enhances existing product lines. For instance, their brands consistently leverage cutting-edge materials and construction techniques. This iterative process of improvement and innovation is a key driver of customer loyalty and market competitiveness.

Fenix Outdoor meticulously oversees the manufacturing of its diverse brand portfolio, including Fjällräven and Hanwag. This involves managing both their own production facilities and working closely with carefully selected third-party manufacturers to uphold rigorous quality standards.

To guarantee product durability and performance, Fenix Outdoor implements stringent quality control measures throughout the production cycle. This commitment extends to ensuring all suppliers adhere to their comprehensive Code of Conduct, promoting ethical and sustainable manufacturing practices.

Fenix Outdoor's brand building and marketing efforts are central to its business model, focusing on distinct strategies for its portfolio of brands. For example, Fjällräven, known for its iconic Kånken backpack, engages heavily in digital marketing and influencer collaborations. In 2024, Fjällräven continued to leverage social media platforms to showcase its products in real-world outdoor settings, fostering community engagement and brand advocacy.

The company also emphasizes the heritage and sustainability of its brands, such as Hanwag's commitment to durable, handcrafted footwear. Marketing campaigns highlight the longevity and repairability of Hanwag boots, resonating with environmentally conscious consumers. This approach aims to build strong brand loyalty by connecting with customers on shared values, a strategy that proved effective throughout 2024.

Royal Robbins, another key brand, focuses on versatile outdoor apparel. Marketing activities for Royal Robbins in 2024 included partnerships with outdoor lifestyle bloggers and events that promote active living. The brand's messaging consistently emphasizes comfort, functionality, and a connection to nature, attracting a broad customer base seeking practical yet stylish outdoor wear.

Global Distribution and Logistics

Fenix Outdoor's global distribution and logistics are central to its operations, ensuring products reach customers efficiently. This involves managing a complex international supply chain, encompassing warehousing, transportation, and customs clearance. The company's dedicated logistics arm, Fenix Outdoor Logistics, is instrumental in orchestrating these intricate processes across numerous markets.

Key activities in this area include:

- Global Supply Chain Management: Overseeing the flow of goods from manufacturing to end-users across various continents.

- Warehousing and Inventory: Strategically placing and managing inventory in distribution centers worldwide to facilitate timely order fulfillment.

- Transportation and Freight: Coordinating diverse shipping methods, including sea, air, and land, to ensure cost-effective and prompt delivery.

- Customs and Compliance: Navigating international trade regulations and customs procedures for seamless cross-border movement of products.

For instance, in 2023, Fenix Outdoor reported a significant portion of its sales originating from outside its home markets, underscoring the importance of its robust global distribution network. The company's focus on optimizing these logistics contributes directly to its ability to serve a diverse international customer base and maintain its competitive edge in the outdoor industry.

Retail Operations and E-commerce Management

Fenix Outdoor's retail operations are a cornerstone of its direct-to-consumer strategy. The company actively manages its own retail store network, featuring well-known brands like Naturkompaniet and Globetrotter. This hands-on approach allows for direct customer interaction and a controlled brand experience.

Managing robust e-commerce platforms is equally vital. These online channels are crucial for reaching a wider audience and providing a seamless shopping journey that complements their physical store presence. Optimizing the online experience is key to driving sales and customer loyalty.

- Direct Sales Channels: Operating owned retail stores and e-commerce platforms enables Fenix Outdoor to directly engage with customers, control brand presentation, and capture full retail margins.

- Customer Experience: These channels are critical for delivering a consistent and high-quality customer service experience, both in-store and online, fostering brand loyalty.

- Sales Contribution: In 2023, Fenix Outdoor's retail segment, which includes their own stores and e-commerce, represented a significant portion of their total sales, underscoring the importance of these activities.

Fenix Outdoor's core activities revolve around creating and delivering high-quality outdoor products. This includes continuous product innovation, meticulous manufacturing oversight, and robust quality control to ensure durability and performance. The company also focuses on building strong brand identities through targeted marketing and fostering customer loyalty by emphasizing heritage and sustainability.

