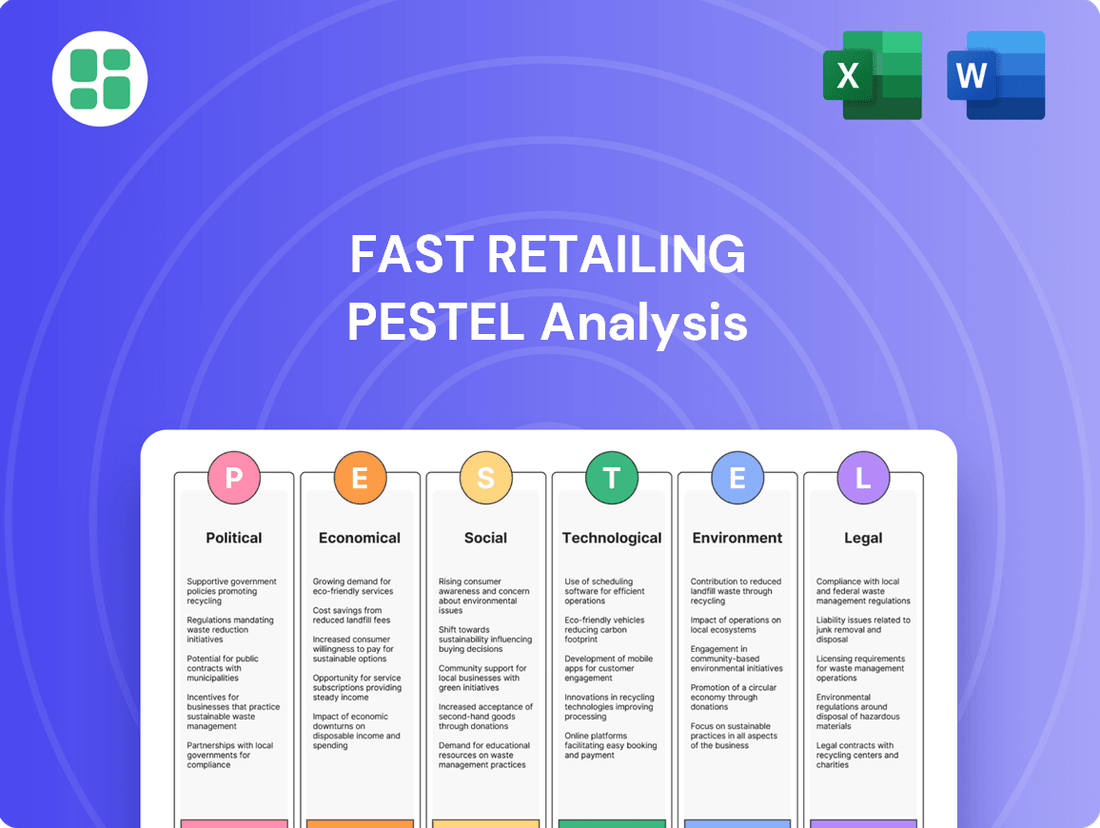

Fast Retailing PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fast Retailing Bundle

Uncover the political, economic, social, technological, legal, and environmental forces shaping Fast Retailing's global strategy. Understand how evolving consumer behaviors and international regulations present both challenges and opportunities for the UNIQLO parent company. Download the full PESTLE analysis now to gain a competitive edge and make informed strategic decisions.

Political factors

Fast Retailing's global footprint exposes it to significant geopolitical risks. For instance, ongoing trade friction between the United States and China, major markets for Fast Retailing, could lead to increased tariffs on apparel imports, directly impacting sourcing costs and consumer prices for brands like Uniqlo. In 2024, the apparel industry continued to navigate complex trade landscapes, with many companies reporting higher logistics expenses due to these tensions.

Shifting trade policies and geopolitical instability can disrupt Fast Retailing's intricate global supply chains. A sudden imposition of import restrictions or sanctions in a key sourcing country could halt production or necessitate costly rerouting of materials, affecting product availability and profitability. The company's reliance on diverse manufacturing bases means it must remain agile to adapt to these evolving international relations.

Fast Retailing operates across many nations, each with its own unique labor laws. This includes varying minimum wage requirements, rules on working hours and conditions, and the right to form unions. For instance, in 2024, countries like Japan saw adjustments to minimum wages, with some prefectures increasing them, impacting Fast Retailing's operational costs.

Compliance with these diverse regulations is vital. Failure to do so can lead to significant fines, damage to the company's public image, and even strikes or other labor actions that disrupt operations. For example, in 2023, several global apparel companies faced scrutiny and potential penalties for labor law violations in their manufacturing countries.

Maintaining ethical labor standards throughout its vast supply chain, particularly in manufacturing centers, presents an ongoing political and operational hurdle. This involves ensuring fair wages, safe working environments, and preventing child labor, which is a key focus for international organizations and consumers alike.

