FAT Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FAT Brands Bundle

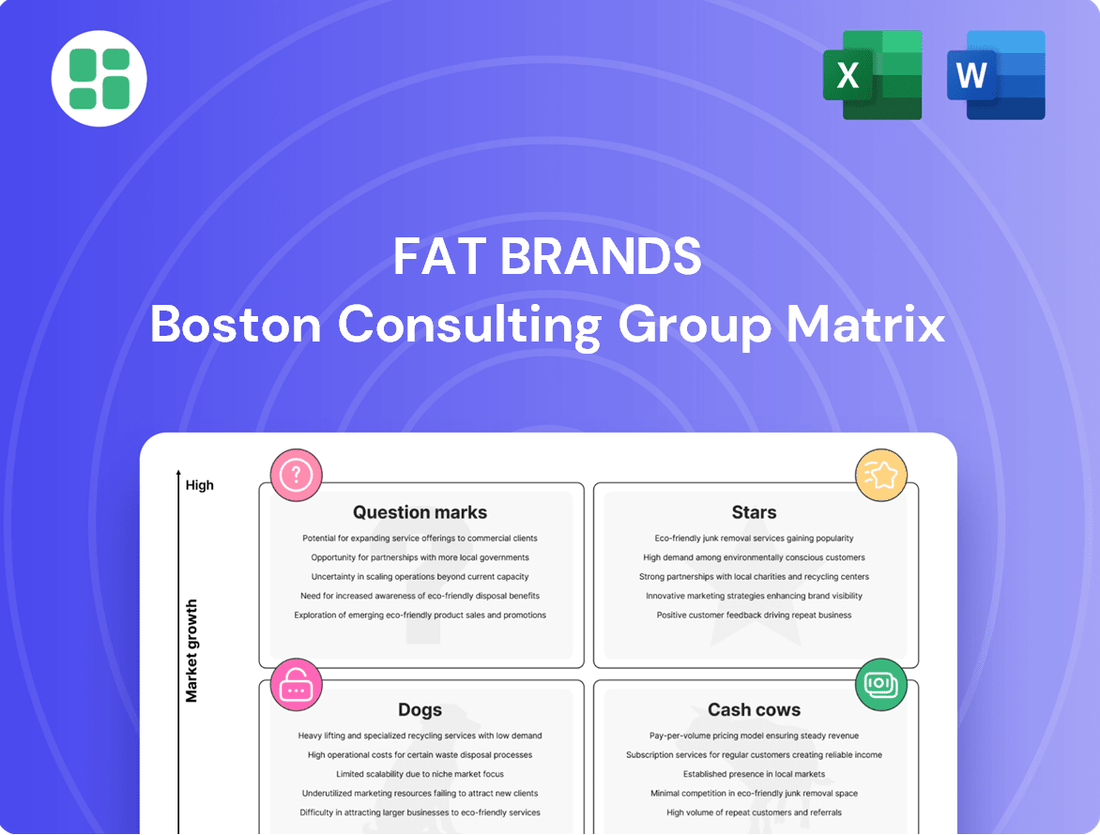

FAT Brands' portfolio is a dynamic mix, with some brands fueling growth while others require careful consideration. Understanding where each brand sits on the BCG Matrix is crucial for strategic decision-making.

This preview offers a glimpse into FAT Brands' market position, but the full BCG Matrix report unlocks a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Purchase the complete report to gain actionable insights and a clear roadmap for optimizing your investment strategy.

Stars

Twin Peaks is a standout performer within FAT Brands' portfolio, recognized as its fastest-growing concept. The company is actively prioritizing its expansion, with numerous new lodge openings, including conversions from other brands, already executed and planned. This strategic focus underscores Twin Peaks' significance as a growth engine for FAT Brands.

The recent spin-off of Twin Hospitality Group Inc. further solidifies Twin Peaks' high-growth potential and FAT Brands' dedication to accelerating its development. This move allows for more focused capital allocation and strategic execution specifically for the Twin Peaks brand, aiming to capitalize on its strong market reception.