Full Document Unlocks After Purchase

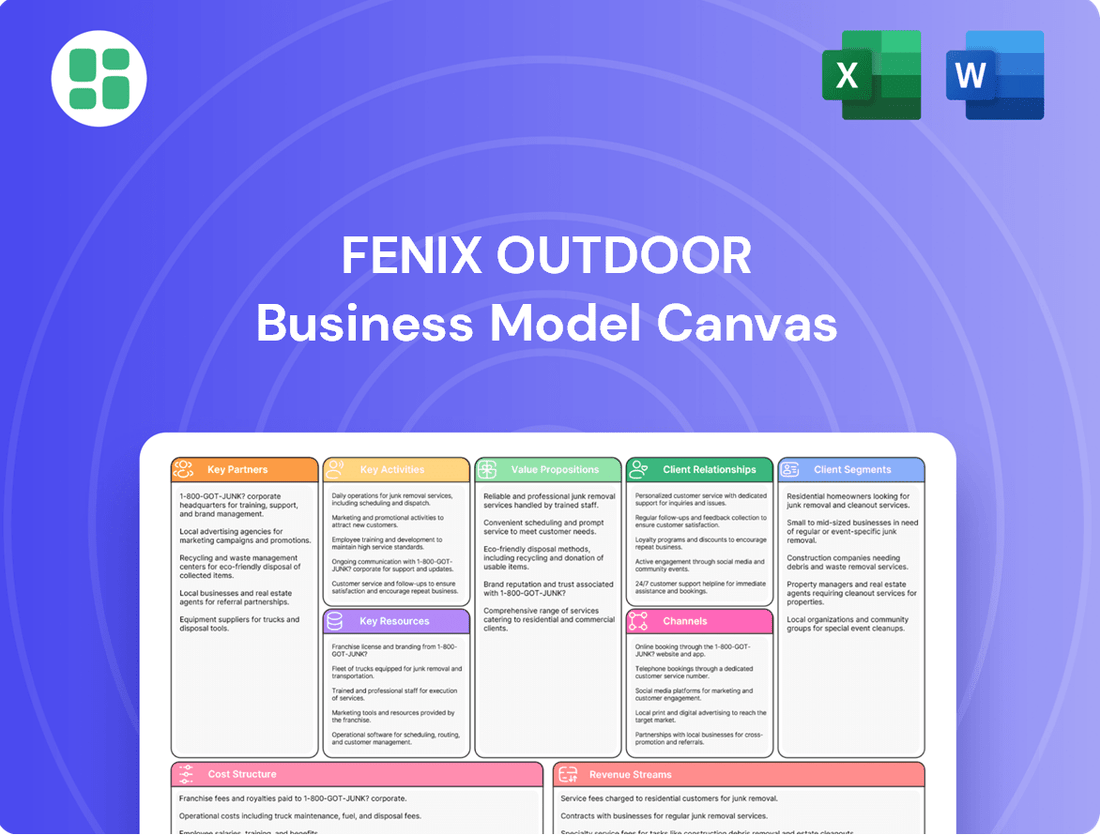

Business Model Canvas

This preview offers a genuine glimpse into the Fenix Outdoor Business Model Canvas you will receive. It's not a sample or a mockup, but an exact representation of the document's structure and content. Upon completing your purchase, you'll gain full access to this comprehensive and ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for strategic planning.

Resources

Fenix Outdoor's core strength lies in its robust portfolio of established outdoor brands. This collection, featuring names like Fjällräven, Hanwag, Primus, Royal Robbins, Tierra, and the recently added Devold of Norway, represents significant brand equity and deep customer loyalty.

These brands are not just names; they embody heritage and trust, offering Fenix Outdoor a substantial competitive edge in the market. For instance, Fjällräven, known for its Kånken backpack, has seen consistent growth, contributing significantly to the group's revenue streams.

Fenix Outdoor holds a significant portfolio of intellectual property, including designs, patents, and proprietary technologies crucial for its outdoor gear and apparel. This IP encompasses innovative fabric technologies, functional design elements, and unique product features that clearly distinguish its brands, such as Fjällräven and Hanwag, in a competitive marketplace.

These intellectual assets are not merely protective; they are core drivers of Fenix Outdoor's competitive advantage and brand identity. For instance, Fjällräven's iconic G-1000 fabric, a blend of cotton and polyester treated with Greenland Wax, represents a key proprietary technology that offers durability, water resistance, and breathability, a testament to their investment in R&D.

The company's commitment to innovation is reflected in its continuous development and protection of new designs and technologies. This intellectual property forms a vital part of their value proposition, enabling them to command premium pricing and foster strong customer loyalty by offering specialized, high-performance products.

Fenix Outdoor leverages a comprehensive global distribution network, including wholesale partners, its own retail stores like Naturkompaniet and Globetrotter, and robust e-commerce operations. This multi-channel strategy is key to their market access.

As of 2024, Fenix Outdoor operates a significant retail footprint with hundreds of stores across Europe and North America, complemented by a growing online presence that extends their reach to a global customer base.

Skilled Human Capital

Skilled human capital is the bedrock of Fenix Outdoor's success, encompassing experienced teams across all crucial business functions. These professionals bring deep expertise in product development, design, manufacturing, marketing, sales, and retail operations, ensuring high-quality execution at every stage. Their collective knowledge is essential for navigating the complexities of the outdoor industry.

The company's strength lies in its employees' profound understanding of the outdoor sector, coupled with a genuine passion for outdoor activities. This intrinsic motivation fuels innovation, allowing Fenix Outdoor to consistently develop cutting-edge products that resonate with its target audience. It also plays a vital role in maintaining the authenticity and integrity of its brands.

Fenix Outdoor's commitment to its workforce is evident in its continuous investment in talent development and fostering a culture that values expertise. For instance, in 2023, the company reported a total workforce of approximately 2,500 individuals, highlighting the scale of its human capital investment. This dedicated team is instrumental in driving the company's strategic objectives and market position.

- Expertise in Product Development and Design: Teams with specialized knowledge in materials science, ergonomics, and sustainable design practices.

- Manufacturing and Supply Chain Proficiency: Skilled personnel managing efficient production processes and robust supply chain networks.

