FAT Brands SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FAT Brands Bundle

FAT Brands boasts a diverse portfolio of well-known restaurant concepts, a key strength in a dynamic market. However, understanding the nuances of their operational efficiencies and potential market saturation is crucial for informed decision-making.

Want the full story behind FAT Brands' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

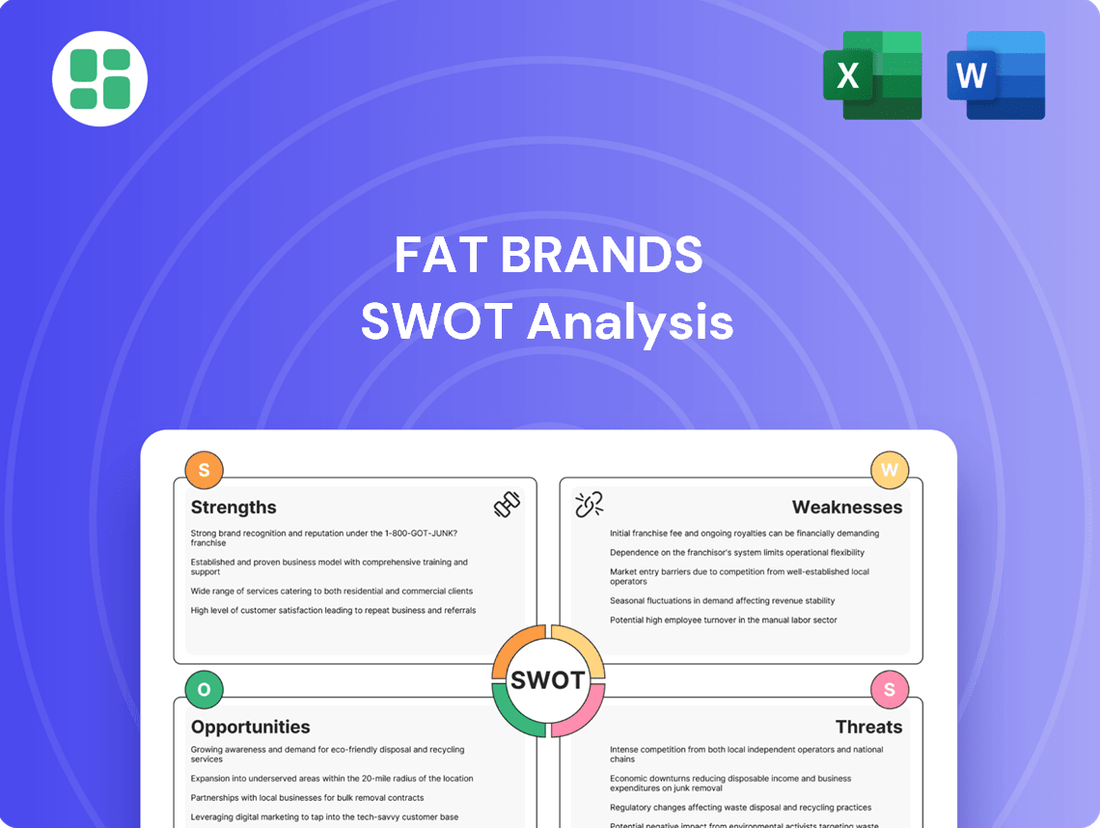

Strengths

FAT Brands Inc. showcases a robust strength in its diverse multi-brand portfolio, encompassing 18 distinct restaurant concepts that cater to a wide array of dining preferences, from quick service to more relaxed casual dining experiences. This broad spectrum of brands, including well-known names like Fatburger and Johnny Rockets, allows the company to tap into various market segments and consumer tastes, reducing dependence on any single brand's performance.

As of early 2024, FAT Brands operates approximately 2,300 units globally, a testament to the broad appeal and market penetration achieved through its diversified brand strategy. This extensive footprint not only provides significant revenue streams but also enhances brand visibility and resilience against localized economic downturns or shifting consumer trends within specific dining categories.

FAT Brands' asset-light franchising model is a core strength, allowing it to generate substantial revenue from royalties and franchise fees. This approach minimizes capital expenditure and operational risk by not directly owning the majority of its restaurant locations.

This strategic focus on franchising enables rapid, scalable growth. For instance, as of the first quarter of 2024, FAT Brands continued its strategic shift, with a significant portion of its portfolio operating under franchise agreements, demonstrating the model's effectiveness in expanding its brand footprint efficiently.

