Fast Retailing Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fast Retailing Bundle

Fast Retailing navigates a competitive retail landscape where buyer bargaining power is significant due to numerous clothing options. The threat of new entrants, while present, is somewhat mitigated by established brand loyalty and supply chain complexities. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Fast Retailing’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fast Retailing's extensive use of the Specialty store retailer of Private-label Apparel (SPA) model grants it considerable sway over its supply chain, from initial design through to final sale. This deep integration minimizes dependence on outside entities for design and manufacturing, thereby diminishing supplier leverage.

By placing substantial orders and fostering enduring partnerships with its manufacturing facilities, Fast Retailing secures favorable terms and pricing. For instance, in fiscal year 2023, Fast Retailing reported total revenue of ¥2,765.5 billion, underscoring the sheer volume of its operations and its consequent bargaining strength.

Fast Retailing, the parent company of Uniqlo, has built a robust, diversified global supplier base. By strategically sourcing from countries beyond China, such as Bangladesh, Vietnam, and nations in Eastern Europe, the company significantly reduces its reliance on any single manufacturing hub. This broad geographical spread is crucial in mitigating risks like trade disputes or localized production challenges.

This multi-country approach directly diminishes the bargaining power of individual suppliers. When Fast Retailing can easily shift production to alternative manufacturers in different regions, suppliers have less leverage to dictate terms or increase prices. For instance, in 2024, Uniqlo continued to expand its manufacturing footprint in Vietnam, a country known for its competitive labor costs and growing textile industry, further solidifying its diversified sourcing strategy.

Fast Retailing prioritizes cultivating deep, enduring partnerships with its production allies, built on mutual respect and shared ethical principles. This strategic alignment, which includes a strong emphasis on human rights and worker well-being, cultivates a sense of loyalty that can mitigate the suppliers' inclination to leverage their bargaining power.

Investment in Supplier Capabilities and Technology

Fast Retailing's strategic investment in supplier capabilities and technology significantly bolsters its position against supplier power. By integrating suppliers into its advanced IT systems, particularly for inventory management, the company fosters a symbiotic relationship. This deepens reliance on Fast Retailing for consistent business and access to cutting-edge technological advancements.

This collaborative approach, exemplified by Fast Retailing's commitment to technological integration, creates a strong dependency. Suppliers benefit from the company's scale and innovation, making them less likely to exert significant pricing power or impose unfavorable terms. For instance, Fast Retailing's focus on digital transformation within its supply chain, a trend accelerating in 2024, ensures suppliers are aligned with its operational needs.

- Supplier Integration: Fast Retailing actively incorporates suppliers into its operational framework, including IT systems for inventory management.

- Technological Advancement: Investments in supplier technology enhance efficiency and quality, creating a mutual benefit.

- Reduced Supplier Leverage: This integration makes suppliers more dependent on Fast Retailing, thereby reducing their bargaining power.

- 2024 Focus: The company's ongoing digital transformation efforts in its supply chain continue to strengthen these supplier relationships.

Impact of Raw Material Costs and Sustainability Demands

While Fast Retailing benefits from its scale, suppliers of specialized sustainable materials, like organic cotton or advanced recycled fabrics, can wield more influence. The growing consumer and regulatory push for eco-friendly apparel, exemplified by the projected global sustainable fashion market reaching an estimated $15.1 billion by 2030, increases demand for these niche inputs. This heightened demand, coupled with potential supply chain vulnerabilities, allows these suppliers to negotiate more favorable terms.

Furthermore, the increasing burden of environmental regulations on suppliers, such as those related to water usage or chemical restrictions, can translate into higher production costs. These suppliers may then attempt to pass these increased costs along to major buyers like Fast Retailing, thereby strengthening their bargaining position.

- Supplier Influence: Suppliers of niche sustainable materials gain leverage due to increasing demand and potential supply chain disruptions.

- Cost Pass-Through: Suppliers facing new sustainability regulations may pass on compliance costs to buyers.

- Market Trends: The growing global sustainable fashion market, projected to reach $15.1 billion by 2030, amplifies the power of eco-conscious material suppliers.