- Marketing and Sales Acumen: Professionals adept at brand building, customer engagement, and driving sales through various channels.

- Retail Operations Excellence: Dedicated staff ensuring optimal customer experiences in physical and online retail environments.

Financial Capital and Strategic Investments

Financial capital is the engine driving Fenix Outdoor's strategic advancements. In 2023, the company reported net sales of SEK 11,958 million, demonstrating a robust financial foundation. This capital is strategically deployed to fuel innovation through research and development, ensuring their product lines remain competitive and cutting-edge.

Crucially, this financial muscle allows Fenix Outdoor to pursue impactful brand acquisitions, such as integrating Devold of Norway, which enhances their portfolio and market reach. These investments are not merely about expansion but about strengthening the core business and creating long-term value.

Furthermore, significant capital allocation is directed towards optimizing the supply chain, a vital component for efficiency and cost management. This includes investments in technology and logistics to ensure timely delivery and reduce environmental impact. The company's commitment to these areas underscores its strategic vision for sustainable growth.

Retail expansion also benefits directly from this financial backing. Fenix Outdoor continues to invest in its physical and digital retail presence, aiming to provide a seamless customer experience across all touchpoints. This strategic investment in retail infrastructure is key to capturing market share and building brand loyalty.

- Research & Development: Fenix Outdoor invests in R&D to innovate and maintain a competitive edge in the outdoor industry.

- Brand Acquisitions: Capital is used for strategic acquisitions, like Devold of Norway, to expand market presence and product offerings.

- Supply Chain Optimization: Financial resources are allocated to improve logistics, efficiency, and sustainability within the supply chain.

- Retail Expansion: Investments are made in both physical and digital retail channels to enhance customer reach and experience.

Fenix Outdoor's key resources are its strong portfolio of well-established outdoor brands, significant intellectual property in product design and materials, a global multi-channel distribution network, skilled human capital with deep industry knowledge, and robust financial capital. These elements collectively form the foundation of its competitive advantage and operational success.

Value Propositions

Fenix Outdoor is renowned for its high-quality, durable products, engineered to endure demanding outdoor adventures. This dedication to robust construction ensures customers receive gear that reliably performs even in harsh conditions.

The company's focus on longevity means their products are built to last, offering a sustainable choice that minimizes the need for frequent replacements. For instance, Fjällräven's iconic Kånken backpack, first introduced in 1978, continues to be a bestseller, demonstrating the enduring appeal and durability of their designs.

Fenix Outdoor's brands focus on classic, timeless designs that blend seamlessly with exceptional functionality. This commitment ensures their gear is not just practical for activities like hiking and trekking but also possesses an enduring aesthetic appeal, resonating with customers who value longevity over fast fashion.

Fenix Outdoor's commitment to sustainability and responsible production is a core value proposition. This includes a strong focus on using sustainable materials and ensuring ethical manufacturing practices throughout their operations. Transparency in their supply chains is also paramount, allowing consumers to understand the journey of their products.

This dedication to minimizing environmental impact and positively contributing to communities resonates deeply with a growing segment of environmentally conscious consumers. For instance, in their 2023 Corporate Social Responsibility (CSR) report, Fenix Outdoor highlighted a 15% reduction in carbon emissions per product compared to their 2020 baseline, demonstrating tangible progress.

The company actively seeks to reduce its ecological footprint by, for example, increasing the use of recycled polyester in their garment production. In 2024, they aimed to source 70% of their polyester from recycled materials, a significant step towards circularity in the outdoor apparel industry.

Brand Heritage and Authenticity

Fenix Outdoor deeply leverages the rich history and authentic outdoor heritage of its brands, such as Fjällräven and Hanwag, to forge strong emotional connections with consumers. This established legacy is a powerful signal of proven performance and unwavering trustworthiness within the dedicated outdoor community. Many of these brands boast decades of invaluable experience, a testament to their enduring quality and relevance in the market.

The brand heritage translates into tangible consumer trust and loyalty, a critical asset in the competitive outdoor gear sector. For instance, Fjällräven's iconic Greenland Jacket, first introduced in 1970, continues to be a bestseller, demonstrating the lasting appeal of its heritage-backed design and durability. This deep-rooted history is not just a narrative; it's a core component of Fenix Outdoor's value proposition, resonating with customers seeking authentic and reliable outdoor equipment.

- Brand Heritage: Fjällräven (founded 1960), Hanwag (founded 1920) provide decades of proven outdoor expertise.

- Authenticity: Consumers connect with the genuine history and craftsmanship embedded in these brands.

- Trust and Loyalty: The long-standing reputation for quality fosters deep customer loyalty and confidence.

- Emotional Connection: Heritage storytelling creates a powerful bond beyond product features.

Specialized Gear for Diverse Outdoor Pursuits

Fenix Outdoor excels by offering a comprehensive selection of specialized gear and apparel designed for a multitude of outdoor pursuits. This extensive range ensures that enthusiasts, whether they are embarking on a challenging trek or enjoying a casual outdoor lifestyle, can find precisely what they need.

