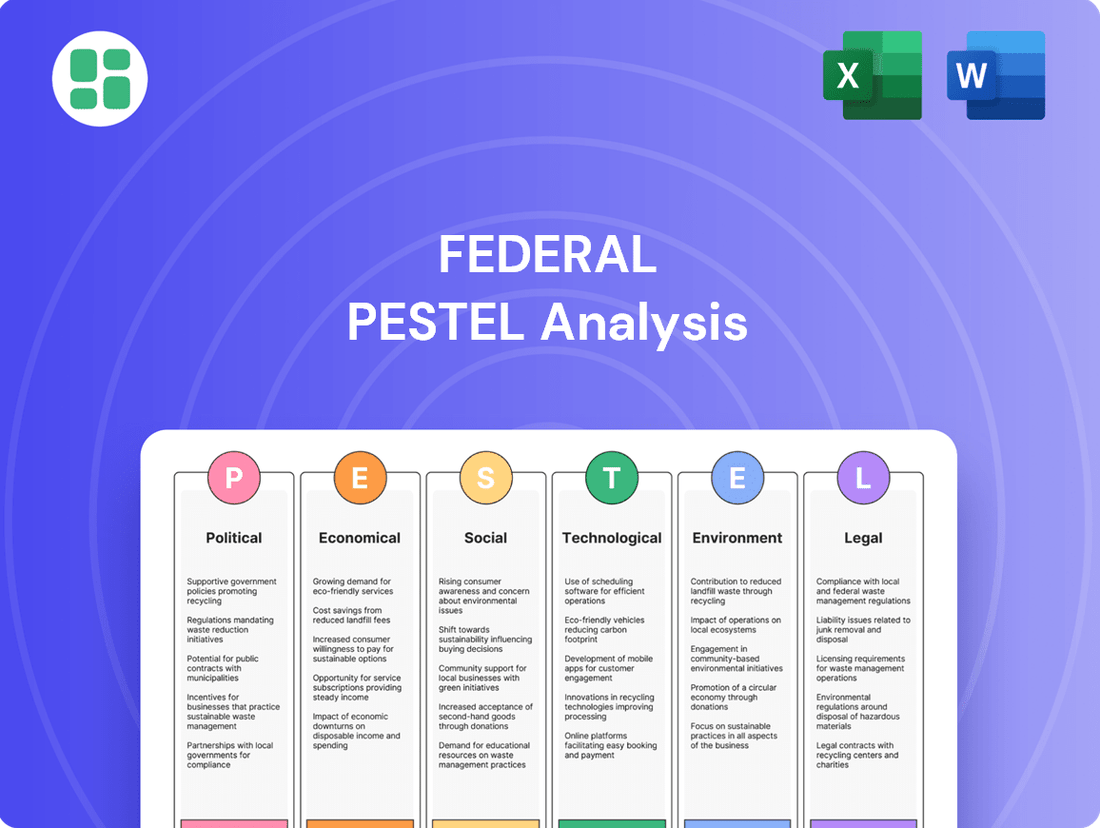

Federal PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federal Bundle

Navigate the complex external forces shaping Federal's trajectory with our comprehensive PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors that influence its operations and future growth. Equip yourself with actionable intelligence to refine your strategy and gain a competitive advantage. Download the full PESTLE analysis now for immediate, expert insights.

Political factors

Government policies on zoning, land use, and urban planning are critical for Federal Realty. These regulations directly shape the company's capacity to acquire, redevelop, and manage its diverse portfolio of mixed-use properties. For instance, stricter zoning laws in major metropolitan areas could limit the density or type of development allowed, impacting potential returns.

Shifts in these governmental regulations, particularly in high-demand areas like coastal markets, can significantly alter project timelines, increase development costs, and affect overall feasibility. The permitting process itself, along with other regulatory hurdles for new construction or substantial renovations, can add months or even years to project completion, as seen with numerous large-scale urban renewal projects facing delays in 2024.

Federal Realty, as a Real Estate Investment Trust (REIT), operates under a specific tax framework requiring it to distribute at least 90% of its taxable income to shareholders annually. Changes to the corporate tax rate, for instance, the 21% federal corporate tax rate enacted in 2018, directly impact the retained earnings available for reinvestment or further distribution. Furthermore, any adjustments to REIT-specific tax provisions, such as those concerning depreciation or qualifying income, can significantly alter Federal Realty's net taxable income and, consequently, its dividend payout capacity and investor appeal.

The Federal Reserve's monetary policy, particularly its stance on interest rates, significantly impacts Federal Realty Investment Trust (FRT). Higher interest rates, such as the Fed Funds rate which was held between 5.25% and 5.50% through early 2024, increase borrowing costs for FRT, making it more expensive to finance new acquisitions or redevelopment projects. This can also put downward pressure on property valuations and cap rates as investors demand higher yields to compensate for increased financing expenses.