Fast Retailing's substantial order volumes, exemplified by its ¥2,765.5 billion revenue in fiscal year 2023, grant it significant leverage over most suppliers. By diversifying its manufacturing base across countries like Vietnam and Bangladesh, the company minimizes reliance on any single supplier, further reducing their individual bargaining power.

The company's deep integration of suppliers into its IT systems and commitment to technological advancements foster dependency, making suppliers less likely to demand unfavorable terms. For instance, continued digital transformation in 2024 ensures supplier alignment with Fast Retailing's operational needs.

However, suppliers of specialized sustainable materials, driven by a global sustainable fashion market projected to reach $15.1 billion by 2030, can exert greater influence. These suppliers may also pass on increased costs due to environmental regulations, strengthening their negotiating position.

| Factor | Fast Retailing's Position | Impact on Supplier Bargaining Power |

| Order Volume | Very High (FY23 Revenue: ¥2,765.5 billion) | Low |

| Supplier Diversification | High (e.g., Vietnam, Bangladesh) | Low |

| Technological Integration | High (Ongoing in 2024) | Low |

| Sustainable Material Suppliers | Moderate (Growing market: $15.1B by 2030) | Moderate to High |

| Regulatory Compliance Costs | Potential for Pass-Through | Moderate to High |

What is included in the product

Tailored exclusively for Fast Retailing, analyzing its position within its competitive landscape by examining the intensity of rivalry, the bargaining power of buyers and suppliers, and the threat of new entrants and substitutes.

Identify and mitigate competitive threats with a visual breakdown of Fast Retailing's industry landscape.

Customers Bargaining Power

Fast Retailing's Uniqlo brand cultivates immense customer loyalty through its 'LifeWear' philosophy, emphasizing high-quality, functional, and affordable apparel designed for everyday life. This broad appeal to a mass market, rather than niche segments, significantly dilutes the bargaining power of any individual customer or small group. In 2024, Uniqlo's global sales reached approximately ¥2.4 trillion (around $16 billion USD), a testament to its widespread consumer acceptance.

Customers in the affordable apparel market, like those Fast Retailing serves, are keenly aware of pricing. Even with some brand loyalty, economic shifts, such as the persistent inflation seen through 2023 and into early 2024, make consumers more cautious about spending. This means Fast Retailing's ability to maintain competitive pricing is paramount for retaining its customer base.

Any substantial increase in prices, particularly for everyday essentials, could easily push customers to explore other brands offering similar value. For instance, if Fast Retailing were to increase the price of a basic UNIQLO t-shirt by 15-20% without a clear perceived improvement in quality, consumers might readily switch to alternatives from competitors like H&M or Zara, especially if those brands maintain their current price points.

The bargaining power of customers is significantly amplified by the sheer number of alternatives available in the fragmented global apparel market. Consumers can easily pivot between fast-fashion giants like Zara and H&M, explore countless online retailers, or opt for more budget-friendly discount stores.

This abundance of choice, a hallmark of the highly competitive fashion industry, empowers customers to demand better prices and quality. For instance, the global online fashion retail market was valued at approximately $347 billion in 2023 and is projected to grow substantially, indicating a vast competitive landscape where customer loyalty is hard-won.

Strong Brand Loyalty through Innovation and Customer Experience

Fast Retailing, through its Uniqlo brand, fosters significant customer loyalty by consistently delivering innovative products and a superior customer experience. Technologies like HEATTECH and AIRism, which provide enhanced comfort and performance, create a tangible benefit that encourages repeat purchases and reduces price sensitivity.

This strong brand connection is further solidified by Uniqlo's investment in engaging in-store environments and robust digital platforms. For instance, Uniqlo's global sales reached ¥2.4 trillion (approximately $16 billion USD) in fiscal year 2023, demonstrating the effectiveness of its customer-centric approach in driving substantial revenue and building a loyal customer base.

- Innovative Fabric Technologies: HEATTECH and AIRism offer tangible performance benefits, driving repeat purchases.

- Enhanced Customer Experience: Investment in store design and digital engagement fosters strong brand connection.

- Reduced Price Sensitivity: Loyalty built on product quality and experience makes customers less likely to switch for lower prices.