Their product assortment covers everything from robust hiking boots and technical outerwear to everyday casual wear that still embodies outdoor functionality. This broad appeal allows Fenix Outdoor to capture a significant share of the diverse outdoor market, catering to a wide spectrum of customer needs and preferences.

- Wide Product Range: Offering specialized equipment and clothing for hiking, trekking, camping, and everyday outdoor living.

- Tailored Solutions: Products are designed to meet the specific demands of various activities and user preferences.

- Market Inclusivity: Caters to both dedicated adventurers and those who embrace an outdoor lifestyle casually.

- Brand Synergy: Brands like Fjällräven and Hanwag contribute to a strong portfolio addressing diverse outdoor needs.

Fenix Outdoor's value proposition centers on delivering high-quality, durable, and timeless outdoor gear. Their products are built to last, appealing to consumers seeking longevity and reliability in demanding environments. This focus on enduring design and robust construction ensures customer satisfaction and reduces the need for frequent replacements.

Sustainability is a cornerstone, with a commitment to responsible sourcing and ethical production. By utilizing recycled materials, such as aiming for 70% recycled polyester in 2024, and transparent supply chains, they resonate with environmentally conscious consumers. This dedication to minimizing their ecological footprint is increasingly important in today's market.

The company leverages the rich heritage and authenticity of its brands, like Fjällräven and Hanwag, to build strong emotional connections. This established legacy fosters trust and loyalty, as seen with iconic products like the Kånken backpack (1978) and Greenland Jacket (1970), which continue to be popular due to their proven quality and enduring appeal.

Fenix Outdoor offers a comprehensive range of specialized gear for various outdoor activities, from technical apparel to everyday wear. This broad product assortment caters to a wide spectrum of customer needs, ensuring enthusiasts can find precisely what they require for both intense adventures and casual outdoor lifestyles.

| Value Proposition Aspect | Key Features | Supporting Evidence/Data |

|---|---|---|

| Product Quality & Durability | High-quality materials, robust construction, long-lasting designs | Fjällräven Kånken (since 1978), Hanwag boots known for longevity |

| Sustainability & Responsibility | Use of recycled materials, ethical manufacturing, supply chain transparency | Aim for 70% recycled polyester in 2024; 15% reduction in carbon emissions per product (2023 CSR report vs. 2020 baseline) |

| Brand Heritage & Authenticity | Established brand history, craftsmanship, emotional connection | Fjällräven (founded 1960), Hanwag (founded 1920); Greenland Jacket (since 1970) |

| Comprehensive Product Range | Specialized gear for diverse outdoor pursuits, timeless aesthetic | Apparel, footwear, and accessories for hiking, trekking, camping, and lifestyle |

Customer Relationships

Fenix Outdoor cultivates brand communities by creating spaces for outdoor enthusiasts to connect around brands like Fjällräven and Hanwag. These communities thrive on shared passion, often fostered through online forums, social media campaigns, and in-person events. For instance, Fjällräven's Arctic Fox Initiative, launched in 2018, not only promotes conservation but also actively engages customers in environmental stewardship, deepening their connection to the brand.

Fenix Outdoor cultivates direct-to-consumer (DTC) relationships through its owned retail stores and e-commerce platforms, ensuring a consistent brand experience. This approach facilitates personalized service and product guidance, fostering a deeper connection with customers.

In 2024, Fenix Outdoor continued to strengthen its DTC presence, recognizing its importance for gathering immediate customer feedback. This direct interaction is crucial for understanding evolving consumer preferences and informing product development and marketing strategies.

Fenix Outdoor prioritizes robust customer service to handle product inquiries, after-sales support, and warranty claims. This dedication fosters customer satisfaction and trust, underscoring their commitment to product quality and longevity.

In 2024, Fenix Outdoor's brands like Fjällräven and Hanwag likely saw continued demand for their durable outdoor gear, necessitating efficient support channels. For instance, Fjällräven reported strong sales growth in recent years, indicating a growing customer base that relies on reliable support for their investments.

Loyalty Programs and Exclusive Content

Fenix Outdoor cultivates customer loyalty through well-structured programs, offering exclusive content and early access to new products. This strategy not only rewards repeat business but also deepens the bond between customers and the Fenix Outdoor brand portfolio. Such initiatives are proven drivers of increased purchase frequency and valuable word-of-mouth marketing.

- Loyalty Program Benefits: Offering points, discounts, or tiered rewards encourages continued engagement. For instance, many outdoor retailers saw loyalty program members spending 10-15% more annually than non-members in 2024.

- Exclusive Content: Providing access to expert guides, behind-the-scenes looks at product development, or sustainability reports can differentiate the brand. This content adds value beyond the product itself, fostering a stronger connection.

- Early Access: Allowing loyal customers to purchase new gear before the general public creates a sense of exclusivity and appreciation. This can significantly boost initial sales for new product launches.

- Community Building: Integrating loyalty programs with online forums or events can further strengthen customer relationships, turning them into brand advocates.

Sustainability Reporting and Transparency

Fenix Outdoor actively engages its customer base by providing transparent reporting on its sustainability efforts and ethical business practices. This commitment fosters trust among consumers who prioritize environmentally and socially responsible companies. For example, in their 2023 Corporate Social Responsibility (CSR) report, Fenix Outdoor detailed progress in areas like reducing carbon emissions and ensuring fair labor conditions throughout their supply chain.

