FAT Brands PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FAT Brands Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping FAT Brands's trajectory. Our comprehensive PESTLE analysis provides the essential intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Don't guess about the future; download the full version now and gain a decisive competitive advantage.

Political factors

Governments worldwide enforce rigorous food safety regulations, covering everything from preparation and hygiene to accurate ingredient labeling. These rules are paramount for safeguarding public health.

FAT Brands must navigate these often-evolving standards, which directly influence operational expenses, how they manage their supply chains, and ultimately, their brand image across its international franchise locations. For instance, in the US, the Food and Drug Administration (FDA) sets stringent guidelines, and non-compliance can lead to costly recalls or penalties.

Adapting to new or altered mandates can necessitate substantial capital outlays for FAT Brands, potentially impacting profitability and requiring strategic adjustments to their business model to maintain compliance and consumer trust.

Changes in labor laws, such as minimum wage increases, directly impact FAT Brands' operational costs. For instance, in the United States, the federal minimum wage has remained at $7.25 per hour since 2009, but many states and cities have implemented higher rates. California, for example, is phasing in a $25 per hour minimum wage for fast-food workers by 2025, a significant increase that will affect FAT Brands' franchisees in that state.

These evolving labor policies, including overtime rules and mandates for employee benefits, create a complex regulatory environment. FAT Brands must adapt its staffing and labor expense strategies to comply with varying requirements across different regions and countries where its brands operate. This adaptability is crucial for maintaining franchise profitability and ensuring consistent operational standards.

FAT Brands, as a global franchisor, is significantly influenced by international trade policies and tariffs. For instance, changes in import duties on food products or restaurant equipment can directly affect the cost of goods sold for its franchisees worldwide. In 2024, the ongoing trade disputes and the potential for new tariffs, particularly between major economic blocs, could add volatility to supply chain costs for brands like Fatburger and Johnny Rockets.

Shifts in trade agreements, such as those affecting the movement of goods between North America and Asia, can also impact FAT Brands' ability to source ingredients or equipment efficiently. For example, a new trade pact could streamline customs procedures, reducing lead times and costs for franchisees, or conversely, new regulations could create barriers. The company’s reliance on a global supply chain means that geopolitical tensions directly translate into potential risks or opportunities for optimizing operations and managing expenses.

Franchise Regulation and Disclosure Requirements

Franchise regulation is a significant political factor for FAT Brands. Laws like the Federal Trade Commission's Franchise Rule mandate detailed disclosure documents, such as the Franchise Disclosure Document (FDD), to prospective franchisees. As of 2024, compliance with these regulations, which vary by state, is crucial for FAT Brands' expansion plans, potentially influencing the pace of new unit acquisitions.

Regulatory scrutiny can directly impact FAT Brands' growth strategies. For instance, failure to meet registration mandates in certain states could hinder the brand's ability to offer franchises there. The ongoing evolution of franchise laws, including potential updates to disclosure requirements or franchisee protections, necessitates continuous adaptation of FAT Brands' operational and legal frameworks.

- FTC Franchise Rule: Requires franchisors to provide a comprehensive FDD at least 14 days before a franchisee signs an agreement or pays any money.

- State-Specific Regulations: Over half of U.S. states have their own franchise registration and disclosure laws, adding layers of complexity for national brands like FAT Brands.

- Impact on Expansion: Non-compliance can lead to fines, rescission rights for franchisees, and reputational damage, directly affecting FAT Brands' ability to attract and onboard new franchisees.

Political Stability and Geopolitical Events

Political stability within FAT Brands' operating regions, including the United States, Canada, and the Middle East, directly influences consumer spending and investor confidence. For instance, the U.S. experienced a period of heightened political discourse leading into the 2024 election cycle, which can sometimes lead to cautious consumer behavior.

Geopolitical events pose significant risks. The ongoing global trade tensions and localized conflicts in various regions can disrupt the international supply chains critical for sourcing ingredients and maintaining consistent product quality across FAT Brands' diverse franchise network. This can lead to increased operational costs and potential shortages.

The impact of geopolitical instability on tourism is also a key concern. Regions experiencing political unrest or significant international disputes often see a decline in tourist arrivals, which directly affects restaurant traffic for brands like Fatburger and Johnny Rockets, particularly in popular tourist destinations. For example, while specific FAT Brands data isn't public, the broader restaurant industry in areas affected by conflict in 2024 saw noticeable dips in revenue.

- Regional Stability: FAT Brands operates in over 50 countries, making regional political stability a crucial factor for consistent franchisee performance and supply chain integrity.

- Trade Policy Impact: Changes in international trade agreements or the imposition of tariffs, as seen in various trade disputes in 2024, can affect the cost of imported goods essential for restaurant operations.

- Consumer Confidence: Geopolitical events often correlate with shifts in consumer confidence, impacting discretionary spending on dining out, a primary revenue driver for FAT Brands' franchisees.

- Geopolitical Risk Mitigation: FAT Brands' strategy likely involves ongoing assessment and diversification of supply chains and market presence to mitigate the impact of localized geopolitical disruptions.

Government regulations, particularly concerning food safety and labor laws, significantly shape FAT Brands' operational landscape. For instance, the phased implementation of a $25 per hour minimum wage for fast-food workers in California by 2025 directly impacts labor costs for franchisees in that state.

