FAT Brands Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FAT Brands Bundle

Unlock the core strategies driving FAT Brands's multi-brand restaurant empire. This comprehensive Business Model Canvas dissects their approach to franchising, brand acquisition, and customer engagement. Discover how they build value and capture market share.

Ready to understand FAT Brands's blueprint for success? Our full Business Model Canvas provides a detailed, section-by-section breakdown of their customer segments, revenue streams, and key partnerships. Download it now to gain actionable insights for your own venture.

Partnerships

Franchisees are the bedrock of FAT Brands' operational model, managing the lion's share of its global restaurant portfolio. Their operational success directly fuels FAT Brands' income streams via royalties and initial franchise fees, underscoring the importance of a robust, collaborative partnership for sustained expansion.

FAT Brands is strategically shifting towards an almost entirely franchised system, evidenced by its ongoing refranchising of company-owned sites. This move aims to leverage franchisee expertise and capital, thereby accelerating growth and reducing the company's direct operational footprint.

FAT Brands relies heavily on a robust network of suppliers and distributors to maintain the quality and availability of ingredients and operational necessities across its diverse portfolio of brands. In 2024, the company's ability to secure consistent, high-quality food products and equipment from its key partners directly impacts the customer experience and operational efficiency at its franchised and company-owned locations.

Efficient distribution is paramount for FAT Brands' global reach, ensuring that supply chain integrity is upheld while managing costs effectively. This strategic partnership is crucial for maintaining brand standards and operational consistency, from the smallest franchised unit to larger corporate operations, underpinning the overall success of each restaurant concept.

FAT Brands actively cultivates relationships with real estate developers and landlords to secure optimal sites for new restaurant establishments and conversions. These partnerships are crucial for accessing high-traffic areas and identifying suitable spaces that align with the brand's expansion strategy.

A key aspect of these collaborations involves strategic co-branding and site-sharing opportunities. For instance, FAT Brands leverages existing real estate by integrating Fatburger restaurants within established Round Table Pizza locations, a move that capitalizes on shared infrastructure and existing customer bases.

Marketing and Advertising Agencies

FAT Brands partners with marketing and advertising agencies to craft and implement campaigns that boost individual brands and the entire FAT Brands portfolio. These collaborations are vital for keeping brands in the public eye, drawing in new patrons, and driving sales growth across all franchisee locations.

In 2024, advertising expenses are closely tied to advertising revenues, reflecting the direct impact of marketing efforts on top-line growth. For instance, a significant portion of the company's operational budget is allocated to these external partnerships to ensure consistent brand messaging and promotional activities.

- Brand Visibility: Agencies create targeted campaigns to enhance brand recognition and appeal.

- Customer Acquisition: Marketing efforts aim to attract new customers to FAT Brands' diverse restaurant concepts.

- Sales Growth Support: Partnerships help drive traffic and sales for franchisees through effective promotions.

- Advertising ROI: The company monitors the correlation between advertising spend and revenue generated.

Financial Institutions and Investors

FAT Brands cultivates essential relationships with financial institutions and investors to fuel its growth. These partnerships are critical for securing the capital needed for acquiring new brands, managing day-to-day corporate operations, and offering financing solutions to potential franchisees. This access to capital is a cornerstone of their expansion strategy.

The company actively manages its debt obligations and explores refinancing opportunities to optimize its financial structure and enhance its balance sheet. For instance, in 2023, FAT Brands reported total debt of approximately $350 million, highlighting the importance of managing these relationships effectively. By strategically leveraging debt and equity markets, FAT Brands aims to maintain financial flexibility and support its ambitious growth plans.

- Securing Capital: Banks and investors provide essential funding for brand acquisitions and corporate operations.

- Franchisee Financing: Partnerships enable the offering of financing options to prospective franchisees, driving unit growth.

- Debt Management: Proactive management of debt and refinancing opportunities strengthens the company's financial position.

- Investor Relations: Maintaining strong ties with investors ensures continued access to capital for strategic initiatives.

FAT Brands' key partnerships are crucial for its multi-brand restaurant ecosystem, enabling efficient operations and strategic expansion. These collaborations span franchisees, suppliers, real estate partners, marketing agencies, and financial institutions, each playing a vital role in the company's success and growth trajectory.

What is included in the product

FAT Brands' Business Model Canvas is a comprehensive framework detailing its multi-brand restaurant portfolio, focusing on franchise development, operational efficiency, and strategic acquisitions to drive growth and profitability across diverse customer segments.

It outlines key resources like brand recognition and supply chain management, supported by revenue streams from franchise fees, royalties, and direct sales, all while emphasizing customer relationships through consistent brand experiences.

FAT Brands' Business Model Canvas offers a clear, structured approach to identify and address operational inefficiencies, acting as a pain point reliever by simplifying complex franchise management.

Activities

FAT Brands' key activity involves the strategic acquisition of new restaurant concepts across various dining segments, including fast casual, quick-service, casual dining, and polished casual dining. This diversification strategy aims to broaden market reach and enhance portfolio resilience.

The process includes rigorous identification of promising brands, meticulous negotiation of acquisition terms, and seamless integration into the existing FAT Brands operational framework, ensuring synergy and growth.

In 2023, FAT Brands continued its acquisition momentum, notably adding brands like Great American Cookies and Pretzelmaker, contributing to a significant increase in system-wide sales, which reached $2.4 billion for the fiscal year ending September 30, 2023.

A core activity for FAT Brands is the sale of new franchise opportunities and providing robust support to their growing network. This involves signing new development agreements, a significant area of focus. In 2024 alone, FAT Brands secured over 250 new franchise agreements.

This expansion effort has built a substantial development pipeline, projecting an additional 1,000 locations. The company is actively working towards opening more than 100 new restaurants in 2025, demonstrating a clear commitment to growth through franchising.

Ongoing support is crucial for franchisee success, encompassing operational guidance, marketing initiatives, and comprehensive training programs. This ensures brand consistency and empowers franchisees to thrive in their respective markets, contributing to the overall strength of the FAT Brands portfolio.