The company’s approach to transparency is a key driver for building strong customer relationships, particularly with the growing segment of consumers who actively seek out brands aligned with their values. This open communication helps to solidify loyalty and attract new customers who are making purchasing decisions based on a brand's commitment to a better future.

- Transparent Reporting: Annual CSR reports detail sustainability progress and challenges.

- Ethical Practices: Communication emphasizes fair labor and responsible sourcing.

- Consumer Trust: Transparency builds loyalty with environmentally and socially conscious customers.

- Value Alignment: Attracts consumers who prioritize responsible business conduct.

Fenix Outdoor fosters deep customer connections through community building, direct engagement via DTC channels, and exceptional customer service. Loyalty programs and transparent sustainability reporting further solidify these relationships, turning customers into brand advocates.

Channels

Wholesale distribution is a cornerstone of Fenix Outdoor's strategy, acting as a primary channel to reach a vast customer base. This involves selling to a diverse network of independent outdoor retailers, specialized sporting goods stores, and large retail chains across the globe. This approach significantly expands their market penetration by utilizing established retail infrastructure.

This broad wholesale network is crucial for Fenix Outdoor's global presence, allowing their brands to be accessible in numerous physical locations. The company relies heavily on these partnerships to get their products to consumers, demonstrating the importance of strong relationships with retail partners.

In 2023, Fenix Outdoor reported net sales of SEK 7,597 million. The wholesale segment represents a substantial portion of these sales, underscoring its critical role in the company's overall revenue generation and market reach.

Fenix Outdoor operates a network of owned retail stores, including well-known chains like Naturkompaniet, Globetrotter, Partioaitta, and Friluftsland. These stores are crucial for offering a curated brand experience and fostering direct engagement with customers, reinforcing Fenix Outdoor's commitment to its store concepts.

In 2024, Fenix Outdoor continued to invest in and refine its retail store concepts, recognizing their importance in building brand loyalty and providing a tangible connection to their outdoor products. The company's strategy emphasizes creating immersive environments where customers can explore and appreciate the quality and functionality of their offerings.

Fenix Outdoor leverages its brand websites like Fjällräven.com, Hanwag.com, and RoyalRobbins.com for direct-to-consumer (DTC) sales, enabling precise control over brand messaging and the customer journey. This DTC approach fosters a deeper connection with consumers by offering a seamless shopping experience and access to the full product range.

In 2024, the global e-commerce market continued its robust growth, with online sales projected to reach trillions of dollars. For brands like those under Fenix Outdoor, these DTC channels are crucial for capturing higher margins and gathering valuable first-party customer data, which is essential for personalized marketing and product development.

Third-Party Online Retailers

Fenix Outdoor leverages partnerships with major online marketplaces and specialized outdoor e-tailers to significantly broaden its digital sales footprint. These collaborations act as crucial extensions to Fenix's proprietary e-commerce platforms, tapping into established customer bases and increasing brand exposure to a wider online demographic.

- Expanded Reach: Partnerships with platforms like Zalando and Amazon provide access to millions of potential customers who actively shop for outdoor gear online.

- Complementary Sales: These third-party channels supplement Fenix's direct-to-consumer sales, offering a diversified revenue stream and reducing reliance on a single online presence.

- Brand Visibility: Listing products on popular marketplaces enhances brand recognition and allows new customers to discover Fenix Outdoor's offerings.

Experiential Marketing and Events

Experiential Marketing and Events are crucial for Fenix Outdoor to connect with its customer base. Participating in major outdoor trade shows and festivals allows direct product showcasing and interaction. For instance, Globetrotter, a key brand within Fenix Outdoor, organizes brand-specific events like hiking days. These initiatives not only build brand awareness but also provide invaluable opportunities for product demonstrations and direct customer feedback, which is vital for product development.

These events foster a sense of community around the brands. By engaging directly with outdoor enthusiasts, Fenix Outdoor can better understand evolving consumer needs and preferences. In 2023, the outdoor industry saw continued growth, with many consumers seeking authentic experiences, underscoring the importance of this channel. For example, participation in events like ISPO Munich, a leading international sports equipment trade fair, provides significant visibility.

- Direct Consumer Engagement: Events allow Fenix Outdoor brands to interact directly with their target audience, fostering loyalty and gathering immediate feedback.

- Brand Awareness and Visibility: Participation in prominent trade shows and festivals significantly increases brand recognition within the outdoor community.

- Product Demonstration and Education: Events offer a platform to showcase product features and benefits effectively, educating consumers on usage and performance.

- Community Building: Organizing and participating in brand-specific events like hiking days cultivates a strong sense of community, aligning consumers with the brand's values.

Fenix Outdoor utilizes a multi-channel strategy, blending wholesale, owned retail, direct-to-consumer (DTC) e-commerce, and partnerships with online marketplaces. This diversified approach ensures broad market reach and direct customer engagement.

