Federal Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federal Bundle

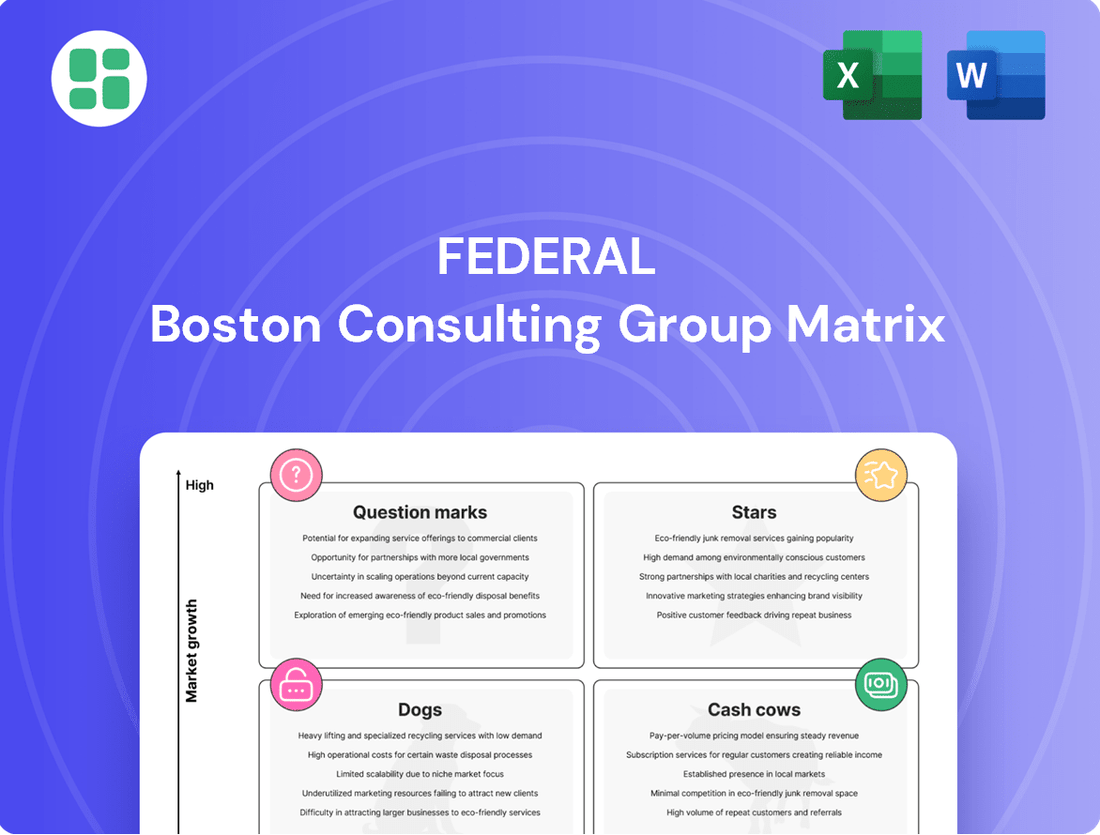

Uncover the strategic positioning of key products within the Federal landscape using the BCG Matrix. This powerful tool categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks, offering a visual roadmap for resource allocation. Get the full BCG Matrix for a comprehensive breakdown and actionable insights to optimize your portfolio.

Stars

Federal Realty's mixed-use properties, exemplified by Santana Row and its new phases like Lot 12, are prime examples of "Stars" within a Federal BCG Matrix. These developments strategically blend retail, residential, and office components in sought-after, affluent urban centers, showcasing robust demand and substantial value generation.

The significant capital allocation towards these projects, such as the $145 million projected investment for Lot 12 at Santana Row, underscores the company's focus on capitalizing on high growth opportunities in prime geographic markets. This strategy aims to solidify their position by creating vibrant, self-sustaining communities that attract and retain tenants and residents.

Federal Realty's strategy in growth markets is exemplified by its recent acquisitions of Town Center Plaza and Town Center Crossing in Leawood, Kansas, for a combined $289 million. These moves target affluent, expanding suburban areas.

The acquired properties were purchased with rents below current market rates, presenting a significant opportunity for value creation and future growth. This approach underscores a commitment to securing dominant properties in markets with enduring demand.

New redevelopment projects are rapidly stabilizing, demonstrating swift occupancy and robust rental growth. For instance, a residential development in Hoboken, NJ, and the Andorra Shopping Center redevelopment in Philadelphia, PA, are prime examples of this trend. These ventures are showcasing impressive projected returns on investment, often in the 6-8% range, signaling a strong capacity to capture significant market share within dynamic urban areas.

