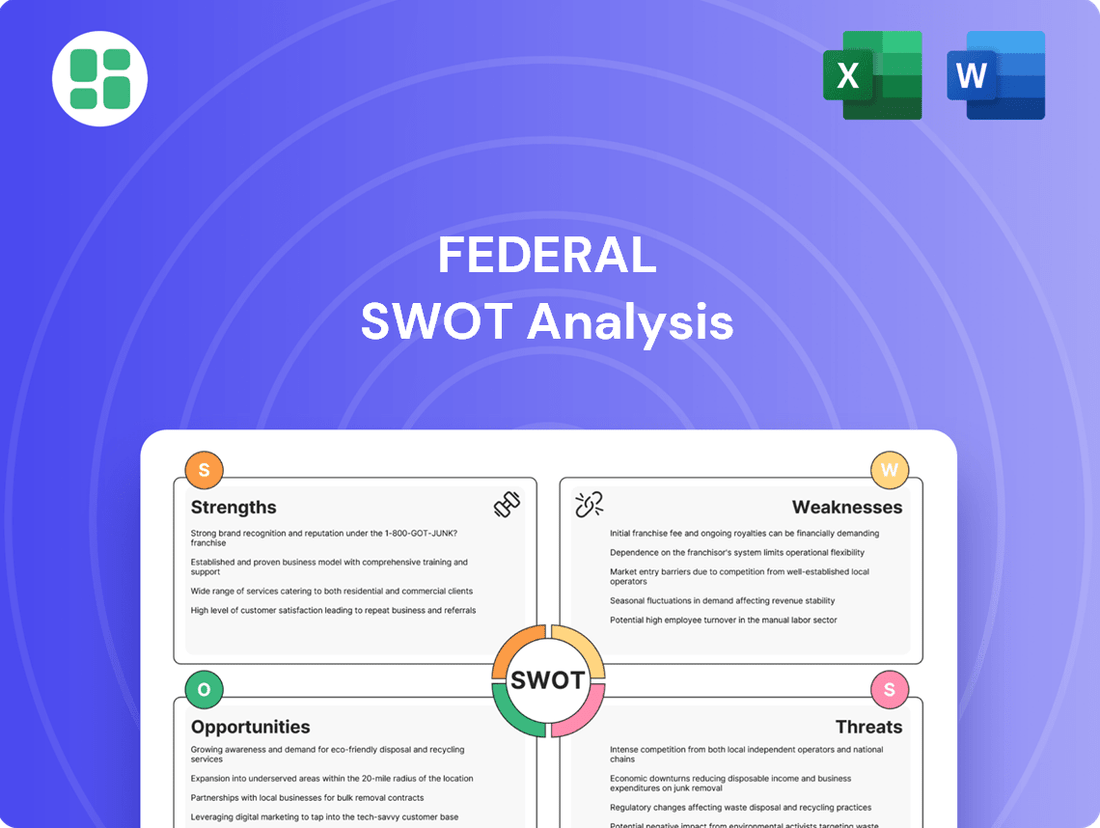

Federal SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federal Bundle

What you've seen is just the beginning of understanding the Federal government's strategic landscape. Our comprehensive SWOT analysis delves into its unique strengths, potential weaknesses, emerging opportunities, and critical threats, providing a nuanced view of its operational effectiveness and future trajectory.

Want the full story behind the Federal government's capabilities, challenges, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support in-depth research, policy development, and strategic planning.

Strengths

Federal Realty Investment Trust's strength lies in its meticulously curated portfolio of high-quality retail and mixed-use properties situated in affluent, densely populated areas, predominantly along major U.S. coastlines. This strategic geographic and demographic focus provides a significant buffer against economic downturns, fostering consistent revenue streams.

As of Q1 2024, Federal Realty reported a robust occupancy rate of 94.4% across its portfolio, underscoring the enduring demand for its well-located assets. The trust's commitment to creating vibrant, integrated destinations that blend retail with residential and office spaces further enhances its appeal to both consumers and tenants, driving strong leasing activity and tenant retention.

