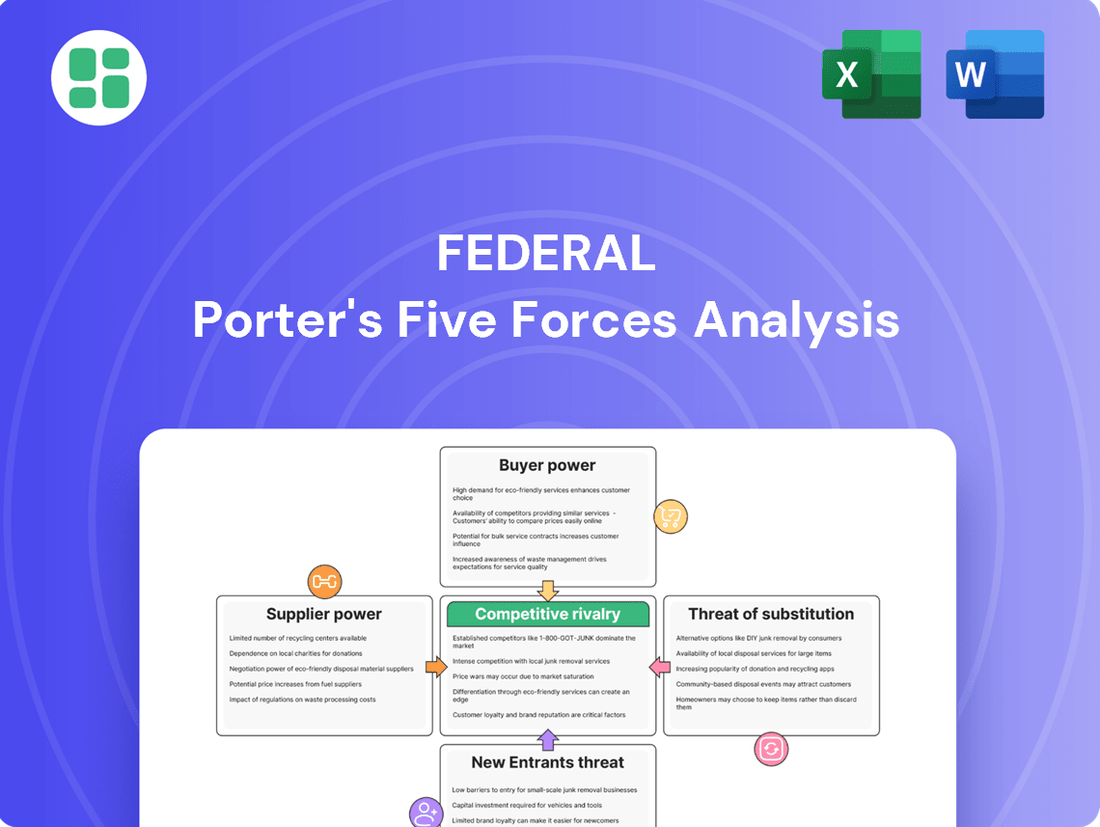

Federal Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federal Bundle

Federal's competitive landscape is shaped by the interplay of powerful forces, from the bargaining power of its customers to the intense rivalry among existing players. Understanding these dynamics is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Federal’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Landowners wield considerable bargaining power when dealing with Federal Realty Investment Trust (FRT). FRT's strategic focus on densely populated, affluent communities means that the available prime land parcels are inherently scarce and in high demand. This scarcity directly translates to increased leverage for land sellers, who can command higher acquisition costs from FRT.

FRT's commitment to acquiring high-quality, irreplaceable real estate in these desirable locations further amplifies the bargaining power of landowners. For instance, in 2024, the demand for well-located retail and mixed-use properties in affluent suburban markets remained robust, as evidenced by continued investor interest and stable to increasing property values in FRT's target geographies.

Construction and development firms can exert significant bargaining power on Federal Realty Investment Trust (FRT) due to industry-wide pressures. In 2024, the U.S. construction sector continued to grapple with elevated material costs, with lumber prices, for example, fluctuating but remaining a key input cost. Labor shortages also persisted, driving up wages and making it harder to secure skilled workers, directly impacting project timelines and budgets for FRT.