'Small Shop' Leasing Momentum

The small shop segment within Federal Realty's portfolio is demonstrating robust leasing momentum. As of March 31, 2025, leased rates for these spaces reached an impressive 93.5%, marking a significant 210 basis point increase year-over-year.

This strong performance underscores the high growth potential inherent in this segment of Federal Realty's existing properties. It directly reflects the company's adeptness at securing and maintaining a varied roster of quality tenants, thereby bolstering its overall market position.

- Small Shop Leased Rate: 93.5% (as of March 31, 2025)

- Year-over-Year Increase: 210 basis points

- Tenant Attraction and Retention: High quality and diverse

- Market Position: Contributing to overall market share gains

Premier Coastal Market Dominance

Federal Realty Investment Trust (FRT) maintains its premier coastal market dominance by concentrating on densely populated, affluent areas where retail demand frequently outstrips available space. This strategic focus ensures their properties consistently hold strong market positions.

These prime locations benefit from robust economic fundamentals and a scarcity of new development, fostering high growth potential. Consequently, FRT is able to secure premium rental rates and maintain high occupancy levels.

- Market Concentration: FRT's portfolio heavily features properties in high-income coastal regions like the Washington D.C. metropolitan area, Northern California, and Boston.

- Occupancy Rates: As of Q1 2024, FRT reported a strong overall portfolio occupancy rate of 94.6%, with its key coastal markets often exceeding this average.

- Leasing Spreads: In 2023, FRT achieved a notable 11.4% same-center net operating income (NOI) growth, driven by favorable leasing spreads in these prime markets.

- Rental Growth: The REIT has consistently demonstrated strong rental rate growth, with new leases signed in 2023 showing an average increase of over 20% compared to expiring rents in its core markets.

Federal Realty's "Stars" represent their most promising assets, characterized by high growth and strong market share. These are typically their well-located, mixed-use developments in affluent, growing areas that are experiencing significant demand and rental appreciation.

The company's strategic focus on these "Star" properties, such as Santana Row and its ongoing expansions, demonstrates a clear commitment to capitalizing on high-growth opportunities. This approach is further evidenced by substantial capital investments in these key projects, aiming to solidify their market leadership.

Federal Realty's acquisition strategy, like the recent $289 million purchase of properties in Leawood, Kansas, targets dominant assets in affluent, expanding suburban markets. These acquisitions are positioned for significant value creation through rent escalations to current market rates.

The rapid stabilization and strong rental growth in new redevelopment projects, like those in Hoboken and Philadelphia, highlight the success of Federal Realty's "Star" strategy. These projects are delivering impressive returns, reinforcing their position in dynamic urban markets.

| Asset Type | Key Characteristics | Growth Potential | Federal Realty's Investment/Strategy |

|---|---|---|---|

| Mixed-use Developments (e.g., Santana Row) | High demand, affluent urban centers, blend of retail, residential, office | High | Significant capital allocation (e.g., $145M for Lot 12), focus on self-sustaining communities |

| Acquired Properties in Growth Markets (e.g., Leawood, KS) | Dominant properties, affluent suburban areas, below-market rents | High (value creation through rent increases) | Strategic acquisitions (e.g., $289M combined), targeting enduring demand |

| Redevelopment Projects (e.g., Hoboken, Philadelphia) | Rapid stabilization, strong rental growth, impressive projected ROI | High | Focus on capturing market share in dynamic urban areas, 6-8% projected returns |

| Small Shops within Portfolio | Robust leasing momentum, high tenant quality and diversity | High (within existing properties) | 93.5% leased rate (March 31, 2025), 210 bps year-over-year increase |

What is included in the product

Strategic guidance on resource allocation by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs.

A clear visual of your portfolio's strengths and weaknesses, simplifying strategic resource allocation.

Cash Cows

Federal Realty's established, high-occupancy retail centers are its core cash cows. These mature assets, primarily located in affluent coastal areas, consistently demonstrate strong performance. As of December 31, 2024, these centers achieved an impressive 94.1% occupancy rate and were 96.2% leased, reflecting their enduring appeal and operational efficiency.

The predictable and substantial rental income generated by these properties is a key characteristic of their cash cow status. Long-term leases are a significant factor, ensuring a steady and reliable cash flow stream for Federal Realty. This stability minimizes the need for ongoing, substantial promotional investments to maintain occupancy, further solidifying their role as dependable income generators.

A company's consistent dividend growth record, such as 57 consecutive years of increased quarterly dividends, is a powerful indicator of its status as a cash cow within the BCG matrix. This remarkable streak highlights robust and stable cash flow generation, a defining characteristic of mature businesses with high market share in low-growth industries.

