FAT Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FAT Brands Bundle

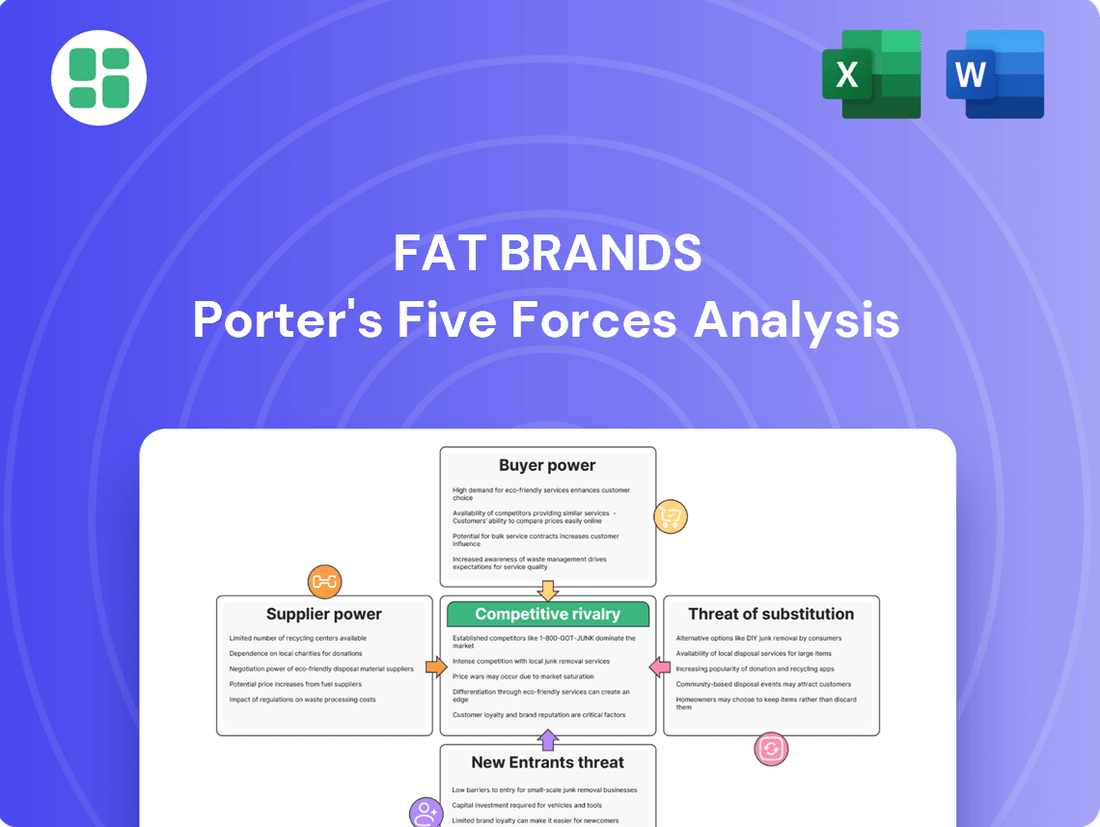

FAT Brands faces a dynamic restaurant industry, where intense rivalry and the threat of new entrants significantly shape its competitive landscape. Understanding the bargaining power of both buyers and suppliers is crucial for navigating this market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore FAT Brands’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for FAT Brands is typically low. This is largely because the food service supply chain is quite fragmented, meaning there are many companies providing ingredients, packaging, and equipment. For example, in 2024, the U.S. restaurant industry relies on a vast network of distributors and manufacturers, making it difficult for any single supplier to exert significant influence over pricing or terms for a large operator like FAT Brands.

However, this can shift for specialized or proprietary ingredients. If a particular brand within FAT Brands requires a unique sauce or a specific type of frozen product that only a few companies can produce, those suppliers gain more leverage. This concentration allows them to potentially negotiate better terms, impacting FAT Brands' cost of goods sold.

The overall fragmentation of the supplier base is a significant advantage for FAT Brands and its franchisees. It enables them to source from a wide array of vendors, fostering competition among suppliers. This competitive environment helps FAT Brands maintain lower input costs and ensures a stable supply chain, as they are not overly dependent on any one source.