- Fiscal Year 2023 Performance: Uniqlo's ¥2.4 trillion global sales underscore the success of its loyalty-building strategies.

Influence of Digital Channels and Consumer Information

The increasing prevalence of digital channels and readily available consumer information significantly amplifies the bargaining power of customers. E-commerce platforms and social media provide consumers with unprecedented access to product details, pricing, and peer reviews, facilitating effortless price comparisons and informed purchasing choices. For Fast Retailing, a robust digital infrastructure and a seamless omnichannel approach are crucial for navigating this landscape, as customer sentiment and emerging online trends can rapidly shape demand.

In 2024, the digital influence is undeniable. For instance, reports indicate that over 70% of consumers research products online before making a purchase, directly impacting brands like Fast Retailing. This empowers customers to switch to competitors offering better value or superior customer experiences with minimal friction. Fast Retailing's ability to leverage its digital channels for personalized engagement and efficient service directly counters this increased customer power.

- Digital Information Access: Customers can easily compare prices and read reviews across multiple online retailers.

- Omnichannel Importance: Fast Retailing's integrated online and offline presence is key to managing customer expectations and feedback.

- Influence of Social Trends: Online discussions and influencer marketing can quickly sway purchasing decisions for apparel brands.

- Customer Feedback Loop: Promptly addressing online reviews and social media comments is vital for brand reputation and sales.

While Fast Retailing's Uniqlo brand enjoys strong customer loyalty, the bargaining power of customers in the affordable apparel sector remains a significant force. The sheer volume of competitors, coupled with readily available online information and price comparison tools, empowers consumers to seek the best value.

In 2024, with ongoing economic considerations, consumers are particularly price-sensitive. A substantial price increase on essential items could easily lead customers to explore alternative brands. For example, a modest 10% price hike on a popular Uniqlo item might prompt shoppers to investigate similar offerings from competitors like Gap or Old Navy, especially if those brands maintain their current price points.

The digital landscape further amplifies this power. With over 70% of consumers researching products online before purchasing in 2024, brands must offer competitive pricing and a compelling value proposition to retain customers. Fast Retailing's success hinges on its ability to leverage its digital presence for engaging customer experiences and efficient service, thereby mitigating the inherent bargaining power of its widespread customer base.

| Factor | Impact on Fast Retailing | Data/Observation (2023-2024) |

|---|---|---|

| Availability of Alternatives | High | Global online fashion market valued at ~$347 billion in 2023, with numerous competitors. |

| Price Sensitivity | Moderate to High | Consumers remain cautious due to persistent inflation, impacting purchasing decisions. |

| Information Availability | High | Over 70% of consumers research online before buying, enabling easy price comparisons. |

| Brand Loyalty (Uniqlo) | Moderate | While strong, loyalty can be tested by significant price differentials with competitors. |