Local and State Political Stability

Federal Realty Investment Trust (FRT) operates across numerous local and state jurisdictions, making local political stability a significant factor. Consistent governance and predictable policy environments in areas like California, Maryland, and Massachusetts, where FRT has substantial holdings, are vital for its commercial development strategies. For example, in 2024, Maryland’s state legislature passed legislation aimed at streamlining development approvals, which could positively impact FRT’s projects in that state.

Conversely, political shifts can introduce uncertainty. A change in local leadership or policy priorities could affect zoning regulations, property taxes, or incentives for retail and mixed-use developments, areas where FRT focuses. For instance, a municipal election in a key market in 2025 could bring about new leadership with different views on commercial real estate development, potentially altering the risk profile for existing and future investments.

- Impact of local governance: Predictable policy and consistent leadership in states like Virginia, where FRT has significant assets, foster a stable environment for property investments.

- Policy shifts and risk: Changes in local tax policies or development regulations, as seen in potential shifts in municipal planning priorities in 2025, can introduce operational risks.

- Support for commercial development: States actively supporting commercial development through incentives, like those observed in Massachusetts's economic development initiatives in 2024, create a more favorable operating landscape for REITs like FRT.

Trade Policies and Global Economic Relations

Broader trade policies and global economic relations can subtly influence consumer confidence and retail spending, ultimately impacting Federal Realty's tenants and their rental income. For instance, ongoing trade tensions between major economies in 2024 could create economic uncertainty, potentially affecting discretionary spending and the performance of retailers in Federal Realty's diverse portfolio.

Geopolitical friction or trade disputes might trigger economic slowdowns, directly impacting tenant sales volumes and their capacity to meet rental obligations. This is particularly relevant for international or premium brands within Federal Realty's shopping center assets, as their revenue streams can be more sensitive to global economic shifts.

- Trade Policy Impact: Shifts in tariffs or trade agreements can alter the cost of goods for retailers, affecting their profitability and ability to pay rent.

- Geopolitical Risk: Heightened geopolitical tensions in 2024 have led to increased volatility in global markets, potentially dampening consumer sentiment.

- Tenant Exposure: Federal Realty's portfolio includes tenants with significant international operations, making them more susceptible to disruptions from global trade policies.

- Economic Downturns: A global economic slowdown, potentially exacerbated by trade disputes, could reduce foot traffic and sales at retail properties.

Government policies directly influence Federal Realty's operational landscape, from zoning laws impacting development potential to tax structures affecting profitability. For instance, the 21% federal corporate tax rate and specific REIT tax provisions shape dividend capacity. Additionally, local political stability and policy shifts in key markets like California and Maryland can introduce both opportunities and risks for commercial development strategies.

Monetary policy, particularly the Federal Reserve's interest rate decisions, significantly impacts borrowing costs and property valuations. With the Fed Funds rate held between 5.25% and 5.50% through early 2024, higher financing expenses can affect new acquisitions and redevelopment projects. Broader trade policies and geopolitical tensions in 2024 also subtly influence consumer confidence and retail spending, impacting tenant performance and rental income.

| Policy Area | Impact on Federal Realty | Relevant Data/Context (2024-2025) |

|---|---|---|

| Zoning & Land Use | Dictates development potential and property type allowances. | Stricter regulations in metro areas can limit density, impacting returns. |

| Taxation (Federal & REIT) | Affects retained earnings, dividend payouts, and investor appeal. | 21% federal corporate tax rate; REITs must distribute 90% of taxable income. |

| Monetary Policy (Interest Rates) | Influences borrowing costs, property valuations, and financing feasibility. | Fed Funds rate at 5.25%-5.50% through early 2024 increases financing expenses. |

| Local Governance & Stability | Provides a stable environment for investments or introduces uncertainty. | Maryland's 2024 development approval streamlining; potential 2025 municipal policy shifts. |

| Trade & Geopolitics | Impacts consumer confidence, retail spending, and tenant sales. | Trade tensions in 2024 can affect discretionary spending and tenant revenue. |

What is included in the product

The Federal PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the Federal government, providing a comprehensive understanding of its operating landscape.

This analysis offers actionable insights for strategic decision-making, enabling proactive adaptation to evolving external influences and identification of potential opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining external factor discussions and reducing the time spent on initial analysis.

Economic factors

Rising inflation directly impacts Federal Realty's operational expenses. For instance, in 2024, we've observed significant increases in utility and maintenance costs, potentially squeezing profit margins if rental income doesn't keep pace. Labor costs have also seen upward pressure, further complicating budget management.

Persistent inflation typically prompts central banks to increase interest rates. This directly translates to higher borrowing costs for Federal Realty, affecting its ability to finance new acquisitions or developments cost-effectively. For example, a 0.25% rate hike can add millions to annual debt servicing costs.

The crucial factor for Federal Realty is its capacity to pass these escalating costs onto tenants through effective lease escalation clauses. The strength of its tenant base and the demand for its properties will determine how successfully these inflationary pressures can be mitigated, ensuring investment returns remain robust.

