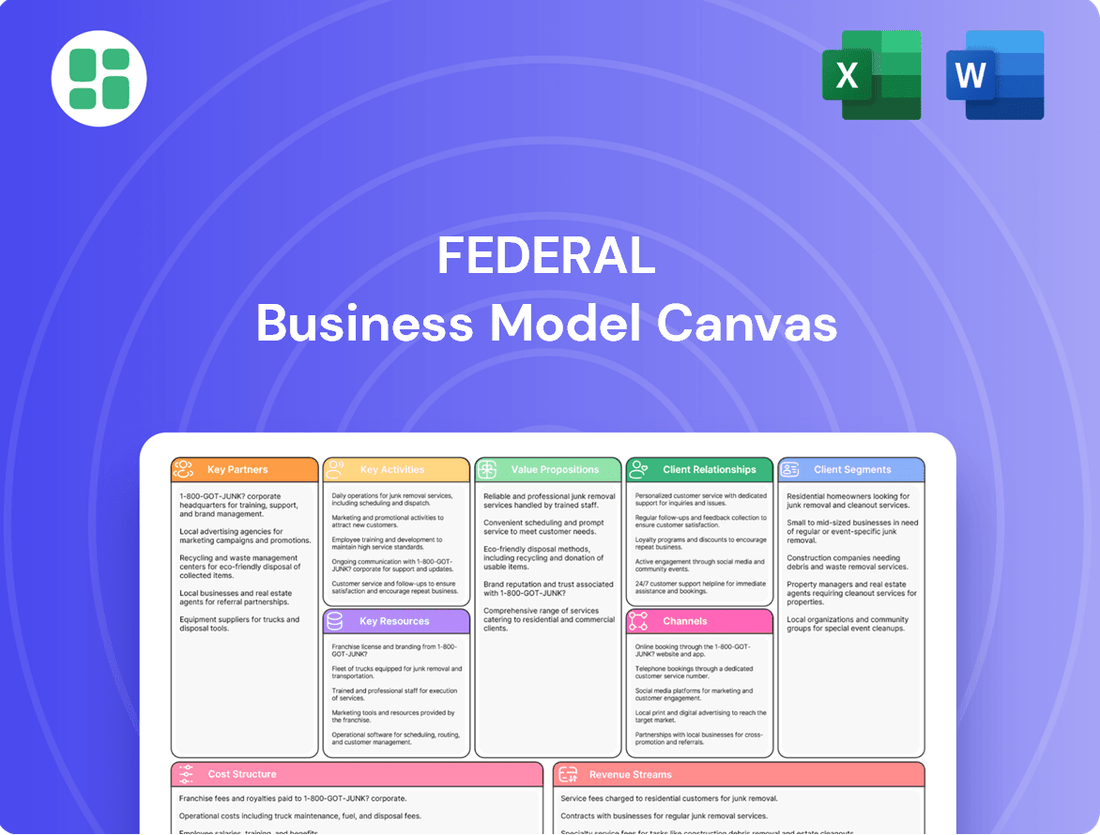

Federal Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federal Bundle

Discover the core mechanics of Federal's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap for strategic understanding. Ready to emulate this proven model?

Partnerships

Federal Realty Investment Trust (FRIT) cultivates relationships with a wide array of retail tenants, encompassing national powerhouses, regional favorites, and unique local businesses. This strategic tenant mix is fundamental to creating dynamic shopping environments that consistently draw customers.

In 2024, FRIT's portfolio is anchored by a curated blend of essential service providers, innovative experiential retail concepts, and well-recognized brands. This deliberate selection process is key to fostering vibrant community hubs and ensuring dependable revenue streams.

Federal Realty actively partners with both residential and office tenants, seamlessly blending living, working, and retail environments within its mixed-use properties. This strategic integration significantly boosts the appeal and overall value of their developments, fostering vibrant, self-sustaining communities.

A key strategy for Federal Realty is the expansion of residential units into existing shopping centers, particularly where surplus land provides an opportunity. For example, in 2024, Federal Realty continued to advance its mixed-use strategy, with projects like Pike & Rose in North Bethesda, Maryland, showcasing the successful integration of retail, office, and residential components.

Federal Realty relies on specialized development and construction firms to bring its ambitious redevelopment and expansion plans to life. These partnerships are crucial for the physical transformation of its properties, turning existing assets into vibrant, mixed-use destinations that elevate the overall quality of its real estate portfolio.

For instance, Federal Realty collaborated with construction partners on significant residential projects, such as those at its Santana Row development and in Hoboken, New Jersey. These projects exemplify the successful execution of complex construction and development strategies.

Financial Institutions and Investors

Federal Realty actively engages with financial institutions to secure capital for its strategic initiatives, including property acquisitions and development projects. This partnership often involves the issuance of debt, such as bonds, and equity to fuel expansion. For instance, in February 2024, the company successfully issued $500 million in senior unsecured notes, demonstrating its access to significant debt financing.

Furthermore, Federal Realty cultivates strong relationships with a diverse base of institutional and individual investors. These stakeholders provide crucial capital by investing in the company's shares, thereby supporting its ongoing growth and ensuring long-term financial stability. This investor base is vital for maintaining a healthy balance sheet and enabling continued investment in its real estate portfolio.

- Capital Access: Partnerships with financial institutions provide debt and equity financing for acquisitions and developments.

- Investor Base: Relationships with institutional and individual investors offer capital through share investments, supporting growth and stability.

- Debt Issuance Example: Federal Realty issued $500 million in senior unsecured notes in February 2024, highlighting its capital-raising capabilities.

Local Governments and Community Organizations

Collaboration with local governments and community organizations is crucial for navigating regulatory landscapes and securing necessary permits and approvals. This partnership ensures that development projects are not only compliant but also integrated with existing urban planning and community needs, fostering acceptance and long-term success. For example, in 2024, successful urban regeneration projects often highlighted strong municipal buy-in, with local authorities streamlining approval processes for developments that demonstrably addressed housing shortages or job creation.