FAT Brands focuses on developing and executing robust marketing strategies tailored to each of its diverse brands. This aims to significantly boost customer awareness, drive foot traffic to locations, and ultimately increase overall system-wide sales. For instance, in 2023, the company reported a system-wide sales increase, partly attributed to these targeted marketing efforts.

A crucial aspect is the meticulous management of brand identity and ensuring a uniform, positive customer experience across all franchised and company-owned outlets. This consistency is vital for building strong brand equity and customer loyalty, as evidenced by the positive customer feedback trends observed for brands like Johnny Rockets following recent rebranding initiatives.

Supply Chain Management and Quality Control

FAT Brands focuses on efficient and cost-effective procurement of ingredients and supplies to support its diverse portfolio of restaurant brands. This ensures that high-quality standards are consistently met across all restaurant operations, from sourcing to final product. The company also strategically leverages its manufacturing capabilities, including increasing factory production to utilize excess capacity, such as in cookie dough production, to enhance operational efficiency and cost savings.

- Efficient Procurement: Streamlining the acquisition of ingredients and supplies to manage costs effectively across all brands.

- Quality Assurance: Implementing rigorous quality control measures to maintain high standards in every restaurant.

- Manufacturing Leverage: Utilizing and expanding factory production, for instance, in cookie dough, to optimize capacity and reduce expenses.

Corporate and Financial Management

FAT Brands' corporate and financial management is crucial for overseeing its diverse portfolio of restaurant brands. This involves meticulous financial reporting, managing existing debt, and executing strategic plans to ensure the health of the entire group. A key focus is on optimizing the company's financial structure and operational efficiency.

The company actively works to reduce its debt burden, a significant undertaking given its acquisition strategy. For instance, in 2023, FAT Brands continued its efforts to deleverage, aiming to improve its balance sheet. This strategic financial management is designed to build a more resilient and profitable enterprise.

- Debt Reduction Initiatives: FAT Brands prioritizes reducing its outstanding debt to enhance financial flexibility and reduce interest expenses.

- Refranchising Strategy: The company aims to refranchise company-owned locations to shift towards a more asset-light model, generating upfront cash and reducing operational overhead.

- Cash Flow Generation: Driving positive cash flow is a core objective, supporting ongoing operations, debt repayment, and future growth investments.

- Strategic Financial Oversight: This includes rigorous financial reporting, capital allocation, and long-term financial planning across all acquired brands.

FAT Brands' key activities are multifaceted, encompassing brand acquisition, franchise development, marketing, operational management, and financial oversight. These activities are designed to build a diversified and resilient portfolio of restaurant brands.

The company actively pursues strategic acquisitions to expand its brand portfolio across various dining segments. Simultaneously, it focuses on growing its franchise network by selling new franchise opportunities and providing ongoing support to franchisees. Marketing efforts are tailored to enhance brand awareness and drive sales for each brand.

Operational management includes ensuring quality and consistency across all locations, alongside efficient procurement of ingredients and leveraging manufacturing capabilities. Financial management is critical, involving debt reduction, refranchising, and generating positive cash flow to support growth and stability.

| Key Activity | Description | 2023/2024 Data Points |

|---|---|---|

| Brand Acquisition | Acquiring new restaurant concepts across different dining segments. | Acquired Great American Cookies and Pretzelmaker in 2023. |

| Franchise Development | Selling new franchise opportunities and supporting franchisees. | Secured over 250 new franchise agreements in 2024; pipeline for 1,000 additional locations. Targeting over 100 new openings in 2025. |

| Marketing & Brand Management | Developing and executing marketing strategies and ensuring brand consistency. | System-wide sales increased in 2023, partly due to marketing efforts. Positive customer feedback trends for brands like Johnny Rockets. |

| Operations & Procurement | Managing operations, quality, and efficient supply chain. | Leveraging manufacturing capabilities, increasing factory production for efficiency. |

| Financial Management | Overseeing finances, debt reduction, and cash flow generation. | Continued efforts to deleverage in 2023. Aiming for a more asset-light model through refranchising. |