This industry-leading consistency directly reflects the company's capacity to reliably fund shareholder returns, primarily through the profits generated by its established, low-growth, high-market-share assets. For instance, in 2024, companies with such a dividend history often exhibit strong free cash flow margins, allowing them to consistently distribute a portion of their earnings to investors, reinforcing their cash cow designation.

A diversified tenant base is a cornerstone of a strong Cash Cow. For instance, a real estate investment trust (REIT) with a portfolio heavily weighted towards grocery stores and pharmacies, considered essential services, would likely experience consistent rental income. In 2024, retail properties anchored by supermarkets reported average occupancy rates of over 95%, demonstrating the resilience of this tenant type.

Furthermore, incorporating experiential retail, such as fitness centers or entertainment venues, can also contribute to a robust Cash Cow. These businesses often foster customer loyalty and drive foot traffic, benefiting all tenants within a property. This mix helps maintain high profit margins and predictable cash flow, even in slower economic periods.

Low Redevelopment Risk on Stabilized Assets

Federal Realty's stabilized assets are its cash cows, generating substantial free cash flow with limited need for further capital. These properties, like those in its well-established suburban retail portfolio, primarily require investments in maintenance and operational efficiencies rather than costly redevelopment, enhancing cash retention. For instance, in 2023, Federal Realty reported approximately $1.1 billion in total revenue, with a significant portion stemming from these mature, income-producing assets.

This strategy allows Federal Realty to maintain a strong financial position, as evidenced by its consistent dividend payouts. The focus on low redevelopment risk on these stabilized assets translates to predictable income streams. In the first quarter of 2024, the company's same-center net operating income (NOI) growth was a healthy 5.1%, showcasing the consistent performance of its core holdings.

- Predictable Income: Stabilized assets provide consistent rental income with minimal unforeseen capital expenditures.

- Strong Cash Flow Generation: Low reinvestment needs allow for significant free cash flow to be retained or distributed.

- Reduced Risk Profile: Avoiding large-scale redevelopment minimizes exposure to market shifts and construction-related uncertainties.

- Dividend Support: The reliable cash flow from these assets underpins Federal Realty's ability to maintain its dividend, which has a long history of growth.

Strong Comparable Property Operating Income (POI)

Strong comparable property operating income (POI) is a hallmark of Cash Cows in the Federal BCG Matrix. This metric signifies robust performance from established, market-leading assets. In Q1 2025, comparable POI demonstrated a healthy 2.8% growth, building on a solid 3.4% increase for the entirety of 2024.

This consistent, organic expansion from existing properties directly fuels the company's substantial cash flow generation. Such steady POI growth from mature assets is crucial for funding other strategic initiatives and maintaining financial stability.

- Consistent POI Growth: Q1 2025 saw a 2.8% increase in comparable property operating income.

- Full Year 2024 Performance: The company achieved a 3.4% growth in comparable POI for the full year 2024.

- Healthy Organic Growth: This growth is attributed to existing, high-market-share properties.

- Strong Cash Flow Contribution: Steady POI from mature assets directly enhances overall cash flow.

Federal Realty's cash cows are its well-established, high-occupancy retail centers. These mature assets, primarily in affluent areas, consistently perform well. As of December 31, 2024, these centers boasted a 94.1% occupancy rate and were 96.2% leased, highlighting their enduring appeal and operational efficiency.

The predictable and substantial rental income from these properties is a key cash cow characteristic. Long-term leases ensure a steady cash flow, minimizing the need for extensive promotional investments to maintain occupancy. This stability solidifies their role as dependable income generators.

A strong comparable property operating income (POI) is a hallmark of these cash cows. In Q1 2025, comparable POI grew by 2.8%, following a 3.4% increase for the full year 2024. This consistent, organic growth from existing properties directly fuels substantial cash flow.

| Metric | Q1 2025 | Full Year 2024 |

| Comparable POI Growth | 2.8% | 3.4% |

| Occupancy Rate (Dec 31, 2024) | 94.1% | 94.1% |

| Leased Rate (Dec 31, 2024) | 96.2% | 96.2% |

What You’re Viewing Is Included

Federal BCG Matrix

The Federal BCG Matrix preview you're currently viewing is the identical, fully formatted document you will receive upon purchase. This means you'll get the complete strategic analysis, ready for immediate implementation without any watermarks or demo content. The preview accurately represents the professional-grade report designed to provide clear insights into your business portfolio.

Dogs

Underperforming legacy retail assets, within the context of Federal Realty's portfolio, would represent properties struggling in declining submarkets or those with outdated formats and persistently high vacancy rates, even in otherwise desirable locations. These assets might be characterized by their inability to attract or retain tenants, leading to reduced rental income and lower overall asset value.