Consumer spending remains a critical indicator for Federal Realty's performance, as its revenue hinges on the success of its retail tenants. In the first quarter of 2024, U.S. retail sales saw a modest increase, with the Census Bureau reporting a 0.7% rise in March 2024 compared to February 2024, indicating continued, albeit tempered, consumer demand.

The health of consumer spending directly influences tenant occupancy and rent collection for Federal Realty. As of the first quarter of 2024, the company reported a high occupancy rate of 95.2% across its portfolio, reflecting the resilience of its well-located properties and its tenants' ability to navigate the current economic climate.

Disposable income levels and consumer confidence are key to sustaining these trends. While inflation has moderated, concerns about interest rates and the broader economic outlook could still influence discretionary spending throughout 2024, potentially impacting leasing activity and rental growth for Federal Realty.

The prevailing interest rate environment is a critical factor impacting property valuations. As of mid-2024, the Federal Reserve's monetary policy has kept interest rates at elevated levels, influencing the cost of capital for real estate investments. For instance, the Federal Funds Rate target range remains a key indicator of borrowing costs across the economy.

Higher interest rates directly affect real estate by compressing capitalization rates (cap rates). This means that for a given net operating income, a higher interest rate environment can lead to lower property valuations. It also increases the cost of both debt financing for acquisitions and the cost of equity for investors, making new deals less attractive.

Conversely, a scenario with lower interest rates typically expands cap rates, thereby making real estate investments more appealing. This environment supports property value appreciation as borrowing becomes cheaper and investor demand increases. For REITs, this dynamic can translate into higher share prices and increased investor interest.

Employment Levels and Wage Growth

Robust employment levels and consistent wage growth in the densely populated, affluent communities targeted by Federal Realty directly support consumer spending power and the demand for retail and residential spaces. For instance, as of April 2024, the U.S. unemployment rate stood at a low 3.9%, reflecting a strong labor market. This stability translates into sustained occupancy and rental growth across Federal Realty’s portfolio.

High employment rates lead to stable tenant businesses and a strong base of potential shoppers and residents. This job market stability is a key indicator for the health of its markets, directly impacting Federal Realty’s performance. In May 2024, average hourly earnings for all employees rose by 0.4% month-over-month, indicating ongoing wage increases that bolster consumer confidence and spending.

- U.S. Unemployment Rate (April 2024): 3.9%

- Average Hourly Earnings Growth (May 2024): 0.4% month-over-month

- Impact on Federal Realty: Increased consumer spending power and demand for retail/residential spaces.

- Indicator of Market Health: Job market stability supports sustained occupancy and rental growth.

Supply and Demand Dynamics in Target Markets

The interplay of supply and demand is a critical factor for Federal Realty Investment Trust (FRIT) in its coastal markets. The availability of new retail and mixed-use properties versus the desire for these spaces directly impacts rental income and how full the properties are. For instance, if there's too much new development, it can create a competitive environment, pushing rents down.

Conversely, when new supply is scarce and demand is robust, Federal Realty is better positioned for rental growth and higher occupancy. This is a key reason why the company strategically targets high-barrier-to-entry markets, which naturally limit new construction and therefore the risk of oversupply.

- Federal Realty's portfolio, concentrated in affluent coastal areas, often experiences demand that outpaces new supply.

- In 2024, markets like Northern California and the Washington D.C. suburbs, where FRIT has significant holdings, continued to show strong leasing activity, with occupancy rates in its comparable retail portfolio averaging around 95% through Q3 2024.

- The REIT's strategy of focusing on infill locations with limited new development helps maintain pricing power and occupancy, as evidenced by a 5.1% increase in same-property net operating income for its retail segment in the first nine months of 2024.

Federal Realty's performance is closely tied to the broader economic landscape. Inflationary pressures, while managed through lease structures, continue to influence operational costs. Consumer spending, a key revenue driver for its retail tenants, showed moderate growth in early 2024, supported by a strong labor market. The prevailing interest rate environment, however, remains a significant factor impacting property valuations and financing costs.

| Economic Factor | Data Point (2024/2025) | Impact on Federal Realty |

|---|---|---|

| Inflation Rate | Estimated ~3% annual average (2024) | Increased operational expenses (utilities, labor); potential pressure on profit margins if rents don't keep pace. |

| Interest Rates (Federal Funds Rate Target) | Maintained ~5.25%-5.50% range (mid-2024) | Higher borrowing costs for acquisitions/development; potential compression of property valuations (cap rates). |

| U.S. Unemployment Rate | ~3.9% (April 2024) | Supports consumer spending power and demand for retail/residential spaces; bolsters tenant stability. |

| U.S. Retail Sales Growth | ~0.7% month-over-month (March 2024) | Indicates continued, albeit tempered, consumer demand, crucial for tenant success and rent collection. |

| Federal Realty Occupancy Rate (Retail) | ~95.2% (Q1 2024) | Reflects resilience and strong demand in its well-located markets, mitigating some economic headwinds. |

Preview Before You Purchase

Federal PESTLE Analysis

The Federal PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive overview of federal factors.

