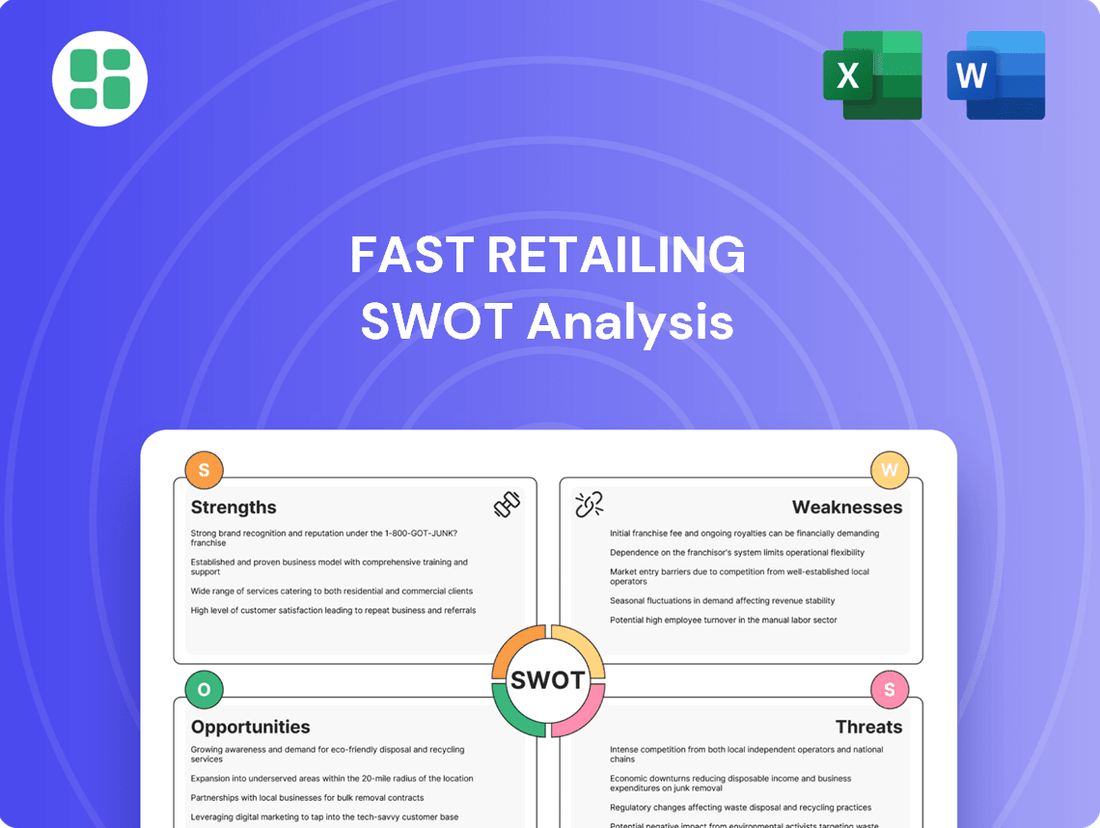

Fast Retailing SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fast Retailing Bundle

Fast Retailing, the powerhouse behind UNIQLO, boasts immense strengths in its brand recognition and efficient supply chain, but also faces significant opportunities in global expansion and digital innovation. However, understanding the full scope of its weaknesses, like reliance on specific markets, and the threats from intense competition and changing consumer trends is crucial for strategic planning.

Want the full story behind Fast Retailing’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Uniqlo, Fast Retailing's cornerstone, is globally recognized for its LifeWear concept, offering functional, high-quality, and accessible apparel. This strong brand equity cultivates a dedicated customer following, a key differentiator in the competitive fashion landscape. The company's strategic global expansion, notably into North America and Europe, has significantly amplified its market penetration and brand visibility.

Fast Retailing consistently leads with innovative product development, exemplified by its functional fabric technologies like HEATTECH and AIRism. These proprietary materials provide distinct consumer benefits, driving product differentiation in the competitive apparel market.

