Fenix Outdoor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fenix Outdoor Bundle

Fenix Outdoor faces intense rivalry, with established brands and emerging players vying for market share in the outdoor and apparel sector. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this competitive landscape.

The threat of new entrants and the availability of substitutes significantly shape Fenix Outdoor's strategic options. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Fenix Outdoor’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Fenix Outdoor's reliance on specialized raw materials and components for its premium outdoor gear often means dealing with a concentrated supplier base. This is particularly true for unique or high-performance inputs that are not easily sourced elsewhere. For instance, in 2024, many outdoor apparel brands faced challenges securing advanced waterproof-breathable fabrics due to limited production capacity among key textile manufacturers.

When a few suppliers dominate the market for essential inputs, their bargaining power significantly increases. This is because Fenix Outdoor, and others in the industry, may have few alternatives if these specialized suppliers decide to raise prices or alter terms. The difficulty in finding substitutes for these unique materials directly translates to greater leverage for the suppliers.

The bargaining power of suppliers for Fenix Outdoor is significantly influenced by switching costs. For instance, if Fenix Outdoor relies on a specific type of high-performance fabric or a unique manufacturing technique, the expenses involved in finding, vetting, and integrating a new supplier can be substantial. These costs can include re-tooling production lines, implementing rigorous new quality control measures, and establishing entirely new working relationships.

While not a dominant force, the theoretical possibility of key suppliers integrating forward to produce their own finished outdoor goods, such as branded apparel or equipment, represents a latent source of bargaining power. This could potentially shift value creation towards the supplier, impacting Fenix Outdoor's margins and market position.

Impact of Supply Chain Disruptions

Recent global events, including ongoing geopolitical tensions in the Middle East, have significantly impacted supply chains. For Fenix Outdoor, this translates into tangible delays and a rise in operational costs. For instance, shipping costs from Asia to Europe saw a notable increase in early 2024, with some routes experiencing surcharges of up to 30% due to rerouting around conflict zones.

These disruptions directly bolster the bargaining power of Fenix Outdoor's suppliers. With constrained availability of raw materials and components, coupled with escalating logistical expenses, suppliers are in a stronger position to dictate terms and pricing. This squeeze on Fenix Outdoor's supply chain can directly affect its profit margins, especially if the company cannot pass these increased costs onto consumers.

- Increased Shipping Costs: Freight rates on key routes experienced a surge in Q1 2024, impacting companies like Fenix Outdoor.

- Material Shortages: Certain specialized fabrics and components faced limited availability, giving suppliers leverage.

- Extended Lead Times: Production and delivery schedules were extended, forcing Fenix Outdoor to hold more inventory or face stockouts.

- Supplier Pricing Power: Suppliers capitalized on these conditions, leading to price adjustments that affected Fenix Outdoor's cost of goods sold.

Sustainability and Ethical Sourcing Requirements

Fenix Outdoor's dedication to sustainability and its rigorous Code of Conduct for suppliers significantly influences the bargaining power of its suppliers. By mandating strict environmental and social standards, Fenix narrows its supplier base to those capable of meeting these requirements.

This focus on ethical sourcing, while enhancing Fenix's brand reputation and appealing to environmentally conscious consumers, can inadvertently strengthen the negotiating position of compliant suppliers. These suppliers, often fewer in number, are aware of their unique value proposition to Fenix, potentially allowing them to command better terms.

- Supplier Compliance Costs: Suppliers must invest in sustainable practices and ethical labor, which can increase their operational costs.

- Limited Supplier Pool: Fenix's stringent requirements reduce the number of eligible suppliers, giving those who qualify more leverage.

- Brand Value Association: Suppliers aligned with Fenix's sustainability goals benefit from the association, increasing their desirability and bargaining power.

- Market Trends: Growing consumer demand for sustainable products empowers suppliers who can demonstrably meet these criteria.