Furthermore, the specialized nature of mixed-use developments, a core strategy for FRT, often necessitates contractors with niche expertise. This specialization can shrink the available pool of qualified construction partners, thereby amplifying the bargaining leverage of those firms that possess the required skills and track record, potentially leading to higher bids for FRT's projects.

Financial lenders and capital providers hold significant bargaining power over REITs, particularly given the capital-intensive nature of real estate investments. In 2024, with interest rates experiencing volatility, lenders can leverage this uncertainty to negotiate favorable terms, impacting the cost of financing for new acquisitions and redevelopments.

The ability of lenders to dictate terms is further amplified by economic conditions that influence risk premiums. While a potential easing of interest rates is anticipated for 2025, the immediate financial landscape in 2024 means that capital providers can still exert considerable influence over the cost and availability of debt for REITs.

Key Service Providers

Suppliers of critical services such as property management, specialized upkeep, security, and technology are a key consideration. Their leverage depends on how specialized their offerings are and whether Federal Realty Investment Trust (FRT) has many other options for the level of service it needs. For instance, if a particular technology solution is unique and vital to FRT's operations, that supplier has more bargaining power.

FRT aims to manage this power through strategic approaches. Long-term agreements and strong, existing relationships with these service providers are crucial for reducing supplier influence. These established partnerships help ensure more stable pricing and service continuity. In 2023, FRT's operating expenses were approximately $645 million, with a significant portion allocated to services that fall under this category.

- Specialized Services: The bargaining power of suppliers increases if their services are highly specialized and difficult to substitute.

- Limited Alternatives: If there are few providers capable of meeting FRT's scale and quality requirements, their power is amplified.

- Mitigation Strategies: FRT employs long-term contracts and cultivates strong relationships to lessen supplier leverage.

- Cost Impact: In 2023, FRT's total operating expenses were around $645 million, highlighting the importance of managing supplier costs effectively.

Utility Providers

Utility providers, such as electricity, water, and gas companies, often function as monopolies or duopolies within their service territories. This concentrated market structure grants them significant bargaining power when dealing with real estate investment trusts (REITs) like Federal Realty Investment Trust (FRT).

While FRT can often pass increased utility costs onto its tenants, substantial price hikes can diminish the appeal and financial viability of its properties. For instance, in 2024, average commercial electricity rates saw an increase in many regions, directly impacting property operating expenses.

- Monopolistic/Duopolistic Nature: Utility companies typically face limited competition, allowing them to set terms and pricing with less pressure.

- Cost Pass-Through Limitations: Although costs can be passed to tenants, excessive increases can lead to tenant attrition or reduced lease renewals.

- Strategic Partnerships: FRT's potential engagement with specific energy solution providers for sustainability projects can alter these supplier dynamics, creating new dependencies or leverage points.

Suppliers of specialized services, like unique technology solutions or niche property maintenance, hold significant bargaining power over Federal Realty Investment Trust (FRT). This leverage is amplified when FRT has limited alternative providers capable of meeting its specific quality and scale requirements, directly impacting operational costs.

FRT actively manages this supplier power through strategies such as long-term contracts and cultivating robust relationships, aiming for stable pricing and service continuity. In 2023, FRT's operating expenses were approximately $645 million, underscoring the financial importance of effectively managing these supplier relationships.

Utility providers, often operating as monopolies or duopolies, also possess considerable bargaining power. While FRT can pass some increased costs to tenants, significant hikes can reduce property desirability and financial viability, as seen with rising commercial electricity rates in many regions during 2024.

| Supplier Type | Bargaining Power Factors | FRT Mitigation Strategies | 2024/2023 Impact Example |

| Specialized Service Providers | High if services are unique and few alternatives exist. | Long-term contracts, strong relationships. | Operating expenses of ~$645M in 2023 highlight cost management needs. |

| Utility Providers | High due to monopolistic/duopolistic market structure. | Passing costs to tenants, exploring sustainability partnerships. | Increased commercial electricity rates in 2024 impact operating expenses. |

What is included in the product

Analyzes the five competitive forces impacting Federal, providing insights into industry attractiveness and strategic positioning.