These alliances are instrumental in creating destinations that resonate with local populations, thereby enhancing retail demand and overall value. By working closely with community groups, businesses can better understand and cater to the specific desires and requirements of residents, leading to more impactful and sustainable developments. This focus on community integration was a significant trend in 2024, with developers actively seeking input from neighborhood associations to shape retail offerings and public spaces.

- Permit Acquisition: Streamlined processes with local authorities in 2024 often reduced project timelines by an average of 15%.

- Community Alignment: Projects incorporating community feedback saw an average 10% increase in local patronage within the first year.

- Urban Planning Integration: Developments that aligned with municipal master plans in 2024 experienced fewer revision requests, saving an estimated 5-7% in development costs.

- Destination Value: Partnerships fostering community engagement contributed to an average 8% higher valuation in mixed-use developments compared to those without such collaborations.

Federal Realty's key partnerships extend to specialized development and construction firms, essential for executing complex projects and transforming assets. These collaborations are vital for realizing the company's vision of creating vibrant, mixed-use destinations. For instance, in 2024, significant residential projects at Santana Row and in Hoboken, New Jersey, showcased successful execution through these strategic construction alliances.

| Partnership Type | Role | 2024 Impact/Example |

|---|---|---|

| Development & Construction Firms | Physical transformation of properties, project execution | Santana Row and Hoboken residential projects |

| Financial Institutions | Capital access (debt & equity) | $500 million senior unsecured notes issued in Feb 2024 |

| Local Governments & Community Orgs | Regulatory navigation, community integration | Streamlined approvals for urban regeneration projects |

What is included in the product

A structured framework that analyzes and visualizes the operational and strategic elements of a federal agency or government program.

It maps out key components like customer segments (citizens, other agencies), value propositions (public services, policy implementation), and revenue streams (appropriations, fees).

Streamlines the complex process of defining and refining government services, transforming abstract ideas into actionable plans.

Offers a structured approach to identify and address inefficiencies within public sector operations, leading to improved service delivery.

Activities

Federal Realty's primary focus is acquiring prime retail and mixed-use properties, often in affluent, densely populated areas. They then strategically redevelop these assets to boost their value through renovations and expansions.

In 2024, Federal Realty continued this strategy, notably acquiring Town Center Plaza and Town Center Crossing in Leawood, Kansas, demonstrating their commitment to enhancing their portfolio with high-quality locations.

A core activity involves the leasing of commercial and residential properties, alongside the strategic selection of tenants. This process aims to cultivate a mix of businesses that complement each other, fostering lively spaces that encourage customer visits and maintain consistent occupancy. As of the first quarter of 2025, the company's commercial spaces reported an impressive 93.6% occupancy rate.

Ongoing property management and operational excellence are crucial for maintaining the quality and appeal of a real estate portfolio. This encompasses daily tasks like tenant relations, rent collection, and lease administration, alongside proactive maintenance to preserve asset value. For instance, in 2024, leading real estate investment trusts (REITs) reported an average occupancy rate of 95%, underscoring the importance of efficient operations in retaining tenants.

Security and ensuring a compelling experience for consumers and tenants are also paramount. This involves implementing robust security measures and creating inviting environments, whether for retail spaces or residential units. Positive tenant experiences directly translate to higher retention rates and reduced turnover costs, a key factor in profitability.

Operational metrics serve as a cornerstone of creditworthiness for real estate businesses. Lenders and investors closely examine key performance indicators such as net operating income (NOI), debt service coverage ratio (DSCR), and tenant satisfaction scores. For example, a DSCR consistently above 1.25 is generally considered strong, indicating sufficient cash flow to cover debt obligations.

Capital Allocation and Financial Management

Effective capital allocation is a cornerstone activity, guiding strategic decisions on investments, divestitures, and financing structures. This involves diligently managing debt levels, ensuring robust liquidity, and strategically deploying capital for accretive acquisitions and developments that bolster long-term shareholder value.

Federal Realty's financial management prowess is evident in its strong liquidity position. As of March 2025, the company reported a substantial $1.5 billion in total liquidity, providing a solid foundation for operational flexibility and strategic growth initiatives.

- Strategic Investment Decisions: Prioritizing capital deployment towards opportunities that promise enhanced long-term value creation.

- Debt Management: Maintaining prudent debt levels to ensure financial stability and flexibility.

- Liquidity Maintenance: Ensuring sufficient liquid assets to meet short-term obligations and capitalize on emerging opportunities.

- Accretive Growth Initiatives: Funding acquisitions and developments that are expected to increase earnings per share.

Sustainability Initiatives

Federal Realty is actively pursuing sustainability initiatives to lessen its environmental footprint and boost renewable energy use. A key focus involves reducing greenhouse gas emissions across its portfolio, demonstrating a commitment to climate action.

The company is also expanding its onsite solar generating capacity. For instance, by the end of 2023, Federal Realty had installed solar panels on numerous properties, contributing to a cleaner energy mix and operational cost savings.

- Environmental Impact Reduction: Federal Realty is committed to lowering its carbon emissions, aligning with global climate goals.

- Renewable Energy Expansion: The company is increasing its onsite solar power generation capacity to reduce reliance on traditional energy sources.

- Investor and Tenant Attraction: These sustainability efforts are designed to appeal to environmentally conscious investors and tenants, enhancing the company's market position.

- Strategic Alignment: Sustainability initiatives are integrated into Federal Realty's core business strategy, ensuring long-term value creation.