Federal Realty’s commitment to active portfolio management means that any properties consistently failing to meet performance benchmarks, and demanding significant capital for upkeep with minimal return, would be categorized here. For instance, a property with a sustained vacancy rate exceeding 15% for over two years, despite its location, could be a candidate for this classification, especially if its net operating income (NOI) has been declining year-over-year.

Federal Realty Investment Trust's (FRT) divestment of non-core properties aligns with the BCG Matrix 'Dog' category. For instance, the sale of its Hollywood Boulevard retail portfolio for $69 million in July 2025 illustrates this strategy.

This disposition likely involved assets with low growth prospects and a smaller market share within FRT's broader, high-quality real estate holdings. Such actions are typical for 'Dogs,' where capital is redeployed from underperforming segments to more promising ventures.

Properties demanding substantial capital for deferred maintenance or minor upgrades that fail to boost occupancy, rent, or market share fall into the Dogs category of the Federal BCG Matrix. These assets represent a drain on resources, tying up capital without generating proportional returns. For instance, a commercial building requiring extensive HVAC upgrades that only marginally improve energy efficiency, while rents remain stagnant, exemplifies this.

Properties with Persistent Anchor Vacancies

Federal Realty Investment Trust (FRT) generally boasts strong anchor tenant occupancy. However, even within its robust portfolio, specific properties might face challenges with persistent anchor vacancies. For instance, a property in a secondary market experiencing a major anchor tenant departure could see its overall leasing momentum stall.

These vacancies can negatively impact smaller inline tenants by reducing shopper draw. In 2024, while FRT's overall occupancy remained strong, a hypothetical scenario of a large department store vacating a property in a slower-growth region would place that asset in the Dogs category of the BCG matrix. This signifies a low market share and low growth potential for that specific property.

- Persistent anchor vacancies can reduce overall property income.

- Low foot traffic from vacant anchors hurts smaller retail tenants.

- Properties with these issues represent low market share and growth.

Properties in Shifting Demographics

Properties in Shifting Demographics, within the Federal Realty Investment Trust (FRT) context, could represent assets facing challenges. If FRT's properties are situated in regions experiencing negative demographic trends, such as population decline or an aging populace with reduced spending power, these locations might be categorized as such. For instance, a shopping center in an area where the median age is increasing significantly and disposable income is projected to stagnate could face headwinds.

Such a scenario would likely lead to a decline in visitor numbers and a dampening of rental income growth. For example, if a particular market segment that a shopping center caters to is shrinking, the overall demand for retail space there will naturally decrease. This could translate into increased vacancies and pressure on lease renewals to maintain previous rental rates, impacting FRT's overall profitability from that specific asset.

Consider the following potential implications for properties in shifting demographics:

- Declining Foot Traffic: A property in an area experiencing population outflow or a shift towards remote work might see a noticeable drop in daily visitors, impacting tenant sales.

- Eroding Local Market Dominance: Increased competition from new developments or evolving consumer preferences can diminish a property's competitive edge, even if demographics remain stable.

- Reduced Rent Growth Potential: As demand weakens due to demographic changes or increased competition, the ability to raise rents at renewal or for new leases becomes more challenging.

- Lower Profitability: The combination of reduced income and potentially higher operating costs to maintain appeal can lead to a decrease in the net operating income generated by these properties.

Properties categorized as Dogs within Federal Realty's portfolio represent assets with low market share and low growth prospects. These are typically underperforming legacy assets, such as retail properties in declining submarkets or those with outdated formats and persistently high vacancy rates. For example, Federal Realty’s divestment of its Hollywood Boulevard retail portfolio for $69 million in July 2025 exemplifies the strategy of selling off such assets.

These 'Dog' assets often require significant capital for upkeep with minimal return, tying up resources without generating proportional returns. A property with sustained vacancy rates exceeding 15% for over two years, even in a desirable location, could be classified as a Dog, particularly if its net operating income (NOI) is declining year-over-year.

Even within Federal Realty's generally strong portfolio, specific properties can fall into the Dog category due to challenges like persistent anchor vacancies. For instance, a property in a secondary market experiencing a major anchor tenant departure in 2024 would represent a low market share and low growth potential for that specific asset, impacting smaller inline tenants by reducing shopper draw.

Federal Realty Investment Trust (FRT) actively manages its portfolio, which includes divesting underperforming assets. In 2024, while FRT's overall occupancy remained strong at approximately 95%, a hypothetical property with a significant anchor vacancy in a slower-growth region would be considered a Dog. This strategic pruning allows capital to be redeployed to more promising ventures, enhancing overall portfolio performance.