International trade policies and franchise regulations also present key political considerations. Changes in import duties or adherence to the FTC's Franchise Rule, requiring detailed disclosures like the FDD, influence expansion and operational expenses for FAT Brands' global network.

Political stability across FAT Brands' operating regions is vital for consumer spending and investor confidence. Geopolitical events and trade tensions in 2024 can disrupt supply chains and reduce tourist traffic, impacting restaurant revenue for brands like Fatburger and Johnny Rockets.

What is included in the product

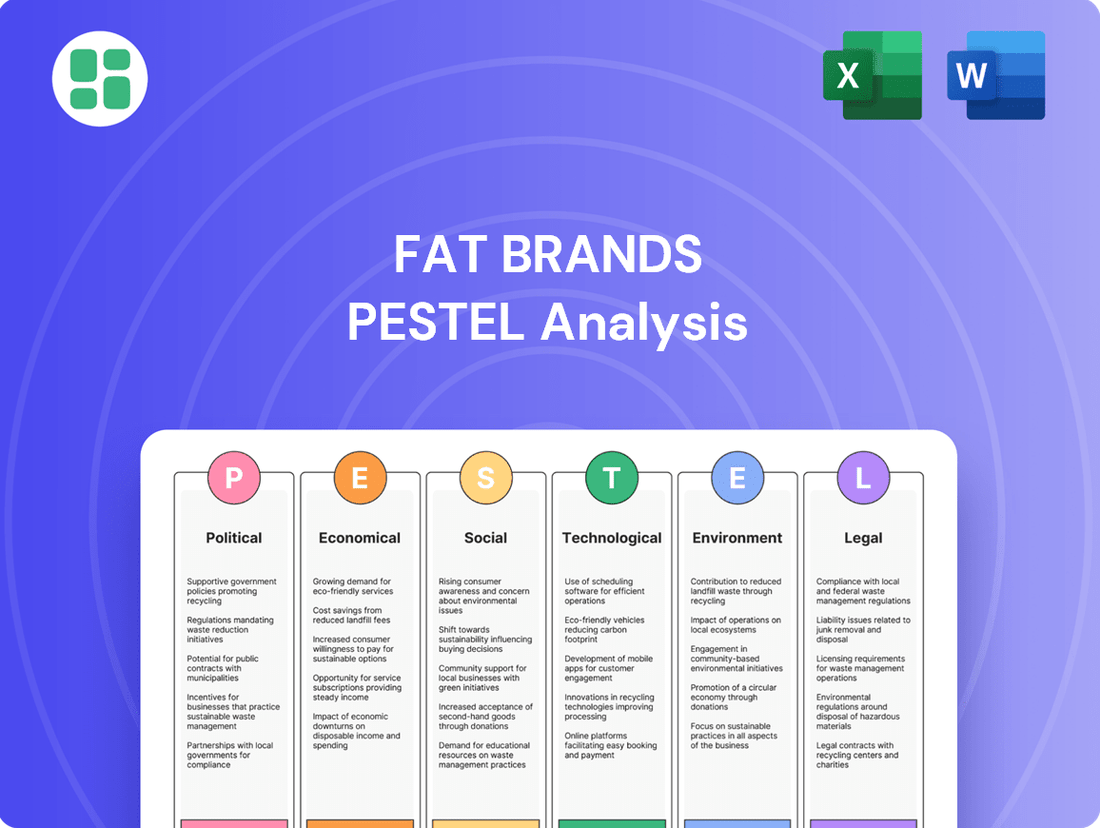

This PESTLE analysis delves into the external macro-environmental forces impacting FAT Brands, examining Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides a strategic framework for understanding market dynamics, identifying potential risks, and capitalizing on emerging opportunities within the restaurant industry.

FAT Brands' PESTLE analysis offers a clear, summarized version of the full analysis for easy referencing during meetings or presentations, simplifying complex external factors for strategic decision-making.

Economic factors

Rising inflation is a significant concern for FAT Brands, directly increasing the costs of essential ingredients, staffing, and operational expenses like utilities. For instance, the U.S. Consumer Price Index for food away from home saw a notable increase throughout 2023 and into early 2024, impacting restaurant operating costs.

These increased input costs can squeeze profit margins for both FAT Brands' franchisees and its company-owned locations. To maintain profitability, the company might need to implement higher menu prices, which could potentially dampen consumer spending on dining out, especially for value-conscious customers.

In response, FAT Brands must prioritize optimizing its supply chain to secure better pricing and explore strategies for negotiating more favorable terms with suppliers. This focus on operational efficiency and cost management is crucial for navigating the inflationary environment and preserving the financial health of its restaurant portfolio.

Consumer disposable income is a major driver for FAT Brands, directly impacting how often people dine out and how much they spend per visit. For instance, in early 2024, reports indicated that while overall consumer spending remained resilient, a noticeable portion of households were becoming more price-sensitive, potentially impacting discretionary categories like casual dining.

Economic headwinds, such as the inflation experienced throughout 2023 and into 2024, can force consumers to re-evaluate their spending. This often means opting for cheaper alternatives, like cooking at home, or choosing value-focused fast-casual options over full-service restaurants within FAT Brands' portfolio.