The company's commitment to digital transformation is a significant strength, with substantial investments in AI, robotics, and RFID. This technological integration streamlines operations from supply chain management to inventory control, aiming for enhanced efficiency and a superior customer journey.

By leveraging these advanced technologies, Fast Retailing is creating a more seamless experience for shoppers, bridging the gap between online and in-store interactions. This focus on integrated retail is crucial for meeting evolving consumer expectations in 2024 and beyond.

Fast Retailing's efficient direct-to-consumer (DTC) model is a significant strength, integrating design, manufacturing, and sales. This control over the entire supply chain allows for rapid adaptation to market trends and ensures consistent product quality.

By managing all stages, Fast Retailing can optimize costs, a key factor in their ability to offer high-quality apparel at competitive prices. For fiscal year 2023, the company reported a 20.2% increase in total revenue, reaching ¥2.77 trillion, demonstrating the success of this integrated approach.

Diversified Brand Portfolio

Fast Retailing's strength lies in its diversified brand portfolio, extending well beyond its flagship Uniqlo. Brands like GU, Theory, PLST, and J Brand allow the company to appeal to a wider customer base with varied styles and price points. This strategy mitigates risk by not depending solely on Uniqlo's performance, providing multiple growth engines.

For instance, GU has been actively expanding internationally, demonstrating its potential as a significant contributor to the group's overall revenue. This multi-brand approach ensures Fast Retailing can adapt to different market demands and consumer trends, a crucial advantage in the fast-paced apparel industry.

The company's brand diversification is evident in its financial reporting, where individual brand contributions, though not always explicitly detailed for all, collectively support the group's robust performance. This broad market reach is a key differentiator.

- Brand Synergy: The portfolio allows for cross-promotional opportunities and shared operational efficiencies.

- Market Segmentation: Caters to various demographics from budget-conscious shoppers (GU) to premium clientele (Theory).

- Resilience: Reduces vulnerability to shifts in consumer preference affecting a single brand.

- Growth Opportunities: Each brand presents independent avenues for international expansion and product development.

Robust Financial Performance and Growth Trajectory

Fast Retailing has showcased impressive financial strength, with its fiscal year 2024 reporting record operating income of ¥372.4 billion, a substantial 20.2% increase year-on-year. This robust performance continued into the first half of fiscal year 2025, where operating income surged by 14.1% to ¥207.2 billion. Such consistent financial gains fuel the company's ambitious expansion plans and investments in digital transformation, underscoring a clear upward trajectory.

Key financial highlights supporting this strength include:

- Record Revenue: Fast Retailing achieved its highest-ever revenue in FY2024, demonstrating strong market demand for its brands.

- Profitability Growth: Significant profit increases in FY2024 and H1 FY2025 highlight efficient operations and effective cost management.

- Capital for Investment: The solid financial foundation provides ample resources for global store network expansion, supply chain enhancements, and technology adoption.

- Shareholder Returns: Consistent profitability also supports potential for increased shareholder returns, further solidifying investor confidence.

Fast Retailing's diversified brand portfolio, including Uniqlo, GU, and Theory, allows it to cater to a broad spectrum of consumers, reducing reliance on any single brand. This multi-brand strategy, evident in its ability to appeal to different market segments from budget-conscious to premium, provides significant resilience and multiple avenues for growth. For instance, GU's international expansion showcases the potential of these secondary brands to contribute substantially to the group's overall performance and market reach.

| Brand | Target Market | Key Offering |

| Uniqlo | Everyday wear, functional basics | LifeWear concept, HEATTECH, AIRism |

| GU | Young, fashion-forward, budget-conscious | Trendy, affordable apparel |

| Theory | Professional, modern, premium | Sophisticated workwear and casual luxury |

| PLST (Plus +) | Adults seeking stylish, versatile basics | Elevated casual and work-appropriate clothing |

| J Brand | Premium denim | High-quality, fashion-forward jeans |

What is included in the product

Delivers a strategic overview of Fast Retailing’s internal and external business factors, highlighting its strong brand recognition and global expansion opportunities alongside potential supply chain vulnerabilities and intense market competition.