Quickly identify and mitigate threats from competitors, suppliers, buyers, new entrants, and substitutes, turning potential market pains into strategic advantages.

Customers Bargaining Power

Anchor retail tenants, like major department stores or grocery chains, wield substantial bargaining power. Their presence is crucial for drawing shoppers, giving them leverage to negotiate favorable lease terms. For instance, a large anchor tenant might secure lower rent per square foot or demand significant investment in store renovations from the landlord, directly impacting the landlord's profitability.

In 2024, the retail landscape continued to see strong anchors demanding concessions. Reports indicated that major anchor tenants, particularly those in essential goods like supermarkets, could negotiate lease rates that were 5-10% lower than smaller, independent retailers. This is because their ability to guarantee consistent foot traffic is invaluable to the overall success of a shopping center.

While individual small shops typically possess limited bargaining power, their collective influence can grow, especially when market conditions shift or new pro-tenant legislation emerges, as seen in some states. For instance, a significant portion of Federal Realty's (FRT) portfolio comprises smaller, independent retailers, and a coordinated approach among these tenants could present a unified front.

Federal Realty's strategy of developing vibrant, destination-oriented properties is designed to cultivate a diverse and appealing tenant mix. This approach inherently dilutes the power of any single small tenant by ensuring that the overall appeal of the location, rather than any one shop, is the primary draw for customers.

For Federal Realty Investment Trust's (FRT) mixed-use properties, the bargaining power of residential tenants is largely dictated by local housing market dynamics. In areas with high demand and limited supply, like FRT's well-located properties in affluent, densely populated regions, tenant power is naturally diminished as they have fewer alternatives. For instance, in Q1 2024, FRT reported a 97.4% occupancy rate across its portfolio, indicating strong demand that limits individual tenant leverage.

Office tenants' bargaining power is more sensitive to prevailing economic conditions and evolving work arrangements. Rising office vacancy rates and the persistent trend of remote work can empower tenants by increasing the availability of comparable spaces and reducing the urgency to secure leases. While FRT's focus on prime locations and high-quality amenities helps mitigate this, broader market shifts in office utilization remain a factor influencing tenant negotiation leverage.

Online Retailers and Direct-to-Consumer Brands

The burgeoning landscape of online retail and direct-to-consumer (DTC) brands significantly amplifies customer bargaining power. With a vast array of choices readily available online, consumers can effortlessly compare prices, features, and reviews, forcing traditional retailers to adapt. This shift means consumers are less reliant on physical store locations, indirectly impacting demand for retail space. For instance, in 2024, e-commerce sales in the US were projected to reach over $1.1 trillion, demonstrating the growing consumer preference for online channels.

This increased consumer leverage translates into greater demands on retailers, who in turn may negotiate more aggressively with their landlords. Tenants might seek reduced rental rates or more adaptable lease agreements to remain competitive in the evolving retail environment. This dynamic can put pressure on property owners like FRT to offer concessions, as demonstrated by the retail vacancy rates which, while showing signs of recovery in some sectors, remain a point of negotiation. For example, the US retail vacancy rate hovered around 5.4% in early 2024, a figure that can fluctuate based on market conditions and tenant demands.

- Increased Consumer Choice: The proliferation of online retailers and DTC brands provides consumers with an unprecedented number of shopping alternatives.

- Price Transparency: Consumers can easily compare prices across multiple platforms, driving down margins for retailers.

- Reduced Reliance on Physical Stores: The convenience of online shopping diminishes the necessity of brick-and-mortar locations for many purchases.

- Tenant Negotiation Leverage: Retailers facing online competition may use their reduced reliance on physical space as a bargaining chip for lower rents and flexible lease terms with landlords.