FAT Brands must stay attuned to these evolving spending habits. A key challenge for 2024 and 2025 will be adapting menus and promotions to appeal to consumers seeking value without sacrificing quality, ensuring continued sales even amidst potential economic uncertainties.

Changes in interest rates directly impact FAT Brands' cost of borrowing for new ventures and expansion projects. For instance, if the Federal Reserve raises the federal funds rate, FAT Brands' own loans for acquiring new brands or building more restaurants will likely become more expensive. This can put a damper on their growth plans, as higher borrowing costs eat into potential profits.

Furthermore, rising interest rates make it harder for potential franchisees to secure the necessary loans to open new FAT Brands locations. If financing becomes less accessible or more costly for franchisees, the pace of new restaurant development will naturally slow down. This directly affects the company's ability to expand its footprint and market share.

Access to affordable capital is the lifeblood of FAT Brands' growth strategy. In the period leading up to July 2025, we've seen fluctuating interest rate environments. For example, if the average prime rate for business loans hovers around 8.5% in early 2025, as some projections suggest, this presents a significant hurdle for capital-intensive expansion compared to a scenario where rates might be closer to 5%.

Exchange Rate Fluctuations

FAT Brands, operating globally, faces significant exposure to exchange rate fluctuations. Changes in currency values directly impact the conversion of international franchise revenues and the cost of imported supplies, affecting overall profitability. For instance, a stronger US dollar could reduce the reported value of earnings from countries with weaker currencies.

These currency movements also influence the cost of goods and services sourced internationally, potentially increasing operating expenses for FAT Brands' global franchisees. The company's financial results for 2024 and projections for 2025 will need to account for the volatility seen in major currency pairs, such as the Euro/USD and GBP/USD, which have experienced significant swings due to geopolitical events and differing monetary policies.

- Impact on Revenue: A depreciating foreign currency against the US dollar will lower the reported revenue from international operations.

- Cost of Goods Sold: Fluctuations can alter the cost of imported ingredients and supplies, impacting margins.

- Profitability of Global Operations: Exchange rate volatility directly affects the net income generated from overseas markets.

- Competitive Landscape: Currency shifts can also influence the pricing competitiveness of FAT Brands' offerings in different international markets.

Economic Growth and Recession Cycles

The restaurant industry, including FAT Brands, is highly sensitive to economic growth cycles. During expansionary periods, consumers have more disposable income, leading to increased spending on discretionary items like dining out. For instance, the U.S. economy experienced a robust GDP growth of 2.5% in 2023, which generally supported consumer spending in the food service sector.

Conversely, economic downturns or recessions can significantly impact FAT Brands. Reduced consumer confidence and tighter budgets often result in consumers cutting back on non-essential expenses, such as eating at restaurants. The threat of a recession, even if not fully realized, can dampen consumer sentiment and lead to cautious spending habits.

- Economic Growth Impact: Higher GDP growth generally translates to increased consumer spending on dining, benefiting FAT Brands' revenue and franchise profitability.

- Recessionary Risks: Economic contractions can lead to decreased customer traffic, lower average checks, and potential strain on franchisee operations due to reduced sales.

- 2024/2025 Outlook: Projections for 2024 and 2025 indicate continued, albeit potentially moderating, economic growth in many key markets, which could offer a supportive environment for FAT Brands, though risks of localized slowdowns remain.

- Consumer Confidence: Fluctuations in consumer confidence, often tied to economic outlook, directly affect discretionary spending on restaurant meals.

Economic growth directly influences consumer spending on dining out, a key revenue driver for FAT Brands. While the U.S. saw a 2.5% GDP growth in 2023, projections for 2024 and 2025 anticipate continued expansion, though potentially at a more moderate pace, offering a generally favorable environment for the restaurant sector.

However, economic downturns pose a significant risk, leading to reduced consumer confidence and discretionary spending cuts, which can negatively impact restaurant traffic and sales for FAT Brands and its franchisees.

The company must remain agile, monitoring economic indicators and consumer sentiment to adapt its strategies and offerings, ensuring resilience against potential economic slowdowns while capitalizing on periods of growth.

FAT Brands' financial performance is closely tied to consumer disposable income, which can be affected by inflation and economic growth. For instance, while overall consumer spending remained resilient in early 2024, a growing sensitivity to price points suggests consumers may opt for more value-oriented dining experiences.

Navigating the period up to July 2025 requires FAT Brands to focus on value propositions and operational efficiencies to appeal to budget-conscious consumers, especially if economic headwinds persist.

The company's ability to manage input costs, such as rising ingredient and labor expenses due to inflation, is critical for maintaining franchisee profitability and its own margins.

| Economic Factor | Impact on FAT Brands | 2023/2024 Data/Outlook |

|---|---|---|

| Economic Growth (GDP) | Drives consumer spending on dining; higher growth supports revenue. | US GDP grew 2.5% in 2023; projected moderate growth for 2024/2025. |

| Disposable Income | Directly influences discretionary spending on restaurant meals. | Consumers showing increased price sensitivity in early 2024. |

| Inflation | Increases operating costs (ingredients, labor, utilities). | Significant increases in food away from home costs throughout 2023-2024. |

| Interest Rates | Affects cost of borrowing for expansion and franchisee financing. | Fluctuating rates; potential for higher borrowing costs impacting growth plans. |

| Exchange Rates | Impacts international revenue and cost of imported goods. | Volatility in major currency pairs affects global operations. |

Same Document Delivered

FAT Brands PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive FAT Brands PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Consumers are increasingly prioritizing healthier, plant-based, and sustainably sourced food. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, indicating a significant shift in consumer demand.