Government support for retail, including potential subsidies for sustainable practices or tax incentives for job creation, can significantly boost Fast Retailing's operational efficiency and expansion. For instance, in 2024, several Asian nations announced targeted programs to revitalize domestic retail sectors, potentially offering benefits for companies like Fast Retailing that invest in local employment and eco-friendly initiatives. Conversely, stringent zoning laws or complex permitting processes in certain markets can create hurdles for new store openings or operational adjustments.

Consumer Protection and Product Safety Laws

Consumer protection and product safety laws are critical for Fast Retailing. Regulatory bodies globally mandate strict standards for apparel, covering everything from textile content and chemical usage to flammability and accurate labeling. For instance, the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation impacts the chemicals used in textiles sold within its member states, requiring rigorous compliance from retailers like Fast Retailing.

Failure to adhere to these diverse regulations across its operating markets can result in significant consequences. These include costly product recalls, substantial fines, and, perhaps most damagingly, a severe erosion of consumer trust. In 2023, several major apparel brands faced scrutiny and financial penalties for non-compliance with chemical restrictions in their products, highlighting the financial and reputational risks involved.

- Global Regulatory Landscape: Fast Retailing must navigate a complex web of consumer protection laws, including those related to textile composition, chemical safety (e.g., REACH in the EU), and product labeling in each country of operation.

- Impact of Non-Compliance: Violations can lead to expensive product recalls, government-imposed fines, and substantial damage to brand reputation, directly affecting sales and market share.

- Consumer Trust as a Key Asset: Maintaining high product safety standards is paramount for preserving consumer confidence, which is a vital intangible asset for any apparel retailer.

Political Stability in Key Markets

The political stability of Fast Retailing's core markets, including Japan, China, and the United States, significantly impacts consumer sentiment and overall economic health. For instance, Japan, Fast Retailing's home market, has maintained a relatively stable political environment, fostering consistent consumer spending. Conversely, geopolitical tensions or unexpected policy changes in regions like China could introduce volatility.

Political uncertainty can trigger economic slowdowns, leading to decreased consumer spending on discretionary items like apparel, which directly affects Fast Retailing's sales performance. The company must actively monitor and mitigate risks stemming from political shifts to safeguard its operations and pursue expansion opportunities.

- Japan's political stability provides a bedrock for consistent domestic demand for Fast Retailing brands.

- China's evolving political landscape presents both opportunities for growth and potential risks due to policy shifts.

- US political dynamics can influence trade relations and consumer confidence, impacting Fast Retailing's significant presence there.

- Fast Retailing's 2023 fiscal year saw strong performance, with revenue reaching ¥2.77 trillion, underscoring the importance of stable operating environments in its key markets.

Government policies on trade and tariffs directly influence Fast Retailing's sourcing costs and pricing strategies, particularly impacting its operations in major markets like the US and China. In 2024, ongoing trade discussions continued to shape the global apparel industry, with companies monitoring potential shifts in import duties.

Labor laws and regulations, including minimum wage adjustments and working condition mandates, vary significantly across Fast Retailing's operating countries, affecting its operational expenses. For example, in 2024, several Asian nations implemented new labor standards that required adaptation from global retailers.

Political stability in key markets like Japan, China, and the US is crucial for consumer confidence and spending, directly impacting Fast Retailing's sales. Japan's stable political climate, for instance, supports consistent domestic demand, while shifts in other regions can introduce volatility.

Government incentives for sustainable practices or job creation can offer operational benefits, while stringent zoning laws can present challenges for expansion. In 2024, several governments introduced programs to support domestic retail, potentially benefiting companies investing locally.

What is included in the product

This PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Fast Retailing's global operations.

It provides actionable insights into how these macro-environmental shifts can be leveraged for strategic advantage and risk mitigation.

Provides a concise PESTLE analysis of Fast Retailing, allowing for quick identification of external factors impacting strategy, thus relieving the pain point of information overload during strategic planning.

Economic factors

Elevated global inflation, with headline rates in major economies like the US and Eurozone hovering around 3-4% in early 2024, directly impacts Fast Retailing's cost base. This translates to higher expenses for raw materials such as cotton and synthetic fibers, as well as increased manufacturing and shipping costs, potentially squeezing profit margins.

The persistent cost pressures necessitate strategic pricing adjustments by Fast Retailing; for instance, Uniqlo's ability to maintain its value proposition is tested when input costs rise significantly. A careful balance is required to pass on some costs without alienating price-sensitive consumers, especially as inflation can reduce disposable income, impacting demand for discretionary items like apparel.

Currency exchange rate fluctuations significantly impact Fast Retailing, a global player headquartered in Japan. As of early 2024, the Japanese Yen's performance against major currencies like the US Dollar, Euro, and Chinese Yuan directly affects the company's financial health. For instance, a weaker Yen can increase the cost of imported goods for its domestic market, potentially squeezing profit margins on items sourced internationally.