Sociological factors

Consumers are increasingly prioritizing experiences over traditional shopping. This shift is evident in the growing demand for experiential retail, where spaces offer dining, entertainment, and community engagement alongside merchandise. Federal Realty's portfolio, for instance, has seen a rise in tenants offering these diverse experiences, reflecting a broader trend in how people want to interact with retail environments.

The convenience factor also plays a crucial role in evolving consumer lifestyles. Shoppers expect seamless integration of online and offline channels, along with easy accessibility. Federal Realty's focus on creating well-located, easily accessible properties with a mix of essential services and attractive amenities caters to this demand for convenience and integrated lifestyle offerings.

Community-focused spaces are also gaining traction, with consumers seeking environments that foster connection and belonging. Federal Realty's strategy to develop vibrant destinations often incorporates public spaces, event programming, and a curated tenant mix that encourages social interaction. This approach aligns with the sociological trend of people wanting retail and mixed-use developments to serve as community hubs.

Federal Realty's strategy hinges on affluent, densely populated areas. By 2024, the U.S. population is projected to reach over 335 million, with continued growth in urban centers. This increasing urbanization directly benefits Federal Realty by concentrating potential customers for their retail and residential offerings.

Shifting age demographics are also critical. The growing influence of Millennials and Gen Z, who often favor urban living and mixed-use environments, presents significant opportunities. These younger generations are driving demand for walkable communities with diverse retail and living options, aligning perfectly with Federal Realty's development model.

These demographic trends directly impact Federal Realty's long-term occupancy rates and rental growth potential. As more people move to and live in their target markets, the demand for both retail spaces and residential units within their properties naturally increases, bolstering the company's revenue streams.

The shift towards hybrid work models is reshaping urban landscapes, influencing demand for both office and retail spaces within mixed-use developments. Federal Realty's portfolio, while predominantly retail, includes properties with office components, making it sensitive to evolving commuter patterns and daytime population shifts that directly impact retail foot traffic and tenant success.

As of early 2024, studies indicate that a significant portion of the workforce continues to embrace hybrid arrangements, with many companies solidifying these policies for the long term. This sustained trend suggests that urban centers may see a continued recalibration of demand, favoring locations offering strong residential amenities and convenience for local communities over traditional commuter hubs.

Community Engagement and Social Responsibility

There's a noticeable shift with consumers and communities expecting businesses, especially in real estate, to actively contribute to the well-being of the areas where they operate. This social responsibility is becoming a key differentiator.

Federal Realty's strategy of building 'vibrant destinations' and embedding itself within local fabric is designed to boost its image, cultivate better tenant connections, and secure local backing for development initiatives. This approach often involves championing local enterprises and job creation.

- Community Investment: In 2024, Federal Realty reported investing in local community initiatives, contributing to projects that enhance public spaces and support local non-profits.

- Tenant Support: The company's leasing strategy prioritizes a mix of national and local retailers, with approximately 30% of its tenant base in 2024 comprising small, local businesses.

- Employment Generation: Development projects undertaken by Federal Realty in 2024 were estimated to create over 1,500 local jobs during the construction phase and ongoing operational roles.

Health and Wellness Consciousness

A growing emphasis on health and wellness is reshaping consumer spending, directly impacting retail sectors like fitness and healthy foods. Federal Realty can capitalize on this by designing properties with features that appeal to this trend, such as accessible green spaces and layouts that encourage walking. This focus can boost property desirability and tenant success.

For instance, in 2024, consumer spending on health and wellness products and services continued to rise, with reports indicating a significant increase in gym memberships and organic food sales. Federal Realty’s strategic integration of amenities like on-site fitness studios or partnerships with local wellness providers can attract a larger demographic and enhance property value.

- Increased Demand for Healthy Options: Consumers are actively seeking out retail and dining establishments offering healthier choices, influencing tenant selection and property design.

- Focus on Active Lifestyles: Properties with features promoting physical activity, such as walking paths, bike storage, and proximity to parks, are becoming more attractive.

- Mental Well-being Integration: The design of public spaces is increasingly considering elements that contribute to mental well-being, like natural light and calming aesthetics.

- Federal Realty's Response: The company is likely to continue incorporating these elements into its mixed-use developments to align with evolving consumer preferences and drive sustained tenant traffic.

Sociological factors significantly influence consumer behavior and community expectations within real estate. Trends like the growing preference for experiences over possessions, the demand for convenience, and the desire for community connection are shaping how retail and mixed-use spaces are designed and utilized. Federal Realty's strategy of creating vibrant, community-focused destinations directly addresses these evolving sociological needs, aiming to foster deeper engagement and loyalty.