Fenix Outdoor's suppliers hold considerable bargaining power due to the specialized nature of materials and the limited number of high-quality providers. In 2024, disruptions like increased shipping costs, up to 30% on some routes in early 2024, and shortages of advanced fabrics further amplified this leverage. Fenix's commitment to sustainability also narrows its supplier pool, empowering compliant providers.

| Factor | Impact on Fenix Outdoor | Supplier Leverage |

|---|---|---|

| Specialized Materials | Reliance on unique inputs | High |

| Supplier Concentration | Few dominant suppliers | High |

| Switching Costs | High for new suppliers | High |

| Global Disruptions (2024) | Increased shipping costs (up to 30%), material shortages | Elevated |

| Sustainability Standards | Limited eligible suppliers | Elevated for compliant suppliers |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Fenix Outdoor's position in the outdoor apparel and equipment industry.

Instantly identify and address competitive threats by visualizing the intensity of each Porter's Five Forces, enabling proactive strategies for Fenix Outdoor.

Customers Bargaining Power

Fenix Outdoor's customer base is diverse, encompassing both wholesale partners and direct-to-consumer sales through its own retail stores and e-commerce platforms. This dual approach means the company must manage relationships with different customer segments, each with varying levels of bargaining power.

Large wholesale retailers, such as major sporting goods chains, represent a significant portion of Fenix Outdoor's sales volume. Their substantial purchasing power allows them to negotiate favorable terms, including pricing, payment schedules, and promotional support, directly impacting Fenix Outdoor's margins and operational flexibility.

For instance, in 2023, Fenix Outdoor's wholesale segment generated a substantial portion of its revenue, highlighting the importance of these relationships. The ability of these large buyers to switch suppliers or consolidate their purchasing makes them a considerable force in pricing negotiations.

Consumers are showing increased price sensitivity, a trend amplified by general market inflation and economic uncertainty, impacting purchasing decisions even for premium brands like those in Fenix Outdoor's portfolio. For instance, in early 2024, reports indicated a noticeable shift in consumer spending habits, with a greater emphasis placed on value and promotional offers across the outdoor and apparel sectors.

The sheer variety of outdoor products available means customers can readily compare prices and features across numerous brands, thereby strengthening their bargaining power. This ease of comparison, facilitated by online platforms and readily accessible product information, allows consumers to find alternatives that offer similar quality at a lower cost, putting pressure on Fenix Outdoor to remain competitive on price.

For the typical end consumer, the decision to switch between outdoor gear brands is often a low-stakes affair. With a plethora of options available from numerous retailers, both brick-and-mortar and online, the effort and expense involved in trying a new brand are minimal. This readily available substitution directly fuels customer bargaining power.

This ease of switching means Fenix Outdoor must constantly strive to differentiate its offerings and foster strong brand loyalty. For instance, in 2024, the global outdoor apparel market was valued at approximately $15 billion, showcasing a highly competitive landscape where consumer choice is paramount. Brands that fail to offer compelling value, innovation, or a strong connection with their customers risk losing market share to competitors.

Information Availability and Online Channels

The rise of e-commerce and digital platforms has significantly boosted information availability for consumers. This allows them to easily compare products, read reviews, and check prices across various retailers, including those selling outdoor gear. For Fenix Outdoor, this means customers can readily assess the value proposition of its offerings against competitors.

This transparency directly impacts customer bargaining power. Armed with detailed product knowledge and price comparisons, consumers are more likely to negotiate for better deals or switch to alternatives that offer superior value. In 2023, global e-commerce sales reached approximately $6.3 trillion, highlighting the immense reach and influence of online channels in shaping consumer behavior and expectations.

- Increased Price Transparency: Online comparison tools and readily available pricing data empower customers to identify the best deals, putting pressure on brands like Fenix Outdoor to remain competitive.

- Access to Reviews and Ratings: Customer reviews and ratings on e-commerce sites and independent platforms offer insights into product quality and brand reputation, influencing purchasing decisions.