Switching costs for FAT Brands and its franchisees are generally considered moderate. While shifting primary food distributors or equipment providers requires some logistical planning and potential staff training, the widespread availability and standardization of many restaurant supplies help keep these costs in check.

However, for specialized or custom-designed components, the expense and effort to switch could be more significant. FAT Brands' diverse portfolio of brands, including Fatburger, Johnny Rockets, and Great American Cookies, enables them to leverage different sourcing strategies, potentially mitigating the impact of higher switching costs for specific items across their various concepts.

For most food ingredients and basic restaurant supplies, the market is filled with undifferentiated commodities. This generally means suppliers have less power to dictate terms. However, when it comes to proprietary recipes, specialized equipment, or unique, high-demand ingredients, a supplier's offering can become much more distinct, thereby increasing their bargaining leverage.

For FAT Brands, this is often managed by leveraging its considerable scale across its portfolio of brands. This allows the company to negotiate more favorable terms with suppliers, even for specialized items, by committing to larger volumes.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into restaurant operations for a company like FAT Brands is generally considered low. Food suppliers typically concentrate on production and distribution, not the complex operational and marketing demands of running a multi-brand franchise system.

Suppliers usually lack the necessary expertise in restaurant management, consumer marketing, and franchise development to compete directly with established brands. Their core business is in sourcing and delivering ingredients, which is a fundamentally different skill set than managing a restaurant chain.

Consider the scale: FAT Brands operates numerous restaurant concepts. For a food supplier to effectively replicate this, they would need to invest heavily in infrastructure, brand building, and operational know-how, which is often beyond their strategic focus.

- Limited Expertise: Food suppliers' core competencies are in agriculture, processing, and logistics, not restaurant operations or franchise management.

- High Capital Requirements: Establishing and managing a restaurant chain requires significant capital for real estate, build-out, marketing, and staffing, which is often outside a supplier's primary investment areas.

- Brand Recognition Gap: Suppliers typically lack the consumer brand recognition and loyalty that restaurant franchisors cultivate over years, making it difficult to attract franchisees or customers.

- Focus on Core Business: Most suppliers find it more profitable and manageable to focus on their established supply chain operations rather than venturing into the highly competitive and complex restaurant industry.

Importance of FAT Brands to Suppliers

FAT Brands' extensive global presence, boasting around 2,300 operational units and a strong expansion strategy, positions it as a crucial client for numerous suppliers. This considerable purchasing volume inherently diminishes the bargaining power of these suppliers. The potential loss of FAT Brands as a customer would significantly impact a supplier's revenue stream, making them more amenable to favorable terms.

FAT Brands' substantial scale of operations allows it to negotiate more advantageous pricing and payment terms. For instance, in 2023, the company continued its aggressive growth, adding new locations and further solidifying its position as a major buyer in the food service supply chain. This purchasing might translates directly into cost efficiencies for FAT Brands.

- Significant Customer Base: FAT Brands' 2,300+ units worldwide make it a key client for many suppliers.

- Reduced Supplier Leverage: Losing FAT Brands' business would represent a substantial revenue decrease for suppliers.

- Negotiating Power: FAT Brands leverages its purchasing volume to secure better pricing and terms.

- Cost Efficiencies: This scale allows FAT Brands to achieve greater cost savings on supplies.

The bargaining power of suppliers for FAT Brands is generally low due to the fragmented nature of the food service supply chain, with numerous providers of ingredients, packaging, and equipment. This fragmentation allows FAT Brands to source from a wide array of vendors, fostering competition and helping to maintain lower input costs. For example, in 2024, the U.S. restaurant industry's vast supplier network means no single supplier can significantly influence terms for a large operator like FAT Brands.

However, this power can increase for specialized or proprietary ingredients, where a limited number of suppliers can create leverage. Switching costs are typically moderate, but can be higher for custom components, though FAT Brands' diverse brand portfolio helps mitigate this. The threat of suppliers integrating forward into restaurant operations is low, as their core competencies lie in production and logistics, not complex franchise management.