FAT Brands needs to adapt its diverse portfolio, which includes brands like Fatburger and Johnny Rockets, to meet these evolving preferences. This could involve introducing more plant-based options, highlighting sustainable sourcing practices, or even acquiring brands that already cater to these trends.

Failing to innovate in response to these changing dietary habits poses a risk to FAT Brands' market share. Companies that successfully integrate healthier and more sustainable options often see increased customer loyalty and attract a wider demographic, as evidenced by the growth of fast-casual chains focusing on these areas.

Modern consumers increasingly prioritize convenience, leading to a surge in demand for food delivery and takeout. This trend is reshaping the restaurant industry, with off-premise dining becoming a critical revenue driver. For FAT Brands, adapting to this shift is paramount for sustained growth.

FAT Brands must enhance its digital infrastructure to support seamless online ordering and integrate effectively with third-party delivery platforms. This strategy is crucial for meeting evolving consumer expectations and ensuring its brands remain competitive. The company's franchise success hinges on its ability to deliver convenient, off-premise dining experiences.

In 2024, the global online food delivery market was projected to reach over $200 billion, highlighting the massive opportunity. FAT Brands' investment in digital ordering and delivery partnerships directly addresses this growing consumer preference, aiming to capture a larger share of this expanding market.

Consumers are increasingly prioritizing health and wellness, directly impacting their dining decisions. This heightened awareness means a closer look at ingredients, calorie counts, and overall food transparency. For FAT Brands, this translates to a need to adapt menus and marketing to cater to these evolving preferences, potentially through offering more nutritional information or lighter fare.

In 2024, the global health and wellness market is projected to reach over $5.6 trillion, underscoring the significant consumer shift towards healthier lifestyles. This trend directly influences the restaurant industry, pushing brands like those under FAT Brands to provide clearer nutritional labeling and potentially introduce more health-conscious menu options to meet consumer demand and maintain market relevance.

Cultural Diversity and Globalization of Cuisines

As global populations become more interconnected, there's a significant rise in consumer appreciation for diverse culinary experiences. This trend directly benefits FAT Brands, whose portfolio of distinct restaurant concepts allows them to tap into various cultural tastes and explore new international markets.

FAT Brands can leverage its diverse brand offerings to cater to a global clientele. For instance, the company's acquisition of Great American Cookies and Pretzelmaker provides accessible, familiar flavors, while concepts like Ponderosa and Western Sizzlin' can be adapted to appeal to different regional palates. This multi-brand strategy is crucial for navigating the complexities of international food preferences, where understanding local tastes is paramount for successful expansion. In 2023, FAT Brands reported total revenue of $230.4 million, indicating a strong foundation from which to pursue these global opportunities.

- Growing Demand: Global food tourism and increased exposure to international cultures fuel a demand for authentic and diverse cuisines.

- FAT Brands' Advantage: The company's portfolio, including brands like Johnny Rockets and Fatburger, allows it to cater to various preferences, from American classics to globally-inspired options.

- Market Penetration: Successful international expansion hinges on adapting menus and marketing to local cultural norms and taste preferences, a strategy FAT Brands is increasingly employing.

- Revenue Growth: FAT Brands' revenue growth in recent years demonstrates its capacity to adapt and expand in a dynamic global market.

Social Media and Influencer Culture

Social media platforms and the burgeoning food influencer culture are undeniably powerful forces in shaping modern dining trends and consumer preferences. For FAT Brands, this means actively participating in the digital conversation is crucial for brand perception and attracting both customers and potential franchisees.

Leveraging social media for targeted marketing campaigns and diligently managing online reviews are essential strategies. For instance, a viral TikTok trend featuring one of FAT Brands' offerings could dramatically boost visibility and sales overnight, as seen with numerous restaurant chains in recent years. In 2024, influencer marketing spend in the US was projected to reach over $21 billion, highlighting the significant reach these platforms offer.

- Shaping Trends: Food influencers directly impact what consumers want to eat, driving demand for specific dishes or restaurant concepts.

- Brand Perception: Positive online reviews and engaging social media content build trust and a favorable image for FAT Brands.

- Customer Acquisition: Influencer endorsements and viral content can introduce the brand to new audiences, driving foot traffic and online orders.

- Franchisee Attraction: A strong, visible online presence signals a healthy and growing brand, making it more appealing to potential franchisees.

Sociological factors significantly influence consumer dining choices, with a growing emphasis on health, plant-based options, and sustainability. This trend is evident in the global plant-based food market, which reached approximately $29.7 billion in 2023 and is expected to grow substantially. FAT Brands must adapt its portfolio to align with these evolving consumer values, potentially by introducing healthier menu items or highlighting ethical sourcing to maintain relevance and attract a broader customer base.

The demand for convenience, driven by busy lifestyles, has propelled off-premise dining, including delivery and takeout, into a critical revenue stream. With the global online food delivery market projected to exceed $200 billion in 2024, FAT Brands' investment in digital ordering and delivery partnerships is essential for capturing market share and meeting consumer expectations.