Preview the Actual Deliverable

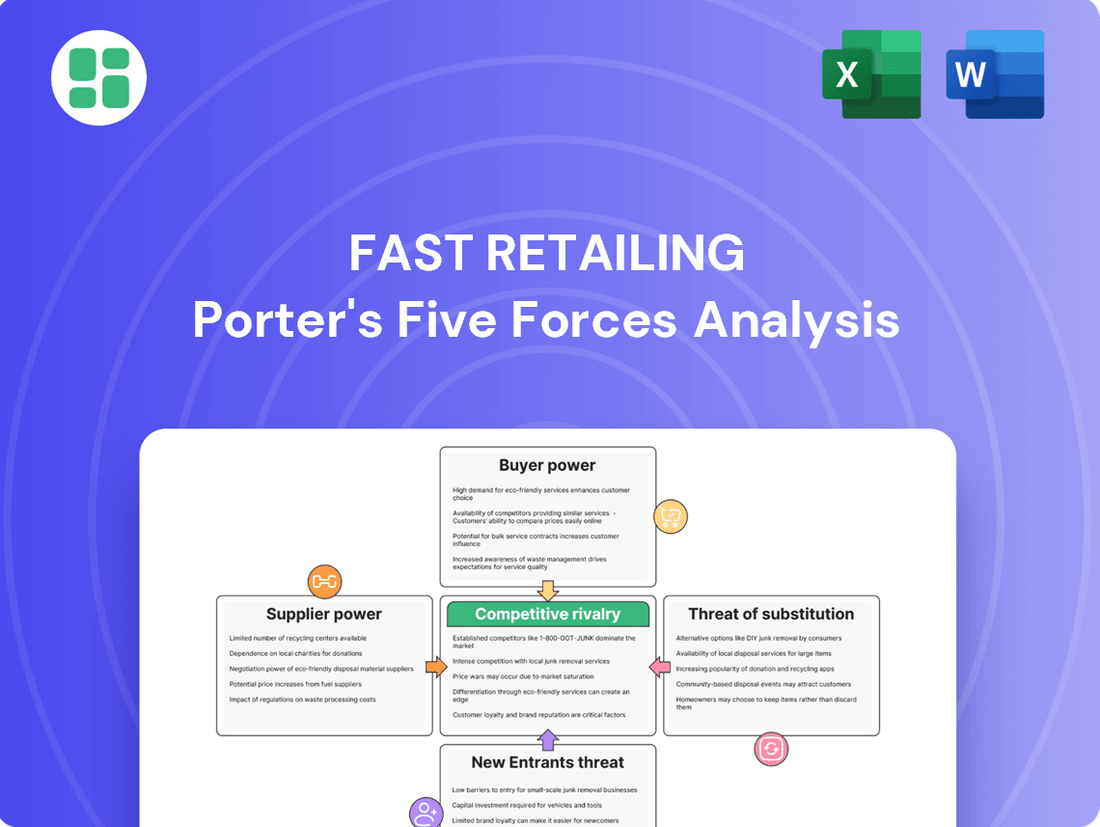

Fast Retailing Porter's Five Forces Analysis

This preview shows the exact Porter's Five Forces Analysis for Fast Retailing you'll receive immediately after purchase—no surprises, no placeholders. It comprehensively details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry among existing competitors, and the threat of substitute products or services, offering actionable insights into Fast Retailing's strategic position.

Rivalry Among Competitors

Fast Retailing faces formidable competition in the global apparel arena. The market is incredibly fragmented, meaning there are countless brands, both large and small, all vying for consumer attention and dollars. This intense rivalry is a defining characteristic of the industry.

Key global competitors for Fast Retailing, particularly through its Uniqlo and GU brands, include giants like Inditex, the parent company of Zara, and H&M. Additionally, fast-fashion disruptors like Shein and established players such as Gap present significant challenges. These companies are constantly innovating and adapting to capture market share across diverse apparel segments.

The sheer number of players means that brands must continually differentiate themselves through product innovation, pricing strategies, and marketing. For instance, in 2023, Inditex reported net sales of €35.9 billion, showcasing the scale of operations and the competitive pressure to achieve such figures. H&M Group's net sales for the fiscal year 2023 reached SEK 236 billion (approximately $22.4 billion), further highlighting the intense competition for market leadership.

Fast Retailing actively combats intense competition by emphasizing its 'LifeWear' philosophy, offering durable, functional, and innovative everyday apparel. This strategy moves away from the fast-fashion cycle, building customer loyalty around quality and practicality.

Proprietary fabric technologies, such as HEATTECH and AIRism, are central to this differentiation. These innovations, developed through significant R&D investment, provide tangible benefits like warmth and breathability, creating a distinct advantage. For instance, in fiscal year 2023, Fast Retailing reported robust sales growth, partly driven by the continued appeal of its core product lines incorporating these advanced materials.

Fast Retailing's aggressive global expansion, targeting markets like Southeast Asia and North America, directly escalates competitive rivalry. The company's ambitious store opening plans, aiming for significant growth in these regions, inevitably put them head-to-head with established and emerging players.

Omnichannel Strategy and Digital Transformation

Fast Retailing's intense focus on its omnichannel strategy, aiming to be a digital consumer retailer, directly impacts competitive rivalry. By heavily investing in e-commerce and digital engagement, the company is raising the bar for customer experience, forcing competitors to accelerate their own digital transformations.