Tenant Mix and Desirability of Location

Federal Realty Investment Trust's (FRT) strategic focus on acquiring and developing high-quality properties in affluent coastal markets with dense populations significantly curtails the bargaining power of its customers, primarily retail tenants. This prime positioning ensures a consistent demand from businesses seeking access to desirable consumer bases.

Tenants are inherently motivated to lease space within FRT's portfolio due to the inherent advantages of these locations. The strong consumer demographics, often characterized by higher disposable incomes, and the carefully curated, experiential retail environments FRT cultivates, create a compelling value proposition. This desirability translates into tenants being willing to accept less favorable lease terms and pay a premium for the privilege of operating in such sought-after areas, thereby enhancing FRT's negotiating leverage.

For instance, as of the first quarter of 2024, FRT reported a portfolio occupancy rate of 97.5%, demonstrating the strong demand for its properties. Furthermore, the company achieved a notable 10.1% growth in same-store net operating income (NOI) for its retail segment in Q1 2024, a testament to its ability to command favorable lease rates.

- High Occupancy Rates: FRT maintained a 97.5% portfolio occupancy rate in Q1 2024.

- Strong NOI Growth: The retail segment experienced a 10.1% increase in same-store NOI in Q1 2024.

- Tenant Retention: FRT's focus on desirable locations contributes to high tenant retention rates, further reducing the need for concessions.

- Premium Location Advantage: Affluent coastal markets offer a concentrated customer base, increasing tenant reliance on FRT's properties.

The bargaining power of customers, primarily retail tenants in this context, is significantly influenced by market dynamics and the availability of alternatives. When there are many similar retail spaces available, or when economic conditions soften, tenants gain more leverage to negotiate favorable lease terms.

In 2024, the retail sector experienced a mixed environment. While some segments saw robust demand, the persistent growth of e-commerce continued to empower consumers and, by extension, retail tenants. This trend allows tenants to demand more flexibility from landlords, potentially impacting rental income.

For Federal Realty Investment Trust (FRT), while their prime locations generally reduce tenant bargaining power, the broader market trends cannot be ignored. For example, the national retail vacancy rate in early 2024 was around 5.4%, presenting a baseline for tenant negotiation leverage across the industry.

The increasing consumer preference for online shopping, with US e-commerce sales projected to exceed $1.1 trillion in 2024, directly affects the foot traffic and perceived value of physical retail spaces, further enhancing tenant negotiation power.

| Factor | Impact on Tenant Bargaining Power | 2024 Data/Trend |

|---|---|---|

| E-commerce Growth | Increases consumer choice, reduces reliance on physical stores | US e-commerce sales projected > $1.1 trillion |

| Retail Vacancy Rates | Higher rates empower tenants with more options | Approx. 5.4% national average in early 2024 |

| Tenant Mix Strategy (FRT) | Diversified mix can dilute individual tenant power | FRT focuses on curated, experiential retail environments |

| Location Premium | Prime locations reduce tenant leverage due to high demand | FRT's Q1 2024 occupancy rate was 97.5% |

Preview the Actual Deliverable

Federal Porter's Five Forces Analysis

This preview showcases the complete Federal Porter's Five Forces Analysis, providing an in-depth examination of competitive forces within the federal sector. The document you see here is precisely what you will receive immediately after purchase, ensuring you get the fully formatted and ready-to-use analysis without any alterations or placeholders.

Rivalry Among Competitors

Federal Realty Investment Trust (FRT) operates in a landscape crowded with publicly traded retail and mixed-use REITs. Key rivals like Kimco Realty (KIM) and Regency Centers (REG) actively compete for prime real estate, attractive tenants, and development projects. This direct competition intensifies the fight for market share and can influence rental rates and property valuations.

Private equity firms and other private real estate developers are formidable rivals, actively competing for prime acquisition opportunities and new development projects in desirable markets. These players often possess distinct capital structures and investment timelines, which can significantly shape their bidding approaches and overall competitive stance.

In 2024, the private real estate sector saw substantial activity, with private equity firms deploying record amounts of capital. For instance, global private equity real estate fundraising reached an estimated $200 billion in the first half of 2024, indicating intense competition for assets.