Cultural shifts towards diverse culinary experiences, fueled by global interconnectedness and food tourism, present an opportunity for FAT Brands. The company's multi-brand strategy, encompassing concepts like Fatburger and Great American Cookies, allows it to cater to varied international tastes, a crucial element for successful global expansion. In 2023, FAT Brands reported $230.4 million in revenue, providing a solid foundation for pursuing these international growth avenues.

The pervasive influence of social media and food influencers significantly shapes consumer preferences and dining trends. FAT Brands can leverage platforms like TikTok, where influencer marketing spend in the US was projected to exceed $21 billion in 2024, to boost brand visibility, attract customers, and appeal to potential franchisees by cultivating a strong online presence and managing reputation effectively.

Technological factors

Digital ordering and mobile apps are vital for FAT Brands' customer engagement and operational efficiency. These platforms facilitate convenient online orders, loyalty programs, and targeted marketing, fostering repeat business and a better customer journey. By mid-2024, the global online food delivery market was projected to reach over $200 billion, highlighting the significant potential for FAT Brands to leverage these digital channels.

FAT Brands' integration with third-party food delivery platforms is crucial for tapping into the expanding off-premise dining market. This allows the company to reach a wider customer base and capitalize on the increasing consumer preference for delivery services. For instance, the food delivery market was valued at over $150 billion globally in 2023 and is projected to continue its strong growth trajectory through 2025.

Ensuring seamless connectivity with services like DoorDash, Uber Eats, and Grubhub is vital for optimizing order processing and managing delivery logistics across FAT Brands' diverse portfolio of restaurants. This integration directly influences revenue generation and operational efficiency, as streamlined processes can reduce errors and improve customer satisfaction.

FAT Brands is increasingly leveraging data analytics to deeply understand customer preferences and purchasing patterns, a trend amplified in 2024. For instance, by analyzing sales data from its various brands like Fatburger and Johnny Rockets, the company can identify popular menu items and predict demand, optimizing inventory and reducing waste. This data-driven approach is crucial for enhancing operational efficiencies across its franchise network.

Implementing advanced Customer Relationship Management (CRM) systems is a key technological factor for FAT Brands in 2024-2025, enabling more personalized marketing campaigns and targeted promotions. By segmenting customers based on their dining habits and loyalty program engagement, FAT Brands can foster improved customer engagement and build stronger brand loyalty. This allows for more effective communication and tailored offers, driving repeat business.

Data-driven insights are directly informing FAT Brands' strategic decisions, from menu development to marketing strategies and franchise support in the 2024-2025 period. For example, analysis of customer feedback and sales trends can guide the introduction of new menu items or the refinement of existing ones. Furthermore, these insights empower the company to provide more effective, data-backed support to its franchisees, enhancing overall performance and profitability.

Kitchen Automation and Robotics

Advancements in kitchen automation and robotics present significant opportunities for FAT Brands to boost efficiency and cut labor expenses. For instance, automated fryers and robotic systems can streamline food preparation, leading to more consistent product quality. This technological integration is projected to improve operational workflows for franchisees.

FAT Brands can leverage technologies like automated inventory management and robotic food assembly to optimize back-of-house operations. These innovations aim to reduce errors and speed up service times, directly impacting profitability. The market for food service robotics is expanding, with projections indicating substantial growth in the coming years, underscoring the strategic importance of these investments.

Key considerations for FAT Brands include the scalability of these robotic solutions across their diverse brand portfolio and seamless integration into existing kitchen setups. The goal is to ensure that these technologies enhance, rather than disrupt, the operational flow. By 2025, the global food robotics market is expected to reach several billion dollars, highlighting a clear trend towards increased automation.

- Operational Efficiency: Automated systems can reduce prep times and improve order accuracy.

- Labor Cost Reduction: Robotics can offset rising labor wages and shortages.

- Food Consistency: Automated cooking processes ensure a uniform product every time.

- Scalability: Implementing solutions that can be adapted across multiple FAT Brands concepts is crucial for widespread adoption.

Supply Chain Technology and Traceability

FAT Brands can significantly boost efficiency and transparency by implementing advanced supply chain technologies. This includes real-time inventory tracking and predictive ordering systems, which are becoming increasingly vital in the fast-moving QSR and casual dining sectors. For instance, many food service companies are investing in AI-powered demand forecasting, aiming to reduce overstocking by up to 15% by 2025, thereby directly impacting ingredient cost management.

Leveraging technologies like blockchain offers unparalleled traceability, assuring customers about the safety and ethical sourcing of ingredients. This is particularly relevant for FAT Brands' diverse portfolio, which includes brands like Fatburger and Johnny Rockets. By 2024, consumer demand for supply chain transparency has grown, with studies indicating that over 60% of consumers are more likely to purchase from brands that can clearly demonstrate their sourcing practices.

These technological advancements directly translate to improved resilience and responsiveness for FAT Brands. In the face of potential disruptions, such as the logistics challenges seen in 2023, having a digitally enabled and traceable supply chain allows for quicker identification of issues and faster rerouting of supplies. This agility is crucial for maintaining consistent product availability and customer satisfaction across all franchised locations.