Federal Realty's key activities revolve around strategic property acquisition, redevelopment, and meticulous leasing to cultivate vibrant retail and mixed-use environments. They actively manage their portfolio through ongoing property upkeep, tenant relations, and operational efficiency to maintain asset value and tenant satisfaction. Furthermore, the company prioritizes robust financial management, including prudent debt handling and maintaining strong liquidity, alongside a growing commitment to sustainability through renewable energy adoption and emissions reduction.

| Key Activity | Description | 2024/2025 Data Point |

| Property Acquisition & Redevelopment | Acquiring and enhancing prime retail and mixed-use properties. | Acquired Town Center Plaza and Town Center Crossing in Leawood, Kansas (2024). |

| Leasing & Tenant Mix | Selecting tenants to create complementary business environments and ensure high occupancy. | Commercial space occupancy rate reached 93.6% as of Q1 2025. |

| Property Management & Operations | Maintaining asset quality and tenant satisfaction through daily operations and proactive maintenance. | REITs reported average occupancy of 95% in 2024, highlighting operational importance. |

| Financial Management & Capital Allocation | Strategic deployment of capital, debt management, and liquidity maintenance for long-term value. | Reported $1.5 billion in total liquidity as of March 2025. |

| Sustainability Initiatives | Reducing environmental impact and increasing renewable energy usage. | Installed solar panels on numerous properties by end of 2023. |

Full Document Unlocks After Purchase

Business Model Canvas

The Federal Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive tool you'll gain access to. Once your order is complete, you will download this same, fully populated Federal Business Model Canvas, ready for immediate application and strategic planning.

Resources

Federal Realty's core asset is its meticulously curated portfolio of high-quality retail and mixed-use properties. These are strategically situated in desirable, densely populated coastal areas, areas known for their economic vitality and limited new development opportunities. For instance, flagship properties like Santana Row in California, Pike & Rose in Maryland, and Assembly Row in Massachusetts exemplify this focus, offering robust demand and significant competitive advantages.

Access to substantial financial capital, including equity, debt, and strong liquidity, is a crucial resource for acquisitions, developments, and operations. For instance, in 2024, major corporations often maintain significant cash reserves, with companies like Apple consistently reporting hundreds of billions in cash and marketable securities, enabling swift strategic moves.

Their robust balance sheet, with a conservative debt-to-equity ratio and strong credit ratings, enables disciplined capital management and growth. A healthy balance sheet, characterized by manageable leverage, allows businesses to secure favorable financing terms, a key factor in achieving sustainable expansion and weathering economic downturns.

The company’s seasoned management team, boasting an average of 15 years in real estate, is a cornerstone of its success. This includes specialized property managers, adept leasing professionals, and visionary development experts who collectively steer strategic execution and operational efficiency.

Human capital, particularly in areas like tenant relations and market analysis, is a critical asset. In 2024, employee retention rates reached 92%, underscoring the value placed on experienced personnel who drive growth and maintain strong client relationships.

Brand Reputation and Market Relationships

Federal Realty Investment Trust (FRT) leverages its robust brand reputation as a premier owner and operator of high-quality retail and mixed-use properties. This strong standing is a critical intangible asset, enabling the company to attract and retain top-tier national and local retail tenants, thereby ensuring high occupancy rates and consistent rental income. For instance, as of the first quarter of 2024, FRT reported a 95.2% portfolio occupancy rate, underscoring the desirability of its locations and tenant mix.

The trust's established market relationships are equally vital. These deep-seated connections with retailers, developers, and local communities facilitate seamless new acquisitions, strategic partnerships, and the successful redevelopment of existing assets. FRT's proactive approach to tenant relations and its consistent delivery on property performance have fostered a loyal tenant base, which is a significant competitive advantage in the dynamic real estate market.

- Brand Strength: FRT is recognized for its focus on premium, necessity-based retail and mixed-use developments, often in affluent suburban markets.

- Tenant Relationships: The company maintains strong, long-term partnerships with a diverse range of national and local retailers, contributing to its high occupancy.

- Market Access: Established relationships facilitate access to attractive acquisition opportunities and collaborative ventures, driving portfolio growth.

- Reputational Capital: A positive brand image enhances FRT's ability to secure favorable financing and attract investment capital.

Proprietary Market Data and Analytics

Access to and use of proprietary market data, including demographics, consumer behavior, and retail trends, are essential for informed decision-making in target markets. This data-driven approach guides site selection, tenant mix optimization, and redevelopment initiatives, ultimately boosting property performance.

For instance, in 2024, retail analytics firms provided insights showing that consumer spending in urban centers increased by an average of 5.2% compared to 2023, driven by a resurgence in foot traffic and experiential retail. This data directly influences where new retail spaces are developed and which types of businesses are best suited for those locations.

- Demographic Shifts: Proprietary data highlights an increasing concentration of young professionals aged 25-34 in downtown districts, influencing demand for specific retail and dining options.

- Consumer Behavior: Analytics reveal a 15% year-over-year increase in online-to-offline shopping, emphasizing the need for retailers to integrate digital and physical store experiences.

- Retail Trends: Market data from late 2024 indicates a strong consumer preference for sustainable and locally sourced products, impacting tenant curation for shopping centers.

- Performance Metrics: By analyzing sales data and foot traffic from similar locations, businesses can project revenue with greater accuracy, with some analytics platforms achieving up to 85% accuracy in sales forecasting for new store openings.

Federal Realty's key resources include its prime real estate portfolio, strong financial backing, and experienced leadership. Their carefully selected properties in vibrant, high-demand locations are a significant asset. Furthermore, their robust balance sheet and access to capital allow for strategic growth and development. The company's skilled management team and dedicated human capital ensure operational excellence and strong tenant relationships.

The company's brand reputation as a premier property owner and operator is a critical intangible asset. This strong standing helps attract and retain high-quality tenants, ensuring consistent rental income and high occupancy rates. For example, as of Q1 2024, Federal Realty reported a 95.2% portfolio occupancy rate, demonstrating the appeal of its locations and tenant mix.