- Digital Sales Performance Impact: Fenix Outdoor's digital sales performance is directly tied to its ability to offer competitive pricing and a compelling value proposition in an environment where information is easily accessible.

Shifting Consumer Preferences and Lifestyle Trends

Customers are increasingly prioritizing versatility, sustainability, and alternative consumption models. The demand for athleisure wear, which blends active and casual styles, is a prime example of this shift. For instance, the global athleisure market was valued at approximately $334 billion in 2023 and is projected to grow significantly in the coming years.

The burgeoning secondhand and rental markets further amplify customer bargaining power. These options provide consumers with access to products at lower price points and cater to a desire for more sustainable consumption. By 2027, the global secondhand apparel market is expected to reach $350 billion, demonstrating a clear trend away from solely new purchases.

This expanding array of choices, from multi-functional apparel to pre-owned goods, empowers customers. They can now easily opt for alternatives that better align with their evolving preferences and values, thereby increasing their leverage when making purchasing decisions.

- Growing Athleisure Demand: Global athleisure market valued around $334 billion in 2023, indicating a strong customer preference for versatile clothing.

- Rise of Secondhand Market: The secondhand apparel market is projected to hit $350 billion by 2027, showcasing a significant shift towards alternative consumption.

- Increased Consumer Options: Customers have more choices than ever, from sustainable materials to rental services, enhancing their bargaining power.

- Impact on Traditional Retail: These evolving preferences challenge traditional retail models, forcing companies to adapt to new consumer behaviors and demands.

Fenix Outdoor faces considerable customer bargaining power due to the highly competitive outdoor apparel market, where product availability and price transparency are high. Consumers can easily compare offerings, influencing Fenix Outdoor's pricing strategies and margin potential.

The increasing consumer focus on value, sustainability, and alternative consumption models like the secondhand market further amplifies their leverage. For instance, the global athleisure market reached approximately $334 billion in 2023, and the secondhand apparel market is projected to grow substantially, offering consumers more budget-friendly and eco-conscious options.

This environment necessitates that Fenix Outdoor continuously innovate and deliver strong value propositions to retain customer loyalty and mitigate the pressure from readily available alternatives.

| Factor | Impact on Fenix Outdoor | Supporting Data (2023/2024 Estimates) |

|---|---|---|

| Price Sensitivity | Increased pressure on pricing and margins | General market inflation and economic uncertainty driving consumer focus on value. |

| Product Availability | Customers can easily switch to competitors | Global outdoor apparel market valued at approximately $15 billion, indicating a crowded space. |

| Information Transparency | Empowers customers to negotiate and compare | Global e-commerce sales reached approximately $6.3 trillion in 2023, facilitating easy comparison. |

| Alternative Consumption | Diversifies customer options beyond new purchases | Athleisure market valued at $334 billion (2023); secondhand apparel market projected to reach $350 billion by 2027. |