FAT Brands boasts a robust development pipeline, with roughly 1,000 franchise agreements signed, signaling strong future growth. This commitment from franchisees is a testament to the brand's appeal and potential.

The company's expansion efforts are clearly visible, with 23 new locations opened in Q1 2025, marking a significant 37% year-over-year increase. FAT Brands is targeting the addition of over 100 new restaurants throughout 2025, further solidifying its growth trajectory.

This extensive pipeline directly translates into a clear path for sustained expansion and a predictable increase in royalty revenue, underpinning the company's long-term financial health.

Strategic Acquisitions and Co-Branding Initiatives

FAT Brands consistently strengthens its market position through strategic acquisitions, notably adding brands like Smokey Bones and Twin Peaks to its portfolio. This expansion fuels growth and diversifies revenue streams.

Co-branding efforts, such as the pairing of Round Table Pizza with Marble Slab Creamery, represent a key strength. This strategy aims to enhance customer experience and drive incremental sales by leveraging the appeal of multiple brands within a single location.

- Acquisition Strategy: FAT Brands has a proven track record of acquiring established brands to broaden its restaurant portfolio.

- Co-Branding Innovation: Initiatives like the Round Table Pizza and Marble Slab Creamery integration create unique customer offerings and cross-promotional opportunities.

- Market Penetration: These combined strategies allow FAT Brands to reach a wider customer base and increase brand visibility.

Focus on Operational Efficiencies and Financial Restructuring

FAT Brands is prioritizing operational efficiencies and financial restructuring to bolster its performance. This includes aggressive cost reduction initiatives and strategic financial adjustments designed to improve its overall financial health.

A key move was securing a bondholder agreement to convert amortizing bonds to interest-only payments. This is projected to yield substantial annual cash flow savings, estimated to be around $10 million in 2024, providing much-needed liquidity.

- Balance Sheet Strengthening: Efforts are underway to improve the company's financial foundation.

- Cash Flow Improvement: The conversion to interest-only payments is expected to free up significant capital.

- Refranchising Strategy: A focus on refranchising company-owned locations aims to boost profitability and cash flow generation.

FAT Brands' diverse portfolio of 18 restaurant concepts, including popular names like Fatburger and Johnny Rockets, allows it to cater to a wide range of consumer preferences and market segments, reducing reliance on any single brand. As of early 2024, the company operated approximately 2,300 units globally, demonstrating significant market reach and brand resilience.

The company's asset-light franchising model is a significant strength, enabling scalable growth with minimal capital expenditure. This strategy allows FAT Brands to generate revenue primarily through royalties and franchise fees, as evidenced by its continued shift towards a franchise-heavy operational structure in early 2024.

FAT Brands is actively expanding its footprint, with a development pipeline of roughly 1,000 signed franchise agreements. This pipeline is translating into tangible growth, with 23 new locations opened in Q1 2025, a 37% year-over-year increase, and a target of over 100 new restaurants for the full year 2025.

Strategic acquisitions, such as the integration of Smokey Bones and Twin Peaks, along with innovative co-branding initiatives like Round Table Pizza and Marble Slab Creamery, further diversify revenue streams and enhance customer appeal. The company's financial health is also being bolstered by operational efficiencies and a strategic restructuring, including a bondholder agreement expected to save approximately $10 million in annual cash flow in 2024.

What is included in the product

Analyzes FAT Brands’s competitive position through key internal and external factors, detailing its strengths in brand portfolio and expansion, weaknesses in debt and integration, opportunities in market growth and acquisitions, and threats from competition and economic downturns.

FAT Brands' SWOT analysis offers a clear, actionable roadmap by identifying key opportunities and mitigating potential threats, simplifying complex strategic planning for executives.

Weaknesses

FAT Brands is grappling with a significant hurdle: declining same-store sales and revenue, even as it pushes for expansion. This trend suggests that the company's established locations are struggling to maintain or grow their sales volume. For instance, Q1 2025 witnessed a 3.4% drop in system-wide same-store sales and a 6.5% decrease in total revenue.

The challenges continued into Q2 2025, with same-store sales falling by 3.9% and revenue declining by 3.4%. These figures point to a potential weakening of consumer demand at existing restaurants, which directly impacts the company's overall financial health and growth prospects.