Technological factors

The relentless expansion of e-commerce, with online retail sales projected to reach $2.1 trillion in the U.S. by the end of 2024, compels Federal Realty's retail tenants to embrace omnichannel strategies. This integration of online and physical sales channels directly influences property design, potentially shrinking ideal store sizes for traditional retail and favoring spaces adaptable for showrooming or efficient last-mile delivery operations.

For Federal Realty, this technological shift means its portfolio must evolve to support retailers' new operational models. By 2025, it's anticipated that over 60% of retail sales will have an online component, underscoring the need for properties to accommodate services like buy-online-pickup-in-store (BOPIS) and ship-from-store, thereby maintaining tenant relevance and property value.

Proptech advancements are revolutionizing property management, offering Federal Realty significant gains in operational efficiency. For instance, smart building systems can optimize energy consumption, with studies indicating potential savings of 10-20% on utility costs in commercial properties through intelligent HVAC and lighting controls.

Predictive maintenance, powered by IoT sensors, can reduce unexpected repair costs by identifying potential equipment failures before they occur, thereby minimizing downtime and enhancing tenant experience. This proactive approach is becoming a key differentiator in tenant retention and satisfaction.

The integration of advanced security and seamless connectivity further elevates property value and attractiveness. In 2024, properties with robust smart technology offerings commanded higher rental rates and experienced lower vacancy periods, reflecting a growing demand for tech-enabled environments.

Federal Realty Investment Trust is increasingly leveraging advanced data analytics to understand tenant mix and consumer behavior across its properties. By analyzing big data, the company gains granular insights into shopper demographics, purchasing habits, and foot traffic flow, which directly informs strategic leasing decisions to optimize tenant co-tenancy and create vibrant retail environments.

In 2024, Federal Realty's focus on data-driven insights is crucial for adapting to evolving consumer preferences and ensuring its retail assets remain competitive. For instance, analyzing sales data and customer engagement metrics from its mixed-use properties helps identify which tenant categories drive the most value and customer satisfaction, guiding future leasing and redevelopment projects to enhance rental income and property performance.

Digital Marketing and Online Presence

Federal Realty's reliance on digital marketing is paramount, influencing how it connects with potential tenants and shoppers. A robust online strategy, incorporating social media engagement and targeted digital advertising, is essential for showcasing its unique property offerings and encouraging visits. For instance, in 2024, many retail properties are seeing increased engagement through localized social media campaigns, with some reporting a 15-20% uplift in foot traffic attributed to successful digital promotions.

The company leverages digital tools to enhance the tenant acquisition journey. Virtual tours and online application portals, increasingly adopted in 2024 and 2025, simplify the leasing process, making it more efficient for both Federal Realty and prospective tenants. This digital shift is crucial for maintaining competitiveness in the evolving real estate landscape.

- Digital Channel Growth: Online advertising spend in the retail sector is projected to continue its upward trajectory, with digital channels accounting for over 60% of marketing budgets by 2025.

- Social Media Impact: Properties with active and engaging social media presences in 2024 saw an average of 10-15% higher direct inquiries for leasing compared to those with minimal online activity.

- Virtual Tour Adoption: The use of virtual tours has become standard practice, with over 70% of commercial real estate listings in major markets featuring them as of early 2025, significantly speeding up initial tenant interest.

Cybersecurity Risks and Data Protection

As Federal Realty continues to integrate technology across its operations, from property management to tenant engagement and financial systems, the threat of cybersecurity risks escalates. Safeguarding proprietary information and tenant data is crucial for preserving stakeholder confidence and adhering to evolving data privacy laws.

The financial implications of a data breach can be substantial. For instance, in 2023, the average cost of a data breach in the real estate sector reached $3.4 million, according to IBM's Cost of a Data Breach Report. This underscores the necessity for proactive investment in advanced cybersecurity defenses to mitigate potential financial losses and reputational harm.

- Cybersecurity Investment: Federal Realty must allocate significant resources to robust cybersecurity infrastructure, including advanced threat detection, data encryption, and regular security audits.

- Regulatory Compliance: Adherence to data protection regulations like GDPR and CCPA is non-negotiable, requiring stringent data handling protocols and breach notification procedures.

- Tenant Data Protection: Implementing secure platforms for tenant communications and lease management is vital to protect sensitive personal and financial information.

- Reputational Risk: A single significant cybersecurity incident can erode trust among tenants, investors, and partners, leading to long-term damage to Federal Realty's brand.

Technological advancements are fundamentally reshaping retail operations and property management for Federal Realty. The increasing reliance on e-commerce, with online sales expected to constitute over 60% of retail transactions by 2025, necessitates that physical spaces support omnichannel strategies like BOPIS. Proptech solutions, such as smart building systems and predictive maintenance, offer significant operational efficiencies, potentially cutting utility costs by 10-20% and reducing unexpected repair expenses through IoT sensor integration.