What You See Is What You Get

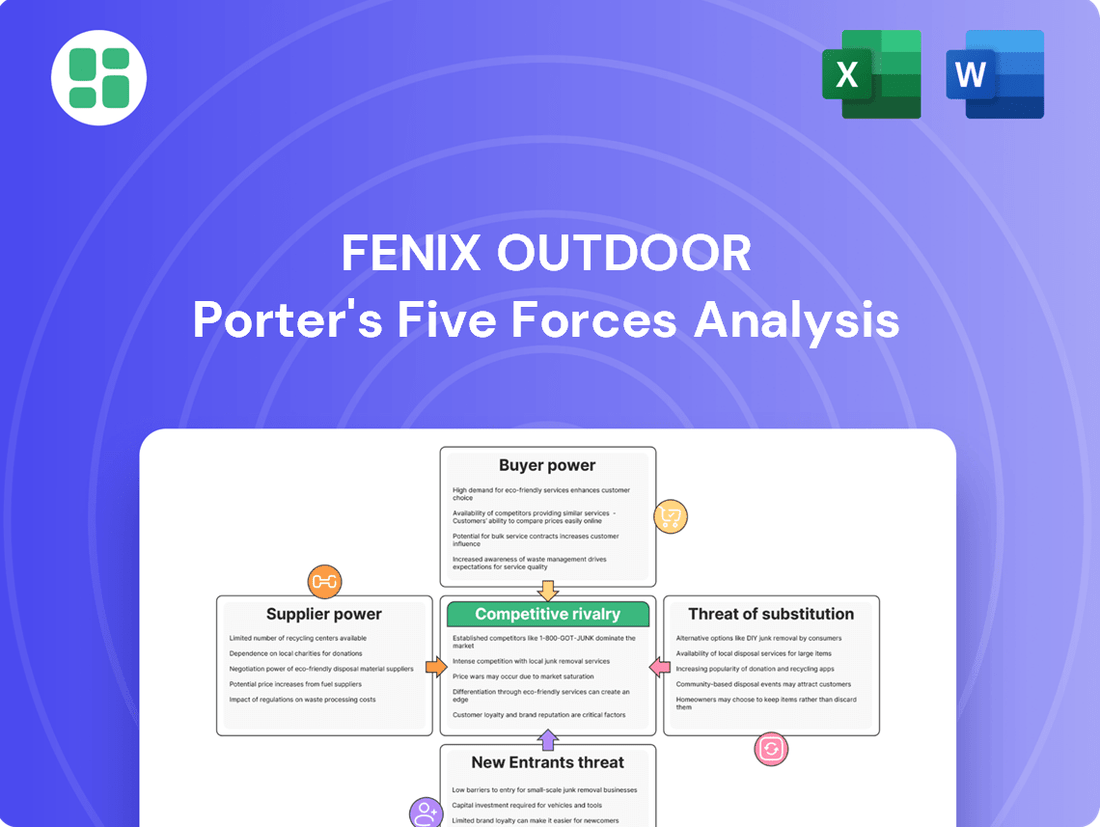

Fenix Outdoor Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Fenix Outdoor Porter's Five Forces Analysis details the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the outdoor recreation industry. This in-depth analysis provides actionable insights for strategic decision-making.

Rivalry Among Competitors

The outdoor gear and apparel sector is a crowded arena, brimming with both global powerhouses and specialized niche brands vying for consumer attention and market share. This intense competition directly impacts Fenix Outdoor's strategic positioning and profitability.

Fenix Outdoor contends with formidable established players such as Columbia Sportswear, which reported net sales of $3.5 billion in 2023, and VF Corporation (owner of The North Face and Patagonia), which generated $10.5 billion in revenue in the fiscal year ending January 2024. These giants possess significant brand recognition, extensive distribution networks, and substantial marketing budgets.

Beyond the major players, a dynamic landscape of emerging brands and direct-to-consumer (DTC) companies continually enters the market, offering innovative products and targeting specific customer segments. This constant influx of new competitors necessitates continuous adaptation and differentiation for Fenix Outdoor to maintain its competitive edge.

The global outdoor market is expected to see continued growth, though certain segments are reaching maturity. In 2024, retail sales experienced a modest rebound, indicating a more stable, rather than booming, market environment. This slower expansion fuels more intense competition as businesses vie for market share in a market that isn't growing as rapidly as it once was.

Fenix Outdoor leans heavily on its established brands, particularly Fjällräven, to stand out. They focus on quality, durability, and a classic aesthetic that fosters strong customer loyalty. This differentiation is key in a market where consumers often seek specific brand experiences.

However, the competitive landscape is intense. Competitors are also pouring resources into new product development and sophisticated branding campaigns. This means Fenix Outdoor must constantly innovate and reinforce its brand message to keep its distinctiveness and maintain the loyalty of its customer base.