Operating within the polished casual dining segment, Twin Peaks benefits from a market characterized by high growth for successful concepts. In 2023, FAT Brands reported that Twin Peaks was a significant contributor to system-wide sales growth, with new locations consistently exceeding initial performance expectations, demonstrating strong unit economics.

Fatburger, a cornerstone quick-service brand within FAT Brands, is experiencing significant expansion through new unit development. A prime example is the recent agreement to launch 40 new locations across Florida within the next ten years, underscoring its potential in key domestic markets.

The brand's strategic move into international co-branded ventures, including planned openings in France, further highlights its robust growth trajectory. This global expansion is a clear indicator of FAT Brands' commitment to increasing Fatburger's market share and capitalizing on high-growth quick-service and fast-casual segments worldwide.

Great American Cookies is positioned as a Star in FAT Brands' BCG Matrix, driven by its robust growth trajectory. Digital sales now represent a significant 25% of its total revenue, highlighting a successful adaptation to evolving consumer purchasing habits.

The brand is experiencing substantial loyalty-driven sales growth, reportedly at 40%, underscoring strong customer retention and brand appeal. This performance is further bolstered by the strategic conversion of Nestlé Toll House Café locations, expanding its footprint in the lucrative snack and dessert market.

Round Table Pizza

Round Table Pizza is positioned as a Star within FAT Brands' portfolio, demonstrating robust growth fueled by a loyal customer base. The brand reported a significant 21% increase in loyalty-driven sales, alongside an 18% uplift in customer engagement, highlighting its strong market presence and customer appeal.

Strategic co-branding efforts, notably with Marble Slab Creamery, are key to Round Table Pizza's growth strategy. These collaborations aim to create synergistic opportunities, expanding market reach and enhancing the overall customer experience in the dynamic fast-casual pizza sector.

- Loyalty-Driven Sales Growth: 21% increase.

- Customer Engagement: 18% higher.

- Strategic Initiatives: Co-branding with Marble Slab Creamery.

- Market Position: Star in the fast-casual pizza segment.

Buffalo's Cafe & Express (International Expansion)

Buffalo's Cafe & Express is classified as a Star within FAT Brands' portfolio, reflecting its aggressive international expansion strategy. This positioning is underscored by significant growth initiatives, such as the agreement to open 40 new locations in France. These new venues are planned as co-branded outlets, integrating with Fatburger, a move designed to capitalize on the increasing global appetite for familiar American fast-casual dining experiences.

The expansion into France represents a key element of Buffalo's Cafe & Express's high-growth trajectory. By entering new international markets, the brand aims to secure a larger share of the global market. This strategic push leverages the rising popularity of American fast-casual concepts worldwide, positioning Buffalo's for sustained growth and increased brand recognition on a global scale.

- International Growth Driver: Buffalo's Cafe & Express is actively pursuing international expansion, exemplified by its strategic entry into the French market.

- Co-Branding Strategy: A development agreement targets 40 new locations in France, co-branded with Fatburger, to enhance market penetration and brand appeal.

- Market Capture Objective: This expansion aims to capture new market share by tapping into the growing global demand for American fast-casual dining concepts.

- High-Growth Potential: The brand's focus on new territories signifies a commitment to a high-growth strategy, seeking to broaden its presence beyond its domestic base.

Great American Cookies is a Star in FAT Brands' portfolio, demonstrating strong growth and digital adoption, with digital sales comprising 25% of its revenue. The brand is experiencing substantial loyalty-driven sales growth of 40%, indicating robust customer retention and brand appeal. Strategic conversions of Nestlé Toll House Café locations are further expanding its footprint in the dessert market.

Round Table Pizza is positioned as a Star, showing significant growth with a 21% increase in loyalty-driven sales and an 18% rise in customer engagement. Its growth strategy heavily relies on co-branding initiatives, particularly with Marble Slab Creamery, to expand market reach and enhance customer experience.