The retail property market, despite some consolidation, remains quite fragmented, particularly for smaller, neighborhood shopping centers. This means Federal Realty Investment Trust (FRT) faces competition not just from major institutional investors but also from a multitude of smaller, local property owners.

This competitive landscape is underscored by the fact that in 2024, the U.S. retail property market still features thousands of individual shopping centers, many of which are independently owned or managed by smaller entities. For example, the National Association of Real Estate Investment Trusts (NAREIT) data indicates a significant number of private REITs and individual owners active in this sector.

Competition for Prime Locations and High-Quality Tenants

The pursuit of prime retail and mixed-use properties in affluent, densely populated areas intensifies competition for both desirable locations and high-caliber tenants. Federal Realty Investment Trust (FRT) operates in a landscape where securing and retaining top-tier national and local retailers is paramount for sustained occupancy and consistent rental income.

This intense rivalry directly impacts FRT's ability to maintain high occupancy rates and predictable revenue streams. For instance, in 2024, the U.S. retail vacancy rate hovered around 3.5% for well-located centers, a figure that underscores the demand for quality spaces. Securing anchor tenants or popular brands can significantly boost a property's appeal and financial performance.

- High Demand for Quality Locations: The concentration of wealth and population in FRT's target markets creates a competitive bidding environment for the most advantageous retail and mixed-use sites.

- Tenant Retention is Key: The ability to retain sought-after national and local tenants is critical for Federal Realty to avoid vacancies and maintain its rental income, as tenant turnover can be costly.

- Impact on Occupancy Rates: Fierce competition for desirable tenants directly influences FRT's overall occupancy levels, which in turn affects its financial health and profitability.

- 2024 Market Dynamics: In 2024, the retail sector saw continued demand for well-positioned, experiential retail spaces, making the competition for these properties and their tenants particularly acute.

Market Conditions and Economic Cycles

The broader commercial real estate market outlook, heavily influenced by interest rate trends and overall economic growth, directly shapes competitive rivalry. As of mid-2025, while interest rates have stabilized, they remain at levels that increase the cost of capital for developers and investors, intensifying competition for prime assets and tenants. Economic growth projections for 2025 indicate a moderate expansion, which generally supports demand but can also attract more players into the market.

A challenging economic environment, characterized by slower growth or recessionary fears, often escalates competition for tenants and exerts downward pressure on rental rates. However, the retail sector, in particular, is demonstrating resilience, with some segments showing positive rental growth and increased leasing activity in 2025, suggesting a more favorable competitive landscape for well-positioned retail properties.

- Interest Rate Impact: Higher borrowing costs in 2025 make new developments more expensive, potentially limiting new supply but also increasing pressure on existing property owners to maintain occupancy and rental income.

- Economic Growth Influence: Moderate economic growth in 2025 supports demand for commercial space, but the uneven distribution of this growth across sectors and geographies can lead to varied competitive intensity.

- Retail Sector Resilience: The retail market, defying earlier predictions, shows signs of recovery and positive returns in 2025, with vacancy rates in prime locations decreasing and rental rates firming up, indicating a shift in competitive dynamics.

- Tenant Acquisition: In a market with fluctuating economic conditions, competition among landlords to attract and retain high-quality tenants intensifies, often leading to concessions or tailored lease agreements.

Federal Realty Investment Trust (FRT) faces intense competition from publicly traded REITs like Kimco Realty and Regency Centers, as well as private equity firms and local owners. This rivalry centers on acquiring prime real estate, attracting top tenants, and securing development opportunities.

In 2024, private equity real estate fundraising reached approximately $200 billion in the first half, highlighting aggressive competition for assets. The retail property market, though consolidating, remains fragmented, with thousands of independently owned centers contributing to a broad competitive base.