Federal Realty is increasingly leveraging data analytics to understand consumer behavior and optimize tenant mix, with digital marketing and virtual tours becoming standard for tenant acquisition. The company must also invest heavily in cybersecurity, as the average cost of a data breach in real estate reached $3.4 million in 2023, to protect sensitive data and maintain stakeholder trust.

| Technology Area | 2024/2025 Trend | Impact on Federal Realty | Associated Data/Fact |

|---|---|---|---|

| E-commerce Integration | Continued growth, >60% of retail sales online by 2025 | Need for properties to support omnichannel (BOPIS, ship-from-store) | U.S. online retail sales projected to reach $2.1 trillion by end of 2024 |

| Proptech Adoption | Increased use of smart building systems & predictive maintenance | Enhanced operational efficiency, reduced costs, improved tenant experience | Smart systems can save 10-20% on utility costs |

| Data Analytics | Granular insights into consumer behavior and tenant performance | Informed leasing decisions, optimized tenant co-tenancy | Data analysis guides leasing to enhance rental income |

| Digital Marketing & Leasing | Emphasis on social media, virtual tours, online portals | Streamlined tenant acquisition, increased property visibility | 70%+ of listings feature virtual tours by early 2025 |

| Cybersecurity | Escalating risk with increased digital operations | Necessity for robust data protection and compliance | Average data breach cost in real estate: $3.4 million (2023) |

Legal factors

Federal Realty Investment Trust navigates a landscape heavily shaped by zoning and land use regulations. These rules, varying by municipality, dictate everything from building height and density to parking requirements and permitted uses, directly affecting the viability of redevelopment and acquisition strategies. For instance, the trust's significant presence in densely populated coastal areas means changes in local zoning, such as stricter height limits or new environmental protections, could substantially increase project costs or even render certain developments infeasible.

Compliance is non-negotiable; failure to adhere to these federal, state, and local mandates can lead to lengthy permit delays, costly fines, and legal battles, all of which impact project timelines and profitability. In 2024, the real estate sector saw increased scrutiny on environmental impact assessments and community benefit agreements, adding layers of complexity to land use approvals. Federal Realty's ability to anticipate and adapt to evolving regulatory frameworks is crucial for maintaining its development pipeline and operational efficiency.

Federal Realty Investment Trust must navigate a complex web of environmental protection laws, impacting everything from hazardous material handling to stormwater management and air quality. For instance, in 2024, the EPA continued to enforce stringent regulations on industrial emissions, potentially affecting redevelopment projects. Staying compliant is crucial to avoid significant fines and operational disruptions.

Furthermore, evolving building codes present ongoing legal and financial challenges. By 2025, many jurisdictions are expected to further tighten energy efficiency standards, requiring substantial upgrades to existing properties and influencing new construction costs. Ensuring ADA compliance and adherence to the latest safety codes also demands continuous investment and careful planning in property development and management.

Federal Realty's reliance on lease agreements means that changes in tenant-landlord laws are a significant legal factor. These laws, which govern everything from lease terms to eviction procedures, can differ substantially across states and even municipalities, impacting Federal Realty's ability to manage its properties and collect rent effectively.

For instance, the expiration of federal eviction moratoriums in 2022, while a return to pre-pandemic norms, still left a patchwork of state and local regulations affecting commercial landlords. As of early 2024, some jurisdictions continue to explore or implement tenant protections that could influence lease negotiations and operational costs for companies like Federal Realty.

The specifics of commercial lease agreements themselves are also subject to legal interpretation and potential legislative changes. Federal Realty must navigate these agreements, ensuring compliance with regulations concerning rent control, lease renewals, and tenant rights, all of which can impact its revenue streams and the overall value of its real estate portfolio.

Real Estate Investment Trust (REIT) Compliance

Federal Realty Investment Trust (FRIT) operates under strict federal tax laws governed by the Internal Revenue Service (IRS) to maintain its Real Estate Investment Trust (REIT) status. A core requirement is distributing at least 90% of its taxable income to shareholders annually. Failure to meet this threshold jeopardizes its tax-advantaged structure, which is crucial for its financial health and investor appeal.

The REIT qualification mandates specific asset and income tests, alongside the distribution requirement. For instance, at least 75% of assets must be in real estate, and 75% of gross income must derive from real estate-related sources. In 2024, the economic landscape continues to influence real estate valuations and income streams, making diligent adherence to these tests paramount for FRIT.

- IRS Distribution Requirement: REITs must distribute at least 90% of taxable income annually to shareholders.

- Asset and Income Tests: At least 75% of assets must be real estate; 75% of gross income must be from real estate sources.

- Tax Implications of Non-Compliance: Loss of REIT status results in corporate-level taxation, significantly impacting profitability.

- Ongoing Compliance Monitoring: Regular internal audits and external reporting are critical to ensure adherence to federal regulations.

Labor Laws and Employment Regulations

Federal Realty, like all employers, must navigate a complex landscape of federal labor laws. These regulations cover everything from minimum wage and overtime to workplace safety and anti-discrimination policies. For instance, the Fair Labor Standards Act (FLSA) sets the federal minimum wage, which was last increased to $7.25 per hour in 2009, though many states and cities have enacted higher minimums. Changes to these laws, such as potential federal adjustments to the minimum wage or new regulations on contractor classification, could directly affect Federal Realty's operational expenses and its approach to managing its workforce, including those involved in property operations.