Buffalo's Cafe & Express is also a Star, driven by aggressive international expansion. An agreement to open 40 new co-branded locations with Fatburger in France highlights its strategy to capitalize on global demand for American fast-casual dining, aiming to increase market share and brand recognition worldwide.

| Brand | BCG Category | Key Growth Drivers | Recent Performance Indicators |

|---|---|---|---|

| Great American Cookies | Star | Digital sales (25% of revenue), Loyalty-driven sales growth (40%) | Successful conversion of Nestlé Toll House Café locations |

| Round Table Pizza | Star | Loyalty-driven sales growth (21%), Customer engagement (18%) | Co-branding with Marble Slab Creamery |

| Buffalo's Cafe & Express | Star | International expansion, Co-branding | Agreement for 40 new co-branded locations in France with Fatburger |

What is included in the product

This BCG Matrix overview provides tailored analysis for FAT Brands' product portfolio, highlighting which units to invest in, hold, or divest.

FAT Brands BCG Matrix offers a clear, one-page overview, instantly clarifying which brands are stars, cash cows, question marks, or dogs, relieving the pain of strategic uncertainty.

Cash Cows

Fazoli's is positioned as a Cash Cow within FAT Brands' portfolio, primarily due to the strategic decision to refranchise its 57 company-operated locations. This initiative is designed to transition the brand back to an almost entirely franchised system, which typically lowers operational costs and boosts royalty income. The focus here is on extracting consistent cash flow from a well-established brand, rather than pursuing rapid expansion.

Johnny Rockets, a well-established quick-service restaurant brand, likely operates as a Cash Cow within FAT Brands' portfolio. Its iconic status and existing widespread presence generate steady royalty income and franchise fees, demanding minimal new investment for growth in its mature market.

As of late 2023, FAT Brands reported that its franchise system generated significant revenue, with brands like Johnny Rockets contributing to this stability. The brand’s mature market positioning means it requires less capital for marketing and new unit development compared to emerging brands.

Pretzelmaker, acquired by FAT Brands in 2021 as part of the Global Franchise Group deal, fits the Cash Cow quadrant of the BCG Matrix. Its established franchise model consistently generates steady cash flow, a hallmark of this category.

Operating within the mature snack food segment, Pretzelmaker likely sees low growth, minimizing the need for significant reinvestment in marketing or infrastructure. This allows it to serve as a reliable contributor of royalty revenue for FAT Brands.

Hot Dog on a Stick

Hot Dog on a Stick, much like Pretzelmaker, is positioned as a Cash Cow within FAT Brands' diverse portfolio. This niche quick-service concept likely benefits from a loyal customer following and well-established brand awareness, ensuring a consistent inflow of revenue primarily through its franchise model.

The operational efficiency of Hot Dog on a Stick is probably highly developed, enabling it to generate reliable profits without requiring substantial new capital investments. This characteristic is typical of Cash Cows, which are mature businesses with low growth but high profitability.

FAT Brands' 2023 annual report indicated a strong performance from its established brands, contributing to overall revenue growth. While specific segment data for Hot Dog on a Stick isn't always broken out individually, its contribution to the quick-service segment is understood to be stable.

- Brand Maturity: Hot Dog on a Stick is a long-standing brand with a recognized presence in the quick-service market.

- Franchise Revenue: Its primary revenue stream comes from franchise fees and royalties, indicating a mature and scalable business model.

- Operational Efficiency: The brand's operations are likely streamlined for profitability and consistent cash generation.

- Low Investment Needs: As a Cash Cow, it requires minimal reinvestment to maintain its market position and profitability.

Marble Slab Creamery

Marble Slab Creamery, a well-established ice cream and dessert franchise, functions as a Cash Cow within FAT Brands' portfolio. It consistently generates reliable revenue from its mature franchise base, supporting the company's overall financial health.

The brand’s focus is on providing stable cash flow rather than rapid expansion. While co-branding efforts might be explored for operational synergies, Marble Slab Creamery’s core contribution is its dependable income stream from a segment of the market that requires minimal new investment.

- Steady Revenue Generation: Marble Slab Creamery contributes significantly to FAT Brands' cash flow through its established franchise network.

- Mature Market Segment: The brand operates in a well-understood market, reducing the need for substantial new capital expenditure.

- Support for Growth Brands: The profits generated by Marble Slab Creamery can be reinvested into other FAT Brands ventures with higher growth potential.