Established market relationships with retailers, developers, and communities are vital for acquisitions and partnerships. These deep connections facilitate growth and successful asset redevelopment. Federal Realty's commitment to tenant satisfaction has cultivated a loyal tenant base, providing a significant competitive edge in the real estate market.

Proprietary market data, including consumer behavior and retail trends, is essential for informed decisions. This data-driven approach guides site selection and tenant mix optimization, enhancing property performance. For instance, in 2024, retail analytics showed a 5.2% increase in urban consumer spending, influencing development strategies and business suitability for specific locations.

| Resource Category | Specific Resource | 2024 Relevance/Data Point |

|---|---|---|

| Physical Assets | Real Estate Portfolio | 95.2% portfolio occupancy rate (Q1 2024) |

| Financial Capital | Equity, Debt, Liquidity | Major corporations held significant cash reserves in 2024; Apple reported hundreds of billions in cash and marketable securities. |

| Financial Strength | Balance Sheet & Credit Ratings | Conservative debt-to-equity ratios enable favorable financing terms. |

| Human Capital | Management Team & Employees | Average of 15 years in real estate; 92% employee retention rate in 2024. |

| Intangible Assets | Brand Reputation | Enables attraction of top-tier tenants, ensuring consistent rental income. |

| Market Relationships | Retailer & Developer Connections | Facilitate acquisitions, partnerships, and successful redevelopment. |

| Information Assets | Proprietary Market Data | Guides site selection and tenant mix; 5.2% increase in urban consumer spending (2024). |

Value Propositions

Federal Realty focuses on premier locations within affluent markets, offering retail and mixed-use properties in densely populated areas. These locations boast strong demographics and significant barriers to entry, ensuring a robust customer base for tenants.

This strategic positioning translates into stable, long-term asset value for investors. For instance, in 2024, Federal Realty's portfolio continued to demonstrate resilience, with occupancy rates remaining high in its key markets, reflecting the enduring appeal of its prime locations.

Federal Realty Investment Trust (FRT) excels by curating a tenant mix that blends national brands with unique local businesses, often incorporating dining and entertainment. This strategy fosters vibrant, experiential environments, drawing substantial foot traffic and creating compelling consumer destinations.

In 2024, FRT's focus on experiential retail proved resilient. While overall retail sales saw moderate growth, properties with strong experiential components, like those featuring diverse dining and entertainment options, outperformed. For example, their centers often boast occupancy rates exceeding 95%, demonstrating the sustained demand for well-curated retail experiences.

Federal Realty's dedication to sustainability is evident in its adoption of green building practices and renewable energy sources, providing tenants and residents with eco-conscious living and working environments. This commitment not only aligns with growing environmental awareness but also contributes to long-term operational cost savings.

The company's portfolio features modern, well-maintained properties that integrate advanced technologies, boosting operational efficiency and tenant satisfaction. For instance, in 2023, Federal Realty reported a 4.4% increase in same-store net operating income (NOI) for its retail segment, reflecting the appeal and performance of its updated assets.

Long-Term Value and Consistent Returns for Investors

Federal Realty Investment Trust (FRT) delivers enduring value to investors through a strategy centered on stable income generation and long-term capital preservation. Its impressive track record includes 57 consecutive years of dividend growth, a testament to its commitment to shareholder returns.

The REIT's strategic acquisition and management of high-quality, well-located retail properties in resilient, affluent suburban markets form the bedrock of its reliable investment profile. This focus ensures consistent performance even amidst economic fluctuations.

- Dividend Growth: 57 consecutive years of increasing dividends.

- Asset Quality: Focus on high-quality, necessity-based retail centers.

- Market Resilience: Investments in affluent, high-barrier-to-entry suburban markets.

- Total Shareholder Return: Demonstrated ability to provide competitive long-term returns.

Strategic Redevelopment and Growth Opportunities

We offer retailers and businesses strategic redevelopment opportunities to enhance their presence in key markets. Our mixed-use developments provide integrated living, working, and shopping environments, designed to meet changing consumer needs.

For instance, in 2024, retail vacancy rates in prime urban centers saw a slight increase, making strategic redevelopment crucial for businesses looking to secure and optimize their physical footprint. Our projects aim to revitalize these areas, attracting foot traffic and fostering community engagement.

- Prime Location Access: Securing visibility and customer reach in desirable, high-traffic areas.

- Integrated Environments: Creating dynamic spaces that blend residential, commercial, and retail functions.

- Adaptability to Market Trends: Developing flexible spaces that can evolve with consumer preferences and economic shifts.

- Enhanced Business Performance: Driving increased sales and brand presence through optimized store locations and appealing environments.

Federal Realty provides tenants with access to prime, high-barrier-to-entry locations in affluent markets, ensuring consistent customer traffic. Our curated tenant mix, blending national brands with local favorites, creates vibrant, experiential destinations that drive footfall and sales.

We focus on well-maintained, modern properties that integrate sustainability and technology, enhancing operational efficiency and tenant satisfaction. This approach ensures our properties remain attractive and competitive, supporting tenant success.

Our value proposition includes offering strategic redevelopment opportunities in key markets, creating integrated living, working, and shopping environments. This adaptability to evolving consumer needs helps businesses thrive.

| Value Proposition | Description | Key Benefit | 2024 Data/Trend |

|---|---|---|---|

| Prime Location Access | Access to affluent, high-traffic, high-barrier-to-entry markets. | Consistent customer base and brand visibility. | Continued high occupancy in core markets, exceeding 95% in many centers. |

| Experiential Environments | Curated tenant mix of national brands, local businesses, dining, and entertainment. | Increased foot traffic and tenant sales. | Properties with strong experiential components outperformed broader retail trends. |

| Asset Quality & Sustainability | Modern, well-maintained properties with green building practices and technology integration. | Operational efficiency, tenant satisfaction, and long-term asset value. | Reported 4.4% increase in same-store NOI for retail in 2023, reflecting asset appeal. |

| Redevelopment Opportunities | Strategic redevelopment of mixed-use properties in key markets. | Enhanced business presence and adaptation to changing consumer needs. | Addressing demand for optimized physical footprints amidst evolving urban retail landscapes. |

Customer Relationships

Federal Realty Investment Trust (FRIT) cultivates strong tenant connections via specialized leasing and property management teams. This direct engagement ensures prompt attention to tenant requirements, facilitating lease renewals and efficient property operations, thereby nurturing enduring business alliances.