In 2023, Fenix Outdoor's net sales reached SEK 7,597 million, with wholesale forming a significant portion. The company's owned retail stores, such as Naturkompaniet and Globetrotter, provide curated brand experiences and direct customer interaction.

The DTC channel, through brand websites like Fjällräven.com, allows for precise brand messaging and customer journey control, with global e-commerce continuing its robust growth in 2024. Partnerships with online marketplaces and e-tailers further extend digital sales, tapping into established customer bases.

Experiential marketing and events, including participation in trade shows and brand-specific activities like hiking days, are vital for community building and direct customer feedback, crucial for product development in the growing outdoor industry.

| Channel Type | Key Brands/Platforms | Strategic Importance | 2023 Performance Indicator |

|---|---|---|---|

| Wholesale | Independent retailers, sporting goods stores, chains | Broad market penetration, global reach | Substantial portion of SEK 7,597 million net sales |

| Owned Retail | Naturkompaniet, Globetrotter, Partioaitta, Friluftsland | Curated brand experience, direct customer engagement | Continued investment in store concepts in 2024 |

| DTC E-commerce | Fjällräven.com, Hanwag.com, RoyalRobbins.com | Brand control, customer journey, higher margins | Leveraging global e-commerce growth |

| Online Marketplaces | Zalando, Amazon, specialized e-tailers | Expanded digital footprint, access to new customers | Complementary to DTC, increased brand visibility |

| Experiential Marketing | Trade shows (ISPO Munich), brand events (hiking days) | Community building, direct feedback, brand awareness | Vital for understanding evolving consumer needs |

Customer Segments

Dedicated Outdoor Enthusiasts are individuals deeply committed to activities such as hiking, trekking, camping, and climbing. They actively seek out gear that is not only high-performing but also exceptionally durable and dependable for their adventures.

This segment places a premium on functionality, superior quality, and the long-term longevity of their outdoor equipment. For instance, in 2023, the global outdoor apparel market reached an estimated USD 48.5 billion, with a significant portion driven by consumers prioritizing durability and performance.

They often have very specific requirements for technical apparel and rugged gear designed to withstand challenging environments. This translates to a willingness to invest in premium products that offer advanced features and a proven track record in the field.

Environmentally conscious consumers are a key segment for Fenix Outdoor. These individuals actively seek out brands that demonstrate a strong commitment to sustainability, ethical sourcing, and the use of eco-friendly materials in their products. They are particularly drawn to Fenix Outdoor's Corporate Social Responsibility (CSR) initiatives and the transparency they offer regarding their supply chain. For instance, in 2023, Fenix Outdoor reported that 85% of their materials were considered sustainable, a significant draw for this customer base.

This segment includes consumers who value the look and feel of outdoor clothing for their daily lives, not necessarily for extreme expeditions. They are drawn to brands with a rich history and enduring, classic designs, prioritizing quality and durability. Fjällräven, for instance, resonates strongly with this group, offering apparel that blends function with a desirable aesthetic for urban environments.

Travelers and Adventurers

Travelers and adventurers represent a core customer segment for Fenix Outdoor, particularly for brands like Royal Robbins. This group actively seeks out gear that is not only durable and comfortable but also highly adaptable to diverse climates and unpredictable conditions. They prioritize functionality and reliability, needing equipment that can withstand the rigors of extensive travel and exploration.

This segment values versatility in their apparel and equipment, looking for items that can perform well across a range of environments, from urban exploration to rugged outdoor pursuits. Their purchasing decisions are often driven by the need for gear that simplifies packing and maximizes utility during their journeys. For instance, many in this segment will invest in quick-drying fabrics and multi-functional garments to reduce the amount of gear they need to carry.

- Extensive Travel Needs: Individuals who frequently travel and require gear that can handle varied climates and activities.

- Versatility and Durability: Customers prioritizing clothing and equipment that is adaptable and long-lasting for diverse travel demands.

- Comfort and Functionality: A focus on apparel and gear that offers both comfort for long journeys and practical features for different environments.

- Brand Loyalty: This segment often shows strong loyalty to brands like Royal Robbins that consistently deliver on quality and performance for adventurers.

Wholesale Partners and Retailers

Wholesale partners and retailers are crucial to Fenix Outdoor's distribution strategy. These businesses, ranging from independent outdoor specialty stores to larger retail chains, acquire Fenix Outdoor's brands for resale. For instance, in 2024, Fenix Outdoor continued to strengthen its relationships with key European outdoor retailers, a segment that represents a significant portion of their wholesale revenue.

These B2B customers are attracted to Fenix Outdoor's portfolio of strong, recognizable brands, such as Fjällräven and Hanwag. Their purchasing decisions are influenced by factors like product quality, reliable stock availability, and the marketing support provided by Fenix Outdoor. The financial health and inventory management of these retail partners directly influence the volume and consistency of Fenix Outdoor's wholesale sales.

- Key Customer Type: Businesses reselling Fenix Outdoor brands.

- Value Proposition: Strong brand recognition, reliable supply, marketing support.

- Impact on Fenix Outdoor: Direct influence on wholesale revenue and inventory turnover.

- 2024 Focus: Continued strengthening of relationships with major European outdoor retailers.