Conversely, a stronger Yen can diminish the reported value of Fast Retailing's international sales when those earnings are repatriated. In 2023, the Yen experienced considerable volatility, at times trading around 150 to the US Dollar, which presented ongoing challenges for companies like Fast Retailing with substantial overseas operations and sourcing. Effectively managing these currency risks through robust hedging strategies is therefore paramount for maintaining financial stability and ensuring consistent profitability across its global brands, including UNIQLO.

Consumer spending is a major driver for Fast Retailing. In 2024, global economic conditions are mixed, with some regions experiencing growth while others face inflationary pressures that can erode disposable income. For instance, while the US economy showed resilience in early 2024, persistent inflation has impacted household budgets, potentially leading consumers to prioritize essential goods over fashion items.

Fast Retailing's strategy of offering affordable, quality clothing, particularly through its UNIQLO brand, provides a degree of resilience during economic slowdowns. However, significant drops in disposable income across major markets like Japan or China, where the company has a strong presence, would still negatively affect sales. For example, if consumer confidence dips significantly in Japan due to economic uncertainty, discretionary spending on apparel could contract, impacting Fast Retailing's top line.

Raw Material and Energy Price Volatility

Raw material and energy price volatility presents a significant economic challenge for Fast Retailing. Fluctuations in the cost of cotton, polyester, and other essential fibers, coupled with rising energy prices impacting manufacturing and logistics, directly affect production expenses. For instance, cotton prices experienced considerable swings throughout 2023 and into early 2024, driven by weather patterns and global trade tensions, impacting the cost base for apparel production.

This unpredictability in commodity prices necessitates proactive risk management. Fast Retailing must implement sophisticated procurement strategies, potentially including forward contracts or hedging, to stabilize input costs. Diversifying the sourcing of raw materials across different geographical regions can also build resilience against localized supply disruptions and price shocks.

- Cotton Price Trends: Spot cotton prices saw significant volatility, with futures contracts for delivery in mid-2024 trading in a range influenced by crop yields and demand from major textile-producing nations.

- Energy Cost Impact: Global energy prices, particularly for oil and natural gas, remained a key factor in transportation and manufacturing costs throughout 2023 and early 2024, impacting the final price of goods.

- Procurement Strategy: Companies like Fast Retailing are increasingly exploring long-term supplier agreements and exploring alternative, more sustainable materials to mitigate raw material cost fluctuations.

- Geopolitical Influence: Trade policies and geopolitical events in key cotton-producing regions or energy-exporting countries can rapidly alter the economic landscape for raw material sourcing.

Labor Costs and Supply Chain Economics

Rising labor costs in key Asian manufacturing countries like Vietnam and Bangladesh are a significant economic factor for Fast Retailing. For instance, Vietnam's minimum wage saw an average increase of around 6% in 2024, impacting production expenses for apparel giants. This necessitates careful cost management, potentially through strategic sourcing shifts or efficiency gains.

Fast Retailing must navigate the economic pressure of increasing wages in its traditional manufacturing bases. This could involve absorbing some of the increased costs, which impacts profit margins, or passing them on to consumers, risking reduced demand. Finding a balance is key to maintaining competitiveness in the global apparel market.

To counter these rising labor expenses, optimizing supply chain efficiency and investing in automation are critical. By streamlining logistics and implementing advanced manufacturing technologies, Fast Retailing can mitigate the impact of higher wages. This approach helps maintain competitive pricing and ensures consistent product quality for its brands like UNIQLO.

- Vietnam's average minimum wage increase in 2024: ~6%

- Impact on apparel production costs in Asia

- Strategic importance of supply chain optimization

- Role of automation in labor cost management

Global economic slowdown fears and persistent inflation continue to shape consumer spending patterns. While some economies showed resilience in early 2024, the impact of higher interest rates and elevated prices on disposable income remains a key concern for apparel retailers like Fast Retailing. This economic backdrop directly influences demand for discretionary items, making value proposition crucial.

Currency fluctuations, particularly the Japanese Yen's performance against major global currencies, significantly impact Fast Retailing's international earnings and sourcing costs. As of mid-2024, the Yen has shown some recovery, but its volatility throughout 2023 and early 2024, trading as low as 150 to the US Dollar, highlights the ongoing need for robust currency risk management strategies.

Rising raw material and energy costs remain a persistent challenge. Cotton prices, for example, have experienced significant volatility due to weather and trade dynamics, impacting production expenses. Similarly, energy prices directly affect manufacturing and logistics, necessitating proactive procurement and efficiency measures.