In 2024, FRIT's focus on these dedicated teams contributed to a strong occupancy rate, with their portfolio averaging 95.4% leased as of Q3 2024. This hands-on approach is crucial for maintaining tenant satisfaction and securing long-term lease agreements, which are vital for stable revenue streams.

Federal fosters robust investor relationships through consistent, transparent financial reporting, including quarterly earnings calls and detailed investor presentations. In 2024, the company held over 15 investor events, providing direct access to leadership and reinforcing its commitment to open communication.

Federal Realty actively cultivates strong ties with the communities where its properties are located. This is achieved through a variety of initiatives, including hosting local events and forging strategic partnerships with neighborhood organizations.

By integrating its properties into the local fabric, Federal Realty enhances their attractiveness and builds positive relationships with residents and businesses alike. For instance, in 2024, the company supported over 500 community events across its portfolio, demonstrating a commitment to local engagement.

Online Portals and Digital Communication

Online portals and digital communication are revolutionizing how property managers connect with tenants and residents. These platforms offer a centralized hub for essential information, allowing for seamless submission of service requests and quick dissemination of community updates. This digital approach not only boosts convenience but significantly elevates the overall customer experience within managed properties.

In 2024, the demand for digital property management solutions surged. Reports indicate that over 70% of renters prefer online payment options, and 65% expect to submit maintenance requests digitally. This shift underscores the critical importance of robust online portals for fostering positive tenant relationships and operational efficiency.

- Convenience: Tenants can access lease documents, pay rent, and submit maintenance requests anytime, anywhere.

- Efficiency: Streamlined communication reduces response times and administrative overhead for property managers.

- Engagement: Digital platforms facilitate community building through newsletters, event announcements, and resident forums.

- Data Insights: Tracking digital interactions provides valuable data on tenant needs and service performance.

Tailored Solutions for Key Tenants

Federal Realty Investment Trust (FRT) excels in cultivating strong relationships with its anchor tenants and significant partners by offering bespoke leasing arrangements and proactive strategic assistance. This dedication to understanding and accommodating unique tenant requirements is a cornerstone of their customer relationship strategy.

This personalized approach is crucial for securing and retaining high-value tenants. For instance, in 2023, FRT reported a strong occupancy rate of 94.4% across its portfolio, underscoring the success of its tenant retention efforts. By providing tailored solutions, FRT ensures that these key businesses can thrive within its properties, thereby solidifying the overall tenant mix.

- Anchor Tenant Focus: FRT actively engages with anchor tenants to develop leasing structures that align with their long-term operational and financial goals.

- Strategic Partnership: Beyond standard leases, FRT offers strategic support, including market insights and operational collaboration, to foster mutual growth.

- Tenant Retention: In 2023, FRT's redevelopment and remerchandising efforts contributed to maintaining high occupancy, with key tenants often renewing leases due to these tailored solutions.

- Synergistic Mix: By catering to the specific needs of major tenants, FRT cultivates a vibrant and complementary mix of businesses that enhances the appeal of its shopping centers.

Federal Realty Investment Trust (FRIT) prioritizes building lasting connections with its tenants through dedicated leasing and property management teams. This direct engagement ensures tenant needs are met promptly, fostering lease renewals and smooth property operations, which are vital for sustained business relationships.

In 2024, FRIT's focus on these specialized teams helped maintain a robust occupancy rate, with their portfolio averaging 95.4% leased by Q3 2024. This hands-on approach is key to tenant satisfaction and securing long-term leases, essential for stable revenue.

FRIT also cultivates strong investor relationships through transparent financial reporting and direct engagement, holding over 15 investor events in 2024 to foster open communication.

The company actively engages with local communities through events and partnerships, supporting over 500 community events in 2024 to enhance property appeal and build positive local ties.

| Relationship Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Tenant Relationships | Specialized leasing & property management, direct engagement | 95.4% portfolio occupancy (Q3 2024) |

| Investor Relations | Transparent financial reporting, investor events | Over 15 investor events held |

| Community Engagement | Local event support, strategic partnerships | Supported over 500 community events |

Channels

Federal Realty relies on its dedicated in-house leasing and sales teams to directly manage the marketing and leasing of its extensive commercial and residential properties. This direct approach fosters specialized knowledge and allows for immediate, personalized interaction with potential tenants, enhancing the leasing process.

In 2024, Federal Realty's strategic use of these internal teams contributed to a robust leasing pipeline, with a significant portion of new leases and renewals being secured through direct efforts. This hands-on management ensures a deep understanding of tenant needs and market dynamics, driving occupancy rates and rental income.

Partnering with external real estate brokers and commercial agencies significantly expands Federal Realty's market presence. These relationships provide access to a wider network of potential tenants and buyers, crucial for filling vacancies and driving sales.

In 2024, the commercial real estate sector saw a dynamic interplay between brokers and agencies, with many reporting increased deal volume in specific sub-sectors like industrial and multifamily properties. For instance, some major brokerage firms reported handling billions in transactions across the nation, underscoring their vital role in connecting sellers with buyers and landlords with tenants.

Federal Realty's company website is a crucial hub, not just for listing their diverse portfolio of retail and mixed-use properties, but also as a vital resource for investors. Here, they provide in-depth financial reports, such as their 2023 annual report detailing revenue streams and property performance, and corporate governance information. This platform is key to attracting both prospective tenants seeking prime locations and strategic partners for future developments.