This digital push, powered by AI and data analytics, is essential for survival as online sales and personalized interactions become the norm. For instance, Fast Retailing's commitment to leveraging technology means rivals must also invest significantly to keep pace, intensifying competition for market share.

- Digital Investment: Fast Retailing is channeling substantial resources into its e-commerce platforms and digital customer engagement initiatives, reinforcing its 'digital consumer retailer' vision.

- AI and Data Analytics: The company is strategically deploying AI and data analytics to enhance customer experiences and operational efficiency, a move that pressures competitors to adopt similar advanced technologies.

- Market Shift: The increasing dominance of online sales and the demand for personalized customer journeys are key drivers behind this omnichannel approach, making it a critical battleground for retailers.

Sustainability and Ethical Practices as a Competitive Factor

Consumers are increasingly prioritizing sustainability, making it a significant competitive factor. Fast Retailing's focus on eco-friendly materials and supply chain transparency resonates with this growing segment, setting it apart from competitors who may lag in these areas.

The fashion industry, including Fast Retailing, faces ongoing scrutiny regarding its environmental footprint. Despite efforts, challenges remain in achieving full circularity and ethical sourcing across the entire value chain.

- Growing Consumer Demand: A 2024 survey indicated that 65% of consumers consider a brand's sustainability efforts when making purchasing decisions.

- Fast Retailing's Initiatives: The company aims to increase its use of recycled and sustainable materials to 50% by 2030.

- Industry-Wide Challenges: The textile industry is a major contributor to global carbon emissions, estimated at 4-10% annually, highlighting the scale of the sustainability challenge.

Fast Retailing operates in a highly competitive apparel market, facing pressure from global giants like Inditex and H&M, as well as agile disruptors such as Shein. This intense rivalry necessitates continuous innovation in product, pricing, and marketing to capture market share.

The company differentiates itself through its LifeWear philosophy, emphasizing durable, functional apparel, and proprietary fabric technologies like HEATTECH and AIRism. This strategy aims to build customer loyalty beyond the typical fast-fashion cycle.

Fast Retailing's aggressive global expansion and significant investments in its omnichannel strategy, leveraging AI and data analytics, further intensify competition. Rivals must also invest heavily in digital transformation and personalized customer experiences to remain competitive.

Sustainability is an increasingly important battleground, with consumers prioritizing eco-friendly brands. Fast Retailing's focus on sustainable materials and supply chain transparency provides a competitive edge, though the industry as a whole faces challenges in achieving full circularity.

| Competitor | 2023 Net Sales (approx.) | Key Differentiators |

|---|---|---|

| Inditex (Zara) | €35.9 billion | Agile supply chain, trend-driven fashion |

| H&M Group | SEK 236 billion ($22.4 billion) | Broad product range, sustainability initiatives |

| Shein | Undisclosed (estimated significant growth) | Ultra-fast fashion, aggressive online marketing |

SSubstitutes Threaten

The burgeoning second-hand and rental clothing markets pose a substantial threat of substitutes for fast fashion retailers like Fast Retailing. Consumers are increasingly drawn to these options due to growing environmental awareness and a desire for more affordable fashion. For instance, the global second-hand apparel market was valued at approximately $177 billion in 2023 and is projected to reach $350 billion by 2027, indicating a clear shift in consumer preferences.

Uniqlo's emphasis on high-quality, durable apparel presents a unique threat of substitutes. Because their garments are designed to last longer than typical fast-fashion items, customers may postpone repurchasing, effectively substituting a new Uniqlo purchase with the continued use of an existing one. This focus on longevity, while a brand strength, can dampen demand for frequent new clothing acquisitions.

The threat of substitutes for Fast Retailing's LifeWear concept is significant due to its inherent versatility. The LifeWear philosophy, focusing on functional and adaptable apparel, means a single Uniqlo item can often replace several specialized garments from competitors, thereby dampening the need for diverse wardrobes and reducing consumption of other brands' products.

DIY and Custom-Made Apparel Trends

The rise of DIY and custom-made apparel presents a nuanced threat to fast fashion retailers like Fast Retailing. While not a direct competitor for the majority of consumers, this niche trend caters to a growing segment seeking unique self-expression. This movement emphasizes individuality over mass production, offering an alternative for those who value personalized style.