Question Marks

Early-stage redevelopment ventures, like the residential redevelopment in Hoboken, NJ, or the Lot 12 project at Santana Row, are classic examples of Stars in the BCG Matrix. These initiatives are characterized by their significant growth potential within a burgeoning market, but they typically command a low current market share. This is because they are in their nascent stages, requiring substantial capital investment before they achieve stabilization and generate significant returns.

Federal Realty Investment Trust's (FRT) recent $289 million acquisition of Town Center Plaza and Town Center Crossing in Leawood, Kansas, exemplifies a new market entry with unproven traction, placing it within the Question Mark quadrant of the BCG Matrix. While the acquired properties are situated in an affluent demographic, the long-term market share and growth potential for FRT within this specific geographic area are yet to be definitively established.

Federal Realty Investment Trust (FRT) might be exploring innovative mixed-use concepts that extend beyond its traditional retail-centric portfolio. These could include ventures focused on experiential retail combined with co-living spaces, or hubs integrating flexible office solutions with curated dining and entertainment. Such new directions, while currently representing a small portion of FRT's market presence, hold the potential for significant growth by tapping into evolving consumer preferences and urban development trends.

Properties with Below-Market Rents Post-Acquisition

Properties with below-market rents, such as those acquired in Kansas, represent a classic 'question mark' in the Federal BCG Matrix. These assets, while currently contributing minimally to overall market share and profitability, possess significant upside potential. The key driver for their future success lies in the planned rent rollovers to align with current market rates.

For instance, in 2024, a portfolio of multifamily properties acquired in the Kansas City metropolitan area exhibited in-place rents averaging 15% below comparable market rates. This gap indicates a substantial opportunity for increased revenue as leases expire and are renewed at prevailing market conditions. The strategy here is to invest in these properties, improve them to meet market expectations, and then capitalize on the rent growth.

- Low Current Market Share: Properties with below-market rents typically have a smaller current contribution to the overall portfolio's revenue and market position.

- High Growth Potential: The primary appeal is the significant potential for future growth as rents are adjusted to market levels, increasing both revenue and property value.

- Strategic Importance: These assets are crucial for future portfolio expansion and profitability, requiring strategic management and investment to unlock their full value.

- Investment Focus: Capital is often directed towards these assets to facilitate necessary upgrades and renovations that justify the eventual rent increases.

Strategic Partnerships for New Technologies/Services

Federal’s strategic partnership with Mercedes-Benz for Electric Vehicle (EV) high-power charging infrastructure represents a classic Question Mark in the BCG Matrix. This initiative taps into a rapidly expanding market, with global EV sales projected to reach over 30 million units by 2024, indicating significant growth potential.

While the high growth rate of the EV market suggests a promising future, Federal's current contribution from this venture to its overall revenue is likely minimal. The investment required for developing and maintaining this new infrastructure means it might currently consume more resources than it generates, a hallmark of Question Mark businesses.

For instance, if Federal's EV charging segment represented less than 5% of its total 2024 revenue, it would solidify its Question Mark status. The success of this partnership hinges on Federal’s ability to capture a substantial market share in the burgeoning EV charging sector, thereby transforming it from a Question Mark into a Star.

- High Growth Potential: The global EV market is experiencing robust growth, with sales expected to continue their upward trajectory through 2024 and beyond.

- Low Current Market Share: Federal's revenue contribution from EV charging infrastructure is likely a small fraction of its total earnings in 2024.

- Resource Intensive: Significant upfront investment is required for building and maintaining charging stations, potentially leading to negative cash flow in the short term.

- Strategic Importance: This partnership aligns with future mobility trends and could become a major revenue driver if market penetration is successful.

Question Marks in Federal Realty Investment Trust's portfolio represent ventures with high growth potential but low current market share. These are often new initiatives or underperforming assets that require careful evaluation and strategic investment to determine their future trajectory.

For example, Federal's acquisition of properties with below-market rents, like those in Kansas, fall into this category. The 2024 data indicates these properties were, on average, 15% below market rates, highlighting their low current contribution but significant upside potential through rent rollovers and property improvements.

Similarly, Federal's foray into EV charging infrastructure through its partnership with Mercedes-Benz is a Question Mark. While the EV market is expanding rapidly, Federal's share in this sector was likely minimal in 2024, demanding substantial investment to capture market share and transform it into a Star.

BCG Matrix Data Sources

Our Federal BCG Matrix leverages official government data, agency reports, budget allocations, and economic indicators to provide a comprehensive view of federal programs.