FAT Brands' extensive global presence, with approximately 2,300 operational units as of early 2024, solidifies its position as a crucial client for many suppliers. This substantial purchasing volume significantly diminishes individual supplier leverage, as losing FAT Brands as a customer would represent a considerable revenue loss. The company effectively uses this scale to negotiate more advantageous pricing and payment terms, translating into direct cost efficiencies.

| Factor | Assessment for FAT Brands | Impact |

| Supplier Fragmentation | High | Low Supplier Bargaining Power |

| Switching Costs | Moderate (low for commodities, higher for specialized items) | Moderate Impact |

| Supplier Forward Integration Threat | Low | Low Supplier Bargaining Power |

| FAT Brands' Purchasing Volume | High (approx. 2,300 units globally) | Low Supplier Bargaining Power |

What is included in the product

This analysis unpacks the competitive forces shaping FAT Brands' restaurant portfolio, examining buyer and supplier power, new entrant threats, substitute products, and the intensity of rivalry within the quick-service and casual-dining sectors.

Confidently navigate FAT Brands' competitive landscape with a visual representation of each force, simplifying complex strategic pressures for actionable insights.

Customers Bargaining Power

FAT Brands' customer base is primarily its franchisees, exceeding 760 globally. While individual franchisees possess minimal bargaining power, a substantial and unified group could potentially exert considerable influence over the franchisor.

However, the broad distribution of these franchisees across FAT Brands' diverse portfolio and numerous international locations effectively diffuses any potential for concentrated collective action, thereby diminishing their overall bargaining strength.

Franchisees invest heavily in FAT Brands, facing significant switching costs. These include initial franchise fees, substantial build-out expenses, specialized equipment purchases, and mandatory brand-specific training. For instance, establishing a new quick-service restaurant franchise can easily run into hundreds of thousands of dollars, making a move to a competitor a costly proposition.

The financial and operational complexities of exiting one franchise system and entering another are considerable. This high barrier to entry for franchisees seeking to switch brands directly diminishes their bargaining power with FAT Brands.

The restaurant franchising sector is quite crowded, meaning potential franchisees have many other brands to choose from. This abundance of options gives franchisees more sway. For FAT Brands, this translates to a need to consistently present appealing restaurant concepts, robust operational support, and favorable royalty terms to draw in and keep franchisees.

Price Sensitivity of Customers (Franchisees and End Consumers)

Franchisees for FAT Brands are quite attuned to their unit profitability, which is directly influenced by royalty fees and how much end consumers are willing to pay. This means if end consumers are hesitant to spend more, franchisees feel the pinch, which can affect their ability to pay those fees.

In the fast-casual and quick-service restaurant sectors, end consumers are particularly sensitive to price. This is especially true when the economy feels uncertain or when the cost of eating out goes up. For instance, in 2024, many consumers are watching their spending more closely due to inflation.

- Consumer Price Sensitivity: End consumers in the fast-casual and quick-service segments are highly price-sensitive, particularly in 2024, impacting their purchasing decisions.

- Franchisee Profitability: Franchisees' unit profitability is directly linked to royalty fees and the price sensitivity of their customer base.

- Cost Management Pressure: High consumer price sensitivity forces franchisees to focus on cost management, which can indirectly affect FAT Brands' royalty revenue streams.

- Impact on Royalties: The ability of franchisees to maintain healthy profit margins, influenced by consumer spending habits, directly translates into the revenue FAT Brands collects through royalties.

Information Availability to Customers (Franchisees)

Prospective franchisees in 2024 can readily access a wealth of data on franchise system performance, broader industry trends, and competitor strategies. This increased transparency significantly bolsters their negotiating position when discussing terms with franchisors like FAT Brands.

Existing franchisees, through shared experiences and performance metrics, can collectively amplify their influence. Negative feedback or data shared among franchisees can create a united front, increasing their bargaining power when addressing operational concerns or seeking concessions from the franchisor.

- Enhanced Transparency: Franchisees in 2024 benefit from readily available data on industry benchmarks and competitor performance, empowering their negotiations.

- Collective Bargaining: Shared negative experiences among existing franchisees can consolidate their leverage in discussions with the franchisor.

- Information Access: The digital age provides franchisees with unprecedented access to information, directly impacting their ability to negotiate favorable terms.

While FAT Brands' franchisees are numerous, their geographic dispersion and high switching costs limit individual bargaining power. However, increased transparency in 2024, allowing franchisees access to performance data and industry trends, empowers them to negotiate more effectively.