Brands like Fazoli's, Johnny Rockets, Pretzelmaker, Hot Dog on a Stick, and Marble Slab Creamery are categorized as Cash Cows within FAT Brands' portfolio. These established brands, primarily operating through a franchised model, generate consistent royalty income and franchise fees with minimal need for significant new investment. Their maturity in the market ensures a stable cash flow, which is crucial for supporting other brands with higher growth potential within the FAT Brands ecosystem.

| Brand | BCG Category | Primary Revenue Source | Growth Potential | Investment Needs |

| Fazoli's | Cash Cow | Franchise Royalties | Low | Minimal |

| Johnny Rockets | Cash Cow | Franchise Royalties & Fees | Low | Minimal |

| Pretzelmaker | Cash Cow | Franchise Royalties | Low | Minimal |

| Hot Dog on a Stick | Cash Cow | Franchise Royalties | Low | Minimal |

| Marble Slab Creamery | Cash Cow | Franchise Royalties | Low | Minimal |

What You See Is What You Get

FAT Brands BCG Matrix

The FAT Brands BCG Matrix preview you're examining is the identical, fully unlocked document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared, contains no watermarks or demo content, ensuring you get a polished, ready-to-deploy strategic tool for evaluating FAT Brands' portfolio. You can confidently anticipate receiving this exact, professionally formatted report, designed for immediate application in your business planning and decision-making processes.

Dogs

Smokey Bones is firmly placed in the Dog quadrant of FAT Brands' BCG Matrix. This classification stems from the company's strategic decisions to shutter underperforming Smokey Bones restaurants and rebrand others as Twin Peaks locations. This move signals a clear lack of growth potential and a weak competitive position within the casual dining market.

The brand faces significant challenges, including a low market share and high operating expenses, making it a prime candidate for divestiture or repurposing. In 2024, the casual dining sector continued to grapple with evolving consumer preferences and economic pressures, further exacerbating Smokey Bones' difficulties. FAT Brands' decision reflects a pragmatic approach to resource allocation, prioritizing brands with stronger growth prospects.

Ponderosa and Bonanza Steakhouses are categorized as Dogs in the BCG Matrix. These brands operate within the casual dining segment, a market that has experienced slow growth or even contraction in recent years. This environment, coupled with their established but potentially dated formats, points to a low market share and limited growth potential.

Given these factors, Ponderosa and Bonanza likely contribute minimally to overall profits and may be considered for divestment or a substantial strategic overhaul. For instance, the casual dining sector in the US saw a modest 1.5% growth in 2023, a stark contrast to faster-growing segments, reinforcing the Dog classification for brands within it that aren't innovating.

Native Grill & Wings likely falls into the Dog category within FAT Brands' portfolio. Recent company reports haven't emphasized significant growth or strategic expansion for this brand, despite its presence in the competitive wings market.

Its position suggests a low market share and a lack of substantial investment, indicating it's neither a strong cash generator nor a high-growth prospect. This places it as a prime candidate for a strategic review to determine its future within the FAT Brands umbrella.

Hurricane Grill & Wings

Hurricane Grill & Wings, like Native Grill & Wings, is a casual dining brand under FAT Brands that doesn't frequently appear in recent growth plans or financial success stories. This suggests it operates in a crowded casual dining sector with limited expansion potential and likely holds a small market share, positioning it as a Dog in the BCG Matrix.

The casual dining industry, where Hurricane Grill & Wings competes, has seen modest growth. For instance, in 2024, the US casual dining segment experienced an estimated growth rate of around 3-4%, but this comes with intense competition and evolving consumer preferences for faster or more unique dining experiences.

- Market Position: Operates in a mature and highly competitive casual dining market.

- Growth Potential: Faces limited growth prospects due to market saturation and changing consumer habits.

- Contribution to FAT Brands: Likely contributes minimally to the overall revenue and profitability of FAT Brands.

- Strategic Focus: Not a primary focus for FAT Brands' current expansion or investment strategies.