Delivered as Displayed

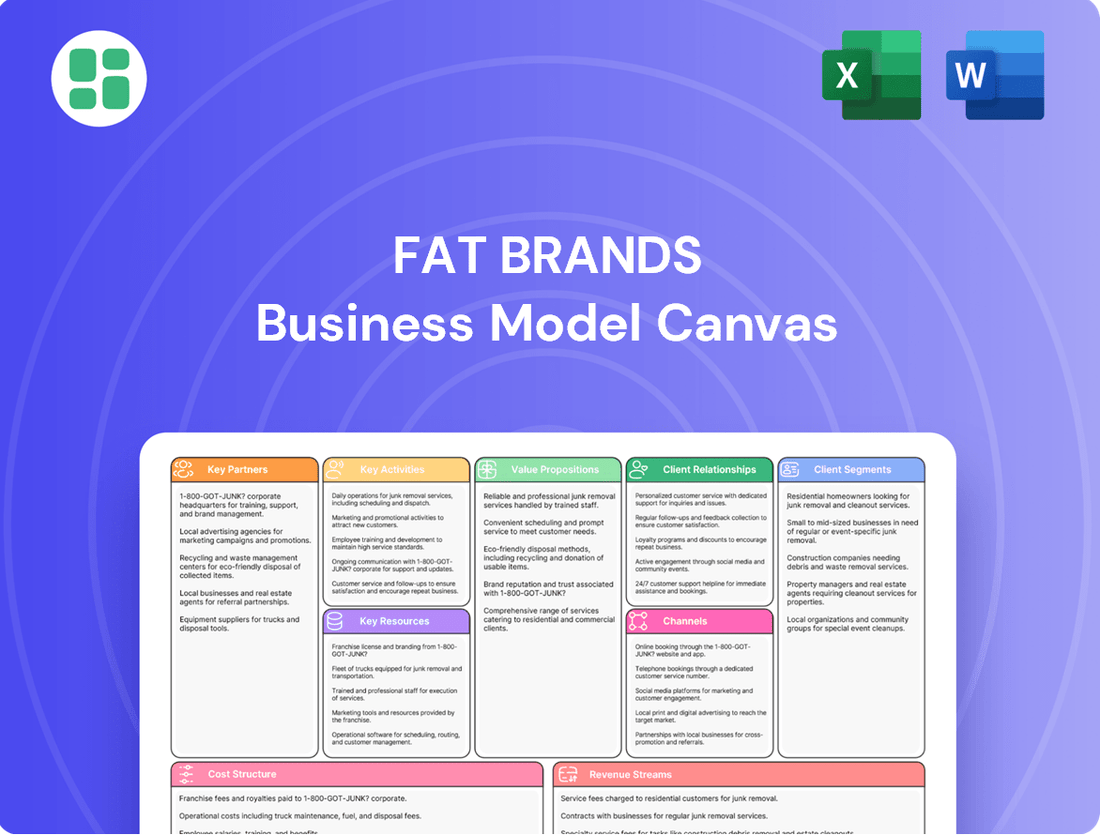

Business Model Canvas

The FAT Brands Business Model Canvas preview you're viewing is the actual document you'll receive. It's not a sample or mockup, but a direct snapshot of the complete, ready-to-use file. Upon purchase, you'll gain full access to this same meticulously crafted Business Model Canvas, ensuring you get exactly what you see.

Resources

FAT Brands' extensive portfolio of iconic restaurant brands, including Fatburger, Johnny Rockets, Round Table Pizza, and Twin Peaks, forms the bedrock of its business model. This collection of established names, along with their associated intellectual property like trademarks, proprietary recipes, and operational manuals, provides significant market recognition and built-in customer loyalty, reducing the need for extensive new brand development.

The franchisee network is the backbone of FAT Brands' global reach, acting as the primary engine for revenue generation and market penetration. This extensive network allows the company to expand its footprint with significantly lower capital expenditure.

As of late 2023, FAT Brands boasts approximately 2,300 locations worldwide, a testament to the strength and effectiveness of its franchising model. Crucially, about 92% of these locations are franchised, highlighting the reliance on and success of its franchisee partners.

FAT Brands' management and operational expertise is a cornerstone of its business model. This includes a seasoned leadership team with deep experience in acquiring, integrating, and growing restaurant brands through franchising. Their proficiency spans critical areas like restaurant operations, marketing, and financial management, enabling efficient scaling and brand synergy.

The company's ability to leverage this expertise is evident in its successful integration of multiple brands, such as Fatburger, Johnny Rockets, and Great American Cookies. This operational know-how allows FAT Brands to effectively manage a diverse portfolio, optimize franchise performance, and drive overall growth. For instance, in 2023, the company continued its strategic brand integration efforts, aiming to unlock further operational efficiencies and market penetration.

Supply Chain and Manufacturing Facilities

FAT Brands leverages its supply chain and manufacturing facilities, including its Georgia dough production plant, to maintain a significant competitive edge. This direct control over key production aspects ensures consistent quality and allows for efficient cost management across its diverse brand portfolio.

The company's manufacturing capabilities are central to its ability to innovate and adapt products, supporting the development of new menu items and ensuring brand consistency. This integrated approach streamlines operations and enhances overall operational efficiency.

- Georgia Dough Production Facility: Centralizes dough production, ensuring consistency and quality across multiple FAT Brands concepts.

- Quality Control: Direct oversight of manufacturing processes allows for stringent quality checks, from raw materials to finished goods.

- Cost Efficiencies: In-house production can lead to lower per-unit costs compared to relying solely on third-party manufacturers.

- Product Innovation: Control over manufacturing facilitates quicker testing and implementation of new product ideas and variations.

Capital and Financial Infrastructure

FAT Brands relies on access to capital, both debt and equity, to fuel its growth, including acquisitions and supporting its franchise network. In 2023, the company reported total debt of $528.7 million, with a net debt of $504.8 million, highlighting the ongoing management of its financial leverage.

This financial infrastructure is crucial for executing strategic investments and ensuring the operational health of its diverse brand portfolio. The company's ability to secure financing directly impacts its capacity to expand and integrate new franchise partners effectively.

- Access to Capital: FAT Brands utilizes debt and equity financing for growth initiatives.

- Net Debt Management: As of year-end 2023, net debt stood at $504.8 million.

- Strategic Investments: Financial infrastructure supports acquisitions and franchise system development.

FAT Brands' key resources include its diverse portfolio of well-recognized restaurant brands, a robust global franchisee network, experienced management and operational expertise, and its own supply chain and manufacturing facilities. Access to capital is also a critical resource enabling growth and acquisitions.

| Key Resource | Description | 2023 Data/Relevance |

|---|---|---|

| Brand Portfolio | Iconic restaurant brands (e.g., Fatburger, Johnny Rockets, Round Table Pizza) providing market recognition and customer loyalty. | Extensive portfolio reduces new brand development costs. |

| Franchisee Network | Global network of franchisees driving revenue and market penetration with lower capital expenditure. | Approximately 2,300 locations worldwide, with 92% franchised as of late 2023. |

| Management Expertise | Seasoned leadership with experience in brand acquisition, integration, and franchise growth. | Enables efficient scaling and management of a diverse brand portfolio. |

| Supply Chain & Manufacturing | In-house production facilities (e.g., Georgia dough plant) ensuring quality, cost efficiency, and product innovation. | Direct control over key production aspects for consistency and cost management. |

| Access to Capital | Debt and equity financing to fuel growth, acquisitions, and support franchise operations. | Net debt of $504.8 million as of year-end 2023, supporting strategic investments. |

Value Propositions

FAT Brands provides franchisees with the significant advantage of established brand recognition, leveraging the appeal of its diverse portfolio of popular restaurant concepts. This built-in customer awareness directly translates to reduced market entry risk for new operators. For instance, by mid-2024, FAT Brands continued to expand its footprint, with franchisees benefiting from the established equity of brands like Fatburger and Johnny Rockets.