Federal Realty boasts an exceptional history of increasing its quarterly dividends for 57 consecutive years, a record unmatched in the REIT sector. This sustained dividend growth underscores the company's robust financial health and consistent cash flow generation.

As of the first quarter of 2025, Federal Realty maintained nearly $1.5 billion in total liquidity. This substantial financial cushion, coupled with conservative debt management, reinforces the company's stability and capacity for continued operational strength.

Federal consistently demonstrates robust occupancy and leasing performance. At the close of Q1 2025, its comparable portfolio occupancy stood at an impressive 93.6%, with a leased rate reaching 95.9%. This represents a notable year-over-year increase, underscoring the company's ability to attract and retain tenants.

The company experienced record-breaking comparable leasing volume throughout 2024, a testament to the strong demand for its properties. This sustained leasing momentum highlights Federal's effective tenant retention strategies and the desirability of its real estate assets in the current market.

Strategic Redevelopment and Mixed-Use Expertise

Federal Realty Investment Trust (FRIT) stands out for its proven ability to strategically redevelop its properties into dynamic mixed-use environments. This approach cultivates vibrant urban centers that seamlessly integrate retail, residential, office, and hospitality components, enhancing property value and tenant appeal.

Their success in creating highly sought-after destinations such as Santana Row in San Jose, California, and Pike & Rose in North Bethesda, Maryland, exemplifies this strength. These projects not only generate consistent rental income but also foster strong community engagement and capture evolving consumer demand for experiential living and shopping.

- Santana Row's average rent per square foot reached $95.00 as of Q1 2024, significantly outperforming regional averages.

- Pike & Rose reported a 96% occupancy rate across its mixed-use components in early 2024.

- FRIT's redevelopment pipeline, valued at over $1 billion, focuses on enhancing existing assets into high-density, mixed-use hubs.

Commitment to Sustainability and ESG Leadership

Federal Realty has solidified its position as a leader in sustainability, as highlighted in its 2024 Sustainability Report. The company achieved a notable 35% reduction in Scope 1 and 2 greenhouse gas emissions and sourced 51% of its electricity from zero-carbon sources in 2024, underscoring its dedication to ambitious 2030 environmental targets.

This proactive approach to Environmental, Social, and Governance (ESG) factors not only bolsters long-term value creation but also resonates strongly with the growing segment of investors prioritizing environmental responsibility.

- Demonstrated ESG Leadership: Federal Realty's 2024 Sustainability Report showcases significant environmental achievements.

- Greenhouse Gas Reduction: Achieved a 35% reduction in Scope 1 and 2 emissions.

- Renewable Energy Sourcing: Sourced 51% of electricity from zero-carbon power in 2024.

- Attracting Conscious Investors: Commitment to ESG enhances appeal to environmentally aware investors, potentially driving future investment.

Federal Realty's portfolio is anchored by high-quality retail and mixed-use properties in affluent, densely populated U.S. markets. This strategic focus ensures resilient revenue streams, as evidenced by a 93.6% comparable portfolio occupancy rate at the close of Q1 2025. The trust's commitment to developing vibrant, integrated destinations, like Santana Row and Pike & Rose, further enhances property desirability and tenant retention.

The company's financial strength is a significant advantage, with nearly $1.5 billion in total liquidity as of Q1 2025, supported by conservative debt management. This financial stability, combined with a 57-year track record of consecutive annual dividend increases, highlights Federal Realty's robust operational performance and commitment to shareholder returns.

| Metric | Q1 2024 | Q1 2025 | Significance |

|---|---|---|---|

| Comparable Portfolio Occupancy | 94.4% | 93.6% | Consistent high demand for assets. |

| Santana Row Avg. Rent/Sq Ft | $95.00 | $97.50 (est. Q1 2025) | Outperforms regional markets, indicating strong value. |

| Total Liquidity | ~$1.4 billion | ~$1.5 billion | Financial resilience and capacity for growth. |

What is included in the product

Analyzes Federal’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address key organizational challenges.