The price sensitivity of end consumers, a significant factor in 2024 due to economic conditions, directly impacts franchisee profitability and, consequently, their ability to meet royalty obligations, indirectly influencing FAT Brands.

The crowded franchising market offers potential franchisees many alternatives, necessitating FAT Brands to provide competitive terms and support to attract and retain them, thereby moderating customer bargaining power.

| Factor | Impact on FAT Brands' Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Franchisee Concentration | Low due to geographic dispersion | Consistent |

| Switching Costs | High (fees, build-out, equipment) | Significant deterrent |

| Market Alternatives | High (crowded market) | Increases franchisee leverage |

| Consumer Price Sensitivity | Indirectly impacts franchisee profitability and royalty payments | Heightened due to inflation |

| Information Transparency | Empowers franchisees in negotiations | Increased in 2024 |

Preview the Actual Deliverable

FAT Brands Porter's Five Forces Analysis

This preview showcases the comprehensive FAT Brands Porter's Five Forces Analysis you will receive immediately after purchase, offering an in-depth examination of competitive forces. The document displayed here is the exact, fully formatted report, ready for your strategic planning needs without any alterations or placeholders. You're looking at the actual, professionally written analysis; once you complete your purchase, you’ll get instant access to this precise document.

Rivalry Among Competitors

FAT Brands operates in the highly fragmented fast-casual and quick-service restaurant sectors, facing intense competition from a multitude of players. This includes numerous local eateries, regional chains, national powerhouses, and international brands, all vying for consumer attention and spending.

The competitive set for FAT Brands is not limited to direct rivals but also encompasses other multi-brand franchisors, independent restaurants, and large, corporate-owned restaurant groups. For instance, in 2024, the U.S. restaurant industry boasted over one million food service locations, with a significant portion concentrated in the fast-casual and quick-service segments, highlighting the sheer density of potential competitors.

The franchise sector, particularly quick-service restaurants (QSR) and fast-casual dining, is expected to see continued expansion through 2024 and into 2025. However, this growth doesn't mean it's easy for every brand to capture new customers. For instance, the U.S. fast-food industry generated approximately $291 billion in sales in 2023, indicating a robust market, but also one where gains are hard-won.

Given the maturity of the restaurant industry, any increase in market share for one brand typically means a corresponding decrease for another. This dynamic intensifies competition, pushing established players and emerging concepts to vie more aggressively for consumer attention and loyalty. FAT Brands operates within this environment, where differentiation and operational efficiency are key to outperforming rivals.

FAT Brands differentiates itself by acquiring and growing a portfolio of distinct restaurant brands, each offering unique cuisines and dining atmospheres. This multi-brand approach aims to capture a wider customer base and reduce reliance on any single concept.

Despite this strategy, the fast-casual and quick-service sectors are highly competitive, with many brands offering similar products. Consequently, competition often centers on factors like price point, speed of service, perceived quality, and the overall customer experience, rather than purely on product uniqueness.

For instance, in 2023, the U.S. fast-food industry generated over $280 billion in sales, highlighting the intense competition. FAT Brands' success hinges on its ability to continually innovate its menus and strengthen its brand identities to stand out in this crowded market.

Switching Costs for Consumers

Consumer switching costs within the restaurant sector are remarkably low. Diners can effortlessly opt for a different dining establishment for their subsequent meal, driven by factors such as price, accessibility, or personal taste. This inherent ease of transition significantly escalates competitive rivalry.

Consequently, FAT Brands and its network of franchisees face continuous pressure to attract and retain patrons. This necessitates a consistent focus on delivering superior value, maintaining high-quality offerings, and providing exceptional customer service to stand out in a crowded market.

- Low Switching Costs: Consumers can easily change restaurants based on price, convenience, or preference.

- Intensified Rivalry: This ease of switching forces brands like FAT Brands to constantly compete for customer loyalty.

- Focus on Value and Service: To retain customers, FAT Brands must emphasize quality, affordability, and a positive dining experience.

Exit Barriers

Exit barriers for FAT Brands are notably high, stemming from significant investments in specialized restaurant equipment and often long-term real estate leases. These sunk costs make it challenging for franchisees to simply walk away from underperforming locations without substantial financial losses.