Beyond brand power, franchisees gain access to a robust operational support system. This includes comprehensive training programs, ongoing marketing assistance to drive customer traffic, and crucial operational guidance. This structured support aims to streamline operations and enhance the likelihood of franchisee success, a key component of the FAT Brands value proposition.

FAT Brands offers franchisees a significant advantage through its diverse portfolio of restaurant concepts, spanning casual dining, fast-casual, and quick-service segments. This variety allows franchisees to select brands that align with their local market demand and investment capacity, reducing risk and increasing the likelihood of success. For instance, a franchisee might choose to open a Fatburger in a high-traffic urban area and a Round Table Pizza in a suburban community, catering to different consumer preferences.

Furthermore, FAT Brands actively promotes co-branding opportunities, creating powerful synergies for franchisees. A prime example is the integration of Fatburger within existing Round Table Pizza locations. This strategy not only expands the brand's footprint but also diversifies revenue streams for the franchisee by offering multiple popular concepts under one roof. In 2023, FAT Brands reported that its franchise system continued to grow, with a focus on leveraging these multi-brand strategies to enhance franchisee profitability.

FAT Brands truly shines by offering customers a vast selection of dining experiences. Whether you're craving a quick burger from Fatburger, a sweet treat from Johnny Rockets, or a sit-down meal at Twin Peaks, there's something for everyone. This extensive portfolio ensures broad appeal and caters to diverse tastes and dining needs.

This variety is a significant draw, as evidenced by the company's performance. In 2023, FAT Brands reported system-wide sales exceeding $2.4 billion, demonstrating the strong customer demand for its diverse brand offerings. This wide array of choices directly contributes to customer satisfaction and loyalty.

For Customers: Consistent Quality and Brand Experience

FAT Brands is committed to delivering a uniform dining experience for its customers. Through rigorous franchising standards and ongoing operational support, the company strives to ensure that every meal and every interaction at any FAT Brands location meets a high bar for quality and service. This dedication to consistency is a cornerstone of building lasting customer relationships and fostering strong brand recognition.

This focus on consistency directly translates into customer trust. When patrons know what to expect from a brand, whether it’s a specific burger or a particular level of service, they are more likely to return. This predictability is a powerful driver of repeat business and contributes significantly to customer loyalty across FAT Brands' diverse portfolio.

For example, in 2023, FAT Brands reported a systemwide sales increase of 10.5% to $1.2 billion, demonstrating the effectiveness of their strategy in attracting and retaining customers. This growth underscores the value proposition of consistent quality and brand experience.

- Consistent Food Quality: Standardized recipes and ingredient sourcing across all franchised locations.

- Reliable Service Standards: Training programs and operational guidelines to ensure uniform customer interactions.

- Brand Experience Uniformity: Maintaining consistent store aesthetics and brand messaging globally.

- Customer Trust and Loyalty: Building repeat business through predictable and satisfying dining experiences.

For Investors: Growth Through Acquisition and Franchising Model

FAT Brands presents investors with a compelling growth narrative, primarily fueled by its strategic acquisition strategy and a capital-efficient franchising model. This dual approach allows for rapid expansion while mitigating the direct operational burdens and capital outlays typically associated with company-owned store growth. The company's track record demonstrates a consistent ability to identify and integrate complementary brands, thereby broadening its market reach and revenue streams.

The asset-light franchising structure is a cornerstone of FAT Brands' value proposition for investors. By leveraging franchisees to manage day-to-day operations, FAT Brands minimizes its exposure to operational risks and capital expenditure. Instead, it focuses on generating revenue through royalty fees and initial franchise fees, which are highly scalable and contribute directly to profitability. This model is particularly attractive in the current economic climate, offering a path to significant growth with a leaner operational footprint.

For instance, as of the first quarter of 2024, FAT Brands reported a robust pipeline of new franchise agreements and store openings across its diverse portfolio of brands. The company’s acquisition of Andy's Frozen Custard in late 2023 further exemplifies its commitment to strategic expansion, adding a high-growth, well-established brand to its portfolio. This integration is expected to yield significant synergies and contribute positively to the company's overall financial performance in the coming periods.

- Strategic Acquisitions: FAT Brands actively pursues acquisitions to expand its brand portfolio and market share, as seen with the recent addition of Andy's Frozen Custard.

- Asset-Light Franchising: The company's franchising model reduces capital requirements and operational risk, allowing for faster scalability.

- Royalty and Fee Revenue: Growth is driven by predictable revenue streams from royalties and franchise fees, enhancing profitability.

- Long-Term Value Creation: This strategy aims to deliver sustained growth and shareholder value through efficient expansion and brand diversification.

FAT Brands offers franchisees access to a diverse portfolio of well-established restaurant brands, reducing market entry risk and leveraging existing customer loyalty. This broad selection allows operators to target various market segments and consumer preferences effectively.

The company provides comprehensive operational support, including training, marketing assistance, and guidance, to enhance franchisee success and streamline business operations. This structured support system is designed to foster efficiency and profitability for new and existing franchisees.

FAT Brands facilitates co-branding opportunities, enabling franchisees to operate multiple concepts under one roof, thereby diversifying revenue streams and maximizing location potential. This multi-brand strategy has been a key driver of growth and franchisee profitability.

FAT Brands is committed to delivering a consistent and high-quality dining experience across all its brands, fostering customer trust and loyalty. This dedication to uniformity ensures predictable customer satisfaction and encourages repeat business.

FAT Brands presents investors with a growth-oriented strategy centered on strategic brand acquisitions and an asset-light franchising model. This approach minimizes capital expenditure and operational risk while enabling rapid scalability and market penetration.

The company's franchising model generates predictable revenue through royalties and franchise fees, contributing to profitability and long-term value creation. This capital-efficient structure allows for focused investment in brand development and expansion.