Key technological implementations for FAT Brands’ supply chain include:

- Real-time Inventory Management: Utilizing IoT sensors and software to monitor stock levels across all locations, minimizing spoilage and stockouts.

- Predictive Analytics for Ordering: Employing AI to forecast demand based on historical data, seasonality, and local events, optimizing ingredient procurement.

- Blockchain for Traceability: Implementing distributed ledger technology to track ingredients from farm to fork, enhancing food safety and ethical sourcing verification.

- Supply Chain Visibility Platforms: Integrating data from various partners to provide end-to-end visibility, enabling rapid response to disruptions.

FAT Brands is actively enhancing its digital presence through mobile ordering and loyalty programs, aiming to boost customer engagement and operational efficiency. By mid-2024, the global online food delivery market was projected to exceed $200 billion, underscoring the immense potential for FAT Brands to capitalize on these digital channels.

Integration with third-party delivery platforms like DoorDash and Uber Eats is critical for FAT Brands to access the expanding off-premise dining market. This strategy allows the company to reach a broader customer base, capitalizing on the growing consumer preference for delivery services, a market valued at over $150 billion globally in 2023.

The company is increasingly utilizing data analytics to understand customer preferences and purchasing habits, a trend that gained significant momentum in 2024. By analyzing sales data from brands such as Fatburger and Johnny Rockets, FAT Brands can optimize inventory and reduce waste, leading to enhanced operational efficiencies across its franchise network.

FAT Brands is exploring kitchen automation and robotics to improve efficiency and manage labor costs, with automated systems promising more consistent product quality and streamlined food preparation. The global food service robotics market is experiencing substantial growth, highlighting the strategic importance of these technological investments for the company.

Legal factors

FAT Brands navigates a complex web of franchise laws, which differ considerably across U.S. states and international jurisdictions. This requires meticulous adherence to disclosure mandates and registration procedures to ensure the lawful sale of franchise units. For instance, the Federal Trade Commission (FTC) Franchise Rule mandates that franchisors provide prospective franchisees with a detailed Franchise Disclosure Document (FDD) at least 14 days before any agreement is signed or payment is made.

Compliance is paramount for FAT Brands to maintain legal standing in its franchise sales and to safeguard both the franchisor and the franchisee from potential disputes. Failure to meet these stringent regulatory demands, such as providing accurate and complete FDD information, can result in severe legal repercussions, including fines and litigation, as well as considerable damage to the brand's reputation. For example, in 2023, several franchise systems faced investigations and penalties for non-compliance with disclosure laws.

FAT Brands heavily relies on intellectual property, including its restaurant brand names like Fatburger and Johnny Rockets, their distinctive logos, proprietary recipes, and unique operational systems. Protecting these assets through trademarks and copyrights is paramount to maintaining brand recognition and value.

Legal frameworks are essential to prevent unauthorized use or imitation of FAT Brands' intellectual property, safeguarding its competitive advantage. This is particularly important as the company expands globally, ensuring consistent brand representation across all locations.

Vigilance in monitoring and actively enforcing these intellectual property rights is crucial. For instance, in 2023, the global IP market was valued at trillions, highlighting the significant financial stake companies like FAT Brands have in their brand assets.

FAT Brands and its franchisees navigate a complex web of labor and employment laws, encompassing wage and hour rules, workplace safety, and anti-discrimination statutes. Compliance is crucial, as demonstrated by the significant fines levied in the restaurant sector; for instance, in 2023, the U.S. Department of Labor recovered over $310 million for workers due to wage and hour violations alone.

These regulations differ significantly across states and even cities, demanding constant vigilance to maintain fair labor practices and prevent costly legal entanglements. The U.S. Bureau of Labor Statistics reported that in 2024, the accommodation and food services industry experienced one of the highest rates of workplace injuries, highlighting the importance of adhering to safety standards.

Improper employee classification, such as misclassifying workers as independent contractors, can result in substantial penalties and back pay claims. Recent class-action lawsuits against restaurant chains for misclassification have resulted in settlements reaching millions of dollars, underscoring the financial risks involved.

Food Safety and Health Regulations

FAT Brands operates within a highly regulated sector where stringent food safety and health regulations are paramount across all jurisdictions. These rules dictate everything from ingredient sourcing and preparation methods to sanitation practices and staff training, impacting every franchisee. For instance, in the United States, the Food and Drug Administration (FDA) sets national standards, while individual states and local health departments enforce their own specific requirements, often leading to variations in compliance protocols. Failure to adhere can result in significant fines, temporary closures, and severe damage to brand reputation.

Ensuring franchisee compliance is a critical legal and operational challenge for FAT Brands. The company must implement robust systems for monitoring adherence to these diverse regulations, which are continuously updated. For example, the U.S. Department of Agriculture (USDA) also plays a role in food safety, particularly concerning meat and poultry, which are common ingredients in many restaurant offerings. FAT Brands’ commitment to consumer trust hinges on its ability to guarantee safe food handling and preparation across its entire network.

- Adherence to FDA and USDA guidelines is non-negotiable for all FAT Brands franchisees.

- Local health department inspections, which can occur without prior notice, are a key compliance metric.