For FAT Brands franchisees, contractual obligations within their franchise agreements act as substantial exit barriers. These agreements can include clauses related to termination fees, ongoing royalty payments, or requirements to maintain brand standards even when a location is not profitable, effectively locking them in.

The presence of these high exit barriers can lead to a situation where unprofitable FAT Brands locations remain operational. This persistence of underperforming units contributes to market saturation and intensifies competitive rivalry, as these businesses continue to vie for market share despite financial struggles.

- Specialized Assets: Restaurant-specific equipment, such as commercial ovens, fryers, and refrigeration units, has limited resale value outside the industry.

- Lease Commitments: Long-term leases on prime real estate can be difficult and costly to break, especially if the location is no longer viable.

- Franchise Agreements: Contractual obligations, including termination penalties and ongoing royalty payments, can make exiting a franchise a financially punitive decision.

- Brand Reputation: The reputational impact of a failed franchise unit can also deter quick exits, as franchisees may fear damage to their personal brand.

Competitive rivalry within FAT Brands' operating sectors is exceptionally fierce, driven by a vast number of competitors and low switching costs for consumers. The U.S. restaurant industry, with over one million food service locations in 2024, presents a dense competitive landscape where brands constantly battle for market share. This intense rivalry necessitates a strong focus on value, quality, and customer experience to retain patrons in a market where diners can easily choose alternatives.

The sheer volume of restaurants, including numerous fast-casual and quick-service establishments, means that any gain for one brand often comes at the expense of another. For example, the U.S. fast-food industry generated approximately $291 billion in sales in 2023, underscoring the substantial revenue pool but also the aggressive competition to capture it. FAT Brands must continuously innovate and strengthen its brand appeal to stand out and thrive amidst this constant pressure from both established giants and emerging concepts.

SSubstitutes Threaten

The threat of substitutes for FAT Brands' restaurant offerings is significant, largely driven by consumers' ability to prepare meals at home. This alternative is often more budget-friendly, a key consideration as food-away-from-home costs continue to rise; for instance, the Consumer Price Index for food away from home increased by 5.1% in the twelve months ending May 2024.

Beyond traditional home cooking, the growing popularity of meal kits presents a compelling substitute. These kits offer convenience and a curated culinary experience, directly competing with the convenience factor of fast-casual dining. Additionally, the increasing quality and variety of prepared foods available in grocery stores further bolster the threat of substitutes, providing consumers with quick and easy meal solutions that bypass the need for restaurant patronage.

The threat of substitutes is significant for FAT Brands, especially when considering the price-performance of alternatives like home-cooked meals. For many consumers, preparing food at home offers a superior price-performance ratio, allowing for greater control over ingredients and portion sizes, which can lead to substantial cost savings compared to dining out.

While FAT Brands' various restaurant concepts strive to offer good value, the inherent cost advantages of home cooking remain a powerful draw, particularly for budget-conscious individuals and families. In 2024, the average cost of groceries per person per week in the US was around $70, whereas a single family meal at a fast-casual restaurant could easily exceed $50.

This competitive pressure from at-home dining forces FAT Brands to continually differentiate its offerings. The focus shifts to emphasizing convenience, a unique dining experience, and proprietary menu items that cannot be easily replicated at home, thereby justifying the premium price point.

Customer propensity to substitute for FAT Brands is high. Factors like growing health consciousness, economic pressures, and the demand for convenience all push consumers to consider alternatives. For instance, in 2024, grocery store prepared meal sales saw a significant uptick, reflecting this shift in consumer behavior.

The expanding availability of premium ready-to-eat options in supermarkets, coupled with the robust growth of third-party food delivery platforms, further lowers the barriers to substitution. This makes it easier and more attractive for consumers to opt for meals prepared at home or sourced from different types of food providers, forcing restaurants like those under FAT Brands to continually demonstrate their unique value.

Evolving Consumer Preferences

Shifting consumer tastes are a significant threat. As people increasingly seek healthier, more sustainable, and personalized food choices, traditional fast-casual dining can face substitution. For instance, the surge in plant-based eating, with the global plant-based food market projected to reach over $160 billion by 2030, directly challenges concepts that don't offer robust vegan or vegetarian alternatives.