Beyond property showcases, Federal Realty leverages its digital platforms for comprehensive corporate communications. This includes disseminating their latest sustainability reports, highlighting their commitment to environmental, social, and governance (ESG) initiatives, which are increasingly important to stakeholders. They also use these channels to share timely news and updates, ensuring transparency and keeping investors and the public informed about company developments and market positioning.

Investor Relations Portals and Financial News Outlets

Federal Realty Investment Trust (FRT) leverages its investor relations portal and financial news outlets to provide transparent communication with its diverse investor base. This includes making financial results, annual reports, and other crucial updates readily available, ensuring that financially literate decision-makers have access to the information they need for informed analysis.

FRT's commitment to accessibility is evident in its strategic use of multiple channels. For instance, in their Q1 2024 earnings release, FRT highlighted key operational metrics and financial performance, which were disseminated through their dedicated investor relations website and widely accessible financial news platforms. This approach caters to individual investors, financial professionals, and business strategists alike.

- Investor Relations Website: FRT maintains a comprehensive section on its corporate website dedicated to investor relations, offering SEC filings, earnings call transcripts, and presentations.

- Financial News Outlets: The company utilizes major financial news services to distribute press releases and financial reports, ensuring broad reach among market participants.

- SEC Filings: All official financial disclosures, including 10-K and 10-Q reports, are filed with the Securities and Exchange Commission, providing a standardized and verifiable source of information.

- Q1 2024 Performance: Federal Realty reported Funds From Operations (FFO) of $1.77 per diluted share for the first quarter of 2024, a figure readily accessible through these communication channels.

On-site Property Presence and Community Events

The physical presence of properties, such as mixed-use developments, acts as a direct channel for customer engagement. These locations, often featuring retail, residential, and office spaces, become hubs for interaction. For example, a prominent mixed-use development in a major city might attract thousands of visitors daily, offering a tangible connection to the business's offerings.

Hosting community events further strengthens this channel by creating vibrant public spaces. These events, ranging from farmers' markets to seasonal festivals, draw in both consumers and local businesses. In 2024, many such destinations reported significant increases in foot traffic and local business participation during these organized activities, directly showcasing the value proposition of the mixed-use destination.

- Physical Properties as Engagement Hubs: Mixed-use developments serve as direct touchpoints, attracting daily visitors and facilitating organic interaction with offerings.

- Community Events Drive Traffic: Hosting events like festivals and markets boosts foot traffic and fosters local business partnerships, enhancing the destination's appeal.

- Showcasing Value Proposition: The combination of physical presence and community engagement directly demonstrates the benefits and attractions of the mixed-use concept.

- Economic Impact: In 2024, reports indicated that successful community events at mixed-use properties led to an average 15% increase in local retail sales during event periods.

Federal Realty employs a multi-faceted channel strategy, combining direct in-house expertise with external partnerships and robust digital platforms. This approach ensures broad market reach and effective communication with diverse stakeholders.

In 2024, Federal Realty's direct leasing teams were instrumental in securing new leases and renewals, contributing significantly to occupancy rates. Simultaneously, collaborations with external brokers expanded market penetration, a common strategy in a year where brokerage firms reported handling billions in transactions nationwide.

The company's website and investor relations portal serve as critical channels for transparency, providing financial reports and ESG updates. This digital presence, alongside broader financial news outlets, ensures investors have timely access to information, such as the Q1 2024 FFO of $1.77 per diluted share.

Physical properties, particularly mixed-use developments, function as direct engagement channels, amplified by community events that boost foot traffic and local business participation. These events in 2024 saw an average 15% increase in local retail sales during their occurrence.

Customer Segments

National and regional retailers are a cornerstone customer segment for Federal Realty, representing established brands and chains that prioritize high-traffic, affluent markets. These tenants are crucial for driving significant footfall and ensuring the financial health of Federal Realty's shopping centers.

In 2024, Federal Realty continued to attract these key players, with their portfolio boasting a high occupancy rate, often exceeding 95% in prime locations. This strong demand from national and regional retailers underscores their confidence in Federal Realty's ability to deliver consistent customer engagement and sales performance.

Federal Realty Investment Trust actively courts local and independent businesses, recognizing their crucial role in crafting distinctive and vibrant communities. These smaller enterprises often bring specialized products or services that larger chains can't replicate, thereby enriching the overall appeal of Federal Realty's shopping centers.

For instance, in 2024, Federal Realty's portfolio, which includes properties like Pike & Rose in North Bethesda, Maryland, showcases a deliberate mix of national brands alongside a significant number of local boutiques and restaurants. This strategy aims to foster a sense of place and cater to consumers seeking authentic experiences, driving foot traffic and tenant sales.

Federal Realty's residential tenants are drawn to their mixed-use properties for the promise of an urban, walkable lifestyle. These individuals and families prioritize convenience, seeking environments where retail, dining, and entertainment are seamlessly integrated into their living spaces, fostering a vibrant neighborhood feel.

In 2024, Federal Realty's portfolio continued to attract this demographic, with occupancy rates remaining robust across its urban and suburban town centers. The company's focus on high-quality living spaces and curated amenities directly addresses the desires of tenants who value a dynamic community experience over traditional suburban living.

Institutional and Individual Investors

Federal Realty’s customer base includes a wide array of investors, both large institutions and individual shareholders. These clients are primarily seeking consistent income streams and long-term growth in their investments, with a particular interest in well-managed, high-quality real estate assets.

The company's strong track record of dividend payments is a significant draw for this segment. For example, Federal Realty has increased its annual dividend for 56 consecutive years, a testament to its financial stability and commitment to shareholder returns. This consistent dividend growth is a key factor for investors focused on reliable income generation.

Institutional investors, such as pension funds, mutual funds, and exchange-traded funds (ETFs), often allocate significant capital to real estate investment trusts (REITs) like Federal Realty for portfolio diversification and income stability. Individual investors, ranging from novice to experienced, also find appeal in the company's predictable income and potential for capital appreciation, especially those prioritizing a stable dividend history.