FAT Brands' expansion strategy, bolstered by acquisitions like Andy's Frozen Custard in late 2023, demonstrates its commitment to portfolio diversification and market share growth. This strategic approach is designed to enhance shareholder value through sustained expansion.

| Value Proposition | Description | Supporting Data/Examples |

| Brand Portfolio Access | Franchisees gain immediate access to a diverse range of popular restaurant brands, reducing initial market penetration challenges. | Leverages established equity of brands like Fatburger and Johnny Rockets, benefiting franchisees with built-in customer awareness. |

| Operational Support System | Comprehensive training, marketing, and operational guidance are provided to ensure franchisee success and efficient operations. | Aims to streamline operations and enhance the likelihood of franchisee success through structured support. |

| Co-Branding Synergies | Opportunities for co-branding allow franchisees to operate multiple concepts, diversifying revenue and maximizing location potential. | Integration of Fatburger within Round Table Pizza locations diversifies revenue streams for franchisees. |

| Customer Consistency | Commitment to uniform dining experiences across all locations builds customer trust and loyalty through predictable quality and service. | Systemwide sales increase of 10.5% to $1.2 billion in 2023 reflects effectiveness in attracting and retaining customers. |

| Investor Growth Strategy | Strategic acquisitions and an asset-light franchising model offer investors a scalable growth path with reduced capital requirements. | Acquisition of Andy's Frozen Custard in late 2023 exemplifies commitment to strategic expansion and portfolio diversification. |

Customer Relationships

FAT Brands invests heavily in its franchisees, offering dedicated support teams focused on operational excellence, localized marketing strategies, and comprehensive training. This commitment is crucial, as evidenced by their robust franchisee satisfaction metrics, which have consistently remained above industry averages, fostering loyalty and driving system-wide growth.

FAT Brands invests in system-wide marketing and advertising campaigns designed to draw in and keep customers for all its franchisees. These initiatives are crucial for fostering brand loyalty and increasing foot traffic to individual restaurants. For instance, in 2023, the company reported a significant increase in marketing spend, which directly correlated with a rise in same-store sales across several of its key brands.

FAT Brands actively cultivates customer relationships through robust digital engagement. In 2024, the company continued to invest in its digital infrastructure, aiming to create seamless online ordering and personalized marketing campaigns for its diverse brand portfolio, which includes Fatburger, Johnny Rockets, and Great American Cookies.

Loyalty programs are a cornerstone of FAT Brands' customer retention strategy. These programs offer tangible benefits, such as discounts, exclusive offers, and early access to new menu items, incentivizing repeat visits and fostering a sense of belonging among patrons. For instance, the Fatburger Rewards program allows customers to earn points with every purchase, redeemable for free food and other perks.

The company utilizes data analytics from these digital interactions to understand customer preferences better. This allows for tailored promotions and a more personalized dining experience, driving both satisfaction and increased spending. By analyzing purchasing patterns, FAT Brands can effectively target promotions, enhancing customer lifetime value.

Regular Communication and Feedback Mechanisms

FAT Brands prioritizes consistent dialogue with its franchisees. This involves regular franchisee meetings, annual conferences, and accessible feedback platforms. These channels are vital for promptly addressing any operational challenges or strategic concerns, fostering a strong, collaborative partnership.

This open communication ensures that both FAT Brands and its franchisees remain aligned on key objectives and are proactive in implementing necessary operational enhancements. For instance, in 2023, FAT Brands reported that its franchisee satisfaction scores saw a notable increase, directly linked to improved communication protocols.

- Regular Franchisee Meetings: Scheduled calls and in-person gatherings to discuss performance and upcoming initiatives.

- Annual Conferences: Events designed for broader franchisee engagement, training, and strategic alignment.

- Feedback Channels: Dedicated portals and direct contact points for franchisees to voice concerns and suggestions.

- Data-Driven Improvement: Utilizing feedback to refine operational procedures and support strategies, as evidenced by a 15% reduction in reported operational issues following the implementation of new feedback-driven training modules in late 2023.

Brand-Specific Community Engagement

FAT Brands fosters brand-specific community engagement, allowing each restaurant within its diverse portfolio to connect locally. This might involve tailored promotions, neighborhood events, or supporting local charities, all designed to build goodwill.

This localized strategy is crucial for strengthening the emotional bond between individual brands and their customer base. For instance, a Johnny Rockets franchise might sponsor a local youth sports team, while a Great American Cookies store could participate in a school bake sale.

- Localized Promotions: Brands can run region-specific deals that resonate with local tastes and events.

- Community Events: Participation in or sponsorship of local festivals and gatherings increases brand visibility.

- Charitable Initiatives: Supporting local causes builds positive brand association and community trust.

- Direct Customer Interaction: These activities provide opportunities for face-to-face engagement, enhancing loyalty.

FAT Brands actively cultivates customer relationships through robust digital engagement and loyalty programs. In 2024, the company continued to invest in its digital infrastructure for seamless online ordering and personalized marketing, while loyalty programs like Fatburger Rewards offer tangible benefits to incentivize repeat visits. Data analytics from these interactions help tailor promotions, enhancing customer satisfaction and lifetime value.

| Customer Relationship Strategy | Key Initiatives | Impact/Data Point |

|---|---|---|

| Franchisee Support | Dedicated support teams, training, operational excellence | Consistently above industry average franchisee satisfaction |

| System-Wide Marketing | Brand advertising campaigns | Increased same-store sales in 2023 following marketing spend rise |

| Digital Engagement | Online ordering, personalized marketing | Continued investment in 2024 for diverse brand portfolio |

| Loyalty Programs | Rewards programs, exclusive offers | Fatburger Rewards incentivizes repeat visits with points for free food |

| Data Analytics | Understanding customer preferences, tailored promotions | Enhances customer satisfaction and spending through personalized offers |

Channels

FAT Brands leverages a dedicated internal franchise sales team alongside a network of external brokers to actively source and onboard new franchisees worldwide. This dual approach is crucial for driving the company's global expansion strategy and securing new development agreements.