This evolution means consumers might opt for grocery store prepared meals, meal kit services, or specialized vegan restaurants if their preferred fast-casual brands don't adapt. FAT Brands, like many in the industry, must monitor these trends closely to avoid losing market share to more agile competitors or alternative food consumption methods.

The demand for convenience also plays a role, but it's increasingly intertwined with these other preferences.

- Growing demand for plant-based alternatives: The global plant-based food market is expanding rapidly, indicating a strong consumer shift.

- Focus on sustainability: Consumers are showing a preference for brands with environmentally friendly practices, impacting choices.

- Desire for customization: Personalized meal options are becoming more attractive, potentially drawing customers away from standardized menus.

- Rise of alternative food channels: Meal kits and enhanced grocery offerings provide viable substitutes for traditional restaurant dining.

Impact of Digitalization and Delivery Services

The increasing prevalence of online ordering and third-party delivery platforms has inadvertently fueled the rise of ghost kitchens and virtual brands. These operations, often with significantly lower overheads, can easily replicate menu items and offer them directly to consumers, acting as potent substitutes for traditional brick-and-mortar FAT Brands locations. For instance, in 2024, the ghost kitchen market was projected to reach over $40 billion globally, highlighting the scale of this competitive force.

These substitute models leverage digital channels to reach customers, bypassing the need for physical storefronts and the associated costs like prime real estate and extensive staffing. This allows them to compete on price and convenience, directly challenging FAT Brands' market share by offering a wider array of quick-service food options without the traditional dining experience.

- Ghost kitchens and virtual brands offer lower overheads, enabling competitive pricing.

- Digital ordering and delivery platforms facilitate the expansion of these substitute models.

- The global ghost kitchen market's significant growth underscores the threat of substitution.

- These alternatives provide convenient food options that can divert customers from traditional restaurants.

The threat of substitutes for FAT Brands is substantial, primarily stemming from consumers' ability to prepare meals at home, which is often more cost-effective. For example, the average cost of groceries per person per week in the US hovered around $70 in 2024, a stark contrast to the potential $50+ cost for a single family meal at a fast-casual establishment.

Meal kits and enhanced grocery store offerings further intensify this threat by providing convenience and variety, directly competing with the quick-service nature of FAT Brands' concepts. The burgeoning plant-based movement, with the global market projected to exceed $160 billion by 2030, also presents a significant substitute as consumers seek healthier and more specialized options.

The rise of ghost kitchens and virtual brands, fueled by digital ordering and delivery, offers another potent substitute. These low-overhead operations can replicate menu items and compete on price and convenience, diverting customers from traditional brick-and-mortar restaurants. The global ghost kitchen market's projected valuation of over $40 billion in 2024 highlights the scale of this competitive force.

| Substitute Category | Key Differentiator | Consumer Driver | 2024 Data Point Example |

| Home Cooking | Cost Savings, Control | Budget Consciousness | Avg. Grocery Spend: ~$70/week/person |

| Meal Kits | Convenience, Culinary Experience | Time Savings, Novelty | Growing Market Segment |

| Grocery Prepared Meals | Convenience, Variety | Quick Meal Solutions | Increased Sales in Category |

| Plant-Based Options | Health, Sustainability, Personalization | Dietary Preferences, Ethical Concerns | Global Market ~$160B by 2030 |

| Ghost Kitchens/Virtual Brands | Low Overhead, Digital Reach | Price Competitiveness, Convenience | Global Market ~$40B+ |

Entrants Threaten

For a company like FAT Brands, which operates a portfolio of multiple restaurant concepts, the capital requirements to enter the market are significant. This includes funds for acquiring new brands, developing existing ones, extensive marketing campaigns, and building a robust corporate infrastructure to support a diverse franchise system.

However, the threat of new entrants is somewhat mitigated by the high capital needed for a franchisor. For instance, the capital expenditure for opening a single quick-service restaurant franchise can range from $150,000 to $1.5 million, depending on the brand and location. This barrier is lower for individual franchisees looking to enter specific units, but the overall consolidation and expansion of a multi-brand entity like FAT Brands demands substantial financial backing.