Fenix Outdoor serves a diverse customer base, including dedicated outdoor enthusiasts who prioritize high-performance, durable gear for activities like hiking and camping. This segment, valuing longevity and functionality, contributed to the global outdoor apparel market's estimated USD 48.5 billion valuation in 2023.

Environmentally conscious consumers are also key, seeking brands with strong sustainability commitments and ethical sourcing. Fenix Outdoor's reported 85% sustainable materials in 2023 resonated well with this group.

Additionally, travelers and adventurers, particularly those drawn to brands like Royal Robbins, seek versatile, comfortable, and reliable gear for varied climates and exploration needs.

Wholesale partners, including specialty stores and larger retailers, form another vital segment. These B2B customers rely on Fenix Outdoor's strong brand portfolio, product quality, and consistent supply, with European retailers being a significant focus in 2024.

Cost Structure

Fenix Outdoor's manufacturing and production costs are significantly influenced by the sourcing of raw materials, labor, and the operation of its production facilities. These expenses include the procurement of sustainable materials, a key focus for the company, and rigorous quality control measures to ensure product durability. For instance, in 2023, the company continued to invest in its supply chain to support its sustainability goals, which can lead to higher upfront material costs but aligns with consumer demand for eco-friendly products.

Fenix Outdoor's marketing and sales expenses are substantial, reflecting significant investments in brand building and advertising across its portfolio. These costs encompass extensive digital marketing initiatives, global sales force operations, and promotional activities for individual brands like Fjällräven and Hanwag. For example, in 2023, the company reported marketing and sales expenses of SEK 1,219 million, a notable increase from SEK 1,006 million in 2022, underscoring their commitment to driving demand even in dynamic market conditions.

Fenix Outdoor invests significantly in Research and Development to drive product innovation and maintain its leadership in the outdoor gear market. These costs cover exploring new material science, such as advanced waterproof and breathable fabrics, and developing cutting-edge technologies to improve product performance and durability. For instance, in 2023, Fenix Outdoor Group's R&D expenses were approximately SEK 120 million (around $11.5 million USD), reflecting a commitment to staying ahead of industry trends and customer expectations.

Logistics and Distribution Costs

Fenix Outdoor's cost structure heavily features logistics and distribution, encompassing warehousing, transportation, inventory management, and international customs duties. These expenses are substantial, as efficient global distribution is paramount to their business model, yet they represent a significant investment. The company actively seeks to optimize its supply chain to mitigate these costs.

For instance, in 2024, Fenix Outdoor reported that its cost of goods sold, which includes many of these direct logistics expenses, was a significant portion of their revenue. While specific figures for distribution alone are often embedded, the overall efficiency of their operations directly impacts profitability. They focus on streamlining processes to reduce the impact of these necessary expenditures.

- Warehousing: Costs associated with storing goods in strategically located facilities.

- Transportation: Expenses for moving products from manufacturers to distribution centers and finally to customers, including freight and fuel.

- Inventory Management: Costs related to holding and managing stock, including potential obsolescence and carrying costs.

- Customs Duties and Tariffs: Fees incurred for importing and exporting goods across international borders, impacting global reach.

Retail Operations and Personnel Costs

Fenix Outdoor's retail operations incur significant costs, primarily from its owned stores. These include expenses like rent for prime retail locations, utilities to keep stores running, and salaries for store staff who directly interact with customers. Maintenance and upkeep of these physical spaces also add to the operational burden.

Beyond the storefronts, general administrative expenses and salaries for corporate employees are substantial. These costs cover essential functions like management, marketing, finance, and human resources, which are crucial for the overall business strategy and execution.

In 2023, Fenix Outdoor implemented cost-saving measures that are expected to show their impact in 2024. These actions were designed to streamline operations and improve efficiency across the board.

- Operating Costs: Rent, utilities, and maintenance for owned retail stores.

- Personnel Costs: Salaries for retail staff and corporate employees.

- Administrative Expenses: General overhead for business management.

- Cost Optimization: Initiatives in 2023 aimed at reducing expenses in 2024.

Fenix Outdoor's cost structure is diverse, encompassing manufacturing, marketing, R&D, logistics, retail operations, and administrative overhead. The company's commitment to sustainability and product innovation drives significant investment in raw materials and research, while its global reach necessitates robust logistics and distribution networks. In 2023, marketing and sales expenses reached SEK 1,219 million, and R&D was approximately SEK 120 million, demonstrating key areas of expenditure aimed at growth and market positioning.

| Cost Category | 2023 Data (SEK millions) | Key Components |

|---|---|---|

| Marketing & Sales | 1,219 | Advertising, Digital Marketing, Sales Force |

| Research & Development | ~120 | New Materials, Product Innovation |

| Manufacturing & Production | (Included in Cost of Goods Sold) | Raw Materials, Labor, Facility Operations |

| Logistics & Distribution | (Embedded in Cost of Goods Sold) | Warehousing, Transportation, Inventory Management |

| Retail Operations & Admin | (Various) | Rent, Utilities, Staff Salaries, Corporate Overhead |

Revenue Streams

Wholesale sales form a cornerstone of Fenix Outdoor's business model, generating revenue by supplying outdoor equipment and apparel to a broad network of independent retailers, major department stores, and other wholesale partners worldwide. This channel is crucial for reaching a wider customer base and establishing brand presence across diverse markets.