High Exit Barriers

High exit barriers in the outdoor industry, driven by substantial investments in significant fixed assets and specialized manufacturing capabilities, mean that companies facing difficulties often remain in the market. This persistence, coupled with established distribution networks, can lead to prolonged competitive pressure and potential oversupply. For instance, a company heavily invested in proprietary fabric technology or specialized equipment for producing high-performance gear will find it exceedingly difficult and costly to divest these assets, forcing them to continue operations even when unprofitable.

These elevated exit barriers contribute to a landscape where even struggling players are compelled to stay active, intensifying rivalry. This situation can particularly affect market dynamics by keeping capacity levels high, potentially leading to price wars or a more aggressive pursuit of market share among all participants. In 2024, the outdoor apparel sector, for example, saw several brands continue to operate despite declining sales, a testament to the difficulty in exiting specialized production lines.

- Significant Fixed Assets: Companies often have substantial investments in factories, specialized machinery, and retail infrastructure.

- Specialized Manufacturing Capabilities: Unique production processes or proprietary technologies can be difficult to repurpose or sell.

- Established Distribution Networks: Long-term relationships with retailers and distributors are hard to replicate or abandon.

- Consequences: Competitors are less likely to exit, leading to sustained pressure and potential oversupply.

Strategic Acquisitions and Market Consolidation

Fenix Outdoor's acquisition of Devold of Norway in March 2025 highlights a key aspect of competitive rivalry: strategic consolidation. This move, aimed at bolstering Fenix's portfolio and securing a stronger position in specialized markets like wool apparel, exemplifies how larger companies actively seek to expand their reach and capabilities.

These types of strategic acquisitions by industry leaders inevitably intensify the competitive landscape. As companies merge and integrate, they often gain greater market share, enhanced product offerings, and improved operational efficiencies, thereby placing increased pressure on smaller or less consolidated rivals.

- Strategic Acquisitions: Fenix Outdoor's purchase of Devold of Norway in March 2025 is a prime example, enhancing its presence in the premium wool clothing segment.

- Market Consolidation: Such deals reduce the number of independent players, concentrating market power and potentially leading to fewer, larger competitors.

- Intensified Rivalry: Companies that successfully consolidate often gain economies of scale and broader market access, forcing remaining competitors to innovate or face reduced market share.

Competitive rivalry within the outdoor sector is fierce, characterized by established giants like Columbia Sportswear, which reported $3.5 billion in net sales in 2023, and VF Corporation, achieving $10.5 billion in revenue for fiscal year 2024. These major players leverage significant brand equity and extensive distribution, intensifying the pressure on Fenix Outdoor.

The market is further complicated by a constant influx of agile direct-to-consumer brands and niche players, forcing Fenix to continually innovate and differentiate its offerings, such as the distinct brand identity of Fjällräven. This dynamic environment means Fenix must actively reinforce its brand messaging to maintain customer loyalty amidst aggressive marketing from competitors.

High exit barriers, stemming from substantial investments in specialized manufacturing and established distribution networks, mean competitors are less likely to leave the market, even when facing financial difficulties. This persistence contributes to sustained competitive pressure and a potential for oversupply, as seen in 2024 where some outdoor brands continued operations despite declining sales.

Strategic consolidation, exemplified by Fenix Outdoor's March 2025 acquisition of Devold of Norway, further shapes the competitive landscape. Such moves consolidate market power, enhance product portfolios, and increase operational efficiencies, placing greater pressure on remaining independent competitors to adapt or risk market share erosion.

| Competitor | 2023/2024 Revenue | Key Brands |

| Columbia Sportswear | $3.5 billion (2023) | Columbia, SOREL, Mountain Hardwear |

| VF Corporation | $10.5 billion (FY ending Jan 2024) | The North Face, Patagonia, Timberland |

| Fenix Outdoor | €438 million (2023) | Fjällräven, Hanwag, Primus |

SSubstitutes Threaten

Generic apparel and equipment present a significant threat to Fenix Outdoor. For many everyday outdoor pursuits, consumers can easily find affordable, non-specialized alternatives. These readily available items often fulfill basic needs at a fraction of the cost of Fenix's premium, performance-oriented gear.