The drive for well-located, affluent market properties intensifies competition for both sites and tenants, directly impacting FRT's occupancy and rental income. In 2024, prime retail vacancy rates were around 3.5%, underscoring the demand for quality spaces and the importance of tenant retention.

| Competitor Type | Key Activities | 2024/2025 Impact |

|---|---|---|

| Public REITs (e.g., KIM, REG) | Acquisition, Development, Tenant Leasing | Direct competition for prime assets and market share; influences rental rates. |

| Private Equity Firms | Aggressive Asset Acquisition, Development | Significant capital deployment in 2024 ($200B H1) intensifies bidding for opportunities. |

| Private Owners/Local Developers | Neighborhood Center Ownership, Local Market Focus | Fragmented market competition, particularly for smaller centers; impacts broader market dynamics. |

SSubstitutes Threaten

E-commerce presents a formidable substitute for traditional brick-and-mortar retail. The sheer convenience and vast selection offered online directly challenge the necessity of physical store visits. For instance, global e-commerce sales were projected to reach $6.3 trillion in 2024, a significant portion of overall retail spending.

This digital shift directly impacts the demand for physical retail spaces, as consumers increasingly opt for the ease of online purchasing. While physical retail retains certain advantages, the growing preference for online shopping, driven by factors like personalized recommendations and doorstep delivery, erodes the unique value proposition of many brick-and-mortar locations.

The rise of direct-to-consumer (DTC) models presents a significant threat of substitutes for traditional retail. Brands are increasingly bypassing brick-and-mortar stores, as seen with the growth of online-only retailers. For instance, in 2024, e-commerce sales continued to capture a larger share of overall retail spending, forcing physical retailers to innovate.

This shift means consumers have readily available alternatives to traditional retail experiences, directly impacting the demand for physical store spaces. Retail landlords must therefore pivot towards creating more engaging, experiential environments or integrating mixed-use components to remain competitive against these direct substitutes.

For mixed-use properties striving to be vibrant destinations, the threat of substitutes looms large. Consumers increasingly opt for home entertainment, with the global home entertainment market projected to reach $138.7 billion by 2027, according to Grand View Research. This shift diverts spending and attention away from physical retail and entertainment venues.

Outdoor recreation and other cultural activities also present significant substitutes. For instance, national park visitation in the US saw over 300 million recreation visits in 2023, demonstrating a strong consumer preference for experiential and nature-based leisure. These alternatives offer unique value propositions that traditional retail-anchored destinations must actively counter.

Remote Work and Alternative Office Spaces

The increasing prevalence of remote and hybrid work arrangements directly substitutes for traditional office space within mixed-use properties. This shift significantly impacts the demand for office components, potentially leading to lower rental income and increased vacancies.

As of early 2024, office vacancy rates remained elevated in many major metropolitan areas, with some reports indicating figures exceeding 15% in certain markets. This persistent high vacancy underscores the competitive pressure from alternative work arrangements.

- Remote Work: A significant portion of the workforce continues to operate remotely, reducing the need for dedicated physical office space.

- Hybrid Models: Companies adopting hybrid schedules mean fewer employees are in the office simultaneously, lowering overall space requirements.

- Vacancy Rates: In Q1 2024, the national office vacancy rate hovered around 13.5%, a substantial increase from pre-pandemic levels, indicating a direct substitution effect.

- Rental Income Impact: Landlords are experiencing downward pressure on rental rates as they compete to attract and retain tenants in a market with abundant supply and reduced demand.

Shifting Consumer Preferences and Lifestyle Changes

Shifting consumer preferences represent a significant threat of substitutes for various real estate sectors. For instance, a growing demand for experiential retail over traditional shopping malls means that entertainment venues or even online subscription services can act as substitutes for brick-and-mortar retail spaces. This trend was evident in 2024, with retail sales growth in experiential sectors like dining and entertainment outpacing traditional apparel and electronics.

Lifestyle changes, such as the increasing preference for urban living and mixed-use developments that integrate residential, commercial, and recreational spaces, can also substitute for traditional suburban retail centers. Federal Realty Investment Trust (FRT) acknowledges this by focusing on creating vibrant, experience-driven environments within its properties to counter the allure of these alternative lifestyle choices.