FAT Brands has struggled with profitability, posting significant net losses. For instance, the company reported a net loss of $46.0 million in the first quarter of 2025 and a $54.2 million loss in the second quarter of 2025. These figures indicate a widening loss trend compared to previous periods, which is a clear concern for its financial health.

Adding to these concerns is the company's substantial debt load. As of the first quarter of 2025, FAT Brands carried a debt burden of $1.57 billion. This level of debt translates into considerable interest expenses, which further strain the company's financial performance and limit its flexibility.

While acquiring new brands fuels FAT Brands' expansion, it brings significant integration hurdles and higher operational expenses. These challenges can strain resources and impact profitability, as seen with the company's Q4 2024 operating profit decline, partially linked to costs from integrating Smokey Bones.

Effectively merging newly acquired businesses into the existing operational framework is a complex and expensive undertaking. Successfully managing this process across a diverse and growing brand portfolio requires substantial investment and careful execution to avoid disruptions and maintain efficiency.

Reliance on Franchisee Performance

FAT Brands' asset-light strategy, while advantageous for growth, creates a significant dependence on the performance of its franchisees. The financial health and operational success of these independent operators directly influence the company's revenue streams. For instance, a downturn in same-store sales at franchised locations, as experienced by many in the casual dining sector during economic slowdowns, directly impacts the royalty and advertising fees FAT Brands collects. This reliance means that broader economic challenges or specific issues affecting individual franchisees can disproportionately affect the parent company's financial results.

The company's revenue is intrinsically linked to the success and expansion of its franchised units. In 2023, FAT Brands reported that a substantial portion of its revenue came from franchise royalties and fees. For example, if a significant number of franchisees struggle with profitability due to rising costs or decreased customer traffic, FAT Brands' ability to collect these fees is diminished, directly impacting its top line. This model requires constant monitoring and support for franchisees to ensure their viability and, by extension, FAT Brands' consistent revenue generation.

- Franchisee Dependence: FAT Brands' revenue is heavily reliant on the financial performance and operational success of its franchisees.

- Impact of Same-Store Sales: Lower same-store sales at franchised locations directly reduce royalty and advertising fee collections for FAT Brands.

- Economic Sensitivity: Broader economic challenges that affect franchisee profitability also negatively impact FAT Brands' income.

- Revenue Stream Linkage: The company's financial health is directly tied to the ability of its franchised units to generate sales and expand.

Increased General and Administrative Expenses

FAT Brands has faced a significant challenge with rising general and administrative (G&A) expenses. In the second quarter of 2025, these costs surged by 50.3%, reaching $44.4 million.

This substantial increase was largely driven by several factors. A key contributor was the higher share-based compensation expense associated with Twin Hospitality Group Inc. Additionally, the company recognized Employee Retention Credits in the previous year, making the current year's comparison appear higher.

- Increased G&A Expenses: G&A costs rose by 50.3% in Q2 2025 to $44.4 million.

- Share-Based Compensation: Higher expenses related to Twin Hospitality Group Inc. were a primary driver.

- Prior Year Credits: The recognition of Employee Retention Credits in the prior year impacted the year-over-year comparison.

- Profitability Strain: Escalating overhead costs can put additional pressure on profitability, especially when revenues are declining.

FAT Brands faces a pronounced weakness in its same-store sales performance, with a notable decline across its brands. For instance, Q1 2025 saw a 3.4% drop in system-wide same-store sales, followed by a 3.9% decrease in Q2 2025. This trend indicates that existing restaurant locations are struggling to attract and retain customers, impacting overall revenue generation and brand vitality.

The company's profitability remains a significant concern, marked by substantial net losses. Q1 2025 reported a net loss of $46.0 million, and this widened to $54.2 million in Q2 2025. These persistent losses, coupled with a considerable debt burden of $1.57 billion as of Q1 2025, create financial strain and limit the company's ability to invest in growth or weather economic downturns.

FAT Brands' reliance on franchisees presents a vulnerability, as its revenue streams are directly tied to their success. Declining franchisee sales directly translate to lower royalty and fee collections for FAT Brands, making the company susceptible to broader economic challenges or issues impacting individual franchisees. This dependence necessitates robust support for franchisees to ensure their ongoing viability and, consequently, the company's financial stability.