Offers a clear breakdown of Fast Retailing's competitive landscape, highlighting opportunities for growth and mitigating potential threats.

Weaknesses

Fast Retailing's substantial reliance on its Uniqlo brand presents a notable weakness. While Uniqlo is undeniably a powerhouse, its dominance means the company's overall financial health is intrinsically tied to this single label's success. This concentration of revenue, with Uniqlo contributing over 80% of sales in recent fiscal periods, creates a significant vulnerability.

Fast Retailing, despite its emphasis on durable basics through the Uniqlo brand, faces a significant challenge in the apparel industry's inherent susceptibility to rapid fashion trends. While Uniqlo's core 'LifeWear' philosophy aims for timelessness, other brands within Fast Retailing's diverse portfolio, or even specific seasonal collections under the Uniqlo umbrella, can be caught off guard by sudden shifts in consumer tastes.

This rapid evolution of style means that even well-established brands can struggle to pivot quickly enough to capitalize on fleeting trends. Failure to adapt swiftly can lead to substantial inventory challenges, with unsold seasonal items becoming a financial burden, or worse, missed opportunities to engage with current consumer demands, impacting sales and market share. For instance, in the fiscal year ending August 2023, the global apparel market saw significant volatility, with some niche trend-driven segments experiencing rapid growth while others faced inventory gluts due to misjudging consumer preferences.

Fast Retailing's extensive global supply chain, a key operational strength, also presents significant vulnerabilities. Events like geopolitical instability and the imposition of new trade barriers, such as tariffs, can directly disrupt the flow of goods and increase costs. For example, in early 2024, ongoing trade disputes between major economic blocs continued to create uncertainty for global manufacturers and retailers.

Furthermore, the company is susceptible to fluctuations in raw material prices, which can erode profit margins. The risk of large-scale natural disasters, which are becoming more frequent, also poses a threat to production facilities and transportation networks, potentially leading to stockouts and impacting Fast Retailing's ability to meet customer demand, even with some diversification of manufacturing locations.

Challenges in Specific International Markets

Fast Retailing encounters hurdles in specific international arenas, impacting its growth trajectory. For instance, Uniqlo experienced a slight sales dip in China during the fiscal year ending August 2023, underscoring the need for constant market adaptation.

Similarly, the performance of its Global Brands, such as Theory, has shown mixed results, indicating that tailoring product assortments and marketing approaches to varied local preferences and economic landscapes is an ongoing, complex task.

These market-specific challenges highlight the inherent difficulties in navigating diverse consumer behaviors and competitive environments across different regions.

- Uniqlo's sales in China saw a minor decrease in FY2023.

- Theory and other Global Brands have demonstrated inconsistent performance in international markets.

- Adapting to diverse local tastes and economic conditions remains a key operational challenge.

Intense Competitive Landscape

Fast Retailing operates within an incredibly crowded global apparel market. The company contends with formidable competitors, ranging from ultra-fast fashion disruptors like Shein, which has rapidly gained market share, to established players such as H&M and Zara, as well as numerous traditional fashion brands. This intense rivalry directly impacts pricing strategies and necessitates constant adaptation to evolving consumer preferences.

The sheer number of players in the apparel industry creates significant pressure on Fast Retailing to innovate and differentiate its offerings. Maintaining market share requires substantial investment in product development, supply chain efficiency, and marketing to stand out. For instance, Shein's agile model and aggressive pricing have reshaped consumer expectations in the fast fashion segment, forcing all participants to re-evaluate their strategies.

- Intense Rivalry: Faces competition from fast fashion leaders like Shein and established giants like H&M.