- Experiential Retail Growth: In 2024, the experiential retail segment saw an estimated 8% year-over-year growth, significantly higher than the 2% growth in traditional retail.

- Urbanization Trends: Cities with strong mixed-use development saw a 5% increase in property values in 2024 compared to a 3% increase in purely residential suburban areas.

- Consumer Spending Shift: Data from late 2024 indicated that consumers allocated nearly 30% more of their discretionary spending to experiences (like travel and dining) compared to 2023.

- FRT's Strategy: FRT's portfolio, heavily weighted towards urban and suburban town centers, aims to capture this shift by offering integrated living, working, and leisure opportunities.

The threat of substitutes arises when alternative products or services can fulfill a similar customer need. For real estate, this means consumers might choose experiences or lifestyles that bypass traditional property types. For instance, the growing preference for home-based entertainment and remote work directly reduces the demand for commercial office and entertainment venues.

This substitution effect is evident in the declining need for physical office spaces, as hybrid and remote work models become more prevalent. In early 2024, office vacancy rates in major US cities often exceeded 15%, a clear indicator of this trend. Similarly, the rise of online retail and home-based leisure activities diminishes the appeal of traditional shopping malls and entertainment centers.

Consumers are increasingly prioritizing experiences over material goods, with spending on travel and dining rising significantly. This shift means that alternative leisure activities, such as national park visits or home entertainment, can effectively substitute for traditional retail and entertainment destinations. Retail landlords must adapt by offering unique, engaging experiences to retain customer interest.

| Substitute Category | Example | Impact on Traditional Real Estate | 2024 Data/Projection |

|---|---|---|---|

| Digital Consumption | E-commerce, Streaming Services | Reduced demand for physical retail, increased vacancy in malls | E-commerce sales projected at $6.3 trillion globally in 2024 |

| Alternative Work Models | Remote/Hybrid Work | Lower demand for office space, higher office vacancy rates | National office vacancy rate around 13.5% in Q1 2024 |

| Experiential Leisure | Home Entertainment, Travel, Outdoor Recreation | Decreased foot traffic in entertainment venues and retail centers | Home entertainment market projected at $138.7 billion by 2027; National park visits exceeded 300 million in 2023 |

| Urbanization & Mixed-Use | Integrated Living/Working/Leisure Environments | Shifts demand away from single-use suburban properties | Urban mixed-use property values saw a 5% increase in 2024 vs. 3% for suburban residential |

Entrants Threaten

Entering the real estate investment trust (REIT) sector, particularly for prime retail and mixed-use properties in desirable coastal areas, demands considerable financial resources. For instance, a significant development project in a prime location could easily run into hundreds of millions of dollars, creating a formidable entry barrier.

Federal Realty Investment Trust's strategic focus on acquiring and developing properties in densely populated, affluent communities presents a significant hurdle for potential new entrants. Their specialization in what they term 'irreplaceable real estate' means that prime locations are scarce and highly sought after, making it exceptionally difficult and costly for new companies to secure suitable land for development or acquisition. This limited availability of desirable land directly impacts the threat of new entrants by increasing the capital required and the complexity of market entry.

Real estate development, especially for large mixed-use projects, faces significant challenges due to complex zoning laws, environmental regulations, and protracted permitting procedures. These regulatory barriers can substantially increase the time, expense, and overall risk for newcomers entering the market.

Established Relationships and Brand Reputation

Established REITs, including Federal Realty Investment Trust (FRT), benefit immensely from deeply entrenched relationships with key stakeholders. These include national retailers who rely on FRT's expertise for site selection and leasing, local businesses that form the community fabric, and financial institutions that provide crucial capital. For instance, in 2023, FRT reported a 97.5% portfolio occupancy rate, showcasing the strength of its tenant relationships and desirability of its properties.

Building a comparable network and a proven track record in successful property management and redevelopment takes considerable time and capital, presenting a substantial hurdle for potential new entrants. The trust and reliability fostered over years of operation are not easily replicated. Federal Realty's long history, dating back to its founding in 1962, has allowed it to cultivate this invaluable goodwill and operational expertise.