Rising operational costs, particularly General and Administrative (G&A) expenses, are another key weakness. G&A costs surged by 50.3% in Q2 2025 to $44.4 million, driven by factors like increased share-based compensation. These escalating overheads can further pressure profitability, especially when combined with declining sales at existing locations.

Same Document Delivered

FAT Brands SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file, offering a clear glimpse into its quality and depth. The complete version becomes available after checkout, ensuring you get the full, comprehensive report.

Opportunities

FAT Brands is poised for substantial international expansion, with recent agreements signaling a strong push into new territories. A key development is the plan to open 40 new Fatburger and Buffalo's Cafe locations across France, highlighting a strategic focus on the European market.

This expansion into France is more than just adding new restaurants; it's about tapping into a large consumer base and diversifying FAT Brands' revenue streams. By entering markets with high growth potential and less penetration, the company can mitigate risks associated with over-reliance on any single region.

Investing in digital transformation offers FAT Brands a significant avenue for growth. Enhancing online ordering systems, loyalty programs, and digital marketing across its portfolio can boost customer engagement and sales.

Great American Cookies, a key brand, demonstrates this potential, with digital sales accounting for 25% of its total revenue and loyalty-driven sales experiencing 40% growth. This success highlights the opportunity to replicate these digital strategies across FAT Brands' other concepts.

Expanding these digital capabilities can lead to improved operational efficiency and a stronger connection with consumers, ultimately driving revenue and market share in the evolving restaurant landscape.

FAT Brands' strategic move to refranchise its company-owned Fazoli's locations, aiming for a nearly 100% franchised model, presents a significant opportunity. This shift is designed to lower the company's capital requirements, freeing up resources and enhancing its cash flow generation capabilities. By adopting a more asset-light approach, FAT Brands can unlock capital that can be strategically deployed towards reducing its existing debt load and further optimizing its operational efficiency.

Leveraging Manufacturing Capabilities

FAT Brands is strategically expanding its manufacturing operations, creating a significant opportunity for growth. The company has already secured its inaugural third-party contract with a prominent national restaurant entertainment chain, slated for execution in the second quarter of 2025. This move highlights the potential to monetize underutilized factory capacity by supplying goods to external businesses.

This expansion into third-party manufacturing offers a clear path to diversifying revenue streams beyond its established franchise model. By leveraging existing infrastructure, FAT Brands can tap into new markets and generate additional income.

- Revenue Diversification: The third-party manufacturing contract is expected to contribute to FAT Brands' top-line growth, moving beyond traditional franchise fees and royalties.

- Capacity Utilization: Effectively utilizing excess manufacturing capacity can improve operational efficiency and profitability.

- Market Expansion: Supplying other businesses opens doors to new customer segments and strengthens FAT Brands' presence in the broader food supply chain.

Strategic Partnerships and Co-Branding Growth

FAT Brands can significantly boost its growth trajectory by actively seeking out and nurturing strategic partnerships and expanding co-branding efforts. This approach allows for shared resources and marketing reach, ultimately driving innovation and customer acquisition.

The proven success of co-branded concepts, such as the integration of Round Table Pizza and Marble Slab Creamery, highlights the powerful synergy achievable. These collaborations not only reduce operational costs but also tap into new customer bases for both brands, potentially increasing revenue per location.

- Synergistic Growth: Co-branding leverages existing customer loyalty and brand recognition to attract new demographics.

- Cost Efficiencies: Shared marketing expenses and operational resources can improve profitability for participating brands.

- Innovation Driver: Partnerships can lead to unique product offerings and enhanced customer experiences.

FAT Brands is strategically expanding its international footprint, with a significant focus on markets like France, where 40 new Fatburger and Buffalo's Cafe locations are planned. This international growth diversifies revenue and taps into new consumer bases.

The company is also leveraging digital transformation to enhance customer engagement and sales, as seen with Great American Cookies' digital sales contributing 25% of its revenue. This digital push is expected to improve operational efficiency and market share.

FAT Brands' move to a nearly 100% franchised model for Fazoli's is designed to reduce capital requirements and improve cash flow, allowing for strategic debt reduction and operational optimization.

Furthermore, the expansion into third-party manufacturing, starting with a national restaurant entertainment chain in Q2 2025, offers a new revenue stream by utilizing existing factory capacity.

Strategic partnerships and co-branding, like the integration of Round Table Pizza and Marble Slab Creamery, present opportunities for synergistic growth, cost efficiencies, and innovation.