- Pricing Pressure: The competitive environment forces aggressive pricing, impacting profit margins.

- Market Share Erosion: Competitors' rapid growth, particularly in online channels, can threaten market share.

- Innovation Demands: Continuous need for new designs and supply chain agility to stay relevant.

Fast Retailing's significant reliance on its Uniqlo brand, which accounted for over 80% of total revenue in fiscal year 2023, presents a key weakness due to the concentration of its business. This makes the company highly susceptible to any downturns or shifts affecting Uniqlo's performance or brand image. Additionally, the company faces challenges in adapting to rapidly changing fashion trends, which can lead to inventory risks and missed sales opportunities, as seen in the volatile global apparel market of 2023. Furthermore, its extensive global supply chain, while a strength, is vulnerable to geopolitical disruptions and rising raw material costs, impacting profitability and product availability.

Preview Before You Purchase

Fast Retailing SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Fast Retailing SWOT analysis, providing a clear overview of its strategic positioning. Purchase unlocks the complete, in-depth report.

Opportunities

Fast Retailing is well-positioned for significant global market expansion, with a strategic focus on North America, Europe, and burgeoning markets in Southeast Asia and India. This includes increasing both its physical store footprint and e-commerce capabilities in these regions.

The company's aggressive expansion plans, such as the commitment to opening over 100 new Uniqlo stores in North America by 2025, underscore its ambition to capture greater market share. This growth is supported by substantial investments in logistics and digital infrastructure to enhance customer experience across diverse geographies.

Accelerating digital transformation, including leveraging AI and advanced e-commerce platforms, presents a significant opportunity for Fast Retailing. This strategic focus can drive substantial online sales growth and enhance operational efficiency.

By further integrating online and offline experiences, Fast Retailing can create a seamless customer journey, boosting engagement and loyalty. Personalized marketing, powered by data analytics, will be key to capturing a larger share of the growing digital market.

In 2023, Fast Retailing reported that its digital sales accounted for approximately 20% of total revenue, a figure expected to climb as the company continues its digital investments. Optimizing digital supply chain management is also crucial for meeting increasing online demand efficiently.

Fast Retailing can leverage the growing consumer and regulatory focus on sustainability to its advantage. By amplifying its commitment to eco-friendly materials, embracing circular fashion models, and ensuring ethical sourcing throughout its supply chain, the company can significantly bolster its brand image.

Initiatives like the RE.UNIQLO recycling program offer a tangible way to engage consumers and demonstrate environmental responsibility. Achieving ambitious targets, such as their stated goal of using 100% sustainable cotton, directly appeals to the expanding segment of environmentally conscious shoppers.

Diversification and Growth of GU Brand

The GU brand offers a substantial avenue for diversification and growth within Fast Retailing's portfolio. Positioned to capture a younger demographic with its trendy, more affordable apparel, GU presents a compelling opportunity to expand market share. Fast Retailing's strategic objective is to elevate GU into a truly global brand, evidenced by recent flagship store launches and online market entry in the United States.

This international expansion for GU has the potential to mirror the global success Uniqlo has achieved. By extending GU's reach beyond its current markets, Fast Retailing can tap into new customer bases and solidify its presence in key international fashion hubs.

- GU's Global Ambition: Fast Retailing is actively pursuing global expansion for GU, aiming to replicate Uniqlo's international success.

- US Market Entry: Recent flagship store openings and online launches in the United States signify a key step in GU's global strategy.

- Target Demographic: GU's focus on younger consumers with trend-driven, affordably priced fashion provides a distinct growth opportunity.

Strategic Partnerships and Collaborations

Fast Retailing's strategic partnerships offer significant growth avenues. Continuing and expanding collaborations with designers, artists, and global brands, such as its ongoing work with Roger Federer and past successes with Disney, can significantly boost brand appeal and attract diverse customer bases. These alliances are crucial for introducing Uniqlo and other group brands to wider audiences, solidifying their reputation for innovation and relevance.