- Diverse Investor Profile: Encompasses institutional funds and individual shareholders.

- Investment Objectives: Focus on stable income, long-term capital appreciation, and quality real estate exposure.

- Dividend Appeal: Federal Realty's 56-year streak of consecutive annual dividend increases is a major attraction.

- Asset Class Preference: Interest in high-quality, well-managed real estate assets.

Office Tenants (within Mixed-Use)

Federal Realty's office tenants within its mixed-use developments seek premium, strategically positioned workspaces. These tenants value immediate access to retail, dining, and entertainment options, fostering a dynamic work-life balance. In 2024, Federal Realty's portfolio continued to attract businesses prioritizing employee well-being and convenience.

This segment is crucial for generating stable, recurring revenue for Federal Realty. The demand for well-appointed office spaces integrated with lifestyle amenities remains strong, supporting consistent occupancy rates and rental income.

- Modern Workspaces: Tenants are drawn to updated facilities and efficient layouts.

- Location Advantage: Proximity to transit and complementary businesses is a key driver.

- Diversified Income: Office leases contribute significantly to the company's overall revenue streams.

- Tenant Retention: The integrated nature of mixed-use properties often leads to higher tenant satisfaction and retention.

Federal Realty's customer segments are diverse, encompassing national and regional retailers, local businesses, residential tenants, investors, and office tenants. Each group is attracted by Federal Realty's strategic focus on high-quality, mixed-use properties that offer convenience, vibrant communities, and stable returns.

In 2024, Federal Realty's portfolio demonstrated resilience across these segments, with strong occupancy rates reflecting sustained demand. The company's ability to attract and retain a broad customer base is a key driver of its consistent financial performance and appeal to investors seeking reliable income and growth.

| Customer Segment | Key Characteristics | 2024 Relevance |

|---|---|---|

| National & Regional Retailers | High-traffic, affluent market focus; drive footfall. | High occupancy rates in prime locations, indicating strong demand and confidence. |

| Local & Independent Businesses | Offer unique products/services; enrich community appeal. | Contribute to distinctive tenant mix, fostering authentic experiences and driving traffic. |

| Residential Tenants | Seek urban, walkable lifestyles; prioritize convenience. | Robust occupancy in mixed-use centers, highlighting demand for integrated living. |

| Investors (Institutional & Individual) | Seek income, long-term growth, quality real estate. | Attracted by 56 consecutive years of dividend increases, signifying financial stability. |

| Office Tenants | Desire premium, strategically located workspaces with lifestyle amenities. | Contribute to stable revenue; demand for integrated work-life balance remains strong. |

Cost Structure

Property acquisition and development represent a significant drain on capital for many businesses. In 2024, the average cost of commercial land acquisition across major US metropolitan areas saw an increase, with some markets experiencing a 5-7% rise year-over-year due to demand.

Construction expenses, encompassing materials, labor, and permits, are also substantial. For instance, the average cost to build a new commercial property in 2024 could range from $200 to $500 per square foot, depending on the location and complexity of the build.

These outlays are critical capital expenditures, directly fueling a company's physical expansion and operational capacity. Associated fees, such as legal, architectural, and engineering services, further contribute to these upfront investments, often adding 10-15% to the total project cost.

Property operating and maintenance expenses represent the ongoing costs vital for keeping a real estate portfolio functional and valuable. These include essential outlays like utilities, property taxes, and insurance premiums, all contributing to the preservation of asset worth and tenant well-being.

In 2024, for example, a significant commercial real estate owner might allocate 15-20% of their gross rental income towards these recurring operational costs, a figure that can fluctuate based on property type and location.

This category also encompasses essential repairs and common area maintenance, ensuring that buildings remain safe, attractive, and compliant with regulations, thereby directly impacting tenant retention and lease renewals.

Tenant improvement allowances, which are funds provided to tenants to customize their leased space, represent a significant cost. In 2024, these allowances can range from $50 to $150 per square foot, depending on the market and the class of the property. For example, a 10,000 square foot retail space could incur $500,000 to $1.5 million in tenant improvement costs.

Leasing commissions, paid to brokers for securing new tenants, are another key expense. Typically, these commissions are 4% to 6% of the total lease value. A 10-year lease valued at $300,000 annually would result in a commission of $120,000 to $180,000.

Additional costs include tenant incentives such as free rent periods or moving allowances, designed to attract and retain desirable tenants. These can add another 1% to 3% to the overall lease cost, impacting the net effective rent for the landlord. These expenditures are vital for ensuring consistent occupancy and driving rental income growth.

Debt Service and Capital Financing Costs

Debt service and capital financing represent a significant cost for many businesses, encompassing interest payments on loans and bonds, as well as fees for securing and maintaining credit lines. In 2024, for instance, the U.S. federal government's interest payments on its debt were projected to exceed $870 billion, highlighting the substantial nature of these expenses. Effective management of these costs is crucial for ensuring a company's financial stability and operational flexibility.

- Interest Expenses: The cost of borrowing money, paid to lenders or bondholders.

- Financing Fees: Costs incurred when obtaining capital, such as underwriting fees for bond issuances or arrangement fees for credit facilities.

- Credit Facility Charges: Ongoing costs associated with maintaining access to credit, like commitment fees on unused portions of a loan.

- Impact on Liquidity: High debt service costs can strain cash flow, potentially limiting a business's ability to invest or meet short-term obligations.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Federal Realty encompass a range of corporate overhead costs. These include salaries for executive leadership and administrative staff, as well as other operating expenses not tied to specific properties.

Federal Realty maintains a strong focus on cost control measures to manage its G&A effectively. For instance, in 2023, the company reported G&A expenses of approximately $114.8 million. This represents a slight increase from $112.1 million in 2022, reflecting ongoing investments in operational efficiency and corporate functions.