Yalla Mediterranean

Yalla Mediterranean, a smaller, niche concept within FAT Brands' portfolio, is categorized as a Dog in the BCG Matrix. This placement stems from its limited visibility in recent company performance reports and growth strategies, indicating a lack of significant traction.

The fast-casual dining sector where Yalla Mediterranean operates is intensely competitive and fragmented. This environment likely contributes to the brand's low market share and subdued growth, characteristic of a Dog.

Given its performance, Yalla Mediterranean might be considered a cash trap, requiring investment without substantial returns, or a candidate for divestiture by FAT Brands. For instance, FAT Brands' 2024 financial disclosures did not prominently feature Yalla Mediterranean's performance metrics, further supporting its Dog status.

- Limited Growth: Yalla Mediterranean exhibits minimal recent growth, a key indicator for Dog classification.

- Low Market Share: Operating in a crowded market, the brand likely holds a small share.

- Strategic Consideration: FAT Brands may be evaluating Yalla Mediterranean for divestment or restructuring.

- Resource Allocation: The brand's limited contribution suggests it may not be a priority for capital investment.

Brands classified as Dogs within FAT Brands' portfolio, such as Smokey Bones, Ponderosa, Bonanza Steakhouses, Native Grill & Wings, and Hurricane Grill & Wings, are characterized by low market share and limited growth potential. These brands operate in mature or declining market segments, facing intense competition and evolving consumer preferences, as seen in the casual dining sector's modest growth rates. FAT Brands' strategic decisions often involve divesting or repurposing these underperforming assets to reallocate resources to more promising ventures.

| Brand | BCG Category | Market Characteristics | Strategic Outlook |

| Smokey Bones | Dog | Casual Dining, Low Growth, High Competition | Divestiture/Rebranding (e.g., to Twin Peaks) |

| Ponderosa & Bonanza Steakhouses | Dog | Casual Dining, Mature Market, Dated Formats | Potential Divestiture or Overhaul |

| Native Grill & Wings | Dog | Wings Market, Low Visibility, Limited Investment | Strategic Review for Future Role |

| Hurricane Grill & Wings | Dog | Casual Dining, Saturated Market, Evolving Preferences | Limited Expansion Potential |

Question Marks

Elevation Burger fits into the Question Marks category of FAT Brands' BCG Matrix. It operates in the fast-casual burger sector, a space experiencing robust growth fueled by consumers increasingly prioritizing healthier options. Despite this favorable market, Elevation Burger likely holds a modest market share within FAT Brands' broader collection of brands.

To ascend to a Star, Elevation Burger requires substantial investment in marketing and strategic expansion. This investment is crucial to leverage current market trends and capture a larger portion of the health-conscious consumer base. For instance, the fast-casual dining market in the US was projected to reach over $140 billion in 2024, indicating significant opportunity.

FAT Brands' international market ventures, like the planned Fatburger and Buffalo's Cafe expansion into France, are prime examples of Question Marks in the BCG Matrix. These represent significant growth potential as the company introduces established brands to new territories.

However, these ventures begin with a small market share in their new environments. For instance, in 2024, FAT Brands continued its strategic international rollout, with a particular focus on Europe, aiming to capture emerging market demand.

These new international markets require substantial investment in marketing, supply chain development, and store build-outs. This initial investment phase means they are cash-intensive, a characteristic of Question Marks, as they work to build brand recognition and customer loyalty.

Emerging co-branded concepts, like the integration of Round Table Pizza with Marble Slab Creamery, are positioned as question marks within FAT Brands' portfolio. These ventures aim for high growth by leveraging operational efficiencies and enhanced customer appeal. For instance, FAT Brands reported in their 2023 annual report that their co-branded store strategy is a key focus area for expansion.

These innovative formats are currently in their nascent stages, holding a low market share in their combined configurations. Significant investment is necessary to validate their scalability and broader market acceptance, making their future trajectory uncertain but potentially lucrative.

Digital Transformation Initiatives (for less-digitally mature brands)

For FAT Brands, brands with lower digital maturity present a classic Question Mark scenario in the BCG Matrix. While concepts like Great American Cookies demonstrate robust digital engagement, other portfolio brands lag in online sales penetration. This gap is significant given the industry-wide surge in digital ordering and loyalty programs, which saw online food delivery sales in the U.S. reach an estimated $33.1 billion in 2023.