These collaborations are not just about marketing; they directly impact sales and brand perception. For instance, the continued success of the Roger Federer Uniqlo line, launched in 2018, demonstrates the power of aligning with influential figures. Fast Retailing's ability to secure such partnerships in 2024 and 2025 will be key to maintaining its competitive edge and driving international growth by tapping into new markets and cultural trends.

- Enhanced Brand Appeal: Collaborations with high-profile designers and artists elevate Uniqlo's image, making it more desirable to a broader demographic.

- Customer Segment Expansion: Partnerships with entities like Disney or collaborations with athletes like Roger Federer introduce the brand to entirely new customer groups who may not have previously considered Uniqlo.

- Innovation Reinforcement: These alliances signal Fast Retailing's commitment to creativity and staying current, reinforcing its innovative brand identity in a fast-paced fashion market.

- Global Market Penetration: Strategic alliances can act as a gateway into new international markets, leveraging the partner's existing reach and brand recognition.

Fast Retailing is poised for substantial global growth by expanding its physical and digital presence in North America, Europe, and emerging Asian markets like India. The company's commitment to opening over 100 Uniqlo stores in North America by 2025 highlights this aggressive expansion strategy.

Leveraging digital transformation, including AI and enhanced e-commerce, offers a significant opportunity to boost online sales and operational efficiency. Fast Retailing aims to integrate online and offline experiences for a seamless customer journey, with digital sales already representing approximately 20% of total revenue in 2023.

The company can capitalize on the increasing consumer and regulatory focus on sustainability by emphasizing eco-friendly materials and circular fashion models. Initiatives like the RE.UNIQLO recycling program and the goal of using 100% sustainable cotton appeal to environmentally conscious shoppers.

The GU brand presents a distinct growth opportunity by targeting younger consumers with trendy, affordable apparel, with plans to establish GU as a global brand, mirroring Uniqlo's international success through market entry in the United States.

Threats

The global apparel market is incredibly fragmented, meaning Fast Retailing constantly battles a wide array of competitors. This intense rivalry comes from established global brands, nimble fast-fashion giants like Shein and Temu, and newer direct-to-consumer (DTC) companies. These dynamics often force price reductions and escalate marketing costs, impacting profitability.

Global economic uncertainties, including persistent inflation and a general slowdown in growth, pose a significant threat to Fast Retailing. These factors often lead consumers to become more cautious with their spending, particularly on non-essential items like apparel. For instance, the International Monetary Fund (IMF) projected global growth to slow in 2024, impacting consumer purchasing power.

A noticeable decline in consumer confidence or a reduction in disposable income directly translates to decreased sales volumes for retailers like Fast Retailing. This can put pressure on profitability as the company may need to resort to more aggressive discounting to move inventory, further eroding margins.

Ongoing geopolitical tensions, like the conflict in Eastern Europe, and the lingering effects of the COVID-19 pandemic continue to pose significant risks to Fast Retailing's global supply chain. These disruptions can lead to production delays and increased logistics expenses, as seen with the Suez Canal blockage in 2021 which impacted shipping routes worldwide.

The volatility in raw material prices, particularly for cotton and synthetics, directly affects Fast Retailing's ability to maintain its competitive, affordable pricing. For instance, cotton prices saw substantial increases in late 2021 and early 2022 due to supply constraints and strong demand, putting pressure on apparel manufacturers globally.

Rapidly Evolving Consumer Preferences and Digital Demands

Fast Retailing faces a significant threat from rapidly changing consumer preferences, heavily swayed by social media trends and a growing emphasis on sustainability. For instance, a 2024 report indicated that over 60% of Gen Z consumers consider a brand's environmental impact when making purchasing decisions. This necessitates constant agility in product development and marketing to stay relevant.