Threats

The restaurant sector, a crowded arena, sees both seasoned brands and emerging concepts constantly battling for customer attention and dollars. This fierce rivalry means FAT Brands and its franchisees face pressure on menu prices and must invest heavily in marketing and new offerings to stand out, potentially squeezing profit margins.

Economic downturns, persistent inflation, and shifts in consumer spending habits represent a significant threat to FAT Brands. Consumers may reduce discretionary spending on dining out, impacting restaurant traffic and sales volumes.

For instance, FAT Brands has observed lower same-store sales in recent quarters. This trend is partly due to economic pressures such as labor inflation and rising food ingredient costs, which directly affect the profitability of both company-owned and franchised locations.

FAT Brands faces a significant challenge with its high debt burden, which directly translates into substantial interest expenses that eat into its profitability. This financial strain is evident in the company's reported figures, where total other expense, net, saw a notable increase during the first two quarters of 2025, largely driven by these interest costs.

The weight of this debt limits FAT Brands' ability to pursue new opportunities or weather economic downturns, increasing its overall financial risk. Managing and refinancing this debt will continue to be a critical focus for the company.

Operational and Integration Risks from Rapid Expansion

FAT Brands' aggressive growth strategy, while an opportunity, presents significant operational and integration risks. Rapidly opening new stores and acquiring multiple brands in a short period can stretch management bandwidth thin. This can lead to challenges in maintaining consistent quality and customer experience across the growing portfolio.

Integrating new acquisitions, such as the Johnny Rockets acquisition in 2020, requires substantial resources and can uncover unforeseen operational issues or costs. For instance, if the integration of systems or supply chains is not seamless, it can disrupt daily operations and impact profitability. The company needs robust systems and experienced personnel to manage this influx effectively.

- Strain on Management: Rapid expansion can overwhelm existing management structures, potentially leading to slower decision-making and less effective oversight.

- Inconsistent Brand Experience: Maintaining brand standards across numerous new and acquired locations is challenging, risking diluted brand equity.

- Unexpected Costs: Integration processes and addressing operational deficiencies in acquired businesses can lead to unbudgeted expenses.

- Integration Challenges: Merging different operational systems, cultures, and supply chains can be complex and time-consuming, impacting efficiency.

Brand Reputation and Litigation Risks

FAT Brands operates a portfolio of distinct restaurant concepts, meaning a misstep or negative publicity surrounding one brand, such as a food safety issue or a viral customer complaint, could tarnish the image of the entire FAT Brands umbrella. This contagion risk is a significant concern for a multi-brand operator.

The company is not immune to the threat of litigation. Pending legal actions can lead to substantial expenses for legal defense and potentially significant financial settlements or judgments. For instance, FAT Brands reported increased professional fees related to litigation in Q3 2025, highlighting the ongoing financial impact of these legal challenges.

- Brand Contagion: Negative events impacting one FAT Brands concept can adversely affect consumer perception of sister brands.

- Litigation Costs: Ongoing legal disputes necessitate considerable expenditure on legal counsel and associated professional services.

- Financial Exposure: Adverse litigation outcomes could result in material financial liabilities, impacting profitability and cash flow.

- Reputational Damage: Litigation, especially if it involves serious allegations, can severely damage brand equity and customer trust across the portfolio.

FAT Brands faces intense competition in the restaurant industry, which can pressure pricing and require significant marketing investment. Economic headwinds, including inflation and potential consumer spending cuts, directly impact sales volumes and profitability, as seen in recent same-store sales trends. The company's substantial debt load is a major threat, leading to increased interest expenses that strain financial performance and limit strategic flexibility.

| Threat Category | Specific Risk | Impact on FAT Brands |

|---|---|---|

| Competition | Intense rivalry, pricing pressure | Reduced profit margins, increased marketing costs |

| Economic Factors | Inflation, reduced consumer spending | Lower sales volumes, decreased profitability |

| Financial Structure | High debt burden, interest expenses | Strain on profitability, limited financial flexibility |

| Operational Risks | Integration challenges, management strain | Inconsistent brand experience, unexpected costs |

| Reputational Risks | Brand contagion, litigation | Damage to brand equity, significant legal expenses |

SWOT Analysis Data Sources

This analysis is built on a foundation of reliable data, including FAT Brands' official financial filings, comprehensive market research reports, and expert industry commentary to provide an accurate and insightful SWOT assessment.