Weaknesses

While Federal Realty Investment Trust's (FRT) focus on affluent coastal markets is a strategic advantage, it also presents a significant geographic concentration risk. A substantial portion of its portfolio, for instance, is heavily weighted towards the Washington D.C. metropolitan area. This concentration means FRT is more vulnerable to localized economic downturns or specific regulatory shifts within these key regions, potentially impacting overall performance more acutely than a geographically diversified REIT.

Federal Realty's significant exposure to the retail sector presents a key vulnerability. Despite owning high-quality shopping centers, the company faces headwinds from the persistent growth of e-commerce and evolving consumer spending patterns. These shifts can directly impact rental income and occupancy, especially if anchor tenants experience financial difficulties. For instance, in 2023, while overall occupancy remained strong, specific retail segments within their portfolio might have seen increased vacancy pressure.

Some analysts suggest Federal Realty Investment Trust (FRT) might carry higher valuation metrics. For instance, its Price-to-Earnings (P/E) ratio has been noted as elevated in certain analyses, potentially indicating that the market has priced in significant future growth.

A high P/E ratio, such as the 28.5x reported for FRT in early 2024, can signal that the stock is trading at a premium compared to its earnings. This could limit the potential for substantial stock price appreciation if the company's actual performance doesn't outpace these high expectations.

Consequently, investors might find FRT less appealing when compared to REITs with more conservative valuation multiples, especially if they are seeking greater upside potential or a more defensive investment profile in the current market environment.

Potential for Increased Interest Expenses

While Federal Realty Investment Trust (FRT) has been proactive in managing its debt, including extending maturities, the company is still susceptible to fluctuations in interest rates. This exposure could translate into higher interest expenses, potentially affecting its bottom line and Funds From Operations (FFO).

For instance, if interest rates were to climb, FRT's borrowing costs would likely increase. This is a significant consideration for REITs like FRT, which often utilize debt to finance growth initiatives such as property acquisitions and redevelopment projects. As of early 2024, the Federal Reserve has maintained a cautious stance on rate cuts, signaling that borrowing costs may remain elevated for a period.

- Interest Rate Sensitivity: REITs are inherently sensitive to interest rate changes due to their reliance on debt financing.

- Impact on Profitability: Rising rates can directly increase interest expenses, squeezing profit margins and FFO.

- Financing Costs: Higher borrowing costs can make new acquisitions or development projects less attractive financially.

- Market Conditions: The current economic environment, with ongoing discussions about inflation and monetary policy, underscores this risk.

Execution Risk in New Market Expansion

Federal Realty's plan to venture beyond its established coastal markets into new affluent regions carries significant execution risk. This involves the challenge of accurately identifying high-potential properties in unfamiliar territories and effectively integrating them into the existing portfolio. For instance, the company's recent acquisition strategy has focused on dynamic urban centers, but expanding into less-tested markets could lead to misjudgments in property selection or valuation.

Navigating the unique operational landscapes and competitive dynamics of these new markets presents another hurdle. Federal Realty must develop robust strategies for tenant acquisition and retention in environments where its brand recognition might be lower. A misstep here could result in underperforming assets, impacting overall portfolio yield and potentially straining financial resources, especially if acquisition costs in these new areas are higher than anticipated.

- Property Identification Challenges: Difficulty in sourcing suitable, high-quality retail assets in new, less familiar affluent markets.

- Integration and Operational Hurdles: Potential difficulties in integrating new acquisitions and managing operations effectively in diverse market conditions.

- Market Dynamics Navigation: Risk of misinterpreting local market trends, tenant demand, and competitive landscapes, leading to suboptimal investment decisions.

- Resource Strain: Expansion into new territories could divert management attention and capital, potentially diluting focus on core, high-performing assets.

Federal Realty's concentrated portfolio in affluent coastal markets, particularly the Washington D.C. area, exposes it to significant localized economic risks. This geographic concentration means that downturns or policy changes in these specific regions can disproportionately affect the REIT's overall financial health and performance.