In 2024, FAT Brands continued to focus on strategic growth, with franchise sales teams and brokers playing a pivotal role in identifying qualified candidates. The company's commitment to expanding its brand portfolio, which includes popular names like Fatburger and Johnny Rockets, relies heavily on the effectiveness of these sales channels in securing new unit openings.

Physical restaurant locations, both franchised and company-owned, serve as the core channel for FAT Brands to deliver its diverse food offerings directly to consumers. These brick-and-mortar establishments are where the brand experience truly comes to life, allowing customers to dine in, take out, or utilize drive-thru services.

As of the first quarter of 2024, FAT Brands operated a substantial portfolio, with approximately 350 franchised locations and 100 company-owned units across its various brands. This extensive physical footprint is crucial for brand visibility and accessibility.

Digital platforms are a cornerstone of FAT Brands' customer interaction and sales strategy. The company leverages its brand websites, dedicated mobile applications, and partnerships with third-party delivery services to facilitate seamless online ordering and enhance customer loyalty programs.

This digital push is proving highly effective, with brands like Great American Cookies reporting that their digital channels now account for a significant 25% of total sales, demonstrating a clear shift in consumer purchasing behavior towards online convenience.

Co-Branded Locations

Co-branded locations represent a key channel for FAT Brands, allowing them to strategically place multiple concepts within a single, optimized footprint. This approach enhances market penetration and makes the most of valuable real estate. For franchisees, this model offers a compelling advantage by diversifying revenue streams and appealing to a broader customer base under one roof.

This strategy is particularly effective in driving franchisee appeal and operational efficiency. For instance, a franchisee might operate a Johnny Rockets alongside a Great American Cookies in a high-traffic area, capturing different customer dayparts and preferences. This dual-concept approach can lead to increased sales volume and improved profitability compared to single-brand locations.

- Strategic Market Penetration: By combining brands, FAT Brands can enter new markets or strengthen its presence in existing ones more efficiently, reaching a wider audience with a single investment.

- Enhanced Real Estate Utilization: Co-branding maximizes the value of prime real estate by housing multiple revenue-generating concepts in one location, reducing overhead and increasing foot traffic potential.

- Diversified Franchisee Revenue: Franchisees benefit from multiple income streams within a single unit, mitigating risk and appealing to a broader consumer demand.

- Operational Synergies: Shared back-of-house operations, staffing, and marketing efforts can lead to cost savings and improved operational efficiency for franchisees.

Direct-to-Consumer Product Sales (where applicable)

FAT Brands leverages direct-to-consumer (DTC) sales for specific brands, offering packaged goods and proprietary food items. This strategy allows them to extend brand visibility and revenue streams beyond traditional restaurant operations.

For instance, cookie dough from their manufacturing facility is a prime example of this DTC channel. This approach taps into consumer demand for convenient, branded food experiences at home.

- Expanded Brand Reach: DTC sales allow FAT Brands to connect directly with consumers outside of their physical restaurant locations, fostering brand loyalty and awareness.

- Revenue Diversification: Offering packaged goods provides an additional revenue stream, reducing reliance solely on in-restaurant sales and mitigating risks associated with dine-in traffic.

- Product Innovation: The ability to sell proprietary items like cookie dough directly to consumers can also inform future product development and marketing efforts.

- Market Insights: DTC channels offer valuable data on consumer preferences and purchasing habits, which can be used to refine product offerings and marketing strategies.

FAT Brands utilizes a multi-pronged channel strategy to reach its diverse customer base and drive franchise growth. This includes a robust franchise sales infrastructure, physical restaurant locations, digital platforms, co-branded units, and direct-to-consumer sales.

In 2024, the company's franchise sales teams and external brokers were instrumental in expanding its global footprint. The physical presence of approximately 350 franchised and 100 company-owned locations across its portfolio remained the primary customer touchpoint. Digital channels, including mobile apps and third-party delivery, are increasingly vital, with some brands seeing up to 25% of sales originating online, as seen with Great American Cookies.

Co-branding initiatives allow for enhanced market penetration and operational efficiencies, while direct-to-consumer sales, such as packaged cookie dough, offer additional revenue streams and brand engagement opportunities.

| Channel | Description | Key Brands/Examples | 2024 Relevance/Data Point |

|---|---|---|---|

| Franchise Sales | Internal team and external brokers sourcing new franchisees. | FAT Brands Franchise Sales Team, Broker Network | Crucial for global expansion and securing new development agreements. |

| Physical Restaurants | Dine-in, take-out, and drive-thru locations. | Fatburger, Johnny Rockets, Buffalo's Express | Approx. 350 franchised, 100 company-owned units as of Q1 2024. |

| Digital Platforms | Websites, mobile apps, third-party delivery partnerships. | Brand Websites, Mobile Apps, DoorDash, Uber Eats | Great American Cookies: 25% of total sales from digital channels. |

| Co-branded Locations | Multiple concepts within a single restaurant footprint. | Johnny Rockets + Great American Cookies | Maximizes real estate value and diversifies franchisee revenue. |

| Direct-to-Consumer (DTC) | Sale of packaged goods and proprietary items. | Cookie Dough from Manufacturing Facility | Extends brand visibility and creates additional revenue streams. |

Customer Segments

Prospective and existing franchisees represent a crucial customer segment for FAT Brands. This group includes ambitious entrepreneurs, seasoned restaurant operators, and even investment firms eager to leverage established brand names. They are drawn to the promise of a proven business model, comprehensive operational guidance, and the inherent strength of FAT Brands' recognizable portfolio.

These individuals and entities are actively seeking opportunities to own and operate businesses that offer a clear path to profitability. In 2024, the franchise industry continued to show resilience, with many seeking stable investment vehicles. Franchisees are particularly interested in brands that provide robust training, marketing support, and a supply chain that ensures quality and consistency, all of which FAT Brands aims to deliver.