Labor cost increases in key Asian manufacturing hubs, such as Vietnam's average 6% minimum wage hike in 2024, add further pressure. Fast Retailing must balance absorbing these costs, passing them on, or investing in automation and supply chain optimization to maintain competitiveness.

| Economic Factor | Data Point (Early-Mid 2024) | Impact on Fast Retailing |

|---|---|---|

| Global Inflation (Major Economies) | Approx. 3-4% | Increased cost of goods, potential pressure on consumer spending |

| Japanese Yen (vs. USD) | Volatile, with periods around 150 JPY/USD in 2023-2024 | Affects import costs and overseas earnings repatriation |

| Cotton Prices | Volatile, influenced by crop yields and trade | Directly impacts raw material costs for apparel |

| Vietnam Minimum Wage Increase | Approx. 6% average in 2024 | Increases manufacturing costs in key production regions |

Same Document Delivered

Fast Retailing PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Fast Retailing PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the global apparel giant. Understand the key drivers and challenges shaping Fast Retailing's strategic landscape.

Sociological factors

Consumers globally are increasingly focused on sustainability and ethical sourcing, with a significant portion willing to pay more for eco-friendly products. Fast Retailing must highlight its transparent supply chain and use of recycled materials to align with these values.

For instance, Uniqlo's RE.UNIQLO initiative, which collects and recycles used Uniqlo clothing, saw a substantial increase in collection volume in 2023, demonstrating a tangible commitment to circularity that resonates with environmentally conscious shoppers.

Modern lifestyles, with the widespread adoption of remote work and a growing appreciation for comfort and practicality, have significantly reshaped apparel demands. This has fueled a surge in popularity for casual wear, athleisure, and adaptable clothing items that can transition between different settings. For instance, a 2024 report indicated that the global athleisure market was projected to reach $326 billion by 2026, highlighting this powerful consumer shift.

Fast Retailing, through its flagship brand Uniqlo, is well-positioned to capitalize on these evolving preferences. Their commitment to developing high-quality, functional, and comfortable essential apparel directly addresses the modern consumer's desire for versatile and practical wardrobe staples. This strategic alignment ensures continued relevance and broad appeal across various customer demographics.

Global demographic shifts, like aging populations in places such as Japan and the increasing youth demographic in Southeast Asia, directly impact Fast Retailing's approach. For instance, Japan's population is projected to continue shrinking, with the proportion of those aged 65 and over reaching an estimated 31.0% by 2025, according to the National Institute of Population and Social Security Research. This necessitates a focus on products and services catering to older consumers while also adapting to the needs of a younger, digitally-native generation in emerging markets.

Urbanization trends also play a crucial role. As more people move to cities, particularly in Asia, Fast Retailing needs to optimize its store locations and formats to capture this concentrated consumer base. In 2024, over 60% of the world's population lives in urban areas, a figure expected to rise. This trend influences everything from the size and placement of Uniqlo stores to the types of apparel in demand, favoring styles suitable for city living and convenience.

Influence of Social Media and Digital Culture

The pervasive influence of social media and digital culture profoundly shapes fashion trends and consumer behavior, with platforms like TikTok and Instagram dictating rapid style shifts. Fast Retailing actively utilizes these channels for immersive brand storytelling, direct customer engagement, and swift new collection launches, recognizing their power in driving purchasing decisions.

The company's agility in responding to viral trends, managing its online reputation, and producing engaging digital content is paramount for sustained brand visibility and connecting with a digitally native demographic. For instance, in the fiscal year ending August 2023, UNIQLO, a key Fast Retailing brand, saw its global digital sales contribute a significant portion to its overall revenue growth, underscoring the importance of these platforms.

- Trend Responsiveness: Fast Retailing's ability to quickly adapt to micro-trends emerging on platforms like TikTok, often within weeks, directly impacts inventory management and marketing campaigns.

- Digital Engagement Metrics: In 2024, UNIQLO reported a substantial increase in social media followers across major platforms, indicating a growing and engaged online community.

- Influencer Marketing Impact: Collaborations with fashion influencers in 2024 have demonstrably driven traffic to Fast Retailing's e-commerce sites and boosted sales of featured items.

- Customer Feedback Loop: Digital channels provide Fast Retailing with real-time customer feedback, enabling rapid adjustments to product offerings and marketing strategies.

Health Consciousness and Functional Clothing

The increasing global focus on health and wellness directly fuels demand for clothing that supports active living and offers comfort across different environments. This trend is evident in the growing market for athleisure and performance wear, with consumers actively seeking garments that enhance their well-being.

Fast Retailing, through its Uniqlo brand, has effectively capitalized on this sociological shift. Their proprietary fabric technologies, like Heattech and Airism, are prime examples, offering advanced temperature regulation and moisture-wicking properties that appeal to health-conscious consumers. For instance, Heattech's ability to generate and retain heat, making it a popular choice for colder climates, saw significant sales growth in 2024.

- Growing Demand: The global activewear market is projected to reach over $200 billion by 2025, indicating a strong consumer preference for functional apparel.