The company's substantial investment in the retail sector faces ongoing challenges from e-commerce growth and shifting consumer habits. This trend can lead to increased vacancies and reduced rental income, even for high-quality properties, as seen in certain retail segments during 2023.

Federal Realty's valuation metrics, such as its Price-to-Earnings (P/E) ratio, have been noted as elevated, with figures around 28.5x in early 2024. This suggests the market may have high expectations, potentially limiting future stock price upside if performance doesn't exceed these projections.

Sensitivity to interest rate fluctuations is a key weakness, as higher borrowing costs can impact profitability and the feasibility of new growth projects. With the Federal Reserve maintaining a cautious stance on rate cuts as of early 2024, financing costs are likely to remain a consideration.

The expansion into new, less familiar affluent markets introduces execution risk, including challenges in property selection, valuation, and integration. Misjudging market dynamics or facing higher acquisition costs in these new territories could negatively impact portfolio yields.

Same Document Delivered

Federal SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Federal Realty has a significant opportunity to broaden its acquisition focus beyond established coastal regions into affluent, yet underserved, inland markets. This strategic pivot allows for the acquisition of potentially undervalued assets in areas with favorable supply and demand characteristics, unlocking new avenues for growth.

This expansion strategy is already demonstrating success. For instance, the acquisition of the Del Monte Shopping Center in Monterey, California, and the Town Center Plaza and Crossing in Kansas showcases Federal Realty's commitment to exploring these less-penetrated, high-potential markets, aiming to diversify its portfolio and capture new growth opportunities.

Federal Realty Investment Trust (FRT) can further capitalize on the trend of mixed-use development by integrating more residential and office spaces into its existing retail centers. This approach transforms properties into dynamic, 24/7 destinations, not just shopping venues. For instance, FRT's successful developments like Santana Row in San Jose, California, and Pike & Rose in North Bethesda, Maryland, demonstrate a proven model for creating vibrant, community-focused environments that attract a wider demographic and diversify revenue beyond traditional retail.

Federal Realty can significantly boost tenant and shopper satisfaction by integrating cutting-edge retail technologies across its properties. This involves deploying smart building systems for better environmental controls, utilizing advanced analytics to understand tenant sales performance, and creating digital platforms that foster visitor engagement. For instance, implementing real-time occupancy sensors can optimize space utilization and improve the overall visitor flow.

These technological upgrades are designed to translate directly into tangible business benefits. By enhancing the shopping experience, Federal Realty can drive increased foot traffic, which in turn supports higher sales volumes for its retail tenants. This improved performance allows Federal Realty to justify and command premium rental rates, directly impacting its revenue and profitability. In 2023, Federal Realty reported a 7.4% increase in same-store operating income, demonstrating the positive impact of its operational strategies.

Capitalizing on ESG Trends and Green Initiatives

Federal Realty's robust dedication to sustainability, evidenced by its progress in lowering greenhouse gas emissions and expanding renewable energy use, is a significant opportunity. For instance, in 2023, the company reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, a key metric for ESG-focused investors. This commitment can attract a growing pool of capital allocated to environmentally responsible investments.

Further investments in green building certifications, like LEED, and enhanced energy efficiency across its portfolio can bolster Federal Realty's brand image and operational performance. By continuing to prioritize sustainable practices, the company can unlock potential cost savings through reduced energy consumption and appeal to tenants increasingly seeking environmentally friendly spaces. This strategic focus aligns with market demand for sustainable real estate solutions.

Key opportunities stemming from ESG trends include:

- Attracting ESG-focused Investors: Federal Realty's demonstrable commitment to sustainability, including its 2023 emissions reduction targets, appeals to a rapidly expanding segment of the investment community prioritizing environmental, social, and governance factors.

- Enhanced Tenant Appeal: Prioritizing green building certifications and energy efficiency improvements makes properties more attractive to tenants with their own sustainability goals, potentially leading to higher occupancy rates and rental premiums.

- Operational Cost Savings: Continued investment in energy-efficient technologies and sustainable operations can lead to tangible reductions in utility expenses, improving the company's bottom line and operational efficiency.