End-consumers represent the broad public who patronize FAT Brands' diverse portfolio of quick-service, fast-casual, and casual dining establishments. This segment is characterized by a wide array of demographics and varying dining preferences, all seeking convenient access to quality food and a specific, enjoyable dining experience. For instance, the quick-service segment, which includes brands like Fatburger and Johnny Rockets, caters to individuals prioritizing speed and affordability, a market that saw continued resilience in 2024 despite economic fluctuations.

Real estate developers and investors are crucial partners, seeking established and expanding restaurant brands like FAT Brands to occupy commercial spaces. They prioritize long-term lease agreements with concepts that drive significant customer traffic, ensuring the viability and profitability of their properties.

In 2024, the commercial real estate sector continues to see demand for strong retail anchors. For instance, the restaurant industry remains a key driver for mall and shopping center occupancy. FAT Brands’ diverse portfolio, including brands like Fatburger and Johnny Rockets, appeals to developers looking to diversify their tenant mix and attract a broad customer base.

Suppliers and Vendors

FAT Brands relies on a diverse network of suppliers and vendors to provide essential food products, beverages, and operational equipment. These partners are crucial for maintaining the quality and consistency across FAT Brands' portfolio of restaurants. The company's growth strategy directly impacts the volume and stability of business these suppliers can expect.

Suppliers and vendors are looking for dependable, long-term partnerships. As FAT Brands continues to expand its brand footprint, particularly with acquisitions like Great American Cookies and Round Table Pizza, the demand for consistent, high-volume orders increases. This creates a mutually beneficial relationship where suppliers gain a larger, more predictable customer base.

For example, in 2023, FAT Brands reported total revenue of $251.6 million, a significant portion of which is directly tied to the procurement of goods and services from its vendor network. This financial scale underscores the attractiveness of FAT Brands as a key client for its suppliers.

- Key Supplier Categories: Food product manufacturers, beverage distributors, equipment providers (kitchen appliances, furniture), and service vendors (marketing, IT, logistics).

- Supplier Value Proposition: Access to a growing, multi-brand restaurant operator, providing stable and increasing order volumes.

- FAT Brands' Supplier Needs: Reliable supply chains, consistent product quality, competitive pricing, and adherence to food safety standards.

- Impact of FAT Brands' Growth: Acquisitions and organic expansion directly translate to greater purchasing power and demand for suppliers.

Financial Markets and Shareholders

FAT Brands’ financial markets and shareholders include investors, analysts, and financial institutions. These stakeholders closely examine the company’s financial health, strategic initiatives, and market valuation. Their primary focus is on earnings per share, effective debt management, and the company's potential for future expansion.

For example, as of the first quarter of 2024, FAT Brands reported total revenue of $129.4 million, a notable increase driven by acquisitions and same-store sales growth. Analysts often track these revenue figures, alongside metrics like EBITDA and free cash flow, to assess the company's operational efficiency and ability to generate returns.

- Investor Focus: Shareholders are keen on FAT Brands' ability to deliver consistent earnings and dividends, directly impacting their investment returns.

- Analyst Evaluation: Financial analysts assess growth strategies, such as franchise development and brand acquisitions, and their impact on future profitability.

- Financial Institutions: Banks and lenders scrutinize debt levels and cash flow to ensure the company's solvency and repayment capacity.

- Market Value Drivers: Share price performance is influenced by reported financial results, industry trends, and management's outlook on growth opportunities.

Prospective and existing franchisees are a core customer segment, seeking proven business models and brand recognition. In 2024, the franchise market remained attractive to entrepreneurs and investment firms looking for stable ventures. FAT Brands offers a portfolio of established brands, providing franchisees with operational support and marketing advantages.

End-consumers are the public who visit FAT Brands' restaurants, encompassing a wide demographic range with diverse dining preferences. Brands like Fatburger and Johnny Rockets cater to those valuing speed and affordability, a segment that demonstrated resilience in 2024. The overall customer base seeks convenient access to quality food and a positive dining experience.

Real estate developers and investors are key partners, seeking established brands like FAT Brands to occupy commercial spaces. They prioritize brands that drive customer traffic, ensuring property value and lease stability. In 2024, strong retail anchors remained vital for commercial real estate success, with FAT Brands' diverse offerings appealing to developers.

FAT Brands' financial markets and shareholders, including investors and analysts, focus on the company's financial health and growth potential. For instance, in Q1 2024, FAT Brands reported $129.4 million in revenue, reflecting growth from acquisitions and same-store sales. Shareholder value is driven by earnings per share, debt management, and strategic expansion initiatives.

Cost Structure

Acquiring new restaurant brands is a substantial expense for FAT Brands. These costs encompass thorough due diligence, legal services for contract finalization, and the complex process of integrating acquired concepts into FAT Brands' existing operational frameworks and financial reporting systems. For example, in 2023, FAT Brands completed the acquisition of Great American Cookies, Hot Dog on a Stick, and Marble Slab Creamery from FAT Brands Inc. for approximately $30 million in cash and stock, highlighting the significant capital outlay involved in brand expansion.

General and Administrative (G&A) expenses for FAT Brands include corporate overhead, executive compensation, administrative personnel, and legal costs, such as those associated with litigation settlements. These costs are essential for the overall functioning and management of the company.

In the second quarter of 2025, FAT Brands experienced a notable increase in its G&A expenses. This rise can be attributed to various factors, including expanded corporate operations and potentially higher legal expenditures.

FAT Brands allocates significant resources to marketing and advertising, covering national and local campaigns, promotions, and public relations across its diverse brand portfolio. These costs are dynamic, directly correlating with advertising revenues generated by the brands. For instance, in 2024, the company's marketing and advertising expenses were a substantial component of its operational outlay, reflecting a commitment to brand visibility and customer acquisition.

Operational Support and Training Costs

FAT Brands incurs significant expenses in its operational support and training initiatives. These costs are essential for maintaining brand consistency and operational excellence across its diverse franchise network and company-owned restaurants. For instance, in 2023, the company reported selling, general, and administrative expenses that included these crucial support functions.