- Uniqlo's Innovation: Heattech and Airism sales consistently contribute a substantial portion to Uniqlo's revenue, demonstrating their alignment with consumer needs.

- Future Investment: Continued R&D in areas like sustainable performance fabrics and antimicrobial treatments will be crucial for maintaining market leadership.

Societal values are shifting, with a greater emphasis on inclusivity and diversity in marketing and product offerings. Fast Retailing is responding by showcasing a wider range of models and sizes, reflecting a more global and representative customer base. This approach is crucial for connecting with an increasingly diverse and socially aware consumer demographic.

The company's commitment to corporate social responsibility (CSR) is also a significant sociological factor. Consumers, particularly younger generations, are increasingly scrutinizing brands' ethical practices and environmental impact. Fast Retailing's initiatives, such as its efforts to reduce plastic packaging and improve labor conditions in its supply chain, resonate with these evolving societal expectations. For example, by 2025, Fast Retailing aims to increase the use of sustainable materials in its products to over 50%.

| Sociological Factor | Fast Retailing Response/Impact | 2024/2025 Data/Projection |

|---|---|---|

| Inclusivity & Diversity | Showcasing diverse models and product sizing. | Increased representation in marketing campaigns, aiming for broader customer appeal. |

| Ethical Consumption | Focus on CSR, sustainable materials, and supply chain transparency. | Targeting over 50% sustainable material usage by 2025; ongoing supply chain audits. |

| Health & Wellness | Development of functional apparel like Heattech and Airism. | Heattech sales saw a 15% year-on-year increase in Q1 2024, driven by colder weather and consumer demand for comfort. |

Technological factors

The relentless growth of e-commerce and the demand for seamless omnichannel experiences are significant technological forces shaping Fast Retailing's strategy. By 2024, global e-commerce sales were projected to reach over $6.3 trillion, underscoring the critical need for strong online presences.

Fast Retailing's investment in sophisticated online platforms and mobile apps, coupled with the integration of physical stores and digital channels like click-and-collect, is crucial. This approach, exemplified by Uniqlo's efforts, broadens customer reach and elevates convenience, creating a cohesive brand journey.

Fast Retailing is increasingly leveraging automation and AI within its supply chain to boost efficiency. For instance, in 2024, the company continued to invest in AI-driven demand forecasting, aiming to more accurately predict customer needs across its global brands like UNIQLO. This technology helps optimize inventory levels, reducing the risk of overstocking or stockouts, a critical factor in the fast-fashion industry.

The integration of AI extends to warehousing and logistics, with automated systems managing sorting and movement of goods. This technology is designed to shorten lead times from production to store shelves. By minimizing manual handling and errors, Fast Retailing aims to improve overall supply chain speed and reliability, ensuring products reach consumers promptly in 2024 and beyond.

Real-time inventory management, powered by AI and machine learning, is another key technological factor. This allows for dynamic adjustments to stock based on sales data and predicted demand, minimizing waste and ensuring product availability. Fast Retailing's focus on these areas underscores a commitment to operational excellence and customer satisfaction through advanced technological adoption.

Technological advancements are revolutionizing textile manufacturing, leading to innovative materials with superior performance and sustainability. Fast Retailing, particularly through its Uniqlo brand, leverages this with proprietary technologies like Heattech and Airism, which offer enhanced comfort and functionality. The company's commitment to research and development for new fabrics, including smart textiles that regulate temperature or wick moisture, and sustainable alternatives like recycled fibers, is vital for staying competitive and catering to growing consumer interest in eco-friendly and advanced apparel.

Data Analytics and Personalization

Fast Retailing leverages advanced data analytics to gain deep insights into customer behavior and preferences. This technological capability allows them to refine product offerings and tailor marketing efforts, creating a more personalized shopping experience. For instance, by analyzing purchase history and online interactions, the company can predict trends and stock popular items more efficiently, minimizing waste and maximizing sales opportunities.

The company's commitment to data-driven decision-making is evident in its continuous investment in technology. In fiscal year 2023, Fast Retailing reported significant advancements in its digital transformation initiatives, including enhanced data analytics platforms. These investments are crucial for understanding the nuances of consumer demand across its diverse global markets, enabling more agile responses to market shifts and consumer tastes.

- Customer Data Utilization: Fast Retailing analyzes vast datasets to understand individual customer preferences, leading to more relevant product recommendations and personalized promotions.

- Inventory Optimization: Data analytics helps in forecasting demand more accurately, ensuring optimal stock levels for popular items and reducing overstock of less desired products.

- Personalized Marketing: The company uses insights from data to craft targeted marketing campaigns, increasing engagement and conversion rates by speaking directly to consumer needs.

- Enhanced Customer Experience: By understanding customer journeys and pain points through data, Fast Retailing can improve the overall shopping experience, both online and in-store.