For instance, while Fenix Outdoor's brands like Fjällräven target discerning customers seeking durable, functional, and stylish outdoor wear, a consumer looking for a simple jacket for a weekend hike might easily choose a generic option from a mass-market retailer. This accessibility and lower price point make these substitutes highly appealing, especially for less demanding activities.

The rise of rental and secondhand markets presents a substantial threat to Fenix Outdoor. Consumers increasingly opt for renting gear for specific trips or buying pre-owned items, driven by both environmental consciousness and budget considerations. This directly diminishes the demand for new Fenix Outdoor products.

For instance, the global secondhand apparel market is projected to reach $350 billion by 2027, indicating a significant shift in consumer behavior. This growing segment offers a compelling alternative for outdoor enthusiasts who may find new equipment prohibitively expensive or unnecessary for infrequent use.

The growing trend of multi-functional and athleisure wear presents a significant threat of substitutes for Fenix Outdoor. Consumers increasingly favor versatile clothing that transitions seamlessly from outdoor activities to everyday casual wear. This blurring of lines means general athletic apparel brands can effectively substitute for specialized outdoor gear, potentially diverting sales from Fenix Outdoor's core offerings.

Alternative Leisure Activities

Consumers have a vast array of leisure and fitness alternatives that bypass the need for specialized outdoor equipment. Think about indoor sports, gym memberships, or simply enjoying urban recreation. These readily available options present a significant threat.

A notable trend is the increasing popularity of home-based fitness and digital entertainment platforms. For example, the global online fitness market was valued at approximately $14.2 billion in 2023 and is projected to grow significantly, indicating a strong preference for convenient, accessible alternatives to traditional outdoor pursuits.

- Rising popularity of home-based fitness: Increased investment in home gym equipment and digital fitness subscriptions offers a direct substitute for outdoor activities.

- Growth of urban and indoor recreation: Cities are increasingly offering diverse indoor entertainment and fitness centers, catering to a broad range of interests.

- Digital entertainment shift: Streaming services and online gaming provide compelling, low-cost alternatives for leisure time, diverting consumer spending and attention from outdoor gear.

DIY Solutions or Lower-Cost Alternatives

For basic outdoor needs, consumers may opt for do-it-yourself solutions or very low-cost alternatives. For instance, a significant portion of the outdoor gear market, particularly in less extreme activities, can be served by mass-market retailers offering products at substantially lower price points. While these lack the performance and durability of specialized brands, they can capture budget-conscious consumers. In 2024, the growth of private label brands in sporting goods, often positioned as value alternatives, continued to put pressure on premium offerings in segments like casual hiking apparel.

These cheaper options can act as substitutes, especially for individuals new to outdoor activities or those with limited budgets. This trend is exacerbated by the increasing availability of affordable, yet functional, gear from non-specialty retailers. For example, reports from late 2023 indicated that discount retailers saw a notable uptick in sales of outdoor-related items, suggesting a diversion of consumer spending from premium brands for less demanding use cases.

- DIY Solutions: Consumers might repurpose existing items or create their own basic gear, bypassing the need to purchase specialized products.

- Mass-Market Retailers: Availability of significantly cheaper, though less durable, alternatives from general retailers can satisfy basic outdoor needs.

- Budget-Conscious Segments: Price-sensitive consumers are more likely to choose these lower-cost substitutes over premium, specialized outdoor equipment.

- Market Trends: The rise of private label brands and increased sales in discount retail channels for outdoor goods highlight the impact of these substitutes in 2024.

The threat of substitutes for Fenix Outdoor is significant, stemming from readily available, lower-cost alternatives across various consumer needs. Generic apparel and equipment, rental services, secondhand markets, and multi-functional athleisure wear all present viable options that can divert customers from Fenix's premium offerings.