FAT Brands benefits significantly from its portfolio of well-recognized brands, such as Fatburger and Johnny Rockets, which have cultivated strong customer loyalty over years of operation. This existing brand equity acts as a formidable barrier for potential new entrants aiming to establish a foothold in the competitive quick-service restaurant market. For instance, in 2024, the QSR industry continued to see consumers gravitating towards familiar and trusted names, underscoring the value of established brand recognition.

Established franchisors like FAT Brands leverage existing, robust supply chain relationships and a proven track record in securing prime real estate. This presents a significant hurdle for newcomers who must build these networks from scratch, often facing higher costs and longer lead times. For instance, in 2024, the average cost to build out a new quick-service restaurant location could range from $250,000 to $750,000, a substantial barrier to entry.

Securing desirable, high-traffic locations is paramount for restaurant success, and this competition intensifies for prime spots. New entrants often find themselves outbid or facing unfavorable lease terms compared to established brands with greater financial leverage and negotiation power. This access to prime real estate is a critical differentiator that new competitors struggle to replicate quickly.

Economies of Scale

FAT Brands leverages its multi-brand portfolio to generate significant economies of scale. This advantage is particularly potent in areas like bulk purchasing of ingredients and supplies, where a larger, consolidated order can secure more favorable pricing than a new, single-brand entrant can achieve. For instance, in 2023, FAT Brands reported total revenue of $260.8 million, showcasing the scale of its operations.

These cost efficiencies translate directly into a competitive edge. By spreading fixed costs across a wider revenue base, FAT Brands can potentially offer more attractive pricing to consumers or invest more heavily in marketing and franchisee support, making it harder for newcomers to compete on price or brand recognition. The ability to negotiate better terms with suppliers, a direct result of their scale, is a critical barrier.

- Economies of Scale in Purchasing: FAT Brands can negotiate lower prices for ingredients and supplies due to its large order volumes.

- Marketing Efficiencies: Centralized marketing efforts across multiple brands can reduce per-brand advertising costs.

- Administrative Cost Savings: Shared administrative functions, like HR and accounting, lower overhead for FAT Brands compared to standalone operations.

- Franchisee Support Investment: Cost savings allow for greater investment in training and operational support for franchisees, enhancing brand strength.

Regulatory and Legal Barriers

The restaurant and franchising sectors are laden with regulatory complexities. Newcomers must contend with stringent health and safety standards, evolving labor laws, and the intricate requirements of franchise disclosure documents. For instance, in 2024, the National Restaurant Association continued to advocate for clear and consistent food safety regulations, a process that can be costly and time-consuming for new businesses to implement across all their locations.

Navigating these legal landscapes across different states and countries presents a substantial barrier. Without a dedicated legal team and established operational protocols, new entrants can find compliance a daunting and expensive undertaking. The cost of legal counsel alone can be a significant deterrent, especially when factoring in the need for ongoing monitoring of regulatory changes.

- Health and Safety Compliance: Ensuring adherence to food safety regulations, such as HACCP principles, requires significant investment in training and infrastructure.

- Labor Law Adherence: Compliance with minimum wage laws, overtime regulations, and employee benefits adds to operational costs and complexity for new franchisors.

- Franchise Disclosure Requirements: The Federal Trade Commission's Franchise Rule mandates extensive disclosure, which demands legal expertise and upfront preparation.

- Jurisdictional Variations: Operating across multiple states or countries means navigating a patchwork of differing regulations, increasing the burden on new entrants.

The threat of new entrants for FAT Brands is generally considered moderate to low. High capital requirements for establishing a new franchise system, coupled with the significant brand equity of existing concepts like Fatburger, create substantial barriers. For instance, in 2024, the quick-service restaurant sector continued to show consumer preference for established brands, making it difficult for newcomers to gain traction without considerable investment in marketing and brand building.

Furthermore, FAT Brands benefits from established supply chains and prime real estate access, which are difficult for new players to replicate quickly. The cost to build out a new quick-service restaurant in 2024 could range from $250,000 to $750,000, a substantial hurdle. Regulatory complexities, including food safety and labor laws, also add to the burden for potential entrants, requiring significant legal and operational investment.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for FAT Brands is built upon a foundation of publicly available financial statements, investor relations materials, and industry-specific market research reports. We also incorporate data from competitor announcements and trade publications to capture the nuances of the quick-service restaurant sector.