Optimizing Capital Allocation through Asset Recycling

Federal Realty Investment Trust (FRT) can further optimize its capital allocation by continuing its proven asset recycling strategy. This involves strategically selling off mature or non-core properties at favorable prices to generate capital for new investments and redevelopment projects. For instance, in 2024, FRT completed several dispositions, generating significant proceeds that were then redeployed into higher-growth opportunities. This disciplined approach ensures capital is consistently funneled into assets with the greatest potential for value appreciation, thereby improving the overall quality of the REIT's portfolio.

This strategy allows FRT to actively manage its real estate holdings, ensuring resources are directed towards properties that align with its long-term growth objectives. By divesting assets that have reached their peak performance or no longer fit the strategic vision, FRT can unlock capital to pursue acquisitions in high-demand markets or invest in redeveloping existing properties to enhance their tenant mix and rental income. This proactive capital management is crucial for maximizing long-term shareholder value and maintaining a competitive edge in the dynamic retail real estate sector.

Key aspects of this opportunity include:

- Strategic Dispositions: Selling mature assets at opportune times to fund growth initiatives. In 2024, FRT's disposition activity supported its acquisition pipeline, demonstrating the effectiveness of this capital recycling.

- Acquisition of Accretive Assets: Using recycled capital to purchase properties with strong leasing potential and embedded growth opportunities.

- Redevelopment Investments: Funding projects that enhance existing property value, tenant appeal, and rental income streams.

- Portfolio Enhancement: Continuously improving the overall quality and growth profile of FRT's real estate portfolio.

Federal Realty can expand its reach into affluent, underserved inland markets, acquiring potentially undervalued assets. This diversification strategy is already showing promise, as seen with acquisitions like the Del Monte Shopping Center in Monterey, California, and Town Center Plaza and Crossing in Kansas, highlighting FRT's commitment to exploring these high-potential areas.

Threats

An economic slowdown or persistent high inflation poses a significant threat to Federal Realty. For instance, if inflation remains elevated, as seen with the Consumer Price Index (CPI) averaging 3.4% in early 2024, consumers may cut back on non-essential purchases. This directly impacts Federal Realty's retail tenants, potentially leading to reduced sales and increased store closures.

Such a decline in consumer spending can translate into lower rental income for Federal Realty, as tenants struggle with profitability. This sensitivity is amplified in the retail sector, where discretionary spending is a key driver of success. The retail vacancy rate, which stood around 7.0% nationally in Q1 2024, could worsen, putting further pressure on Federal Realty's occupancy and revenue streams.

Federal Realty Investment Trust (FRT) faces significant competition in its affluent market segments, even though these markets are difficult for new players to enter. Well-funded REITs and developers are actively pursuing opportunities in these desirable locations, which can escalate property acquisition expenses and necessitate greater tenant concessions.

This heightened competition can put pressure on Federal Realty's ability to achieve its projected rent growth and potentially impact its leasing spreads. For instance, in 2023, while FRT reported strong leasing activity, the competitive landscape in its core markets, such as the Washington D.C. metropolitan area, means that securing prime retail space often involves more strategic negotiation and potentially higher tenant improvement allowances than in less contested areas.

Persistent increases in interest rates, as seen with the Federal Reserve's continued tightening cycle through 2024, directly elevate Federal Realty's cost of capital. This makes future property acquisitions and development projects significantly more expensive, potentially impacting growth strategies.

Higher borrowing costs translate to increased interest expenses, which can compress Federal Realty's profit margins and reduce Funds From Operations (FFO). For instance, a 1% increase in interest rates on Federal Realty's outstanding debt could lead to millions in additional annual interest payments, directly affecting shareholder returns.

This trend is particularly concerning for Real Estate Investment Trusts (REITs) like Federal Realty, which historically rely on leverage to fund expansion and acquire new assets. The current elevated interest rate environment, with the Federal Funds Rate hovering around 5.25%-5.50% in early 2024, presents a substantial headwind to this capital-intensive business model.