For instance, while Fenix brands like Fjällräven cater to a specific market, a consumer seeking basic outdoor wear can easily find affordable substitutes from mass-market retailers. The secondhand apparel market, projected to reach $350 billion by 2027, further illustrates this shift, with budget and environmental concerns driving consumers towards pre-owned gear.

Moreover, the rise of home-based fitness and digital entertainment, with the online fitness market valued at approximately $14.2 billion in 2023, offers compelling alternatives to traditional outdoor activities, directly impacting demand for specialized equipment.

| Threat Type | Description | Impact on Fenix Outdoor | Supporting Data/Trend |

| Generic Apparel/Equipment | Affordable, non-specialized alternatives for basic outdoor needs. | Captures budget-conscious consumers, reducing demand for premium products. | Growth of private label brands in sporting goods in 2024. |

| Rental & Secondhand Markets | Gear rental for specific trips and purchasing pre-owned items. | Diminishes demand for new product sales, driven by cost and environmental factors. | Secondhand apparel market projected to reach $350 billion by 2027. |

| Athleisure & Multi-functional Wear | Versatile clothing suitable for both outdoor and everyday casual use. | Blurs lines between specialized and general apparel, allowing athleisure brands to substitute. | Increasing consumer preference for versatile clothing. |

| Alternative Leisure Activities | Indoor sports, gym memberships, home fitness, digital entertainment. | Diverts consumer time, attention, and spending away from outdoor pursuits. | Online fitness market valued at ~$14.2 billion in 2023. |

Entrants Threaten

The outdoor apparel and equipment industry presents a significant threat of new entrants due to high capital requirements. Establishing a new brand or manufacturing operation demands substantial investment in design, product development, sourcing, and building a robust supply chain. For instance, launching a new line of technical outdoor gear can easily require millions of dollars in initial setup and inventory, a considerable hurdle for aspiring competitors.

Furthermore, creating and maintaining a competitive inventory across various product categories, from tents to specialized clothing, necessitates significant upfront capital. Newcomers must also invest heavily in marketing and brand building to gain visibility against established players like Fenix Outdoor, which already possess strong brand recognition and customer loyalty. In 2024, the average cost to establish a new e-commerce brand in the apparel sector, even without physical retail, often exceeds $500,000, highlighting the financial barrier.

Fenix Outdoor benefits from a strong foundation of well-established brands like Fjällräven and Hanwag. These brands have spent decades building deep trust and loyalty with consumers, making it difficult for newcomers to gain traction.

The outdoor gear market is already quite crowded, and for any new entrant to compete, they must overcome the significant hurdle of establishing a comparable level of brand recognition and consumer confidence. This requires substantial investment in marketing and product development.

For instance, Fjällräven reported a revenue of SEK 7.1 billion in 2023, showcasing the scale and market penetration its established brand enjoys. This financial strength allows Fenix Outdoor to reinvest in brand building and innovation, further solidifying its competitive position against potential new entrants.

Fenix Outdoor benefits from a robust and well-established distribution network, encompassing both extensive wholesale partnerships and its own direct-to-consumer channels. As of the end of 2023, the company operated 106 retail stores and a significant e-commerce presence, providing broad market reach.

New competitors face a substantial barrier in replicating Fenix Outdoor's established distribution infrastructure. Building similar wholesale relationships and physical retail footprints is time-consuming and capital-intensive, making it difficult for new entrants to achieve comparable market penetration and customer access.

Economies of Scale in Production and Sourcing

Existing giants in the outdoor recreation sector, such as Fenix Outdoor, leverage substantial economies of scale. This advantage extends across their entire operation, from negotiating better prices for raw materials and components due to high-volume purchasing to achieving greater efficiency in manufacturing processes and optimizing logistics for distribution. For instance, in 2023, Fenix Outdoor reported net sales of SEK 9,744 million (approximately $900 million USD), indicating a significant operational footprint that allows for cost absorption not available to newcomers.