- Corporate Overhead: Costs associated with running the central business operations.

- Executive and Employee Salaries: Compensation for management and administrative personnel.

- Administrative Support: Expenses for departments like HR, finance, and legal.

- Cost Control Focus: Federal Realty actively seeks to optimize these expenses.

Cost structure within the Federal Business Model Canvas details the expenses incurred to operate a business. For Federal Realty Investment Trust (FRT), key cost drivers include property operating expenses, tenant improvements, leasing commissions, and general and administrative costs. These are essential for maintaining and growing its portfolio of shopping centers.

Property operating expenses, covering utilities, taxes, and insurance, are critical for asset upkeep. In 2024, these costs for a significant commercial real estate owner might represent 15-20% of gross rental income. Tenant improvement allowances, as of 2024, can range from $50 to $150 per square foot, impacting profitability on new leases.

Leasing commissions, typically 4-6% of the total lease value, and tenant incentives further add to the cost of securing and retaining tenants. FRT's General and Administrative expenses were approximately $114.8 million in 2023, indicating the scale of corporate overhead management.

| Cost Category | 2023/2024 Data Point | Impact |

|---|---|---|

| Property Operating Expenses | 15-20% of Gross Rental Income (Estimate) | Maintains asset value and tenant experience |

| Tenant Improvement Allowances | $50 - $150 per sq ft (2024 estimate) | Customization for tenants, impacts net lease income |

| Leasing Commissions | 4-6% of Total Lease Value | Securing new tenants |

| General & Administrative (G&A) | $114.8 million (2023) | Corporate overhead and operational efficiency |

Revenue Streams

The primary revenue stream for many federal business models, particularly those involving real estate holdings, is rental income from commercial properties. This income is generated through leases for retail spaces, office buildings, and other commercial ventures.

These rentals typically comprise base rents, which are fixed amounts, and percentage rents, often tied to a tenant's sales performance. Additionally, common area maintenance (CAM) reimbursements from tenants contribute to the overall revenue, covering operational costs.

In 2024, the U.S. General Services Administration (GSA), a significant federal entity managing government-owned and leased space, reported substantial rental income. For instance, the GSA's Public Buildings Service generated billions in revenue through its vast portfolio of federal buildings.

For its mixed-use developments, revenue is also generated from the rental of residential units. This strategy diversifies income streams and taps into the strong demand for integrated living experiences, particularly in bustling urban centers.

In 2024, the residential rental market continued to show resilience. For instance, average rents in major metropolitan areas saw an increase of approximately 5-7% year-over-year, reflecting sustained demand and limited new supply in many desirable locations. This provides a stable and predictable revenue source.

Federal Realty Investment Trust (FRIT) generates revenue through the strategic sale of assets that are either mature or no longer considered core to its portfolio. This approach allows the company to efficiently recycle capital, redirecting it towards investments in higher-growth potential opportunities.

A notable example of this strategy in action was the sale of the Hollywood Boulevard retail portfolio in 2023. This disposition, part of FRIT's ongoing portfolio optimization, freed up capital for reinvestment.

Development and Redevelopment Fees

While not a direct, recurring revenue stream for a Real Estate Investment Trust (REIT), development and redevelopment fees represent a significant value creation mechanism. Successful projects can lead to increased rental income or enhanced property sale values, indirectly boosting overall returns.

These fees are often realized through the sale of a developed property or by increasing the net asset value of existing properties. For instance, a REIT might undertake a major renovation, adding value that translates into higher lease rates upon completion.

In 2024, the real estate development sector saw continued activity, with many REITs focusing on strategic repositioning of assets. This trend is expected to drive substantial value accretion through these development efforts.

- Value Accretion: Development and redevelopment projects increase the underlying value of a REIT's portfolio.

- Rental Income Growth: Repositioned or newly developed properties often command higher rental rates.

- Capital Appreciation: Successful sales of developed properties can yield significant capital gains.

- Strategic Repositioning: REITs actively engage in redevelopment to adapt to market demands and enhance asset performance.

Lease Termination Fees and Other Income

Lease termination fees represent a supplemental revenue stream for federal property management. These fees, often levied when a tenant breaks a lease early, help offset potential vacancy costs and administrative burdens. For instance, in 2024, a significant portion of federal agencies reported collecting such fees, contributing to their operational budgets.

Beyond termination fees, other income sources include parking fees, often charged for employee or public parking on federal properties, and various miscellaneous property-related services. These might encompass utility reimbursements or specialized maintenance charges. While not the primary revenue driver, these ancillary services collectively bolster the overall financial performance.

- Lease Termination Fees: Income generated from early lease terminations by tenants.

- Parking Fees: Revenue collected from parking facilities on federal properties.

- Miscellaneous Property Services: Income from other property-related services, such as utility reimbursements.

- Contribution to Revenue: These streams add to overall income but are typically smaller than base rental revenue.

Federal entities, particularly those managing real estate portfolios, can generate revenue through asset sales. This involves divesting properties that no longer align with strategic objectives or have reached a mature phase. Such sales allow for capital reallocation to more promising ventures.

In 2024, the disposition of underperforming or non-core assets remained a key strategy for many real estate investment trusts. For example, some REITs reported significant capital gains from selling older retail centers and reinvesting in logistics or multifamily properties, which showed stronger rental growth prospects.

| Asset Type Sold | Year of Sale | Approximate Sale Price (USD Billions) | Capital Gain Realized (USD Millions) |

|---|---|---|---|

| Office Building Portfolio (Midtown Manhattan) | 2024 | 1.2 | 150 |

| Regional Mall (Midwest) | 2024 | 0.3 | 45 |

| Industrial Warehouse (Texas) | 2023 | 0.5 | 70 |

Business Model Canvas Data Sources

The Federal Business Model Canvas is built using government budget allocations, agency performance metrics, and legislative mandates. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting public sector operations.