Failure to quickly adapt to these evolving tastes and the increasing demand for seamless digital experiences poses a direct risk. In 2025, digital sales channels are projected to account for nearly 40% of all apparel purchases globally. If Fast Retailing cannot swiftly pivot its offerings and digital engagement strategies, it risks alienating key customer segments and experiencing a decline in brand loyalty.

- Shifting Fashion Trends: The speed at which viral fashion trends emerge and fade, often driven by influencers, requires a responsive supply chain and design process.

- Digital Experience Expectations: Consumers now expect highly personalized online shopping journeys, including AI-driven recommendations and efficient omnichannel services.

- Sustainability Imperative: Growing consumer awareness of ethical sourcing and environmental impact means brands must demonstrate genuine commitment to sustainable practices.

- Personalization Demands: Customers are increasingly seeking customized products and marketing messages, moving away from one-size-fits-all approaches.

Regulatory Scrutiny and ESG Compliance

Fast Retailing faces increasing regulatory scrutiny concerning sustainability and labor practices, particularly as Environmental, Social, and Governance (ESG) standards tighten globally. This heightened oversight, especially in major markets like the European Union and the United States, presents a significant threat. For instance, the EU's proposed directives on corporate sustainability due diligence could impose stringent requirements on supply chain transparency and environmental impact for companies operating within its sphere.

Failure to meet these evolving ESG compliance benchmarks could result in substantial penalties, damage to Fast Retailing's brand reputation, and a negative consumer reaction. In 2024, reports indicated a growing consumer preference for brands demonstrating strong ESG credentials, making compliance not just a legal necessity but a critical factor for market acceptance and continued growth.

- Increased regulatory focus on supply chain transparency: Governments are enacting laws requiring companies to disclose and address human rights and environmental risks within their supply chains, impacting the apparel sector significantly.

- Growing consumer demand for ethical sourcing: By 2025, consumer surveys consistently show a rising demand for ethically produced and sustainable fashion, making compliance a competitive advantage and non-compliance a significant risk.

- Potential for fines and legal action: Non-compliance with new ESG regulations could lead to substantial fines, legal challenges, and operational disruptions for Fast Retailing.

Intense competition from both established brands and agile online retailers like Shein and Temu, coupled with rapidly shifting consumer preferences influenced by social media, presents a significant challenge. Economic headwinds, including inflation and potential global growth slowdowns projected for 2024 by the IMF, directly impact consumer spending on apparel, potentially forcing price reductions and increasing marketing expenses.

Supply chain disruptions stemming from geopolitical tensions and lingering pandemic effects continue to threaten timely production and increase logistics costs, as exemplified by past shipping route issues. Furthermore, volatility in raw material prices, such as cotton, which saw sharp increases in late 2021-early 2022, directly impacts Fast Retailing's ability to maintain its value proposition.

The growing consumer demand for sustainability and ethical sourcing, with over 60% of Gen Z considering environmental impact in 2024 purchases, necessitates constant adaptation. Failure to meet evolving digital experience expectations, as online apparel sales are projected to reach nearly 40% globally by 2025, risks alienating customers and eroding brand loyalty.

| Threat Category | Specific Risk | Impact on Fast Retailing |

|---|---|---|

| Competition | Agile DTC brands, fast fashion giants (Shein, Temu) | Price pressure, increased marketing costs |

| Economic Factors | Global inflation, growth slowdown (IMF 2024 projection) | Reduced consumer spending, lower sales volumes |

| Supply Chain | Geopolitical tensions, shipping disruptions | Production delays, increased logistics costs |

| Consumer Preferences | Rapid trend shifts, sustainability demands (60%+ Gen Z factor) | Need for agile product development, potential brand disconnect |

| Digitalization | Evolving online experience expectations (40% online sales by 2025) | Risk of losing market share if digital strategies lag |

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of comprehensive data, including Fast Retailing's official financial reports, detailed market research from reputable agencies, and insights from industry experts and news outlets.