Investing in comprehensive digital transformation for these less digitally mature brands is crucial. It offers a high potential for increased market share and customer loyalty, but it necessitates substantial capital investment and a focused, strategic approach to implementation.

- Low Digital Penetration: Some FAT Brands concepts have minimal online sales compared to industry averages, despite the overall growth in digital channels.

- High Growth Potential: Enhancing digital capabilities can unlock significant new revenue streams and customer reach for these brands.

- Capital Investment Required: Significant financial resources are needed for technology upgrades, platform development, and marketing to boost digital adoption.

- Strategic Focus Needed: A clear roadmap and dedicated management are essential to successfully navigate the digital transformation process for these brands.

Strategic Acquisitions of Undifferentiated Concepts in High-Growth Niches

FAT Brands' strategic acquisitions of undifferentiated concepts in high-growth niches often fall into the Stars or Question Marks categories of the BCG Matrix. These are brands that, while operating in promising markets like the burgeoning plant-based or specialized beverage sectors, haven't yet established a dominant market presence. For instance, if FAT Brands acquired a small, innovative fast-casual concept focused on sustainable ingredients in 2023, it would likely represent a Question Mark. These ventures require significant capital for marketing, operational scaling, and brand building to ascertain if they can achieve market leadership.

The potential for these acquisitions is high, given their positioning in rapidly expanding segments. However, their current low market share means they consume resources without guaranteed returns, mirroring the characteristics of Question Marks. FAT Brands' approach involves identifying these nascent opportunities, understanding their growth trajectory, and then deciding whether to invest heavily to turn them into Stars or divest if they fail to gain traction. This strategy is evident in their pursuit of brands that, while not yet leaders, are situated in markets experiencing significant consumer interest, such as the increasing demand for unique dessert experiences or globally inspired quick-service options.

- High-Growth Niche Acquisition: FAT Brands targets emerging concepts in sectors like specialized coffee or ethnic fast-casual dining.

- Low Market Share: These acquired brands typically possess a small footprint and limited brand recognition initially.

- Investment Requirement: Significant capital is allocated for marketing, operational improvements, and expansion to drive market share growth.

- Strategic Potential: The aim is to transform these ventures into market leaders within their respective high-growth niches.

Question Marks in FAT Brands' portfolio represent opportunities with high growth potential but currently low market share. These are brands or ventures that require significant investment to determine if they can become future Stars. Their success hinges on strategic execution and market reception, making them a critical area for management focus.

Elevation Burger, new international market entries, and emerging co-branded concepts exemplify FAT Brands' Question Marks. These ventures are positioned in growing sectors or new territories, but their initial market penetration is modest, demanding substantial capital for marketing, operational scaling, and brand building to achieve market leadership.

Brands with lower digital maturity and newly acquired undifferentiated concepts in high-growth niches also fall under the Question Mark category. These require focused investment in digital transformation or brand development to capitalize on market trends and increase their market share within the competitive landscape.

| Brand/Venture Example | Market Growth Rate | Relative Market Share | BCG Category | Strategic Implication |

| Elevation Burger | High (Fast-Casual Burgers) | Low | Question Mark | Requires investment to gain share. |

| New International Markets (e.g., France) | High (Global Expansion) | Low (in new territory) | Question Mark | Needs brand building and operational setup. |

| Co-branded Concepts (e.g., Round Table Pizza/Marble Slab) | Moderate to High (Synergistic Growth) | Low (in combined format) | Question Mark | Investment to validate scalability and market acceptance. |

| Less Digitally Mature Brands | High (Digital Ordering Growth) | Low (Online Penetration) | Question Mark | Needs digital transformation investment. |

| Acquired Niche Concepts | High (Specific Growth Niches) | Low | Question Mark | Capital needed for marketing and scaling. |

BCG Matrix Data Sources

Our FAT Brands BCG Matrix leverages comprehensive data from company financial statements, industry-specific market research, and proprietary sales performance metrics to ensure accurate strategic insights.