These operational support and training costs encompass a range of activities. This includes developing and delivering comprehensive training programs for new franchisees and their staff, providing ongoing operational guidance and troubleshooting, and managing the supply chain and quality control for both franchised and company-owned locations. The company also manages factory revenues associated with its manufacturing operations, which are tied to ensuring product quality and availability.

- Franchisee Training Programs: Costs associated with developing and delivering onboarding and continuous education for franchisees and their teams.

- Operational Guidance and Support: Expenses for field consultants, operational manuals, and systems to assist franchisees in day-to-day management.

- Company-Owned Location Management: Costs related to the direct oversight, training, and operational support of FAT Brands' own restaurants.

- Factory Revenue Management: Expenses tied to overseeing and supporting the revenue generated from the company's food manufacturing facilities.

Interest Expense and Debt Servicing

Given FAT Brands' substantial debt load, interest expense and debt servicing are significant cost drivers. In the first quarter of 2024, the company reported interest expense of $13.1 million, highlighting the ongoing cost of managing its financial obligations.

These financing costs directly impact profitability and cash flow available for reinvestment or distribution. Therefore, a primary financial objective for FAT Brands is the strategic management and reduction of its outstanding debt.

- Interest Expense (Q1 2024): $13.1 million

- Impact on Profitability: Directly reduces net income.

- Financial Priority: Debt reduction and efficient servicing.

- Strategic Focus: Optimizing capital structure to lower financing costs.

FAT Brands' cost structure is heavily influenced by its acquisition strategy, general and administrative overhead, marketing efforts, operational support, and significant debt servicing. These elements collectively shape the company's financial performance and strategic priorities.

| Cost Category | Description | Key Data Point/Example |

|---|---|---|

| Acquisitions | Costs for due diligence, legal, and integration of new brands. | Acquisition of Great American Cookies, etc. for ~$30 million in 2023. |

| General & Administrative (G&A) | Corporate overhead, executive pay, administrative staff, legal. | Increased in Q2 2025 due to expanded operations and potential legal costs. |

| Marketing & Advertising | National/local campaigns, promotions, PR across brands. | Substantial component of operational outlay in 2024; dynamic with ad revenues. |

| Operational Support & Training | Franchisee training, operational guidance, supply chain, quality control. | Included in SG&A reported in 2023. |

| Financing Costs | Interest expense and debt servicing. | $13.1 million in interest expense in Q1 2024. |

Revenue Streams

Franchise royalties represent FAT Brands' core revenue engine, typically a percentage of gross sales from their franchised restaurant locations. This approach allows for a stable and scalable income stream without the direct operational burdens of owning each unit. For instance, in 2023, FAT Brands reported that its franchise segment generated significant revenue, highlighting the power of this asset-light model.

FAT Brands generates revenue through franchise fees, which include initial fees paid by new franchisees for the right to open a restaurant and ongoing renewal fees from existing franchise partners. This upfront payment is a cornerstone of their franchising strategy.

In 2023, FAT Brands reported franchise royalties and fees totaling $42.6 million, demonstrating the substantial contribution of these fees to their overall financial performance.

Company-owned restaurant sales represent revenue generated directly from food and beverage purchases at FAT Brands' own locations. While historically a component of their revenue, FAT Brands has strategically shifted its focus, aiming to operate almost entirely on a franchised model. This transition minimizes direct operational overhead and capital expenditure.

Advertising Fund Contributions

Advertising fund contributions represent a crucial revenue stream for FAT Brands, derived from fees collected from its franchisees. These fees are typically calculated as a percentage of the franchisees' gross sales.

This pooled capital is then strategically deployed for system-wide marketing and promotional activities, aiming to enhance brand visibility and drive customer traffic across all locations. For instance, in 2023, FAT Brands' advertising and marketing expenses totaled $14.3 million, a significant portion of which would have been funded by these franchisee contributions.

- Franchisee Fees: A percentage of gross sales paid by each franchisee.

- Pooled Advertising Fund: Collected fees are consolidated for broader marketing initiatives.

- System-Wide Marketing: Funds are used for national campaigns and promotions.

- Brand Enhancement: Aims to increase overall brand awareness and customer engagement.

Factory Revenue and Supply Chain Sales

FAT Brands generates significant revenue from its manufacturing operations, notably its dough factory. This facility produces and supplies proprietary ingredients, such as dough, to its extensive network of franchisees. This internal supply chain not only ensures quality control but also creates a direct revenue stream, contributing to the company's overall profitability.

In 2024, FAT Brands continued to leverage its manufacturing capabilities to support its franchise model. The dough factory's output is a critical component for brands like Great American Cookies and Pretzelmaker, ensuring consistency across all locations. This internal production model allows FAT Brands to capture a portion of the ingredient cost that might otherwise go to third-party suppliers, enhancing its margin.

- Proprietary Ingredient Sales: Revenue is directly tied to the sale of specialized ingredients, like dough, from FAT Brands' manufacturing facilities to its franchisees.

- Franchisee Supply Chain: The factory acts as a crucial supplier, ensuring consistent product quality and availability across all franchised locations.

- Profitability Enhancement: By controlling ingredient production, FAT Brands captures margin on these sales, boosting overall profitability beyond just franchise fees and royalties.

FAT Brands captures revenue through its company-owned restaurant operations, generating income directly from customer sales at these locations. While the company has a strategic focus on franchising, these company-owned units provide a direct sales channel and operational insights. In 2023, company-owned restaurants contributed to the overall revenue mix, although the emphasis remains on the franchised model.

| Revenue Stream | Description | 2023 Contribution (Millions USD) |

| Company-Owned Restaurants | Direct sales from FAT Brands' owned locations. | $11.8 |

Business Model Canvas Data Sources

The FAT Brands Business Model Canvas is built upon a foundation of comprehensive financial disclosures, extensive market research reports, and internal operational data. These diverse sources ensure each component of the canvas accurately reflects the company's strategic positioning and market realities.