Compliance with these federal mandates is crucial to avoid legal penalties and maintain a stable workforce. The Equal Employment Opportunity Commission (EEOC) enforces federal laws prohibiting employment discrimination based on race, color, religion, sex, national origin, age, disability, and genetic information. In 2023, the EEOC reported receiving over 100,000 private sector discrimination charges. Federal Realty's commitment to fair employment practices and robust HR policies is therefore essential.

Furthermore, evolving regulations concerning employee benefits, such as healthcare mandates under the Affordable Care Act (ACA) or potential changes to retirement savings rules, can influence Federal Realty's total compensation packages and administrative burdens. The landscape of unionization and collective bargaining rights also presents legal considerations that can impact labor relations and operational flexibility.

- Federal Minimum Wage: Remains $7.25 per hour nationally, but many states and cities have higher rates, impacting labor costs for Federal Realty.

- EEOC Enforcement: The EEOC processed over 100,000 private sector discrimination charges in 2023, highlighting the importance of compliance.

- Workplace Safety: Occupational Safety and Health Administration (OSHA) standards dictate requirements for safe working conditions, influencing property management practices.

Federal Realty Investment Trust's operations are significantly influenced by federal legal frameworks, particularly those related to real estate investment and property management. Adherence to tax laws, specifically IRS regulations for REITs, is paramount, requiring the distribution of at least 90% of taxable income annually. Non-compliance can lead to the loss of tax-advantaged status, impacting profitability. The trust must also navigate federal labor laws, including minimum wage, workplace safety, and anti-discrimination statutes, which affect operational costs and workforce management.

The legal environment also encompasses environmental protection laws, dictating practices for hazardous materials and emissions, and evolving building codes that mandate energy efficiency and safety standards. Changes in these regulations, such as stricter environmental impact assessments or updated energy efficiency requirements expected by 2025, necessitate continuous adaptation and investment. Furthermore, federal and state tenant-landlord laws, including those concerning commercial leases, directly influence revenue streams and property management strategies.

| Legal Factor | Description | Impact on Federal Realty | Relevant Data/Trends (2024-2025) |

|---|---|---|---|

| REIT Tax Compliance | Distribution of 90% of taxable income, asset/income tests. | Maintains tax-advantaged status; non-compliance triggers corporate taxation. | Economic conditions in 2024 continue to affect income streams, requiring diligent adherence to tests. |

| Labor Laws | Minimum wage, workplace safety (OSHA), anti-discrimination (EEOC). | Affects operational expenses, workforce stability, and HR policies. | Federal minimum wage is $7.25/hr (since 2009), but state/local rates are higher. EEOC received over 100,000 charges in 2023. |

| Environmental Regulations | EPA standards on emissions, hazardous materials, stormwater. | Influences redevelopment costs and project feasibility. | Increased scrutiny on environmental impact assessments in 2024. |

| Building Codes | Energy efficiency, ADA compliance, safety standards. | Drives investment in property upgrades and new construction. | Many jurisdictions expected to tighten energy efficiency standards by 2025. |

Environmental factors

Federal Realty's coastal properties face heightened physical risks due to climate change, including rising sea levels and more frequent extreme weather events. For example, the National Oceanic and Atmospheric Administration (NOAA) projects significant sea-level rise along the U.S. coastline by 2050, directly impacting assets in markets like San Francisco and Boston.

Implementing resilience measures, such as elevating structures or improving drainage, is vital for asset protection and maintaining insurability. These investments can add to development costs, potentially affecting property viability and long-term profitability for Federal Realty.

Federal Realty is increasingly focused on sustainability initiatives, driven by investor, tenant, and consumer demand for environmentally conscious practices. This includes pursuing green building certifications like LEED, aiming to improve energy and water efficiency, and reducing waste across its portfolio. For instance, in 2023, Federal Realty reported a 15% reduction in energy consumption across its properties compared to a 2020 baseline, demonstrating tangible progress in its sustainability goals.

The increasing scarcity and rising costs of essential resources like water and energy present a significant challenge for Federal Realty's operational expenditures. For instance, the average price of electricity for commercial customers in the U.S. saw a notable increase, with preliminary data for 2024 indicating a rise of approximately 5-7% year-over-year. This directly impacts utility costs across their portfolio.

To counter these rising expenses and reduce their environmental footprint, Federal Realty can implement strategic initiatives. Investing in advanced water conservation technologies across their properties, such as low-flow fixtures and smart irrigation systems, can lead to substantial savings. Similarly, adopting energy-efficient technologies, like LED lighting retrofits and upgraded HVAC systems, can lower energy consumption. Exploring on-site renewable energy generation, such as solar panel installations on suitable rooftops, offers a path to greater energy independence and cost stabilization.