- In 2023, the Centers for Disease Control and Prevention (CDC) reported an estimated 48 million cases of foodborne illness in the U.S., highlighting the ongoing importance of food safety.

- FAT Brands must invest in training and auditing programs to mitigate the legal and financial risks associated with non-compliance.

Data Privacy and Cybersecurity Laws

FAT Brands navigates a complex legal landscape concerning data privacy and cybersecurity. The company must adhere to stringent regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, which govern how customer and franchisee data is collected, processed, and stored. As of 2024, data breaches continue to be a significant concern, with the average cost of a data breach globally reaching $4.45 million in 2024, according to IBM's Cost of a Data Breach Report.

Protecting sensitive information is critical for FAT Brands, not only to avoid substantial fines and legal penalties but also to maintain the trust of its customers and franchisees. Failure to implement robust cybersecurity measures and transparent data handling practices can lead to severe reputational damage and loss of business. For instance, the European Union's GDPR can impose fines of up to 4% of global annual revenue for non-compliance.

- GDPR Compliance: FAT Brands must ensure all data handling practices involving EU residents meet GDPR standards, including obtaining explicit consent for data collection.

- CCPA Adherence: For operations in California, compliance with CCPA mandates transparency in data collection and provides consumers with rights regarding their personal information.

- Cybersecurity Investments: Significant investment in advanced cybersecurity infrastructure is necessary to safeguard against increasingly sophisticated cyber threats targeting restaurant chains and their associated data.

- Data Breach Preparedness: Developing and regularly testing incident response plans for data breaches is crucial to mitigate damage and ensure swift, compliant notification procedures.

FAT Brands must navigate evolving franchise regulations, which vary significantly by state and country, necessitating strict adherence to disclosure requirements like the FTC's Franchise Rule. Failure to provide accurate Franchise Disclosure Documents (FDDs) can lead to substantial fines and litigation, as seen in numerous franchise system investigations in 2023.

Protecting intellectual property, including brand names like Fatburger and Johnny Rockets, is crucial for maintaining brand value and competitive advantage. The global IP market's valuation in the trillions in 2023 underscores the significant financial stake companies have in their brand assets, requiring vigilant enforcement against unauthorized use.

Labor laws, including wage and hour rules and workplace safety, demand constant attention. The restaurant industry saw over $310 million recovered for workers due to wage and hour violations in 2023, and workplace injury rates remain high, emphasizing the need for compliance.

Food safety regulations, enforced by bodies like the FDA and USDA, are critical. An estimated 48 million foodborne illnesses occurred in the U.S. in 2023, highlighting the ongoing importance of adherence to stringent preparation and sanitation standards across all FAT Brands locations.

Data privacy laws like GDPR and CCPA require robust cybersecurity measures. The average cost of a data breach in 2024 reached $4.45 million, and non-compliance with GDPR can result in fines up to 4% of global annual revenue.

| Legal Area | Key Compliance Aspects | 2023-2024 Data/Examples | FAT Brands' Focus |

|---|---|---|---|

| Franchise Law | FTC Franchise Rule, FDD disclosure | Investigations and penalties for non-compliance in 2023 | Meticulous adherence to disclosure mandates |

| Intellectual Property | Trademarks, copyrights, brand protection | Global IP market valued in trillions (2023) | Safeguarding brand recognition and value |

| Labor & Employment | Wage/hour, safety, anti-discrimination | $310M recovered for wage violations (2023); high injury rates | Maintaining fair labor practices, preventing costly disputes |

| Food Safety | FDA, USDA, local health codes | 48M foodborne illnesses (2023); FDA/USDA standards | Ensuring safe food handling across all franchisees |

| Data Privacy & Cybersecurity | GDPR, CCPA, data breach protection | $4.45M avg. data breach cost (2024); GDPR fines up to 4% revenue | Protecting customer/franchisee data, mitigating cyber threats |

Environmental factors

The restaurant industry faces increasing demand for sustainable sourcing, encompassing ethical ingredient production, water conservation, and effective waste management. FAT Brands must assess its supply chain to integrate greener alternatives, which can attract eco-conscious customers and potentially lower future operating expenses.

For instance, a 2024 report by the Sustainable Restaurant Association indicated that 75% of consumers are more likely to dine at restaurants with demonstrable sustainability commitments. FAT Brands' adoption of transparent sourcing practices could significantly bolster its brand reputation among this growing consumer segment.

The restaurant sector, including FAT Brands' diverse portfolio, is a significant contributor to waste streams, encompassing everything from food scraps to single-use packaging. Growing consumer and regulatory pressure is pushing companies like FAT Brands to adopt more robust waste management and recycling strategies across their franchised locations.

FAT Brands is increasingly expected to lead in implementing effective waste reduction and recycling programs. This involves exploring options like compostable packaging, which is gaining traction as a sustainable alternative, and developing food waste diversion programs, potentially through partnerships with composting facilities or food banks. Encouraging franchisees to adopt eco-friendly waste disposal methods is crucial for minimizing the company's overall environmental footprint.

For context, the U.S. restaurant industry alone generates an estimated 11.4 million tons of food waste annually, according to USDA data. Initiatives focused on reducing this, alongside packaging waste, are becoming not just environmentally responsible but also a key aspect of brand reputation and operational efficiency for companies like FAT Brands.