In 2024, Fenix Outdoor continued to leverage its wholesale relationships to drive sales. For instance, the company's strong performance in the wholesale segment is often reflected in its overall financial reports, where sales to distributors and retailers represent a substantial percentage of total revenue, underscoring its importance in the company's global distribution strategy.

Fenix Outdoor generates revenue directly from shoppers through its owned retail chains and brand-specific stores. This direct-to-consumer (DTC) approach allows for better control over the customer experience and typically leads to higher profit margins compared to wholesale. In 2024, the company continued to invest in and expand its store concepts, recognizing the strategic importance of these physical touchpoints for brand building and sales.

Direct-to-consumer (DTC) sales via Fenix Outdoor's e-commerce platforms, including brand websites, are a key revenue stream. This channel provides customers with direct access and convenience, supplementing their physical retail presence.

Globally, digital sales channels experienced a slowdown in 2024, underperforming compared to the resilience shown by brick-and-mortar stores. This trend impacted Fenix Outdoor's e-commerce performance, necessitating a strategic focus on optimizing online customer experience and digital marketing efforts to drive growth in this segment.

Brand Acquisitions and Strategic Investments

Fenix Outdoor leverages brand acquisitions as a strategic growth driver, expanding its portfolio and market reach. While not a direct recurring revenue stream, these acquisitions, such as the purchase of Devold of Norway AS, are designed to fuel future revenue by integrating new brands and customer bases into the group. This strategy broadens the overall product offering and enhances market penetration.

The impact of such strategic investments is evident in the group's consolidated performance. For instance, in 2024, Fenix Outdoor continued to assess and pursue opportunities that align with its long-term vision for brand development and market expansion. The integration of acquired brands often leads to synergies in operations, marketing, and distribution, ultimately contributing to increased sales and profitability across the group.

- Brand Portfolio Expansion: Acquisitions broaden the range of products and services offered, attracting a wider customer demographic.

- Market Share Growth: Integrating new brands increases the company's overall presence and competitive standing in the outdoor industry.

- Synergistic Opportunities: Acquired brands can benefit from Fenix Outdoor's existing infrastructure, leading to operational efficiencies and cost savings.

- Future Revenue Generation: While not immediate recurring income, acquisitions lay the groundwork for sustained revenue growth through expanded market access and product diversification.

Licensing and Other Services (Potential)

While Fenix Outdoor's primary revenue comes from product sales, the company could explore licensing its brand or proprietary technologies. This could include agreements with other companies to use the Fenix Outdoor name on specific products or to leverage their expertise in areas like sustainable materials or outdoor gear design. Such ventures, though likely minor compared to core sales, offer diversification.

Additionally, Fenix Outdoor might offer specialized consulting or training services. This could tap into their deep knowledge of the outdoor industry, providing valuable insights to other businesses or individuals. Think of workshops on sustainable business practices in the apparel sector or technical training on outdoor equipment development.

- Licensing Opportunities: Potential to license brand IP or technology for niche markets.

- Specialized Services: Offering expertise in outdoor industry best practices or product development.

- Minor Revenue Streams: These are considered supplementary to the core retail and e-commerce operations.

Fenix Outdoor's revenue streams are multifaceted, encompassing both traditional wholesale and direct-to-consumer (DTC) channels. The company also strategically grows through brand acquisitions, which contribute to future revenue potential by expanding its market reach and product offerings.

In 2024, Fenix Outdoor observed a notable trend where physical retail channels, including their own stores, demonstrated greater resilience compared to online sales, which experienced a general slowdown. This highlights the continued importance of brick-and-mortar presence for the company's revenue generation.

The company's diverse portfolio of brands, such as Fjällräven and Hanwag, are key drivers across these revenue streams. For instance, the wholesale channel remains significant, supplying products to a vast network of independent retailers and department stores globally, ensuring broad market penetration.

Direct sales through owned retail stores and brand-specific e-commerce platforms are also critical. This DTC approach allows Fenix Outdoor to capture higher margins and directly engage with its customer base, fostering brand loyalty and providing a controlled customer experience.

| Revenue Stream | Primary Channels | 2024 Trend/Observation |

|---|---|---|

| Wholesale Sales | Independent retailers, department stores, distributors | Continued strong performance, crucial for global reach |

| Direct-to-Consumer (DTC) - Retail | Owned retail chains, brand-specific stores | Resilient performance, investment in store concepts ongoing |

| Direct-to-Consumer (DTC) - E-commerce | Brand websites, online platforms | Experienced a slowdown globally, focus on optimization needed |

| Brand Acquisitions | Integration of acquired brands (e.g., Devold of Norway AS) | Strategic growth driver for future revenue potential |

Business Model Canvas Data Sources

The Fenix Outdoor Business Model Canvas is informed by a blend of internal financial reports, customer feedback mechanisms, and extensive market research. These sources provide a comprehensive view of customer needs, operational costs, and competitive landscapes.