Shifting Retail Landscape and E-commerce Impact

The retail sector's ongoing transformation, fueled by the relentless rise of e-commerce, remains a significant challenge. While Federal Realty's strategy of emphasizing experiential and mixed-use properties aims to buffer this impact, a faster-than-expected shift to online purchasing could still negatively affect physical store traffic and the overall demand for brick-and-mortar retail spaces.

Adapting to these evolving consumer habits necessitates ongoing innovation in property offerings and a strategic approach to selecting tenants who can draw consistent customer engagement. For instance, e-commerce sales in the U.S. are projected to reach over $2.1 trillion by 2025, underscoring the scale of this trend.

- E-commerce Growth: Continued acceleration in online sales directly impacts physical retail foot traffic.

- Tenant Mix Strategy: The need for curated, experience-driven tenants becomes more critical to maintain property appeal.

- Adaptation Costs: Investing in property modernization and new retail concepts to counter e-commerce threats requires capital.

Tenant Bankruptcies and Lease Defaults

Even with a diversified tenant portfolio, the specter of tenant bankruptcies and lease defaults looms, particularly for smaller, independent businesses or those operating in less resilient sectors. For instance, during the economic slowdown of 2023, retail bankruptcies saw an uptick, impacting commercial real estate portfolios. This can lead to immediate vacancies, necessitating costly tenant acquisition processes and causing a temporary dip in rental income. Effective tenant risk management is therefore crucial to mitigate these potential disruptions.

The potential for unexpected vacancies due to tenant financial distress is a significant concern. In 2024, analysts projected that certain sectors, like apparel and electronics retail, might face higher default rates due to evolving consumer spending habits and increased competition. Such events can disrupt cash flow projections and require proactive strategies to secure replacement tenants quickly.

- Increased Vacancy Rates: Tenant defaults directly translate to empty spaces, reducing occupancy and rental income.

- Re-leasing Costs: Finding new tenants involves marketing, legal fees, and potential tenant improvement allowances, adding to expenses.

- Income Volatility: Lease defaults create unpredictable gaps in revenue streams, impacting financial planning and stability.

The accelerating growth of e-commerce presents a persistent threat, potentially reducing foot traffic for brick-and-mortar stores. Federal Realty must continue to adapt its tenant mix towards experiential retail and mixed-use concepts to counter this trend. For example, U.S. e-commerce sales are projected to exceed $2.1 trillion by 2025, highlighting the scale of this shift.

Rising interest rates, with the Federal Funds Rate around 5.25%-5.50% in early 2024, increase Federal Realty's cost of capital, making acquisitions and development more expensive. This directly impacts profitability by raising interest expenses on its debt, potentially millions annually for every 1% increase.

Increased competition in Federal Realty's affluent markets can drive up acquisition costs and necessitate greater tenant concessions, potentially impacting rent growth and leasing spreads. For instance, in 2023, securing prime locations in markets like the Washington D.C. area involved more strategic negotiations.

Tenant bankruptcies and lease defaults, especially in sectors vulnerable to economic shifts, pose a risk of increased vacancies and income volatility. Retail bankruptcies saw an uptick in 2023, underscoring the need for robust tenant risk management.

| Threat | Impact on Federal Realty | Relevant Data/Example |

|---|---|---|

| E-commerce Growth | Reduced physical store foot traffic, need for experiential tenants | U.S. e-commerce sales projected to exceed $2.1 trillion by 2025 |

| Rising Interest Rates | Increased cost of capital, higher interest expenses, compressed margins | Federal Funds Rate ~5.25%-5.50% (early 2024) |

| Competition | Higher acquisition costs, pressure on rent growth and leasing spreads | Competitive landscape in D.C. metro area in 2023 |

| Tenant Defaults/Bankruptcies | Increased vacancies, income volatility, re-leasing costs | Retail bankruptcies increased in 2023 |

SWOT Analysis Data Sources

This Federal SWOT Analysis is constructed from a robust foundation of government financial reports, legislative analyses, and expert testimony from policymakers and agency leaders to provide a comprehensive and authoritative assessment.