This trend is fueled by accessible online platforms and a desire for sustainable, unique pieces. For instance, platforms like Etsy saw a significant increase in handmade apparel sales in 2023, with many sellers specializing in custom designs. This indicates a consumer willingness to seek out alternatives that offer a more personal touch, potentially diverting some demand from fast fashion's broader appeal.

- DIY and custom apparel appeal to consumers seeking unique, personalized clothing items.

- Platforms like Etsy reported a surge in handmade apparel sales in 2023, highlighting this growing consumer preference.

- This trend offers a substitute for individuals prioritizing individuality and self-expression over mass-produced fashion.

Shift Towards Minimalism and Reduced Consumption

A growing societal movement towards minimalism and conscious consumption presents a significant threat. Consumers are increasingly prioritizing fewer, higher-quality items, potentially reducing the overall demand for apparel. This trend, while aligning with Uniqlo's emphasis on quality, could shrink the total addressable market for all clothing retailers.

For instance, a 2024 report indicated that 45% of consumers are actively trying to buy less and make more sustainable choices. This shift directly impacts the volume of purchases, acting as a substitute for simply buying more clothing.

- Societal Shift: Growing consumer preference for minimalism and reduced consumption.

- Impact on Demand: Potential decrease in overall apparel purchasing volume.

- Alignment with Quality: Trend can align with Uniqlo's quality focus but may reduce market size.

- Substitute Threat: Consumers opting for fewer, more durable items instead of frequent purchases.

The expanding second-hand and rental clothing markets represent a significant threat of substitutes for fast fashion. Consumers are increasingly opting for these alternatives due to environmental concerns and a desire for affordability, with the global second-hand apparel market projected to reach $350 billion by 2027 from an estimated $177 billion in 2023.

Uniqlo's focus on durable, high-quality garments also acts as a substitute, as customers may delay new purchases by continuing to use their existing, longer-lasting items. This emphasis on longevity, while a brand strength, can reduce the frequency of new clothing acquisition.

The LifeWear concept itself, with its versatile and functional apparel, poses a threat by allowing a single item to replace multiple specialized pieces from other brands, thus limiting the need for extensive wardrobes.

| Substitute Category | Market Value (2023 Est.) | Projected Growth | Key Driver |

|---|---|---|---|

| Second-hand Apparel | $177 Billion | $350 Billion by 2027 | Affordability & Sustainability |

| Rental Apparel | N/A (Growing Segment) | Significant Growth | Occasional Wear & Variety |

| Durable/Long-lasting Fashion | N/A (Brand Strategy) | Indirect Impact | Reduced Purchase Frequency |

Entrants Threaten

Fast Retailing's formidable brand recognition, particularly through Uniqlo and GU, acts as a significant deterrent to potential newcomers. With an expansive network of over 2,400 stores spanning more than 25 countries, establishing a comparable global presence and customer trust presents a substantial hurdle for any emerging competitor.

Fast Retailing's vertically integrated SPA (Specialty store retailer of Private label Apparel) model, exemplified by brands like UNIQLO, creates substantial economies of scale. This allows them to negotiate favorable terms for raw materials and manufacturing, driving down per-unit costs significantly.

For instance, in fiscal year 2023, UNIQLO's global sales reached ¥2.4 trillion (approximately $16 billion USD), underscoring the sheer volume of their operations. New entrants would find it incredibly challenging to achieve similar cost efficiencies in sourcing and production, hindering their ability to compete on price against an established player with such vast purchasing power.

Fast Retailing's significant and ongoing investment in proprietary fabric technology, such as HEATTECH and AIRism, acts as a formidable barrier to new entrants. This continuous R&D expenditure, which is substantial, cultivates a unique selling proposition that is not easily or quickly matched by competitors seeking to enter the market.

Complex Global Supply Chain and Distribution Network

The threat of new entrants to Fast Retailing is significantly mitigated by the intricate global supply chain and distribution network required. Establishing a highly efficient and ethical supply chain, complete with direct manufacturer relationships and sophisticated inventory management, is a monumental and costly endeavor.