New entrants into the market face a considerable hurdle in matching these cost efficiencies. Without the established volume of production and established supplier relationships, new companies often pay higher per-unit costs for materials and manufacturing. This initial cost disadvantage can make it difficult for them to compete on price with established players, thereby limiting their ability to gain market share quickly.

- High-volume purchasing power significantly reduces per-unit costs for raw materials and components for established firms.

- Efficient manufacturing processes, honed through years of operation, further lower production expenses for incumbents.

- Optimized logistics networks provide cost savings in warehousing and transportation, a benefit new entrants lack.

- Economies of scale create a substantial price barrier, making it challenging for new companies to enter profitably.

Regulatory Hurdles and Sustainability Standards

The threat of new entrants for Fenix Outdoor is significantly shaped by escalating regulatory demands, particularly concerning sustainability. Legislation like the EU Corporate Sustainability Reporting Directive (CSRD) and the German Supply Chain Due Diligence Act are creating substantial compliance burdens. These regulations necessitate intricate tracking of supply chains and rigorous reporting on environmental, social, and governance (ESG) factors.

New companies entering the outdoor apparel and equipment market must invest heavily in understanding and adhering to these complex rules from day one. This includes establishing robust systems for data collection, verification, and transparent disclosure, which can represent a considerable upfront cost and operational challenge. For instance, the CSRD, applicable to large EU companies and their subsidiaries, requires extensive reporting on a wide range of sustainability topics, impacting the entire value chain.

The financial implications are also noteworthy. Compliance costs can range from significant investments in new software and personnel to potential fines for non-adherence. Estimates suggest that implementing comprehensive sustainability reporting could add several percentage points to operating expenses for businesses, making it a formidable barrier for smaller, less capitalized entrants aiming to compete with established players like Fenix Outdoor.

- Regulatory Complexity: Laws like the EU CSRD and German Supply Chain Act demand detailed ESG reporting and supply chain transparency.

- High Compliance Costs: New entrants face substantial upfront investments in data systems, personnel, and auditing to meet these standards.

- Operational Challenges: Navigating and implementing these stringent requirements from the outset adds significant operational complexity for new businesses.

- Financial Burden: Compliance can increase operating expenses, potentially by several percentage points, acting as a deterrent to market entry.

The threat of new entrants in the outdoor apparel and equipment sector is moderate, primarily due to significant capital requirements for brand building, product development, and establishing distribution networks. Fenix Outdoor, with its established brands like Fjällräven and Hanwag, benefits from strong customer loyalty and market penetration, as evidenced by Fjällräven's 2023 revenue of SEK 7.1 billion.

Economies of scale also present a formidable barrier, with Fenix Outdoor's 2023 net sales of SEK 9,744 million (approximately $900 million USD) allowing for cost efficiencies in purchasing and manufacturing that newcomers struggle to match. Furthermore, increasing regulatory demands around sustainability, such as the EU's CSRD, add substantial compliance costs and operational complexity for potential market entrants.

| Factor | Impact on New Entrants | Fenix Outdoor's Advantage |

| Capital Requirements | High initial investment needed for brand, product, and distribution. | Established infrastructure and brand equity reduce relative entry cost. |

| Brand Loyalty & Recognition | Difficult to build trust against established names. | Decades of brand building (e.g., Fjällräven's SEK 7.1B revenue in 2023) create deep customer loyalty. |

| Economies of Scale | Higher per-unit costs due to lower production volume. | SEK 9,744M (approx. $900M USD) 2023 net sales enable cost efficiencies. |

| Regulatory Compliance (Sustainability) | Significant upfront costs and operational complexity for ESG reporting. | Existing systems and resources better equipped to handle evolving regulations. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fenix Outdoor is built upon a foundation of publicly available information, including the company's annual reports and investor presentations. We also integrate data from reputable industry analysis firms and market research reports to provide a comprehensive understanding of the competitive landscape.