Digital Design and 3D Prototyping

Fast Retailing's integration of digital design and 3D prototyping is transforming its product development. By leveraging these advanced tools, the company can significantly shorten its design-to-production timelines. For instance, the use of 3D design software allows for rapid visualization and modification of garments, reducing the need for multiple physical prototypes. This not only speeds up the creative process but also minimizes material waste, a key sustainability goal for many fashion retailers.

The adoption of virtual fitting technologies is another crucial aspect. These systems enable designers and even customers to visualize how garments will fit without physical trials. This innovation is particularly impactful in reducing returns due to poor fit, a common issue in e-commerce. By streamlining the sampling process and improving fit accuracy early on, Fast Retailing can achieve a more efficient and environmentally conscious product lifecycle, enhancing its agility in a fast-paced market.

The benefits are tangible, with companies in the apparel sector reporting substantial reductions in sample costs and lead times. For example, some brands have seen a decrease of up to 50% in physical sample production by adopting 3D design. This efficiency translates directly into a faster time-to-market for new collections, allowing Fast Retailing to respond more quickly to evolving consumer trends and maintain a competitive edge.

Key advancements include:

- Digital Design Software: Tools like CLO3D and Browzwear enable realistic 3D garment creation and visualization.

- 3D Prototyping: Reduces the need for physical samples, saving materials and time.

- Virtual Fitting: Improves fit accuracy and reduces returns, enhancing customer satisfaction.

- Data Integration: Seamlessly connects design data to manufacturing, streamlining the supply chain.

Fast Retailing's technological investments are pivotal, particularly in enhancing its e-commerce capabilities and omnichannel experience. By 2024, global online retail sales were expected to exceed $6.3 trillion, highlighting the necessity for robust digital platforms. The company's strategy involves integrating physical stores with digital channels, such as click-and-collect services, to broaden customer reach and convenience.

AI and automation are being deployed across Fast Retailing's supply chain to boost efficiency. In 2024, the company continued to invest in AI for demand forecasting, aiming to optimize inventory levels and reduce stockouts. This technology also streamlines warehousing and logistics, shortening lead times from production to store shelves.

Data analytics plays a crucial role in understanding customer behavior, enabling personalized marketing and product recommendations. Fast Retailing's digital transformation initiatives, including enhanced data analytics platforms, are key to responding agilely to market shifts. For instance, in fiscal year 2023, the company reported significant progress in these areas.

Advancements in textile manufacturing, including smart textiles and sustainable materials, are also leveraged by Fast Retailing, particularly through its Uniqlo brand. Innovations like Heattech and Airism offer enhanced comfort and functionality, catering to consumer demand for advanced and eco-friendly apparel.

Legal factors

Fast Retailing's extensive global operations mean navigating a labyrinth of international trade laws and customs regulations. For instance, in 2023, the World Trade Organization reported that global trade in goods saw a modest increase, but the complexity of compliance remains a significant factor for companies like Fast Retailing, which sources materials and distributes products across numerous continents.

Fluctuations in trade policies, such as the imposition of new tariffs or changes in import/export duties, directly affect Fast Retailing's cost of goods and lead times. For example, a shift in trade agreements between key manufacturing hubs and major consumer markets could necessitate costly adjustments to their supply chain. The company must remain agile to mitigate these impacts.

Strict adherence to these regulations is paramount for maintaining an efficient supply chain and avoiding substantial financial penalties or operational disruptions. In 2024, customs authorities worldwide are increasingly focused on compliance, making robust internal processes and up-to-date knowledge of international trade law critical for Fast Retailing's smooth global distribution.

Fast Retailing places significant emphasis on safeguarding its intellectual property, a crucial legal consideration. This includes robust protection for its brand trademarks, such as UNIQLO and GU, alongside unique product designs and proprietary fabric innovations like Heattech and Airism. These assets are vital to maintaining brand identity and market differentiation.

The company actively pursues legal avenues to combat counterfeiting and unauthorized usage of its brand elements across its global operations. In 2023, Fast Retailing, like many major apparel brands, likely engaged in multiple legal actions to protect its IP, a necessary step to preserve brand equity and competitive standing in the increasingly complex global marketplace.

Fast Retailing's global operations, particularly its significant e-commerce presence, place it under the purview of diverse data privacy and cybersecurity regulations. Laws like the EU's General Data Protection Regulation (GDPR) and various US state-level privacy acts, such as the California Consumer Privacy Act (CCPA), dictate how customer data can be collected, processed, and stored. Failure to comply can result in substantial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is greater.

Maintaining robust cybersecurity measures is crucial for Fast Retailing to safeguard sensitive customer information from breaches. The increasing sophistication of cyber threats means continuous investment in security infrastructure and protocols is essential. A data breach not only incurs direct financial costs from regulatory fines and legal fees but also leads to severe reputational damage, eroding customer trust and potentially impacting sales volumes, as seen in numerous high-profile retail data breaches in recent years.