New players would struggle to replicate Fast Retailing's robust and transparent supply chain infrastructure. For instance, in 2023, Fast Retailing reported that its supply chain operations involved over 1,000 production partners worldwide, highlighting the sheer scale and complexity involved.

- Capital Investment: Building a comparable global logistics and manufacturing network demands substantial upfront capital, creating a high barrier to entry.

- Operational Expertise: Mastering the complexities of international sourcing, quality control, and efficient distribution requires years of accumulated operational knowledge.

- Ethical Sourcing Compliance: Meeting stringent ethical and sustainability standards across a vast supplier base, as increasingly demanded by consumers and regulators, adds another layer of difficulty.

- Technology Integration: Advanced inventory management and data analytics systems, crucial for optimizing operations and responding to market trends, represent significant technological hurdles for newcomers.

High Marketing Spend and Customer Loyalty Building

The apparel industry, particularly the fast-fashion segment where Fast Retailing operates, demands significant marketing expenditure. New entrants must allocate substantial funds to build brand recognition and foster customer loyalty. For instance, in 2023, major apparel retailers reported marketing budgets in the hundreds of millions of dollars, highlighting the high entry barrier.

Fast Retailing, through its brands like UNIQLO, has cultivated a strong global customer base and employs sophisticated marketing campaigns. This established loyalty means newcomers face an uphill battle, requiring considerable capital and a lengthy period to chip away at existing market share and brand affinity.

- High Marketing Investment: Newcomers need extensive funds for advertising, promotions, and influencer collaborations to gain visibility in the crowded apparel market.

- Customer Loyalty: Fast Retailing's established customer relationships, built over years of consistent quality and branding, present a significant hurdle for new entrants.

- Brand Differentiation: Creating a unique brand identity that resonates with consumers and stands out from established players like UNIQLO requires substantial effort and resources.

- Economies of Scale: Existing players benefit from economies of scale in sourcing, production, and marketing, which new entrants often struggle to match initially.

The threat of new entrants for Fast Retailing is considerably low due to high capital requirements for establishing global supply chains and brand recognition. The significant investments in proprietary fabric technology and extensive marketing campaigns create substantial barriers, making it difficult for newcomers to compete on price and differentiation.

New entrants would need to overcome Fast Retailing's established economies of scale in sourcing and production, a feat that requires immense capital and operational expertise. For example, in fiscal year 2023, UNIQLO's global sales of ¥2.4 trillion demonstrate the scale new entrants must contend with.

The complexity of replicating Fast Retailing's vertically integrated SPA model, coupled with the need for substantial marketing budgets akin to the hundreds of millions spent by major apparel retailers in 2023, presents a formidable challenge.

Fast Retailing's robust global supply chain, involving over 1,000 production partners as of 2023, and its commitment to ethical sourcing add further layers of difficulty for potential new entrants seeking to enter the apparel market.

| Barrier Type | Description | Impact on New Entrants | Fast Retailing's Advantage |

|---|---|---|---|

| Brand Recognition & Loyalty | Established customer base and strong brand identity. | High hurdle to overcome through marketing. | Uniqlo and GU have significant global recognition. |

| Economies of Scale | Lower per-unit costs due to high production volume. | Difficulty competing on price. | Vast purchasing power for materials and manufacturing. |

| Proprietary Technology | Unique fabric innovations like HEATTECH and AIRism. | Challenging to match product differentiation. | Continuous R&D investment. |

| Supply Chain & Logistics | Complex, efficient, and ethical global network. | High capital and operational expertise needed. | Over 1,000 production partners in 2023. |

| Marketing Expenditure | Significant investment required for market penetration. | Substantial financial commitment necessary. | Proven track record in global marketing campaigns. |

Porter's Five Forces Analysis Data Sources

Our Fast Retailing Porter's Five Forces analysis is built upon a foundation of publicly available information, including Fast Retailing's annual reports, investor presentations, and SEC filings. We also incorporate data from reputable industry research firms and financial news outlets to provide a comprehensive view of the competitive landscape.