Restaurants, including those under the FAT Brands umbrella, are inherently energy-intensive, making energy consumption a critical environmental factor. In 2023, the US restaurant industry's energy expenditures were estimated to be around $25 billion, highlighting the scale of this issue.

FAT Brands can proactively guide its franchisees toward adopting energy-efficient technologies. This includes encouraging the use of LED lighting, ENERGY STAR certified kitchen appliances, and modern HVAC systems, which can collectively reduce a restaurant's carbon footprint and operational costs.

Furthermore, exploring investments in renewable energy sources, such as solar panels for locations with suitable infrastructure, or implementing robust energy-saving practices like smart thermostat controls and regular equipment maintenance, can significantly lower utility bills and align with growing consumer demand for sustainable businesses.

Water Usage and Conservation

Water scarcity is a significant environmental factor impacting businesses globally, including restaurant chains like FAT Brands. As concerns about water conservation intensify, FAT Brands must diligently assess its water consumption across all operational facets, from food preparation and cooking to dishwashing and general cleaning. Implementing water-saving technologies, such as low-flow faucets and efficient dishwashers, can directly address this challenge.

Promoting robust water management practices throughout its extensive franchise network is crucial. This not only contributes to operational cost reductions for individual franchisees but also reinforces FAT Brands' commitment to environmental stewardship. For instance, the restaurant industry in the US, a key market for FAT Brands, faces increasing scrutiny over its water footprint, with some studies indicating significant water usage in commercial kitchens.

FAT Brands can leverage this environmental consideration by:

- Implementing water-efficient equipment across all locations.

- Educating staff on best practices for water conservation in daily operations.

- Exploring partnerships with water conservation organizations to share knowledge and resources.

- Reporting on water usage reduction targets and achievements in sustainability reports.

Climate Change and Carbon Footprint

Growing concerns over climate change are increasingly shaping consumer preferences and intensifying regulatory scrutiny. FAT Brands, like many in the food service industry, faces pressure to address its environmental impact. This includes evaluating its carbon footprint across the entire value chain, from sourcing ingredients to the energy consumption of its restaurant locations.

Optimizing logistics to reduce transportation emissions and supporting sustainable agricultural practices for ingredient sourcing are key strategies FAT Brands can explore. These initiatives not only contribute to corporate social responsibility but also resonate with a growing segment of environmentally conscious consumers. For instance, the food industry is a significant contributor to global greenhouse gas emissions, with agriculture alone accounting for roughly 25% of the total emissions in 2023, according to the UN's Food and Agriculture Organization.

- Consumer Demand: A 2024 survey indicated that over 60% of consumers consider a brand's sustainability practices when making purchasing decisions.

- Regulatory Landscape: Governments worldwide are implementing stricter regulations on carbon emissions and waste management, potentially impacting operational costs.

- Supply Chain Impact: The transportation of food ingredients, a significant component of FAT Brands' operations, is a major source of carbon emissions.

- Brand Reputation: Proactive environmental stewardship can enhance FAT Brands' public image and attract environmentally aware investors and customers.

Environmental factors significantly influence FAT Brands' operations, driven by increasing consumer demand for sustainability and evolving regulatory landscapes. The company must navigate pressures related to waste management, energy consumption, and water usage across its diverse franchise portfolio.

The restaurant industry's substantial environmental footprint, particularly concerning food waste and energy use, presents both challenges and opportunities for FAT Brands. For example, the U.S. restaurant industry alone generates millions of tons of food waste annually, underscoring the need for robust reduction strategies.

FAT Brands can enhance its brand image and operational efficiency by adopting eco-friendly practices, such as implementing water-saving technologies and promoting energy-efficient equipment among franchisees. These initiatives align with growing consumer preferences for sustainable businesses and can lead to cost savings.

Climate change concerns also necessitate a focus on reducing carbon emissions throughout the supply chain, from ingredient sourcing to logistics. By proactively addressing these environmental aspects, FAT Brands can strengthen its market position and appeal to environmentally conscious stakeholders.

| Environmental Factor | Impact on FAT Brands | Key Considerations/Actions | Relevant Data (2023-2024) |

|---|---|---|---|

| Waste Management | Operational costs, brand reputation | Reduce food waste, sustainable packaging, recycling programs | 75% of consumers favor restaurants with sustainability commitments. U.S. restaurants generate 11.4 million tons of food waste annually. |

| Energy Consumption | Operating expenses, carbon footprint | Energy-efficient appliances, LED lighting, renewable energy options | U.S. restaurant industry energy expenditures ~$25 billion in 2023. |

| Water Usage | Operational costs, regulatory scrutiny | Water-efficient fixtures, staff training, water conservation practices | Growing scrutiny over the restaurant industry's water footprint in key markets. |

| Climate Change & Emissions | Supply chain resilience, brand perception | Optimize logistics, support sustainable agriculture, report emissions | Food industry contributes ~25% of global greenhouse gas emissions (2023). 60% of consumers consider sustainability in purchasing decisions. |

PESTLE Analysis Data Sources

Our FAT Brands PESTLE Analysis is built on a robust foundation of data from leading financial news outlets, industry-specific trade publications, and publicly available company filings. We meticulously analyze economic indicators, consumer spending trends, and regulatory changes impacting the restaurant sector.