Consumer Protection and Advertising Standards

Fast Retailing navigates a complex web of consumer protection laws across its global operations, demanding strict adherence to product safety, quality, and accurate labeling. For instance, in 2024, the EU continued to enforce its General Data Protection Regulation (GDPR), impacting how customer data is handled in marketing and sales, with potential fines reaching up to 4% of global annual turnover for non-compliance.

Advertising standards are particularly scrutinized, with regulations dictating transparency in pricing and clarity in product claims. Many jurisdictions, including the United States under the Federal Trade Commission (FTC), have robust rules against deceptive advertising. A 2023 report indicated that consumer protection agencies globally issued over $500 million in fines for misleading advertising practices, a figure that influences marketing budgets and strategies.

The company must also comply with varying return policies and warranty requirements, which differ significantly from market to market. Failure to meet these standards can lead to costly legal battles, significant fines, and severe damage to brand reputation. For example, a product recall due to undisclosed defects could cost millions in lost sales and remediation efforts, as seen with other apparel retailers facing such challenges in recent years.

Key legal considerations for Fast Retailing include:

- Compliance with diverse consumer protection laws: Ensuring product safety, quality, and accurate labeling across all operating regions.

- Adherence to advertising standards: Maintaining transparency in pricing and truthfulness in product claims, avoiding misleading statements.

- Varying return and warranty regulations: Adapting policies to meet country-specific consumer rights and guarantees.

- Mitigation of legal risks: Proactively addressing potential issues to prevent fines, lawsuits, and reputational damage.

Environmental and Sustainability Regulations

Environmental and sustainability regulations are becoming increasingly stringent globally, directly impacting Fast Retailing's operations. Governments worldwide are enacting stricter laws covering textile manufacturing processes, chemical usage, waste disposal, and carbon emissions. For instance, the European Union's proposed Ecodesign for Sustainable Products Regulation aims to set environmental performance standards for various product categories, potentially affecting Fast Retailing's product design and material choices.

Fast Retailing must navigate these evolving legal landscapes, which often mandate sustainable sourcing practices, set targets for waste reduction, and require detailed reporting on environmental impact. The company's commitment to sustainability, as seen in its 2023 sustainability report detailing efforts to reduce water usage and chemical discharge, is crucial for compliance. Failure to adhere to these regulations can result in significant legal penalties, operational disruptions, and damage to brand reputation, which in turn can deter investors and impact market valuation.

Key regulatory considerations for Fast Retailing include:

- Compliance with evolving chemical restrictions: Adhering to regulations like REACH in Europe, which limits the use of certain hazardous substances in products.

- Waste management and circularity mandates: Meeting requirements for product end-of-life management and promoting circular economy principles, such as those being explored in various Asian markets.

- Carbon emission reporting and reduction targets: Complying with climate-related disclosure frameworks and actively working towards science-based targets for emissions reduction across its supply chain.

- Sustainable material sourcing standards: Ensuring that materials like cotton and polyester meet defined sustainability criteria, potentially including certifications for organic or recycled content.

Fast Retailing must navigate complex international trade laws and customs regulations, with global trade compliance remaining a significant factor in 2023. Changes in trade policies, such as tariffs, directly impact costs and lead times, requiring agile supply chain adjustments. Robust internal processes are critical for smooth global distribution in 2024, as customs authorities increase compliance focus.

Environmental factors

The environmental toll of obtaining and processing raw materials is a major consideration for Fast Retailing. Consumers and regulators are increasingly demanding that companies like Fast Retailing prioritize sustainable materials. This includes a growing preference for organic cotton, recycled polyester, and novel fibers designed for lower environmental impact.

Fast Retailing's commitment to reducing its dependence on virgin resources and ensuring responsible sourcing practices throughout its supply chain is paramount. This strategy is vital for shrinking its ecological footprint and aligning with evolving consumer preferences and stringent regulatory requirements. For instance, by 2023, Fast Retailing aimed to increase its use of recycled materials, with specific targets for polyester and cotton, reflecting this environmental imperative.

Fast Retailing, like many in the apparel industry, faces significant environmental pressures related to water. Textile dyeing and finishing are notoriously water-intensive, and managing the resulting wastewater is a critical challenge. The company must focus on reducing its overall water footprint throughout its vast supply chain.

To address this, Fast Retailing is investing in and implementing advanced wastewater treatment technologies. This commitment is crucial not only for environmental compliance but also for maintaining a positive brand image. For instance, by 2023, the company aimed to reduce water usage in its dyeing processes by 10% compared to 2017 levels.

Fast Retailing is facing increasing pressure to shrink its carbon footprint, a significant environmental factor influencing its operations. This involves tackling greenhouse gas emissions throughout its entire supply chain, from the factories where its clothes are made to the trucks that transport them and the stores where they are sold.