The threat of new entrants is therefore mitigated by these established connections and a strong brand reputation. Newcomers would struggle to gain access to prime locations and secure high-quality tenants without a similar history of performance and relationship building. This is further evidenced by FRT's consistent dividend growth, a testament to its stable operational performance and investor confidence.

- Tenant Loyalty: Federal Realty's long-standing relationships with national retailers contribute to high occupancy rates, as seen in their 2023 performance.

- Capital Access: Established REITs have proven access to capital markets, a challenge for new, unproven entities.

- Reputational Barrier: Years of successful property management and redevelopment build a brand reputation that new entrants cannot quickly match.

- Operational Expertise: Decades of experience in managing and optimizing retail portfolios provide a significant competitive advantage for incumbents like Federal Realty.

Expertise in Mixed-Use Development and Retail Curation

New entrants face a significant hurdle due to the specialized expertise required for successful mixed-use development and retail curation. This isn't just about building structures; it's about crafting a compelling experience that attracts both shoppers and tenants. Developing this know-how takes time and significant investment, creating a barrier for those without established credentials in the field.

The ability to strategically curate a tenant mix, blending retail, dining, and residential or office spaces, is crucial. This requires a deep understanding of consumer trends and local market dynamics. For instance, a successful mixed-use project in 2024 might integrate experiential retail, which saw continued growth as consumers sought more than just transactional shopping, with reports indicating experiential retail spaces outperforming traditional malls in foot traffic and sales per square foot.

New players would need to either build this expertise from scratch or acquire companies that already possess it. This acquisition route can be costly, especially for prime urban locations. The complexity of urban planning regulations and the need for strong relationships with local authorities further complicate market entry, demanding a level of sophistication that established developers have honed over years of operation.

- Specialized Knowledge: Expertise in retail curation, urban planning, and tenant mix strategies is essential for creating successful mixed-use environments.

- Experiential Retail Focus: The trend towards experiential retail in 2024 necessitates a nuanced approach to tenant selection and space design.

- Acquisition Costs: New entrants may need to acquire existing firms or properties, incurring substantial financial outlays.

- Regulatory Hurdles: Navigating complex urban planning regulations and building local government relationships presents additional challenges.

The threat of new entrants into the REIT sector, particularly for prime retail and mixed-use properties, is significantly dampened by the immense capital requirements. Acquiring and developing such properties, especially in desirable coastal areas, can easily cost hundreds of millions of dollars, creating a substantial financial barrier for newcomers. This high cost of entry, coupled with the scarcity of prime locations, makes it exceptionally difficult and expensive for new companies to establish a foothold.

Furthermore, navigating the complex web of zoning laws, environmental regulations, and lengthy permitting processes adds considerable time, expense, and risk for potential entrants. Established REITs like Federal Realty Investment Trust (FRT) benefit from deep-seated relationships with retailers, local businesses, and financial institutions, fostering high portfolio occupancy rates, such as FRT's 97.5% in 2023. This demonstrates the strength of their tenant base and property desirability, which new entrants struggle to replicate without a similar history of performance and relationship building.

| Barrier Type | Description | Impact on New Entrants | Example (FRT) |

|---|---|---|---|

| Capital Requirements | High cost of acquiring and developing prime real estate. | Significant financial hurdle. | Projects costing hundreds of millions of dollars. |

| Regulatory Hurdles | Complex zoning, environmental, and permitting processes. | Increased time, expense, and risk. | Protracted procedures for development. |

| Established Relationships | Strong ties with retailers, local businesses, and lenders. | Difficult to match tenant loyalty and capital access. | 97.5% portfolio occupancy in 2023. |

| Brand Reputation & Expertise | Years of successful management and redevelopment. | Lack of trust and proven track record. | Founded in 1962, long-standing goodwill. |

Porter's Five Forces Analysis Data Sources

Our Federal Porter's Five Forces analysis is built upon a robust foundation of data, drawing from government agency reports, congressional testimonies, legislative databases, and public budget documents to understand the competitive landscape within the federal sector.