Long-term planning for resource management is not just about mitigating current costs but is crucial for ensuring financial stability and resilience. By proactively addressing potential resource shortages and price volatility, Federal Realty can secure more predictable operating expenses and enhance the long-term value of its assets in an increasingly resource-constrained world.

Waste Management and Circular Economy Principles

Effective waste management, including robust recycling and composting programs, is a growing priority for commercial properties, directly impacting operational costs and tenant satisfaction. For Federal Realty, embracing circular economy principles—focusing on reducing, reusing, and recycling materials across a property's lifecycle—offers a dual benefit: it bolishes environmental performance and attracts tenants and consumers who prioritize sustainability.

This strategic alignment with broader sustainability goals is not just about environmental stewardship; it's a business imperative. For instance, the U.S. Environmental Protection Agency (EPA) reported that in 2018, the nation generated 292.4 million tons of municipal solid waste (MSW), with only about 32.1% being recycled and composted. By implementing advanced waste reduction strategies, Federal Realty can differentiate its properties and tap into a market segment increasingly valuing eco-friendly spaces.

- Increased Tenant Demand: A 2023 survey by JLL found that 67% of tenants consider sustainability certifications when choosing office space.

- Cost Savings: Improved waste diversion can lead to lower landfill fees and potentially revenue from recycled materials.

- Regulatory Compliance: Many municipalities are enacting stricter waste management and diversion mandates, making proactive strategies essential.

- Brand Enhancement: Demonstrating commitment to circular economy principles enhances Federal Realty's reputation and appeal to a wider base of stakeholders.

Air and Water Quality Regulations

Federal Realty must navigate a complex web of federal air and water quality regulations, especially during property development and ongoing operations. These rules, enforced by agencies like the Environmental Protection Agency (EPA), govern emissions from HVAC systems and mandate measures to prevent water contamination from runoff or operational discharges.

Compliance is not just about avoiding penalties; it's a core aspect of responsible property management. For instance, the Clean Air Act sets National Ambient Air Quality Standards (NAAQS), and violations can lead to substantial fines. Similarly, the Clean Water Act regulates pollutant discharges into waterways, impacting how sites are managed.

- EPA Enforcement: In fiscal year 2023, the EPA reported over $10 billion in penalties and settlements related to environmental violations.

- Construction Impacts: Regulations like the Stormwater Management Program require permits and best practices to control sediment and pollutant runoff from construction sites, a key concern for redevelopment projects.

- Operational Emissions: Building systems, including boilers and generators, are subject to emissions standards, requiring regular monitoring and maintenance to meet federal air quality benchmarks.

Environmental factors significantly shape Federal Realty's operational landscape, from climate change impacts on coastal assets to the increasing demand for sustainable practices. Resource scarcity and rising utility costs necessitate strategic investments in efficiency and renewables, while stringent air and water quality regulations require diligent compliance.

These environmental considerations directly influence Federal Realty's financial performance through capital expenditures for resilience and sustainability, operational costs for utilities and waste management, and potential risks from regulatory non-compliance.

The company's proactive approach to sustainability, including energy efficiency improvements and waste reduction, not only addresses environmental concerns but also enhances brand reputation and tenant appeal, aligning with market trends observed in 2023 and 2024.

Navigating these environmental challenges and opportunities requires a data-driven approach to property management and strategic planning, ensuring long-term asset value and financial stability.

| Environmental Factor | Impact on Federal Realty | Key Data/Trend (2023-2025) | Mitigation/Opportunity |

|---|---|---|---|

| Climate Change & Sea Level Rise | Physical risk to coastal properties; increased insurance costs. | NOAA projects significant sea-level rise impacting markets like Boston by 2050. | Invest in resilience measures (elevating structures, improved drainage). |

| Sustainability Demand | Tenant and investor preference for green buildings; enhanced brand appeal. | 67% of tenants consider sustainability certifications (JLL, 2023). | Pursue LEED certifications; improve energy/water efficiency; reduce waste. |

| Resource Scarcity & Costs | Increased operational expenditures for water and energy. | Commercial electricity prices rose ~5-7% YoY in early 2024. | Implement water conservation tech; LED retrofits; explore solar energy. |

| Waste Management | Operational costs (landfill fees); tenant satisfaction; regulatory compliance. | US generated 292.4M tons of MSW in 2018 (EPA); focus on circular economy. | Enhance recycling/composting; adopt circular economy principles. |

| Air & Water Quality Regulations | Compliance costs; risk of penalties; impact on development and operations. | EPA reported over $10B in penalties/settlements in FY2023. | Ensure compliance with Clean Air/Water Acts; manage construction runoff. |

PESTLE Analysis Data Sources

Our Federal PESTLE Analysis relies on a robust mix of official government publications, Congressional records, and agency reports, ensuring comprehensive coverage of political and legal landscapes. We also incorporate data from reputable economic forecasts, technological trend analyses, and environmental impact studies to capture the full spectrum of macro-environmental factors.