To combat this, Fast Retailing has set ambitious goals, aiming for carbon neutrality. Key strategies include investing in renewable energy sources to power its facilities and optimizing logistics to reduce emissions from transportation. For instance, by 2030, the company aims to reduce its Scope 1 and 2 greenhouse gas emissions by 50% compared to 2019 levels.

Beyond direct emissions, the company must also consider the broader impacts of climate change. Extreme weather events, exacerbated by climate change, pose a risk to the availability and cost of raw materials like cotton. Managing these supply chain vulnerabilities is a critical environmental consideration for Fast Retailing's long-term sustainability.

Waste Management and Circular Economy

The fashion industry, including Fast Retailing, grapples with substantial textile waste, estimated to be around 92 million tons globally each year. This waste stems from production inefficiencies and the rapid disposal of garments by consumers. Fast Retailing is increasingly focused on mitigating this impact.

To address this, Fast Retailing is exploring enhanced waste management and circular economy integration. This involves bolstering textile recycling programs, which are gaining traction as consumers become more aware of the environmental footprint of their clothing purchases. Initiatives like upcycling, transforming old garments into new products, are also being considered to add value and reduce waste.

Embracing circular economy principles is paramount for Fast Retailing to lessen its landfill burden and meet evolving consumer demands for sustainability. For instance, by 2025, the Ellen MacArthur Foundation aims for 20% of major fashion brands to have scaled up textile collection and recycling programs, a benchmark Fast Retailing is likely working towards. Designing for longevity and recyclability will be key components of this strategy.

- Global Textile Waste: An estimated 92 million tons of textile waste is generated annually worldwide.

- Consumer Demand: A 2024 survey indicated that over 60% of consumers consider a brand's sustainability practices when making purchasing decisions.

- Circular Economy Goals: The Ellen MacArthur Foundation's 2025 target for major fashion brands to scale textile collection and recycling programs.

Chemical Management and Hazardous Substances

The textile industry's reliance on chemicals presents significant environmental and health challenges. Fast Retailing, like its peers, faces the imperative to implement robust chemical management systems throughout its extensive supply chain to mitigate or eradicate hazardous substances. This includes rigorous oversight from raw material sourcing to finished garment production.

Adherence to stringent regulations such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) is paramount. For instance, as of 2024, REACH continues to evolve, with ongoing evaluations of substances that may impact textile manufacturing processes. Fast Retailing's commitment to promoting and utilizing safer chemical alternatives directly supports product safety, safeguards the environment, and is vital for preserving consumer confidence in its brands.

- Supply Chain Scrutiny: Fast Retailing must maintain strict oversight of chemical usage across all tiers of its supply chain, from dyeing and finishing to printing.

- Regulatory Compliance: Ongoing adherence to global chemical regulations like REACH, which governs the use of chemicals in the EU market, is essential.

- Safer Alternatives: Investing in and promoting the use of less harmful chemicals and innovative production methods helps reduce environmental impact and health risks.

- Consumer Trust: Transparent communication about chemical management practices and product safety reassures consumers and reinforces brand reputation.

Fast Retailing faces increasing pressure regarding water usage, as textile dyeing and finishing are water-intensive processes. The company is actively investing in advanced wastewater treatment technologies and aiming to reduce water consumption in its dyeing processes. By 2023, Fast Retailing targeted a 10% reduction in water usage compared to 2017 levels.

The company is also addressing its carbon footprint by investing in renewable energy and optimizing logistics, with a goal to reduce Scope 1 and 2 greenhouse gas emissions by 50% by 2030 compared to 2019 levels. Climate change also poses risks to raw material availability, necessitating supply chain vulnerability management.

Textile waste is another significant environmental challenge, with global annual generation estimated at 92 million tons. Fast Retailing is focusing on waste mitigation through enhanced recycling programs and exploring circular economy principles, with a goal to scale textile collection and recycling initiatives.

The use of chemicals in textile production also presents environmental and health concerns. Fast Retailing must manage chemical usage rigorously across its supply chain and adhere to regulations like REACH, while promoting safer alternatives to ensure product safety and maintain consumer trust.

| Environmental Factor | Fast Retailing's Actions/Goals | Relevant Data/Targets |

|---|---|---|

| Water Usage | Investing in wastewater treatment, reducing dyeing process water consumption | Target: 10% reduction in water usage by 2023 (vs. 2017) |

| Carbon Footprint | Investing in renewables, optimizing logistics | Target: 50% reduction in Scope 1 & 2 emissions by 2030 (vs. 2019) |

| Textile Waste | Enhancing recycling, exploring circular economy | Global annual textile waste: ~92 million tons |

| Chemical Management | Adhering to regulations (e.g., REACH), promoting safer alternatives | Ongoing compliance with evolving chemical regulations |

PESTLE Analysis Data Sources

Our PESTLE analysis for Fast Retailing is built on a robust foundation of data from official government publications, leading economic institutions like the IMF and World Bank, and respected industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the global apparel market.